Last two days gas futures down by 5% – What impact is that?

Everyday the model results of the latest market changes are awaiting for you. The majority of the time, the market doesn’t moved dramatically enough for you to care, but when it does Power Market Analysis (PMA)is there for you.

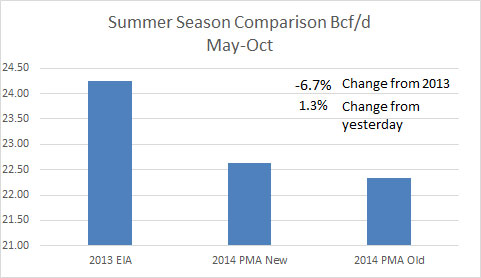

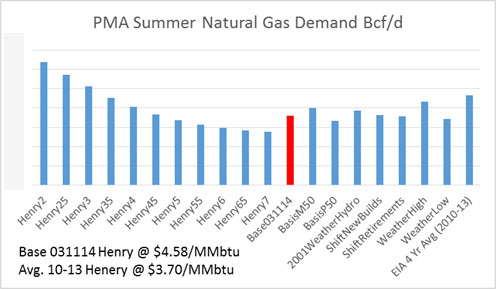

April 1st, 2014’s daily file shows the changing commodity prices resulted in an increase of 1.3% for natural gas demand for this summer relative to the March 31st file. The figure below comes from the daily file.

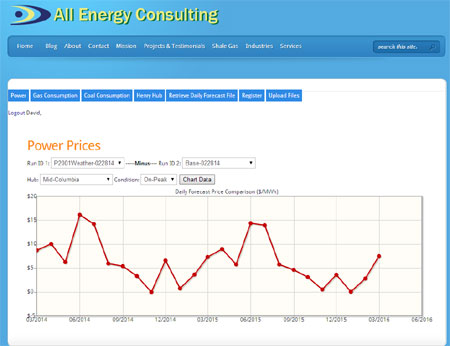

Our online interface allows you to compare daily runs on the fly. The below graph comes straight from the online interface and it shows the change in gas demand from April 1st, 2014 to March 28th, 2013 run. The above compared the April 1st, 2014 run to the March 31st, 2014 run. Summing up the below chart change for this summer, the last two days have changed the expected summer gas demand by more than 4%. (~0.9 Bcf/d.) Click graph to get enlarged version.

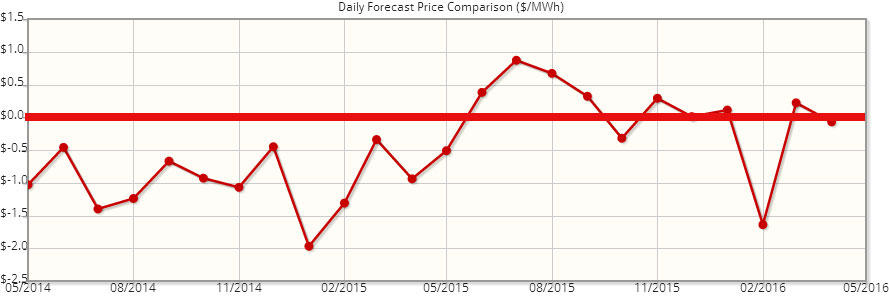

You can also compare future prices over time to get a sense of how the future’s market has changed over time. The below graph compares the Henry future curves of April 1st, 2014 versus February 28th, 2014. The red line is the zero line. Click graph to get enlarged version.

The market is valuing more future winter risk relative to the end of February. However, the rest of the time the market is lower than it was just a month ago. The prompt year is down by around $0.30/mmbtu.

The online interface offers a simple drop down to compare different gas basis. Dominion South Point continues to get more negative in April relative to February futures. Click graph to get enlarged version.

