Most Energy Efficient State – Apples and Oranges

The American Council for an Energy-Efficient Economy (ACEEE) produces a list of the most energy efficient state each year – link to the report. This report was blasted across the news – Forbes, US News, Bloomberg etc… There was no doubt made by the reporters that the report was empirical and 100% accurate. However, energy efficiency is not an absolute number and requires some thought to produce given the uses of energy and the environment. There are many issues with energy efficiency rankings and how one deciphers the ranking. We will show you a perspective that makes one of the highest ranked energy efficient state in ACEEE rankings to be not that energy efficient after all.

The simple definition for energy efficiency is using less energy to provide the same service. In the end, energy efficiency like energy is only a means to an end, not the end in itself. Without a thorough understanding of that fact, this can lead to misleading conclusions. There are many opportunities in energy efficiency analysis that can lead to apples and oranges comparisons causing poor policy choices.

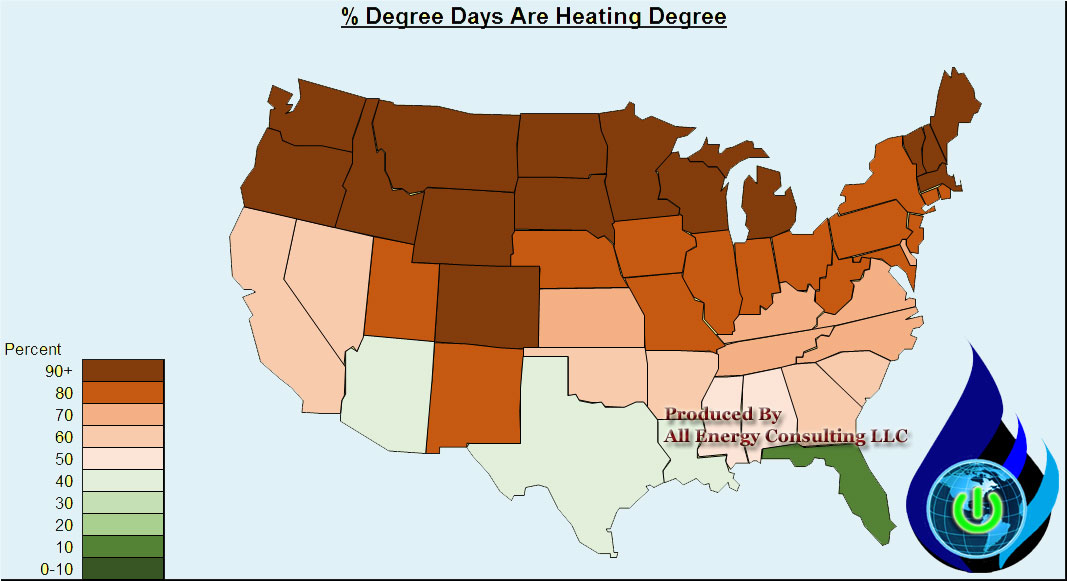

If one state is mild in weather and yet produces widgets with less energy – this does not mean they are more energy efficient via their programs or technology, but perhaps they are more efficient because of location. Therefore, to deduce that programs and technology from one state should apply to another state without weather normalization is misleading. For those not aware of this fact – the majority use of energy when it comes to weather in the US is for heating. There are more Heating Degree Days than Cooling Degree Days – see figure below. Trying to compare states without being aware and accounting for weather difference can lead to poor policy choices. (Will global warming reduce energy consumption for climate control in the US? See figure below)

