Shale Gas and Carbon thoughts

Taking a break on the various issues of utilities from my previous blogs, I was inspired by this article to take on a macro issues of energy involving Shale gas and carbon issues – Is shale gas our future or should we look at other sources of energy? (Molten Consulting).

The title is opened ended… how far is future? And whose future? Shale gas does not and will not make up the majority of energy usage worldwide. It is a substantial portion for the US oil and gas balance. Before there were shale expectations, the theme to balance the energy market was to use all sources of energy including improvement in efficiencies. Supply and demand always meet, it is just a matter of convergence with price as the critical variable to impact supply and demand.

Before Shale:

- LNG imports were going to save the US from sustained $8+/mmbtu prices.

- Imports of crude with a large dependency from Canadian tar sands were going to fill in to maintain oil markets while we slowly convert the US auto fleet to alternative fuels.

- Advance coal would even play a part.

- Nuclear plants were going to easily be relicensed.

- Wind and solar cost would come down in cost and the cross intersection with gas prices at $8+/mmbtu would allow the elimination of subsidies in a few years.

However, shale has allowed this delay as it came with a bonus of liquids production. Middle East LNG and Canadian heavy oil are still there. Both coal and nuclear are actually being hampered because of the shale gas producing poor economics, therefore a significant decline is likely in the US. Renewables will likely continue to require subsidies, and the ability to transform quickly is hampered by the fact that there are physically known recoverable sources of energy to be used if shale gas drops off whether heavy oil, LNG, or even coal.

Technology breakthrough in energy is extremely tough given the capital intensity in the industry. New technology cannot plan or wish for peak oil to produce higher prices to enable their technology. Shale gas has pushed the peak curve much farther out than any of these peak oil theorists would ever imagined. Mr. Shaw brings up the carbon issue as a critical path. Once again, as much new technology cannot plan for peak oil, they probably should not plan on significant carbon prices to make their technology viable. Carbon is not going away, but when countries and individuals cannot even balance their check books, can we really plan beyond 10 years much less 100 years which many of the impacts of climate change will be felt? Debt is no different than carbon, it is kicking the can for the next generation. Therefore, to see any government put in a sustained economic penalty for benefits not seen in decades does not seem likely.

The stretch goal for all new technology in the energy space try to compete with prices now, not on a dependence on something in the future. Just as shale gas came into the picture, other sources of technology have the same opportunity.

Your Optimistic Energy Consultant,

614-356-0484

It’s not the end of the world – Climate Change& Quantitative Easing (Printing Money)

I have wanted to write about the similarity between the two most potentially transformative societal issues confronting us, Climate Change & Quantitative Easing (AKA Printing Money). Of recent the latest debacle in a spreadsheet error by Rogoff and Reinhart in their paper “Growth in a Time of Debt” has led my writing astray. However this issue further substantiates the similarity. I am sure my readers know that there was also an issue with climate change data. The most famous was the hockey stick graph presented in the IPCC report. The graph originally came from a report done by Michael Mann in the paper “Northern Hemisphere Temperatures During the Past Millennium: Inferences, Uncertainties, and Limitations”. (One difference is the climate change titles are much longer than economic papers!)

Though the recent debacle includes a simple spreadsheet error the biggest difference from what was reported to what is being challenged by Thomas Herndon, Michael Ash, and Robert Pollin is based on how one treats data and what one excludes or includes. Mr. Herndon and team believe since more data was available for other countries they should be weighted more no matter the differences in economy or time period. Many of the same arguments were made to refute the Mann graph. In the end, BOTH data sets from Mann and Rogoff can be presented to be less dramatic than what both authors presented. However in BOTH cases it does not eliminate the issue that both have presented. In Rogoff case, Mr. Herndon and team state and their own data shows that high debt does not likely lead to better outcomes relative to a lower debt situation. The Herndon and team did conclude there is no magic number that leads to a NEGATIVE growth. However they do note that growth is much less than it would be when debt levels grow above the 90% level. In Mann case, one could argue the graph he presented was on the high-end of uncertainty but the end message no matter what statistical approach you use there is some warming relative to the last 1000 year perhaps just not as dramatic as Mann’s graph.

