Renewables No Impact with Low Oil Price – False

The belief that low oil prices will have no impact on renewable is very misguided and optimistically biased. The practical reality is the path of renewables will be altered with continued low oil prices. Many of those focused on renewables, having nothing to do with oil, are focused on the power sector being isolated from the rest of the world. It is a true statement that renewable generation is likely less costly than oil generation even at $50/bbl. However, in the power sector, the competition is not with oil directly but with natural gas and coal.

The coal market benefits when oil prices are low as transportation can make up over 50% of the end cost of coal. The natural gas markets may results in higher prices as economics of some oil field gets reduced, thereby, reducing the associated natural gas production. However, this may lead to more focus on natural gas finds versus oil finds increasing gas production. At best I think the impact of low oil prices on natural gas may only slightly increase gas prices.

Given renewables connection to electric generation, the amount of renewable will be highly dependent on the amount of electric demand. Also one of the largest mechanisms to de-carbonize came from the conversion of vehicles to electric vehicle as renewable generation offered a potential zero carbon source. Therefore, one of the largest anticipated sources of electric demand in the future was going to come from electric vehicles. However, with low oil prices, this makes the economics of mass electric vehicle adoption very unlikely.

In most cases, the economic break-even of electric vehicles vs. gasoline vehicles requires gasoline prices north of $4/gallon. More likely it would be north of $5/gallon given most of these economic analysis were based on a huge advantage of gasoline vehicles paying for the road infrastructure. This is unsustainable once EV vehicles grow in usage – eventually the road tax will be collected from EV vehicles. Nonetheless $4+/gallon prices are now diminishing in probability as oil price remain below $100/bbl. With low oil prices, this transition to electric vehicles will be limited. In order to transition, a much larger carbon price will be needed which will not likely be politically sustainable. The sacrifice for saving a potential disaster may just be too high for society.

Low oil prices will limit the ability for renewables to grow in the energy mix. The portability of energy is superior in petroleum products relative to any other forms of energy including batteries. This physical attribute of petroleum will require a monetary mechanism to allow a switch to greater renewable forms of energy. A rising crude oil price with transportation north of $4/gallon, and with an expected small impact of carbon allowed many to discuss the potential of a zero carbon system. However, with the recent changes in oil prices and potentially a protracted time period below the $100/bbl mark, many dreams of the zero-carbon world are likely shattered.

The energy markets are intertwined. High oil prices lead to greater opportunities for change. A low oil price supports the status quo. Renewables can continue to grow with current societal goals within the power sector – but the potential will be so much less now than when oil was north of $100/bbl.

Your All Forms of Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Oil Market Outlook Change – Too Low Demand Expectations

BP released their 2015 Energy Outlook. As noted by their Chief Economist this is not to address prices or near term events. However, price, in the end, is the meat of a discussion for an energy outlook as price and outlook for supply and demand are intertwined.

