Another 30% return in Month Time? – Next Trade De Jour

It will be hard to beat my BEST winter trade call for buying the Dec. 2014 AD-HUB minus NYJ spread – As of 11/24/14 close, the spread moved to -$31/MWh vs. when we wrote about it at -$44/MWh – up 30% since October 9th 2014. I hope all of you took my advice when you read about it.

Likely my last and final timely free call to you (in this case the release was delayed only a few days -some received an early release of the analysis ahead of time) will be to sell the January Ercot North On-Peak Heat Rate (ERCOT North On-Peak / Henry Hub) and to once again take a look at buying the AD-HUB minus NYJ Spread this time in March 2015. As previously discussed, the process to identify these trades was to use the built in screeners from PMA-NT default runs. Then, a complete analysis was applied to stress test these trades, both from a future and historical perspective, as described in my previous article.

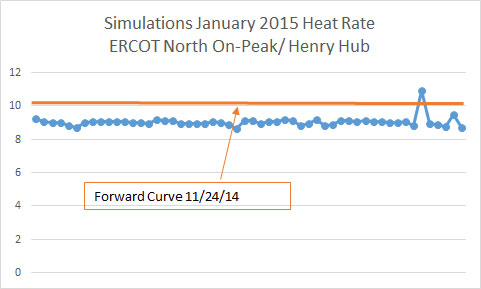

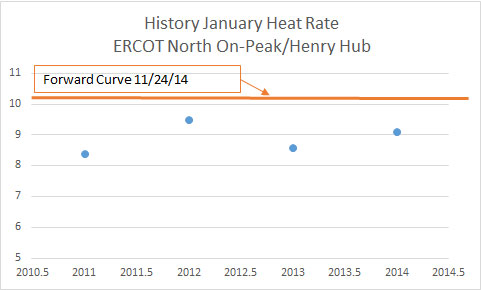

The ERCOT North Heat Rate sell is based on over 50 simulations plus a historical perspective. This is not going to be a huge money maker but the risk of loss is minimal. The current forward curve is showing a 10.11 mmbtu/ MW heat rate. In the last 4 years, the highest heat rate achieved was 9.54 in January 2012 and the lowest was 8.4 January 2011. Based on over 50+ simulations, the average heat rate was 9 with only 1 simulation greater than 10 at 10.5. I feel very comfortable with this trade.

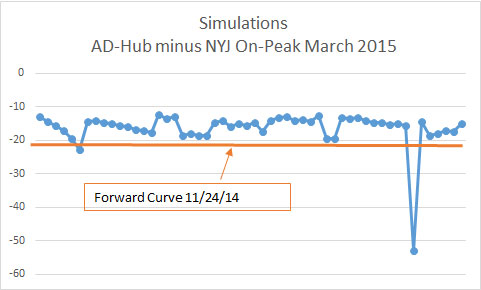

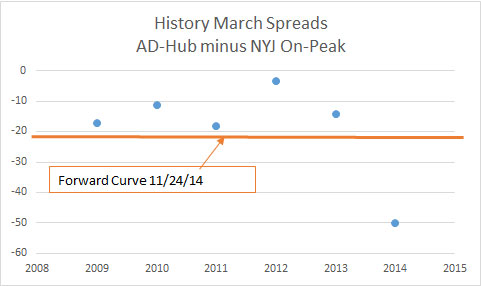

The AD-Hub minus NYJ On-peak spread has treated us very well this winter. Examining the March 2015 spread, we see the same opportunities. Currently, the spread is trading at -$23/MWh. Unlike our past call, there is more risk in this trade. There is 1 simulation – the weather profile of 2013-2014 – which produces a -$52/MWh trade. This compares with the historical actuals of 2014 March of -$51/MWh (Nice Calibration!). Outside last year, from 2009-2013, the March spread has averaged -$13/MWh. The 50+ simulations produced an average of -$16/MWh (which includes the one simulation that was more negative than $25/MWh). This is a great trade if you feel comfortable with the weather risk. In our slew of simulations we did run the weather for the past 12 years with only 1 year indicating a loss for this trade.

I will release a new publication product – PMA-TradeWatch. PMA-TradeWatch will screen out trades based on the default setup of PMA with a layer of historical screening. These trades will represent the first layer (identification) of trades to look into. A file will be sent daily to subscribers. As I noted in my process in finding the BEST winter trade, it takes more work than the initial screen to really prove this to be a trade to place your money on. PMA-TradeWatch is a report to indicate to you potential trades. With this list it will narrow the amount of investigation. Ultimately I would recommend running more simulations and applying more historical analysis. Following this process will lead to successful trades similar to my best winter trade. We could facilitate the process for additional simulation and analysis for an additional fee. However, at some point, it would be more cost effective to do PMA-NT.

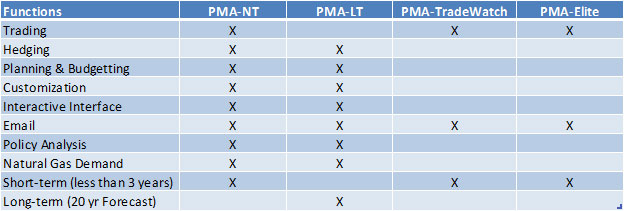

We may release another product PMA-Elite which goes above and beyond PMA-TradeWatch and goes through the process and does the work to give these winning trades. PMA-TradeWatch is an ideal augmentation for those who already are staffed with a full team of analyst. They can shoot holes and discover the winning trades from the list supplied by PMA-TradeWatch. PMA-Elite is designed for traders needing the complete analytical solution to finding money making power trades. Both PMA-TradeWatch and PMA-Elite are focused on trading. Our other products are designed for greater breadth of usage – see below table for summary.

We hope that all our articles have proven the success and efficacy of our Power Market Analysis platform (Summer Trading, Summer Hedging, Winter Trading). Please do consider All Energy Consulting for your analytical needs in the power spectrum. All fuels ultimately lead to power. Building up the energy foundation from power makes sure all things are tied together.

I hope you had a wonderful Thanksgiving. Thank you so much for all of your support.

Your VERY Thankful Need to Exercise Energy Consultant,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/