Oil price drop impacts beyond the obvious – Part 1

I am analyzing many areas as a result of the oil price drop. There are a ton of discussions of oil price drop and the impact it will have on oil production and economy. However there are impacts at the secondary level which can have billions of dollars of impact on the market.

The oil market drop will impact the Renewable Fuel Standard (RFS). EPA suspiciously delayed the release of the Renewable Volume Obligations (RVO) for 2014 twice. With the latest oil price drop, I suspect they will have support for revising and recalculating gasoline demand expectations, which will then thwart any attempts to modify the RFS. Most of the support for revising the RFS requirements was due to falling US gasoline demand and the theoretical limit of the amount of ethanol allowed in the market – aka “blend wall”. This is based on gasoline with greater than 10% ethanol will impact the mechanical aspect of the existing auto fleet. I will not argue the point surrounding this and save that discussion for another time. Given this conclusion, I do anticipate you will see renewable identification number (RIN) prices move up once they do finalize the 2014 and 2015 volumes in the spring.

What are RIN?

For those not involved in the power markets, you will be slightly lost. For those who have gone through the trials and tribulations of the Clean Air Act (CAA) and the emissions markets the government created in order to create an “optimal” path to emissions reductions – it is very similar. Very similar to SO2 and NOx markets, the government assigns a target of volume and produces a certification for each unit of volume. The only difference this time is rather than wanting the volume to be reduced, they want the volumes to grow. Instead of assigning an emission credit, they assign a production credit. As a producer of gasoline or diesel, you are required to obtain a set amount of RIN for each volume produced. One can do this by physical blending and/or purchasing a RIN. Another difference is instead of assigning a multi-year level of commitment ahead of time as they did in the CAA, the EPA is supposed to assign it each year in the spring. The market does have a general idea given the RFS does state targets, but as a fuel producer you don’t know your specific requirements. The brilliance of this design, and at the same time the most confusing, is the banking system which is very similar to the CAA construct.

The RFS includes the magical banking system. They have learned from the initial CAA markets and have adopted the banking restriction similar to the NOx markets, but actually slightly easier to follow as they limited the banking system to 20% of the total RVO for each year. There is no decline in values on vintage basis. The vintages from each bank can be carried into future years. The banking system is the greatest invention since slice bread for those into Operations Research and Game Theory – my two favorite subjects. I have spent much time in the analysis of emissions banking and game theory, and I presented to AEP management the relationship between the CAA emission markets and the Nash Equilibriums which can be generated. Funny enough Dr. Nash grew up near one of AEP power plants, which I believed is pictured in the movie – Brilliant Mind. There are fixed outcomes for these types of systems. They are equilibrium points when all market participants achieve a certain goal.

I was the lead proponent in AEP to sell the emissions credit heading into the newly created NOx market in 2005. The NOx market once introduced and, upon an extreme winter, decided to go crazy. The prices of NOx went over $5500/ton. This far exceeded any of the equilibrium points. The other nuance you need to realize in markets which turn in a credit on a fixed date is the cost of a credit in a given time is somewhat irrelevant since the only real value of a credit is when you turn it in. If you want to make money on a system like this you had better spend time on the end market vs. what the market is now. Starting the NOX season with a huge rise in price was pointless, and one could run 50+ simulations and show even the hottest summer could not generate a demand level of NOX that would necessitate the price above the highest market equilibrium point. In the end, after a few years, the market achieved one of the lowest equilibrium points – variable cost of running the control equipment.

The other unique aspect of the RFS is the three levels of targets – Conventional, Biodiesel, and Advance. In theory, and so far in practice, this is the order of greater complexity and cost. The order also represents the highest volume targets to the lowest. The rules do allow one to use a credit from the more complex target into the simpler target not vice versa e.g. Biodiesel RIN can be used for Conventional RIN.

RIN Future

With the lower oil prices and the market structure with banking, I don’t see how one anticipates the modification of RFS with lower goals. The main argument of “blend wall” will succumb to greater oil demand as consumers not only drive more, but consume more. The US will not likely save more given the design of our system and culture. The very act of consuming more whether food or services increases petroleum demand. The banking ability of 20% gives much room to buffer the changing weather from crop issues to the changing economy from driving.