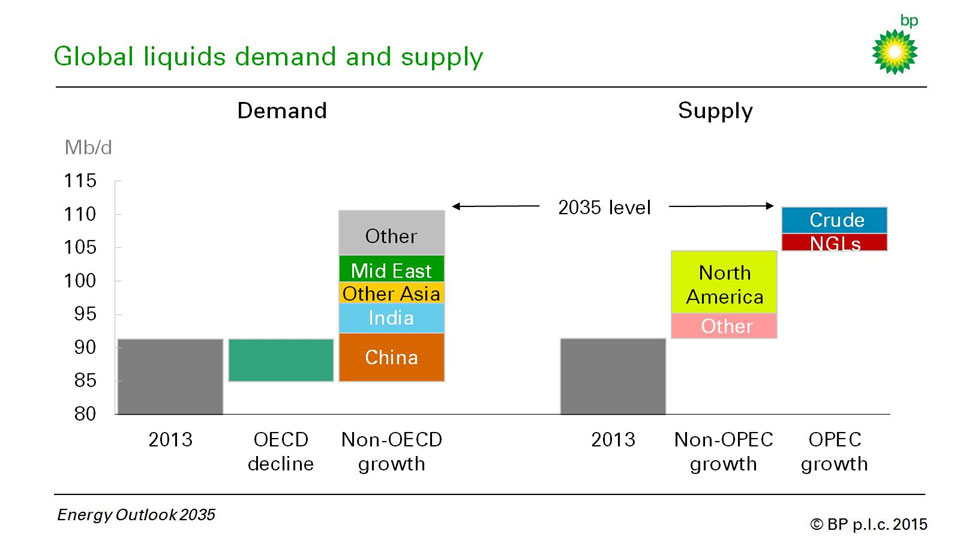

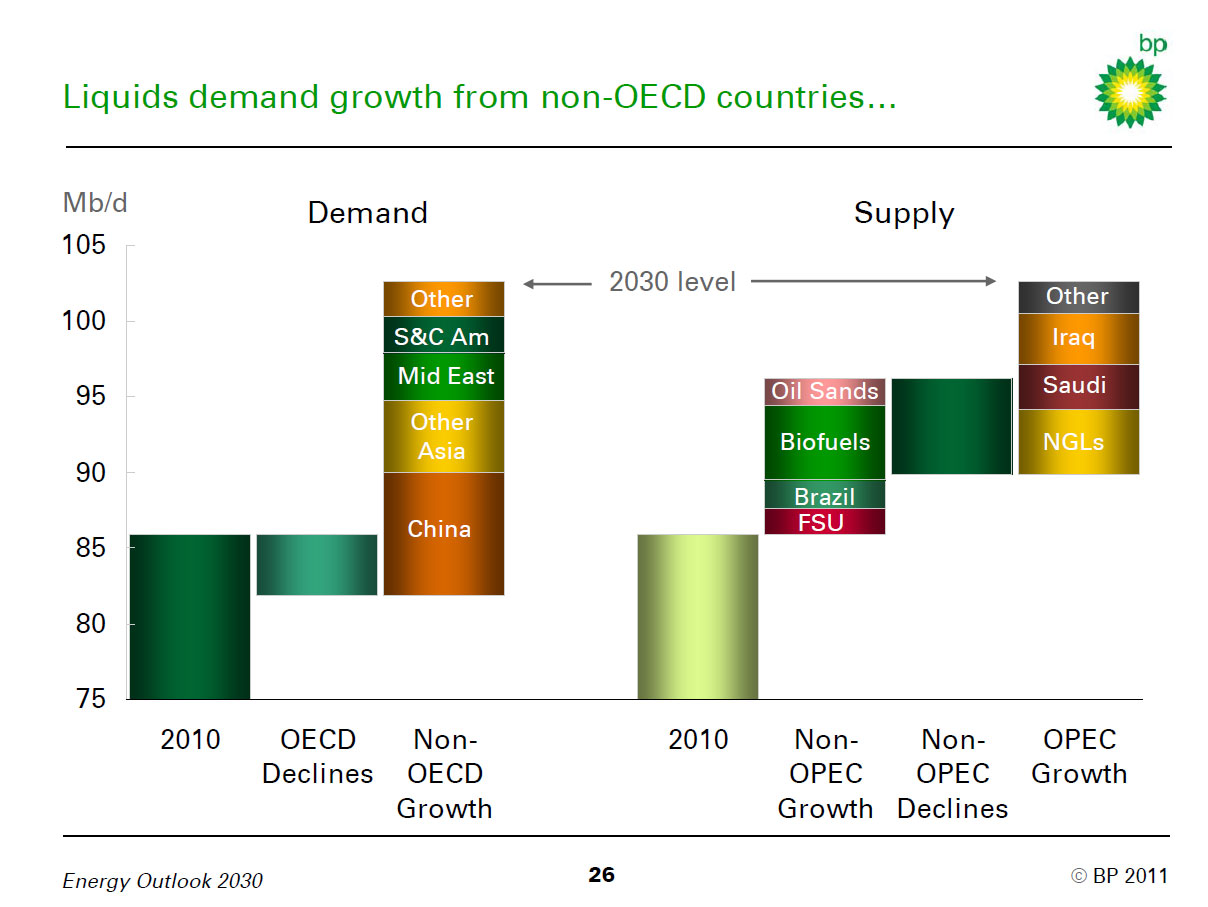

The outlook by itself is useful to gather facts and trends. The real value for someone like me comes from the change in the outlook. In theory, the process of formulating these outlooks should not change. Therefore a change in outlooks signifies a change in market place expectations. The best slide in reviewing the change to show the dramatic shift in expectations is slide 13 in the presentation. The latest forecast for 2035 shows a very small call in OPEC <5 million barrels/day see figure below.