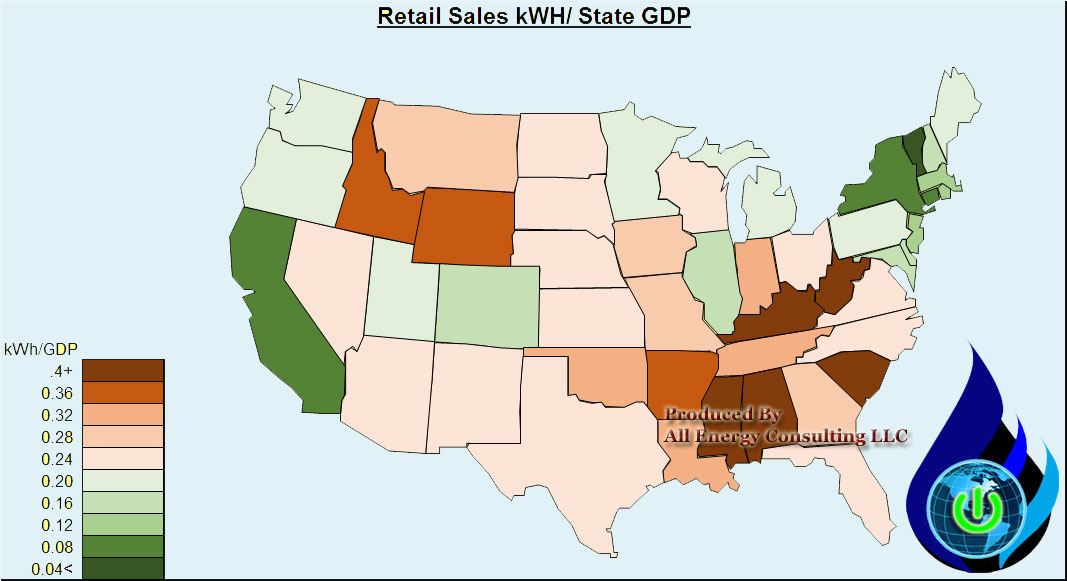

Energy efficiency has also been expressed as energy intensity – a measurement with economic parameter typically Gross Domestic Product or Gross Domestic Product per capita. Therefore, the outcome expresses the use of energy and the conversion to the economic parameters – Energy/Dollar. The figure below displays Retail Sales MWH / GDP on a state by state basis. California and the East Coast states look superior to others.

If state A economy depends on industrial manufacturing to make the widgets used by state B whose economy involved services such as finance to telecom, the energy intensity calculation would infer that state B is superior to state A. However, this is not the case in reality. Using more energy to generate the equivalent GDP does not mean state A is inefficient. State A should not be made to confirm to state B energy standards for the sole purpose of energy efficiency. An energy efficiency comparison can be made to state C whose economy is very similar and makes the same amount of widgets. States with different economies cannot be compared in terms of energy efficiency. One could argue the merits of the economy choice (production vs. service economy), but one cannot take the energy efficiency as being comparable given the end product is completely different.

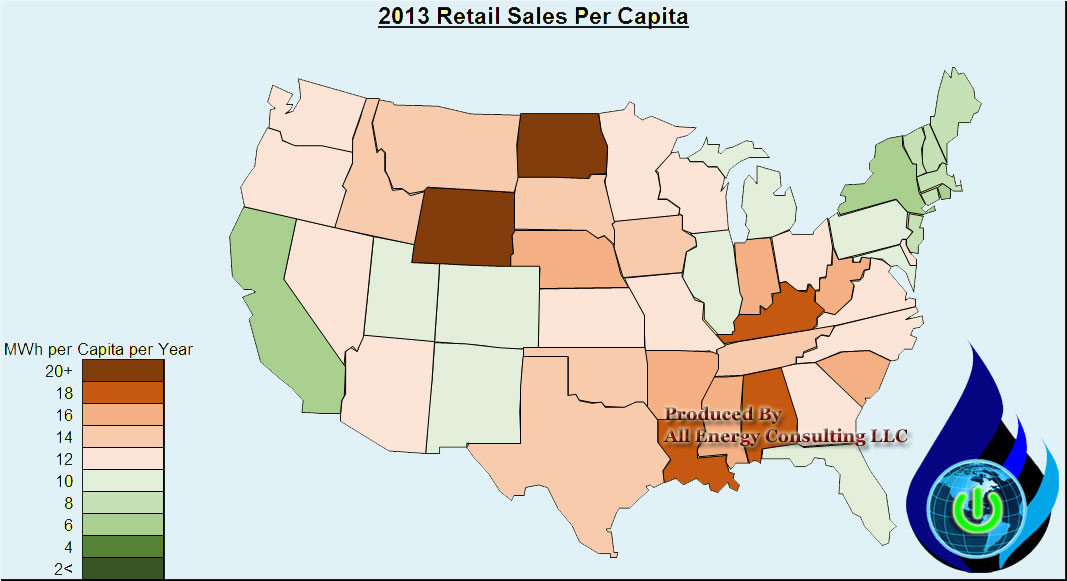

The amount of people in a state is also a key point to address. The shear population density changes the use of energy. Those living in close quarters will generally use less energy as the housing is likely smaller and the ambient energy use from your neighbor can reduce your energy use. To take a more dense population region and try to extrapolate the energy efficiency programs and goals to a region not as dense is comparing apples to oranges. By doing, so you are requiring a change beyond energy use if you plan to produce similar results. The figure below presents the Retail Sales Per Capita by state. Once again California and the East Coast states look superior to others. However, we know they have a much higher population density per square foot than the rest of the country.

