Gasoline Prices Will Impact the Economy

As promised from my last blog, I have a rebuttal for Barclays Capital economists Peter Newland premise, that the key concern is the rise, not the absolute price of gasoline.

“The effect on growth of a rise in energy prices depends importantly on the abruptness of the increase. We found that, given a gradual and temporary rise, consumers are able to adjust saving patterns to smooth consumption, minimizing the impact,”; Peter Newland, an economist at Barclays, said in a recent note.

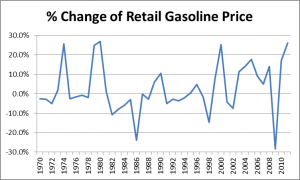

I do believe consumers will change, but I am not sure whether one would consider these price gyrations not abrupt. To support my claim all one needs to do is to look at the historical retail price changes. The price rise in 2011 was much greater than 2008 price, largely since 2008 had the back end price drop. In terms of all the other years this price change is the greatest price rise since 1980 on a year to year basis.

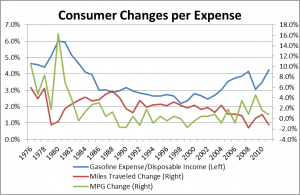

In terms of consumer behavior change, I believe the extent of consumer change is limited compared to what Peter may believe. The following graph shows that consumers do react in two areas – being more efficient and driving less.

As the cost of gasoline to the consumer increases more rapidly than their disposable income growth in the range of 3% or higher, we see an eventual reaction from the consumer. Howeve, the change in the consumer behavior is very narrow other than in the late 70’s and early 80’s. The largest miles traveled drop was only -1.8% in 2008. Also, I expect the fleet mile per gallon to change more slowly, given the fleet is so large now with over 250 million registered vehicles compared to 1980 of only 161 million. MPG change is a function of the fleet calculation by EPA. I do have the explicit miles traveled divided by the gasoline consumed. The last time that improved by over 2% was back in 1992.

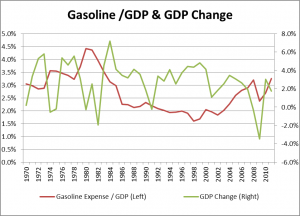

There is no doubt the gasoline prices is dragging the economy. As I have pointed out in many of my blogs, energy is a means to an end. Gasoline is no different. Having all the gasoline without the ability to use it to be productive will do nothing to an economy. Whether one is driving to work or getting goods delivered, the increase in cost will result in a reduction of the economy. There are critical price/expense points. I believe we are likely to cross that point this year. The below graph shows the historical trends of gasoline expense related to the economy.

As the graph shows, as soon as the economy starts spending over 3% on gasoline we see a slowdown in the economy. For 2012 I would expect another year above 3%.

I have spent much of my career analyzing the gasoline markets, given its importance to the US petroleum balance. I have many more graphs and views into the gasoline markets. For 2012, I expect gasoline demand to see the same fate as was observed in 2011.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,