We can ignore both the issues just because of some technicalities and potential showmanship or we can pay attention to these both very critical points because they contain some probability. We can argue to death to the extent of probability, but there is some threshold that action becomes required no matter what. I believe we have crossed that threshold a while ago in both issues. In terms of actionable items I am not as extreme as some could be since everything is a probable outcome in my mind. Actions need to be commensurate with the probability and timing of the impact. And both issues probability and timing may change as more information and responses are made.

Getting back to the discussion of similarity, both are issues that rely on sacrifice of the future for the current state. Clearly it is “easier” and “cheaper” to continue to burn fossil fuel versus transform the economy. The consequences may be dire, but they are many years off. It is also easier and politically more appealing to increase the money supply driving investments now and have the savers and the future generation deal with the pain later. In each case one could argue we don’t really know the future and perhaps even solutions in the future we cannot predict now will come to fruition. However I would attest that is very poor planning.

There are measures we do each day thinking of the future. Some are simple and have been engrained in society – such as buckling up. We buckle up because it can save our lives. The odd of getting into a serious car accident in your lifetime is 30%. I am not arguing for you not to buckle up, but to show we do act when probabilities are not as great along as the action can be commensurate with the risk and its probability. I am sure you can find many climate deniers to admit there is a 20-30% probability they are wrong – of course that means they are 70% confident it is not. Nonetheless this would argue for action at SOME level if one cared about the future.

Both climate change and quantitative easing are actions that are not apparent at the moment similar to indulging on funnel cake and other unhealthy foods. It feels good now but eventually you will likely get obese and have health issues not worth the gains gathered from the near term enjoyment of sweets. In fact, it will typically be better to emit and print money now. The ultimate consequence of each of them requires a view over many years if not hundreds of years.

On the point of obesity, it clearly shows society is not ready for problems requiring long-term thought. Obesity in the US is very high. This is a matter of caring about what you eat and the long-term issues involved with your choices. We are a society designed for Carpe-Diem and keeping up with the Jones. It may be quite pointless to argue the science of climate change and/or long-term impacts of quantitative easing when society could really care less. It amazes me to see such low savings in both general and retirement savings. So much of society is living on debt. By that logic people don’t really focus on the long-term. I can see somewhat the rationale for many religions to eliminate interest charges – usury. Most religions are focused on maintaining/reducing our vices – e.g. Ten Commandments. I think they realize debt living is not healthy. Living on debt makes you feel good in the moment, but any day it can overwhelm you with a change in your life. A humble lifestyle is too easily gone with the ability to borrow money. We cannot solve these two very large issues without changing society to think longer term. If people do not care about their own lives and cannot plan even their meals to live healthy, do we really expect them to be able to comprehend and plan for climate change which impacts us significantly in 100 years?

Climate change to me seems more tangible and more discussed with various opinions across academia compared to quantitative easing. This may be based on my career largely in the energy space. However I do read quite a bit and find much more literature on climate than quantitative easing impacts. Climate change certainly seems to have much more historical data with ice core samples thousands of years old. The oldest data set Rogoff and Herndon was working with was 1830. Given this I thought I put some graphs up from various recent reports just so you see why I am alarmed with quantitative easing even though the “market” is doing well.

We are in a world so dependent on debt and fossil fuels. Current trends on climate change and quantitative easing cannot be changed until we change the mindsets of people to think ahead. Planning is gone for Carpe Diem. I like the concept to live for the moment, but what if the next moment depends on how you live in this moment. Do you want more moments? We do not live in Hollywood we live in reality. Please take care of yourselves – eat healthy – do not over-extend your finances – reduce the temptation to keep up with the Jones.

The world will not end because of climate change and quantitative easing. However the world could be very different and potentially less inhabitable and stable if we don’t start dealing with some of our issues which require thought. The probabilities of significant harm to society may not be significant (+50%) but given the extent of outcomes it does make it worthwhile to do some actions similarly as we buckle up.

