It’s not the end of the world – Climate Change& Quantitative Easing (Printing Money)

I have wanted to write about the similarity between the two most potentially transformative societal issues confronting us, Climate Change & Quantitative Easing (AKA Printing Money). Of recent the latest debacle in a spreadsheet error by Rogoff and Reinhart in their paper “Growth in a Time of Debt” has led my writing astray. However this issue further substantiates the similarity. I am sure my readers know that there was also an issue with climate change data. The most famous was the hockey stick graph presented in the IPCC report. The graph originally came from a report done by Michael Mann in the paper “Northern Hemisphere Temperatures During the Past Millennium: Inferences, Uncertainties, and Limitations”. (One difference is the climate change titles are much longer than economic papers!)

Though the recent debacle includes a simple spreadsheet error the biggest difference from what was reported to what is being challenged by Thomas Herndon, Michael Ash, and Robert Pollin is based on how one treats data and what one excludes or includes. Mr. Herndon and team believe since more data was available for other countries they should be weighted more no matter the differences in economy or time period. Many of the same arguments were made to refute the Mann graph. In the end, BOTH data sets from Mann and Rogoff can be presented to be less dramatic than what both authors presented. However in BOTH cases it does not eliminate the issue that both have presented. In Rogoff case, Mr. Herndon and team state and their own data shows that high debt does not likely lead to better outcomes relative to a lower debt situation. The Herndon and team did conclude there is no magic number that leads to a NEGATIVE growth. However they do note that growth is much less than it would be when debt levels grow above the 90% level. In Mann case, one could argue the graph he presented was on the high-end of uncertainty but the end message no matter what statistical approach you use there is some warming relative to the last 1000 year perhaps just not as dramatic as Mann’s graph.

We can ignore both the issues just because of some technicalities and potential showmanship or we can pay attention to these both very critical points because they contain some probability. We can argue to death to the extent of probability, but there is some threshold that action becomes required no matter what. I believe we have crossed that threshold a while ago in both issues. In terms of actionable items I am not as extreme as some could be since everything is a probable outcome in my mind. Actions need to be commensurate with the probability and timing of the impact. And both issues probability and timing may change as more information and responses are made.

Getting back to the discussion of similarity, both are issues that rely on sacrifice of the future for the current state. Clearly it is “easier” and “cheaper” to continue to burn fossil fuel versus transform the economy. The consequences may be dire, but they are many years off. It is also easier and politically more appealing to increase the money supply driving investments now and have the savers and the future generation deal with the pain later. In each case one could argue we don’t really know the future and perhaps even solutions in the future we cannot predict now will come to fruition. However I would attest that is very poor planning.

There are measures we do each day thinking of the future. Some are simple and have been engrained in society – such as buckling up. We buckle up because it can save our lives. The odd of getting into a serious car accident in your lifetime is 30%. I am not arguing for you not to buckle up, but to show we do act when probabilities are not as great along as the action can be commensurate with the risk and its probability. I am sure you can find many climate deniers to admit there is a 20-30% probability they are wrong – of course that means they are 70% confident it is not. Nonetheless this would argue for action at SOME level if one cared about the future.

Both climate change and quantitative easing are actions that are not apparent at the moment similar to indulging on funnel cake and other unhealthy foods. It feels good now but eventually you will likely get obese and have health issues not worth the gains gathered from the near term enjoyment of sweets. In fact, it will typically be better to emit and print money now. The ultimate consequence of each of them requires a view over many years if not hundreds of years.

On the point of obesity, it clearly shows society is not ready for problems requiring long-term thought. Obesity in the US is very high. This is a matter of caring about what you eat and the long-term issues involved with your choices. We are a society designed for Carpe-Diem and keeping up with the Jones. It may be quite pointless to argue the science of climate change and/or long-term impacts of quantitative easing when society could really care less. It amazes me to see such low savings in both general and retirement savings. So much of society is living on debt. By that logic people don’t really focus on the long-term. I can see somewhat the rationale for many religions to eliminate interest charges – usury. Most religions are focused on maintaining/reducing our vices – e.g. Ten Commandments. I think they realize debt living is not healthy. Living on debt makes you feel good in the moment, but any day it can overwhelm you with a change in your life. A humble lifestyle is too easily gone with the ability to borrow money. We cannot solve these two very large issues without changing society to think longer term. If people do not care about their own lives and cannot plan even their meals to live healthy, do we really expect them to be able to comprehend and plan for climate change which impacts us significantly in 100 years?

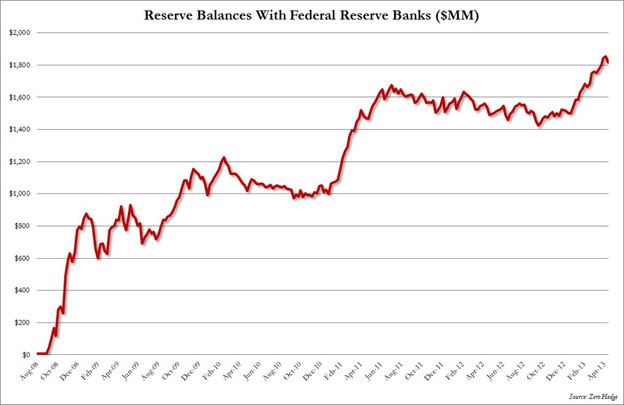

Climate change to me seems more tangible and more discussed with various opinions across academia compared to quantitative easing. This may be based on my career largely in the energy space. However I do read quite a bit and find much more literature on climate than quantitative easing impacts. Climate change certainly seems to have much more historical data with ice core samples thousands of years old. The oldest data set Rogoff and Herndon was working with was 1830. Given this I thought I put some graphs up from various recent reports just so you see why I am alarmed with quantitative easing even though the “market” is doing well.