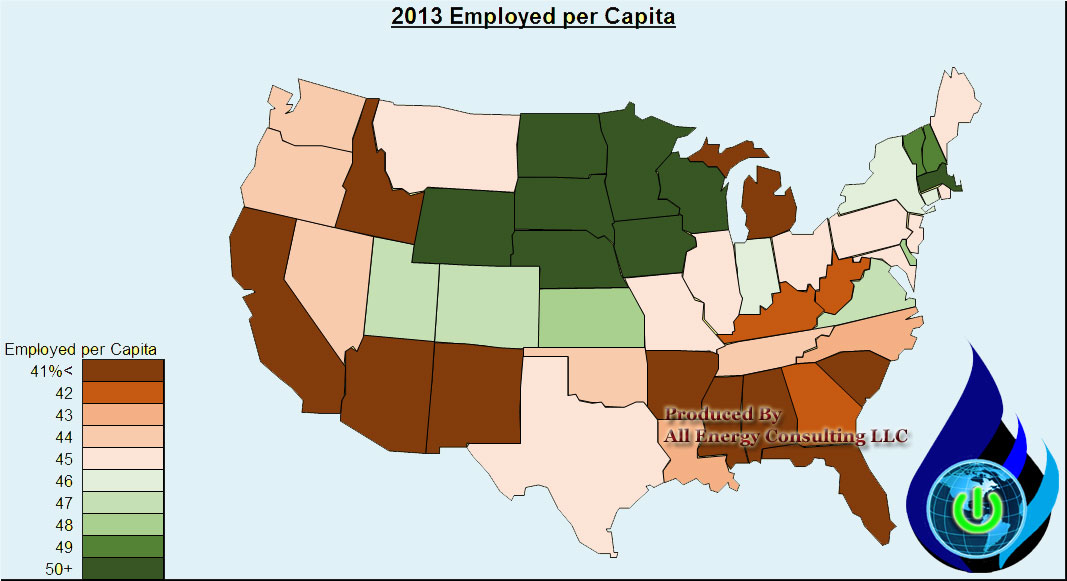

What people are doing in each state is also important in analyzing energy usage as it relates to the economy. If you have a region where significant portion of the population are not employed (a result of unemployed adult and more children in one state than another) their energy usage will be much less than those whose population is working. The employed force potentially creates a more balanced metric of economic parameter than GDP and population given the credit for job creation. In addition, those people are the ones paying for energy whether at home or in the workplace. The figure below shows the percentage of employed workforce by state. The surprise is California. California no doubt will be more youthful, but the temperate weather probably leads to heighten level of a casual beach life. There is not much energy usage sleeping on or near the beach. Policy makers would not want to produce policy that lead to great efficiency only to lose jobs.

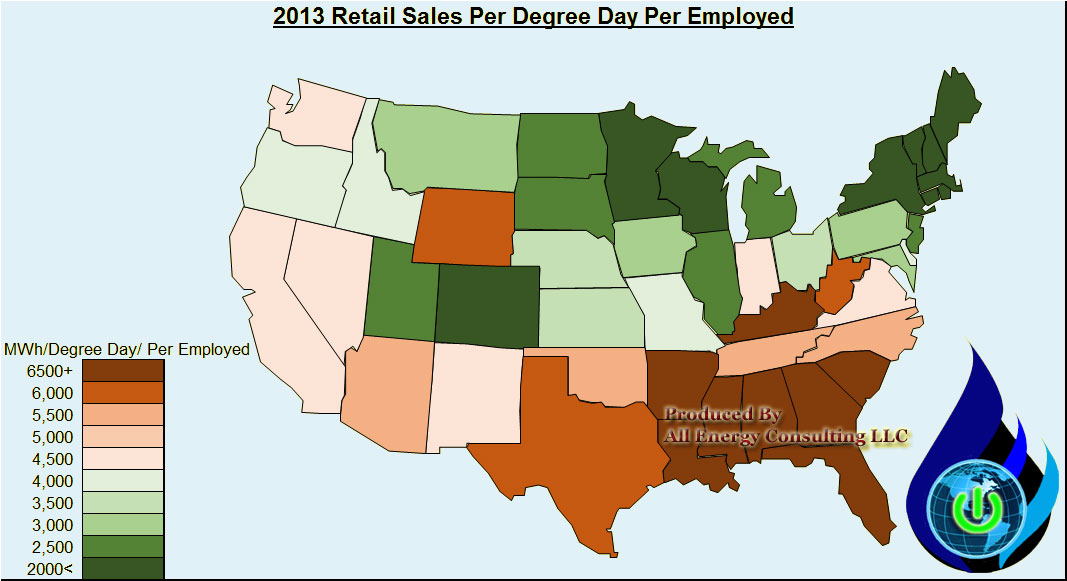

If we view the metric that normalizes weather by dividing energy use by degree day plus incorporate the amount of people employed we can produce a metric less on locational luck and more focused on energy usage and underlying economy – jobs. The figure below does just that.

The ACEE report perspective is similar with this perspective for the NE states. Those states, as noted in ACEEE, use their energy well given the weather conditions. However, the number 2 state in their ranking, California, seems to be very lucky given their sunny and temperate disposition based on this perspective. Ohio, in this measure, actually ranks better than California. This perspective still does not account for the less density living found in Ohio relative to California, so in that light, Ohio is doing quite well.

