Wind generation footprint and other issues

Wind generation footprint came to my mind as I drove across Indiana. It was amazing to see these structures. Then it started annoying me as I continued to drive through the farmland, seeing them over and over. Initially, I was thinking it was a unique and impressive structure, but if I had to see that all the time it would not be so impressive. I actually started missing the skyline.

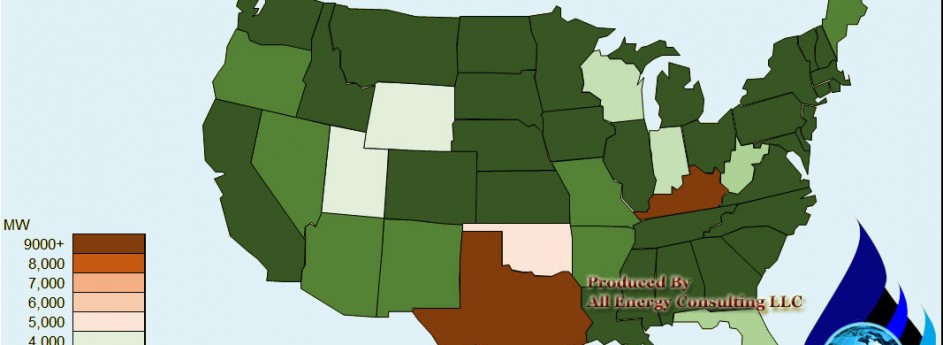

I know one can build a 200MW gas plant in about 10 acres. In order to build the same 200MW for a wind farm you would need 12,000 acres – just about 60 acres per MW. If we assume it was built evenly, it would take almost 19 miles of driving parallel to the wind farm before your eyes could take a break. Whereas the gas plants, you can drive by it in fraction of the time and potentially not even know it.

Then I started to think about the farmers, since most of the blades were on farmland. Did these farmers get properly compensated? Did the farmers get compensated for loss of crop yield due to compaction of the soil as install and maintenance will likely cause long-term compaction? Did they account for their inability to do aerial spraying? I see there are reports of positive aspects of wind. They say they can increase the ambient lower temperature which could lead to greater crop yield.

I am not writing to bash wind generation, but only to point out to many of the proponents of wind that there are some reasonable objections. In addition, as with most things, there are pros and cons. The extent of development can only go so far when the technology does have cons. Too many studies conclude significant renewables can be developed without balancing some of the real issues that will limit renewables. A balance portfolio of generation will likely be the outcome with each area balancing out their level of pros and cons.

At All Energy Consulting we can help you run and model your resource options/plans to balance those pros and cons. We can either offer a third-party assessment or help design and build you a process plan for which you can manage yourself.

Your Energy Consultant,

614-356-0484

Adaptation will happen as the climate changes

The key sentence with keywords bolded from my previous discussion of climate change is “statistical odd that climate change is real, and that it could have significant impact to society.” I leave room for doubt as many things cannot be modeled. Simple things such as predicting cloud formation is still not understood. Given simple things cannot be understood one could surely extrapolate, perhaps more complicated feedbacks are not incorporated appropriately in many climate models. A recent discovery in the arctic articulates this issue.

The article points out a new massive discovery of phytoplankton in the arctic. In addition they note the following: “…it could explain how the ocean has been absorbing larger quantities of carbon dioxide (CO2) from the atmosphere than data could verify, the researchers suggest.” This bio-feedback from higher CO2 contents demonstrates how the earth/nature will adapt to changes. There are other bio-feedbacks that have been demonstrated. Scientists have noted that certain plants are becoming more dominant as CO2 content in the atmosphere increases. This would make Darwinian sense in the fact if the environment is changing those creatures/plants that would prefer easier access to CO2 will be more dominant as more CO2 is available in the atmosphere. Duke demonstrated this bio-feedback with poison ivy being the beneficial plant.

These types of bio-feedback are not all captured in the various climate models. There are so many areas we do not fully understand or can comprehend. However on a risk adjusted basis, I will stick with my premise that there is a statistical odd that the models are showing a possibility of unintended consequences of our emissions of CO2. As I concluded in the previous blog, we will likely have to adapt due to societies focus on Carpe Diem.

At All Energy Consulting we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant,

David K. Bellman

614-356-0484

Hedging Pitfalls

A timely article related to my recent blog on hedging came out two days ago in regards to Ft. Lauderdale evaluating hedging their fuel exposure. There are some positive and alarming statements from the article. Clearly the city can better plan and manage their finances with a steady price of energy. Below are the postitive statements:

City Manager Lee Feldman correctly noted “What I’m looking at is budget certainty,” Feldman said. “When we start budgeting, we don’t want to artificially inflate our budget to make sure we have enough money in our fuel budget to protect against price increases.” Mayor Jack Seiler makes a correct statement about hedging “We’re not in the business of playing the market,” Seiler said. “The problem we have is you have such a fluctuation in gas prices.”