The low oil prices will impact the economics of many ethanol plants, particularly those that have not been built. On a sunk cost analysis, the economics should allow them to continue to produce ethanol. This situation only leads to even greater value for RIN. The trading and risk mitigation of RIN need serious consideration for those producing transportation petroleum for the US or for those making the RIN. At All Energy Consulting, we can take our knowledge in the emissions and petroleum market to help you weather the storms of the RIN market.

Other topics to come due to the drop in crude oil prices – Condensate Value …Octane Value…..

Your Energy Analyst Thinking Beyond the Obvious for Your Success,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

How low will oil go?

I tried to avoid this answer for many reasons. My hesitancy in answering is due to my jagged edge of experience in trading commodities. The price of a commodity, in a fixed given time period, does not have to hold any fundamental characteristic. In today’s world of constantly being “online”, traders chase the next move through any means including reading into a statements made by OPEC members. As much as today’s spot price of oil predicts the price of oil 6 months from now, the same applies to the futures market price (How much? Answer: Not Much).

The price now for oil, whether spot or futures, represents the condition of buying, selling, and managing internal storage with a system of risk of tomorrows price. If the market believes the oil prices can go lower, you have fewer buyers as they would rather use their inventory until a point the price holds too much risk it will be higher. If the market believes the oil prices will go higher you have more buyers wanting to build inventory and will buy it to the point the price holds too much risk it will be lower. There are losing and winning trades throughout the year.

Right now you have a bunch of “losers” who have locked in oil prices at way higher prices. Hedging is dangerous when your market competitors don’t and your prices for your service/product can be eroded by competition. There is not much intelligence when one hedges all your volumes at once. A balanced hedging program should step into the changing markets. An effective oil hedging program would have allowed the market to fall while gradually adding to the hedge over time. Calling the bottom of the oil price would be as lucky as trying to catch the handle on a sharp falling knife from a 10 story building. It is possible, but not likely. An effective hedging program would let the knife fall and realize you won’t catch the bottom, but you won’t ignore it either.

The bottom price of oil will likely not occur without an event. Traders need to see the market is responding before stopping the momentum of a falling knife. Unfortunately, the oil markets are operating on sunk cost investments. A reaction on drilling and production will take time. I believe one of the first signals for a slowdown of production will not come from the physical production declines, but from the insistence of the debt holders to quantify what they own. The operating company management team will likely go ahead and produce whatever they can – the debt holders will want them to stop so they quantify the volumes and use those volumes to payback the debt. This will take time to play out via bankruptcy. The other reaction to low prices will come from the demand side. This is winter for the largest consumers of petroleum. Demand can only rise so much now. However, as we move into spring and summer, expect a rebound in demand. The ironic statement is that the current market is not so trusting of the market to react.

Oil prices can continue to fall. However, as a business, I would not be planning based on this market aberration. The fundamentals will re-align the markets as real data and information becomes available, and actions by participants occur. This could take as long as 6-12 months. I still believe oil prices due to the global nature realign itself in 6-12 months north of $60/bbl. Some have tried to compare the drop in oil to the drop in US natural gas price, which has not really rebounded. However, US natural gas markets are not global – yet – and potentially never will be as LNG and GTL investments are likely being questioned with low oil prices. The issues we discussed that will drive this market hasn’t changed – Oil Market Doomsayer.

If you are dependent on oil prices and have never hedged your purchase, this could be an opportunity to develop a systematic method for hedging some of your oil needs. A true hedge creates a system to manage your budgets while balancing your business and energy risk. Hedging programs should never be constructed to make money or save money. If so, you are now trading, which is a valid business option if you have the appropriate experience.

Please consider All Energy Consulting for you energy consulting needs. We add insights to the energy market for your success for now and years to come.

Your Energy Analyst Not Interested in Catching Falling Knives,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Year of Model Building 2014

2014 Modeling Efforts

At All Energy Consulting, we specialize in modeling the energy markets. To give you a sense of our capabilities, below are the list of models built in 2014.

Reviewing the list, it reminds me of the saying :

“People who love what they do wear themselves down doing it, they even forget to wash or eat….When they’re really possessed by what they do, they’d rather stop eating and sleeping than give up practicing their arts.” Marcus Aurelius, Meditations

Please do consider All Energy Consulting for your energy modeling needs. I truly enjoy what I do and it will show in my work and commitment to you – Thanks for 2014.