Many in the state of Ohio are enamored about all the great efficiency reports being claimed from California. They are desperate to follow California down their path – we just hope they separate the apples and oranges. To even approach some of the metrics presented from California, Ohio will need to change its culture and temperature – both improbable task. All Energy Consulting is not advocating this is the one correct view – we are being observant and open-minded when it comes to variables such as energy efficiency. There are many lenses to look through to fully appreciate the various energy issues.

If you enjoy this type of analysis, please do consider supporting All Energy Consulting by contacting us for your energy consulting needs. We are able to offer these types of analysis because of the support we get from our clients. All Energy Consulting offers a pragmatic but enlightening approach to analyzing the energy markets. Our focus will always be for your success.

Your Looking Through Multiple Lenses Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Coal to Gas Switching – 2012 Déjà vu?

This report available in PDF Form.

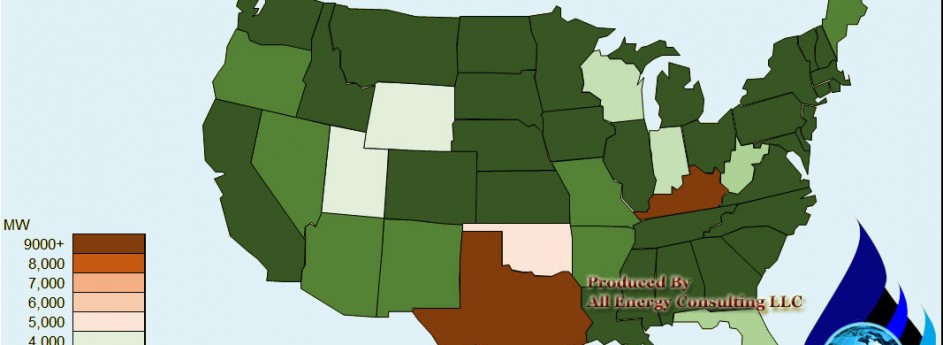

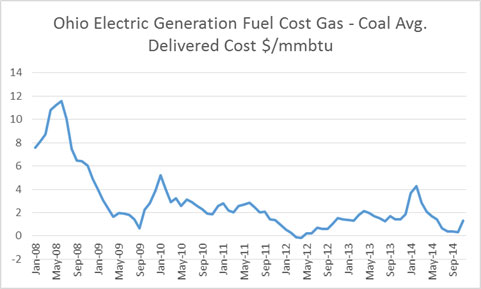

The amount of gas and coal burns in the power markets go beyond simple economics when the price spread between gas and coal are very narrow as observed in 2012 – see figure below. Those attempting to use supply stacks or historical calculations will likely see incorrect numbers. When the price spread is high, those methods will work quite well, as long as the markets do not observe large retirements or new builds in the power fleet.

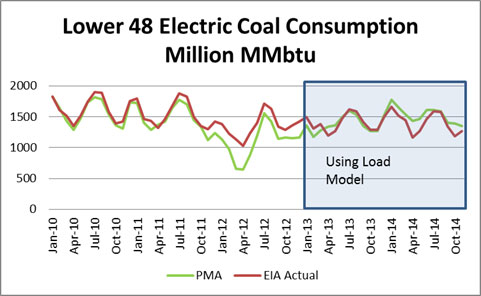

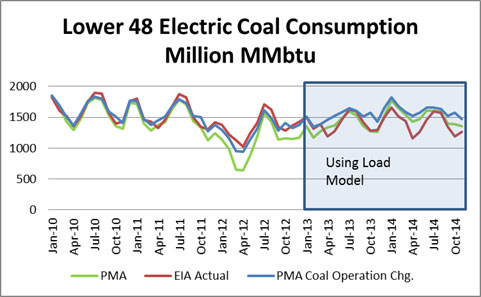

To demonstrate the issue with low gas to coal price spread, we present our calibration results of fuel burns over the last few years. Please note the 2012 discrepancy. One could conclude our models are fatally flawed.

However, the goal of PMA is to understand the markets and quantify the risk in the market place. The calibration run represents the default runs that we run forward in time in our BASE case. The key inputs, which drive the BASE case, are weather, economy, and commodity price. Two large areas not demonstrated in the base inputs are outages and utility operations. However, these are simulated in our risk runs that run daily with the BASE runs. The default outage profiles in the BASE case were developed based on a unit by unit investigation over a 5 year period. For the 2014 deviation, much of this can be attributed to outages which are captured in our risk cases. The winter deviation was discussed in our winter assessment. In addition, greater maintenance outage occurred in the shoulder months in 2014 as units have been installing FGD, SCR, and baghouses for the EPA regulations. The relevant issue for 2015 summer is how coal generators plan to operate and dispatch their plant. In the BASE case, utility operations are assumed to be market driven. However, in 2012, this is not what happened for several coal units.

To prove this, we re-ran the BASE case with modifying the market behavior of several coal units. Now the figure of coal consumption matches quite well in 2012.

