Power Industry Challenges – Strategic Threat

The power industry is the most capital intensive industry. This capital intensity was one of the key factors in regulating the market. Centralizing a large unit lowered the cost significantly even though transmission and distribution cost would be increased. The irony is we now build units such as wind that are more expensive and also cost more in transmission and distribution cost. In addition, we have de-regulated the generation piece of the business in several markets. The de-regulation experiment is bound to have some significant failures as the ends may not be great enough to justify the means. Society is use to capacity being built when market prices return a 10-12% return. However in de-regulated world returns would need to be commensurate with the risk. High capital cost in addition to volatile uncertainty in commodity and policy would require a 20+% return. In order to get such a return the prices in the market will likely be at levels that brownouts and rolling black out occurs at peak time periods. Society will not deem this as acceptable.

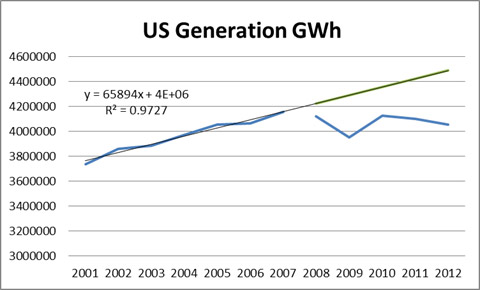

The weighted average age of all the plants in the US is 28 years old. This means somewhere between 10 and 30 years from now 600GW will need to be built assuming NO load growth. If we add 1% load growth over the next 40 year we are looking at an additional 100GW. The total investment for just the generation piece will be around $700 billion.

This comes at a time when utilities are bleeding in the nation from lack of load growth. Load growth is the key revenue line item for utilities. Projects and investments are based on assumed load growth and rates are adjusted to represent the revenue requirements. When load does not grow as it didn’t for the last few year, revenues dramatically fall and rates will need to be adjusted up to account for the expected load growth which did not appear.

Based on the expected trend before 2008, utilities load drop has resulted in a loss of expected revenue around $140 billion.

In addition, there are so many other initiatives beyond generation that are on the shoulder of utilities. This includes Environmental controls, Smart grid, Demand side management, Conservation, Efficiency, Renewables / Feed In Tariffs, Carbon, Pension obligations, Jobs support, Transmission, and Distribution investments. If you think the ages of plants are old distribution equipment is much older.

All this added cost points to higher rates for the consumer. Rates can only go so high before society revolts and/or the business model of the utility folds. This issue becomes a strategic threat.

Please do consider All Energy Consulting in helping you assess your strategic risk and understanding the future of the energy markets.

Your Energy Consultant,

614-356-0484

Twitter: AECDKB

Study vs. Advocacy – Wind Generation

I recently came across this “study” – The Net Benefits of Increased Wind Power in PJM – done by Synapse Energy Economics for Americans for a Clean Energy Grid. Based on the information on the website from their website they seem to be a very credible organization. However I think the “study” shows that they are smart enough to manipulate the setup and presentation to create a document to their client’s desire. The study became an advocacy piece and those calling it a study better review it first.

The first alarm bell from any study requiring a model, particularly the power markets, there needs to be back test of the model. They should show the back cast results and prove the model is ready for future applications. The main mechanism to show the impact of increasing wind actually was beneficial was to start the analysis with a draconian setup and to guise the result under a delta impact of 2026. By pushing the analysis to 2026 they were able to state a capacity setup which does not exist and will likely not exist, thereby making a delta analysis potentially more positive. Below table shows the current PJM resource mix (http://www.pjm.com/~/media/documents/reports/2012-rtep/2012-rtep-book-2.ashx) vs. the proposed 2026 setup by Synapse.

|

Installed Capacity GW |

||

| Synapse 2026 | PJM Current 2012 | |

| Wind |

32 |

1 |

| Gas |

123 |

54 |

| Coal |

18 |

73 |

| Nuclear |

34 |

34 |

| Hydro |

3 |

8 |

| Other |

42 |

11 |

| Total |

252 |

181 |

I will agree to the direction of the reduction of coal, but the extent is far from reality. First, there are 37 GW of coal assets with scrubber installed in the last 5 years. Do you think utilities spend a billion dollar not to recover their assets over a longer time period? In addition in the planning queue for scrubber installation I see 12GW of coal. I suspect not all of those will install, but compared to the 18GW Synapse is assuming to be left in 2026 because it doesn’t pass the sanity check.

