“Prophesy is a good line of business, but it is full of risks.” Mark Twain

It has been quite some time since I have posted an article.

The end of the year is a good time to reflect on past prognostications. I do have a list of publicly made prognostications. Of course, my most famous prophecy was the collapse of the oil markets in 1998. I was noted in several publications including front page USA Today. Since then, given my move into the real world from consulting world, my prophecies have been privy to the companies at which I’ve worked. However, you can find some public appearances at conferences where my prognostication skills can be bench marked to reality, I have dug up two from the past – one in 2011 and another while I was running my consultancy in 2015. Both, coincidentally, were at a Platts conference. I seem to do quite well at Platts conferences – perhaps I should be presenting more often there. Last, but not least, the latest news of auto manufacturers layoffs and cutting models made me go back to one of my previous blogs I posted.

The last public statement was made at the Platts Refinery Conference back in 2015. Right after that, I was implementing PMA at EDF Trading. At the conference, I was not given much attention as many of my ideas did no support the on-going trend and sentiment. In addition, I hadn’t spent a lot of time back in the refinery industry – but to be honest, its really not as complicated as power – for me it was easy to pick back up where I left. I rebuilt supply/demand models for each commodity. Reviewed and traced each demand and supply sector and examine key inflection points. I also followed up with respective experts/leaders in each product and had wonderful conversations with them. An expert with passion can’t stop talking :)! Please click on this link for the 2015 Platts Refinery Conference Presentation. I started my presentation noting how all the experts in the industry over the past decades have gotten major trends wrong and I wasn’t excluding myself (e.g. lighter crude slate – peak oil etc…). Many in the rooms did not like to hear this. However, if you ever get a consultant/expert to not review and face the facts of the past and admit their errors – run – run as fast as you can. An over confident consultant/expert can cost you a lot more than their fee. I discussed the current landscape with all the new oil and gas production and how ethane will need to find a new home. Currently ethane exports are almost at my 2024 foretasted export level! Also noted was the possible Naphtha issue and the two chemical feedstock would inevitably collide in the market. All of it came true, and the extent was even more than the tempered forecast I presented. I am a realist in the sense there is no reward to forecasting way above consensus – just being away from consensus is enough to get the point. I had an inclination that the situation could be much more dire than I presented, but I was already going against the grain so I tempered the expectations in the presentation. Creating scenarios also allowed the visuals of the direction of the market – note the high case.

Going even further back is a presentation I gave at Platts Coal Conference in 2011. I was in a similar situation where I had to relay a bad message to the room – and once again, many did not want to hear it. To view the presentation click on the following link – Platts Coal Refining Conference in March 2011. I noted my calculations of coal retirements made when I was Managing Director Strategic Planning for AEP – which was available in the public documents in one of the AEP Analysts meetings presentation. Essentially I was telling the audience that almost 50% of their demand might go away and that exporting would not solve their financial situations. Of course, no one in the coal conference wanted to heed my warning. The KOL etf had already dropped from highs of 50 in the year to 30’s in October 2011. I heard from some that this David person had no idea what he was talking about – because I was a power guy not a coal guy. Hmmm… when most of your demand is from the power sector shouldn’t that be the person you should be listening to? Anyways, the KOL etf is now 12 and we have seen some major bankruptcies in the industry. Export coal is up in volumes but just not even close to drop of volumes from US coal generation. The surprising reflection to note is how well the rail sector has done – perhaps replacing coal with oil and continued Chinese imports – but at some point that will likely end, too.

The latest news of auto manufactures laying off and cutting models made me think of an article I posted back in Feb 2015 which I reviewed the BP Energy Outlook. If only the auto guys took heed to my warnings – “…eventually with the falling prices and the improved efficiency improvement the auto manufacturer can produce an SUV with mass appeal and size that can go 0 to 60 in few seconds yet offer 25-40 mpg. Auto manufacturers who ignore this trend will be left in the dust as was seen last time SUV sales outsold compact vehicles. The move to this larger and faster car will swallow the small vehicles leading to overall growth in oil demand while maintaining the CAFE standards.” US total petroleum demand almost re-hit its monthly peak demand set in August 2005. Overall US petroleum demand has been in an upward projection since bottoming after the financial crisis.

