Current Design of Minimum Wage Increases Income Inequality and Stifles Innovation

I came across this USA Today article while sitting at the airport – Minimum Wage Rates May Climb. I felt inspired to throw out another perspective on this issue. The premise of minimum wage was to prevent income inequality. Fair Labor Standards Act passed in 1938; noted wages should ensure a “minimum standard of living necessary for health, efficiency and general well-being,” plus, “without substantially curtailing employment.”

I believe there is sufficient history to re-examine the efficacy of minimum wage. My contention is the current construct of minimum wage not only provides a minimum standard of living, but it also promotes that form of living versus a desire to do better. The “substantially curtailing employment” is objective. In my mind, minimum wage has substantially curtailed employment. In fact, it has also curtailed innovation. Minimum wage has supported the incumbent companies stifling competition and innovation.

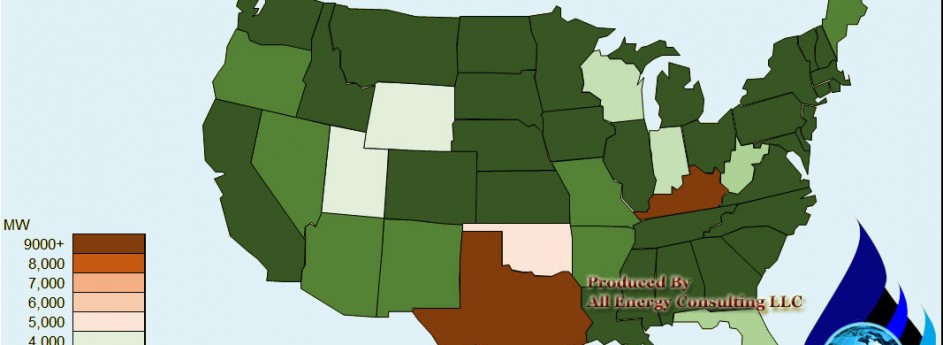

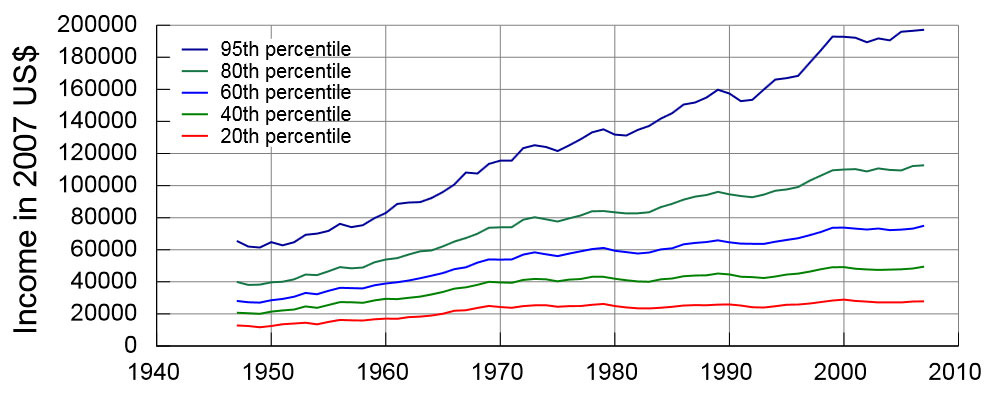

Refuting the core efficacy of the current design of minimum wage is easy. Examining the history of income inequality, it shows the value of having the current design of minimum wage has not helped. The below graph I pulled from Wikipedia – of course I have validated it – (one cannot trust Wikipedia 100%).

Many other sites have shown the income equality has only gotten worse with a minimum wage policy (see http://www.ritholtz.com/blog/wp-content/uploads/2011/09/Rising-executive-pay.png & http://www.ips-dc.org/campaigns/tax-dodging-ceos/index.php ) Re-designing the minimum wage and the multiple restrictions in starting and creating a company, I would contend, will create many competitive companies not allowing corporations to outsource and further consolidate wages. Mitigation of income inequality has failed to occur in the time period of minimum wage. We can pretend that it will eventually prove itself, but I will reference Albert Einstein – doing the same thing over and over again and expecting different results is insanity.

