Regulatory Capture in the Utility Space?

I really did not want to be writing about this. However, since I have found this article not in my own backyard, I can assume this could be a universal issue. Therefore, it becomes an important issue that the public should understand. The article here describes a deferral strategy employed by BC Hydro [update 9/19/12 oops looks like they got rid of the story – found another link for you]. Unfortunately, this deferral strategy is not uncommon. In my own backyard, with my own previous company; they have employed that strategy.

In essence the reason to employ the strategy is twofold. Deferring cost allows the commission, who are typically politically appointed, to appease their constituents, by not allowing significant price increases on their watch. The utility enjoys it as the commission allows a return (8+%) on the deferral much like a credit card. In a business sense, it is not wrong, but perhaps without full disclosure and explanation to the public; it could be perceived as wrong.

Clearly the commission is being self-serving by deferring cost. The rationale could be to smooth out prices. Howeve, if smooth pricing was so important; how about allowing the utility to hedge prices. This is the case of wanting to have your cake and eat it to. In many cases, one can see hedging could lead to increase cost to the ratepayer, but with a smoother price. The irony is many of the initiatives for smart grid are to enable the consumer to get better price discovery. Deferring a real cost to the consumer certainly is not offering price discovery.

For the utility, it really becomes a no brainer for them. However, if they sat back and actually thought it through; in the long run it may come back to haunt them. Deferring cost could potentially leave not much room for actual projects. In addition, deferral creates false signals in the market places. Many economists have espoused, “The cure to high prices is high prices”.

The utility has their work cut out for them when they actually have to recover the deferral. The most obvious concern when recovering the deferral is those who consume may not be the ones that will actually pay. The recovery mechanism cannot directly bill back to those that consumed; given many can move. Even tracking consumption by class is very tricky. Typically this enables the commission and the utility to once again “game” the system to their liking – whether it is to subsidize industrials at the expense of the consumer or vice versa. Typically it will be the industrials over the consumers; since the political strength and advocacy groups from the industrial class overwhelm the consumer and commercial class.

On a positive note, rates rising will allow innovative players in the space of energy efficiency, and new business models to focus on monetizing energy use to successfully come to fruition. At All Energy Consulting we are committed to making a better tomorrow. One of our key areas of focus is the transformation of the business model for property owners and developers.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider and contact All Energy Consulting for all your consulting needs.

Your Energy Consultant,

AEO 2012 Natural Gas Liquids (NGL) & Condensates: Glut of Supply

This blog is adding on top of our previous blog, discussing the latest release of the Annual Energy Outlook 2012 (AEO 2012) by the Energy Information Agency (EIA). Shale gas revolution encompasses not only natural gas, but a glut of liquids from condensates to natural gas liquids (NGL). Shale gas is not only impacting the natural gas markets, but has and will impact the chemicals and refining markets. The AEO 2012 shows an increase of only ~600 kbd of NGL from 2010 to 2020. This is a very conservative number. In terms of condensate, the AEO does not break it out, but crude oil and condensates grow only 1.3 mmbpd. In the write up, much of the growth is a function of tight oil not condensates. Once again, I believe this to be almost too conservative.

In order to justify this stance, one can examine the many recent assessments done by the USGS. Adding up just the Eagle Ford, Marcellus, and Permian assessments; the mean NGL technically recoverable volumes total over 6 billion barrels. According to USGS, they have places the condensates into the NGL category. Liquids are clearly driving the shale gas production. Gas is almost becoming a loss leader. As I discussed in my previous blog, there are multiple projects focused on expanding the infrastructure in order to monetize the NGLs coming from these shale plays. One of my estimates of NGL and condensate additional volumes for 2020 compared to 2010 would be an increase of 2 mmbpd.