There are many out there denying the ability of human beings to predict/understand the future. Books like Undoing Project by Micheal Lewis and the conclusions that Israeli psychologists Daniel Kahneman and Amos Tversky demonstrated that humans have a breakdown in their psyche creating poor decisions and inefficiencies in the market. They did not examined learned/experienced forecasters and also did not reach out to successful prognosticators. Much of their tests involve normal sample people, not experienced and trained-to-forecast individuals. We are also seeing the rise of AI and neural networks to take the human psyche out of the equation for decision making. However, it is the human that can relate to the human that is making decisions, even if the human is using AI. So far, I have yet to see an AI be able to go beyond short term analysis given its learning sample is always based on the past and the multiple forward inputs still require some creativity and art for which only an experienced person can create. I good benchmark for when AI is ready is when AI starts making art work so profound. At that point, I would say human prognosticators could likely be looking for another career, but until then – For my fellow aspiring prognosticators I leave you with these tips in order to be a better forecaster.

- One. Get a real job in the real industry and eventually in the planning and strategy group. Being a consultant your entire career leaves out the feedback loop of reality and you end up in this strange world of advice giving and not knowing how it really matters to the company and the multiple lives you could impact. This is also a note to companies hiring consultants – get one that has been in the industry in a position of planning/forecasting. They will understand your position best and know the bigger picture of what an outlook/position could mean to you and your company.

- Two. Have a fundamental foundation – examine as deeply as you can the drivers of supply and demand e.g. what are the economics parameters that drive more supply? When and how much does demand respond to price? What alternatives are there? etc.. The devil is in the details – get your hands dirty and get into the details. This is where IF you have passion, it will shine. IF you want to be the best, this is where sacrifices are made. Work longer – sleep and dream the problems – let nothing get in your way – if you really want to understand the market your forecasting. If you don’t, I promise you someone else will, and you won’t be getting it right consistently. Forget all those that say you must sleep so much and rest so much – I believe, when your in the midst of an issue, you must engross yourself and get your rest and leisure later. Nothing worthwhile that can be claimed as a great achievement comes without sacrifices. My first professional boss at Purvin & Gertz, Ken Miller, taught me about having passion for your work. His life was his work. He would carry the largest suitcase full of reading materials everyday. I have never stopped reading as much as I can because of him. He passed away this year, and may he rest in peace – but, knowing Ken, his rest would be reviewing refinery economics. Everyone should have such a boss with so much passion. There is so much that I owe him for showing me the way.

- Three. Be humble – know that you don’t know everything nor do you have to. In the mid 2000’s, I knew gas couldn’t just rise to the teens without something in between. Did I know it was shale at the time? No. But, I did know the principle of greed and human ingenuity. My premise to pull the prices down from the every growing forward curve came from the underlying thought of greed and human ingenuity, and I used LNG as my placeholder. In my calculations, at the very most, prices would be around $6-7/mmbtu. In the end, we see the development of shale was the ultimate greed and human ingenuity mechanism pulling gas prices back down even farther than I foresaw at that time. However, my premise was still right. It was not ever growing as the forward curve/market thought, and I didn’t have to know everything to save the company billions of dollars from jumping into more coal assets and not buying distress gas assets that later sold for multiple times on the dollar. It is so important to reach an understanding at some point in your career that no matter how much modeling and research is done, the world will unfold not even close to many experts predictions. With that humbleness you will open your mind and begin to, more accurately, prognosticate. You will realize and be more open to multiple outcome probabilities. Having ranges of outcomes does not make you weak, but makes you cognizant of the multiple dependencies that are out of your control e.g. weather. However, you will still need to have a base forecast to discuss where things are likely headed as long as all the dependencies likely head your direction.

Over the years, I have come to the realization that humble, but passionate, consultants are the best consultants, as they have been weathered and understand some of the unpredictable nature of the past and very much willing to put in the effort required to maintain expert status. They are confident enough to change their forecast before it is too late and also be brave enough to forecast against the trend.

May you have a prosperous 2019 – and stay thirsty to knowledge!

David K. Bellman

Your most humble, super passionate, and grateful but very lucky prognosticator of the energy market!

Year of Model Building 2014

2014 Modeling Efforts

At All Energy Consulting, we specialize in modeling the energy markets. To give you a sense of our capabilities, below are the list of models built in 2014.

Reviewing the list, it reminds me of the saying :

“People who love what they do wear themselves down doing it, they even forget to wash or eat….When they’re really possessed by what they do, they’d rather stop eating and sleeping than give up practicing their arts.” Marcus Aurelius, Meditations

Please do consider All Energy Consulting for your energy modeling needs. I truly enjoy what I do and it will show in my work and commitment to you – Thanks for 2014.