By starting at the reference point at a system that is already expensive, makes it very easy to conclude wind generation is better. Another advocacy maneuver was to have wind generation at such high levels 36+% compared to NREL own assessment for many of the PJM states in the upper 20%. Besides the output, I would be curious to see the wind shapes they used to and whether they are close to industry standards or biased.

I could go on and do more analysis, but I think my concerns thatI have addressed are sufficient to make the conclusion the report is more advocacy than study. It is ashame they went that direction. I believe the assessment done by NREL that wind costs are coming down is real and will have an impact for more wind. I also believe solar impacts will be larger than stated in this study, but this would likely not support the initiatives set forth by the Americans for Clean Energy Grid as most of the members are wind centric.

I don’t think I would be a good advocate. The numbers drive me. However I am open to latitudes of probabilities, but those probabilities must sit inside some reality. I suspect over time people would want to deal with people who don’t just color the picture how you want them to, but actually consult with you to make better decisions. At All Energy Consulting we promise to offer you real consulting minus the advocacy.

Your Energy Analyst who paints it like he sees it,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

Shale Gas Bashing Gone Wrong

There are some very poor “journalism/reporting” on the internet. Businessinsider.com seems to be getting worse. I give them credit for being good entertainment at times. I usually just laugh and scoff at the poor articles and move on. However this latest attempt of journalism/reporting hit home with me – 12 Reasons The American Energy Boom Is Totally Overrated . I didnt read Michael Levi’s book that may have sparked this. I believe Michael would have been more logical and less sensational than BI, given I do follow Michael’s work.

The biggest oversight is the fact the low natural gas price over the last few years have allowed the population to have much more disposable income. This is very simple math as I showed in my previous blog I did last year in January. In that blog, I showed at least a savings of $193 billion dollars. Adding 2012 figures into the analysis total savings are now $283 billion. One needs to remember energy is just a MEANS to an end. Having energy by itself is worthless. Therefore anything to reduce the cost of the means adds directly to the benefit of society.

Let me go graph by graph and refute and/or elaborate where they should have.

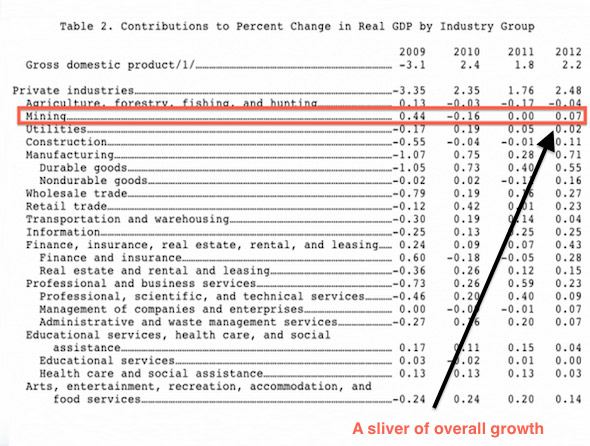

BI:“According to the BEA, the U.S. mining sector, which includes oil and gas production, contributed a measly 7/100ths of a point to the 2.2 GDP growth we saw in 2012”. Please don’t just focus on what they are highlighting, but notice the largest item of growth is manufacturing. Having lower cost power and more disposable income allows this gain.

