Best of Market Insights 2014

To my readers, clients, and prospective clients,

I appreciate your feedback throughout 2014. The year 2014 will be remembered as the year of discovery for All Energy Consulting (AEC). An identity for AEC had to be discovered – better late than never. I know I had to work more on delivering my value proposition to you. I have spent so much time on developing products/services plus analyzing markets I lost sight of delivering this message. You will see an enlightened AEC moving into 2015. Our value proposition to my readers and prospects will be clear. I want to share the current thoughts on this in our Branding Positioning Statement:

“For those who need forecasted energy commodity prices, we are experienced market analysts who assist in the navigation of uncertain energy markets with a proven process and methodology, and a collaborative approach in consulting that yields clarity, transparency and empowers decision-making.”

You will see a change in 2015 with a clear direction to support the statement above.

Below are the best of market insights in 2014 rated based on web statistics – page views and downloads.

Your Very Grateful More Focused Energy Analyst – Happy New Years!,

David

614-356-0484

Best of Market Insights 2014:

– With the most page views (60K+) –Peak Energy – Are we there in the US? This is very surprising. Perhaps this is a result of peak oil conspirators or just an error in the web stats. The article uncovers the decoupling of the economy with load in several areas in the US.

– Excellent Returns Were Produced From PMA Summer Model Predictions This article highlights the performance of the generic PMA model for the summer. PMA correctly highlighted the hype from Polar Vortex bleed into the summer forwards. Also should read theBest Winter Trade which yielded 30%.

– Ready for March Gas Demand? Duke’s Merchant Coal Plant Value This article demonstrated PMA flexibility to not only help create risk-adjusted forward curves but also calculate natural gas demand and do specific power plant analysis. We also highlighted our agility with the ability to deliver results within 24 hours.

– US Refining Margins Outlook Sept. 2012 – Wow. An oldie had nearly 20K page views. This article highlighted that condensate production was going to change the markets and that US refining margins will be robust for years to come. Well it was an UNDERSTATEMENT – even though I was probably one of the few analyst mentioning the significance of condensate in 2012 the production of condensate blew past my old outlook. US Refining margins were and will be robust! See 2014 US Refining Outlook

– Most downloaded (403 downloads) – Summer of 2014 Analysis – I threw the kitchen sink and all into this analysis. If you took the time to really digest all of the information in the report you would have been prepared for what transpired in summer 2014.

The Clean Power Plan is Unconstitutional – Straight Up!

A flurry of comments has been made on the Clean Power Plan proposed by the EPA. Some of those comments came with actual study results behind them. The ERCOT study presents similar results based on my paper published in Fortnightly in the October issue. Texas will likely see a carbon price/cost somewhere between $20-$30/ton depending on the effectiveness in the building blocks described in the plan. I do try to make it clear in my paper, the biggest issue is not the cost, but how that cost is distributed among states.

The one comment making the headlines, which personally resonates with the paper I wrote, is by Harvard law professor Laurence Tribe – The Clean Power Plan Is Unconstitutional. In essence, I discuss this constitutional concern, but arising from the state’s economic pain. In my paper, I demonstrate the disproportional economic impact among the states and I actually run a sophisticated power model to do the mathematical calculations of the individual state impacts. Mr. Tribe paper is more eloquently focused on the constitutional merit by saying “… such federal commandeering of state governments defeats political accountability and violates principles of federalism that are basic to our constitutional order.”

The significant rebuttal to Mr. Tribe is his monetary gain from Peabody Energy, the largest private-sector coal company. I will not present arguments for Mr. Tribe’s potential bias or honor, but I will note my work on the Clean Power Plan was done with ZERO, NONE, NO monetary gain – to the dismay of my family finances. No one commissioned or paid or has paid for my work done on Clean Power Plan. I took time out from my schedule which was focused on launching my new product/service Power Market Analysis (PMA) to produce the paper presented in Fortnightly. The driver was pure intellectual curiosity and the desire for the truth – per my Alma Mata saying “The Truth Shall Set You Free” Hook’em.

I stand with Mr. Tribe in saying the current Clean Power Plan violates the principles of federalism that are basic to our constitutional order. This is not a debate on the cost or the benefits though there is much to discuss there. I believe the Clean Power Plan sets the stage for changing the political landscape towards a federalism world not supported by the original constitution. For not being a constitutional scholar as such as Mr Tribe, I was hesitant to directly discuss the constitution in my paper. I had to prove the issue through cost pains from various states, which would arise to the constitutional concerns. With such a scholar of the constitution now coming out on the legislation, I would have written my paper with more discussion on the constitutional concerns versus hinting at the issue.

