US Refining Margin Outlook Sept. 2012

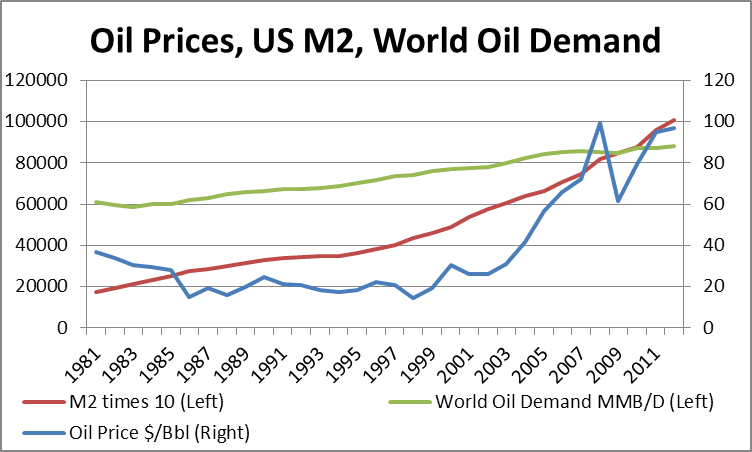

The refining outlook has been impacted by two major fundamental changes in the crude oil market. The first major change is the new crude oil price regime, driven by increase demand from Asia and partially due to global monetary policy from central banks. In relative short time, crude oil markets have moved into the $100/bbl environment. From the 80’s to 2000 prices stayed in the range of $20-40/bbl.

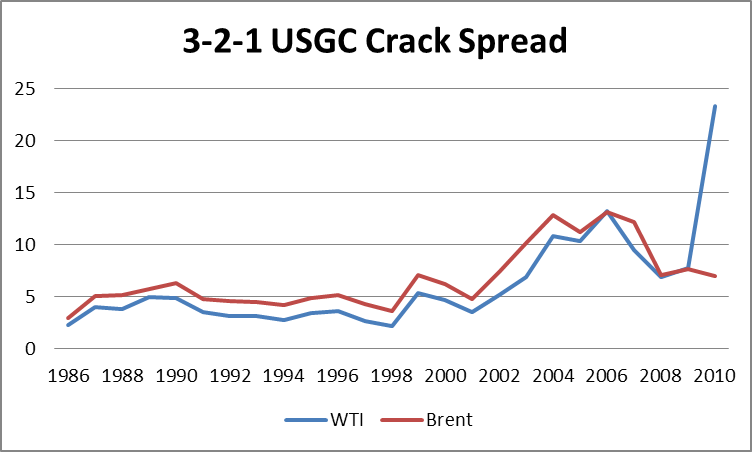

Since 2003 oil prices continued to climb and only very recently have settled into a range $80-100/bbl. Given the much higher crude oil prices, refining margins seen in the 80’s to 2000 will likely not be comparable on an absolute basis. On an absolute basis the current margins would be deemed as historical by multiple factors.

A certain amount of the WTI crack spread can be attributed to the current disconnect between WTI and the USGC, which represents the product part of the spread. The difference in the WTI crack spread can be attributed to the region – Cushing, Oklahoma – existing infrastructure. The WTI – Brent Spread is producing a historical discount to Brent. This is translated to the WTI – LLS spread, to a lesser extent.

However, this spread is not likely to exist for a substantial amount of time since the arbitrage to move oil to the USGC can easily be solved/monetized through investments in pipeline. This is already being seen in the reversal of the Seaway pipeline which will increase flows from Cushing to Gulf Coast from 150,000 bpd to 400,000 in 2013. In addition, there are several other discussions from the TransCanada Gulf Coast project.

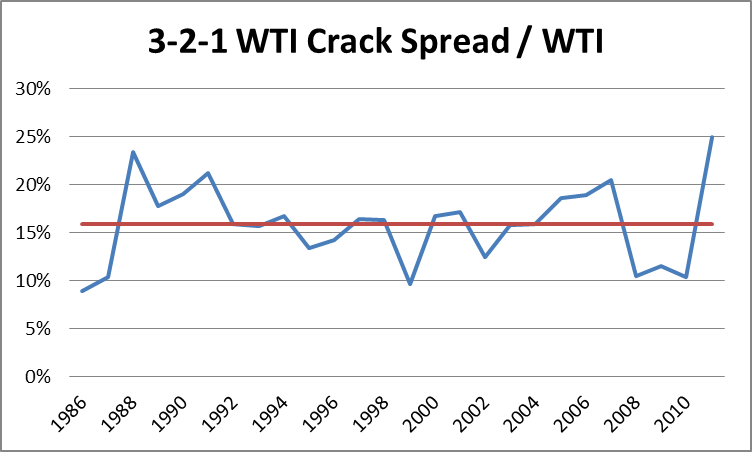

Besides the local issue with WTI, Brent and LLS are still showing a rather high absolute refining margin compared to history. This portion is attributed to the elevated price of oil which is producing a larger absolute refining margin. In economic sense, it is rationale to expect a higher absolute value of return as the cost of the feedstock rises. On a percentage basis of the feedstock, the returns are high now, but are not historically high.