David

[email protected]

614-356-0484

Oil & Gas

-

Built a USGC refinery model in various configurations – Hydroskimming, Cracking, and Coking

-

Discounted Cash Flow Model for Refinery Acquisition and Refurbishment

-

USGC and Caribbean petroleum pricing model

-

Modeled the US Natural Gas Deliveries to Electric Power Consumers by State

-

Modeled and Calculated the discount value for Eagle Ford Condensate

-

Built World Supply/Demand Balance Model for Crude Oil and Petroleum Products

Power

-

Assisted Platte River Power Authority (PRPA) in deployment (setup, build, and operate) of a power model used for their Integrated Resource Plan

-

Several Discounted Cash Flow Model for Power Generation Asset – 800 MW CC to 1MW Reciprocating Engine including the associated power modeling work

-

Worked with the University of Texas Center for Energy Economic on modeling and publishing papers regarding ERCOT

-

Modeled EPA Clean Power Plan and published paper in Fortnightly

-

Modeled and produced a risk analysis for a set of generating assets

-

Long-term Power Modeling along with integrating GCPM gas pipeline model

-

Built and Operate Power Market Analysis (PMA) Platform – includes integrated trade screeners to integrated natural gas storage models.

-

Built an interactive load model for 118 load zones representing N. America

-

Built a coal pricing model to deliver and price coal to all 1000+ coal units in N. America

-

Discounted Cash Flow Model for an Integrated Desalination Plant with Associated Power Generation and Recycle Facility for Waste Water from Fracking

Models are only as good as the inputs and the ability to decipher the outputs to business solutions. More information on modeling and other services can be found on our website.

Best of Market Insights 2014

To my readers, clients, and prospective clients,

I appreciate your feedback throughout 2014. The year 2014 will be remembered as the year of discovery for All Energy Consulting (AEC). An identity for AEC had to be discovered – better late than never. I know I had to work more on delivering my value proposition to you. I have spent so much time on developing products/services plus analyzing markets I lost sight of delivering this message. You will see an enlightened AEC moving into 2015. Our value proposition to my readers and prospects will be clear. I want to share the current thoughts on this in our Branding Positioning Statement:

“For those who need forecasted energy commodity prices, we are experienced market analysts who assist in the navigation of uncertain energy markets with a proven process and methodology, and a collaborative approach in consulting that yields clarity, transparency and empowers decision-making.”

You will see a change in 2015 with a clear direction to support the statement above.

Below are the best of market insights in 2014 rated based on web statistics – page views and downloads.

Your Very Grateful More Focused Energy Analyst – Happy New Years!,

David

614-356-0484

Best of Market Insights 2014:

– With the most page views (60K+) –Peak Energy – Are we there in the US? This is very surprising. Perhaps this is a result of peak oil conspirators or just an error in the web stats. The article uncovers the decoupling of the economy with load in several areas in the US.

– Excellent Returns Were Produced From PMA Summer Model Predictions This article highlights the performance of the generic PMA model for the summer. PMA correctly highlighted the hype from Polar Vortex bleed into the summer forwards. Also should read theBest Winter Trade which yielded 30%.

– Ready for March Gas Demand? Duke’s Merchant Coal Plant Value This article demonstrated PMA flexibility to not only help create risk-adjusted forward curves but also calculate natural gas demand and do specific power plant analysis. We also highlighted our agility with the ability to deliver results within 24 hours.

– US Refining Margins Outlook Sept. 2012 – Wow. An oldie had nearly 20K page views. This article highlighted that condensate production was going to change the markets and that US refining margins will be robust for years to come. Well it was an UNDERSTATEMENT – even though I was probably one of the few analyst mentioning the significance of condensate in 2012 the production of condensate blew past my old outlook. US Refining margins were and will be robust! See 2014 US Refining Outlook

– Most downloaded (403 downloads) – Summer of 2014 Analysis – I threw the kitchen sink and all into this analysis. If you took the time to really digest all of the information in the report you would have been prepared for what transpired in summer 2014.

Oil Market Doomsayer & OPEC Bashers –Not Putting the Money Up

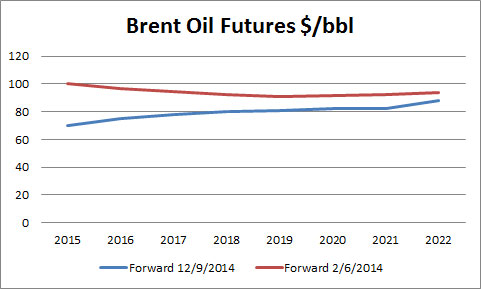

Over the past week, there were so many pundits noting the poor decision by OPEC and that the market will continue to spiral down. As I worked on refreshing my oil price forecast given this market change, the remarkable difference is that there is not much difference in the forward curve. Yes we have a near term capitulation, but extending further into the curve the drop becomes much less. By 2020 the difference can be attributed to the rising dollar valuation.