If we go back into time and look at the very same slide in 2011, we see the call for OPEC in 2030 (even less demand requirement given 20 year gap vs. 22 year gap in current forecast) amounts to over 10 million b/d. This is a dramatic swing see figure below for 2011 BP Energy Outlook.

IF one believed in the process and the forecast output, the shift between the two forecasts would dramatically drop the expectations of crude oil price. As a longtime forecaster of the crude oil markets, the call on OPEC is key component on price forecast. This piece of the puzzle represented the additional swing from OPEC who, in theory, purposely holds spare capacity to sustain a reasonable market level. With the need of OPEC being diminished, the overall pressure for oil prices to move upwards is limited.

Obviously, BP cannot state or present a price view given its role in the market place, but if their trade floor was made well aware of this trend and believed it, they would have made a good call over the last year. However, the long-term aspect of this trend does not bode well for BP as a company. In fact, the overall energy sector would not benefit from this including renewable energy and refining industry.

The demand side also shows some major shift in expectations. In 2011, the expectation for China oil growth was nearly 10 million b/d more than the base year (2010). Now expectations have fallen to around 5 million b/d from the base year (2013). The interesting outcome of this is whether BP flowed back the price response from the expectations of lower prices per the lower call in OPEC to the response of China demand. To lose 5 million b/d would require a much lower expectations of GDP outlook, in addition a very inelastic response to the price of oil is needed to maintain such a drop in demand. OECD demand decline is nearly the same – yet the price expectations from 2011 to 2015 must have dropped.

From my experience, the demand piece is typically the flawed portion of the forecast after coming off a major supply shift. Supply can be well understood in terms of cost of development and potential technology improvement curves. It is my belief that the demand outlook presented is too low. The expectations of this come from both the price feedback of consumers and the fact that the demand side has included a significant portion of efficiency improvements over the past few years.

Efficiency improvements do not lead to reduce consumption of a commodity without a continued price increase. This is supported by the Khazzoom-Brookes postulate and Jevons Paradox. My caveat to the theory is to add the price component. Improving efficiency of a commodity leads to more use of that product without a corresponding price increase. I also expect this with electricity as we make up for the large efficiency improvement by having more devices and more appliance than we had a decade ago, even though, a single appliance may be 50% more efficient.

I do not expect our human desires to have a car that is faster and bigger to be different by region or time. Corporate Average Fleet Efficiency (CAFE) improvements have and will result in near-term gasoline demand improvement in the US, but eventually with the falling prices and the improved efficiency improvement the auto manufacturer can produce an SUV with mass appeal and size that can go 0 to 60 in few seconds yet offer 25-40 mpg. Auto manufacturers who ignore this trend will be left in the dust as was seen last time SUV sales outsold compact vehicles. This move to this larger and faster car will swallow the small vehicles leading to overall growth in oil demand while maintaining the CAFE standards.

This mass appeal will also eventually migrate to other areas of the world. The ability to stop this rebound is the corresponding price. In the oil markets that seems to be muted as expectations of price is likely between $50 to $100/bbl and not rising over $100/bbl for the next decade or so. Power markets may thwart the rebound given the trend in transmission and distribution cost, but this will be highly dependent on the region. Obviously adding a carbon tax would increase the cost curtailing the demand.

Please consider All Energy Consulting for your energy consulting needs. We offer a unique and fresh perspective on the energy markets to help you succeed

Your Fundamental Supply / Demand Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Eagle Ford What Are You?

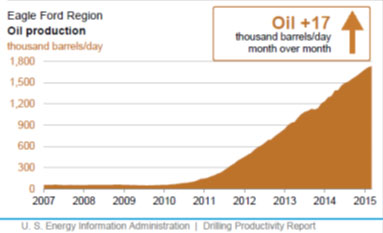

“May the real Eagle Ford stand up” is another title I was thinking for this article. As I get ready to launch Oil Market Analysis,one of the areas I have been focusing in is the condensate issues in the Gulf. In particular, the production from the Eagle Ford region – see figure below.