David

[email protected]

614-356-0484

Oil & Gas

-

Built a USGC refinery model in various configurations – Hydroskimming, Cracking, and Coking

-

Discounted Cash Flow Model for Refinery Acquisition and Refurbishment

-

USGC and Caribbean petroleum pricing model

-

Modeled the US Natural Gas Deliveries to Electric Power Consumers by State

-

Modeled and Calculated the discount value for Eagle Ford Condensate

-

Built World Supply/Demand Balance Model for Crude Oil and Petroleum Products

Power

-

Assisted Platte River Power Authority (PRPA) in deployment (setup, build, and operate) of a power model used for their Integrated Resource Plan

-

Several Discounted Cash Flow Model for Power Generation Asset – 800 MW CC to 1MW Reciprocating Engine including the associated power modeling work

-

Worked with the University of Texas Center for Energy Economic on modeling and publishing papers regarding ERCOT

-

Modeled EPA Clean Power Plan and published paper in Fortnightly

-

Modeled and produced a risk analysis for a set of generating assets

-

Long-term Power Modeling along with integrating GCPM gas pipeline model

-

Built and Operate Power Market Analysis (PMA) Platform – includes integrated trade screeners to integrated natural gas storage models.

-

Built an interactive load model for 118 load zones representing N. America

-

Built a coal pricing model to deliver and price coal to all 1000+ coal units in N. America

-

Discounted Cash Flow Model for an Integrated Desalination Plant with Associated Power Generation and Recycle Facility for Waste Water from Fracking

Models are only as good as the inputs and the ability to decipher the outputs to business solutions. More information on modeling and other services can be found on our website.

Best of Market Insights 2014

To my readers, clients, and prospective clients,

I appreciate your feedback throughout 2014. The year 2014 will be remembered as the year of discovery for All Energy Consulting (AEC). An identity for AEC had to be discovered – better late than never. I know I had to work more on delivering my value proposition to you. I have spent so much time on developing products/services plus analyzing markets I lost sight of delivering this message. You will see an enlightened AEC moving into 2015. Our value proposition to my readers and prospects will be clear. I want to share the current thoughts on this in our Branding Positioning Statement:

“For those who need forecasted energy commodity prices, we are experienced market analysts who assist in the navigation of uncertain energy markets with a proven process and methodology, and a collaborative approach in consulting that yields clarity, transparency and empowers decision-making.”

You will see a change in 2015 with a clear direction to support the statement above.

Below are the best of market insights in 2014 rated based on web statistics – page views and downloads.

Your Very Grateful More Focused Energy Analyst – Happy New Years!,

David

614-356-0484

Best of Market Insights 2014:

– With the most page views (60K+) –Peak Energy – Are we there in the US? This is very surprising. Perhaps this is a result of peak oil conspirators or just an error in the web stats. The article uncovers the decoupling of the economy with load in several areas in the US.

– Excellent Returns Were Produced From PMA Summer Model Predictions This article highlights the performance of the generic PMA model for the summer. PMA correctly highlighted the hype from Polar Vortex bleed into the summer forwards. Also should read theBest Winter Trade which yielded 30%.

– Ready for March Gas Demand? Duke’s Merchant Coal Plant Value This article demonstrated PMA flexibility to not only help create risk-adjusted forward curves but also calculate natural gas demand and do specific power plant analysis. We also highlighted our agility with the ability to deliver results within 24 hours.

– US Refining Margins Outlook Sept. 2012 – Wow. An oldie had nearly 20K page views. This article highlighted that condensate production was going to change the markets and that US refining margins will be robust for years to come. Well it was an UNDERSTATEMENT – even though I was probably one of the few analyst mentioning the significance of condensate in 2012 the production of condensate blew past my old outlook. US Refining margins were and will be robust! See 2014 US Refining Outlook

– Most downloaded (403 downloads) – Summer of 2014 Analysis – I threw the kitchen sink and all into this analysis. If you took the time to really digest all of the information in the report you would have been prepared for what transpired in summer 2014.

Ethane Favored Status – another convergence to power

I have had many responses to my previous article Splitting the Profit – Condensate Splitter Under Pressure. Let me clarify some of my points and highlight some valid feedback.

