Being Green is Hard

Once again I sit in the airport writing this blog. Your energy analyst has been very busy – which is a good thing. As I noted in my previous blog, I have been doing the twitter thing. The people I have chosen to follow are not just the people that believe what I believe in. One person I follow, David Roberts, is from the Grist. The Grist is an interesting publication focused on the environment. They claim not to be too much of a tree-hugger. Mr. Roberts is clearly a self-professed liberal – I deduce this from the continuous negative connotations for the GOP, along with little to none negativity with the democrats. Once again I don’t mind at all to view and read his point of views. Clearly he is right on many of the issues that he points out with regards to the GOP.

One of his latest blog he asked the twitter world whether he should buy a Prius V or VW TDI. I really didn’t think he meant to ask me, but I do follow him. Therefore I suggested to him he should probably think about buying a used car or better yet drive his existing car to death. This is largely due to the fact that most of a car CO2 emission is from the manufacturing and marketing of the vehicle versus the actual fuel consumption for the life of the vehicle. Those who feel they are being green by buying a new ultra-efficient vehicle, while they have a mechanically functioning vehicle, have not seriously examined the complete picture. I even note an article from the Guardian who also supports that claim.

I have yet received a reply for my kindness of taking the time and answering his request from his twitter follower. However, I write this only to point out the reality that it really is hard to be green. Being green takes sacrifice in your lifestyle, which many do not want to do.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

Capitalism to Creditism to Green Economy?

Mike Shedlock posted an interesting blog discussing Richard Duncan perception on the end of Capitalism, and the conversion to “creditism”. Mr. Duncan also noted the reversal of the situation is near to impossible, therefore he concludes government should go ahead and borrow and spend money to make the world a better place. Unfortunately, he chooses the recent Green Economy as his choice of government spending pointing out a government solar build out in Nevada would be an ideal project.

Mr. Shedlock argues the issue that government projects never seem to work out as planned. Generally speaking I agree with most of Mr. Shedlock arguments to Mr. Duncan plan. However, I think they both miss the point I have been preaching “Energy is a means to an end.” If the government wants to take the Mr. Duncan suggestions, the most effective way to advance society is to focus on the ends not the means. One can have all the energy in the world, but if you don’t plan on using it in a productive manner that advantage becomes irrelevant. We need to stop with this Green economy concept. We need to think about how we better utilize and use energy in order to produce and manufacture products and services that society can use to better us all. I believe if we do focus on this, naturally, we will produce “greener” energy. However right now we are just fooling ourselves that by making a Green Economy we will be better in the long run. I never have seen a case where if I challenge my means/path it produces a better end.

I am pro-renewables in many ways. The subsidization path, particularly without innovation beyond the engineering sense, will not lead to a better outcome in the long run. I discuss this some more in previous blog.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

614-356-0484

The Demise of Coal Overstated

As I noted in my previous blog, I spoke at a power symposium last week. Many of the speakers had concluded coal is dead. The rhetoric is the same on the internet and major publications. People have even spoken to the point to say coal is more expensive than gas. This is sadly far from the truth.

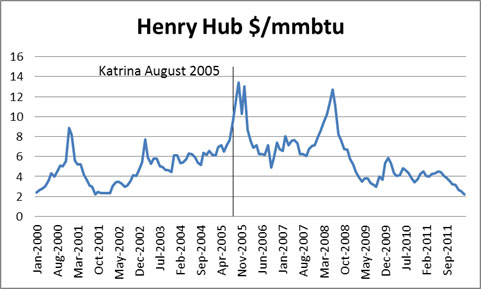

Weather played a key role in the current price predicament for natural gas. One year should never be extrapolated when weather played such a crucial role – case in point look at the price action in natural gas prices after Hurricane Katrina.

It is a true statement for those trading – “Markets can remain irrational longer than you can remain solvent.” You can see it almost took 6 months for Katrina’s price impact to fade. One could look at the current situation as the inverse situation – instead of a hurricane reducing supply you have a mild winter reducing demand. It takes time for fundamentals to rebalance the market. The price rebalancing can take even longer as noted in the irrational markets discussion. The irrational price levels of today’s market are natural gas prices below coal market contracts. Ultimately those contracts will roll off and the negotiations for the coal contracts will come down or no longer cease to exist. Conservatively, I would estimate we are in the fourth month of un-fundamentally low prices. I can foresee continued pressure downward on natural gas prices, but not past this year as long as we revert to normal weather.