For those less numerically inclined, I will try to employ some logical deductions. When one decides to start a business and try something innovative and different, there are many roadblocks developed over time to prevent you from succeeding, largely from the support of the incumbent corporations. One of the key areas of growing a business is expanding through employment. However, as those who have hired before, realize the choices of people vary in terms of work ethic and capability and it is extremely hard to know beforehand. An ideal situation would be to hire multiple employees in hopes of finding the one or two that will just fit in perfectly. Ideally, they would promote that individual to take on greater responsibility with greater rewards. With a minimum wage structure your ability to experiment and hire multiple employees and eventually promote and reward become limited. A cost structure that does not allow experimentation will result in lowering the potential of the individual and the new company. Obviously, an incumbent organization can more afford to employ the strategy of hiring multiple individual to find that star performer, leaving the pool even smaller for the new company.

One of the original reasons that minimum wage exist was due to significant abuses by employers. During those time periods, communications and information traveled very slowly. The sweat shop concerns in the US will be nullified via social network. Much of the US has the ability/access to the internet as compared to the third world employees. An elimination of minimum wage will likely do more to reduce sweat shops since these third world sweat shops are ignored by the general public. Creating a competitive US workforce company will bring the discussion to the forefront.

Another logical deduction is to come from the employee point of view. I could imagine a situation for a young student to work for “free” or very minimal for only the pure desire to obtain knowledge, which can be used later in life. My thinking is focused on enabling the individual to get out and do something with their skill set. It’s rooted in finding and maximizing the ingenuity of the individual. Eventually some of those individuals will create a small business then perhaps a large business. In addition, I am not advocating the removal of all regulations (e.g. building standards – but if one can build to a standard why not allow that person to build – buyer beware in terms of cost). Let us unlock the power of the individual versus holding everyone back.

Given the historical results of the past 74 years, the current design of minimum wage is holding a large segment back. With a re-design of minimum wage and other similar obstacles for new companies, this country will see a resurgence of private companies and employment. A potential re-design solution could be eliminating the minimum wage for companies under a certain income level. These new companies will create a competitive force to the inertia of status quo and make a change to corporations’ ability to outsource and further consolidate wages.

The value of multiple smaller companies can be seen in the shale gas revolution. Shale gas was driven by the smaller independents as the large multi-national companies could not see and/or innovate to produce shale gas.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

Weatherization Assistance Program True Colors

I came across an article titled “Highest Recovery Act Job Creator” , which is really just reporting the article found on the recovery.gov site. The reporting initially is perceived to be a positive report card for the Department of Energy low-income Weatherization Assistance Program (WAP). The positive notes touted:

- 2nd out of 200 federal programs in job creation

- Top ten for Recovery Act in terms of creation and retention

- Saved $320 Million in energy cost in just the first year

- Reduces home energy use by 35%, saving $400 per household

- More than 600K homes

As reported the numbers seem fine, but let us do some math. In the same article, they note the following:

- WAP cost $5 billion

- Created OR retained more than 13000 jobs

Given my concerns about the cost, whether it was actually spent or even appropriated, I searched the database to evaluate the awards given for the program. From searching the recovery.gov database for CFDA code 81.042 Weatherization Assistance for Low-Income Persons:

Total Awards

1,384

Total Award Amount

$4,885,043,224

The $5 billion figure would seem to be the appropriate cost the taxpayer has spent to achieve the above results. The government could have reported the following results in this manner:

- Program cost per employed $370K ($5 Billion/13,500 jobs)

- Almost 20 years on a non-discounted basis to break even on energy savings ($5 Billion/($400*600,000 homes)

The above stats when presented in that fashion does not look so appealing. I know many argue, and rightly so; job creation is greater than the one year. However, these types of jobs are not sustainable as one can only do so much weatherization. Parks and services would generate more sustainable jobs and at a much lower cost than weatherization. In terms of the energy savings, it is a small number because the fact is energy prices are not that high relative to the value it brings as compared to a cup of coffee. Who is saving the $400? Low income housing energy prices are subsidized to begin with. There are several nuances with low income particularly section 8 housing. I have seen where the land owner pays the utility and other cases where the tenant pays, but its average use is rolled into the calculation of the rent. Either way the “return” to the tenant is not clear. It is possible some of these projects are just funding the owner.

The scary thing for me is to see that this is the #2 out of 200 federal programs for job creation. I hope the others have better calculated stats.