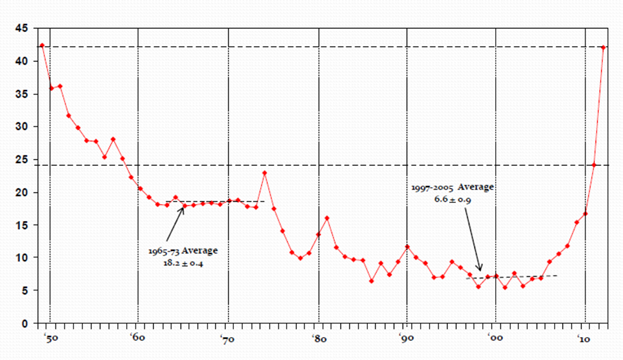

The average percentage of the 3-2-1 WTI Crack Spread / WTI is around 16% from 1986 to 2011. The future should be expected to be around that level with perhaps a chance for it be slightly higher. The rationale for this is the increase level in crude oil prices increases the carrying cost relative to a lower crude oil market. In addition, the higher crude oil price has led to higher volatility. Both of these issues add additional cost that will likely be passed on in the market. In a $100/bbl crude oil market, a sustainable 3-2-1 crack spread for WTI should be around $16/bbl.

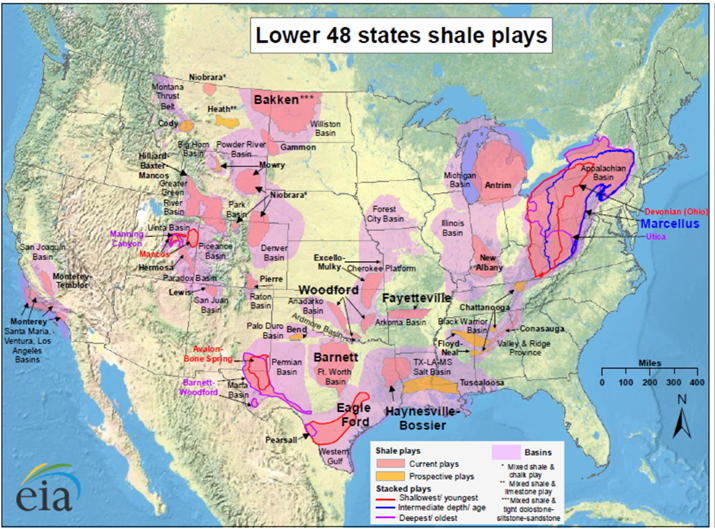

The next major fundamental impact for refining margins comes from the shale gas revolution. As noted by several oil analysts, shale gas has and will continue to significantly alter the energy space. The various shale gas areas are shown in the map below.

Besides the natural gas production, shale gas has added significant volumes of liquids as the shale gas technology led to an increase in extractions of natural gas liquids. The desire for more liquids is due to circular loop. In a circular fashion, the increase in natural gas production led to a lower value in gas, but with oil markets being strong the spread between oil and natural gas is the highest since 1950’s. This has led to increase focus on liquids rich shale gas plays.

US Oil price divided by Natural Gas Price

The drive for shale gas is currently been driven by the liquid value. Natural gas plays by themselves are not very economic with the current natural gas price. However adding the liquids economics justify some of the decisions to continue to develop gas fields – see figure below.

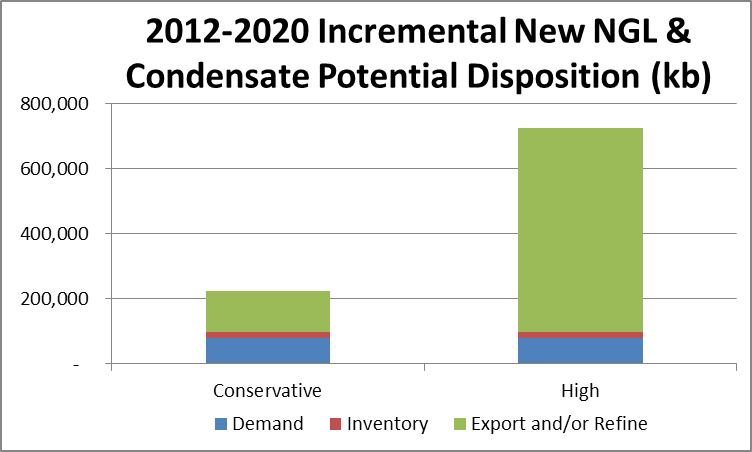

Based on the various USGS surveys and production trends, the liquids from shale gas should amount to an additional 400,000-2,200,000 bpd by 2020 with most of that volume needing to be exported or refined. A recent Morgan Stanley report evaluated the Eagle Ford and expects over 600,000 bpd of oil production by 2013 versus the current level of 170,000 bpd. Currently the Energy Policy and Conservation Act of 1975 (P.L. 94-163, EPCA) directs the President to restrict the export of crude oil. This will put pressure on US condensate prices and giving price advantages to US facilities that can process the condensate.