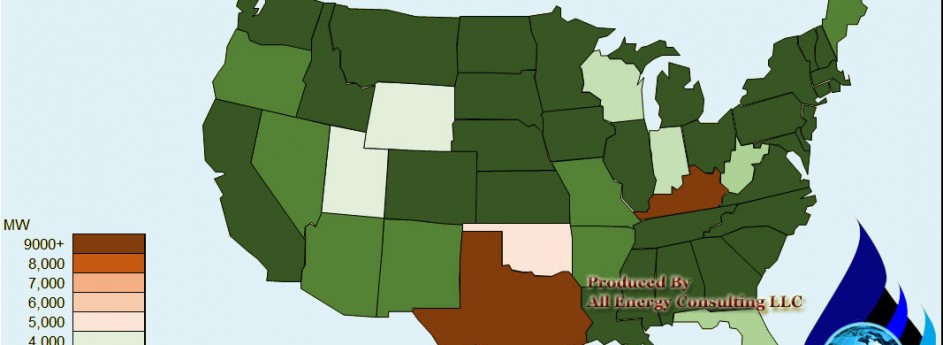

For those saying it is over for coal, they are forgetting their game theory rules. For every action there will be a reaction from those most impacted. Coal consumption could potentially drop over 20% this year relative to last year’s consumption. Inversely gas consumption in the power sector could see a rise of over 60% from last year’s consumption. These two actions do not come without consequences/reactions. As I indicated above, I expect coal prices to come down. Inversely, I expect gas prices to rise. It is not if, it is just a matter of when. This combination will allow coal to once again prosper. Coal consumption will not regain its majority spot for generation (>50%) given the environmental policies and the corresponding retirements, but I expect coal will continue to be the top 3 source type of generation for the US for many years to come.

Please do consider All Energy Consulting to help you understand where the markets will be and how best to align your organization to capture the change.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

614-356-0484

Volatility in the Power Markets Inevitable

Last week, I spoke at the Flexible Power Symposium. I will note for my readers that I was rated as one of the highest speakers for the symposium. Many told me first hand, I was the best speaker. Speaking on a stage is natural for me, given my youth background as an aspiring actor. I had the privilege of attending the High School for the Performing Visual Arts in Houston. However, my analytical mind got the best of my aspirations as I looked at my probabilities of success and my required income.

Nonetheless, my talk consisted of laying out the issues confronting the energy markets. I titled my presentation “Unintended Consequences from Good Intentions in the Electric Markets”. As typical of my style of presenting, the slides were much less important than what I had to say. I focused on the three areas on which, as a society ,we should strive for in the electric markets – Renewables, Environmental Policy, and Better Market Design. I made it clear to the audience, I am pro-renewable and environment, but I am also cognizant of the trade-offs. This is probably where I may lose some of you. The externality of the fossil generation is real. The plant is emitting potentially harmful chemicals. However, as in life, there are trade-offs and the corresponding externalities. Extreme environmentalists like to ignore this other side of the equation. Having low cost generation, though more environmentally harmful, offer externality factors of greater expanded use of power which can generate jobs, save lives, and include making society feel better (e.g. comfortable temperature). As I noted in my discussion of the MATS rule by the EPA, our choices to spend for environmental improvements need to be balanced with alternative for use for that capital (financial and human). In addition we really need to understand what our goals are when we plan to spend resources.

Many speakers ahead of me already discussed the variability of renewables in terms of generation. The interesting points in the variability discussions, the wind is hourly whereas the variability of solar is in minutes. In addition, wind is quite spatially consistent. Wind blows simultaneously at the same levels for large regions. Whereas solar can have some balancing effect if there is large regions of solar. I also pointed out the choice of renewables given the higher cost, does take away from the economy as energy is only a means to an end. Many models only consider the wholesale power price, but given renewables are largely done through power purchase agreements (PPA) which are rolled into rates wholesale power prices are less relevant when it pertains to consumer pricing.