Your very concerned and thoughtful Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

Macroeconomic Impacts of LNG Exports from the United States – Review

Macroeconomic Impacts of LNG Exports from the United States report done by NERA for the EIA brings to mind my saying- It is better to know what questions to ask than to have all the answers. There are many wise sayings that are very similar. One missing from that list is “It is better to ask some of the questions than to know all of the answers.” James Thurber.

There are several issues I could comment on in the report, but many are already discussed by the several commentators . A good acquaintance of mine, Carlton Buford, does a fine job highlighting his concerns with point 4 resonating with my response. However, as I discussed above, the report should have asked a bigger question beyond energy markets impact.

I will agree with the overall conclusions of the report – exporting LNG will benefit the country to some extent. However, this should never have been the goal or the premise of the report. NERA cannot be faulted in terms of answering the question. However, as a consultants, there is somewhat a responsibility to address the clients’ real concerns.

I directly addressed this issue with another consultant’s report done on renewables about green jobs, where I discussed with the author about not addressing net jobs. The author told me they did not do it, because they were not asked to. In both of these reports, someone at the consulting companies should have brought up the real issue to each of these clients. A true consultant will make sure their client is asking the right question before setting out and answering the question asked. The real concern for LNG is whether exporting LNG is the BEST option for the country in terms of maximizing the economic potential for the US. This question is not just an economic study to impact the energy markets, but it should be about getting the US back onto the path of economic prosperity.

Even if natural gas prices were to minimally changed, as the report indicated, the next question should be:” Will the US be better benefited from consuming its own resources knowing it is a net consumer of most products?”. This question was not addressed in the report. It is the crucial benchmark of deciding to export. It does not take a massive model to understand the holistic value of using your own resource. If you know you will have to consume products which are made from the natural resources that you have available; could you not economically increase the internal value of your system by using the resource to produce what you plan to consume? Perhaps if the outside system can more effectively produce a good above and beyond the cost of shipping both the goods and resources to make it –the outside system could be a better option economically.

This then leads to the question:” why can they produce/manufactures goods we need with our resources more effectively? labor policies, subsidies, etc.. “. Is there a better way for us to produce and manufacture products in this country versus outsourcing? In addition, simple economics typically do not cover the social economic issues at hand. As I mentioned in my previous blog – Energy Independence Misguided Focus – the value of manufacturing a good goes beyond the simple economics of making the product. Manufacturing offers a level of social economic stability while still giving people the opportunity to aspire if they so wish. We need to make sure we take this into account. Many countries do value being able to keep their people at work. They know social unrest is likely when mass amounts of people sit around. I will further address this issue in my next blog.

The report fails to address the root of the issue which the leaders of this country should be asking and thinking about – how best to maximize the US economic well-being using the resources available. I will contend we should do what we can to offer incentives to use our resource locally first and foremost. If our ineptness to do the right thing by restructuring our society to allow for manufacturing continues, I would then support the exportation of LNG through a strategic approach. First, there is an obvious US outlet for LNG. Right now Puerto Rico – one of the poorest regions in the US – has to purchase LNG at oil related prices. This brings to mind the technical concerns of LNG vessel. Will the LNG vessels be US flagged vessels – none so far? If not given the Jones Act, the US territories could not even benefit from the liquefaction facilities.

The largest deficiency in the report, as many of the others have commentated, is not considering the chess move made by the largest exporter of LNG – Qatar. This would be akin to forecasting oil markets with no consideration of Saudi Arabia – do we not remember the 70’s oil crisis or 1998 when Saudi Arabia showed the rest of OPEC what it meant to take market share? The plain fact is the cost of natural gas in Qatar is likely below or near $0.50/mmbtu. In the US, even with greater shale development, the cost will still be greater than $2/mmbtu. Even if we subtract some value for liquids, development cost may approach $1/mmbtu, still twice as large as Qatar. Who in their right mind can see grounds to compete with Qatar without some internal subsidy/incentive or it being a niche play? Unless foreign money is financing the projects, I would be skeptical on the extent of LNG exports vs. the report’s conclusions in terms of the economic value to the US.