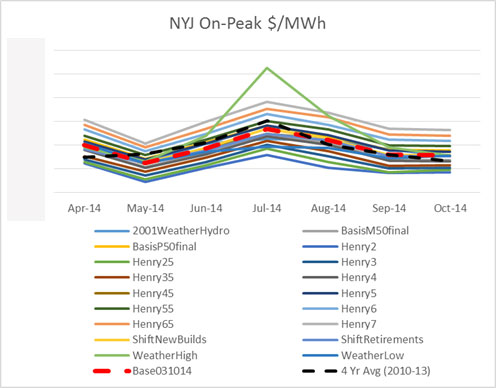

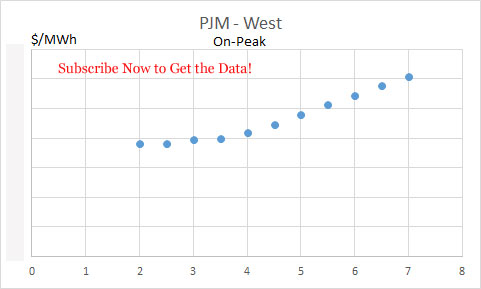

The online interface also allows comparisons of power prices across the country. The below show the impact of the last two days gas price drop on PJM-West On-Peak prices.

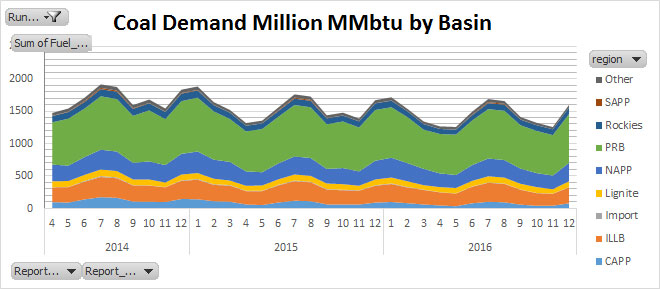

Coal burns by basin are now available. As coal units install control equipment, will we see a reduction in PRB? What type of coal will be hurt the most as coal units retire? These answers are available to PMA subscribers.

PMA subscribers get the online access, the daily files, and the study files. In addition, prime members receive-at no additional cost-reports such as the Summer 2014 Outlook report , the recent briefing on what is causing the gas demand drop, and where it is coming from. Subscribers also have the opportunity for free private consultations. Discussions can range from answering more detailed questions on the studies to discussing potential scenarios of the future.

Please contact me to schedule an online demo meeting [email protected] or 614-356-0484

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

2014 vs. 2013 Gas Demand – Where and what is causing the drop?

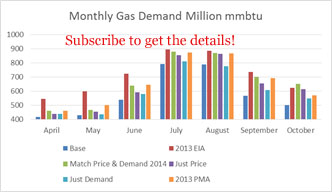

This briefing is a result of PMA subscriber request in better understanding the Summer 2014 Outlook report. After each analysis we spend time with our clients to explain the analysis and answer any questions they may have. One of our subscribers requested a set of 3 additional cases to further explain this year’s natural gas demand drop in the base case relative to last year. In one case, we used the 2013 price in 2014. In another case, we used the 2013 demand in 2014. For the final case, we ran both cases together to confirm the majority of the changes were coming from the both of them combined. The turn-around for these custom cases was less than a day. The results were formally presented on March 24th along with a call which included a question and answer period.

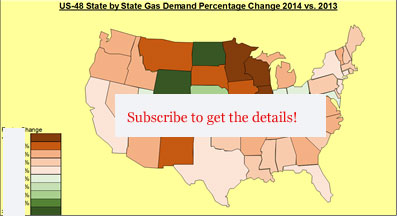

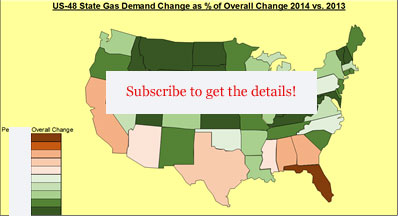

Another request was made by another subscriber to understand where the demand is dropping. A state by state analysis was done by comparing the 2013 benchmark run vs. the current 2014 base case. We compared the state changes. Several states had high percentage change as they were coming from small numbers to begin with. We then looked at it by the percentage of the total change for the US-48.

Download a free version of the briefing.

Please contact me to schedule an online demo meeting [email protected] or 614-356-0484

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Summer 2014 Outlook – Power, Gas, Coal, and Generation Fleets!

Over 90 graphs and 79 pages of hard-hitting analysis. This report does not regurgitate what you already know. Executive summary along with some graphs are presented below.

Though the report is 79 pages, it is still only a small fraction of what we could present. We are able to build off this analysis to produce any custom view or further analysis that is directly your concern. The power markets touch many, from traders, energy managers, fuel buyers, plant operators, government officials to fuel producers and many more. We have the ability to help you better understand the market by explaining what has happened and how the future can unfold and what you can do to prepare for that future.