We are in a world so dependent on debt and fossil fuels. Current trends on climate change and quantitative easing cannot be changed until we change the mindsets of people to think ahead. Planning is gone for Carpe Diem. I like the concept to live for the moment, but what if the next moment depends on how you live in this moment. Do you want more moments? We do not live in Hollywood we live in reality. Please take care of yourselves – eat healthy – do not over-extend your finances – reduce the temptation to keep up with the Jones.

The world will not end because of climate change and quantitative easing. However the world could be very different and potentially less inhabitable and stable if we don’t start dealing with some of our issues which require thought. The probabilities of significant harm to society may not be significant (+50%) but given the extent of outcomes it does make it worthwhile to do some actions similarly as we buckle up.

Your very concerned and thoughtful Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

Revisited Post – Coal is not Dead!

Coal is not dead as I pointed out in last years post – https://allenergyconsulting.com/blog/2012/04/11/the-demise-of-coal-overstated/

I am sorry I am late in publishing my blog. Life is catching up on me. For a quick blog I thought I review what I wrote around this time last year. It was good that I was right. Gas prices have significantly firmed up relative to last year – in fact they have DOUBLED!

As I pointed out in my blog last year, much of the downfall can be attributed to the weather. There is some attribution for weather again for the move up. This years winter was cold relative to normal. Global warming this year took a break – unfortunate for those in Ohio. We actually had a freeze warning last week! Nonetheless, as I expected, prices of natural gas price rose from their extreme low. Even if winter was not as cold but normal, I am sure gas would be still north of $3.75/mmbtu.

The fun thing to watch this year will be spot prices of coal. I suspect we will see firming in the spot prices as I expect many coal generators given their pain over the past few years under contracted the amount of coal they will actually consume. This may not present itself till after June/July given they are right now suspecting weather could save them.

I am still working on my piece of Global Warming and Quantitative Easing and their similarities. Just like the hockey stick issue that occured in Global Warming – looks like there is a hockey stick issue for QE in academia – http://www.forbes.com/sites/realspin/2013/04/18/that-reinhart-and-rogoff-committed-a-spreadsheet-error-completely-misses-the-point/

Please do consider All Energy Consulting for your energy consulting needs. The blog has documented our general outlook. As you can review my blog we are quite prescient of the future as it pertains to energy.

Your very Prescient Energy Consultant,

David K. Bellman

614-356-0484

Refining in the 21st Century Part 2

Part 2: Where do we go from here….

“It is far better to foresee even without certainty than not to foresee at all.” Henri Poincare

It is very important to ponder the implications discussed in Part 1. There is quite a bit of uncertainty but one should not give up the process of predicting. The very process of forecasting can gain you immense knowledge even when you fail miserably. Forecasting takes time and humility. Very similar to wine if you keep at it – like I have been – it will be much better over time. And like a good cellar – having a consultant, like myself, guiding you through the process, your wine will come out better and require less aging.

Subsidies are being removed in many regions with the intent of going to market based pricing. However monetary policy has not changed and will not likely in the near future. I believe we will continue to be priced in the $100/bbl range plus or minus $20/bbl. There is a chance with economic destabilization, prices may fall somewhat; but I suspect it will be temporary as printing becomes the only acceptable way to avoid pain.

Given this new elevated pricing of $100/bbl, we expect to see healthy absolute margin with the return on feedstock falling to around 16-18% rate of return. This, coupled with lower requirements of refining complexity, should allow many smaller refiners to prosper.

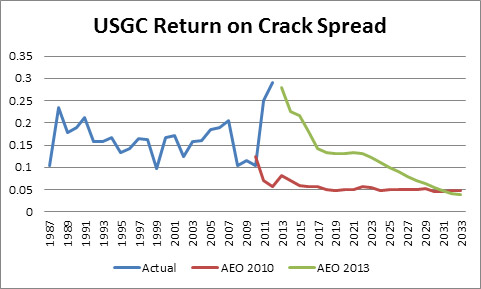

There is no doubt that there is a systematic issue with DOE/EIA models of the petroleum market – see below graph. The model wants to revert back to an historical level of absolute margin forgetting the business/economics side. The risk is not commensurate with a 5% return if we use the crack spread as a guide to returns. The AEO 2010 was wrong and I suspect the final AEO 2013 will be wrong. Being wrong is inevitable, but the level of error is too large to be acceptable. They have not learned from their errors which is key component in successful forecasting. Question everything! You drive your model not the other way around. Common business understanding would likely lead a model to produce a retirement cycle when returns fell below 10%, and then a rebound in returns as the market responds to loss of refining capability. Hopefully oil pundits stay away from this type of modeling.

As noted in the previous blog, there are some very interesting inter-relationships worth pondering for the future. I have given a general assessment of the future and even though I believe in knowledge sharing, there is a pragmatic side of me that requires me to hold back some information in order to balance my business side. If you were to send me an email with a business email and a description of your business role I will offer an additional write ups with graphs detailing a “base” case projection.

It is quite intentional to see that part 2 is much briefer than part 1. As a forecaster, one should spend a lot more time understanding the past and the inputs going into your model. The forecast stands on the past understanding and is the marginal output of all your work.

Your Pragmatic Energy Analyst,

614-356-0484