There is much discussion on this production being mainly condensate. Condensate is a crude oil – just a really light crude oil. A common unit of measurement for the density/gravity of the crude is API. The higher the API, the lighter the crude oil becomes. Some consider 45+API to be condensate. Most condensates are also extremely low in sulfur – very sweet. To put it into context LLS is around 36 and WTI is around 41 API. There is an issue in being too light – but you can never be too sweet (such is life). Your product yields will suffer particularly in the No. 2 cut (Diesel, Heating Oil, and Jet). Also being so light, in a refining region not expecting this trend, causes operational issues that can be addressed overtime given the right pricing incentive.

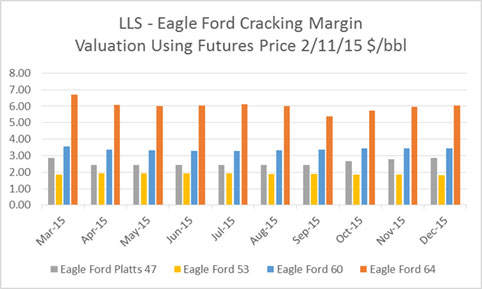

I have gathered 4 different assays of Eagle Ford. They range from 47 to 64 API. Platts own price marker methodology notes the range of assays from 40.1-62.3 . They settled upon a 47 API. They also note the cut range used and I adjusted another assay to reflect the Platts assessment seen in the figure below. The other interesting thing to note is there seems to be an Eagle Ford and an Eagle Ford Condensate marketed. This may explain the large variance. However, regardless of the marketing, the value of your Eagle Ford as a refiner can swing significantly. Below is the cracking value of the various Eagle Ford assays relative to LLS from our USGC cracking model, from our Oil Market Analysis Platform using the futures market strip on 2/11/15.

Cracking valuation models are strictly based on the yield and product value. This does not take into account the logistic issues of having to truck condensate, which could easily add another few dollars to the discount of Eagle Ford. The model does take into account the quality issues for both octane and sulfur. Having run and managed the South Louisiana Quality Bank, crude quality can have significant ramifications. Declaring a label of Eagle Ford, given the variations of quality, will likely not mean much. Contracts dealing with Eagle Ford will have to have quality specifications and processes to deal with variations.

The largest driver among the various assays is the amount of diesel and jet produced. In some assays, we produce too much light ends, making a limited amount of finished gasoline and left with Naphtha. This drives the discount seen in the Eagle Ford 64. Increasing the reformer capacity is needed.

To deal with the lighter crudes, more reformer capacity will be needed along with greater alkylation. The octane values from these lighters crudes are not high, at least from the data I have. The discount to Eagle Ford will come in some, over time. This will not be due to the ability to export the crude oil. The export market is expected to be ultra-competitive when it comes to condensates (discussed at a later time). There will be operation issues in the US as refiners adapt to the new feedstock. These issues could include needing to run your crackers less; thereby, likely impacting heat balances. However, these are solvable engineering issues, given an economic incentive. The infrastructure of Eagle Ford is being built out. This will lead to a reduction in discount as the transportation cost is reduced. Eventually the market will see a uniform stabilized Eagle Ford blend. Until then, pay attention to your quality specifications in your contract and hopefully leave room for adjustments.

By the way, I will be speaking at the Platts 4th Annual Refining Convention in May – See agenda. I will be addressing the issue of condensate and NGL’s in the market and what we can expect to see in terms of market forces in the future. I hope to see you there or even sooner. Please do consider All Energy Consulting to help you in the crude oil and refined products market space.

Your Crude Processing Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Capacity Market and Updated Performance

For our followers, we have a link to our complete thought piece published in Public Utilities Fortnightly – February 2015 Click Here. In this article, we examined the capacity market. For those tired of all the numbers I present, this piece is focused on explaining and presenting a concern with the latest adaption of capacity markets. There are limited numbers in this discussion. This is not an anti-capacity market article – nor is it a very supportive article on where the capacity market is going. The major underlying concern is we are developing a market with limited downside for participants, but leaving major upside to them. If this is the case then why not consider re-regulation. Please enjoy the thought piece and I look forward to your feedback.