My curiosity continues to get the best of me versus focusing my efforts to grow my family nest egg. I have not written much given I am spending so much time reading and analyzing the “Most expensive regulation ever” claimed by the National Association of Manufacturers. On November 25, 2014 EPA proposed strengthening the National Ambient Air Quality Standards (NAAQS). The proposal is an astounding 626 pages! We need verbage control! The original Clean Air Act in 1970 is 36 pages long. There is a ton of repetition and just plain verbose in the proposal. I wonder if this is a strategy so people no longer read the entire bill. I am half way through as I stop to learn and verify the comments made. My recent curiosity drove me to look at actual improvements in ozone over the last decade. We have come a long way in reducing ozone levels. The New England area has seen 90 days of exceeding the standards in 1983 to under 10 days over the last few years. They should be presenting the efficacy of this effort, but they spend more time on laboratory experiments deducing ozone MAY/CAN/LIKELY be harmful. More to come….

From my family to yours, we wish you a Happy, Healthy, and Safe Holiday season. Please do consider All Energy Consulting for your energy consulting needs.

Your Ever Curious Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Oil Market Doomsayer & OPEC Bashers –Not Putting the Money Up

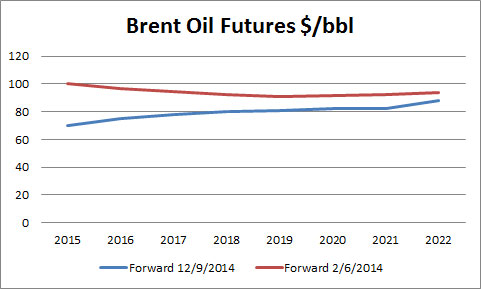

Over the past week, there were so many pundits noting the poor decision by OPEC and that the market will continue to spiral down. As I worked on refreshing my oil price forecast given this market change, the remarkable difference is that there is not much difference in the forward curve. Yes we have a near term capitulation, but extending further into the curve the drop becomes much less. By 2020 the difference can be attributed to the rising dollar valuation.

No doubt, the forward markets are poor predictors of actual results, but they do represent a financial view now. The numerous pessimistic pundits must not be persuasive enough to those with money in hand. As I tried to relay in my previous writing on the oil markets, this is a timing issue. There is little doubt oil demand will grow at some point as population and improvements in standard of living are expected to grow (unless someone believes in Armageddon).

The current situation was inevitable as demand growth was not meeting the supply growth as noted in my previous article. However, in the end, as all fundamental analysts will point out, supply and demand always meet. The price will take care of this convergence.

Oil production will change its path. Oil & Gas companies will take the time to be more efficient and less wasteful versus focusing on the next barrel to be produced. This mitigates some of the decline expectations, but all it will take is a slowing of investment at a shale play to see the production profile change within a year or two.

Oil demand will also change its path. The consumer will consider oil prices to be low given their conditioning of $100/bbl markets. I expect SUV sales to rise as they have done in the past when oil prices dip. The developing nation is also getting a break and they will take on more demand.

I know many of us are trained now to be immediately responsive given our access to Twitter, Facebook, and other always connected social media devices but this is not how the energy markets operate. Aberrations are inevitable. Energy planners need to consider all the aberration potential from large discoveries to political unrest. In the long run, as a planner, these events eventually produce a net belief of the likely outcome of the supply/demand balance with price playing interference when one gets too overwhelming over another.

In this instance, I think the forward curve is quite rational. The big issues to weigh are:

-

Is there another political unrest around the corner to take a few million b/d off the market (e.g. ISIS, please not another war)? (bullish)

-

Is there enough cost savings in the supply chain to keep the production flowing in the US and Canada at or below current prices? (potentially bearish)

-

When and how long will it take for demand to rebound given a consumer saving of 20-30%? (bullish)

-

Will oil subsidies given to many producing countries citizens end? (bearish)

-

How much and how long can efficiency improvements keep down oil demand – Khazzoom Brookes Postulate? Postulate shows when you improve efficiency of a commodity you end up using it more. (bullish)

-

Will OPEC cave in and try to maintain prices? (depends)

-

Any real carbon reducing initiatives? (bullish – Canadians eh’ – tar sands processing is pretty carbon intensive and expensive)

-

Advancement of US shale capabilities into other countries? (bearish)

We will all have our own opinions on each of these topics and the probabilities of each. As you can see there are still many bullish variables despite all the bearish pundits. Based on the financial markets, they are still bullish on oil and it is not all hot air given their money is at risk.

