Shale Gas Revolution adds $193 Billion to the US Economy

The naysayers and those who want shale gas to go away have not seriously looked at the benefits of lower natural gas prices to the US economy. In this blog, I decided to evaluate the savings the shale gas revolution has given to the US economy. As I have been espousing, energy is just a means to an end. Reducing energy cost, immediately increases value to society. The inverse is also true.

In order to calculate the value of the shale gas revolution, I looked at the natural gas price trend on a three year rolling average from the EIA. I started in 1997 and stopped the graph in 2008 right before the shale revolution presented itself. Interesting to see the three year rolling average price is quite linear with an R^2=0.9552.

Obviously extracting the equation for future years is a plausible method to calculate the price of natural gas without shale gas. However, there are concerns with that method in that eventually prices do hit a plateau as alternative uses and demand response do occur. A cautious and conservative calculation is to assume the price of $7/mmbtu.

With this price, we can cross multiply the consumption and compare the cost to the US economy with or without shale gas. I know one of the first comments would be higher gas prices would have lowered consumption. I will agree with that in principle. However, did you know from 2002 to 2008 gas demand rose in the midst of the largest sustained gas price rise of over 270%? This growth came from the fact the incremental demand of power had to be met. Since the US did not build any significant baseload generation outside gas units over the past 10 years it was left to gas units to fill the gap. The price of electricity is small when compared to the value it can bring therefore a 270% rise in gas price was not going to stop gas demand. In reviewing my math in the table below, I took a conservative view and held demand at 2009 levels in the case of without shale gas.

| With Shale | Without Shale | ||||||

| Wellhead Price | US Demand | Cost of Gas | Wellhead Price | US Demand | Cost of Gas | US Savings | |

| $/MCF | MMCF | $Billion | $/MCF | MMCF | $Billion | $ Billion | |

| 2009 | 3.67 | 22910078 | $ 84.08 | 7 | 22910078 | $ 160.371 | $76.291 |

| 2010 | 4.48 | 23775388 | $ 106.514 | 7 | 22910078 | $ 160.371 | $53.857 |

| 2011 | 4 | 24466323 | $ 97.865 | 7 | 22910078 | $ 160.371 | $62.505 |

| Total | $192.653 |

With the shale gas revolution, the US saw a stimulus to the tune of $193 billion over the last three years. The $193 billion savings to the US economy is conservative in the fact without shale gas more money would have been expatriated via LNG if it were not for shale gas. To put this number in perspective I reviewed the Recovery Act spending. In the grand scheme $193 billion compared to the total Recover Act of $840 represents 23%. On several individual parts of the Recovery Act, shale gas savings dwarfed many categories (e.g. Unemployment benefits $61 Billion, Infrastructure $24.5 Billion, Energy Incentives $10.8 Billion, Housing $5.5 Billion).

The industry needs to learn how to extract and educate the public on the value it has produced for society. Innovation and hard work produces more return and more transparent stimulus to society than any government program could ever create.

I do agree and support the regulation of the industry to limit the amount of bad actors that are willing to cut corners and sacrifice the environment for small increments. Our recent significant problems (Accounting Scandals to Housing/Banking to Oil Spills) can be blamed on the actors directly involved, but there is much blame to be placed on the appointed regulators for each of those industries. Regulatory capture has been and continues to be a constant theme in these economic woes. More rules do not solve the problem; we need better regulators to enforce existing laws and apply common sense.

The administration should thank and embrace those who created and produced this shale gas revolution, as the economy could be $193 billion worse and rising each year.

I have been prescient in forecasting economic calamity and the impact on the major commodity markets (Forecasted both the 1998 Asian Financial crisis and the recent financial crisis and the drop in the major commodity markets in each case).

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

The Good, the Bad, and the Ugly of the recent EPA Mercury Air Toxics Standards (MATS)

Mercury Air Toxics Standards (MATS) recently released along with the associated analysis show some interesting numbers. There are quite a few good points in the ruling and the corresponding analysis, even if you are a coal plant owner. Let me first say this and the recent Cross State Air Pollution Rule (CSAPR) was / should have been expected. For those claiming these rules are all of the sudden, they need to get a new risk and planning group and/or better consultants. In the analysis, the EPA did quite an extensive job in analyzing all the benefits of MATS. Overall, I believe they listed out the benefits and cost appropriately, but I am not sure neither the extent nor the valuation of the benefits may be appropriate when put in context of other situations (see the ugly). I actually do agree with their cost estimates. On an annualized basis to 2030 it will cost slightly under $10 billion annualized per year.