So far everything above is reasonable and perfect for a hedging program. The alarming parts are below:

“Palm Bay accumulated almost $600,000 in savings during the three years the program was in place, said John Cady, the city’s fleet services division manager.”

The word of savings is not correct in the context of the hedge program. It is true the hedge saved you, but I think the important stress needs to be budget and planning certainty. Because it could have been easily $600,000 in extra cost.

Another concerning statement “”That’s why you want to have somebody on your team, basically an adviser in the fuel market, telling you now’s the time to place your hedge and now’s the time not to,” Feldman said.”

Once again this leads you off the track of the prime reason, which is budget certainty and planning. If you believe someone can advise you of better timing – which I don’t doubt – then you now want to have your cake and eat it to. You want to speculate and make sure your budget certainty also makes you good money. The best method for a pure hedge program is not timing the markets via the advice of a person, but to develop a systematic method of building the hedge. I do believe in good trading, but I don’t think you want to be an active player in the trading markets as a city, when you prime goal is budget certainty for better planning. A trader’s goal is to make money. The risk reward profiles are much different. I would advise someone in the energy business of that route, but not an entity, not staffed or experienced in the energy world.

A systematic method allows all stakeholders to remove any concerns of manipulation and/or risk taking. As I pointed out in the previous blog, I have many years in the trading environment along with the corporate planning environment. My group at AEP was instrumental in designing the first approved hedging program by the public utility commission for our supply chains consumption of on-road diesel and gasoline. At All Energy Consulting we understand the energy markets and can effectively navigate you in deciding and designing a hedging program for the various energy commodities.

Your Energy Consultant,

614-356-0484

Climate Change Discussion

Though David Roberts from the Grist once called me a “troll” via twitter because of my perceived different opinions– I don’t mind subscribing to his twitter and viewing his works. Mr. Roberts self-professed in the video below that he is just a blogger. I am: a beginning blogger, but a recognized and an accomplished prognosticator of the commodity markets (1998 crude oil collapse – noted in USA Today among the many other publications), employed for many years on a management team of one of the largest utilities American Electric Power, served on multiple committees from the National Petroleum Council to the National Renewable Energy Laboratories, rated as one of the best speakers in multiple energy conferences, and more importantly a successful family man who has been with his wife for over 20 years and has five wonderful kids. So perhaps next time Mr. Roberts would come up with a better adjective for me than a “troll” just because of some differences. Nonetheless, I don’t see the value of surrounding one-self with liked minded individuals -where is the fun and the learning experience in that? Mr. Roberts recently did a TEDx video, which I thought was very well done and intelligently articulated about the concerns of climate change.

Personally, I do believe with a statistical odd that climate change is real and that it could have significant impact to society. Mr. Robert is correct to point out the 2C is likely past. The odds of this occurring are very high. The depth of the problem is very large. Using the mathematical models and running my own simulations, I showed that de-carbonizing both the US and Europe would amount to a delay of 30-50 years in hitting the same level of ppm. Without worldwide effort, the problem is almost futile to solve.

The problem is more than an economic question, it is a philosophical issue. Our society, particularly in the US, is hell-bent on living for the now – Carpe Diem. Many people are not properly planning for retirement. Our political leaders, rather borrow from the future than to have a recession on their watch. In fact, one could probably plot the growth of credit/debt along with the global climate problem, which Mr. Roberts presents in the video; it would be a similar story to global warming. We have a refusal to change the financial path, since it is much easier to see that borrowing now makes us feel better. Likewise changing our energy consumption would take “work” to say the least. Many politicians have little regards for future consequences much like their statement for climate change as Mr. Roberts points out. Therefore in order to solve this problem, we need to change society and its view on planning. Taking near term pain maybe what the doctor is ordering for long-term survival. If we can’t do it in the financial world, I am afraid we cannot do it in the real world for energy.

Beyond our own societal sentiment for Carpe Diem, we need to contemplate balancing all our concerns/special projects. We cannot solve everything equally – capital allocations are a necessity. I don’t see a way out to have social security, medicare, our policing of the world, and then add more expenses for global climate change. Money is really not just paper. Something needs to give. Our attitude to be able to fund everything is due to society being used to living on debt. We need to start making some tough decisions and ultimately sacrifices will be made. Very similar to families on a budget, one cannot spend on everything even if the desire is great.