The report is free to PMA Prime Members. Power Market Analysis (PMA) is a compelling product that provides subscribers a dynamic new approach to interpreting and explaining market fundamentals affecting North America’s power markets and their impact on the coal and gas industry. PMA Prime members can expect to get 4 quality in-depth reports a year along with other smaller insight reports each month. As an introductory price we are offering the report for $10K or $5K for one section.

A free version is available. Given our introduction into the market, the difference in the free version is limited. Free version is lower resolution and some parts are redacted.

Thoroughly analyzing the power markets can offer something for everyone given how much power touches everyone’s life. As demonstration of breadth, in the Summer 2014 report, we created a company fleet view. This would add valuable insights to investors in the utility industry.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

Executive Summary

Summer of 2014 will differ from previous years as a result of one of the coldest winters in decades. The weather will continue to play a key role in how the summer unfolds. An in-depth and rigorous analysis is done on fuel consumption, power prices, and the top 10 utilities generation fleet. Power Market Analysis (PMA) processed 19 different potential sensitivities that could impact the power markets and presents key findings from those runs.

Gas demand is the most sensitive variable being easily impacted by elements such as changing commodity prices to weather. With the current forward curve of Henry Hub, prices this year will increase +23%, relative to 2013. This price change will significantly reduce gas demand in the power sector, assuming normal weather. Coincidently, the base case is showing a 23% drop in summer power gas demand compared to the four year average. The recent EIA Short Term Energy Outlook (STEO) is not anticipating much drop in power demand in 2014 relative to 2013. In order for that to happen, there are several changes in key variables needed, in some cases by themselves or in combination with other variables, to mitigate the gas demand drop in the power sector compared to 2013. An unusually warm span of weather can make up for the drop in gas, but this would have to be even warmer than the record setting summers of recent. The Western drought could impact the gas demand in the sector by almost 7% if the drought was similar to that in 2001. A price drop of almost $1/MMbtu could produce no drop in demand from the power sector. In addition, a further decline in negative basis could also add to gas demand. All this is displayed in the analysis below.

Power prices across the US will perform differently depending on the existing infrastructure and current generation fleet. There are areas which are very sensitive and can easily experience significant prices spikes – NY and ERCOT. Many areas are directly tied to natural gas prices. Other areas are showing little impact to power prices even if gas prices were to fall. There are usually trading arbitrages in power markets as the ability for the market to efficiently compute all possible changes is limited. Power market analysis requires a platitude of skill sets which then must be combined and deciphered to produce a cohesive picture. Many times, by the time the process is complete, the market has moved on. PMA subscribers get fresh daily runs, so whenever the market shifts, PMA is there with a snapshot of possible scenarios. The various power markets have their own characteristics. This can be seen in the analysis below.

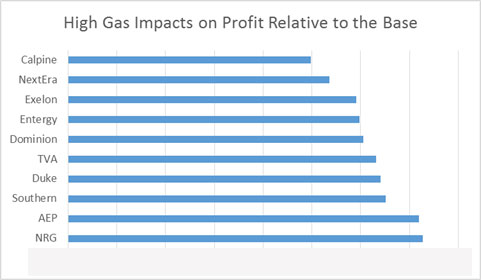

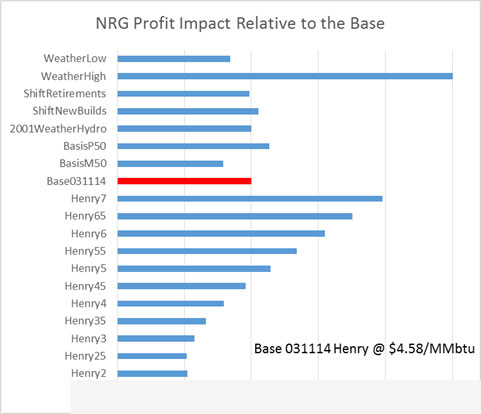

The top ten utilities fleet, by size of generation capacity, was reviewed under the various 19 cases. A proxy calculation was made on how the fleet could be impacted from the base case. Some fleets were much less risk averse to changes in the market. Whereas others could see a devastating profitability change if certain sensitivities come to fruition. All fleets would like to see a warmer than usual summer, but NRG and Calpine fleet can hit the lottery if this were to happen. There are many business strategies that can be designed once the knowledge is made on what makes the fleet “tick”. More company fleets are available upon request.

The Summer 2014 PMA analysis demonstrates the vastness of analytical capability and information available if power market analysis is well thought out and performed. PMA is designed for flexibility to offer multi-faceted views of the power market. There is so much more available in terms of reporting. If you would like additional information from these runs please contact us at [email protected] or at 614-356-0484. Also customized cases can be done for a fee.

Sample Figures:

April Natural Gas Demand Range

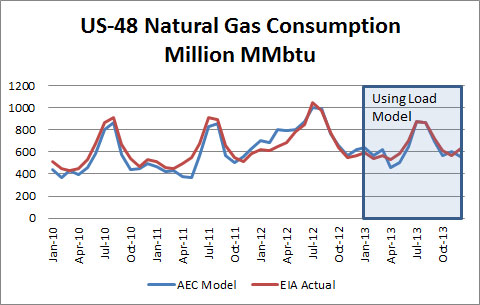

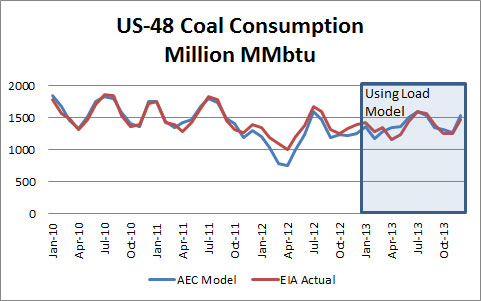

All Energy Consulting’s (AEC) latest product offering,Power Market Analysis (PMA) is a compelling product that provides subscribers a dynamic new approach to interpreting and explaining market fundamentals affecting North America’s power markets and their impact on the coal and gas industry. As requested, we have run our model in 2013 using AEC’s proprietaryload forecasting model. The results are outstanding! Once again substantiating the power modeling techniques used, plus adding more credibility to our load forecasting model.

Gas Burn in the US-48 Power Sector:

In 2013, the average gas burn was within 3%.

Coal Burn in the US-48 Power Sector:

In 2013, the average coal burn was within 1.5%.

Complete charts and data available now for subscribers.

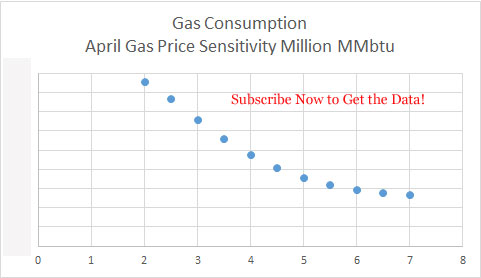

We also had time to take an early look into April gas consumption ranges running our monthly snapshot case. We reproduced our gas price iteration case and our sensitivity cases for the month of April.

Henry Hub Price Iteration Runs:

Complete chart and data available now for subscribers.

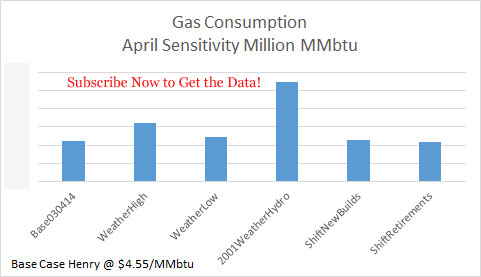

Natural Gas Demand at Various Sensitivities:

Complete chart and data available now for subscribers.

April hydro condition is still a key variable to keep an eye on just as we pointed out in our March analysis.

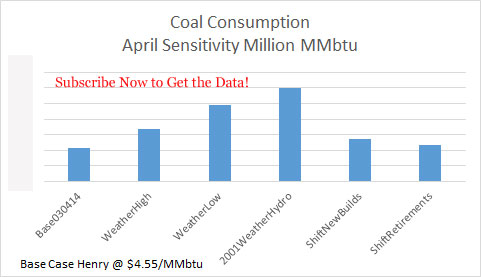

We improved our reporting spreadsheet by including the coal consumption plots. The improved output spreadsheet is available now for subscribers.

Henry Hub Price Iteration Impact to Coal:

Complete chart and data available now for subscribers.

Coal Demand at Various Sensitivities:

Complete chart and data available now for subscribers.

We also added a power price charting capability to our spreadsheet allowing our subscribers to see how the various changes impacted power prices from across the country.

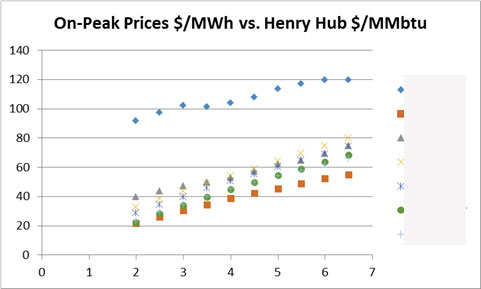

Henry Hub Price Iteration Impact to PJM-West On-Peak:

Complete chart and data available now for subscribers.

PJM-West On-Peak Power Prices at Various Sensitivities:

Complete chart and data available now for subscribers.

The above analysis is all available to Prime Subscribers each month.

We are continually adding and improving PMA. One of our current projects is adding another insights category – Investors. We are compiling the various portfolio’s of the largest generating companies and will display their performance from PMA. In this section, we will answer the questions asked by investors, such as whose generating assets are at risk given various policies and commodity changes. Besides identifying the risk, we will calculate the extent of that risk. This will be another category that can be subscribed to individually. We will likely include it at no additional cost to those subscribing to the prime package.

Hopefully, it has been demonstrated that PMA can bring you great insights into the power markets at an incredible value. The above analysis can easily pay back your investment by helping you make better decisions whether trading, planning, purchasing assets, or being an investor in a utility. PMA will offer a better understanding of the power market from power prices to coal and gas consumption.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

P.S. Send an email to get a free one week trial.

Ready for March Gas Demand? Duke’s Merchant Coal Plant Value?

All Energy Consulting’s (AEC) latest product offering,Power Market Analysis (PMA) is a compelling product that provides subscribers a dynamic new approach to interpreting and explaining market fundamentals affecting North America’s power markets and their impact on the coal and gas industry. Prime subscribers get additional analysis which is demonstrated below. Also demonstrated is the value PMA offers in generating custom reports from the daily runs at minimal cost for our subscribers.

In February, we started examining the hydro impact due to the drought in the West that is occurring now. Our initial findings show natural gas demand changes throughout the year with the most dramatic change in March.

Online Interface Screenshot – 2001 Weather and Hydro Condition Impact on Gas Demand:

Complete chart and data available now for subscribers.

Prices did materially change, but mainly in the West, as expected. As a subscriber you will get the full output and briefing of the run.

Online Interface Screenshot – 2001 Weather and Hydro Condition Impact on Mid-Columbia Power Prices:

2001 Weather/Hydro Run files available online see power prices and fuel consumption.

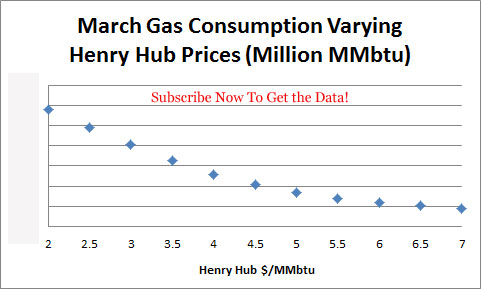

With March right here and now, we decided to investigate March gas demand. Our first analysis examined changing Henry hub prices by 50 cents from $2/mmbtu to $7/mmbtu. *This graph will be generated for the next month gas demand for our prime subscribers in the middle of each month.

Henry Hub Price Iteration Runs:

Complete chart and data available now for subscribers.

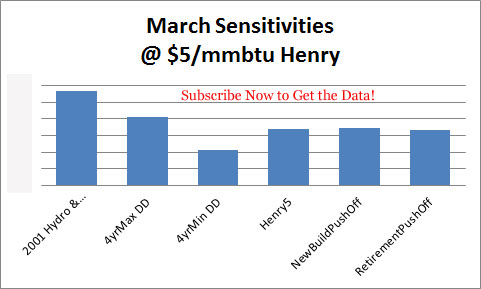

We then examined the various sensitivities at the $5/MMbtu range. From our analysis, it shows that if the hydro and weather aligns with 2001, we could experience a gas demand increase as significant as a dollar drop in Henry Hub prices.

Natural Gas Demand at Various Sensitivities:

Complete chart and data available now for subscribers.

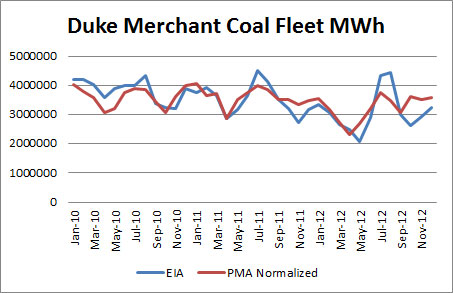

The above analysis is all available to Prime Subscribers each month. In terms of a custom report example, we put together an analysis of the Duke coal assets in the portfolio which is up on the market. Duke is selling this portfolio as whole looking for $2 billion. The coal assets represent the majority of the MWhs produced. In 2010, the coal assets represented 87% of the MWhs for those plants. An example of a custom report request might show how units performed in the model in the past and how they are expected to perform in future.

History of Coal Plants in Duke’s Portfolio MWh:

Based on our quick analysis, without any fine tuning, we can anticipate the Duke units will generate 6% less energy from their 2010-2012 actuals as Beckjord, and a Miami Fort unit is retiring. However, the economics compared to 2010-2012 will improve by 60+% as higher gas prices and regional supply/demand will benefit the units still running.

Future Expectation of Coal Plants in Duke’s Portfolio MWh:

As a subscriber to PMA, the above custom output request would cost you only $2K. In addition, you can expect a 24 hour turn around from request to final output. Output will include all the data behind the graphs.

We would recommend further due diligence if an acquisition was being pursued. AEC can help. Our due diligence efforts would involve reviewing historical performance to evaluate sustainability of the assets, fine tuning our model to accurately reflect cash flow for those assets, and performing long term scenario analysis to understand your risk. As a subscriber, you will get a discount to our consulting fee.

Hopefully, I have demonstrated that PMA can bring you great insights into the power markets at an incredible value. The above analysis can easily payback your investment by helping you make better decisions whether trading, planning, or purchasing assets. PMA will offer a better understanding of the power market from power prices to coal and gas consumption.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

P.S. Send an email to get a free one week trial.

Peak Demand in US Electric Sector

Continuing with our analysis from the previous post discussing Peak Energy, we delved into the Peak Demand. Peak Demand is measured in MW vs. Peak Energy MWa. Peak demand is typically define as the highest point of energy consumption. This is very important due to the nature of electricity. Compared to other commodities, the whole market would not crash for an extended period of time if one could not supply the peak demand point. However, in the case of electricity this becomes a real problem. Therefore, much planning is focused on peak demand and figuring alternatives to avoid peaks. Many commercial and industrial customers can see the bulk of their bill is tied to the peak vs. their average energy consumption.

As we discussed in the previous post, our objective is to produce a forecasting method for our new product, Power Market Analysis (PMA). Now that we had a very good system in forecasting monthly energy across N. America using GDP and CDD and HDD from various parts of the country, we needed a way to forecast the monthly peaks. The analysis of peak demand differed greatly from the analysis of peak energy. Applying the same statistical approach used in peak energy was going nowhere. First, we had to replace the monthly CDD and HDD with weekly maximums given we wanted to forecast peaks not averages. This improved the analysis. As expected, given the economic value of reducing peak vs. energy efficiency we saw many more regions decouple from economic growth in establishing peaks. We also modified the analysis to look at the relationship between average energy and peak demand. This method established a range for expected peaks in both a normal expectation of weather to extreme cases of weather variations within a month.

Counter to many who are have been alarmed at peak demand growing faster than energy, our analysis leads us to forecast a much slower growth in peak vs. energy. This is supported by the economic incentives to reduce peak demand is far greater than reducing energy consumption. In addition, measurement and validation of the various programs to mitigate peak demand is much more “accurate” than energy efficiency programs.

Power Market Analysis (PMA) will allow subscribers a very good view of the power markets and their relationship to the Coal and Gas markets. One of our goals is to increase the fundamental understanding of the market. We will issue monthly studies to our subscribers. The inputs will be clearly displayed for both the base and the extreme cases. Subscribers will also be able to customize runs. There is a large incentive for early bird subscribers. Please do reach out to me ASAP if you are interested in signing up to PMA (614-356-0484 [email protected] ). We will send a sample file you can expect from PMA. The official product launch likely in the later part of February. Besides a financial discount early birds will also be able to guide the product development of PMA and be able to get “free” reports while we finalize the product. We are building PMA to allow the evolution of the product. Our current long-term vision could have users having the ability to submit input changes and output be generated for them overnight.

Your Enthused Energy Consultant,

614-356-0484

Twitter: AECDKB