AEO 2012 Natural Gas Liquids (NGL) & Condensates: Glut of Supply

This blog is adding on top of our previous blog, discussing the latest release of the Annual Energy Outlook 2012 (AEO 2012) by the Energy Information Agency (EIA). Shale gas revolution encompasses not only natural gas, but a glut of liquids from condensates to natural gas liquids (NGL). Shale gas is not only impacting the natural gas markets, but has and will impact the chemicals and refining markets. The AEO 2012 shows an increase of only ~600 kbd of NGL from 2010 to 2020. This is a very conservative number. In terms of condensate, the AEO does not break it out, but crude oil and condensates grow only 1.3 mmbpd. In the write up, much of the growth is a function of tight oil not condensates. Once again, I believe this to be almost too conservative.

In order to justify this stance, one can examine the many recent assessments done by the USGS. Adding up just the Eagle Ford, Marcellus, and Permian assessments; the mean NGL technically recoverable volumes total over 6 billion barrels. According to USGS, they have places the condensates into the NGL category. Liquids are clearly driving the shale gas production. Gas is almost becoming a loss leader. As I discussed in my previous blog, there are multiple projects focused on expanding the infrastructure in order to monetize the NGLs coming from these shale plays. One of my estimates of NGL and condensate additional volumes for 2020 compared to 2010 would be an increase of 2 mmbpd.

With this much volume of light feedstock, the US refining markets will see a drastic change. A historical given was the crude slate was going to get heavier requiring more and more conversion capacity. With the amount of NGL and condensates, the US market could potentially see a pause to this belief is inevitable if not a reversal from this trend. Much of the refining capacity has been designed to process heavy crudes not light feedstock. Refining margins from a highly complex refinery will not be pretty. Perhaps many have come to this thinking with all the refining closures and selling announcements. Simple condensate splitters economics would not bode well either, as a surplus in naphtha will likely occur. NGL and condensates will need to find a home. A re-configuration of existing refineries will come at significant losses to the current owners. There will be winners. Those who have access to capital and can think outside the box will win. The consumers will also be a big beneficiary of refining margin compression.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider and contact All Energy Consulting when you need consulting services.

Your Energy Consultant,

Potential for Natural Gas Demand in the Power Sector

As a forecaster, I have typically been inclined to go full steam ahead and use the fundamentals to drive my forecast. However for the past 7 years, my approach has changed given the amount of uncertainty we see in the market. These uncertainties are no longer driven by pure economic fundamentals, but stem from political bias. These political bias ranges from perpetuating economic risk taking by keeping interest rates low to banning types of energy because of irrational fear. This requires a sense of humility to realize your forecast may be far from the truth. However, all is not lost, since it is still best to foresee than not to foresee at all (Henri Poincare). In order to forecast in this world of uncertainty, one needs a scenario planning perspective. The goal is not to point forecast, but to get a sense of risk and rewards. One wants to find the plan that will be robust in multiple scenarios, if not downright one-sided to your favor – the latter being much less frequent. A good starting point is to look at the world in terms of potentials. This simplifies the multitude of scenarios one could create. If one can tail-end your scenarios, you will have a better grasp of why you are looking at a certain view point to being able to drive to a scenario of better reasoning.

In the analysis work we did with the Center for Energy Economics at the University of Texas, we examined the tail-end potential for natural gas consumption in the power sector. Our final results of this potential study can be found here. We show that the potential gas demand in the power sector is significantly greater (30+% – 17 tcf vs. 12.8 tcf) than the highest potential examined in the latest National Petroleum Council report – “Prudent Development – Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources”. The most likely reality as noted in the report are the results we presented. This will not likely be achieved in terms of total gas consumption in the power sector, but the results do highlight the need for the gas and power industry to be cognizant of each other. Our result supports the premise for further continued monitoring and evaluation for natural gas demand in the power sector.

Let us help you frame and develop a methodology to model your energy concerns. The Center for Energy Economics is just one case about us that we delivered on our promise; leaving them with useful knowledge and the potential to grow without further consulting.

At All Energy Consulting, we positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting when you need a consulting service.

Your Energy Consultant,

Current Design of Minimum Wage Increases Income Inequality and Stifles Innovation

I came across this USA Today article while sitting at the airport – Minimum Wage Rates May Climb. I felt inspired to throw out another perspective on this issue. The premise of minimum wage was to prevent income inequality. Fair Labor Standards Act passed in 1938; noted wages should ensure a “minimum standard of living necessary for health, efficiency and general well-being,” plus, “without substantially curtailing employment.”

I believe there is sufficient history to re-examine the efficacy of minimum wage. My contention is the current construct of minimum wage not only provides a minimum standard of living, but it also promotes that form of living versus a desire to do better. The “substantially curtailing employment” is objective. In my mind, minimum wage has substantially curtailed employment. In fact, it has also curtailed innovation. Minimum wage has supported the incumbent companies stifling competition and innovation.