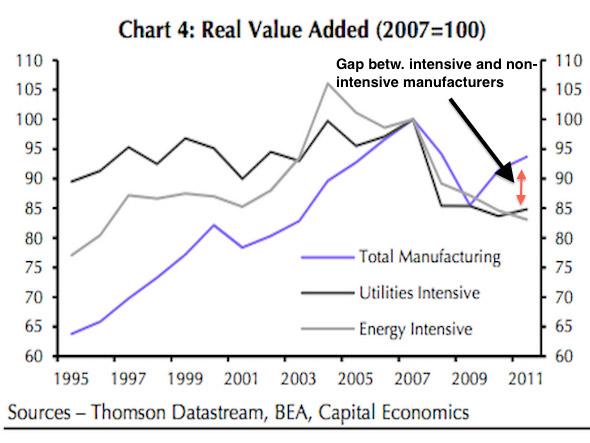

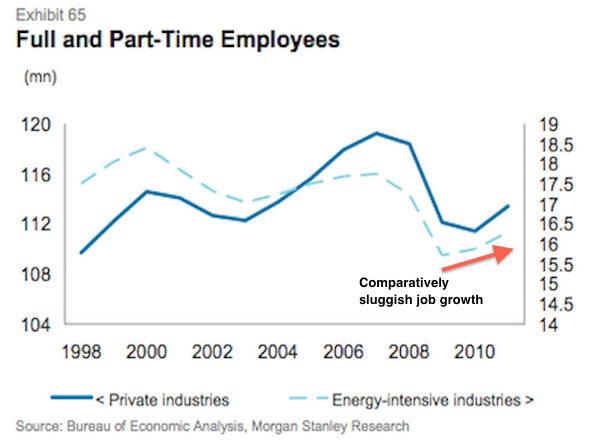

BI: “Energy intensive industries are adding about 10% less value than all manufacturers.” Energy intensive industries take many years to develop due to their large capital investments needed. It is not reasonable to expect the uptick in the energy intensive sectors first. As pointed out in my blog my first year point of shale impact started in 2008. The graph above shows only to 2011 – hardly any time for people to believe and put billions into a project requiring low gas prices.

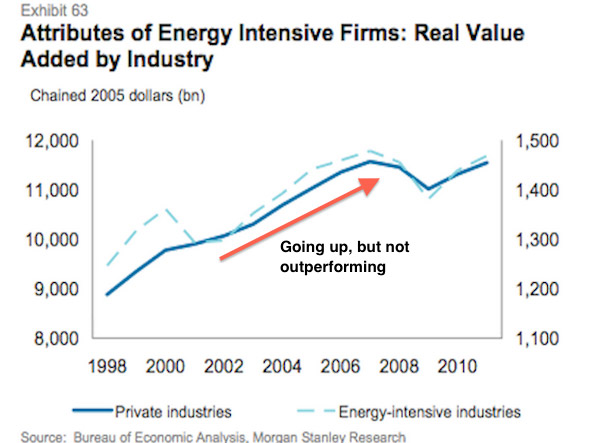

BI: “Relative to the rest of the economy, the energy intensive industries aren’t outperforming.” My response would be similar to the point above. The graphic is even worse since only up to 2010.

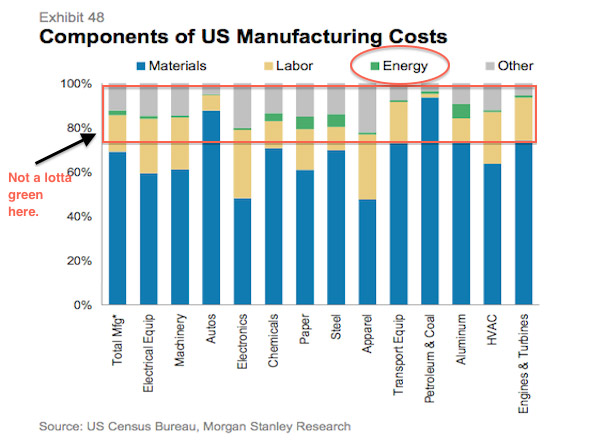

BI: “Energy comprises just a tiny 2% of US of manufacturing costs.” There is a multiplier effect for energy cost in manufacturing. Materials are clearly a large part of manufacturing. How do you think you get materials such as aluminum to make cars? Though Auto, HVAC, Engines, Electronics, Machinery, Transportation, Electrical Equipment shows little energy cost they are highly dependent on the cost of energy per the materials. Materials are not naturally produced as the BI “reporter” would like you to believe.