At All Energy Consulting we pursue on looking at various issues in numerous lights. This is the only way to make sure bias viewpoints are removed.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

David K. Bellman

6143560484

Green Energy Better and More Sustainable without Subsidy

There is no doubt in my mind that green / renewable energy is capable of being sustainable without subsidies or even a CO2 price. Articles such as the one I recently read put doubt in many readers as they approach the issue on the basis of competition with fossil fuel. With subsidies and a CO2 price, renewable energy will come into the market; but the adoption into society as the right thing to do may not come as quick. The role of the government, as many see it, is to not only provide for essential infrastructure (roads, police, etc…) but to also induce appropriate behavior. Our decision on appropriateness can range significantly. Personally, I believe appropriate behavior will develop and be produced from innovators capitalizing on the fact that people will make good choices when someone makes it easy for them. This is an optimistic stance on humanity in that the premise is that the natural tendency is to do good. Let me caveat my statement, major behavior changes involving humane treatment for our fellow men do require government intervention (e.g. slavery, racism, etc…) to progress in a timely fashion. In terms of renewable, innovation in marketing and advancing the value of renewable has been very poor. I would suggest a reason for this is the subsidies. Subsidies have crowded out the innovators and put the path for renewable in the hands of mega-corporations. Significant lifestyle innovation does not come from large corporations, though much credit should be given to them for lowering cost of production for renewables.

I want to focus my case for renewables without subsidies on the organic food industry. The organic food industry was far from being promoted by the US government. Organic food trend also encompasses the desire to purchase local farmed products. There was no subsidy or “push” by government. The product is a premium in cost compared to the non-organic food. However through the innovative entrepreneurial spirits of people involved in companies such as Whole Foods, Trader Joes, etc… society has a rather large and growing organic food industry. This was not done by pushing cost to people who could not afford or see value from it. A decent portion of society has naturally decided that it would be appropriate to purchase from local farmers and to reward organic food producers and marketers. Those who could initially afford it eventually allowed more people to afford it later – as seen by Walmart offering organic food.

There is no doubt in my mind someone can take a segment of the economy to push forward into renewables. It is matter of changing the approach and tact on renewables. So many people have a deep commitment in green living, but act so little upon it. When I note some of the hypocrisy in their lifestyle choices, many note they don’t plan to change their lifestyle significantly unless we all do it. This is the failure of leadership. In addition, it shows no one has learned to extract a potential revenue stream. Someone needs to be able to create a mechanism where it makes it easy and desirable to be green. True innovation requires innovative marketing. People are always trying to relate renewables with fossil fuel. Learn from Apple, my Apple fanatic friends would give no credence to any competition/comparison with the PC. I can envision the possibility of creating communities /neighborhoods where people choose to pay a premium to live a renewable and efficient way of living. Obviously I am not Steve Jobs of renewables, so I can only envision so much in the future on how this revolutionary way of developing renewables may unfold. It could be quite a game changing event, if people chose a lifestyle that would incorporate and unify the energy incentives of the developer, property manager, and tenant.

A better tomorrow can be achieved if we realize the individual and the various actors involved in energy use cannot make the time to individually make appropriate lifestyle decisions when in aggregate make a large difference. Energy is a means to an end. An innovator is needed to make it easy and desirable to change our choices. As Steve Jobs has said “A lot of times, people don’t know what they want until you show it to them.” Remove and/or transfer the mechanism of subsidies to the innovators not the corporation, if you truly want society to massively and effectively adopt renewables and efficient living.

All Energy Consulting is committed to deep thought and thorough analysis.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

614-356-0484

Renewable Portfolio Standards – Require a Portfolio

Many utilities fulfill their renewable portfolio standards with very few options. The easy way for the utility is to do a Power Purchase Agreement (PPA). Most PPA’s are for wind as it has been the economic leader of the renewable choices. Essentially, the utility typically requires the commission to approve the agreement. Once the commission agrees the PPA becomes a cost pass thru. Given the numerous market structures throughout the country, the cost recovery is done through various mechanisms. In the end, the rate payer will pay whether they like it or can afford it. The worst form of cost pass thru is where the utility puts the cost in the distribution rates. This obscures the tracking of actual generation cost.

Regardless of the mechanism, utilities incentives to do renewable is to avoid costly penalties which are typically paid by shareholders not rate payers. The PPA usually will not mandate the developer to a fixed amount of volume. There is a performance criteria and several demonstrated calculations proving a certain yield is very likely. However, as we all know Mother Nature offers no guarantees. I can envision a year where the sun does not shine or the wind does not blow as much as predicted/expected. This could lead to a massive short of renewable credits. In developing an Integrated Resource Plan (IRP), much focus is given to reliability. Therefore a diversity of various generation options (baseload, intermediate, peaking, and market purchases) is a typical outcome. An IRP should strive for robustness not optimal planning, since the future is quite unpredictable and electricity is a unique commodity with limited storage and particular characteristics to maintain (e.g. frequency). I can tell you from multiple experiences, when the lights are out many would gladly pay more for better reliability.