All Energy Consulting can work with you and your team to create scenarios and play out the market outcomes. We offer unique sets of skills which incorporates the extended reach of energy from oil to electricity. In the end a BTU is a BTU – some are more functional than others.

Your more than hot air Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Capacity Market – Lipstick on a Pig – Part 2

“The desire for safety stands against every great and noble enterprise” Tacitus

If you do not already know about the capacity market please read Part 1 – History of Capacity Market.

The Proposed Capacity Market

Due to the polar vortex of 2013/2014, several hours observed extremely high outages leaving a potential reliability concern. The deduction from PJM for the cause of this issue was that the compensation and non-performance penalty was not sufficient to ensure system reliability. Therefore, they have created a modification of the RPM Model. The new rules will add significant constraints to participation in the capacity auction plus adds more penalties. The bulk of the capacity value will come from Capacity Performance (CP) resources. These resources need to provide sustained, predictable operation 16 continuous hours per day for three consecutive days – during both summer and winter peak load and extreme weather conditions. CP resources must also have a startup time of less than 24 hours under normal conditions, and 14 hours under hot or cold weather alert periods. This essentially eliminates any consumer behavioral options including many popular Demand Response programs such as A/C cycling since this will not likely occur in the winter.

In general, all the utilities are supporting this move other than a little maneuvering to lower the penalty cost. This new layer of RPM will essentially give existing generation a huge boost in earnings – hence the upgrades of many utilities. This certainly smells and feels like a knee jerk reaction by PJM. This move appeases the utility and will very likely avoid the societal backlash of having to deal with brownouts.

The consumer is not seeing the price signal nor the real cost of power by overlaying it with such a high level of capacity value with limited participation from outside technology. The utilities and PJM are certainly making sure to take advantage of the situation by pushing this through.

My first concern is the extrapolation from the outages being related to the capacity payments. It is true that RPM is designed for the peak- which is summer not winter. However, the balance issue cannot be attributed to the RPM construct. In order to understand the PJM issue that occurred in January 2014, you have to have an appreciation of what occurred in the past two years.

For the past two years, PJM observed relatively mild winters. In addition, in each of those two years, natural gas price eroded the energy share of coal generation. For most of 2013, you had the natural gas price forward prices below $4/mmbtu throughout the winter of 2013/2014. In addition, 2012 and 2013 were not good years for any generators in particular coal generators due to the low power prices. It would be very reasonable to expect a Sr. Commercial Operations Manager to question the budget for winterizing coal units to run in the winter time leading into the 2013/2014 winter. Based on two years of history, one could see the coal plants did not run significantly, yet required a fixed cost that was not being recovered. In my estimate, many took the gamble to cut the FOM allocation for winterizing the coal units. The data potentially shows this to be the case. On January 7th 2014, coal units represented the largest component of the outages at 34% with gas following at 23%. This is not a case of capacity rules having to be modified. The reason I state this is because it is clearly a free market lesson on not being penny wise and pound foolish. AEP coal units fared well in the outage and they ended up with record profits almost doubling 2013 1Q profits – $560 million in profits. I can promise one thing this year. The Sr. Commercial Operations Manager is not questioning the budget request from the coal plants to winterize the facility. He can get fired for making the mistake twice, but he won’t get fired for spending more fixed cost on a unit that may not run this winter.

In terms of the gas unit outages, this can be partially attributed to the past. Typically, gas units did not run very much particularly in the western PA and Ohio regions. Firm gas capacity can be purchased by the utility. Because the units historically didn’t run much, fixed cost would translate to much higher gas bidding cost which, in turn, would lead to even less running of the gas plants. When I was at AEP, I was promoting buying firm capacity and selling the capacity to various counter parties during low usage time periods to mitigate some of the cost. However, as noted before, change is very hard in a utility and there is more risk than reward to change behavior. Even though many utilities generation are de-regulated, it still takes time to change the culture. It will change. But, one shouldn’t expect it to change within only a few years. However now that gas prices have been competitive for multiple years, the utilities should have learned the value of buying firm capacity. I am confident firm gas transport is being purchased now and will grow in the future. Sometimes, the market needs time to learn from first-hand experience vs. people advising them.