Environmental policy already in effect will retire coal units. Many of the coal units support many of the ancillary services: of the electric market – load, following ability, voltage and reactive load support, unit frequency response and system restoration or black start. In a Catch-22, the price signals of each of these services are essentially non-existent due to the large sunk cost in these facilities. There is bound to be a bumpy path as the units get removed from the system and the price signals for investments in these services catch up.

Market design, to regulate or to de-regulate, that is the question. I talked about the pros and cons. Ultimately many markets are already on the path of de-regulation. These markets are bound for market volatility as returns required for investments are higher in de-regulated environment. In addition, high return industries naturally move in business cycles (over to under investments).

In conclusion, given the three areas of renewables: environmental policy, market design, and the future electric markets are bound to see volatile pricing. There will be winners and losers. The losers may be the rate payers as they could see higher prices with less reliability. The winners will be those who have the flexibility and the forethought to skate to where the market will be not where it is now.

Please do consider All Energy Consulting to help you understand where the markets will be and how best to align your organization to capture the change.

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society.

Independent analysis and opinions without a bias right is what we offer to our clients. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

Refining Economics Will Be Focused on Simplicity

Refining in the US has been focused on a premise that never came true. The age old belief in refining economics:

1. Crude oil was going to get heavier and higher in sulfur.

2. Gasoline demand would continue to grow and represent a premium of diesel.

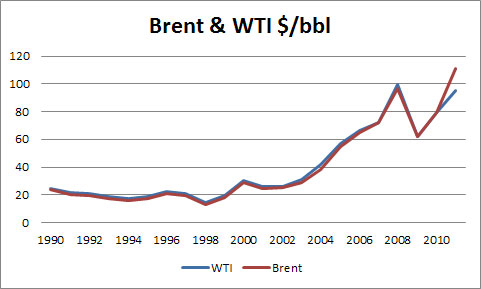

Unfortunately for many, those beliefs never transpired. This belief breakdown can be attributed to the strength of the word markets versus US markets. Crude oil prices breaking beyond the historical norm of $20-40/bbl changed the game.

With prices this high, what was once un-economic now has become proven reserves. These new recoverable supply broke the trend of heavier crudes by offer lighter finds. Shale development is leading to an increase in condensates lightening US refiners feedstock.

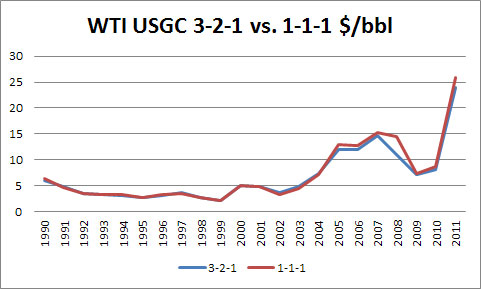

The quality of condensates also produces yields of more gasoline than diesel. World oil demand is growing from diesel demand, not gasoline demand. Diesel is the premium product. US refiners had geared up to produce gasoline, only to have the product, not offer the value compared to all the expenses refiners put into to produce gasoline. As seen below, simpler refining setup would produce better margins, particularly if one account for fixed and variable expenses.

What does this all mean and where do we go from here: I expect US gasoline demand to continue to fall this year. Diesel will continue to be the premium product. Even though refining margins seem high relative to history, this is the wrong perspective.

With the higher crude oil price paradigm, one needs to look at margins at a percent of feedstock cost. With a cost of $20/bbl one could be satisfied with a $4/bbl return (20%). However at $100/bbl, a $4/bbl really wouldn’t satisfy the risk or cost. The figure below shows the current margins are not high on a historical basis when one accounts for the underlying feedstock cost.

Refiners who will be successful in this environment will be those who can simplify. Lower operating cost will be the key, as added complexity with additional cost offers no value. Hovensa and Valero Aruba refineries both noted they have much higher operating cost than USGC refiners. This is a result of the higher crude oil price world. Refiners who have access to natural gas can save over $2/bbl on operating cost, as fuel oil prices remain de-coupled from the gas markets.

At All Energy Consulting we have put together forecast for our clients. We can use our expertise for margins calculation to developing a crude oil forecast. If you are evaluating a project/investment, I would suggest calling or emailing All Energy Consulting. We can provide an independent analysis along with key solutions to maximize your potential in making a successful project/investment.

Your Energy Consultant,

David K. Bellman