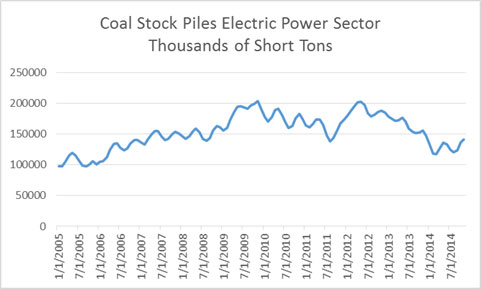

The issue in 2012 which resulted in the need to change the operation mode of coal units was a result of the coal purchased in 2011. The futures market curve in 2011 for 2012 showed a much larger spread in gas and coal prices and also a robust power market price. This resulted in a much larger purchase of coal than required in the market place in 2012. This caused coal inventories to be very high- see figure below. This dynamic of coal purchasing was a result in the shift in coal and power markets – see our discussion on Coal Market Changes below.

Many plants cited hazardous conditions of stock piles resulting in the need to use the coal regardless of power plant economics. If this behavior did not occur, the trajectory of coal inventories would have gone much higher.

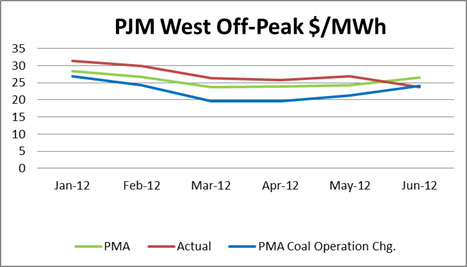

The reason not to adopt this method in the BASE case is the issue with power prices and the principle of market behavior being rationale over time. As expected, if the coal generators ran uneconomically, they would distort the price – see figure below. There is a Heisenberg Uncertainty Principle in power modeling. The volumes and price of the market cannot be discovered simultaneously in the same level of precision. As soon as you get your volumes correct your prices will be off. There is a give and take between those two. Given the model was developed for trading power prices and understanding the power market price risk – we prefer to be more accurate on prices than fuel burns. However we can adjust the settings for our clients need.

Most utilities still use the futures market as their guideline to purchasing. They should run multiple scenarios and situations using a platform like PMA to really understand the meaning of the futures market. The futures market clearly weighs the risk of near term events more than the actual possibilities. PMA can correctly quantify this risk, so you can make an educated decision on your fuel purchase. Not only can we quantify economy, weather, and commodity price risk, but we can quantify the other facets of the market place such as utility operations presented here.

Our 2015 summer assessment (May-Sept) shows if we applied the same utility modifications done in 2012 we can see an increase of coal consumption of 14% from our base case. The likelihood of this is less given the current coal stocks levels are lower plus the change in the market place as several coal units are de-regulated. Before, many of the coal plants could get fuel recovery from their un-economic dispatch – see more explanation below in our discussion Coal Market Changes. This is less likely than in 2012, therefore there is less incentive to run uneconomically.

Contact us to get a range of coal and gas consumption in the power sector plus power prices. The current futures market is showing a very tight spread between gas and coal. This may reduce price volatility, but it will make up for it in coal and gas volume volatility.

Also, consider creating your own set of conditions and parameters to run through PMA to get a much greater insight in the market space. PMA enables you to use your knowledge applied to our market knowledge.

Please consider our services – help us help you succeed.

Your Ever Evolving Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Sign Up to AEC Free Energy Market Insights Newsletter

Changing Coal Markets

An appreciation of what was occurring in the coal and power market pre 2012 is important to understand the current coal dynamics in the power markets. In the past, coal contracts were developed over long periods of time (some over decades). Overall commodities prices were rising worldwide, including coal. Many coal producers no longer wanted to have long-term contracts in favor of shorter term allowing them to participate in this rising environment. (Oh how they wish they didn’t think that way now – greed gets the best of us.) Coal generators felt the squeeze, particularly, if you had to purchase spot coal. The price of spot coal was very high and would be typically $10+/ton more than contract coal. During the height of the export markets, there were possibilities of not being to obtain coal at any price. Therefore, there was much incentive to lock in most, if not all, of your expected coal purchase ahead of time, even if it was for just a year.

Also contributing was the deregulation aspects of the power market. Before, a utility could plan and make a decision to produce power at fixed price given a fixed price contract for coal. The regulated utility had a mechanism to fully recover all their fuel cost. However, with deregulation and the developed option to obtain power from a market versus your planned generation, this caused a disconnect in the way things were done and how they can be done going forward. This new construct put several utilities in a position to not want to be bounded by too long of contracts either.

Coal operators and coal generators need to come up with new ways to align themselves. I believe coal contracts need to be structured on spark/dark spreads allowing protection from low gas prices for the generators to ease inventory concerns and at the same time giving coal producers the upsides during peak time periods. If you are interested in this process, All Energy Consulting will be happy to demonstrate and work with both the coal generator and coal producer to structure a win-win situation.