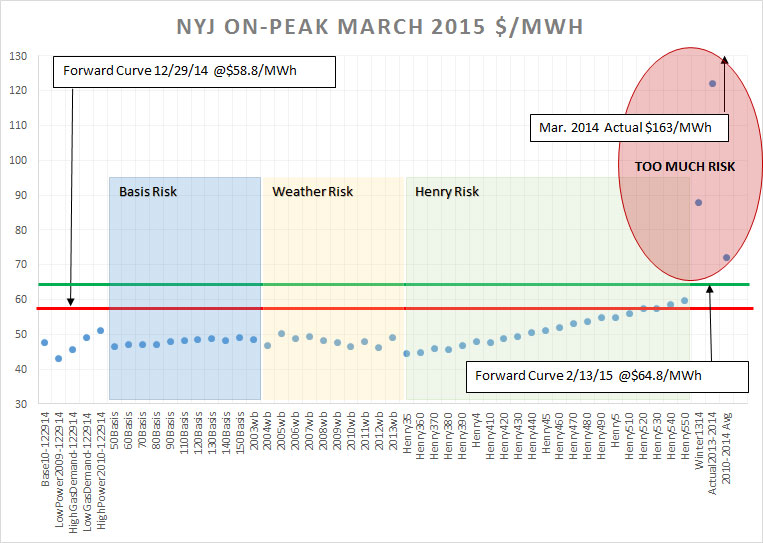

On another note we have updated the results of our December trade strategy screener – click here to see the results. The amazing performance continues with the December strategy producing the most calls and all but one lost money (Sell March NYJ On-peak 2015). The one that lost probably would not have been suggested if we applied one more layer of analysis – see below figure. Using a historical screener and running our weather risk of last year, we see the risk was likely too great to put a NYJ ON-Peak March sell.

We will continue to show and track the performance of the model in the pdf. Our clients were presented the strategy two weeks ago. This time the model only has two recommendations for April.

We realize this platform can be used beyond enriching power traders so we have expanded our offering to help End Users evaluate their power purchase. Please review our presentation that shows how All Energy Consulting can help End Users navigate the complexity of the power markets. No other energy management nor energy providers offer such in-depth analytical capability to let you know what impacts particular events may have to the power markets. We can really quantify the future power market risk to help you make an informed decision. This is a state of the art dispatch model with in-depth industry experience applied not just some historical price analysis typically done for the sector. We will collaborate with you to create an optimal strategy balancing your budget and energy needs.

Please help us help you! Call now before it is too late 614-356-0484.

Your Trying to Help You Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Case Study on Using Analytics to Save Money for Ratepayers

The origin of Power Market Analysis (PMA) was for power trading. However given my experience in all facets at one of the largest utility in N. America – American Electric Power – I knew the use of the knowledge of the power markets extended beyond enriching power traders. With the growth of deregulation and development of regional transmission organization (RTO), the power market has evolved as a legitimate option for power generation versus self-generation for utilities, municipals, Co-op, energy providers, and large consumers.

The power market is fascinating to me as compared to the stock market or other commodity markets as it offers a market that is pure. The power market has limited storage opportunities producing a fundamental convergence immediately not many months from now. The ability to manipulate the markets has situated from the rules of the market not the market itself.

Many utilities have only touch the surface of the power markets as they still largely depend on their own generation. This is changing as many baseload plants will be retiring over the next several years. In addition, dependence on renewable generation will lead to greater market reliance as intermittent issues are real. I have put together this case study to demonstrate and calculate a real dollar impact to the ratepayer if one can better account for the risk in the future market power prices. PMA cannot forecast the future in terms of weather, commodity prices, outages, etc… but it can let you know how much each of those variables can impact the market. This knowledge allows an informed decision on evaluating the option of using the future power market as part of your generation mix. In addition, this analysis gives you a firm and reasonable support for your decision making removing the stress from Monday morning quarterbacks. Many people understand there is much uncertainty in future events; however one should not leave decisions to chance or just assume futures markets represent reality – we can do better than a flip of a coin.

Please enjoy the case study and I look forward to your comments. CLICK HERE TO DOWNLOAD CASE STUDY – Case Study on Using Analytics to Save Money for Ratepayers – Beyond a Flip of a Coin

Your Energy Analyst Looking to Help You Succeed,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Renewable Cost Dropping – Impact to Resource Planning

A very good report on renewable cost is supplied by IRENA – Renewable Power Generation Costs in 2014. The absolute price numbers presented are hard to confirm, but the trends are likely undeniable. Most of the report is based on Levelized Cost of Electricity (LCOE). I have noted LCOE is not the best metric given the structure of the electricity market per my old article in 2012 (which, by the way, is the most popular page on my website for the last few months – not sure why, but it is). IRENA did note the issue with LCOE in their report.