It is not an either/or issue in terms of export LNG versus using it domestically, but the report was done as if LNG exporting was the only issue. Ultimately a portfolio option with more of the portfolio balance to what will add value is the best approach. If the goal is to maximize the US economy, domestic uses of resources should be the number one priority, LNG exports should be examined in the context of first supporting the US territories, and only after those issues are resolved we should examine the exportation of our resources. I am optimistic that our consumption levels are high enough to support the use of all our domestic resources. Plus, I anticipate that we can become a net exporter of products, keeping further margins in supplying products to the world.

As with everything I put out, this analysis was done given the current construct that exist today. There are many levers that could change my mind to believe LNG exportation is the BEST path for this country; but at this time I believe it is best to maximize our natural gas resources first. States in the US will also benefit from this message – e.g. Ohio. I would not let your resources easily leave the boundaries of your system if you are to maximize your potential economic value. Whoever advised the Houston Mayor, Anise Parker, was wrong in her response. Houston could significantly gain more, if more industrial and manufacturing complexes were built near and around Houston than a few liquefaction facilities. The same can be said for comments made by Senator Jake Corman and State Representative Matthew E. Baker.

In order to right the economic ship of the United States, we must find better ways to use our resources be it fossil, renewables, or human capital. Perhaps beyond the scope of the Department of Energy, but the real issue at hand is to transform our economy back into a balance economy with a strong producing/manufacturing sector. The DOE does have the capability to jump start the sector by continuing to signal there will be cost effective resources for some time to come and support the use of our resources domestically. A strong and vibrate manufacturing sector will go a long way in creating a more stable and prosperous society. It will not make everyone wealthy, but it will allow those who are willing and capable the pursuit of happiness.

We really need to apply some common sense when dealing with complicated issues. Huge models allow one to bias and obfuscate the truth through manipulation of inputs and relationships. Models do have value – being a modeler myself – but the models should never drive the outcome; they are there to enhance the understanding. Ultimately, someone needs to be accountable for the decision and not use models as their excuse for making a decision.

Please do consider All Energy Consulting for your energy consulting needs. We ALWAYS have our client’s best interest in mind. We know the questions to ask and can help find the right answers to them.

Your Energy Analyst,

614-356-0484

Energy Independence Misguided Focus

A recent article posted in the NY Times by Michael Levi highlights my past concerns about Energy Independence talk. Amazingly enough I wrote about Energy Independence last December – https://allenergyconsulting.com/blog/2011/12/15/energy-independence-really/

I want to fine tune my message.

I do see Michael’s perspective in being concerned that we are mistaken about being energy independent as allowing the US to be ambivalent to the worlds energy markets. Clearly, the energy markets are global and will likely to be in the distant future. The theme I think Michael leaves out is the real message politicians and the like need to focus on, versus the concept of being energy independent – that is being productive with the resources we have.

I disagree with many about allowing exports of natural gas. If we are under full employment and the economy is humming along perhaps I could change my mind. However, since this is not the case, we need to think long and hard about why we can’t use our resources in a productive manner. The focus needs to be on stimulating manufacturing. We need to grow America to regain some of what we have lost over the last 30 years.

I like to note, manufacturing is not a path to riches for people, but it is a path to productivity and opportunity. What we have in this country is binary thought. If the working class can’t get a standard of living that allows 40-60K in income plus benefits, we shall accept nothing. It is no doubt a global economy for better or for worse. I have a very contentious thought about wealth which I mulled around with and discussed at bars with my most educated friends. I believe wealth is just like mass. It cannot be created or destroyed. There is a finite wealth in this world. Wealth is discrete globally and when one does better the other will have to do worse.

Let me define wealth more generally than just buying power, but also influence, and the ability to make others act. I believe my thesis holds water when you think about global economic growth. China and much of Asia, at one time, was thought as “third” world; they have grown to become an economic power.

With my thesis in place, the US and Europeans have slowly lost some ground to them holding the economic wealth in balance. The direct impact is the shift in “lower” end jobs in manufacturing. Time would eventually not allow a person making $60K plus benefit with the sole purpose to screw in 4 bolts to be able to compete with people in Asia, making less than $1 dollar a day. Likewise, let me not focus just on the lower income case. CEO’s in the US who do not add value but perpetuate the same concepts and ideas from previous CEO’s that are increasingly making more money than past CEO is also unsustainable. The competing landscape and the wealth balance that will occur, will produce sacrifices to allow others in the world to rise. In a holistic way and perhaps Altruistic – people living in such low standards of living for prolong time becomes inhumane and the sacrifices made from the developed regions have promoted a better lifestyle for them.