Requirements of Modeling

We are currently in our continuous improvement plan cycle for Power Modeling Analysis (PMA). This includes updating our loads and revisiting our calibrations and adding other regions into our suite of fully calibrated pricing hubs. The process of calibrations requires the knowledge of understanding all the drivers of a dispatch model. With over 85 characteristics that drive unit operation and another 30+ combination of logic switches to change the dispatch algorithm requires years of experience to navigate and find the right recipe to produce the correct results.

Building and maintaining models is not an easy task. Typically these task are regulated to an inexperienced analyst which can lead to frustrating results and multiple waste of time. Our Power Modeling Analysis (PMA) requires 100’s of hours to maintain and that is using a decade long full-ranged experience power analyst who, not only is experienced in the analytics and software side, but also experienced in the management and operation of utilities.

There will be no model that is perfect – but we at All Energy Consulting have the pursuit of a perfect model. Waiting for the perfect model, you will be stuck in analysis paralysis which is as worse as having no model at all. Using inexperience analyst, you will lose the most important things in a model – the intimate awareness of the models limitations. I personally know all the limitations and issues with the PMA model. Many have asked the PMA model to do weekly projections – this is very possible, but this requires a different setup and data feed. The current data feed (monthly forward curves) limits the current setup. Plus the weekly requirements will need greater precision, such as outage feeds and more real-time load. All this is possible and we will pursue this, if our clients desire it.

As I noted in my Power Modeling whitepaper there is a significant amount of work required to model the power markets. Can you afford to leave that work to inexperienced analyst? I know some companies have a staff of 10+ trying to manage a power model. With that many hands in the model, there will be many issues in just the maintenance of the model. Then, typically many of them are all working on other projects not related to the model. This causes a lot of the work of maintaining and managing a power model to an inexperienced analyst. I have observed the destruction of great initial work, crumbling to meaningless garbage of output.

Besides running our own model and having the ability to customize it for each client, we can also help you maintain and operate your internal power models. It would not be cost effective to have a full-time, very experienced power analyst spending their effort on a model, given all the other task required to do in the company. Even if you could afford it, your typical employee probably does not enjoy that. They rather be fully engage in the results and leading the company in actionable decisions.

A model, no matter a power model or refinery model, the value is ultimately the ability to decipher the results and apply meaning to them. The only way that occurs is if you intimately know the models limitations and continuously maintain it. The markets are changing and your model will never be perfect, so a continuous improvement plan is needed. PMA has a continuous improvement plan. All Energy Consulting can help you understand the power markets by offering our PMA platform or helping you with your internal modeling efforts.

Stay tune our PMA results of Gas to Coal switching for 2015 summer will be released soon.

Your Tireless Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Renewables No Impact with Low Oil Price – False

The belief that low oil prices will have no impact on renewable is very misguided and optimistically biased. The practical reality is the path of renewables will be altered with continued low oil prices. Many of those focused on renewables, having nothing to do with oil, are focused on the power sector being isolated from the rest of the world. It is a true statement that renewable generation is likely less costly than oil generation even at $50/bbl. However, in the power sector, the competition is not with oil directly but with natural gas and coal.

The coal market benefits when oil prices are low as transportation can make up over 50% of the end cost of coal. The natural gas markets may results in higher prices as economics of some oil field gets reduced, thereby, reducing the associated natural gas production. However, this may lead to more focus on natural gas finds versus oil finds increasing gas production. At best I think the impact of low oil prices on natural gas may only slightly increase gas prices.

Given renewables connection to electric generation, the amount of renewable will be highly dependent on the amount of electric demand. Also one of the largest mechanisms to de-carbonize came from the conversion of vehicles to electric vehicle as renewable generation offered a potential zero carbon source. Therefore, one of the largest anticipated sources of electric demand in the future was going to come from electric vehicles. However, with low oil prices, this makes the economics of mass electric vehicle adoption very unlikely.

In most cases, the economic break-even of electric vehicles vs. gasoline vehicles requires gasoline prices north of $4/gallon. More likely it would be north of $5/gallon given most of these economic analysis were based on a huge advantage of gasoline vehicles paying for the road infrastructure. This is unsustainable once EV vehicles grow in usage – eventually the road tax will be collected from EV vehicles. Nonetheless $4+/gallon prices are now diminishing in probability as oil price remain below $100/bbl. With low oil prices, this transition to electric vehicles will be limited. In order to transition, a much larger carbon price will be needed which will not likely be politically sustainable. The sacrifice for saving a potential disaster may just be too high for society.

Low oil prices will limit the ability for renewables to grow in the energy mix. The portability of energy is superior in petroleum products relative to any other forms of energy including batteries. This physical attribute of petroleum will require a monetary mechanism to allow a switch to greater renewable forms of energy. A rising crude oil price with transportation north of $4/gallon, and with an expected small impact of carbon allowed many to discuss the potential of a zero carbon system. However, with the recent changes in oil prices and potentially a protracted time period below the $100/bbl mark, many dreams of the zero-carbon world are likely shattered.