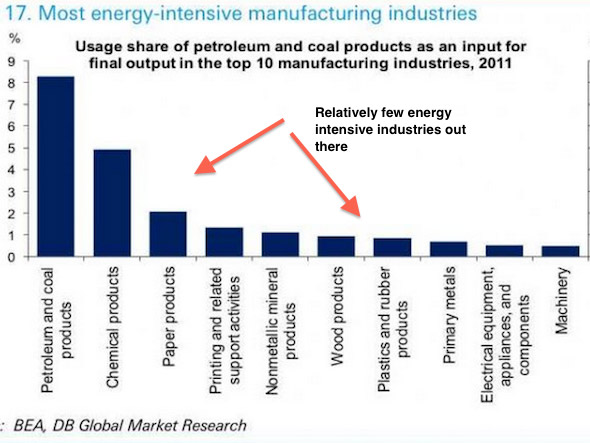

BI: “And only handful of industries are truly energy intensive.” This is a chicken and egg issue. The reason our economy has shifted to be less energy intensive is because of the cost of energy and labor increased relative to the rest of the world. With sustainable lower energy cost there will be a change in the above profile. This is another failure to think and deduce a wrong conclusion. It takes a certain amount of time before energy intensive industries come back, but they will if we don’t mess it up.

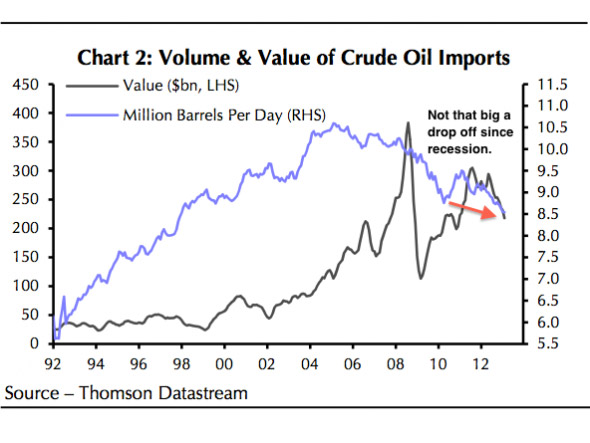

BI: “The volume of petroleum imports have long been declining, and have moved independent of prices.” This is less to do with shale. Shale’s focus is natural gas not oil. The oil decline has more to do with the price of the global oil markets.

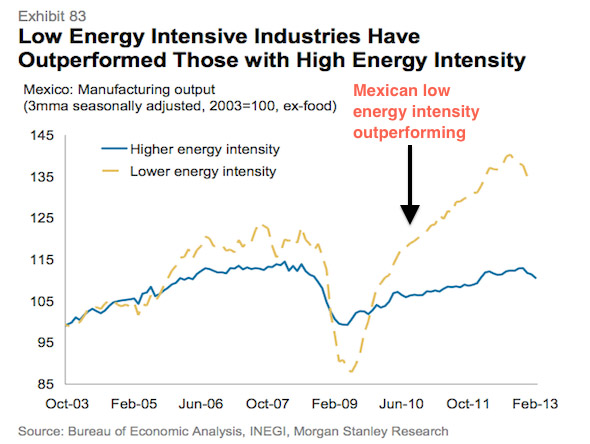

BI: “Mexico has long enjoyed abundant natural gas reserves, but it too hasn’t seen its energy-intensive industries go gangbusters.” Mexico has enjoyed abundant amount of oil also. This has more to do with the political structure and the inefficiencies in their market. Their infrastructure is so bad they import electricity from the US.