US ethylene production is mainly from ethane, whereas the rest of the world is Naphtha. However, the point I was trying to extend is the rest of the world may very well also move to more ethane, as I believe ethane exports are viable via ships that carry ethylene – see below. This puts more pressure on Naphtha pricing as the rest of the world can eventually shift to ethane if Naphtha pricing is not in balance with ethane. In addition, given the expansion of ethane crackers in the US, this may very well put pressure on ethylene cracking margins which then translates to feedstock such as Naphtha.

In summary, my main concern being expressed in the original article are those investing in condensate splitters, in hopes of mitigating the condensate discount, may just be shifting their concerns to Naphtha discounts. As noted previously I believe there is room for condensate refineries. I have been working on one that just needs funding. As with many things, in order to make money you need money. This is a refurbishment for an existing condensate refinery with a cost range between $400-600 million. I can supply more information just send me an email [email protected].

I certainly was not trying to completely solve the ethane issues in the previous article. There is no doubt ethane problems are real and will be very challenging, particularly the next few years as many projects are still in permitting phase. Based on the available information, I believe exporting ethane is the way to balance the market in the meantime. As noted above, one could use ethylene carriers to transport ethane. Ethane can potentially be the “bridge” fuel for locations requiring power, but without the required scale of LNG. There are several engine manufacturers working to be able to use higher and higher content of ethane. Ethane use for power generation can easily be converted to LNG when the required scale is reached. In the meantime, regions burning oil (many outside US) can look to this economical and viable alternative to oil. With ethane flexibility to be used in petrochemical and power generation, ethane may actually end up being a favorite child from a step child as I alluded to in the first article.

All fuels ultimately lead to power. Building up the energy foundation from power makes sure all things are tied together. Many consulting companies are driven from the Oil & Gas side of the analysis as more revenue comes from those industries, but at All Energy Consulting we are driven through intellectual integrity. We report to no shareholders and have no targeted mandates.

We wish you a Happy and Safe Thanksgiving. Thank you so much for all of your support.

Your VERY Thankful Full Spectrum Energy Consultant,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter

“Pull a thread here and you’ll find it’s attached to the rest of the world.”

Nadeem Aslam, The Wasted Vigil

Splitting the Profit – Condensate Splitters Under Pressure

As I noted in the Condensate Economics Explained this summer, condensate splitters will not be a sustainable solution to the condensate flood in the US by itself. The recent article by RBN indirectly supports this claim. RBN expects very high natural gas liquids (NGL) production. The problem child in NGL is ethane. Ethane, because of its unique property relative to propane, butane, and pentanes plus, requires much more effort to liquefy. Therefore, often ethane is left in the gas stream (rejected) versus extracting and supplying it to the petchem industry. However, only so much ethane can be left in the dry gas stream before it would fail to meet pipeline specifications.

