Condensate Economics Explained

Introduction

As discussed in my previous article, the Oil & Gas Industry, producers in particular, are trying to export condensates. The industry has recently gotten some exemptions, and perhaps this may lead to more. As noted in the previous article, this may not be the best policy decision for the US economy. Constraining exports will allow the entrepreneurs and innovators to find ways to use the feedstock more effectively domestically. This will then create better economic multipliers versus shipping out the feedstock. The restrictions do put an additional downward price pressure on the producers, forcing them to sell at more of a discount in order for the US refiners to take the condensate. However, the condensate will be sold at discount regardless of the export rule as explained in more detail below.

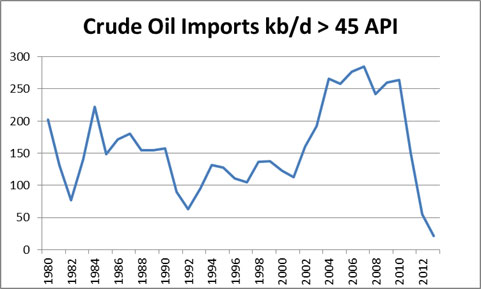

The producers believe they can sell the feedstock more effectively in the global market. This is yet to be proven. Overall Condensate is not very valuable in terms of product yield relative to most crude oil. The US has already displaced a significant volume of international condensates which was being imported to the US as seen in the figure below.

A large percentage of imports above 45 API are condensate. The dramatic drop off is due to the explosion of condensate in the US from fracking, thereby displacing the imports that were coming to the US. Wherever condensate goes, it will still have to compete on global basis plus shipping and the poor product yield. In fact, condensates yield a lot more gasoline than diesel and jet when refined. Diesel is the primary product in the rest of the world compared to the US, which is mainly gasoline.

There is lack of economic pricing discussion on condensate, including my previous piece. This time I will present the economics of condensate to prove the points that condensate exports will not likely result in economic gain for the US. The very first thing is to understand basic refining economics. I am working on a new multi-client product – Oil Market Analysis (OMA). The first part of OMA will involve an oil refining index model. This daily product will track and calculate the value of various crude oils through various refining configurations. I am using the initial results from the model for this discussion.

Analysis

There are three major configurations for refining – hydroskimming, cracking, and coking. Each of them is progressively more advanced and costly. Advancements come in two forms

1. Increasing yield of products vs. residual product

2. Increasing capability to process heavier and more complex crude.

A good presentation on the various configurations can be found from Statoil. From their presentation, they expected increasing complexity requirements from refineries. The US refineries also believed this, and as a result have caused this predicament – too much condensate without an optimal home.

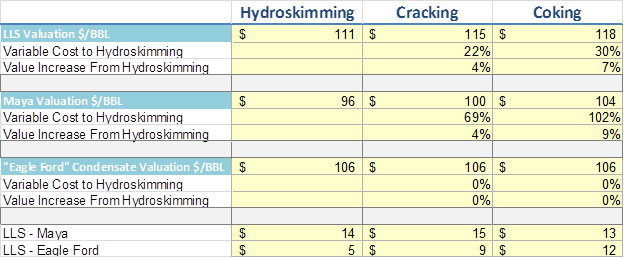

Running OMA refining model for the USGC Light Louisiana Sweet (LLS), Maya (Mexico Heavy Crude Oil), and Eagle Ford Condensate shows the following result in each configuration using the average USGC 2013 prices for Gasoline, iso & normal Butane, Jet, Propane, Diesel, Naphtha, Residual Fuel Oil, and Petroleum Coke. The value is essentially the revenue minus the variable cost obtain per barrel of feedstock. If LLS was processed in a cracking refinery, in the USGC they could expect $115/bbl of revenue per barrel. LLS averaged $106/bbl in 2013 – therefore a USGC refiner running LLS should have produced a margin of $9/bbl. This is not weighted nor optimized. An optimized refiner should have been able to extract more margin through better inventory management, purchasing, and offering a broader product suite.

Takeaways

Increasing complexity increases the variable cost of the facility – largely energy cost. The value of increasing complexity is more apparent when the crude oil is heavier. LLS is 66% lighter than Maya. “Eagle Ford” Condensate is about 277% lighter than Maya. Therefor, light crudes such as condensates cannot benefit from the increase complexity.

Refineries do not get much value from processing condensate as seen in the table above. Refiners are likely asking for significant discounts relative to LLS in order to process the condensate. The marginal refinery in the USGC is the cracking refinery. Given this market dynamic, the market should have priced the condensate around a $9/bbl discount to LLS. IF the export market marginal refinery unit is a hydroskimming, then perhaps a $5/bbl discount is possible. Given the shipping cost, the discount to condensate will still likely be greater than $7/bbl, even if exports were allowed. It is possible to create a mixture of heavy crude oil and condensate, thereby creating an optimal blend for cracking refinery to be cost competitive with a coking refinery. This could reduce some of the discount for the condensate. This would be a more sustainable path for delivering maximum value vs. trying to export the condensate. In addition, market forces would likely create a mechanism to capture the condensate discount. Many have turned to splitter projects. I don’t believe splitters would be a sustainable solution. Splitters will just flood the market with more unfinished product,s e.g. Naphtha. Naphtha prices are already under so much pressure. Naphtha eventually will have to be processed to produce finish product.

Conclusion

In the end, exports may reduce the discount to Condensate by a few dollars. Those dollars will not likely show back up as a significant saving for the US consumer. The producers will benefit the most from the ability to export and find market arbitrages. The many that chose to do splitter projects will likely not fare as well as the feedstock discount may not keep up with unfinished product decline in prices. The condensate discount will likely continue to be greater than $7/bbl relative to LLS. There is still room to formulate a better refinery blend and even expand the US refining capability by adding a condensate refinery. (I do know a 80,000 b/d condensate refinery that can be brought back to life for $800 million in 18 month time projected IRR 30+% – email me if you are interested)

Please do consider All Energy Consulting for your refining market analysis. We have many years of practical experience and now offer a dynamic market refinery model. Please email me if you are interested in hearing more about Oil Market Analysis (OMA) – [email protected]

Your Digging Beyond Skin Deep Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Good overview.