There are coal units that are beyond their age that do need to retire. MATS should make these units retire. With the recent shale gas evolution, the economics to replacing these old coal units make it more justified.

The Bad

It is interesting the EPA cost conclusions focus on the claim – increment cost of only 3%. In my analysis, that I worked with the University of Texas Center for Energy Economics, we came to that similar conclusion. However, as this professor would say compounding rates can be misleading. His conclusion “The greatest shortcoming of the human race is our inability to understand exponential functions.” When we presented the analysis, we showed it in the bar graph form below.

Instead of annualizing the cost, we showed from the reference case the cost would be over 80% from the base case for the time period of 2012-2030. (Note the CSAPR case includes MATS. More details of this analysis can be obtained by emailing or calling me.) Annualizing the data does produce 3%, but people need to understand the math of compounding if you plan to present it that way. Annualized 3% increases will double the cost in 24 years.

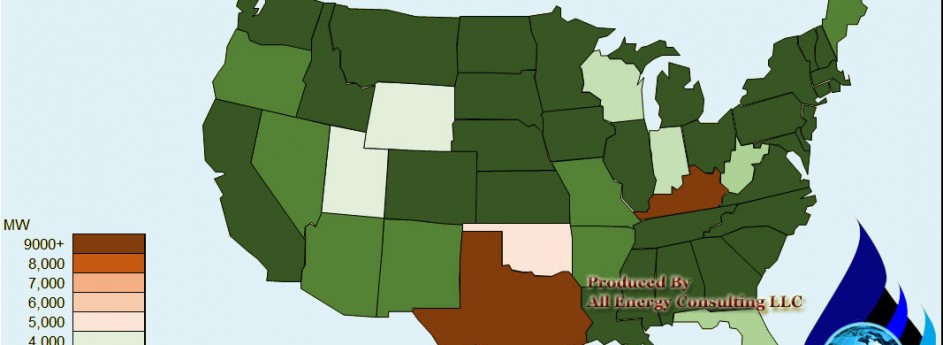

Another bad is the fact the totals cost are being reflected across the system. However, there are regions/states where the cost increase will be much greater. Several states could see an annualized increase of 6% over the reference case. Generalizing numbers for the entire system is good for understanding overall impacts, but actual implementation does require some local understanding and reality checks.

Another outcome of this ruling, which is not good but is not ugly, will be inefficient decision making from local utilities and commissions. I already hear from my various sources many plants will be installing very expensive control equipment under the concepts of maintaining jobs and the cost will be fully recovered through the rate base. Without full prudent unbiased evaluation of these types of decisions, the rate based will be overburden. It has been my experience when inefficient decision making occurs in regulated utilities, reliability will fall. This happens because the rate base can only take so much. Cost cutting becomes inevitable to make up for the costly decisions. Unfortunately, we don’t live in the university economics land where cost cutting is optimally done. Cost cuts will likely first come from the downstream portion of the business (Distribution), as many executives are farther removed from these decisions.

Another point to ponder, bordering on the ugly, is the point a good friend told me few years back. Eventually environmental mitigations become a subsidy for the wealthy. This takes much thought to fully appreciate this point. If the environment becomes clean to remove immediate concerns, but we continue to make it cleaner. In effect, we are making society pay for issues that are probably not directly affecting them as compared to other issues. As an example, I would surmise the poor will be more concern about food, education, housing, transportation, etc… before they are concerned about the environment, whereas the wealthy already has all those issues resolved for them. Therefore the wealthy would like the environment to be even cleaner. By making society pay for cleaner environment, eventually you are asking the poor to subsidize the wealthy in their agenda.

The Ugly

The ugly comes from the development / de-evolution of our society. Society has chosen to focus and develop specialties reducing the role of generalist/universalist who cover multi-fields. This trend has led to our lobbyist nature to find a particular subject and attack it at all cost regardless of the collateral damage it may set on other issues. This thinking along with insatiable use of debt has created a system that has lost the concept of capital allocation. We cannot solve everything at full levels of commitment. There are finite resources for both human and capital resources. I spoke about this at the 15th Annual Washington Energy Policy Conference, US Electricity Dynamics: Markets and Policy Options.