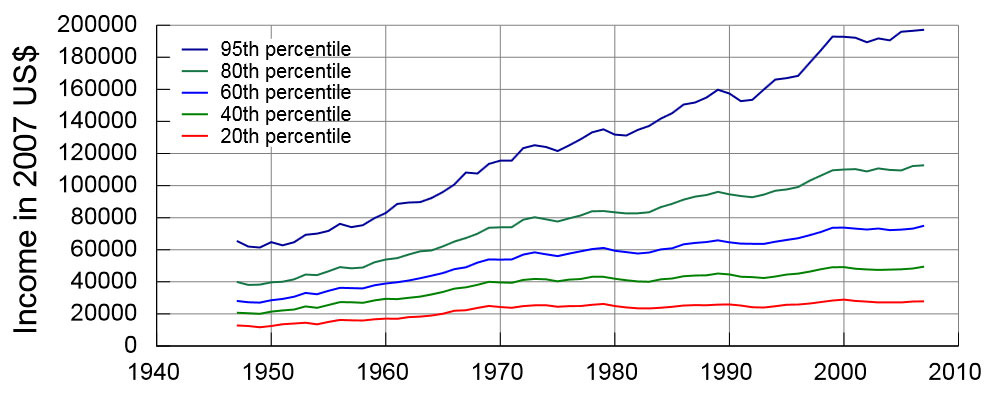

Refuting the core efficacy of the current design of minimum wage is easy. Examining the history of income inequality, it shows the value of having the current design of minimum wage has not helped. The below graph I pulled from Wikipedia – of course I have validated it – (one cannot trust Wikipedia 100%).

Many other sites have shown the income equality has only gotten worse with a minimum wage policy (see http://www.ritholtz.com/blog/wp-content/uploads/2011/09/Rising-executive-pay.png & http://www.ips-dc.org/campaigns/tax-dodging-ceos/index.php ) Re-designing the minimum wage and the multiple restrictions in starting and creating a company, I would contend, will create many competitive companies not allowing corporations to outsource and further consolidate wages. Mitigation of income inequality has failed to occur in the time period of minimum wage. We can pretend that it will eventually prove itself, but I will reference Albert Einstein – doing the same thing over and over again and expecting different results is insanity.

For those less numerically inclined, I will try to employ some logical deductions. When one decides to start a business and try something innovative and different, there are many roadblocks developed over time to prevent you from succeeding, largely from the support of the incumbent corporations. One of the key areas of growing a business is expanding through employment. However, as those who have hired before, realize the choices of people vary in terms of work ethic and capability and it is extremely hard to know beforehand. An ideal situation would be to hire multiple employees in hopes of finding the one or two that will just fit in perfectly. Ideally, they would promote that individual to take on greater responsibility with greater rewards. With a minimum wage structure your ability to experiment and hire multiple employees and eventually promote and reward become limited. A cost structure that does not allow experimentation will result in lowering the potential of the individual and the new company. Obviously, an incumbent organization can more afford to employ the strategy of hiring multiple individual to find that star performer, leaving the pool even smaller for the new company.

One of the original reasons that minimum wage exist was due to significant abuses by employers. During those time periods, communications and information traveled very slowly. The sweat shop concerns in the US will be nullified via social network. Much of the US has the ability/access to the internet as compared to the third world employees. An elimination of minimum wage will likely do more to reduce sweat shops since these third world sweat shops are ignored by the general public. Creating a competitive US workforce company will bring the discussion to the forefront.

Another logical deduction is to come from the employee point of view. I could imagine a situation for a young student to work for “free” or very minimal for only the pure desire to obtain knowledge, which can be used later in life. My thinking is focused on enabling the individual to get out and do something with their skill set. It’s rooted in finding and maximizing the ingenuity of the individual. Eventually some of those individuals will create a small business then perhaps a large business. In addition, I am not advocating the removal of all regulations (e.g. building standards – but if one can build to a standard why not allow that person to build – buyer beware in terms of cost). Let us unlock the power of the individual versus holding everyone back.

Given the historical results of the past 74 years, the current design of minimum wage is holding a large segment back. With a re-design of minimum wage and other similar obstacles for new companies, this country will see a resurgence of private companies and employment. A potential re-design solution could be eliminating the minimum wage for companies under a certain income level. These new companies will create a competitive force to the inertia of status quo and make a change to corporations’ ability to outsource and further consolidate wages.

The value of multiple smaller companies can be seen in the shale gas revolution. Shale gas was driven by the smaller independents as the large multi-national companies could not see and/or innovate to produce shale gas.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

Gas Producers Entering the Power World

A question was asked “could you blog about the strategy for a gas producer to participate in the power market as an independent power producer (IPP)?” Given my background in both Oil & Gas and Power it puts me in the perfect position to discuss this.