The energy markets are intertwined. High oil prices lead to greater opportunities for change. A low oil price supports the status quo. Renewables can continue to grow with current societal goals within the power sector – but the potential will be so much less now than when oil was north of $100/bbl.

Your All Forms of Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Oil Market Outlook Change – Too Low Demand Expectations

BP released their 2015 Energy Outlook. As noted by their Chief Economist this is not to address prices or near term events. However, price, in the end, is the meat of a discussion for an energy outlook as price and outlook for supply and demand are intertwined.

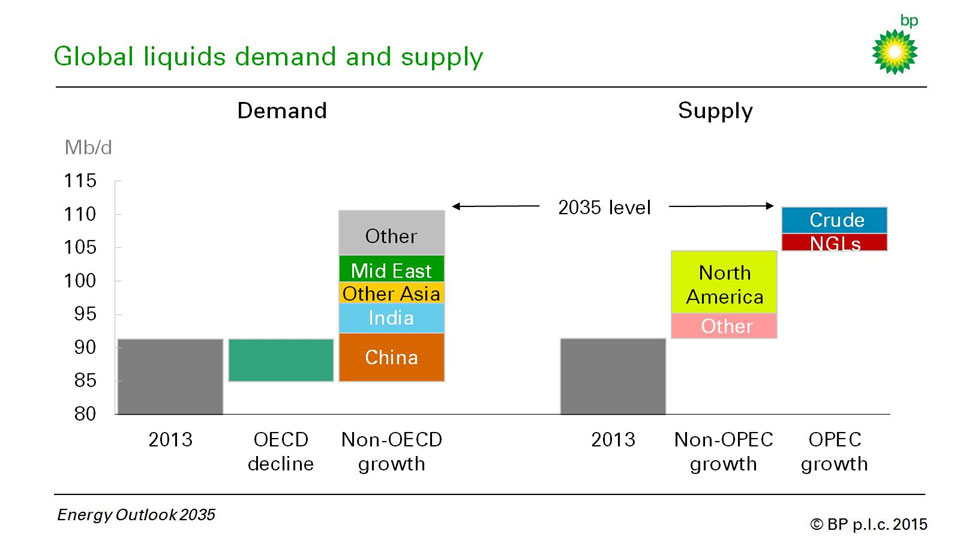

The outlook by itself is useful to gather facts and trends. The real value for someone like me comes from the change in the outlook. In theory, the process of formulating these outlooks should not change. Therefore a change in outlooks signifies a change in market place expectations. The best slide in reviewing the change to show the dramatic shift in expectations is slide 13 in the presentation. The latest forecast for 2035 shows a very small call in OPEC <5 million barrels/day see figure below.