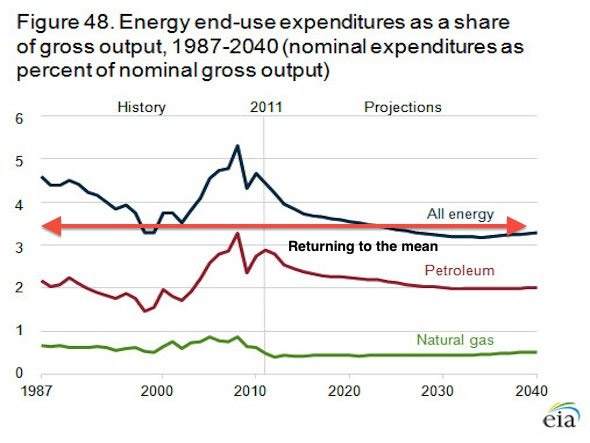

BI: “Energy as a share of gross output has declined to a little over 3%, but it’s almost certainly more a function of oil prices resetting after spiking in 2008.” This is so wrong in so many ways. Half the graph is based on a very poor forecast. The EIA forecast models I have debunked several times on my blog. Just because an agency says something doesn’t make it so, particularly since you can look at their old forecast and see they have a poor track record.

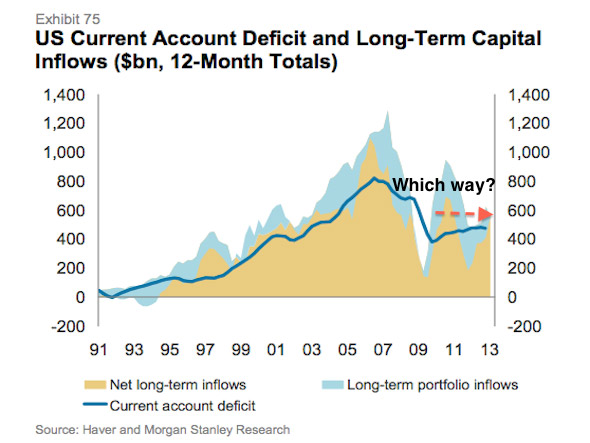

BI: “America’s current account deficit is narrowing, but Morgan Stanley says it’s unclear whether energy will have a material impact on this.” I don’t see this supporting the stance that shale is not impactful. In addition the own statement of “unclear” they should have left it out of the analysis.

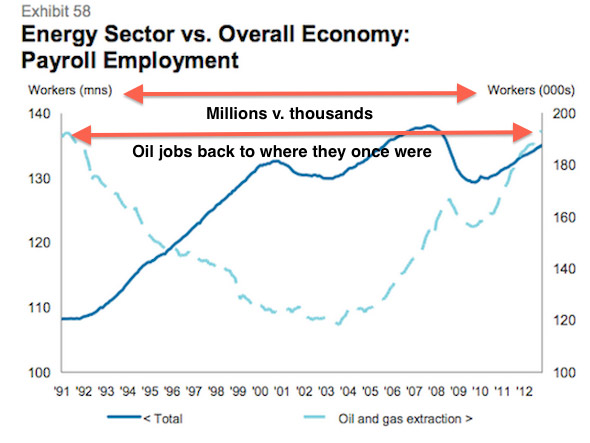

BI: “Employment in the oil and gas industry is less than 1% of the national total, according to Morgan Stanley.” Employment in the oil and gas industry is not the target. As noted energy is a means to an end. You use energy because it allows you to do something. The cheaper the energy the more things get created.

