CERAweek 2012 Summary from the Outside

This years CERAweek marks my first year in almost 10 years in not going to CERAweek. I had the privilege to be invited and speak at CERAweek two times. The amazing thing about CERAweek is the shear size. I have seen it grown from the days in the Galleria area to now at the Hilton Convention Center hotel.

One of the values of being at CERAweek, which you cannot get from reading summaries, comes from the time to reacquaint yourself with your fellow energy colleagues. Also, one of things I always marveled at from being at CERAweek is the logistics of the staff to serve meals. When you attend CERAweek, it is not a buffet line – it is a three course meal for lunch and dinner.

In terms of content summary, Platts did a fine job summarizing many key points in their blog. In addition, twitter works out well when you search #CERAweek. The highlights, I believe, were noteworthy:

CERAweek Oil Day:

I have to agree with Iain Conn, group managing director and chief executive of BP’s worldwide refining and marketing group. Mr. Conn said refinery investments will continue happen in the Atlantic Basin, but it will be strategically done. He also specified he expected to see investments in facilities to take the condensates from the shale development and make products. Those who have been reading my blog will note I made that call early February.

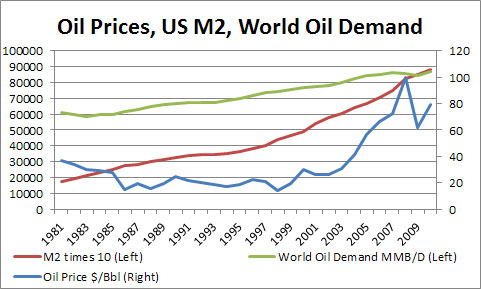

A group made of a good aquiantance Marianne Kuh, Chief Economist ConocoPhillips, and my friend Frank Verrastro, senior vice president and program director at CSIS Energy and National Security Program; noted the high crude oil price is more of a function of actual demand growth, not only political uncertainty of Iran. I do agree with these points, but I still think monetary policy has influenced the price of oil as significantly as demand, if not more.

To prove my point, I have pulled annual oil prices, M2 money supply, and oil demand since 1981. I have graphed the information below. I also ran regressions on each of the variables to oil price. M2 money supply has a better R^2 with 0.61 vs. 0.48. Together they produce a rather strong correlation for an R^2 of 0.70. Another interesting outcome of this analysis is it shows for the first time the amount of M2 is now greater than 10% of the world demand expressed in millions of barrels/day. This started in 2009 as the FED aggressively moved to “save” the system.

CERAweek Gas Day:

There were several discussions of natural gas vehicles. I think it’s a clear choice for fleets to convert to natural gas. Mass transit vehicles should move towards CNG. There was discussion on a recent article in the Wall Street Journal by Robert McFarlane, served as President Reagan’s national security adviser from 1983-85. In the article Mr. McFarlane talks about methanol vehicles. Speakers at CERAweek disagreed with him largely on the premise of structural issues. I think the more valid concern would be the history and fate of MTBE. From what I have gathered methanol would be more toxic than MTBE. I do disagree in how we handle the MTBE issue – requiring MTBE then banning it. MTBE was a messenger to a problem that is still happening. MTBE gave you a mechanism to trace and track leaking gasoline. By eliminating MTBE you did not solve the real problem.

Apache CEO, Steven Farris, made remarks in regards to supplying utilities with long-term contracts, but with a floating gas price. Once again I have blogged about this before. It would be worthwhile to continue to watch this evolution. Many are trying to emulate coal contracts, but the reason and the value of contracting gas is not the same as it was with coal.

Of course it wouldn’t be gas day without a deluge of shale discussion and fracking concerns. Many speakers talked about transparency and the efficacy of fracking. I will have to agree here that it can be done in a responsible and safe way. It is a matter of regulators to effectively regulate, because there will always be bad actors.

My former consulting company, Purvin & Gertz, who got acquired by IHS had their own session at CERAweek. They spoke about the NGL markets. Once again I did note about the dynamics of what is going on in this market in my previous blogs. This is an exciting area, full of opportunities.

CERAweek Power Day:

For some reason, the day opened with a discussion of nuclear renaissance. I will have to agree with GE CEO Immelt – there has never been or will be a nuclear renaissance in the US. I will add the caveat – unless significant structural changes are made to our electric industry design. This country has cost-effective options whereas other countries do not (e.g. France, Japan, etc…).

I will have to differ with many of Alstoms thoughts. Alstom has been a very vocal and huge supporter of CERAweek for the past few years. They spoke many times during the conferences. I have read that they still are investing heavily in CCS. They believe the focus for clean energy should be on the technology side. Once again in my blogs, I elude to the point it is not the technology that is limiting “clean” energy; it is the business strategy and incentives. They also point out that gas generation should focus on bigger turbines with lower cost. Of course, that sounds ideal, but I think over the next 3 years the value proposition will be for more dynamic turbines versus bigger and efficient. I say this because of the need to serve the intermittent nature of wind.