As I mentioned in the good, I do agree there are harms being generated from burning of fossil fuel and in particular coal. Coal does produce particulate matter and releases toxic chemicals. However, the report does not talk about the benefits of burning and using coal. These benefits can be seen in learning and reflecting upon the history of our electrification and the benefits it has so greatly given to us. There is also no context of the amount of pollution that has been reduced. Most people don’t know the amount of SO2 being emitted in the US is now close to the levels seen in the 1920’s. Considering we have more people and a much larger economy this is an amazing accomplishment. I do believe as a human race we can always say things can be better. It is a matter of balancing which of these things we focus on (e.g. healthcare, education, environment, security, poverty, hunger, etc…)

Below are key statements from the EPA analysis I want to focus on:

“EPA estimates that this final rule will yield annual monetized benefits (in 2007$) of between $37 to $90 billion using a 3% discount rate”

“The reduction in premature fatalities each year accounts for over 90% of total monetized benefits.”

“The great majority of the estimates are attributable to co-benefits from 4,200 to 11,000 fewer PM2.5-related premature mortalities”

“For a period of time (2004-2008), the Office of Air and Radiation (OAR) valued mortality risk reductions using a value of statistical life (VSL) estimate derived from a limited analysis of some of the available studies. OAR arrived at a VSL using a range of $1 million to $10 million (2000$) consistent with two meta-analyses of the wage-risk literature.”

“The mean VSL across these studies is $6.3 million (2000$).”

If we look at the first statement, we can multiply the benefits by 90% to get a sense of the value of an unborn person. Using the 11,000 saved figure per year from premature fatalities the value of an unborn person amounts to $3 to $7 million. I do not have or thought of value to life, but I do believe I have the logic to put suggested values into context. A $3million value for an unborn is a very considerable figure, particularly when we put this into context. Currently, there are around 1 million abortions per year in the US. Based on the EPA logic this amounts to, on the low end, a $3 trillion dollar loss per year if we could prevent those. Perhaps the above context may have not been the best linkage for an unemotional discussion, but it was the only direct context I found that directly involved unborn with a potential for mitigation.

Non-direct context is to compare the cost to other issues to evaluate whether this is a more appropriate issue to allocate $10 billion per year. Personally I like to focus on children issues since they are not directly at fault with any of the current problems, plus they have a full life ahead of them to make it better. I found the following statements from the Children Defense:

“A total of 15.5 million children, or one in every five children in America, lived in poverty in 2009, an increase of nearly four million children since 2000.”

“According to the USDA, over 16 million children lived in food insecure (low food security and very low food security) households in 2010.”

According to Feeding America, they note $1 can represent 8 meals. This is a very fascinating figure, I am not sure the reality of that figure, but imagine $10 billion a year being allocated to give the 16 million children food security. Using $1 represent 2 meals, each of those 16 million children could have 3 meals a day for the entire year. Is it best to allocate $10 billion a year to 11,000 unborn or to help those 16 million children who are currently hungry?

I know the argument to my logic is the allocation of capital is not that fungible. In addition, poor funding is inevitable therefore to optimize this spending will just result in wasteful spending somewhere else. This is the ugly part of our system that I cannot disagree. We do spend on issues, which perhaps could be allocated to other parts of society that would be more productive.

Conclusion

The truth is we have fixed amount of human and capital resources. Any spending will be taken from something else. We do not directly see this now, because much of our spending is based on debt. Debt spending is taking the ability from future generation to make decisions. Increasing the cost of compliance across this country will result in allocating capital to an issue to save 11,000 unborn fatalities. Can this cost be better allocated? I do agree this expenditure is a worthy cause, I just don’t know if it is the best or even a top 10 cause given all the other issues. We need to bring back the Universalist thinkers so we can make better decisions not just for the immediate future, but for future generations.

I have done numerous Policy/Regulation impact studies. Please do keep All Energy Consulting in mind for your consulting needs. Let us write you a proposal.

Your Energy Consultant,

Gasoline Prices for Next Year

Repost from my other blog with an updated note.

One of the most common questions I get asked by my friends is “What will be the price of gasoline?”

I have this rule of thumb that I learned by observation – I never really tested the theory till now. The rule I tell my friends just take the average of 4th quarter price of gasoline and you can expect the peak price in the driving season to be around 70 cents/gallon higher.

Once again with the magic of the Internet one can test that rule of thumb. I went back from 2010 to 2000 and discovered the US Gulf Coast (USGC) December average subtracted by the peak of next year driving season averaged 76 cents/gallon. Over the last five years the min was 40 cents/gallon and the max was 1.70 cents/gallon. Now of course my friends are focused on the retail price so I say if you are looking at the wholesale price you need to add another 70 cents/gallon to get to retail.

