Last two days gas futures down by 5% – What impact is that?

Everyday the model results of the latest market changes are awaiting for you. The majority of the time, the market doesn’t moved dramatically enough for you to care, but when it does Power Market Analysis (PMA)is there for you.

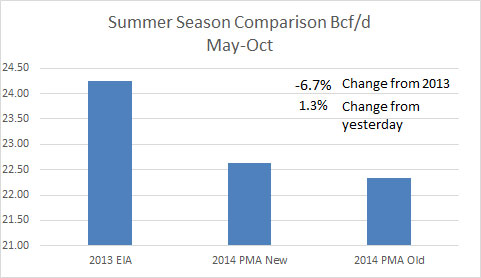

April 1st, 2014’s daily file shows the changing commodity prices resulted in an increase of 1.3% for natural gas demand for this summer relative to the March 31st file. The figure below comes from the daily file.

Our online interface allows you to compare daily runs on the fly. The below graph comes straight from the online interface and it shows the change in gas demand from April 1st, 2014 to March 28th, 2013 run. The above compared the April 1st, 2014 run to the March 31st, 2014 run. Summing up the below chart change for this summer, the last two days have changed the expected summer gas demand by more than 4%. (~0.9 Bcf/d.) Click graph to get enlarged version.

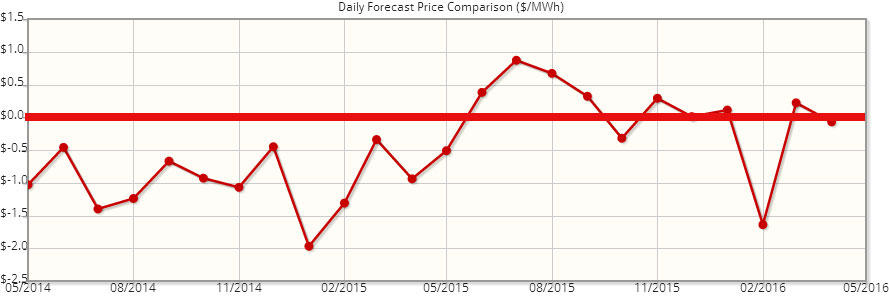

You can also compare future prices over time to get a sense of how the future’s market has changed over time. The below graph compares the Henry future curves of April 1st, 2014 versus February 28th, 2014. The red line is the zero line. Click graph to get enlarged version.

The market is valuing more future winter risk relative to the end of February. However, the rest of the time the market is lower than it was just a month ago. The prompt year is down by around $0.30/mmbtu.

The online interface offers a simple drop down to compare different gas basis. Dominion South Point continues to get more negative in April relative to February futures. Click graph to get enlarged version.

The online interface also allows comparisons of power prices across the country. The below show the impact of the last two days gas price drop on PJM-West On-Peak prices.

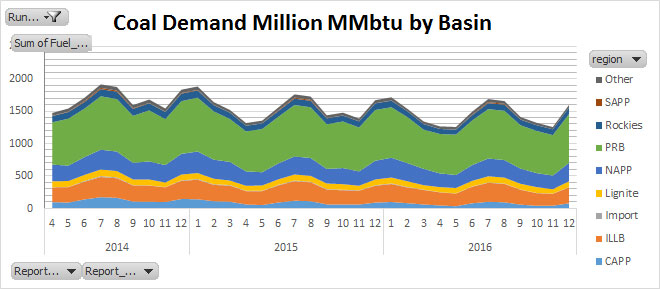

Coal burns by basin are now available. As coal units install control equipment, will we see a reduction in PRB? What type of coal will be hurt the most as coal units retire? These answers are available to PMA subscribers.

PMA subscribers get the online access, the daily files, and the study files. In addition, prime members receive-at no additional cost-reports such as the Summer 2014 Outlook report , the recent briefing on what is causing the gas demand drop, and where it is coming from. Subscribers also have the opportunity for free private consultations. Discussions can range from answering more detailed questions on the studies to discussing potential scenarios of the future.

Please contact me to schedule an online demo meeting [email protected] or 614-356-0484

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/