With this much volume of light feedstock, the US refining markets will see a drastic change. A historical given was the crude slate was going to get heavier requiring more and more conversion capacity. With the amount of NGL and condensates, the US market could potentially see a pause to this belief is inevitable if not a reversal from this trend. Much of the refining capacity has been designed to process heavy crudes not light feedstock. Refining margins from a highly complex refinery will not be pretty. Perhaps many have come to this thinking with all the refining closures and selling announcements. Simple condensate splitters economics would not bode well either, as a surplus in naphtha will likely occur. NGL and condensates will need to find a home. A re-configuration of existing refineries will come at significant losses to the current owners. There will be winners. Those who have access to capital and can think outside the box will win. The consumers will also be a big beneficiary of refining margin compression.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider and contact All Energy Consulting when you need consulting services.

Your Energy Consultant,

Potential for Natural Gas Demand in the Power Sector

As a forecaster, I have typically been inclined to go full steam ahead and use the fundamentals to drive my forecast. However for the past 7 years, my approach has changed given the amount of uncertainty we see in the market. These uncertainties are no longer driven by pure economic fundamentals, but stem from political bias. These political bias ranges from perpetuating economic risk taking by keeping interest rates low to banning types of energy because of irrational fear. This requires a sense of humility to realize your forecast may be far from the truth. However, all is not lost, since it is still best to foresee than not to foresee at all (Henri Poincare). In order to forecast in this world of uncertainty, one needs a scenario planning perspective. The goal is not to point forecast, but to get a sense of risk and rewards. One wants to find the plan that will be robust in multiple scenarios, if not downright one-sided to your favor – the latter being much less frequent. A good starting point is to look at the world in terms of potentials. This simplifies the multitude of scenarios one could create. If one can tail-end your scenarios, you will have a better grasp of why you are looking at a certain view point to being able to drive to a scenario of better reasoning.

In the analysis work we did with the Center for Energy Economics at the University of Texas, we examined the tail-end potential for natural gas consumption in the power sector. Our final results of this potential study can be found here. We show that the potential gas demand in the power sector is significantly greater (30+% – 17 tcf vs. 12.8 tcf) than the highest potential examined in the latest National Petroleum Council report – “Prudent Development – Realizing the Potential of North America’s Abundant Natural Gas and Oil Resources”. The most likely reality as noted in the report are the results we presented. This will not likely be achieved in terms of total gas consumption in the power sector, but the results do highlight the need for the gas and power industry to be cognizant of each other. Our result supports the premise for further continued monitoring and evaluation for natural gas demand in the power sector.

Let us help you frame and develop a methodology to model your energy concerns. The Center for Energy Economics is just one case about us that we delivered on our promise; leaving them with useful knowledge and the potential to grow without further consulting.

At All Energy Consulting, we positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting when you need a consulting service.

Your Energy Consultant,

Environmental Accounting for Pollution in the United States Economy: One Sided View

I came across this report from the American Economic Association (AEA) as I am following a bunch of really interesting people on twitter. The people I follow don’t always agree on subjects; but why would you follow people who believe what you believe. Where is the fun in this? How will you get color and perspective following the people who believe the same thing? This report was done by academics from Yale and Middlebury College. My qualifications certainly do not match them, but at some point common sense and reason should prevail.

The report was to analyze the cost of externalities, and apply that to each industry to get the gross external damages (GED) from pollution and to compare the “value-add”(VA) from each industry. The purpose of the ratio of GED/VA in their own words “The purpose of this comparison is to determine whether correcting for external costs has a substantial effect on the net economic impact of different industries”. They further point out on the same page when the ratio is greater than 1 “This indicates that the air pollution damages from these industries are greater than their net contribution to output”. They are indicating industry such as coal plants, sewage treatment, etc… may not be worth the value for the harm they produce.

The report did a great job going over the details of how they were going to compute the GED. In fact the majority of the report was to describe and show the GED calculation. Once again they use a controversial adder to put a value on pollution – mortality rates as a result of pollution. Overall, I am willing to agree upon their GED calculations, but the problem I feel is that they have one-sided the ratio.

Their only reference to how the value add was computed came from two sentences – “The VA of an industry is the market value of output minus the market value of inputs, not including the factors of production—labor, land, and capital. The VA data are gathered from the BEA and from the US Census Department Economic Census.” Adding mortality consequences to pollution is essential, how about adding value for mortality increases as a result of electrification and sewage treatments?

Many sectors produced a ratio greater than one which could lead the layman to believe those sectors should be destroyed. In the report, they note this should not be the case. However they make a point to say that the high ratios would indicate these sectors should be further regulated. Therefore, I believe it is important they put the same amount of work in the denominator (value add) as they did with the numerator (GED). The oddity of the ratios can be accounted for by their one sided calculation.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider and contact All Energy Consulting when you need consulting services.

Your Energy Consultant,

EPA Total Greenhouse Gas Data Emissions for 2010: Bad Reporting

EPA has finalized their greenhouse gas data for 2010. Once again, the reporting is lacking and the added step to confirm and highlight the critical issues is missing. This article notes the top emitting CO2 plants to be “Southern Co.’s Robert W Scherer power plant in Juliette, Ga. (22,978,929 metric tons); Southern Co.’s Bowen coal plant in Cartersville, Ga. (21,026,397 metric tons); Alabama Power’s James M. Barry coal and gas plant in Quinton, Ala. (20,752,490 metric tons); Luminant’s Martin Lake coal plant in Tatum, Texas (18,701,286 metric tons); and Duke Energy’s Gibson coal plant in Owensville, Ind. (17,993,350 metric tons).”

First the obvious, poor Barry plant is lumped in as the top 5 largest emitting plant. Barry barely makes the top 50. The article should have noted James H. Miller Jr. plant, not Barry, which is another coal plant in Alabama.

The second and more important issue is the focus on plants that emit the most CO2. In reality these plants are just large, but efficiently deliver CO2. The EPA could have easily linked up with the EIA to show the energy produced at each of these plants in 2010. It is obvious if you are larger plant and supply electricity to millions of people you will emit more CO2. The “bad” plants are really the plants who fail to efficiently deliver energy when the technologies exist to do so. I have taken my time to link the two databases together.

The worst top 30 plants, in terms of CO2 emissions per MWh, combined emit more CO2 than Scherer. The Scherer plant actually is in the 300’s in terms of worst plants in CO2 emissions per MWh. Many people want to focus on the top emitters without normalizing the scale. Failure to look at the numbers in a different light will result in poor conclusions to the problem.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider and contact All Energy Consulting when you need consulting services.

Your Energy Consultant,

Current Design of Minimum Wage Increases Income Inequality and Stifles Innovation

I came across this USA Today article while sitting at the airport – Minimum Wage Rates May Climb. I felt inspired to throw out another perspective on this issue. The premise of minimum wage was to prevent income inequality. Fair Labor Standards Act passed in 1938; noted wages should ensure a “minimum standard of living necessary for health, efficiency and general well-being,” plus, “without substantially curtailing employment.”

I believe there is sufficient history to re-examine the efficacy of minimum wage. My contention is the current construct of minimum wage not only provides a minimum standard of living, but it also promotes that form of living versus a desire to do better. The “substantially curtailing employment” is objective. In my mind, minimum wage has substantially curtailed employment. In fact, it has also curtailed innovation. Minimum wage has supported the incumbent companies stifling competition and innovation.

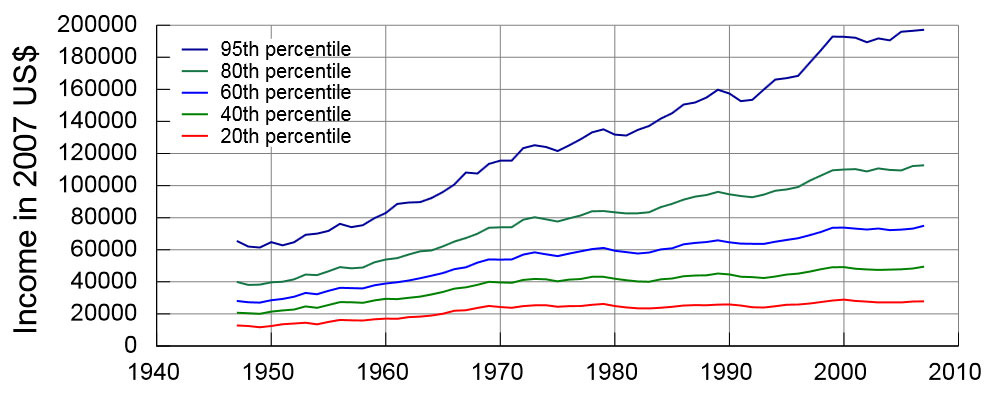

Refuting the core efficacy of the current design of minimum wage is easy. Examining the history of income inequality, it shows the value of having the current design of minimum wage has not helped. The below graph I pulled from Wikipedia – of course I have validated it – (one cannot trust Wikipedia 100%).

Many other sites have shown the income equality has only gotten worse with a minimum wage policy (see http://www.ritholtz.com/blog/wp-content/uploads/2011/09/Rising-executive-pay.png & http://www.ips-dc.org/campaigns/tax-dodging-ceos/index.php ) Re-designing the minimum wage and the multiple restrictions in starting and creating a company, I would contend, will create many competitive companies not allowing corporations to outsource and further consolidate wages. Mitigation of income inequality has failed to occur in the time period of minimum wage. We can pretend that it will eventually prove itself, but I will reference Albert Einstein – doing the same thing over and over again and expecting different results is insanity.

For those less numerically inclined, I will try to employ some logical deductions. When one decides to start a business and try something innovative and different, there are many roadblocks developed over time to prevent you from succeeding, largely from the support of the incumbent corporations. One of the key areas of growing a business is expanding through employment. However, as those who have hired before, realize the choices of people vary in terms of work ethic and capability and it is extremely hard to know beforehand. An ideal situation would be to hire multiple employees in hopes of finding the one or two that will just fit in perfectly. Ideally, they would promote that individual to take on greater responsibility with greater rewards. With a minimum wage structure your ability to experiment and hire multiple employees and eventually promote and reward become limited. A cost structure that does not allow experimentation will result in lowering the potential of the individual and the new company. Obviously, an incumbent organization can more afford to employ the strategy of hiring multiple individual to find that star performer, leaving the pool even smaller for the new company.

One of the original reasons that minimum wage exist was due to significant abuses by employers. During those time periods, communications and information traveled very slowly. The sweat shop concerns in the US will be nullified via social network. Much of the US has the ability/access to the internet as compared to the third world employees. An elimination of minimum wage will likely do more to reduce sweat shops since these third world sweat shops are ignored by the general public. Creating a competitive US workforce company will bring the discussion to the forefront.

Another logical deduction is to come from the employee point of view. I could imagine a situation for a young student to work for “free” or very minimal for only the pure desire to obtain knowledge, which can be used later in life. My thinking is focused on enabling the individual to get out and do something with their skill set. It’s rooted in finding and maximizing the ingenuity of the individual. Eventually some of those individuals will create a small business then perhaps a large business. In addition, I am not advocating the removal of all regulations (e.g. building standards – but if one can build to a standard why not allow that person to build – buyer beware in terms of cost). Let us unlock the power of the individual versus holding everyone back.

Given the historical results of the past 74 years, the current design of minimum wage is holding a large segment back. With a re-design of minimum wage and other similar obstacles for new companies, this country will see a resurgence of private companies and employment. A potential re-design solution could be eliminating the minimum wage for companies under a certain income level. These new companies will create a competitive force to the inertia of status quo and make a change to corporations’ ability to outsource and further consolidate wages.

The value of multiple smaller companies can be seen in the shale gas revolution. Shale gas was driven by the smaller independents as the large multi-national companies could not see and/or innovate to produce shale gas.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,