FERC commission, Philip D. Moeller, discussed the point that the consumer needed to see the real price. I believe he is trying to point out the desire of real-time metering. However I will disagree with this since there are several ways to make pricing more transparent to the consumer. Rate design in itself does not hide the cost of power, since regulation comes with cost recovery. It is the actors behind the rate design that hide the true cost of power – as noted in my previous blog. Real-time pricing will change consumption, but the bulk of the impact could be done by having block metering – on and off-peak hours with no dynamic pricing, but a statement to the consumer. The hours between 7am-10pm will be more expensive than 10pm-7am. This method would come at a fraction of the cost and involve much less complexity. I do understand the value of the “smart” grid that it comes from other forms, such as reliability; but this is not how it is being sold to the consumer.

I couldn’t agree more with CEO and President Bruce Grewcock of Kiewet – “In a lot of jurisdictions, people are going to see rate shock when they see the true costs.” Once again this is not coming from a smart grid realtime perspective, but the fact that there has been an underinvestment by the utilities. Instead of focusing on true needs over the past years, we have focused on projects and mechanism of style (e.g. CCS, IGCC, fuel deferral, smart grid, etc…). Inefficiency in markets will always come back to haunt you.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

Gasoline Prices Will Impact the Economy

As promised from my last blog, I have a rebuttal for Barclays Capital economists Peter Newland premise, that the key concern is the rise, not the absolute price of gasoline.

“The effect on growth of a rise in energy prices depends importantly on the abruptness of the increase. We found that, given a gradual and temporary rise, consumers are able to adjust saving patterns to smooth consumption, minimizing the impact,”; Peter Newland, an economist at Barclays, said in a recent note.

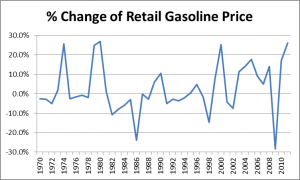

I do believe consumers will change, but I am not sure whether one would consider these price gyrations not abrupt. To support my claim all one needs to do is to look at the historical retail price changes. The price rise in 2011 was much greater than 2008 price, largely since 2008 had the back end price drop. In terms of all the other years this price change is the greatest price rise since 1980 on a year to year basis.

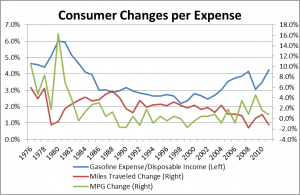

In terms of consumer behavior change, I believe the extent of consumer change is limited compared to what Peter may believe. The following graph shows that consumers do react in two areas – being more efficient and driving less.

As the cost of gasoline to the consumer increases more rapidly than their disposable income growth in the range of 3% or higher, we see an eventual reaction from the consumer. Howeve, the change in the consumer behavior is very narrow other than in the late 70’s and early 80’s. The largest miles traveled drop was only -1.8% in 2008. Also, I expect the fleet mile per gallon to change more slowly, given the fleet is so large now with over 250 million registered vehicles compared to 1980 of only 161 million. MPG change is a function of the fleet calculation by EPA. I do have the explicit miles traveled divided by the gasoline consumed. The last time that improved by over 2% was back in 1992.

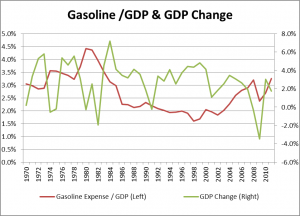

There is no doubt the gasoline prices is dragging the economy. As I have pointed out in many of my blogs, energy is a means to an end. Gasoline is no different. Having all the gasoline without the ability to use it to be productive will do nothing to an economy. Whether one is driving to work or getting goods delivered, the increase in cost will result in a reduction of the economy. There are critical price/expense points. I believe we are likely to cross that point this year. The below graph shows the historical trends of gasoline expense related to the economy.

As the graph shows, as soon as the economy starts spending over 3% on gasoline we see a slowdown in the economy. For 2012 I would expect another year above 3%.

I have spent much of my career analyzing the gasoline markets, given its importance to the US petroleum balance. I have many more graphs and views into the gasoline markets. For 2012, I expect gasoline demand to see the same fate as was observed in 2011.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

Regulation does not equal zero risk

As I pointed out in my previous blog, dealing with commissions without the thought of long-term implications can come back to bite you. Regulation is not risk free. In fact, it could be argued that regulation risk is higher and harder to quantify than market risk. In the regulation world, you are making deals which are perceived to be set in stone. Whereas in the free market, no one believes in any deals being set in stone. This makes the free market companies more agile and proactive. A regulated company without foresight will be punished. AEP recently saw this as the public utility commission reset the rates which was agreed upon. I don’t recall an event like this ever occurring. AEP clearly miscalculated the reaction and the potential pull of many of the small businesses. In general, the new rates impacted the commercial and residential class the most. The impact was greater than 60% for several customers. The outcry was too much for the commission and they quickly dismissed the rate agreement.