The very party who stands to benefit from the de-regulation and the free market model is not allowing the model to be free. Free markets need to learn from the market not to be coddled by additional monetary mechanism, or else you get a system that would extensively be more costly than regulation. This new capacity construct eliminates innovation. It will produce a safe environment for reliability – but so did regulation. If we continue down this path of coddling the system and not allowing the consumer and participants to see their consequences of their actions, we will be no better than regulation and likely potentially worse. PJM will be creating a system of limited downside risk with all the upside rewards. Case in point, AEP Ohio historical earnings for 2014 Q1 would have been shared back to the rate payers in Ohio. Because AEP Ohio generation spun off in 2013, it was all kept in house – Good Timing for AEP!

If we want to keep it safe then let us go back to regulation or let the market learn its lesson and remove the knee-jerk safe call so we can create something great and noble.

Your Open to New Ideas and Thoughts Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Part 1: Capacity Market – Lipstick on a Pig

“The desire for safety stands against every great and noble enterprise” Tacitus

Please ponder the above quote from a Roman philosopher. This quote applies to many things beyond this discussion of capacity markets in the power sector.

PJM is making a drastic change in its capacity model. This is a two part article with the first part covering the creation of the capacity market. I believe if you understand how you got to where you are now, you will be better equipped to reflect on the future. Part 2 will go over the issues in the new PJM proposed capacity market.

History of Capacity Markets

Unfortunately, an analysis on the capacity markets cannot be examined without a discussion of regulation vs. de-regulation. To many, this is akin to discussing politics, race, and/or religion. I will attempt to stick with the facts and avoid absolutes.

In a regulated world, there is no need for a capacity market as investments are made once the utility shows to the utility commission the investment is prudent to meet a certain loss of load probability requirement. In a perfect world, the commission, interveners (industrial lobbyist, consumer protections groups), and the utility produce some reasonable acceptance to the need of generation capacity and then, and only then, does generation get built. In return for this consensus opinion, the utility is protected from a loss if the generation is not needed in the future. At the same time, the utility is capped in its earning potential.

However, this regulated system does come with some cost as previously discussed in my Regulation vs. De-Regulation article. A regulated system does not bode well for adoption of new methods and technology. The system is focused on maintaining. Overtime cost can rise without proper oversight from the commission. As I noted in a previous article, this is likely inevitable given the poor levels of compensation in the commission. In my latest research, the Ohio public utility commission earns between $75-$160K per governor approval. This is a full time job as commissioners are not only regulating electric utilities but also natural gas, telephone, water, railroad, and motor carriers.

Within the electric sector, they are dealing with the executives making multi-million dollar salaries each year. Then the senior management team earns around $500K with directors making $130-300K. You have analysts coming out of college in the utility, potentially, making more than the commissioners and their staff. With this design, it is no wonder the effectiveness of regulation would wane. It is certainly reasonable to expect commissioners and staff to have the potential desire to work at the utility in order to support their families. This very fact could make it hard for some to really clamp down on their potential employer. Please note none of my statements are absolutes nor are they confirmed in anyway with current commissioners or staff. I use my practical insights on human behavior to potentially deduce these outcomes along with past history. There has been confirmed revolving door in the electric utility space as in the Duke Energy Corp case where the chief legal counsel for the states utility regulatory agency joined Duke Energy Corp after presiding on two cases favorable to Duke. I strongly suspect, if he ruled unfavorably in the cases, he might not have had the job.

The history of poor regulatory decisions led many to investigate the de-regulation option vs. fixing the regulatory process through increase budget to source and retain skilled and experience commission and staff. Ideally, competition will drive the inefficiencies out of the market that the regulatory body could not. Theoretically it made sense given poor decisions were not being punitive as in a free market and the drive for innovation was not there as there was no earnings potential beyond a set return. Both of these points still could have been somewhat managed by the regulatory agencies. Another bonus of de-regulation many touted was allowing greater transparency and market discovery which would potentially allow new companies to innovate and capture the market thereby reducing society cost. De-regulation would drive the inefficiencies out of the market and the innovative nature of competition will drive the cost down further. It all sounds so good on paper.