Clearly gasoline and the crude oil markets are seasonal. What I find really funny is the politicians and economist touting how petroleum prices were down over the last few months. Relative to last year our 4Q average YTD gasoline price is up by almost 30% – 58 cents/gallon. This does not bode well for next years driving season nor the economy. We could very likely see $4/gallon pump prices next year given the current prices.

Added note – beyond the simple seasonal demand trend of gasoline, prices also move up due to the cost to produce gasoline goes up. Gasoline blend changes in the summer time. This blend reduces the Reid Vapor Pressure (RVP) of the gasoline which makes it less likely to evaporate. Typically summer gasoline will have less butane which is more cost effective than other components that make up gasoline.

I can help you forecast any commodity through a fundamental approach of supply/demand and finding cross market dynamics. Please do keep All Energy Consulting in mind for your consulting needs. Let us write you a proposal.

Your Energy Consultant,

Regulation vs. Deregulation Utilities

This subject matter can be as contentious as religion and political affiliation. Therefore let me start by saying I certainly would be willing to change my mind as I have already done over the past few years. I do like and live by Thomas Paine statement – “You will do me the justice to remember, that I have always strenuously supported the Right of every Man to his own opinion, however different that opinion might be to mine. He who denies to another this right, makes a slave of himself to his present opinion, because he precludes himself the right of changing it.”

What is regulation? Most people understand the need for police, roads, and fireman – hence the need for some tax. Electricity and water have become equal to those needs. A definition for utility can be functional rather than attractive. Society has chosen electricity and water to be utilities. They are a means to an end. However, the complexity of creating and delivering these utilities are not as easy as paving a road or having a fire station. These investments are much larger with much longer time frame of impact.

Natural evolution was to create a framework to allow these investments to occur for the greater good of society. The simple form was a Co-Op model. Local business and municipals come together and state everyone in this area will pay for this service at rate to make the product to support the local need. However, the cost was considered very prohibitive and greater scale could achieve greater cost reduction. The large utility model was created. The incentive structure for these investors to come together and supply such large volume of money was to create a guaranteed return for investment.

Regulation involves a return on investment. The incentive structure of utility in a regulated framework is investment. Without investments the utility would not make any return. Enter the public shareholder utility, the shareholder of these regulated utility makes a return on the investment piece. The cost of maintaining and operating the investments are cost based. There is no return for this part of the business. Balancing this cost pass through is the lack of competition, allowing the ability to recover investments with guaranteed returns even though the decision may have not been the best choice in hindsight.

With this model, if left unchecked inefficiencies will grow in two areas. One the cost structure to maintain and operate has the potential to grow beyond reasonable practice. This includes operating cost and compensation. Reliability becomes the goal over innovation and optimal decision making. Regulated model supports the themes if it is not broken don’t fix it. Economics 101 states rewards are typically commensurate with risk. For management teams in regulated utilities to make relative income to other sectors fails that. As a regulated entity, there is monopoly power with a relative less risk on return as compared to various other sectors. Hence one reason to drive for de-regulation not related to optimal market design was the executive suites desire to justify pay relative to other industry. Regulated utility should be considered similar to government – cost center with structured risk.

The other area of inefficiency comes from the desire of the shareholder and potentially management team to boost earnings. This earnings drive may cause non-optimal investment decision since returns are generated through investments. The higher the investments they can get approved, the higher the return. This does not necessarily bode well for promotion of efficiency and conservation.

The key solution to mitigate these inefficiencies is to have a strong regulatory body. The regulatory body should be compensated as highly as the utility to avoid any regulatory capture. Without this, abuses will likely to occur.

The de-regulation model, in theory, would bring more innovation as competition will necessitates that behavior. Competition in general leads to cycles (e.g. Operating Systems: DOS,Windows,Apple, Android, etc…) There are risk as your competitors can make you obsolete. Currently many of the de-regulated markets can claim they are successful and good for society. This is being masked by the long time frame generation assets offer, 40-60 years. Much of our generation capacity was decided in the 1970’s and 80’s. However, those assets are coming to their end of life. Now these large investments need to be made again, but now you have a competitive landscape with decisions requiring much larger returns due to the risk of making a wrong decision. There are no guarantees for these investments in a fully de-regulated world. Therefore decisions to limit the capital risk will occur. Most new generation build will likely be natural gas. Largely because it’s upfront cost is limited. You saw this even when gas prices were above $8/mmbtu. Future generation decisions will not be balanced nor focused on reliability, but based on the best way to maintain risk and extract as much profit as possible.