However as I point out to my kids that nothing in life is free. The sacrifices have been real and have been exaggerated by the binary thought – all or nothing. In order to balance wealth so that there is reasonable living standards for the masses, the developed country will need to reduce the standards of living, as their standards must compete with the other parts of the world standards. Alternatively one can be stubborn and go with the nothing attitude and live off the state, but this will lead to a very unstable society. I go back to my first point the value of manufacturing is not wealth building. The value comes from volume of employment it can produce. The ability to give masses something to do from 8 to 5 Monday thru Friday. Without this there will be trouble.

The US needs to innovate and take advantage of the abundant resources by creating efficient process to produce things the world uses from fertilizers to plastics to even vehicles. The abundant energy along with sacrifices from the top can ease the lowering of standard of living for the masses as parity is met with the rest of the world. Once again, let me stress both the low paying and high paying jobs. Both tails of the economic spectrum will have to sacrifice; a message that no politician can give since they need funding (high income) and volumes of vote (low income).

Happiness is not derived from money, but money is a requirement in today’s society. In addition, happiness does not come from consuming. We need to move off the binary thoughts and allow compromise. The US should move away from consumerism and regain our productivity focus. Letting any of our resources be exported is giving up on the American dream without fighting for it.

I wish all a safe and Happy Holiday. God bless this country and may we make the right choices.

Please do consider All Energy Consulting for all your energy consulting needs.

Your Energy Consultant,

614-356-0484

Adaptation will happen as the climate changes

The key sentence with keywords bolded from my previous discussion of climate change is “statistical odd that climate change is real, and that it could have significant impact to society.” I leave room for doubt as many things cannot be modeled. Simple things such as predicting cloud formation is still not understood. Given simple things cannot be understood one could surely extrapolate, perhaps more complicated feedbacks are not incorporated appropriately in many climate models. A recent discovery in the arctic articulates this issue.

The article points out a new massive discovery of phytoplankton in the arctic. In addition they note the following: “…it could explain how the ocean has been absorbing larger quantities of carbon dioxide (CO2) from the atmosphere than data could verify, the researchers suggest.” This bio-feedback from higher CO2 contents demonstrates how the earth/nature will adapt to changes. There are other bio-feedbacks that have been demonstrated. Scientists have noted that certain plants are becoming more dominant as CO2 content in the atmosphere increases. This would make Darwinian sense in the fact if the environment is changing those creatures/plants that would prefer easier access to CO2 will be more dominant as more CO2 is available in the atmosphere. Duke demonstrated this bio-feedback with poison ivy being the beneficial plant.

These types of bio-feedback are not all captured in the various climate models. There are so many areas we do not fully understand or can comprehend. However on a risk adjusted basis, I will stick with my premise that there is a statistical odd that the models are showing a possibility of unintended consequences of our emissions of CO2. As I concluded in the previous blog, we will likely have to adapt due to societies focus on Carpe Diem.

At All Energy Consulting we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant,

David K. Bellman

614-356-0484

Climate Change Discussion

Though David Roberts from the Grist once called me a “troll” via twitter because of my perceived different opinions– I don’t mind subscribing to his twitter and viewing his works. Mr. Roberts self-professed in the video below that he is just a blogger. I am: a beginning blogger, but a recognized and an accomplished prognosticator of the commodity markets (1998 crude oil collapse – noted in USA Today among the many other publications), employed for many years on a management team of one of the largest utilities American Electric Power, served on multiple committees from the National Petroleum Council to the National Renewable Energy Laboratories, rated as one of the best speakers in multiple energy conferences, and more importantly a successful family man who has been with his wife for over 20 years and has five wonderful kids. So perhaps next time Mr. Roberts would come up with a better adjective for me than a “troll” just because of some differences. Nonetheless, I don’t see the value of surrounding one-self with liked minded individuals -where is the fun and the learning experience in that? Mr. Roberts recently did a TEDx video, which I thought was very well done and intelligently articulated about the concerns of climate change.