Markets became de-regulated with California leading the way. We all know what happened there. The first market inefficiency they attacked wasn’t the inefficient operation of the utility but the inefficiencies of the market model – Enron Strategy. To me, this highlights that the inefficiency of the utility really isn’t that large compared to the inefficient market designs. If you think this was resolved due to the experience in California – think again. In 2010 JP Morgan hired John Howard Bartholomew. He wasn’t hired to progress the electric industry nor drive out inefficiencies in the utility but to find the inefficiencies in the market design. Once again they quickly identified inefficiencies and targeted those arbitrages to the benefit of themselves. A regulated entity would have not done that given the lack of incentive. However, these free market players realize there is more money in market manipulation than the boring optimization of power plant supply chain. In addition, the risk from getting “caught” still produces a decent return on investment after accounting for the penalties.

As an outcome, many deregulated markets kept a price cap to “protect” the consumer. PJM price cap is at $1000/MWh. ERCOT is having to raise their price cap as they stayed on the moral high ground on de-regulation and continued without a capacity market. The one thing ERCOT is doing is raising the market price cap from $2,500/MWH (2011) to $9,000/MWH (2015) in order to incentivize generation build. To prevent a market brownout or blackout, demand must be met even in the one instantaneous moment of ultra-high demand. Typically, power planners will build peakers to run for those given moments. However, in a free market system, they need to have enough revenue during those small times to make up for the cost of building the unit. Therefore, if your peaker cost you 85 million dollars for 85 MW and you only ran 40 hours in the year in order to have a payback in 3 years without any discounting you would need prices to average over $8300/MWh PLUS variable cost during those 40 hours. Variable cost can be over $100+/MWh given rise in fuel prices in extreme times. ERCOT is running the grand experiment to drive new technology and new methods through price incentives – the quintessential mechanism of a free market. It is just math. A market with regulation typically gets a return on investment between 8-12%. If the market is free to compete, the risk is increased. Therefore, the reward needs to increase above the regulated return requirements. The returns will likely need to grow to over 15+% rate of return. The means to this return, I contend, is too great for society. I do agree the potential for a more efficient market is very possible with an open market, but society and potentially the oversight body is not willing to take the means needed to achieve the ends of a more efficient market.

Other Regional Transmission Organizations (RTO) realized the incentive to build generation with power prices alone did not meet their historical comforts of market reserve margins and consumer pricing. They became concerned about the customer backlash to the de-regulated market, if they could not deliver the same comforts of a regulated market. The capacity market was born to hide this issue while still touting the free market solution as the answer to society’s needs. PJM came out with Reliability Pricing Model (RPM). RPM creates another layer of payment beyond the price of power. In theory, it is the value of having capacity available to serve load. Payment is based on the size of your capacity offer. The initial model was opened to all sorts of capacity options from coal plants to non-generating capacity from demand response aggregators. This model still offered some innovation by just targeting the peak demand and not putting so many strings to the participation in the auction. At this point I still believed there was a possibility to obtain the promise savings of de-regulation.

However, the latest proposal to modify RPM by PJM goes against the “free” de-regulated concepts of free market competition. The proposed RPM is likely losing all the value of being de-regulated compared to regulation. Stay tune for your early Sunday release as we detail the latest PJM PRM proposal in Part 2 Capacity Market – Lipstick on a Pig.

Your Willing to Step Out of the Box Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

OPEC Decision Expected and Justified

OPEC meeting went as expected. There was no formal agreement to cut production in the first meeting since the price correction. This part is very similar to 1998. Prices did their thing by falling down and now slowly rebounding. OPEC is making the decision they are not the marginal barrel. Unlike their decision in 1997, they are likely right. Time is the key to how this all unfolds. The daily and weekly gyrations of crude oil prices are made by traders who believe they are able to read the dynamic tea leaves. The story of the oil markets can be explained by examining the details in the demand and supply fundamentals from the past and now.

Supply

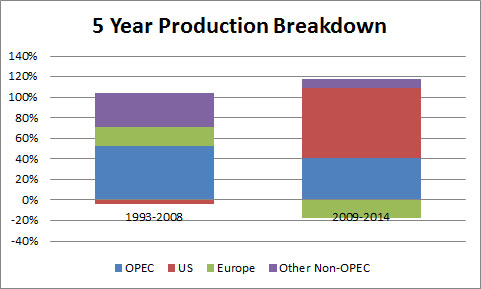

From 1993 to 1998, Non-OPEC production grew almost by 10% with OPEC growth in production nearly 20%. In addition, the Non-OPEC production outside US and Europe represented the majority of the Non-OPEC production increases. This is much different than 2009 to 2014 figures. Both OPEC and Non-OPEC production grew close to 8%. The majority of the Non-OPEC production growth came from the US. The dynamics of the increasing production will lead to a different result compared to 1998.