Adding to the complexity, some of these special projects also include projects that for 100% certainty can save millions of lives at a discrete cost – as proven by the Bill and Melinda Gates Foundation as they try to eliminate polio and malaria. Where is the humanity balance between saving lives now or for some statistical probability saves lives later? Perhaps this brings me to a very interesting possible paper on human behavior action – if someone hasn’t already written one. I would hypothesize one could mathematically derive that the level of certainty must approach infinity as time goes beyond a few years for action to occur. Meaning I believe the way we are wired is to act on known issues, but when there are unknowns the greater the time the greater of increased probability is needed before we act. Given this thesis, I find our ability to react to global warming very minimal at this time – even though it may be the correct thing to do.

Mr. Roberts alludes to the point – it would seem adaptation is inevitable. Personally I wish it wasn’t the case, but wishing doesn’t usually solve problems. It may be more appropriate to start making decisions on the adaptation level e.g. building near or below sea level seems to be very short sighted. Perhaps one should contemplate redirecting existing mitigation research to proactive ways to modify the climate via geo-engineering since by the time we act; mitigation will not be an option. We certainly need to be more open minded – myself included – in viewing these issues in multiple lenses. The problem is a lot more complex than what a single individual can comprehend.

At All Energy Consulting, we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant / Troll to some,

614-356-0484

Renewable Futures Part 2 Idealistic Speak

This is partly a continuation of my last blog – Renewable Electricity Futures NREL Report Critical Assessment. I had personal emails on the assessment discussing the other topic I did not want to get into at the time – Cost. I also received references to the report put out by the WWF and Ecofys report. This report is very pretty in its design and perhaps a good document for a stretch goal concept, but in terms of application and reality it is far from real.

For some reason we have an idealism that the cost of placing renewables into the system will be at zero cost relative to the baseline. To address this topic let me first say in general; most people including myself would very much like renewable power that is until the discussion of cost and allocation is brought up. The executives at utility companies are also very inclined for renewables. Essentially almost every human being other than those individuals who are so incentivized to maintain current ways are pro-renewable. If it was really no incremental cost, I promise you renewable technology and implementation would be much further along. There is no hidden conspiracy – particularly at the generation level to not implement renewable. The utilities could/should care less where and what was making the electrons. There is very little connection between a utility and the various fossil fuel producers particularly for a regulated utility. The regulated utility is incentivized by capital investments. Most utilities should drive to achieve greater renewables which require large capital investments-that is a direct return to shareholders. Whereas operating costs are not, they are passed through – therefore shareholders get no return. However, what causes them not to build massive renewables is the cost. Higher cost limits the ability to spend on maintaining the system, since rates are limited by a political/societal demand. By allocating cost to renewables, it will leave little room for other spending- some perhaps more necessary than others.

The way to view cost from studies like this is to view the total investment needed. For some reason many want to discuss retail rates. However many fail to note and/or realize rate structures are very complicated and are not just a function of wholesale power prices and/or generation investments. The NREL Renewable Futures Report did note it, but ended up using a wrong proxy in my estimates – “…the retail price of electricity must also cover distribution and other costs. These additional costs are not estimated directly in ReEDS. Instead, the markup from wholesale to retail prices is estimated based on a calibration with historical (2006) prices.” I will promise you the difference between wholesale and retail will continue to grow. Many right now will see on their bill that the Transmission & Distribution (T&D) cost will be greater than the Generation (G). This is a function of many things. One was a failure for many utilities to allocate capital appropriately in the past for required T&D expenses. In addition, given many markets decoupling of generation many of the cost which are traditional G cost are being moved into T&D. As an example, many utilities are attempting to move their renewable requirements as T&D expenses.

The figure to examine in the NREL Renewables Future Report – assuming it is done appropriately to include investment cost – for cost is A-4 A. It shows the baseline investment of $4 Trillion dollars – $100 Billion per year for the next 40 years. For the 80% case it shows an additional Trillion dollars – $25 billion per year. It is true there will be a fuel savings which is the basis of many of the “crazy speak” announcing renewables are zero cost. However, the fuel savings needs to be discounted back to present since the savings are coming from the outer years. In addition, you are asking a society to think about the future when in general people are not thinking about their own personal finances with a median 401k savings amounting to $23K. Also, you have global financial system/society fixated on debt as a way of growth. To have society care about future savings is truly an uphill battle now. The cost to increase renewable generation is not free. However if we think about capital allocation and the areas to invest/spend money which we may or may not have, renewable investments certainly would not rank the lowest compared to wars, executive compensation, financial bailouts – but it will have to compete with other societies special projects social security, education, shelter, nutrition, etc…

At All Energy Consulting we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant,

614-356-0484