The results from this report lead to implications that go beyond the obvious that renewable cost are coming down and potentially being very competitive with fossil generation. The first implication is the fact a report like this will lead to significant second guessing and planning work by resource planners.

Price discovery and the realities of renewable projects should be made transparent. IRENA report notes cost is very dependent on location. In states or local areas with renewable mandates with incentives, an open platform for project submissions should be created given ratepayer subsidies. Developers, ratepayers, utilities, and government officials should be able to access this site. I noted this in my article with my concerns to Senate Bill 310 in Ohio. There was an advance energy requirement in SB 221 which was removed per reasoning that there was a lack of projects under the guidelines of advance energy. My main concern with SB221 was the failure of the legislation to enable the commission to regulate and enforced the targets set forth. An enabler could have been budgeting and creating an open bidding platform promoted and managed by the state for advance energy projects. The platform would remove the concerns of pricing and the availability of advanced energy projects. This is beneficial to all parties. The utility removes the second guessing of the market place. Ratepayers and the commission know the project premiums and the depth of projects available. The cloak of the “evil” utilities preventing renewables will be removed with an open bid platform for advance energy. Cost produced from reports like IRENA will quickly be confirmed or denied. There is no need for commercial secrecy and competitive advantage when the ratepayer is willing to subsidize and potentially pay a premium.

The second implication from this report is to realize utility scale projects saves money. The report shows utility scale vs. residential PV produces a savings of over 50%. This savings not only comes in scale of projects, but by the utility cost of capital and other business intrinsic properties. Utilities should move into the PV space as Tucson Electric Power has done. There is no doubt a utility can drive more installation than a private company given the correct leadership and vision.

The third implication is the need to revisit biomass opportunities. Biomass generation’s ability to operate more closely to traditional resources offers significant operational advantages over wind and solar. The cost from this report indicate the premium for biomass is in line if not more favorable than many wind and solar projects. Many coal plants are making the conversion to gas. However given the trends and technology improvements in biomass a serious option to consider is the conversion from coal to biomass or even co-firing. The initial biomass projects in the US were a disaster in many cases. However, as with anything new, sometimes it takes a few failures to become a great success. The ratepayers should be equally willing to pay a premium for biomass as they do for solar and wind.

A final implication I will discuss is the subsidies applied to renewable generation. According to the IRENA report all their numbers represented cost without subsidies. Perhaps subsidies need to be removed from the most developed forms of renewables (e.g. wind) and the subsidies rolled down to other advanced energy forms. Advanced energy initiatives can be consider as insurance to the unknown of the future. As a society, we should be able to realize paying an insurance premium at a certain level is reasonable. Legislatures and commissions need to work to establish that reasonable level. Progress from anything new will come with some failures, but we must learn from these failures and move forward. The trend in falling prices from renewables was stimulated from government mandates. As generally a libertarian, this claim is hard for me to make, but being a realistic libertarian one realizes the system is not free to begin with therefore ideal principles cannot always work in an unideal environment. Utilities in their design are quasi-governments with limited competition. Stimulating the renewable investments from government mandates were likely necessary to achieve the fall in prices being observed. Much credit still must be given to the market players who took advantage of the mandates and delivered the cost improvements. It is my hope that at some point the subsidies and mandates will not be needed and we will have the capability to remove them. History is not our friend on subsidy removal. The agriculture industry still sees subsidies developed from the great depression. Even though our economy has shifted from agriculture, we continue with huge subsidies for farms no longer owned by families, but large corporations. Common in today’s political climate, we accept corporate welfare much easier than we accept social welfare. The reason for this is likely the effective capability of recycling corporate welfare dollars to the political process. I guess corporations are people to – right (Citizens United vs. Federal Election Commission)?

All Energy Consulting examines all the areas involved in energy and works hard to be open minded to the changing landscape. Please do consider us for your consulting needs as we are here for your success and have a proven track record of successfully identifying the paradigm shifts.

Your Continually Advancing Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB