Condensate Economics Explained

Introduction

As discussed in my previous article, the Oil & Gas Industry, producers in particular, are trying to export condensates. The industry has recently gotten some exemptions, and perhaps this may lead to more. As noted in the previous article, this may not be the best policy decision for the US economy. Constraining exports will allow the entrepreneurs and innovators to find ways to use the feedstock more effectively domestically. This will then create better economic multipliers versus shipping out the feedstock. The restrictions do put an additional downward price pressure on the producers, forcing them to sell at more of a discount in order for the US refiners to take the condensate. However, the condensate will be sold at discount regardless of the export rule as explained in more detail below.

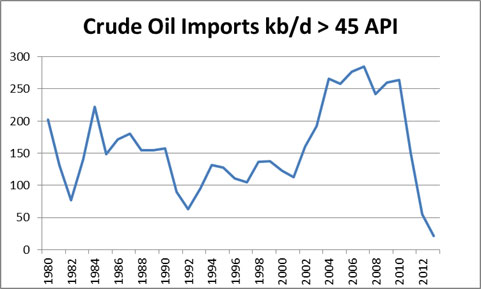

The producers believe they can sell the feedstock more effectively in the global market. This is yet to be proven. Overall Condensate is not very valuable in terms of product yield relative to most crude oil. The US has already displaced a significant volume of international condensates which was being imported to the US as seen in the figure below.

A large percentage of imports above 45 API are condensate. The dramatic drop off is due to the explosion of condensate in the US from fracking, thereby displacing the imports that were coming to the US. Wherever condensate goes, it will still have to compete on global basis plus shipping and the poor product yield. In fact, condensates yield a lot more gasoline than diesel and jet when refined. Diesel is the primary product in the rest of the world compared to the US, which is mainly gasoline.

There is lack of economic pricing discussion on condensate, including my previous piece. This time I will present the economics of condensate to prove the points that condensate exports will not likely result in economic gain for the US. The very first thing is to understand basic refining economics. I am working on a new multi-client product – Oil Market Analysis (OMA). The first part of OMA will involve an oil refining index model. This daily product will track and calculate the value of various crude oils through various refining configurations. I am using the initial results from the model for this discussion.

Analysis

There are three major configurations for refining – hydroskimming, cracking, and coking. Each of them is progressively more advanced and costly. Advancements come in two forms

1. Increasing yield of products vs. residual product

2. Increasing capability to process heavier and more complex crude.

A good presentation on the various configurations can be found from Statoil. From their presentation, they expected increasing complexity requirements from refineries. The US refineries also believed this, and as a result have caused this predicament – too much condensate without an optimal home.

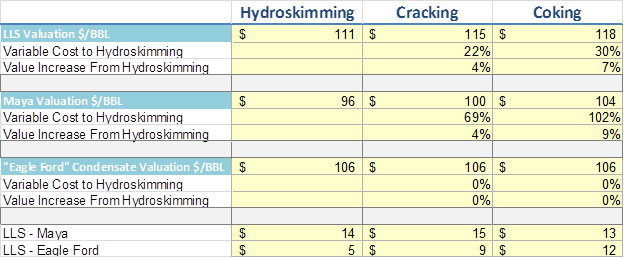

Running OMA refining model for the USGC Light Louisiana Sweet (LLS), Maya (Mexico Heavy Crude Oil), and Eagle Ford Condensate shows the following result in each configuration using the average USGC 2013 prices for Gasoline, iso & normal Butane, Jet, Propane, Diesel, Naphtha, Residual Fuel Oil, and Petroleum Coke. The value is essentially the revenue minus the variable cost obtain per barrel of feedstock. If LLS was processed in a cracking refinery, in the USGC they could expect $115/bbl of revenue per barrel. LLS averaged $106/bbl in 2013 – therefore a USGC refiner running LLS should have produced a margin of $9/bbl. This is not weighted nor optimized. An optimized refiner should have been able to extract more margin through better inventory management, purchasing, and offering a broader product suite.

Takeaways

Increasing complexity increases the variable cost of the facility – largely energy cost. The value of increasing complexity is more apparent when the crude oil is heavier. LLS is 66% lighter than Maya. “Eagle Ford” Condensate is about 277% lighter than Maya. Therefor, light crudes such as condensates cannot benefit from the increase complexity.

Refineries do not get much value from processing condensate as seen in the table above. Refiners are likely asking for significant discounts relative to LLS in order to process the condensate. The marginal refinery in the USGC is the cracking refinery. Given this market dynamic, the market should have priced the condensate around a $9/bbl discount to LLS. IF the export market marginal refinery unit is a hydroskimming, then perhaps a $5/bbl discount is possible. Given the shipping cost, the discount to condensate will still likely be greater than $7/bbl, even if exports were allowed. It is possible to create a mixture of heavy crude oil and condensate, thereby creating an optimal blend for cracking refinery to be cost competitive with a coking refinery. This could reduce some of the discount for the condensate. This would be a more sustainable path for delivering maximum value vs. trying to export the condensate. In addition, market forces would likely create a mechanism to capture the condensate discount. Many have turned to splitter projects. I don’t believe splitters would be a sustainable solution. Splitters will just flood the market with more unfinished product,s e.g. Naphtha. Naphtha prices are already under so much pressure. Naphtha eventually will have to be processed to produce finish product.

Conclusion

In the end, exports may reduce the discount to Condensate by a few dollars. Those dollars will not likely show back up as a significant saving for the US consumer. The producers will benefit the most from the ability to export and find market arbitrages. The many that chose to do splitter projects will likely not fare as well as the feedstock discount may not keep up with unfinished product decline in prices. The condensate discount will likely continue to be greater than $7/bbl relative to LLS. There is still room to formulate a better refinery blend and even expand the US refining capability by adding a condensate refinery. (I do know a 80,000 b/d condensate refinery that can be brought back to life for $800 million in 18 month time projected IRR 30+% – email me if you are interested)

Please do consider All Energy Consulting for your refining market analysis. We have many years of practical experience and now offer a dynamic market refinery model. Please email me if you are interested in hearing more about Oil Market Analysis (OMA) – [email protected]

Your Digging Beyond Skin Deep Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Winning Power Trades Identified by PMA

Many have given up on power trading due to various reasons from new banking regulations to limited volatility over the past few years due to gas prices. However as many leave the market, there is much opportunity being created in the market place. The power markets are vast and complex requiring a comprehensive energy background to truly understand the inner workings. With many years and significant market knowledge, Power Market Analysis (PMA) was developed to help unlock the opportunities in the power markets. The following will present post analysis of June trades and an example value of PMA.

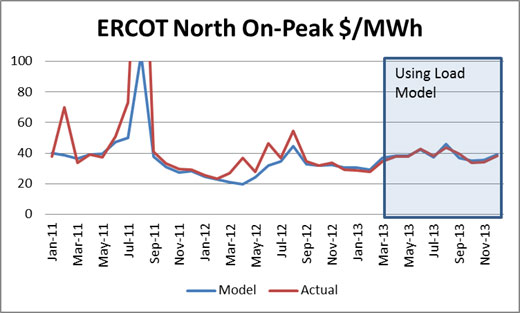

One of the latest tools within PMA is the power trade screener. The power trade screener is capable of processing the entire N. American markets and producing a table of trades given a set of criteria on the various dispatch simulations used in the PMA. The basic PMA offering is running three runs focused on power price volatility – Base, High, and Low power price cases. The formulation of these runs are available for subscribers plus can be customized for each client depending on location interest and volatility expectations. The current criteria for the screener is to find trades that in ALL three cases produce a result that lies on one side of the current forward curve. Therefore if all three cases are below the forward curve, it is a sell. And if all three cases are above, it is a buy.

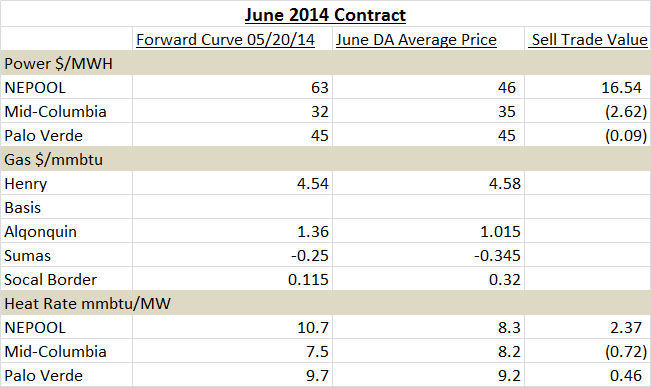

On May 20th 2014, the following represented the power trade screener view examining On-Peak Trades for the month of June. (Click on Image to Zoom)

In addition to the power trade screener, the heat rate screener also shows the same June Sell alerts for those regions. (Heat Rate trade is Power Contract / Gas Contract – if you believe heat rates are going down you sell power and buy gas)

The results of these trade recommendations can be examined now. The below table show the results of those trades. (Click on Image to Zoom)

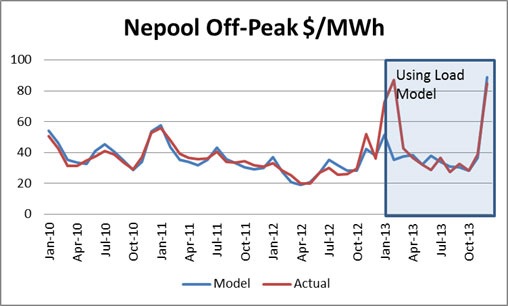

The power trades identified by the screener produce 1 out of 3 winning trades. However, if each trade was purchased in equal volumes the trades would have netted out $13.8/MWh. The best trade was NEPOOL. This is also supported by the backcasting of NEPOOL in the model being superior relative to other markets. On a heat rates basis, 2 out 3 trades would have been winning trades.

Everyday, this analysis is done. Users can learn the patterns and make the adjustments. There is money to be made with markets that are less liquid for those who have the financial and aptitude capabilities. The screener and the simulated runs can be customized for each client.

Please contact me for a demo – [email protected] – 614-356-0484

Your Ever Improving Energy Analyst,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

A Balanced Discussion on the Merits of SB 310 – Throwing the Baby out with the Bathwater?

Summary of Senate Bill 221 and Senate Bill 310

Let me begin briefly explaining Ohio Bills Senate Bill 221 and Senate Bill 310.

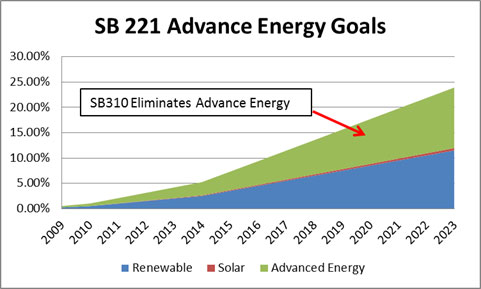

SB 221 is a bill focused on increasing the state diversity of energy to cleaner and potentially game changing technology while focusing the state’s consumers on becoming more energy efficient . The bill mandates that a certain percentage of the generation come from advanced energy resources as defined by the State Commission NOT the utilities. This is important to understand. Examples of these sources can come from carbon neutral technology (e.g. modular nuclear, wind, solar, etc.) or technologies that improve how efficiently energy is consumed (e.g. combined heat and power, distributed technology, etc.). Of the advanced energy resources, the legislation calls for half of the targets to be made using traditional renewable sources (mainly wind and solar). The bill also set efficiency targets for the electric utilities to drive the consumers by implanting programs like CFL light subsidies which can be evaluated, measured, and verified by an approved vendor. The targets contained in SB 221 specific to development of advanced energy resources had price caps to prevent significant price increases for the consumer. The efficiency targets do not contain any price caps.

SB 310 is a bill focused on delaying and cutting back on SB 221 mandates. In other words, SB 310 waters down SB 221. SB 310 is designed for the utilities, because it eliminates the portions of SB 221 that threatens the utility business model (more on this later). Everyone seems to focus on SB 310’s 2 year delay of the targets outlined in SB 221 while further studies of its ramifications are conducted. SB 310 also eliminates the advanced energy resource requirement, except for the traditional renewable targets (solar, wind) which remain the same, but are affected by the two year delay. The other advanced energy portions of the bill could have enabled end-users to identify and pursue energy savings opportunities at their facilities within the state.

History of the Bill

As the dust settles on the controversial Ohio senate bill 310, critics and supporters must reassess the situation. Regardless of your position, the bills bottom line impact needs to be understood in dollars for both actual value and potential value so that informed decisions can be made on the bill and its potential changes. As noted above, the bills intent is for diversity of energy and development of new technology. This comes at additional cost that does not always show value right away.

I had previously spent time reviewing Senate Bill 221 while I was the Managing Director Strategic Planning at American Electric Power. SB 221 was passed in 2008 by a 132-1 margin (Republican-controlled House and Senate, combined) and signed into law by former Democratic Governor Ted Strickland. Senate Bill 221 was initially proposed with the good intentions of increasing the state diversity of energy, moving towards cleaner and potentially game changing technology, and becoming more efficient. It would be hard to vote against, hence the 132-1 margin that passed the bill. Given the current design of the utilities and public utility commission, the bill really did not have a chance to be successful.

Issues with SB 221

SB 221 bill only attempts to change the utility, not the commission. The bill adds more responsibility and oversight to the commission, but does not offer any additional budget or suggestions of any action plans to the commission. The bill offers some rewards, incentives and penalties to motivate the utilities to change . The utility typically are slow to innovate and turn change into opportunities, and therefore largely sees only the penalties. “Where there is change there is opportunity” applies to many, but not those who do not want to see change. Given their history of regulation, the utilities need to be nudged into acting more pro-actively . Therefore, bills such as SB221 were needed. However, the commission responsible for the nudging is ill-equipped.

To understand why the utility culture is not designed to capture opportunities of change, one needs to understand the history of regulation. (For more details read Regulation vs. Deregulation Utilities). The utility and Public Utility Commission capabilities are not designed for the new technological world of competitive advanced energy resources and energy efficiency. The utilities failure to innovate largely stems from their incentive structures and historical legacy. The typical consumer wanted reliable power at a reasonable price and was not really interested in the details beyond that. The end-user just wanted to turn on the switch and when the electric bill arrived, they did not want to be surprised.

Utilities have, therefore, worked hard to maintain strong relationships with the Public Utilities Commission since it regulates and approves all utility rate structures. It is no surprise that utilities remain friends with the commission since this keeps the cash flowing to their bottom line. However, when enough consumers react to poor service, the commission could be forced to insist on changes at the utility. This creates a strong incentive for utilities to maintain the status quo, rather than shake things up. Innovation requires some trial and error, which results in increased cost and potential disruptions. The cost based structure, where the Public Utility Commission approves the utility costs and fixed rate of return, does not provide additional rewards for innovation. Thus utilities have traditionally seen zero return for innovation. This mechanism focuses on reliability and reasonable costs, not innovation. This scenario has played out largely unchallenged for decades, but a shift began to occur as a growing group of society started to become more aware of the environment and vocal about repairing and improving it. That movement caught the utilities and the public utilities commissions somewhat off guard . Policy makers moved ahead of the utilities and the commission by implementing policies including SB 221.

The commission’s existing knowledge base was sufficient to oversee reliability while minimizing cost. However, the commission is ill-equipped to oversee an energy industry with new challenges and new technologies. The mandates ask for advanced energy resources and energy efficiency to be implemented with competition and un-bundling in Ohio’s shopping marketplace. Now, there is a tug-of-war between the consumer, the marketplace, and the commission with the utility stuck in the middle. At odds with the commission skill sets, SB 221 is pushing for change . The commission is now required to manage and think beyond current experience. If the commission is to acquire the needed new knowledge and experience, the budget at the commission will likely require an increase, so that they can recruit and retain the right talent to oversee Ohio’s new energy marketplace. Larger utility management teams are making nearly twice as much as commission senior staff. Yet the commission is expected to comprehend the multiple utilities plans cooked up by well-funded teams of experts whose goal is to limit disruptions of the current utility business model. Thus the commission will likely not succeed in effectively regulating policies requiring utilities to change from their current form. Any legislation is only as good as the regulation and enforcement of the bill.

Changes to SB 221 in SB 310

Advance Energy

There are many issues with SB 221. However, these concerns could have been fixed without the drastic change in SB 310. As noted, SB 310 eliminates the advanced energy resources initiative, but leaves the renewable requirements.

The better option would have been to open up all advanced technology and renewable energies under one category. This would have allowed the marketplace to pick the winners of future advanced technology. By eliminating advanced technology, which cover the following: Distributed generation, cogeneration, clean coal technology, fuel cell, solid water conversions, and few others, SB 310 seriously erodes the good intentions of the bill. One of the reasons discussed for eliminating advance energy resource portion of the bill is the lack of progress made by utilities in this effort. However, the lack of progress is largely due to the lack of effort, limited capabilities of the commission, and the desire of the utility to not disrupt the business model.

The utilities only targeted and developed the renewable portion since SB 221 was enacted. The utilities would have you believe there was no advanced technology that was a cost effective option relative to traditional renewable energies. I don’t believe this to be the case. The better reason was because there were no transparent medium to encourage projects that would supply portions of the advanced resource category. Advanced technology is very broad, covering distributed generation to co-generation. The real issue limiting advance technology development was the lack of incentive for utilities to look for these advance technology. They understand the traditional renewable energies and those projects are less likely to hamper some of the utilities current business operation. Distributed generation projects and co-generation options are smaller in scale and directly alter a customer class, potentially causing havoc in tariff structures. The large renewable projects can be uniformly spread across classes. If it was solicited to end-users that the utility would purchase and operate a combine heat and power in their area, thereby lowering their price of power by at least 20% and reducing the environmental foot print by over 20%, I am sure there would be plenty of projects. Advance technology given its very nature will require a change from historic business operations.

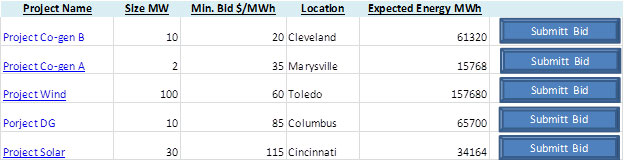

Many deals in the power industry are made behind closed doors yet at times they offer competitive advantages. However, given a case where there is a regulated enforcement for certain projects, it would be reasonable to create a transparent pricing platform. The commission could do an initial pre-screen to qualify the projects as advance technology (this still can include traditional renewables) – SB 221 gave them this power. The state would be acting prudently and wisely by allowing commission to approve each new “advance technology” source. Due diligence would still be required from the utility just like every other project. Creating such a platform would prevent the excuse that there are no cost effective advance technology projects available compared to traditional renewable projects. At the same time, it would give commercial and industrial clients, plus developers, an ability to propose innovative projects that could transform a portion of the energy use in the state towards the intentions of the original goals of SB 221.

The abuse of the system would be limited by price caps and volume requirement in the bill. End-users should realize prices would not climb any more than the explicit price caps – “An electric distribution utility or an electric services company need not comply with a benchmark under division (B)(1) or (2) of this section to the extent that its reasonably expected cost of that compliance exceeds its reasonably expected cost of otherwise producing or acquiring the requisite electricity by three per cent or more.” Utilities should realize their business is not required to transform quickly and drastically given the initial volumes are slowly being ramped up plus the cost limits should mitigate some of the rise. Inside the platform, vendors and developers would submit their project information. They would also submit a minimum subsidy value needed to have the project go forward. The various utilities would then bid on the various projects. A sample screen of the platform I have in mind is shown below:

The platform would enable the commission to have a market price to observe the cost of advance technology relative to traditional renewable. This would also enable the utilities to find projects quicker and develop a portfolio for achieving the requirements while staying under the restrictions of the bill. The end-users and developers would have ways to participate in the future of Ohio energy mix.

The other big propaganda for SB 310 was that SB 221 is too costly. Too costly is questionable given the advanced energy resource requirements had price caps as noted above. If the targets are too costly the utilities did not have to achieve those targets. The overarching cost rise was limited to 3%.

There were also cost limits, specifically, on renewables:

“The compliance payment pertaining to the renewable energy resource benchmarks under division (B)(2) of this section shall equal the number of additional renewable energy credits that the electric distribution utility or electric services company would have needed to comply with the applicable benchmark in the period under review times an amount that shall begin at forty-five dollars and shall be adjusted annually by the commission to reflect any change in the consumer price index as defined in section 101.27 of the Revised Code, but shall not be less than forty-five dollars.”

In addition, there were limits on the solar piece:

“The compliance payment pertaining to the solar energy resource benchmarks under division (B)(2) of this section shall be an amount per megawatt hour of under-compliance or non-compliance in the period under review, starting at four hundred fifty dollars for 2009, four hundred dollars for 2010 and 2011, and similarly reduced every two years thereafter through 2024 by fifty dollars, to a minimum of fifty dollars”

However, there was a disclaimer that made the use these price caps quite troublesome – “The compliance payment shall not be passed through by the electric distribution utility or electric services company to consumers. The compliance payment shall be remitted to the commission, for deposit to the credit of the advanced energy fund created under section 4928.61 of the Revised Code. The compliance payment shall be subject to such collection and enforcement procedures as apply to the collection of forfeiture penalties under sections 4905.55 to 4905.60 and 4905.64 of the Revised Code.” This basically directs the utility to implement more expensive programs to avoid the compliance penalty since this was not a legitimate bridge.

Those supporting SB310 for cost reasons could have sought adjustment of the above cost numbers versus throwing the entire advanced energy requirement out of the equation. A simple rewrite of the compliance payment could have also assured the utility never spent any more than allowed. The one area which was left open to unlimited cost was the Energy Efficiency and Demand Side Management (EE/DSM) programs. As with the alternative energy requirement, a price cap should have been established in terms of rate increases from EE/DSM programs. SB310 still does nothing to address future cost of EE/DSM programs.

Energy Efficiency (EE)/ Demand Side Management (DSM)

The EE/DSM arena is a scary place given its spectacular growth. As noted in my Clean Power Plan review paper #3 , the industry has grown significantly from $1.6 billion in 2006 to $5.9 billion in 2011 and projected at over $8 billion (figures from the American Council for an Energy-Efficient Economy). With that much money in the system in such short time and the fact that the industry depends on estimates, there is bound to be “corruption” unless there are good checks and balances. EPA notes this in their discussion of EE/DSM – “Regardless of how the energy savings of an energy efficiency measure are determined, all energy savings values are estimates of savings and not directly measured”.

I am a supporter of energy efficiency and conservation programs having seen some fantastic data and work while assisting the Northwest Power & Conservation Council. However, I have also seen the darker side while assisting a utility in Indiana and reviewing some of the AEP plans. The companies who are in charge of evaluating, measuring, and verification are typically working in all three spaces. I have seen an evaluator in one state who acted as a measurer in another state. This cannot be allowed. Given that many utilities get shared savings, they are somewhat indifferent in this discussion. Shared savings is an incentive mechanism created to align the utilities with reducing energy usage. In the traditional regulated format, the utility only gets a return on capital investment, which incentivizes the utility to grow energy usage. If demand is falling, there is less likely any need for capital investment. Shared savings allows a utility to share in the savings of an efficiency program by collecting a certain percentage from the reduction of energy usage. Therefore, when an evaluator approves a plan the utility proposed, and the measurer and verifier support it, the utility would not oppose the assumed large savings in kWh, even though it may not be real, because the cost difference and savings are shared with the utility. The bigger the saving, the more the utility gets back. The only consequence is the load forecast will typically be too low and the rate payer is stuck paying more for plans that really add no savings. Most of the time, the commission is not equipped to understand the nuances in the EE/DSM program, so the utilities can bring in their expensive lawyers and impressive EMV. Before you know it, the programs is approved. The last leg of defense in an overwhelmed commission is the consumer protection council, which was cut in half by Kasich in 2011, even though they received their pay from the utilities, not the state budget. This was in the year they saved the rate payers significant amounts of money and was a true thorn in the utility. “The Supreme Court of Ohio ruled 7-0 in its April 19 decision that the PUCO improperly allowed AEP to charge customers unlawful and unreasonable rates. The Court ruled in favor of the OCC in agreeing that AEP’s 2009-2011 rate plan was unlawful by including $63 million in retroactive rates, $456 million in costs to potentially provide default service for customers who shop for an alternative supplier and $330 million in carrying charges for environmental investments.”

The energy efficiency cost you are currently paying can be easily computed from your bill if you belong to AEP. They post the calculation of your rate. Download the excel file and enter your information and review the corresponding sheet that represents your profile. In my case, I am paying $5/month or a total of $60/a year to pay for the energy efficiency program. The residential energy efficiency program is essentially reducing subsidies with a little portion for O-Power. O-Power is a report, telling me how much more I consume relative to my supposed comparable house. Is it truly worth $60/a year to subsidize light bulbs and a report to tell me my consumption relative to other houses? What alternative light bulb would I buy if it wasn’t for the subsidy? Does it achieve the value that the measurer and verification company is stating? In this case, my rate is being impacted nearly 4% by this program.

Better oversight is needed in the EMV space for EE/DSM. Some worthwhile programs can be found in the data, which are likely around 50-70% of the total programs. Many other programs are predominantly number tricks, enabling the EE/DSM industry to support itself and grow. SB 310 should have addressed price caps and better oversight EE/DSM.

Other Changes

SB 310 still carved out a solar requirement in one of the cloudiest states in the country. I think, in large part, the belief was if you had a solar mandate, solar manufacturers would come here. There is enough solar demand in the US market that if the state of Ohio could create a supply chain and manufacturing advantage, they would come here to manufacture and even to export to other states. China is a leading manufacturer of solar not because they placed a solar mandate.

SB 310 also ended a requirement that utilities purchase half of their renewable energy from within the state. This, in effect, produces a subsidy to other states. The purpose of the renewable program for many was to stimulate economic development. As I noted in the solar argument, mandates do not stimulate manufacturing, but if you are going to have a mandate, you might as well force some of the development in the state – or don’t have the mandate at all. One cannot criticize too much on cost given the price caps for cost in renewable compliance.

SB 310 does create a committee – “There is hereby created the Energy Mandates Study Committee to study Ohio’s renewable energy, energy efficiency, and peak demand reduction mandates.” The study will cover 8 objectives which I will give my precursory estimate of the results:

(1) A cost-benefit analysis of the renewable energy, energy efficiency, and peak demand reduction mandates, including the projected costs on electric customers if the mandates were to remain at the percentage levels required under sections 4928.64 and 4928.66 of the Revised Code, as amended by this act;

DKB: Cost for the renewable piece will not rise any greater than the 3% required by the bill. EE/DSM mandates are questionable in cost and delivery of actual kWh savings. The current system over accounts 10-40% energy savings, therefore better checks and balances will be need in the EE/DSM arena. Recommend putting a cost rise limit with EE/DSM as with the renewable goals.

(2) A recommendation of the best, evidence-based standard for reviewing the mandates in the future, including an examination of readily available technology to attain such a standard;

DKB: Having qualified commission staff and consultants with significant experience in the region along with some power modeling experience to analyze future mandates.

(3) The potential benefits of an opt-in system for the mandates, in contrast to an opt-out system for the mandates, and a recommendation as to whether an opt-in system should apply to all electric customers, whether an opt-out system should apply to only certain customers, or whether a hybrid of these two systems is recommended;

DKB: If the commission wants to guarantee savings from current structure an opt-in is applicable. However education is the key for consumer actions.

(4) A recommendation on whether costs incurred by an electric distribution utility or an electric services company pursuant to any contract, which may be entered into by the utility or company on or after the effective date of S.B. 310 of the 130th General Assembly for the purpose of procuring renewable energy resources or renewable energy credits and complying with the requirements of section 4928.64 of the Revised Code, may be passed through to any consumer, if such costs could have been avoided with the inclusion of a change of law provision in the contract;

DKB: This is a very slippery slope. Adding contracts with change of law would result in significant risk premiums. Creating sustainable laws is a better answer.

(5) A review of the risk of increased grid congestion due to the anticipated retirement of coal-fired generation capacity and other factors; the ability of distributed generation, including combined heat and power and waste energy recovery, to reduce electric grid congestion; and the potential benefit to all energy consumers resulting from reduced grid congestion;

DKB: The conclusion will reflect how much the utilities influence the committee. Based on my experience, CHP and distributed generation can play a significant part. Not only do they offer energy savings by being close to the demand source and using the heat, which is not used at all at centralized plants, they offer resiliency to the grid and can be used to support the grid in times of need.

(6) An analysis of whether there are alternatives for the development of advanced energy resources as that term is defined in section 4928.01 of the Revised Code;

DKB: There is always room for alternatives and innovation – this is the USA. Governments can play a role in nudging development without overly committing by using price caps such as in SB 310 and SB 221. The fear of transformation only comes from the incumbent who does not want change. A marketplace platform could offer market transparency and a place for end-users and developers to participate in the evolution of the energy industry.

(7) An assessment of the environmental impact of the renewable energy, energy efficiency, and peak demand reduction mandates on reductions of greenhouse gas and fossil fuel emissions;

DKB: Estimation should use a dispatch model to produce these figures since the commitment of the units will likely change particularly if the load curves flatten. A flat load curve is actually to the benefit of the coal units. Ohio is a net exporter of electricity, so bordering states programs will be of significant influence.

(8) A review of payments made by electric distribution utilities to third-party administrators to promote energy efficiency and peak demand reduction programs under the terms of the utilities’ portfolio plans. The review shall include, but shall not be limited to, a complete analysis of all fixed and variable payments made to those administrators since the effective date of S.B. 221 of the 127th General Assembly, jobs created, retained, and impacted, whether those payments outweigh the benefits to ratepayers, and whether those payments should no longer be recovered from ratepayers. The review also shall include a recommendation regarding whether the administrators should submit periodic reports to the Commission documenting the payments received from utilities.

DKB: If they really audited this, I think they will uncover quite a bit of dirt. Once again this is not due to the efficacy of the mission, but to the fact the industry has grown so rapidly and there is just so much money now.

Politics SB 310

Lastly, I want to address the politics of SB 310. Many insiders deem SB 310 as the First Energy Corporation bill. Rumors express a concern that some of these programs were causing a drop in capacity prices in this region. Given that First Energy coal fleet is deregulated, this was a big concern for them. Mathematically, this would occur, but the volumes from SB 221 at this time are too small to have a significant impact. The real drop in capacity prices was a function of the aggregators in other parts in the PJM markets, the MISO imports, and stagnating demand which drove the capacity price down. Dropping of advance technology resource requirements would have only threatened the utilities. No one else would have been detrimentally impacted by having the advance energy resource option given the price caps – unless you think 3 percent is too much to pay for diversification – perhaps 2 percent? I believe Distributed Generation and Cogeneration incentive mechanism provided a threat to the utility that they did not want to risk taking on. SB 310 is a bill to leave no utility behind, but at the cost of potentially stagnating advancement. The keyword is potential – it is possible that nothing would change, but a cost of 3% may have been worth the risk. A positive, I see from SB 310 relative to SB 221 is the dropped responsibility of the commission. They don’t have to understand the potential advance technology. They lose a key oversight piece “For the purpose of this section and as it considers appropriate, the public utilities commission may classify any new technology as such an advanced energy resource or a qualifying renewable energy resource”

Conclusion

In conclusion, the major weaknesses of SB 221 were not improved and the intent of the bill weakened in SB 310. I regret I did not have time nor was asked to review SB 310 before the bill was signed. The impacts of SB 310 will benefit a few. The few are mainly the utilities. It is possible End-users may save some money with SB 310 relative to SB 221, but the savings likely will not amount to much given the potential gains of transforming the energy mix for Ohio to be more resilient and environmentally friendly. The next adaptation to the Ohio energy bill needs to re-introduce the advance technology portion found in SB 221 and create a mechanism for success by increasing the commission’s budget and the development of a clearinghouse platform for advanced technology. Other adaptions include adding a price cap on EE/DSM similar to the alternative energy source option, greater oversight of EE/DSM programs, and fine-tuning the compliance costs to give more flexibility for the commission to modify and utilities to be able to recover some of the alternative compliance payments.

End-users are still left with many other uncertainties including the recent EPA Clean Power Plan to mitigate CO2 emissions. If you are an end-user trying to understand the future of power, I can and will be able to help you navigate through the storm of uncertainty. I have many years of experience in forecasting and developing risk mitigation strategies in the energy industry. I am always up to date in current markets and offer a daily forecast of all North American power hubs. This product is being used by hedge funds and utilities.

Your Enthused and Optimistic Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Assessing the Cost of EPA’s Clean Power Plan

In order to understand the following, one needs to have read the Clean Power Plan and/or read the 3 summaries I put together of the Clean Power Plan (Paper #1, Paper #2, Paper #3). Reading those three will allow you to get an understanding of the areas of cost that I plan to discuss below.

The Clean Power Plan notes the cost metrics in consumer terms: “Under Option 1, average nationwide retail electricity prices are projected to increase by roughly 6 to 7 percent in 2020 relative to the base case, and by roughly 3 percent in 2030 (contiguous U.S.). Average monthly electricity bills are anticipated to increase by roughly 3 percent in 2020, but decline by approximately 9 percent by 2030. This is a result of the increasing penetration of demand-side programs that more than offset increased prices to end users by their expected savings from reduced electricity use.”

In demonstrating the cost metrics in utility terms, they offer a significant amount of disclaimers “The compliance assumptions – and, therefore, the projected compliance costs – set forth in this analysis are illustrative in nature and do not represent the full suite of compliance flexibilities states may ultimately pursue. These illustrative compliance scenarios are designed to reflect, to the extent possible, the scope and the nature of the proposed guidelines. However, there is considerable uncertainty with regards to the precise measures that states will adopt to meet the proposed requirements, because there are considerable flexibilities afforded to the states in developing their state plans.”

The EPA estimated compliance cost states “The EPA projects that the annual incremental compliance cost of Option 1 is estimated to be between $5.5 and $7.5 billion in 2020 and between $7.3 and $8.8 billion (2011$) in 2030, including the costs associated with monitoring, reporting, and recordkeeping (MRR).” The key word in the statement is annual. These costs can be expected each year. The EPA noted this is based on the difference to their base case, but was not explicit in their base case assumptions.

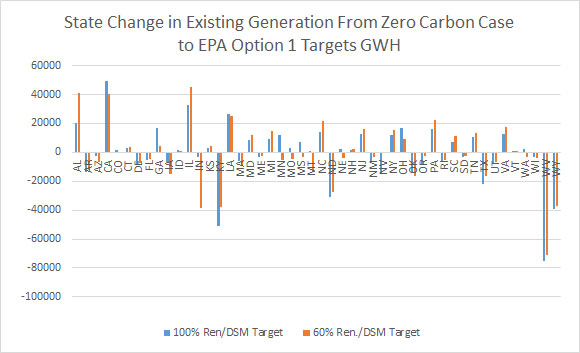

There are significant moving blocks, and the ability to model all of these options take time. In order to speed up the process, I approach the problem focused on the existing fleet and current load projection for 2016. Using 2016 will essentially show the remaining fossil fleet that is likely going to be impacted by the Clean Power Plan. This part of the analysis is centered on BSER 1 & 2 (plant efficiency improvement & redispatching). The targeted CO2 values for each state existing fossil fleet were extracted from the EPA model assuming BSER 3 & 4 (Non-Carbon Generation and Demand Side Efficiency) will deliver as EPA projected. Out of all the blocks, BSER 1 & 2 are the most tied to the market place given their impact is on the existing fleet. The BSER 1 & 2 represents almost 40% of the total rate reduction.

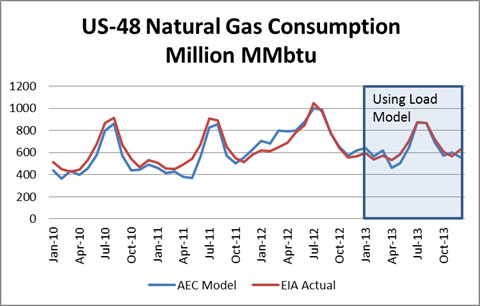

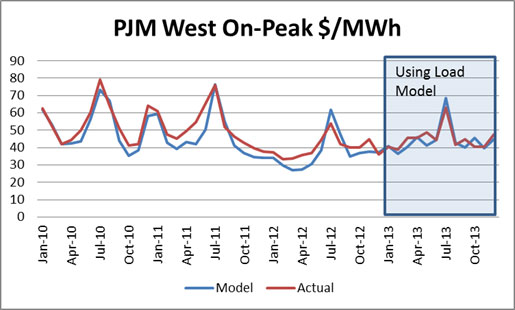

The models I am using are very sophisticated and robust. These models are used to make financial decisions in the current market place for both gas and power markets through the product line – of Power Market Analysis (PMA). The base dispatch model is the AuroraXMP model by EPIS. The entire N. America is being modeled. A significant amount of work was needed to produce a model that is applicable to today’s market.

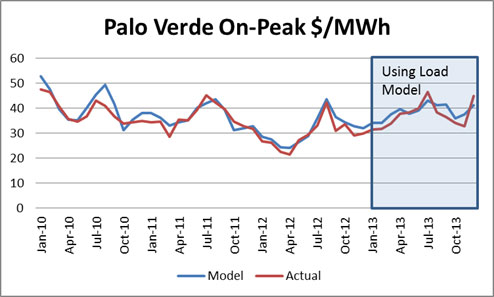

Validation of the model is continually being done. If your consultant is charging to see validations or has not done one in some time I would be skeptical on the results. Below are a few graphs validating my process – many more available per request:

These large models as used by the EPA – EPA used the Integrated Planning Model (IPM), developed by ICF International – I have always been interested in their ability to backcast the actuals on a monthly basis using their forecast methodology. Without first presenting and establishing the model tendency how do you know that the model can forecast? It may not be the model, but the data inputs the user is applying to model which could result in wrong output. Many large models typically make the excuse they are not interested in the daily or monthly changes, but want to show the “high” level impacts. I would be cautious on the ability to calculate economics in the market at that point.

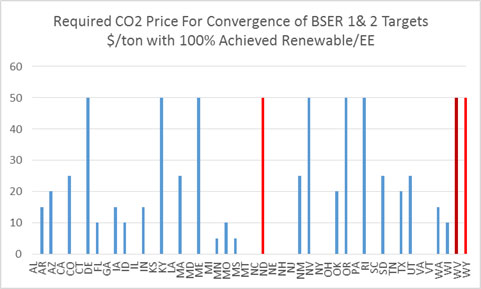

The simulations were all based on the forward curve prices published on June 5th 2014. After around 14 iterations I was able to reach an acceptable convergence to produce the state rates suggested by the EPA through re-dispatching with individual state CO2 price being the variable to target state rates. There were 3 states that could not converge to an acceptable level so I left them at the max of $50/ton. There are 21 states where the price of CO2 was essentially zero – see chart below. Significant renewable and DSM and the retirement of coal units in these states drove them to essentially not have to alter their dispatch to achieve the state targeted CO2 rate.

In addition to EPA “optimize” case, I ran a case with only 60% of the renewable and DSM/EE. This is reasonable case in the sense the EPA guideline for BSER 3 & 4 are based on non-empirical goals (State Renewable Program Goals and Other State Experiences). I discuss the concerns of this method in Paper #3. Nonetheless, I do believe more than half of the expectations can and will be achieved – hence I chose 60%. This obviously dropped the targeted rate with some as low as 60% of the initial targeted rate. In the 60% case there were 6 more states that hit the maximum $50/ton case. There were only 15 states with zero carbon cost – See Charts Below.

Note Illinois did not require any carbon cost in both cases. Ohio actually fared well because the utilities had to burn through many of their coal plants in 2012 even though it was uneconomical, and scheduled retirements in 2014-2016 help achieved the targeted rate. The big question for Ohio is can they achieve their renewable target. I have done a state by state report plus added a feature to be able to extract particular units within the state to inform you. A sample file for Colorado is available. If interested please send me your state(s) interest and the amount you are willing to pay for this highly informative report. Also add a note if you want a particular group of assets evaluated.

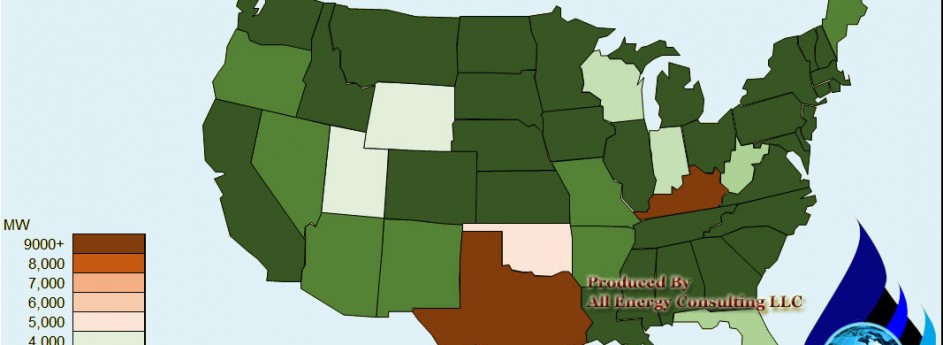

The runs did produce a list of winners and losers in terms of existing power plants. As an existing power plant you want to be in Illinois, Alabama, and California not Kentucky, Indiana, or West Virginia – See Chart Below

In theory, the quantification of just BSER 1&2 cost would be below the actual cost of the total Clean Power Plan. The other parts of the program involved new creation. In most cases, an existing already paid for resource cannot be economically challenged from new items including many DSM programs. The 2016 run already retires many of the uneconomical units. The below chart shows the impact of wholesale power prices as a result of “forcing” redispatching to achieve target.

Wholesale power prices increase 20% in the 100% BSER 3&4 case and in the 60% BSER 3 & 4 case almost 40%. The way power prices are set, the marginal unit sets the price for all units in a given hour. Therefore, even if you bid into the system at $5/MWh, if the marginal unit (the last MW to fill the required electric demand of the system) is $100/MWh, you will get $100/MWh. In a regulated framework, this is less important since the structure is built on cost and depending on if there are outside shareholder additional returns (8-15%). Given the EPA statement, “retail electricity prices are projected to increase by roughly 6 to 7 percent in 2020 relative to the base case” & “Projected wholesale electricity price increases over the same period were less than seven percent”, I am not sure they are appreciating the deregulation impact. The 7% does align with comparing my fuel cost from the increases seen in the various cases. However, I did not change the fuel prices even though EPA analysis did show this would likely happen – increase gas price and lower coal price. The cost world is generally gone in the generation space. Generators below the marginal power plant will keep all the gains vs. being satisfied with a cost basis. The box on de-regulation is open and not likely to come back.

Energy revenue for the entire system went up $130 Billion in 100% BSER 3 & 4 and $243 Billion in 60% BSER 3 & 4. There are still systems that are fully integrated therefore will not capitalize on the opportunity to charge more to the customer. There is no doubt the cost of the power price impact will be much greater than noted by EPA.

As pointed out several times, this is the piece involved in the existing fleet which is an integral part in achieving EPA Clean Power Plan CO2 rate targets.

There are several points made by the EPA alluding to cost being reduced due to energy efficiency – “Average monthly electricity bills are anticipated to increase by roughly 3 percent in 2020, but decline by approximately 9 percent by 2030. This is a result of the increasing penetration of demand-side programs that more than offset increased prices to end users by their expected savings from reduced electricity use.” This is true for some, but not all. The other half of the system (transmission & distribution) is still regulated. The programs are not free. They do cost money and must be paid for. The local distribution company can save when you are efficient in not causing large capacity payments and/or limiting inopportune times of buying power (high demand periods). This has been known for many years. As users become more efficient the regulated group still is promised the cost of operation. The only means of collecting the cost is charging users of electricity. As usage goes down, the cost collection goes down. Therefore, rates go up to compensate. The issue will become creating balance programs so that the wealthier who can afford the programs do not cause the rest of society to pay more. The regulated world is a zero sum game even more so without the generation piece.

It is easy to calculate the cost of the renewable piece. I have a state by state sheet showing the various targets set forth and calculating the cost using conservative estimates on the cost of wind and its performance. The renewable piece will be easily $200 Billion which comes out to be $11 billion a year. This makes this statement very confusing “The EPA projects that the annual incremental compliance cost of Option 1 is estimated to be between $5.5 and $7.5 billion in 2020 and between $7.3 and $8.8 billion (2011$) in 2030” Perhaps the rationale for difference is the base will already have that cost built in. However, with low gas prices and a lack of incentive, such as a carbon price, I don’t believe the renewable levels would be achieved to the extent the EPA is targeting. Even half the difference still shows the capital cost to be low. The DSM/EE programs do cost money. The higher power prices will cost the local distribution companies more and the generators who are left to compete are not going to send a bill that is cost plus.

Though the cost is higher than EPA projects, the benefits may still be there. In the next and final synopsis on the Clean Power Plan, we will review the benefits.

As noted previously, I have spent significant hours analyzing and modeling the Clean Power Plan Act with no payment from any source for this effort. The big driver in taking on this task is my personal intellectual interest. There is hope I can monetize some of my work. I do have the state by state report which I am hoping will be of interest – State of Colorado sample. Plus I can do a fleet analysis if you want to know how your assets will perform in this new world. I can also assist in developing a strategy to not only survive but to capitalize – where there is change there is opportunity.

Please do consider me for your energy consulting needs.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Fact Check – Lifting Oil Export Ban to Create Lower Gasoline Prices – Likely True for Some Time

There is so much material to discuss recently as I try to finish my review of the EPA Clean Power Plan (Paper #1, Paper #2, Paper #3). This morning I saw the solar discussion and now I see this article with one of my former colleague and friend as co-author. The heading was very catchy – “Why the U.S. Needs to Lift the Ban on Oil Exports Surprisingly, this will mean lower gas prices at the pump, and a greater supply of crude in an unstable world.”

They did a great job pointing out the history and facts of the export ban. They also presented the major concern of the oil producers. “…so called tight oil, or “light oil” recovered by hydraulic fracturing and horizontal drilling—is a poor match for refineries in the Midwest and along the Gulf Coast. Refineries have spent more than $100 billion in recent decades reconfiguring their equipment to process heavy, lower-quality imported oil from Canada, Mexico and Venezuela, as well as the new supplies coming from the Gulf of Mexico. They have been able so far to absorb the new light crude but are reaching their limit even as tight production keeps growing. If these reconfigured refineries run more light instead of heavy crude oil, they lose output capacity—and revenue—due to a mismatch of the light oil with their equipment. To make up for the lost revenue, refineries won’t buy the light oil except at a discount, which could run as high as 20%. At that price, oil producers can’t cover the cost of some of the new wells, and cash flows would decline. This means less drilling and lower crude production.”

This same issue was pointed out in my US refining outlook for 2014 done back in February. I will respectfully disagree with the hidden conclusion that eliminating oil exports in the US will be the BEST decision. At the same time, I will agree with their conclusions that there is a possibility that gasoline prices can be reduced by as much as 12 cents a gallon by removing the restriction. The reason for this is not that 12 cents cannot happen but it may not answer the real question that should be posed which is this removal of the ban the best decision over time. The logic that world markets could get immediate relief and an optimized US refining industry would produce a more optimal solution for the world system is reasonable. However this conclusion does not state that it is the best for the US. It does show benefits in a discrete time period. There is a possibility those 12 cents savings disappears over time as demand grows in other markets.

Economics would lead you to rationalize making a finished product is worth more than the raw commodity that made up that product. The difference becomes the margin in applying work. This margin and the value for that creation can be kept in the US if the export ban was continued. There is a solution to the significant light oil discount beyond reconfiguring existing refineries, which made a business decision based on full knowledge of the restriction and the potential landscape shifts. Capital investments can be made in existing facilities, brownfield/refurbishment (I do know a 80,000 b/d condensate refinery that can be brought back to life for $800 million in 18 month time projected IRR 30+% – email me if you are interested), or build a new refinery. They did note the option of new refineries would take time. However, it is this time element which is needed to make business decisions that last decades. Continued certainty of discounts will add to decisions to build/refurbished/retrofit refiners in the US. This will create multiple jobs plus convert the US to potentially being a net exporter. Currently, the US is still net importing around 6 million barrels per day. The Latin America market is growing and it would be the ideal export area for finished products such as gasoline. Given the statement from the article “U.S. gasoline prices are set by global gasoline prices”, as a country you wouldn’t want to be the importer particularly in the scenario when other markets start valuing gasoline much higher. Being a net exporter, you are guaranteeing the local consumer a discount to world market prices per transportation netback calculation.

I will conclude with their statement and append it “Ending the ban would enable the U.S. to benefit significantly more from its oil-production renaissance” in the near-term, however if we could get our act together perhaps there is a chance to revitalize our trade imbalances and become a net exporter and serve the growing markets of L. America by keeping the ban.

By the way, I am a libertarian at heart and many know me to be. However I am a practical libertarian in that I understand a system with limited government intervention is the best, but the world is full of government intervention (e.g. huge oil subsidy to local consumers in the Middle East) therefore it would be foolish to blindly stay 100% with an ideology that the premise of the ideology cannot be created.

Your ever searching for the Truth Energy Consultant,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/