Let me first start simple and then build up to be a large scale IPP. The question posed was black and white in terms of participating in the power markets as an IPP. However, it really isn’t that black and white. There is potential strategy for the gas producer to unite with the power markets without actually operating a facility. This can be as simple as acting as the hedging agent for the utility. We see many people try to emulate the coal markets with their long-term contract arrangements. The difference for gas is the product is fungible – a molecule at Y is essentially the same as the molecule at X. This cannot be said for coal. Coal products are non-fungible with unique characteristics. Therefore building a coal plant with a boiler specified to operate with certain characteristics puts the power generator at fuel risk without a long-term contract. Beyond the equipment flexibility, fungible nature of natural gas has allowed the forward gas markets to be active and representative to the actual market in the near term. This cannot be said for coal as the coal forward market does not represent a significant portion of the physical market. Therefore, utilities, who would like a fixed price on natural gas price, can obtain a fix price by participating in the forward gas markets. There are several utility executives who would like to deal with gas like coal, but by doing so, all they are doing is shifting the burden of the hedge to the producer. There is still value for them to do this, as long as the premium of the hedge is understood. Shifting the hedge to the producer will allow the utility who is typically lean on the balance sheet not to be concerned about the fluctuations to the market. In theory, the producer should be able to hedge the gas better than the utility since it is their business therefore economy of scale should play into it. The premiums of the hedge will certainly be passed onto the power generator with a little return for the added risk. I suspect a small producer could not fill this role for the utility, since the counter party risk could be too great relative to the value of the producer. In a de-regulated environment, it is essentially betting on a position, which is no different than fixed coal pricing if the price is low enough. Clearly a bad deal will result in both parties losing in the end. Teaming up with a regulated entity to supply a fixed gas and volume has many significant advantages once the public utility commission has approved the deal. There is less risk of not being paid as the market risk is essentially being socialized.

The large scale alternative for the gas producer to act as an IPP offers many competitive advantages along with the associated challenges. This strategy still is not black and white. There is a potential to take small enough volumes from various fields and qualify as a distributive generator. The technology has progressed in the micro-turbine world to make it economical. This volume will not be large, but could work well for areas having to flare gas. In essence, most of the generation will be used to supply internal energy use, and on occasion be used to support the grid. Once again, depending on the market dynamics the challenges will differ. ERCOT related markets, where most of the market and several actors are de-regulated; more upside value can be captured. Markets with significant regulated actors could compress margins as their returns are less a result of optimal decision making, but more on the approvals of the public utility. In today’s market of essentially zero yields for cash, it becomes a very compelling reason to put your money to work. The power sector can bring a relative consistent return with a conservative outlook. Building or acquiring a combined cycle can offer decent returns with upside potential. Examining the cost of production of some shale plays, it makes sense to have part of the portfolio of production sold with upside potential. By operating a combined cycle a producer can essentially sell their production with an upside potential. There are locational issues which must be examined, but I suspect given the various transmission initiative for renewables, gas units can piggy back on that infrastructure build out.

There are several other key points to consider and local market analysis needed before producers jump into the power market, but I am sure there are several markets/situations it will make sense for producers to be more active in the power sector. Actual implementation will require back office support. The positive note most producers already have some form of risk group and a trade floor. If you are a producer, please do call or email me as I can help guide/assess/re-affirm your decisions [email protected] 614-356-0484.

EIA Annual Energy Outlook AEO 2012 Points of Interest

Each year when the EIA releases their Annual Energy Outlook AEO, there is much talk about the results. The problem I find each year is trying to understand the change in the relationships between various markets. This is a function of the underlying model they are using. They are using the NEMS model which uses a general equilibrium concept. Personally, I never felt modeling should be left to the model. General equilibrium models are very dependent on all the experts to enter the relationships. Then the model will model those relationships. However, if you don’t have an expert of all things, the model may produce interesting relationship changes; since these experts are experts without integration.

My quick review focused on the Natural Gas, Coal, and Distillate: This is largely because the power market comingles these fuels, therefore, these relationships should be acted upon by the power market. Below are the gas price comparisons to coal and distillate deltas to the 2011 AEO deltas.

AEO 2012 decided in this year’s outlook that the oil spread to gas will be larger than last years by over $5/MMbtu. The gas to coal spread will decline by $0.30/MMbtu. This is largely a result of coal prices being stronger than gas prices being weaker.

Given these relationships before examining the consumption numbers, I would believe that more gas will be in the power sector. Coal use should decline. There should be some gas to liquids (GTL) at some point given the large economic incentive.