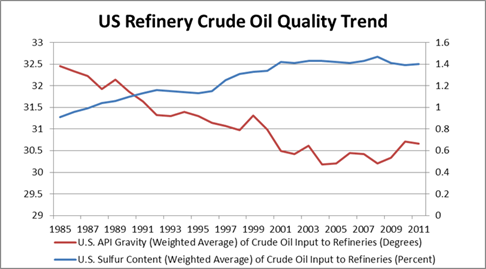

The volume of liquids from the shale gas play is not significant to change the overall oil markets over the next few years. However the volume is significant in terms of the impact on the quality differential. All of the liquids from shale gas represent a category of light sweet oil – API >40 and Sulfur <1%. This has caused a dramatic shift in the oil paradigm. For the greater part of the last two decades it was common theme to consider the crude oil slate to become heavier and higher sulfur. This caused the refinery industry to believe a successful refinery is one with size and technology in order to convert the heavier crude oil. The light-heavy differential was expected to widen significantly putting simple refineries out of business. However shale gas revolution with its exclusive light liquids is reversing that trend in the US.

The impact of the lighter crude oil will be bringing a simple refinery back into positive economics. In addition, without the large spread in light-heavy crude oils, highly complex refineries can actually be put in negative economics given their high variable cost. This is partially responsible for the Aruba and Hovensa refineries closing down. Both of those facilities are designed to convert heavy crudes from Latin. America. In addition, those refineries are dependent on oil for its energy whereas all the gulf coast refineries can rely on natural gas.

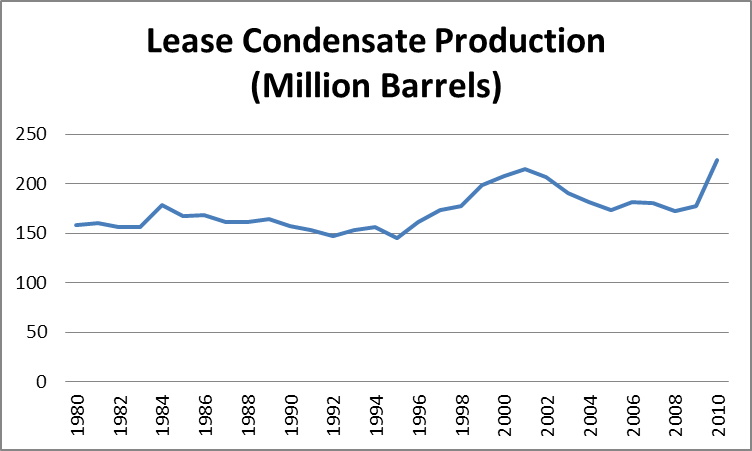

The impact of the liquids can be directly seen in the drop of imports from light oil greater than API 45. Beginning in 2011, the imports of crude oil greater than 45.1 API fell by over 100 kbd.

This drop coincides with the increasing domestic production of lease condensates. Lease condensates as defined by the Energy Information Agency (EIA): A mixture consisting primarily of hydrocarbons heavier than pentanes that is recovered as a liquid from natural gas in lease separation facilities. This category excludes natural gas plant liquids, such as butane and propane, which are recovered at downstream natural gas processing plants or facilities.

I believe the two fundamental shifts impacting the refining industry, higher crude oil price and increase in lighter feedstock, is sustainable for some time period (5+ years). The US economic solution is fixated on continued quantitative easing. With M2 currently producing the highest correlation for crude oil prices using data since 1981 – R^2 ~0.6 vs. world demand R^2 ~0.5 – high crude oil prices ($80+/bbl) will likely continue into the future years. Shale gas production is not likely to cease, given the high value of oil products and the cost of production being around $3-5/mmbtu on just a natural gas basis. Liquids rich plays will continue to be found and produced. The combination of these fundamental shifts will result in higher absolute refining margins. The recipe for a successful refinery will be modified from size and technology to refineries able to minimize operating cost, given that the complexity advantages have eroded with lighter feedstock.

Higher resolution graphics are available upon request. Presentation with Q and A are also available. Please do consider All Energy Consulting for your energy consulting needs.

Your energy analyst,

David K. Bellman

614-356-0484