AEP rolled all their concerns into one rate case. This works well when the rate shock is not so great. In this case, given the expected rate shock, there was a significant risk of rejection. This has left AEP holding the bag on many legitimate rate increases. There were several gray areas of rate increases, which I will not get into. Utilities should learn from Barclays Capital economist Peter Newland and his latest discussion on gasoline prices. Peter notes, it is not the price, but the rise of gasoline prices. To an extent I agree with him, but in the gasoline case it is still important to look at the price. I will leave this discussion for another blog.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

Green Jobs the Renewable Quandary

The recent article on green jobs from the Wall Street Journal ends very well:

“Green energy is a future for all communities we should embrace,” he said. “But they shouldn’t tell us it is for jobs.”

Let me first start out and say I believe in renewable energy that there is a place for it in our portfolio of energy choices. In addition, it can survive without subsidies as I noted in my previous blog. The focus on jobs is a red herring. The issue is not job, but it is our commitment and our ability to be competitive and productive. Jobs are a symptom for the poor capital allocation in our economy. If the number of jobs itself was so important, there is no way renewables can compete with fossil fuel on a net basis. To prove this point, think about the massive supply chain requirements of finding, mining, and delivering coal. Each component of the supply chain has their ancillary needs, requiring merchants to support. In addition, the safety concerns and incidents occurring in fossil fuel support jobs from lawyers, doctors, to safety inspectors. If we examine renewables, particularly wind, once the structure is in place; God/nature is in charge of the supply chain.

The anti-renewables can use this logic to bash renewables. However, I would counter by saying renewables will be freeing up human resources to be more productive for society. This is true as I have been espousing; energy is just a means to an end. We can now allocate people to actually use the energy to advance society. Increasing a work force to support energy production, ultimately does not lead to productive advancements; unless increasing the workforce actually reduces the cost of energy in order to allow more productive advancements. When we have an underemployed society, it is reasonable to want to search for places for jobs in order to maintain order. In the long-run, we must not just focus on the number of jobs, but on the complete equation: productivity = jobs X [(value-add )– (cost of jobs)]. A Milton Friedman story I read, points out the fallacy of focusing on the number of jobs:

Milton recalled traveling to an Asian country in the 1960s. and visiting a worksite, where a new canal was being built. He was shocked to see that, instead of modern tractors and earth movers, the workers had shovels. He asked why there were so few machines. The government bureaucrat explained: “You don’t understand. This is a jobs program.” To which Milton replied: “Oh, I thought you were trying to build a canal. If it’s jobs you want, then you should give these workers spoons, not shovels.”

We must not lose sight that we want to have jobs that are productive. Jobs delivering less productivity should be less costly – this applies to all spectrum, from Executives to Assembly line jobs. Energy is just a means to an end. Using energy efficiently to produce and make things to enhance our lives, and advancing society, will lead to positive growth to the economy. There is no doubt we cannot simply be a service economy, at the same time, we cannot just be a manufacturing economy. We need a balance economy focused on the productivity equation above. There are sacrifices which must occur in both ends of the economic spectrum to support a growing economy.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider All Energy Consulting for your energy consulting needs.

Your Energy Consultant,

2012 Gasoline Price Forecast

As I sit in the airport, I see the front page USA Today “Most ever could get hit by $5 gasoline”. This reminds me to revisit my old blog I posted last year about the rule of thumb for forecasting the peak gasoline price. Now that the fourth quarter data is available, your trusted energy consultant has given you the magic wand to be as great of a pundit as those found in the USA Today article. According to the EIA , the fourth quarter USGC gasoline averaged $2.59/gallon. Using the magic wand, we produce a retail price range of $3.70-$5/gallon with the most likely result being closer to $4/gallon. Now you too can be in the USA Today.

Let me remind you the reason I posted the original article in the first place. At the time of the blog, the administration was taking credit for the lower gasoline price. I warned them in the blog this was not wise and that they are missing the seasonal factors. In addition, I noted prices on a year to year basis were up 30%. Now we see the Republicans blaming the President for high gasoline prices. I will say the President’s ability to control gasoline prices in the near term is very limited, but it goes with the territory for taking credit when it was low in December. The lesson to learn is: Be careful about taking credit when it is not yours to take.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider All Energy Consulting for your energy consulting needs.

Your Energy Consultant (Former Front Page USA Today Pundit ’98 Crude Oil Collapse),