Eagle Ford What Are You?

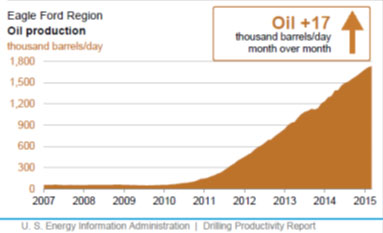

“May the real Eagle Ford stand up” is another title I was thinking for this article. As I get ready to launch Oil Market Analysis,one of the areas I have been focusing in is the condensate issues in the Gulf. In particular, the production from the Eagle Ford region – see figure below.

There is much discussion on this production being mainly condensate. Condensate is a crude oil – just a really light crude oil. A common unit of measurement for the density/gravity of the crude is API. The higher the API, the lighter the crude oil becomes. Some consider 45+API to be condensate. Most condensates are also extremely low in sulfur – very sweet. To put it into context LLS is around 36 and WTI is around 41 API. There is an issue in being too light – but you can never be too sweet (such is life). Your product yields will suffer particularly in the No. 2 cut (Diesel, Heating Oil, and Jet). Also being so light, in a refining region not expecting this trend, causes operational issues that can be addressed overtime given the right pricing incentive.

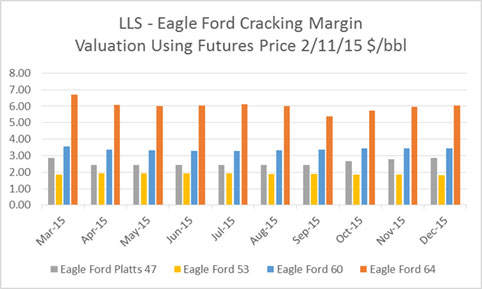

I have gathered 4 different assays of Eagle Ford. They range from 47 to 64 API. Platts own price marker methodology notes the range of assays from 40.1-62.3 . They settled upon a 47 API. They also note the cut range used and I adjusted another assay to reflect the Platts assessment seen in the figure below. The other interesting thing to note is there seems to be an Eagle Ford and an Eagle Ford Condensate marketed. This may explain the large variance. However, regardless of the marketing, the value of your Eagle Ford as a refiner can swing significantly. Below is the cracking value of the various Eagle Ford assays relative to LLS from our USGC cracking model, from our Oil Market Analysis Platform using the futures market strip on 2/11/15.

Cracking valuation models are strictly based on the yield and product value. This does not take into account the logistic issues of having to truck condensate, which could easily add another few dollars to the discount of Eagle Ford. The model does take into account the quality issues for both octane and sulfur. Having run and managed the South Louisiana Quality Bank, crude quality can have significant ramifications. Declaring a label of Eagle Ford, given the variations of quality, will likely not mean much. Contracts dealing with Eagle Ford will have to have quality specifications and processes to deal with variations.

The largest driver among the various assays is the amount of diesel and jet produced. In some assays, we produce too much light ends, making a limited amount of finished gasoline and left with Naphtha. This drives the discount seen in the Eagle Ford 64. Increasing the reformer capacity is needed.

To deal with the lighter crudes, more reformer capacity will be needed along with greater alkylation. The octane values from these lighters crudes are not high, at least from the data I have. The discount to Eagle Ford will come in some, over time. This will not be due to the ability to export the crude oil. The export market is expected to be ultra-competitive when it comes to condensates (discussed at a later time). There will be operation issues in the US as refiners adapt to the new feedstock. These issues could include needing to run your crackers less; thereby, likely impacting heat balances. However, these are solvable engineering issues, given an economic incentive. The infrastructure of Eagle Ford is being built out. This will lead to a reduction in discount as the transportation cost is reduced. Eventually the market will see a uniform stabilized Eagle Ford blend. Until then, pay attention to your quality specifications in your contract and hopefully leave room for adjustments.

By the way, I will be speaking at the Platts 4th Annual Refining Convention in May – See agenda. I will be addressing the issue of condensate and NGL’s in the market and what we can expect to see in terms of market forces in the future. I hope to see you there or even sooner. Please do consider All Energy Consulting to help you in the crude oil and refined products market space.

Your Crude Processing Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Good analysis from the refiners’ point of view.

The export definition of condensate has recently been clarified by the Bureau of Industry and Security, part of the U.S. Department of Commerce, and it is not related to API numbers. Your readers could be interested: http://www.molten-group.com/news/us-exports-of-condensates/