No doubt, the forward markets are poor predictors of actual results, but they do represent a financial view now. The numerous pessimistic pundits must not be persuasive enough to those with money in hand. As I tried to relay in my previous writing on the oil markets, this is a timing issue. There is little doubt oil demand will grow at some point as population and improvements in standard of living are expected to grow (unless someone believes in Armageddon).

The current situation was inevitable as demand growth was not meeting the supply growth as noted in my previous article. However, in the end, as all fundamental analysts will point out, supply and demand always meet. The price will take care of this convergence.

Oil production will change its path. Oil & Gas companies will take the time to be more efficient and less wasteful versus focusing on the next barrel to be produced. This mitigates some of the decline expectations, but all it will take is a slowing of investment at a shale play to see the production profile change within a year or two.

Oil demand will also change its path. The consumer will consider oil prices to be low given their conditioning of $100/bbl markets. I expect SUV sales to rise as they have done in the past when oil prices dip. The developing nation is also getting a break and they will take on more demand.

I know many of us are trained now to be immediately responsive given our access to Twitter, Facebook, and other always connected social media devices but this is not how the energy markets operate. Aberrations are inevitable. Energy planners need to consider all the aberration potential from large discoveries to political unrest. In the long run, as a planner, these events eventually produce a net belief of the likely outcome of the supply/demand balance with price playing interference when one gets too overwhelming over another.

In this instance, I think the forward curve is quite rational. The big issues to weigh are:

-

Is there another political unrest around the corner to take a few million b/d off the market (e.g. ISIS, please not another war)? (bullish)

-

Is there enough cost savings in the supply chain to keep the production flowing in the US and Canada at or below current prices? (potentially bearish)

-

When and how long will it take for demand to rebound given a consumer saving of 20-30%? (bullish)

-

Will oil subsidies given to many producing countries citizens end? (bearish)

-

How much and how long can efficiency improvements keep down oil demand – Khazzoom Brookes Postulate? Postulate shows when you improve efficiency of a commodity you end up using it more. (bullish)

-

Will OPEC cave in and try to maintain prices? (depends)

-

Any real carbon reducing initiatives? (bullish – Canadians eh’ – tar sands processing is pretty carbon intensive and expensive)

-

Advancement of US shale capabilities into other countries? (bearish)

We will all have our own opinions on each of these topics and the probabilities of each. As you can see there are still many bullish variables despite all the bearish pundits. Based on the financial markets, they are still bullish on oil and it is not all hot air given their money is at risk.

All Energy Consulting can work with you and your team to create scenarios and play out the market outcomes. We offer unique sets of skills which incorporates the extended reach of energy from oil to electricity. In the end a BTU is a BTU – some are more functional than others.

Your more than hot air Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

OPEC Decision Expected and Justified

OPEC meeting went as expected. There was no formal agreement to cut production in the first meeting since the price correction. This part is very similar to 1998. Prices did their thing by falling down and now slowly rebounding. OPEC is making the decision they are not the marginal barrel. Unlike their decision in 1997, they are likely right. Time is the key to how this all unfolds. The daily and weekly gyrations of crude oil prices are made by traders who believe they are able to read the dynamic tea leaves. The story of the oil markets can be explained by examining the details in the demand and supply fundamentals from the past and now.

Supply

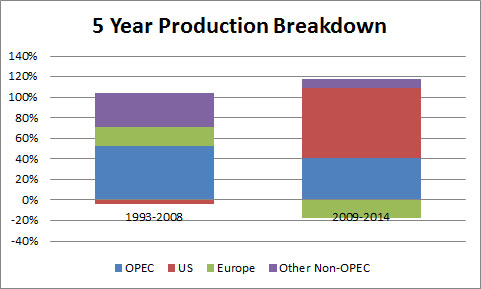

From 1993 to 1998, Non-OPEC production grew almost by 10% with OPEC growth in production nearly 20%. In addition, the Non-OPEC production outside US and Europe represented the majority of the Non-OPEC production increases. This is much different than 2009 to 2014 figures. Both OPEC and Non-OPEC production grew close to 8%. The majority of the Non-OPEC production growth came from the US. The dynamics of the increasing production will lead to a different result compared to 1998.