Personally, I do believe with a statistical odd that climate change is real and that it could have significant impact to society. Mr. Robert is correct to point out the 2C is likely past. The odds of this occurring are very high. The depth of the problem is very large. Using the mathematical models and running my own simulations, I showed that de-carbonizing both the US and Europe would amount to a delay of 30-50 years in hitting the same level of ppm. Without worldwide effort, the problem is almost futile to solve.

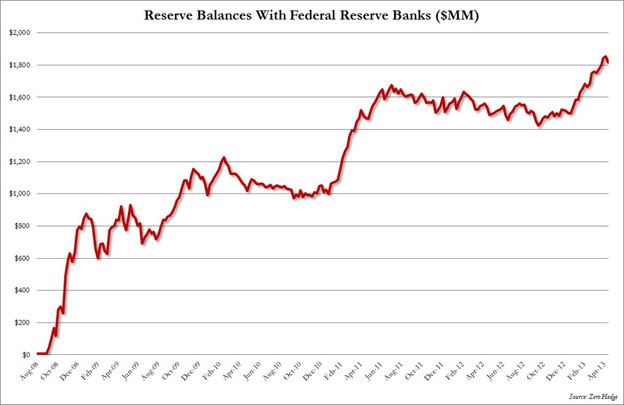

The problem is more than an economic question, it is a philosophical issue. Our society, particularly in the US, is hell-bent on living for the now – Carpe Diem. Many people are not properly planning for retirement. Our political leaders, rather borrow from the future than to have a recession on their watch. In fact, one could probably plot the growth of credit/debt along with the global climate problem, which Mr. Roberts presents in the video; it would be a similar story to global warming. We have a refusal to change the financial path, since it is much easier to see that borrowing now makes us feel better. Likewise changing our energy consumption would take “work” to say the least. Many politicians have little regards for future consequences much like their statement for climate change as Mr. Roberts points out. Therefore in order to solve this problem, we need to change society and its view on planning. Taking near term pain maybe what the doctor is ordering for long-term survival. If we can’t do it in the financial world, I am afraid we cannot do it in the real world for energy.

Beyond our own societal sentiment for Carpe Diem, we need to contemplate balancing all our concerns/special projects. We cannot solve everything equally – capital allocations are a necessity. I don’t see a way out to have social security, medicare, our policing of the world, and then add more expenses for global climate change. Money is really not just paper. Something needs to give. Our attitude to be able to fund everything is due to society being used to living on debt. We need to start making some tough decisions and ultimately sacrifices will be made. Very similar to families on a budget, one cannot spend on everything even if the desire is great.

Adding to the complexity, some of these special projects also include projects that for 100% certainty can save millions of lives at a discrete cost – as proven by the Bill and Melinda Gates Foundation as they try to eliminate polio and malaria. Where is the humanity balance between saving lives now or for some statistical probability saves lives later? Perhaps this brings me to a very interesting possible paper on human behavior action – if someone hasn’t already written one. I would hypothesize one could mathematically derive that the level of certainty must approach infinity as time goes beyond a few years for action to occur. Meaning I believe the way we are wired is to act on known issues, but when there are unknowns the greater the time the greater of increased probability is needed before we act. Given this thesis, I find our ability to react to global warming very minimal at this time – even though it may be the correct thing to do.

Mr. Roberts alludes to the point – it would seem adaptation is inevitable. Personally I wish it wasn’t the case, but wishing doesn’t usually solve problems. It may be more appropriate to start making decisions on the adaptation level e.g. building near or below sea level seems to be very short sighted. Perhaps one should contemplate redirecting existing mitigation research to proactive ways to modify the climate via geo-engineering since by the time we act; mitigation will not be an option. We certainly need to be more open minded – myself included – in viewing these issues in multiple lenses. The problem is a lot more complex than what a single individual can comprehend.

At All Energy Consulting, we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant / Troll to some,

614-356-0484