If utilities would approach their renewable portfolio standard similar to their IRP, it would suggest a balanced portfolio approach. The portfolio would give some added value to the higher upfront capital risk projects such as geothermal and biomass. These types of generation would represent the baseload of the renewable portfolio. This will allow for a consistent level of renewable regardless of weather conditions. Adding to the diversity of the portfolio in many instances, I would suggest the utility to actually invest a portion to develop and operate renewable assets versus PPA. Given the similar operating features of geothermal and biomass to fossil fuel units, they would make an ideal candidate to be owned and operated within the renewable portfolio. In the long run, the capital spend will also likely payoff for the utility shareholders. As discussed above current wind PPA’s are just passed through with all the value going to the developer. An investment in actual renewable baseload generation allows the utility to capture some return on investment.

I have much experience in the renewable world. I have served on the technical review panel of the National Renewable Energy Laboratory (NREL). In addition with my utility planning background, I can bridge the two areas to help you create a robust renewable portfolio.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society (see projects).

Please consider All Energy Consulting for your consulting needs.

Your Energy Consultant,

Gas Producers Entering the Power World

A question was asked “could you blog about the strategy for a gas producer to participate in the power market as an independent power producer (IPP)?” Given my background in both Oil & Gas and Power it puts me in the perfect position to discuss this.

Let me first start simple and then build up to be a large scale IPP. The question posed was black and white in terms of participating in the power markets as an IPP. However, it really isn’t that black and white. There is potential strategy for the gas producer to unite with the power markets without actually operating a facility. This can be as simple as acting as the hedging agent for the utility. We see many people try to emulate the coal markets with their long-term contract arrangements. The difference for gas is the product is fungible – a molecule at Y is essentially the same as the molecule at X. This cannot be said for coal. Coal products are non-fungible with unique characteristics. Therefore building a coal plant with a boiler specified to operate with certain characteristics puts the power generator at fuel risk without a long-term contract. Beyond the equipment flexibility, fungible nature of natural gas has allowed the forward gas markets to be active and representative to the actual market in the near term. This cannot be said for coal as the coal forward market does not represent a significant portion of the physical market. Therefore, utilities, who would like a fixed price on natural gas price, can obtain a fix price by participating in the forward gas markets. There are several utility executives who would like to deal with gas like coal, but by doing so, all they are doing is shifting the burden of the hedge to the producer. There is still value for them to do this, as long as the premium of the hedge is understood. Shifting the hedge to the producer will allow the utility who is typically lean on the balance sheet not to be concerned about the fluctuations to the market. In theory, the producer should be able to hedge the gas better than the utility since it is their business therefore economy of scale should play into it. The premiums of the hedge will certainly be passed onto the power generator with a little return for the added risk. I suspect a small producer could not fill this role for the utility, since the counter party risk could be too great relative to the value of the producer. In a de-regulated environment, it is essentially betting on a position, which is no different than fixed coal pricing if the price is low enough. Clearly a bad deal will result in both parties losing in the end. Teaming up with a regulated entity to supply a fixed gas and volume has many significant advantages once the public utility commission has approved the deal. There is less risk of not being paid as the market risk is essentially being socialized.

The large scale alternative for the gas producer to act as an IPP offers many competitive advantages along with the associated challenges. This strategy still is not black and white. There is a potential to take small enough volumes from various fields and qualify as a distributive generator. The technology has progressed in the micro-turbine world to make it economical. This volume will not be large, but could work well for areas having to flare gas. In essence, most of the generation will be used to supply internal energy use, and on occasion be used to support the grid. Once again, depending on the market dynamics the challenges will differ. ERCOT related markets, where most of the market and several actors are de-regulated; more upside value can be captured. Markets with significant regulated actors could compress margins as their returns are less a result of optimal decision making, but more on the approvals of the public utility. In today’s market of essentially zero yields for cash, it becomes a very compelling reason to put your money to work. The power sector can bring a relative consistent return with a conservative outlook. Building or acquiring a combined cycle can offer decent returns with upside potential. Examining the cost of production of some shale plays, it makes sense to have part of the portfolio of production sold with upside potential. By operating a combined cycle a producer can essentially sell their production with an upside potential. There are locational issues which must be examined, but I suspect given the various transmission initiative for renewables, gas units can piggy back on that infrastructure build out.

There are several other key points to consider and local market analysis needed before producers jump into the power market, but I am sure there are several markets/situations it will make sense for producers to be more active in the power sector. Actual implementation will require back office support. The positive note most producers already have some form of risk group and a trade floor. If you are a producer, please do call or email me as I can help guide/assess/re-affirm your decisions [email protected] 614-356-0484.