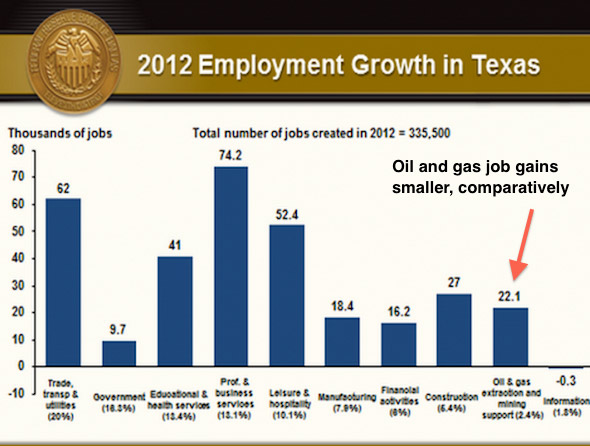

BI: “Even in Texas, the oil and gas industry and its support services constituted just 6.5% of all jobs.” Why would you want a sector who only allows you to do something be the major portion of your economy? Energy is creator of jobs which should be focused in the use of energy not the finding or developing.

BI: “Employment in energy intensive industries has picked up, but the rate trails that of the rest of the economy.” As I pointed out in many points above, the energy intensive industry takes time to develop given the billions required. A new steel or chemical plant is not cheap. They are assets which will last decades. Making an investment decision takes time to build a sustained belief in lower natural gas price – just few years back gas was forecasted to $8+/mmbtu. The shale revolution is only in its 4th year.

Very funny the next article in BI after this shale article is the SOLAR BOOM! Well, I bet they will discuss how many jobs are created. Once again having an energy source which requires lots of manpower is not something to strive for. Having employment in using energy by creating something to better society should be the goal.

This was a very poor article by BusinessInsider. I hope Henry Blodget does a better job screening. My appreciation for BI has dropped over the past year. The page creation machine will eventually get you if you don’t manage your quality.

Energy is a means to an end. The shale revolution is advantageous to the US if we let it be. I believe carefully constructed regulation and enforcement should be implemented to constrain the bad actors, but we should not villianized a whole sector out of ignorance.

Your Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

Positive Externalities Still Missing in Academia for Power

I was made aware of this study during a dialogue on a LinkedIn group – http://www.aeaweb.org/articles.php?doi=10.1257/aer.101.5.1649 To see the context of dialogue please click here.

There is a huge assumption made by the authors. And that is the current price of power holds all the value of power in it. The authors fail to realize power markets are not based on personal value of power but mainly on power COST plus a fix return – particularly in regulated markets. In de-regulated markets perhaps one could argue to some extent, but I would contend there are no completely de-regulated markets yet. Many markets still have legacy regulated assets in them.

When goods are sold below their personal value (the price someone would pay in order to balance the value they receive from it) many academia market models will fail. First the mere fact a good would sell below their personal value breaks some of the free market model. Typically a good will sell below their personal value because of excess supply and governmental involvement. Clean water is a simple example. The personal value of having clean water is quite high – you get to live and not be sick. We could probably all individually boil water and everyone would probably have different levels of clean water. Or we could have governmental/regulated entity treat water and make it convenient, standardize, and accessible for everyone. Society then pays a price for this which typically is based on COST plus a return not personal value to each individual.

In the case of electricity, the cost of individual electricity production is quite high and dangerous – everyone can’t simply boil water like in the water example. It would have been out of the reach of so many. Therefore the utility model was built – A guaranteed return on investment on a COST basis, so that people may have access to power on a cost effective and safe basis. Once again it is not priced at the personal value that a person is getting from power. Ask yourself if access to power was limited and it was auctioned on ebay how much would you pay and outbid your neighbor? In times of blackout that value is quite high. Certainly worth sacrificing your monthly cell phone, internet, and cable bill since without power the phone, internet, and cable is meaningless. Because electricity is sold at a cost plus basis there exist many positive externalities beyond the simple cost of power. The personal value generated by having electricity will vary by individual. To the simple mundane person who does nothing with electricity, but indulges one-self with entertainment perhaps the personal value caps out at the value of that individuals disposable income. However if we use the authors example of a Berry farmer perhaps that value is much higher.