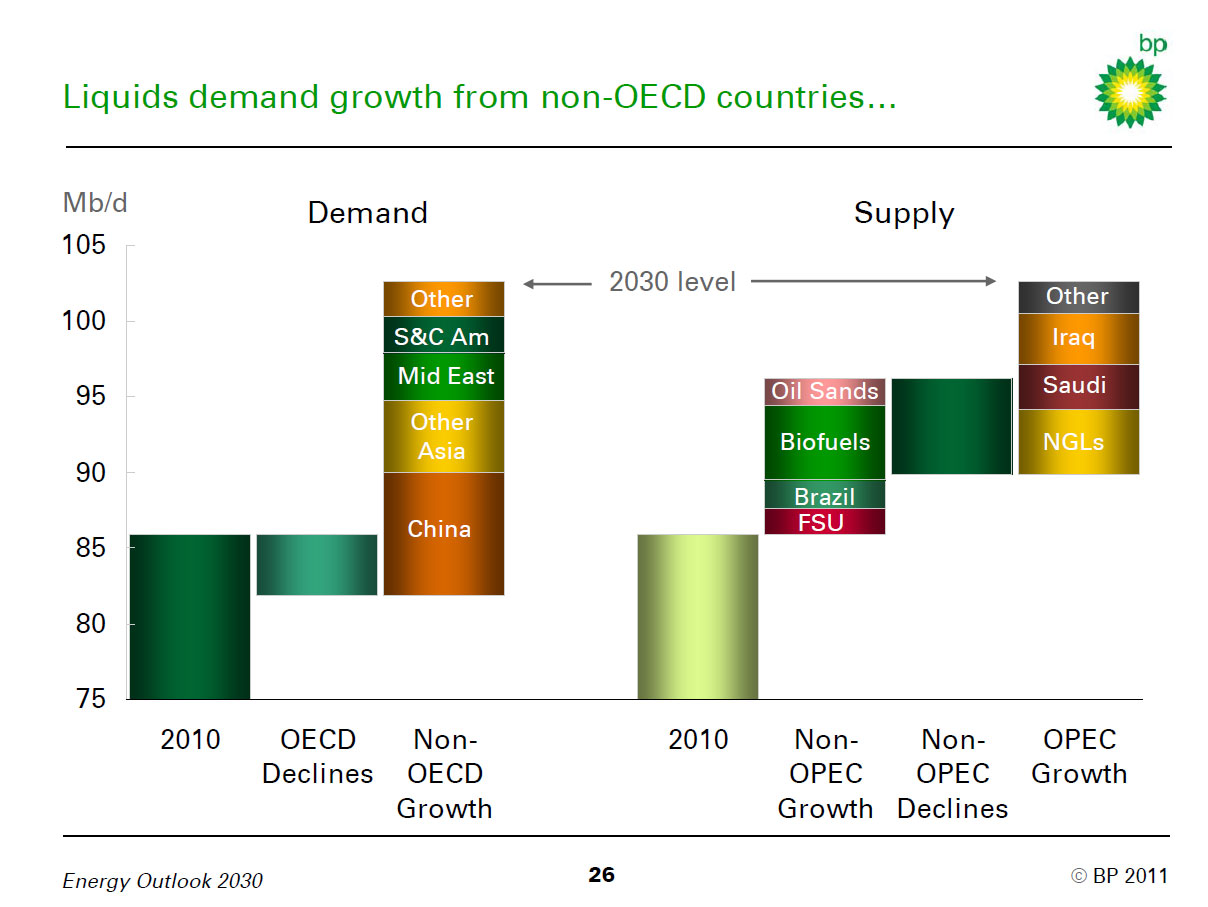

If we go back into time and look at the very same slide in 2011, we see the call for OPEC in 2030 (even less demand requirement given 20 year gap vs. 22 year gap in current forecast) amounts to over 10 million b/d. This is a dramatic swing see figure below for 2011 BP Energy Outlook.

IF one believed in the process and the forecast output, the shift between the two forecasts would dramatically drop the expectations of crude oil price. As a longtime forecaster of the crude oil markets, the call on OPEC is key component on price forecast. This piece of the puzzle represented the additional swing from OPEC who, in theory, purposely holds spare capacity to sustain a reasonable market level. With the need of OPEC being diminished, the overall pressure for oil prices to move upwards is limited.

Obviously, BP cannot state or present a price view given its role in the market place, but if their trade floor was made well aware of this trend and believed it, they would have made a good call over the last year. However, the long-term aspect of this trend does not bode well for BP as a company. In fact, the overall energy sector would not benefit from this including renewable energy and refining industry.

The demand side also shows some major shift in expectations. In 2011, the expectation for China oil growth was nearly 10 million b/d more than the base year (2010). Now expectations have fallen to around 5 million b/d from the base year (2013). The interesting outcome of this is whether BP flowed back the price response from the expectations of lower prices per the lower call in OPEC to the response of China demand. To lose 5 million b/d would require a much lower expectations of GDP outlook, in addition a very inelastic response to the price of oil is needed to maintain such a drop in demand. OECD demand decline is nearly the same – yet the price expectations from 2011 to 2015 must have dropped.

From my experience, the demand piece is typically the flawed portion of the forecast after coming off a major supply shift. Supply can be well understood in terms of cost of development and potential technology improvement curves. It is my belief that the demand outlook presented is too low. The expectations of this come from both the price feedback of consumers and the fact that the demand side has included a significant portion of efficiency improvements over the past few years.

Efficiency improvements do not lead to reduce consumption of a commodity without a continued price increase. This is supported by the Khazzoom-Brookes postulate and Jevons Paradox. My caveat to the theory is to add the price component. Improving efficiency of a commodity leads to more use of that product without a corresponding price increase. I also expect this with electricity as we make up for the large efficiency improvement by having more devices and more appliance than we had a decade ago, even though, a single appliance may be 50% more efficient.

I do not expect our human desires to have a car that is faster and bigger to be different by region or time. Corporate Average Fleet Efficiency (CAFE) improvements have and will result in near-term gasoline demand improvement in the US, but eventually with the falling prices and the improved efficiency improvement the auto manufacturer can produce an SUV with mass appeal and size that can go 0 to 60 in few seconds yet offer 25-40 mpg. Auto manufacturers who ignore this trend will be left in the dust as was seen last time SUV sales outsold compact vehicles. This move to this larger and faster car will swallow the small vehicles leading to overall growth in oil demand while maintaining the CAFE standards.

This mass appeal will also eventually migrate to other areas of the world. The ability to stop this rebound is the corresponding price. In the oil markets that seems to be muted as expectations of price is likely between $50 to $100/bbl and not rising over $100/bbl for the next decade or so. Power markets may thwart the rebound given the trend in transmission and distribution cost, but this will be highly dependent on the region. Obviously adding a carbon tax would increase the cost curtailing the demand.

Please consider All Energy Consulting for your energy consulting needs. We offer a unique and fresh perspective on the energy markets to help you succeed

Your Fundamental Supply / Demand Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB