April Natural Gas Demand Range

All Energy Consulting’s (AEC) latest product offering,Power Market Analysis (PMA) is a compelling product that provides subscribers a dynamic new approach to interpreting and explaining market fundamentals affecting North America’s power markets and their impact on the coal and gas industry. As requested, we have run our model in 2013 using AEC’s proprietaryload forecasting model. The results are outstanding! Once again substantiating the power modeling techniques used, plus adding more credibility to our load forecasting model.

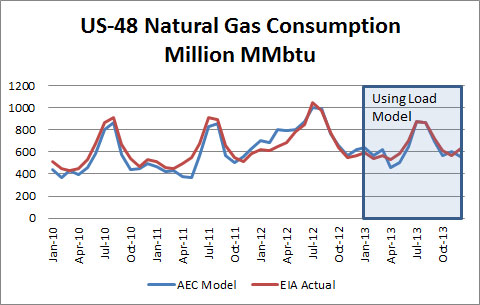

Gas Burn in the US-48 Power Sector:

In 2013, the average gas burn was within 3%.

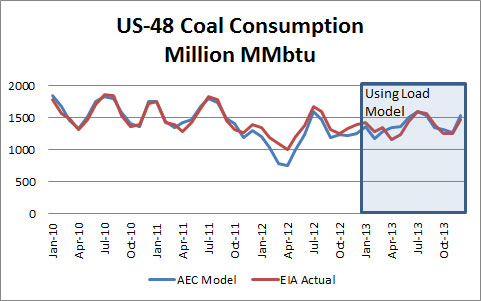

Coal Burn in the US-48 Power Sector:

In 2013, the average coal burn was within 1.5%.

Complete charts and data available now for subscribers.

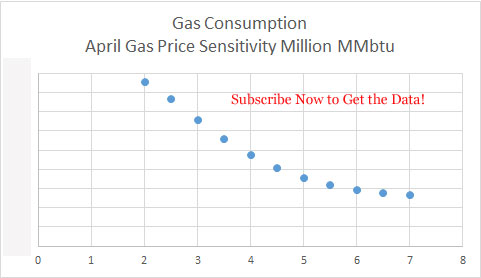

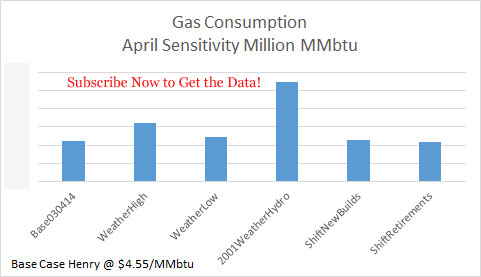

We also had time to take an early look into April gas consumption ranges running our monthly snapshot case. We reproduced our gas price iteration case and our sensitivity cases for the month of April.

Henry Hub Price Iteration Runs:

Complete chart and data available now for subscribers.

Natural Gas Demand at Various Sensitivities:

Complete chart and data available now for subscribers.

April hydro condition is still a key variable to keep an eye on just as we pointed out in our March analysis.

We improved our reporting spreadsheet by including the coal consumption plots. The improved output spreadsheet is available now for subscribers.

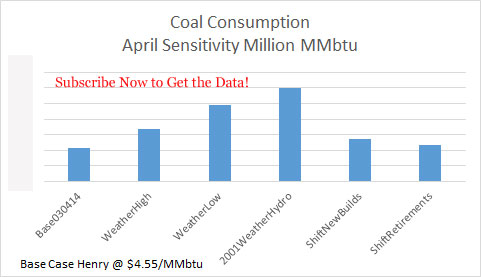

Henry Hub Price Iteration Impact to Coal:

Complete chart and data available now for subscribers.

Coal Demand at Various Sensitivities:

Complete chart and data available now for subscribers.

We also added a power price charting capability to our spreadsheet allowing our subscribers to see how the various changes impacted power prices from across the country.

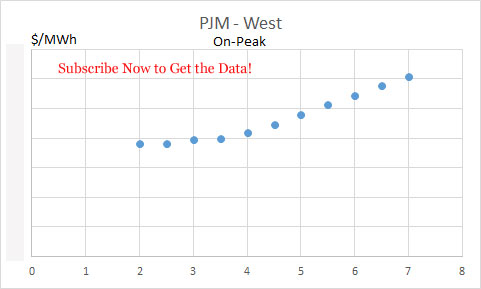

Henry Hub Price Iteration Impact to PJM-West On-Peak:

Complete chart and data available now for subscribers.

PJM-West On-Peak Power Prices at Various Sensitivities:

Complete chart and data available now for subscribers.

The above analysis is all available to Prime Subscribers each month.

We are continually adding and improving PMA. One of our current projects is adding another insights category – Investors. We are compiling the various portfolio’s of the largest generating companies and will display their performance from PMA. In this section, we will answer the questions asked by investors, such as whose generating assets are at risk given various policies and commodity changes. Besides identifying the risk, we will calculate the extent of that risk. This will be another category that can be subscribed to individually. We will likely include it at no additional cost to those subscribing to the prime package.

Hopefully, it has been demonstrated that PMA can bring you great insights into the power markets at an incredible value. The above analysis can easily pay back your investment by helping you make better decisions whether trading, planning, purchasing assets, or being an investor in a utility. PMA will offer a better understanding of the power market from power prices to coal and gas consumption.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

P.S. Send an email to get a free one week trial.