The consumptions on a high level show coal consumption being 10% less – no surprise there. However, total gas consumption is essentially the same as last year’s AEO 2011. Digging deeper the power sector use of natural gas climbs over 12% from last year’s AEO. Where is the demand for gas falling to keep the totals the same? It would seem the EIA has a more bearish outlook for natural gas use in the industrial sector and commercial sector. The commercial sector falls 7% which perhaps can be accounted for by efficiency improvements. Industrials seem counter intuitive given the many chemical projects recently announced.

Coal to liquids (CTL) demand fell by half, directionally correct since coal prices are higher but certainly not to the degree that liquid prices are higher. Interesting to see no gas to liquid (GTL) demand. I understand the complexity of GTL (I have a BS Chemical Engineering degree from the University of Texas). Numerous reports suggest GTL likely many years out. However all those reports were written when gas and oil were much closer to parity in the United States.

In addition, the driver for GTL was for stranded gas not in the US. The US innovative market structure plus the sustained large spread between gas and oil should lead to GTL development. My skepticism in GTL lies in the premise the spread will be that large for such a sustained time period. Based on my assessment, the amount of natural gas usage in the power sector is still too low by around 20%. It would be hard press to maintain the coal fleet as it ages with gas prices below $5/MMbtu for the next 10 years. In terms of balancing capital and environmental risk, no other form of generation can beat natural gas for baseload demand across the country. New coal units cannot compete with new natural gas plants with gas-coal spreads less than $3/MMbtu. Around $3/MMbtu, it is marginable and when considering the CO2 risk, it would take spreads closer $4/MMbtu+. Commissions approving coal plants in this environment are typically incorporating other unrelated energy economics (e.g. local jobs, resources). The only thing that haunts natural gas is the price spike seen in 2005-2008. However, if you think about the catalyst that drove that price rise, hurricane Katrina, it becomes less likely to vision in the future. Shale gas has created another layer of gas in the supply curve, which is less sensitive to gulf coast storms.

Further analysis of the AEO is warranted. A certain credit must be given to them for being the pundit willing to go out on the limb and supply every bit of information. I don’t usually agree with the EIA forecast, but they have made great strides in their forecasting ability. They have incorporated more reasonable capital cost projections. They are a good benchmark for modeling. We can only wish other countries around the world would emulate the EIA in supplying historical information and estimated forecast figures.

Market assessments and market forecasting are one of our specialties.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

Heating Degree Days Show Winter Never Came

In my previous article on natural gas prices, I stated eventually gas prices were going to come back up. However, I carefully noted in the last sentence “when the winter weather comes”. Based on the data so far, winter is not coming. Below chart comes from the NOAA data showing the previous 30 years of December heating degree day (HDD). As you can see from the chart, December 2011 was warm compared to the last four years. It is almost a whole standard deviation from the average.

Looking at the weekly January HDD, January is trending even lower from normal weather. This natural gas price capitulation could get much worse before it gets better; as the natural gas must be withdrawn in several areas else damage to the aquifers can occur. There are contractual agreements requiring withdrawal of gas by the end of the heating season.

Once again it shows the most important variable to understand is DEMAND – which in this case is driven primarily by weather. This statement is certainly true in power. One can have all the knowledge in market relationships, but if your demand is off all bets are off.

In the longer run (6months+), gas at this price will put significant pressure on the utilities to curtail/retire their marginal coal plants. As natural gas price falls, more coal plants are considered marginal. I suspect some coal plants are running regardless of economics as the operator probably has contracted too much coal. In this case, one would hope the public utility commission steps up and denies some of the fuel cost pass-thru for poor planning; else there will be no incentive to plan better next time. In this low gas price environment, utilities should have weatherized their gas units to perform over the winter while also firming some transportation to their gas plants. They should have adjusted their spot to coal contract ratio to be lower. I know it is easier to quarterback after the fact, but last year showed several indicators that low gas prices are very likely. This is not an after the fact quarterbacking session. As the Managing Director Strategic Planning at AEP, I consistently championed the company to diversify to gas and believed in natural gas being the appropriate fuel in terms of managing capital and market risk. Simple fundamental analysis even back in the 2005-2008 period showed gas prices were not going to rise and stay above $10/mmbtu for long. Large LNG projects were lined up with the capability to supply the US markets for $7/mmbtu with a huge return on investment for those investors. In addition, the free market should drive innovation as the price incentives rose from the $2/mmbtu enviroment to an ever growing price slope – as documented in my previous post. Entrepreneurs who thought they could get gas out of shale for less than the market projections came and developed this shale gas revolution.

The big question to whether natural gas prices climb back above $4 will likely be answered by those who can predict the weather. Will this summer be one of the hottest, coolest, or just normal?

I have been evaluating risk, developing scenarios, and forming hedging programs. Please do keep All Energy Consulting in mind for your consulting needs. Let us write you a proposal.

Your Energy Consultant,