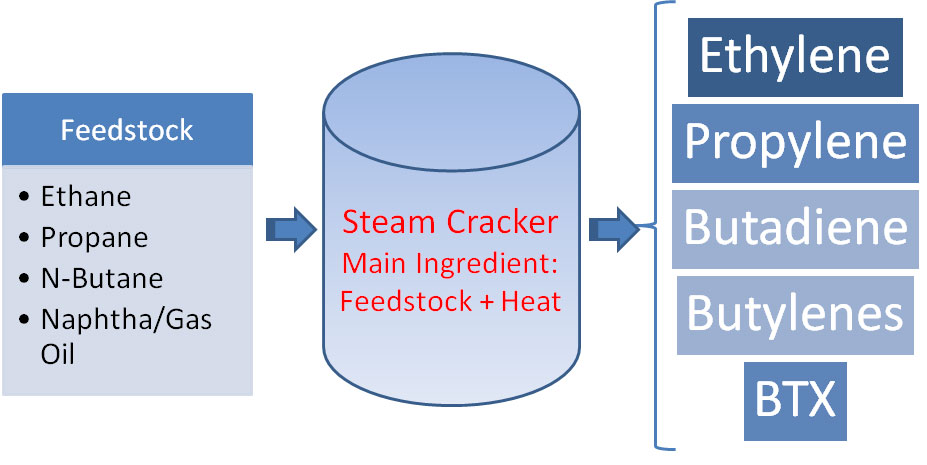

With ethane falling to the lowest level ratio in decades to natural gas, there is a large incentive to go ahead and leave as much as one can in the dry gas stream. As also noted by RBN, there is just so much NGL that ethane will easily exceed the current demand levels leaving prices to likely free fall in certain regions. This will result in petchem plant demand which brings us back to Condensate splitters. The yield of condensate splitters is mainly Naphtha. Naphtha is used by many petchem plants. There exist many chemical plants which can take multiple feedstocks to produce the same product. The driving products of the petchem industry are known as Olefins (CnH2n) – a hydrocarbon with one double bond carbon and single bonds elsewhere – aka Alkenes (sorry about being so nerdy, but sometimes you just have to be technical to really understand it all – I also need to use my Chemical Engineering Degree every now and then). These Olefins include the more recognized names of ethylene, propylene, and butylene. The process of taking the feedstock and converting the product is typically called cracking. The reason for this is because you are breaking the molecular bonds and producing a new combination which constitutes your product.

Historically speaking Naphtha is the dominant feedstock for world production of olefins. For ethylene production Naphtha represents almost 50% of the primary feedstock. However the use of ethane to make ethylene is rapidly growing. Hopefully by now you are starting to see the convergence of Condensate Splitter and Ethane. Even if a petchem plant is designed for a certain feedstock – all it takes is some capital to be able to process other feedstock. Those who built US condensate splitter hopefully did their economics based on significant market competition with ethane.

Petchem plants are essentially a simplified refinery. Compared to trying to model refineries, petchem modeling is much simpler. The feedstock is typically already cleaned out and the process can be placed in one block versus multiple conversion equipment in refining – see Figure below.

Cracking a certain feedstock will result in varying yields of product – similar to processing crude oil in refineries. There is a value point where one feedstock will be more profitable than another. A complete gross margin can be computed for the varying types of crackers. Gross Margin at a Petchem plant = Product Prices x Yields – Variable Cost – Cash Cost – Fixed Cost. Similar to a refinery each of these components will be different depending on your feedstock.

Potentially All Energy Consulting will release another product Chemical Market Analysis (CMA) where, on a daily basis, a computed value of the various cracking modes (ethane, propane, butane, natural gasoline, and Naphtha) is computed based on future markets. We are close on our Oil Market Analysis (OMA) product release. Both these platforms will enable the user to input their own future expectations of price and a computed value will be calculated. We have the models and the platform and are just looking to finalize our data provider. Please email me if you are interested in either of these products. If you have your own forecast data, we can deliver this to you right now.

Your Split in Many Ways Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter

“Pull a thread here and you’ll find it’s attached to the rest of the world.”

? Nadeem Aslam, The Wasted Vigil

Energy Policy – Too Complex to do for the US?

In several energy conferences I have attended, many people are dismayed on how we fail to have a national energy policy in the United States. At the same time, many people are actually very grateful for that fact. This is typically coming from those who are very cynical of government action and ability to appropriately execute. An in-depth national energy policy for the United States is likely infeasible due to the geographical diversity of the US to use various energy forms and the complexity of energy. The only energy policy I could see from a US federal perspective would be a generic focus on allowing inter-state energy transfer no matter what form of energy, a focus on maintaining some level of energy security through technology, storage, and trade, and finally a push to use energy productively.

Energy is a means to many ends. Having energy does nothing useful without an objective of using the energy. The discussion of energy in the public space is typically done with a bias to favor one form of energy to another even though they may not even be directly related. Energy is so broad making it very complex. The complexity allows the energy discussion to be manipulated to the public. This manipulation is sometimes intentional and sometimes out of ignorance.

The two broad forms of energy is potential and kinetic energy. Kinetic energy is the useable form of energy. The potential form of energy is eventually converted to kinetic for final use to achieve an end goal. An example of end goal could be heating your house to traveling from point A to point B. The usable forms of kinetic energy are radiant, thermal, motion, sound, and electrical. To produce those forms of energy, a medium is needed. These can be Oil, Natural Gas, Wind, Sun, Coal, Earth (Geothermal), Hydro, Atoms (Nuclear), etc… Within each of these forms and mediums, people have dedicated their lives to them generating multiple academic and business people. Only a few actually involve themselves across the various forms of kinetic energy and the mediums.