In 1998, most of the battle of production/market share was battle within the organization. The Non-OPEC production was coming from a diverse group with Europe production gains representing the largest group. Non-OPEC gains were coming from some significant finds which took a large capital cost to develop and was going to take many years to fully hit the production peaks. OPEC tried to hold the line, but they were only going to capitulate themselves. The Saudi’s showed the world a glimpse of producing oil near the kingdom marginal economics. This was too painful for many of the members and they succumbed to over producing their quotas which realigned the market over many years given the growing Non-OPEC production.

In 2014 most of the production gains is resulting in OPEC market share eroding in the largest oil demand market. This is no longer a battle within the organization. The marginal economics for this increasing production is much higher than in 1998. In addition, the profile of this production requires continual investments versus large capital outlays to maintain and increase production. This very fact will create a dynamic response to price which was missing in 1998. This is not a cure for a rebound in price over the next few weeks to months, but it will be a response which could not have occurred in 1998 without OPEC coordination.

Demand

The demand picture has some similarity between 1998 and now, but there are some distinct differences, just like in the supply picture. The similar aspect is the fact that the first sign of market weakness stemmed from the demand concerns in the Asian economy. The distinct difference is the development of the demand concern is much different.

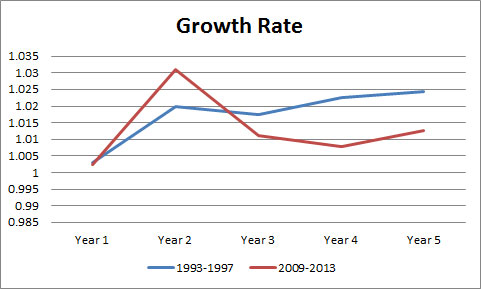

Going into 1998, world oil demand growth was averaging a 2% growth per year with Asian demand growing by over 5% a year. China was growing nearly 8% a year. Most pundits at the time were expecting continued growth in the region. The problem I identified early on is the massive growth year after year was leading to some very large absolute numbers. In examining historical growth of developing countries, it showed eventually a country demand growth slows down after 5 to 10 years of strong growth as infrastructure is needed to expand further. The Asian financial crisis created a dramatic shift in demand expectations. Oil producers were caught off guard as capital was spent in expectations of demand growth.

Going into 2014, world oil demand growth was only averaging 1.3% after the 2008 financial crisis. Asian demand was averaging 3.5%. World oil demand growth from 2011-2013 has averaged only 1% a year. European petroleum has been in a downward spiral since 2007. Unlike 1998, no one should be surprised with lackluster demand growth. Given the dismal demand numbers for the past few years, demand is likely to be more surprising than a production correction.

Putting it All Together

With slowing demand growth and increasing production, a price correction becomes inevitable. The price is now trying to find the price point to slow production and/or increase demand. Production is going to react faster than demand. OPEC made the right decision to let the prices come off. If they cut their production it would have created a dislocation in the supply curve and ultimately lead to a reduced revenue stream. In 1998, this strategy would not have worked given the production competition was largely within the group and with the Non-OPEC production coming from large capital projects. This time, we have a market with production coming from N. America which is dependent on continued capital investment to maintain production. We expect the market to find enough marginal wells in US and Canada around the $60-$80/bbl range to balance the market for the next few months. After that, I expect the market to recover as demand will naturally rebound given the 20-30% price decline. I think, by next year, we will see demand much stronger than the current IEA outlook.

Some have asked why I skip the 2008 price correction. The 2008 price change was more of a function of the global economic crisis, and I consider this an outlier in terms of fundamental supply/demand issue in the oil market. However, in the presentation, I do cover the 2008 peak price and the actual prediction I made in calculating the maximum peak of the oil prices – $145/bbl (prediction) vs. actual of $147/bbl.

As noted, in my other articles on the oil markets (Crude Oil Markets not 1998 & Crude Oil Collapse) I have a complete presentation that I can present to you and your team offering a unique perspective on the oil market. We take the time to truly understand the past so we can appropriately reflect on the future. Please do consider All Energy Consulting to offer your team insights on the oil markets. The presentation includes price forecasts and explanations including a discussion on refining margins.

Your Over 10,000 hours of Analyzing the Oil Markets Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/