The author takes a very pessimistic view point of the value of electricity and ONLY views electricity production as having negative externalities. I do acknowledge the negatives do exist, but I am also a political and pragmatic to realize inherit personal value being derived by electricity beyond the cost paid. In the case of the berry farmer example, which they start to discuss on page 5, they only note the negative cost that power production has on the farmer. I acknowledge this does exist. However the gain not mentioned is the availability of cheap power. Clearly the market choice was to take the cheap power and deal with some of the consequences and in return the cheap power will deliver value beyond the cost. For example, it could have enabled the berry farmer to create an electronic packing system which doubles his productivity. If it wasn’t for the environmentally damaging, but cheap generation the cost of electricity may have been out of reach to install and operate this new packing system.

In an ideal world perhaps he could have BOTH cheap power and clean energy, but the laws of nature did not make it so. We can easily create a scenario that the pollution caused from the generation may reduce his production by 20%, but having an electronic packing system more than made up for his losses; as getting his product to market in efficient time before the berries expired was a crucial step. In addition because electricity is available for the masses in relative cheaper cost, more people have more disposable income to purchase berries vs. the 99 cent menu at the local fast food store.

The access of cost effective electricity allows internet and commerce to grow. If we add a global view to it – the berry farm and their access to low power enabled them to be competitive from farmers from S. America. If the cost of power was greater the farmer may not be able to compete. Having cleaner air by itself does the berry farmer no good if his livelihood is eliminated. Clearly the Berry Farmer would pay a lot more for power – particularly in hindsight given all the economic gains he may have not imagined. They simplified the problem too much and focused only on the negatives of generation. There are positive externalities not shown in the price perhaps as much as negative externalities. Both of the externalities are hard to discuss.

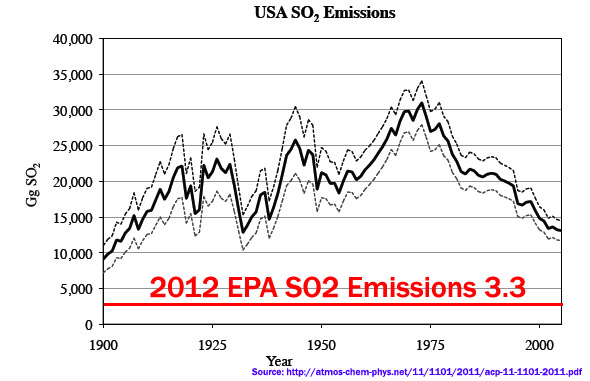

Increasing the cost of electricity could put electricity out of the reach to the common man. At a point, air pollution becomes a subsidy for the wealthy. I would contend the current air standards in the US are suffice for the majority of society if they were given the option to allocate money into either housing, food, healthcare, and even transportation versus better/cleaner air. I do believe the air could be cleaner, it is just a question of priorities. The inverse to the US, I would contend is probably China. The pollution is so bad there that it is at the tipping point that priorities need to shift. It is good to have a job, but if you can’t live very well what is the point. In the US we prioritized the environment later in our industrial revolution. Did you know – US sulfur dioxide emissions are below 1890 levels now!? http://atmos-chem-phys.net/11/1101/2011/acp-11-1101-2011.pdf

When will it be enough? To believe that you have infinite amount of money/resources and can effectively solve everything is not reality. Perhaps we are designed to listen to the squeakiest wheel versus helping the truly needed. The nation needs to prioritize and make some sacrifices. This has been proven over time.

Please do consider All Energy Consulting for your energy consulting needs. We offer well-rounded pragmatic solutions to your issues.

Your Pragmatic Energy Analyst,

614-356-0484