I was fortunate only because of my career path and my desire to continue to learn. Most of my colleagues and friends in the energy space are dedicated to one medium and one form of kinetic energy. This highlights the complexity of the space and the desire for individuals to bias a certain form and medium of energy. My Oil and Gas colleagues would not be interested in understanding the Demand Response call option value compared to the tariff rates structured, just as my Utility colleagues would not be interested in understanding the light-heavy relationships in petroleum products and its impact on crude oil valuations. At some level each of the groups will be “fighting” to support his or her industry. Therefore just as Eisenhower was concerned about the military-industrial complex, I would be concerned about an energy policy driven by one of the energy forms complex versus generating a generic goal of using energy productively and securely.

Having a clear discussion on energy is near to impossible because of the generic “energy” concepts. Energy discussions are littered with ignorant or bias agenda. Case in point, many articles will point to the renewable initiatives leading to a reduction of petroleum products (gasoline, diesel, jet fuel, etc…). However, this is not genuine since the renewables mediums are generally focused on the electric form of kinetic energy whereas the petroleum medium is focused on the thermal form of kinetic energy. Therefore, significant transformation to renewables will not displace the petroleum uses without a mass change in vehicles which in itself will take decades.

State energy policy focused on specific mediums would make more sense than federal. If federal policy were to take a medium stance this would immediately favor certain states over other states. However, keeping it on a state basis allows the state to excel their mediums and create a competitive landscape. The evolution of civilization to use one form of medium to another is typically not altruistic, but of natural evolution of necessity. People always point out the vast nuclear usage of the French as a potential ideal goal for a carbon free world. The French did not set out to do this for the sake of carbon, but because France lacked the abundance of oil and coal. If France was sitting on the Powder River Basin or Barnett Shale, France’s nuclear fleet would be much smaller. The same can be said of the US distribution of energy medium uses in the various states. There is an abundance of hydro plants in the North West and coal plants in the Appalachian area because of the resources there. If there were significant coal in Washington and huge hydro opportunities in West Virginia, they would be promoting each other’s current concerns. A national energy policy would have to be careful to not pick winners, but to support the individual states and a national goal of energy security.

Energy is too generic and covers too many topics for too many people. A discussion on a particular medium and form is required for people to understand the topic. However, the fact is a global market for thermal uses have grown. The domestic surpluses of the electric form of energy have been consumed. US society is slowly changing from a thermal to electric form of energy. This is seen in electric vehicle to telecommunicating. The growing abundance of our gadgets from laptops to tablets to phones has increased our dependence on electricity vs. thermal.

In addition, the mediums of energy are being used in different forms of energy versus historical norms. Natural gas typically was used in thermal form of energy, but is now being more used in its electric form. Coal to liquids could become an option as coal plants are being shunned. Renewables offer a competitive option to not only substitute electric mediums, but could be used to substitute thermal forms of energy. In order to use energy productively we need to cross over the various forms and mediums to develop an optimal path. More people who have experience and knowledge in multi-energy forms and mediums need to be developed.

The cross overs are very hard. I have consulted with Oil & Gas companies to let them know the future of their largest demand source, but several don’t like to understand the regulatory nuances. I have tried to discuss with utilities the dynamics of the gas business, but several don’t like the market risk and the need to change. I have also consulted with renewables institutions and companies. I did serve on the National Renewable Energy Laboratories (NREL) technical advisory team. The issue I saw at NREL is the limited commercialization focus and the limited appreciation of the other fuels. They did a wonderful job in the technical world for renewable, but to see how it was going to enter the market space you have to understand the current investments.

In the end, the convergence will be made and those standing in resistance or blissfully ignorant will likely be left behind. A convergence in the various forms of energy and the mediums has become inevitable. A larger holistic approach to energy planning is needed not just on a national and state basis, but in individual companies. Companies who consider themselves an Oil & Gas or Electric Company should rethink their models and their plans.

Energy is a means to many ends. The energy sector serves society not the other way around. If we do develop a national energy policy, let us hope the developers remember that. States with abundant mediums of energy should think about using the energy. To export the energy medium to only buy back the medium in another form of energy is not optimal for the state economy. Optimal economic benefits occur from productive uses of energy not exporting energy mediums. This is one reason Nations (e.g. Venezuela, Libya, Mexico, etc..) with huge oil resources fail to progress as they do not come up with productive uses of energy and in the end purchase back their own energy mediums, but in more expensive forms.

Let me end with a Thank You! I am grateful for my past in order to have the current moment. I wish each and everyone a wonderful and enlightening 2014.

Your very grateful and humble Energy consultant,

David K. Bellman