In 1998, most of the battle of production/market share was battle within the organization. The Non-OPEC production was coming from a diverse group with Europe production gains representing the largest group. Non-OPEC gains were coming from some significant finds which took a large capital cost to develop and was going to take many years to fully hit the production peaks. OPEC tried to hold the line, but they were only going to capitulate themselves. The Saudi’s showed the world a glimpse of producing oil near the kingdom marginal economics. This was too painful for many of the members and they succumbed to over producing their quotas which realigned the market over many years given the growing Non-OPEC production.

In 2014 most of the production gains is resulting in OPEC market share eroding in the largest oil demand market. This is no longer a battle within the organization. The marginal economics for this increasing production is much higher than in 1998. In addition, the profile of this production requires continual investments versus large capital outlays to maintain and increase production. This very fact will create a dynamic response to price which was missing in 1998. This is not a cure for a rebound in price over the next few weeks to months, but it will be a response which could not have occurred in 1998 without OPEC coordination.

Demand

The demand picture has some similarity between 1998 and now, but there are some distinct differences, just like in the supply picture. The similar aspect is the fact that the first sign of market weakness stemmed from the demand concerns in the Asian economy. The distinct difference is the development of the demand concern is much different.

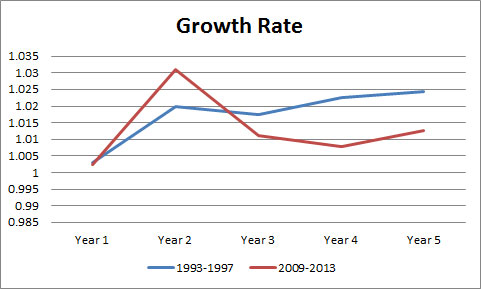

Going into 1998, world oil demand growth was averaging a 2% growth per year with Asian demand growing by over 5% a year. China was growing nearly 8% a year. Most pundits at the time were expecting continued growth in the region. The problem I identified early on is the massive growth year after year was leading to some very large absolute numbers. In examining historical growth of developing countries, it showed eventually a country demand growth slows down after 5 to 10 years of strong growth as infrastructure is needed to expand further. The Asian financial crisis created a dramatic shift in demand expectations. Oil producers were caught off guard as capital was spent in expectations of demand growth.

Going into 2014, world oil demand growth was only averaging 1.3% after the 2008 financial crisis. Asian demand was averaging 3.5%. World oil demand growth from 2011-2013 has averaged only 1% a year. European petroleum has been in a downward spiral since 2007. Unlike 1998, no one should be surprised with lackluster demand growth. Given the dismal demand numbers for the past few years, demand is likely to be more surprising than a production correction.

Putting it All Together

With slowing demand growth and increasing production, a price correction becomes inevitable. The price is now trying to find the price point to slow production and/or increase demand. Production is going to react faster than demand. OPEC made the right decision to let the prices come off. If they cut their production it would have created a dislocation in the supply curve and ultimately lead to a reduced revenue stream. In 1998, this strategy would not have worked given the production competition was largely within the group and with the Non-OPEC production coming from large capital projects. This time, we have a market with production coming from N. America which is dependent on continued capital investment to maintain production. We expect the market to find enough marginal wells in US and Canada around the $60-$80/bbl range to balance the market for the next few months. After that, I expect the market to recover as demand will naturally rebound given the 20-30% price decline. I think, by next year, we will see demand much stronger than the current IEA outlook.

Some have asked why I skip the 2008 price correction. The 2008 price change was more of a function of the global economic crisis, and I consider this an outlier in terms of fundamental supply/demand issue in the oil market. However, in the presentation, I do cover the 2008 peak price and the actual prediction I made in calculating the maximum peak of the oil prices – $145/bbl (prediction) vs. actual of $147/bbl.

As noted, in my other articles on the oil markets (Crude Oil Markets not 1998 & Crude Oil Collapse) I have a complete presentation that I can present to you and your team offering a unique perspective on the oil market. We take the time to truly understand the past so we can appropriately reflect on the future. Please do consider All Energy Consulting to offer your team insights on the oil markets. The presentation includes price forecasts and explanations including a discussion on refining margins.

Your Over 10,000 hours of Analyzing the Oil Markets Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/