At this time, I believe as big of an error as Alan Greenspan suggestions that the bankers would police themselves, the belief that a competitive electric market will bring a more optimal solution than regulation may result in a similar fate. I have seen and do believe the regulated model can be abused as much as the de-regulated model can result in undesired results. The key question is which one of these can be more easily adjusted and remedied when they tend to stray from theoretical operations?

I contend the regulated markets are more likely to be maintained than the de-regulated markets. I only accept this premise under the same premise that I appreciate driving on roads and having a fire force take care of my neighbor’s house on fire before it spreads further. In general, I support free markets, but some things are utilities – purely functional and not attractive.

Please send me your comments or suggestions David K. Bellman [email protected] Perhaps I will change my mind if given more information. I have heard and thought of ways to make the de-regulated markets work, but each of those ways result in making it more regulated. One suggestion was to have the RTO pay for and permit greenfield development and allow participants to bid for those projects. This sounds promising, but I am not sure if it would do enough to offer baseload alternatives such as nuclear.

Given my experience in the power markets, I can help design and/or evaluate various market changes.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

Solar Projects being approved in California

I am going to be a little critical with today’s reporting. More than once EnergyBiz will report on a deal , but they never delve into the deal. Yes EnergyBiz is free, but seriously it doesn’t take much work with the internet. For example, today’s article I came across on EnergyBiz involves the California Public Utility Commission (CPUC) approving PG&E solar deal with Sempra. In the article, they note how the commission approved the project, the dates, and the size. However, how come no discussion on the cost or expected performance of the project? Yes the project is a bilateral deal so the information is somewhat hidden. A little investigated journalism you can conclude the project is likely a 25 year commitment for under 0.10852 $/kWh with an expected capacity factor of 23%. First you go to the CPUC website. Do a simple search on “PG&E Sempra Nevada Solar “and you will get this link to the deal. In the deal you will note in the beginning “Generation from the 150 MW Project is expected to contribute an average of 303 gigawatt-hours (GWh) annually towards PG&E’s annual procurement target”. This would calculate to a 23% capacity factor. This is not the best capacity factor, but not the worst either.

In terms of cost the same link shows the statement “Based on 2012 commercial online date for the Copper Mountain 2 facility, the 25-year PPA is below the 2009 MPR and accordingly the PPA does not have above-market costs associated with it.” A little more investigative journalism would have you search on the website to see the 2009 MPR. The 2009 MPR can be seen on this link. From the link there is a table showing the 2012 25 year contract MPR is 0.10852 $/kWh. Interestingly if they had used the 2011 MPR, the limit was 0.09274$/kWh a drop of more than 10%.

The next level of investigated journalism is to see what type of cost Sempra is paying to build this facility. To do this I went to a publically available levelized costing calculator supplied by the very capable National Renewal Energy Laboratory (NREL) – note I served on the advisory panel for the technical review team. In addition to the calculator, if you click on the labels NREL will display the tables showing the range of cost. The lowest cost for solar is $5000/kW. For the remaining variables I used period 25, discount rate 4%, capacity factor 23%, FOM 10, VOM 0.002, HR 10000, and Fuel Cost 0. This produced a levelized cost of 0.166. I then changed the capital cost till the levelized cost was below 0.11. This occurs at $3200. If the investment tax credit is computed from the $5000 basis you do get around $3500. Applying a negative fuel cost (-1) from the $3500 capital cost you would produce 0.108. This implies likely the technology cost is still around $5000/kWh with a need for a 30% investment tax credit and some value of renewable credit around $10/MWh.

If you are of the very curious mind, you will be asking yourself how in the world is the MPR that high? Since you will note in the MPR link they state – “The MPR represents what it would cost to own and operate a baseload combined cycle gas turbine (CCGT) power plant over various time periods”. Well you see that’s not really a “true” statement on many fronts. Obviously there are forecast that need to be employed to calculate a CCGT cost in the future. They decided on using a NYMEX future curve for fuel which is understandable. The big driver pushing the MPR high is the assumption of CO2 price.

If this forecast became true, in the near future (in two weeks), Californians would be adding an extra 10 cpg on gasoline and by 2030 they will be paying almost a dollar extra on gasoline. This CO2 cost stream adds roughly $19/MWh on the levelized cost of CCGT– almost a 20% premium. Even removing the CO2 cost and comparing it with NREL levelized cost calculator the CPUC model shows an additional 0.01 $/kWh cost using the same inputs.

With simple investigative journalism the article EnergyBiz reported, which anyone could do scraping a company’s website, transforms into real value and knowledge.

At AEC we are committed to giving you knowledge not just information. Feel free to email me your comments or suggestions David K. Bellman [email protected]