Southern’s Georgia Power Advanced Solar Initiative (“GPASI”)

Southern’s Georgia Power Advanced Solar Initiative (“GPASI”) has been making headway among the renewable press with much praise. However, as we all need to recognize the devil is in the detail and depending on your perspective; this may or may not achieve what you desire. I know many people do not have time and we depend on our journalists. However, every now and then, one needs to check on the thoroughness of the journalists. I went ahead and downloaded the complete filing.

Southern has done a fine job getting ahead of the mandate. In fact, this is what most utilities should strive for. In essence they have pre-crafted the legislation in a more intelligent way than any lobbyist or legislature could have done. The have covered the basics of dealing with cost, the associated fees of solar, taken care of performance concerns, and made it clear how they plan to recover their cost.

Key statements: “We do not intend to build or own solar facilities as part of this GPASI program…. Georgia Power will earn no profit or return.”

These are noble statements from the local utility. In order to make such bold statement, they must be anticipating the volumes not to be worthy of a return. However it is a large enough cost threat that it would be nice to guarantee cost recovery. In this area Georgia Power did a great job outlining the cost and hassle of solar power and making sure the responsibility and the cost will be borne by the developers.

Cost Capping

Key statement: “Each RFP will require bidders to bid a “not to exceed” price of 12 cents per kWh, the calculation of which will include a capacity benefit that will be benchmarked to current market pricing obtained in the 2015 RFP in Docket No. 34218” “Under the Small-Scale option, purchases will be for a fixed energy amount at a levelized solar price of 13 cents per kWh for a term of twenty years”.

They have set a price cap for the solar. I believe this figure will be hard to meet. By getting this level approved ahead of time, they won’t have to deal with projects being forced to reduce their cost structures.

Ancillary Cost (Headaches of solar)

Key statements: “…bidders will be required to pay a fee of $0.25 per kW bid to participate in the RFP to help defray the program costs.” “Bidders will be responsible for the cost of all metering to be installed, owned, operated and maintained by Georgia Power and would be required to provide performance security”. “Costs to interconnect will be provided to the bidder and are the responsibility of the bidder.” “Each bidder is required to make separate applications to interconnect to the distribution or transmission system. Participation in the RFP does not initiate interconnection activities.” “Georgia Power will make it clear to every bidder that the bidder is solely responsible for ensuring the technical, regulatory and financial viability of its project.” “The Company will install metering for the Participant’s solar facility. The Participant will enter into a contract with the Company to cover all incremental metering (e.g. poly-phase meters, trans sockets, dual-gang sockets, etc.) and interconnection costs. Additionally, the Participant must pay the monthly metering cost for the facility.”

All the statements above deal with the headaches of a solar mandate. They are attempting to stop the developers using a shotgun approach by charging a fee to participate in the RFP. All the nuisance costs of installation will all be on the developer including the meters and interconnections.

Performance

Key statement: “If Participant’s monthly capacity factor is less than 10 percent, Participant must make necessary adjustments or repairs to improve the monthly capacity factor to greater than or equal to 10 percent. If the monthly capacity factor for any four months within a calendar year is less than 10 percent, the Company has the right to terminate this agreement.

“If the capacity factor is greater than 20 percent, the Company has the right to inspect the facility to ensure its applicability. Due to the limitations of current solar photovoltaic technology, if the monthly capacity factor is greater than 20 percent in a second month, the Company may ask the Participant to explain the greater than 20 percent capacity factor. If the reason does not justify a capacity factor greater than 20 percent in the Company’s reasonable discretion, the Company may consider the resource to be in default and has the right to terminate the agreement.”

Solar performance and any lack of consistency is now the responsibility of the developer. They are essentially forcing them to perform the needed maintenance (window washing). In addition they are dealing, ahead of time, with some of the shady business practices like running other generation through the meter.

Recovery Method

Key statement: “Payments for energy purchased through this program are a recoverable fuel cost of the Company”.

This makes it clear how they plan to recover the cost. It will be on the fuel cost component. This is a very crucial point because most of the plans developed by legislature do not make that part clear.

In the end, I expect everything outlined would reduce the amount of solar that would have been done if it was legislated. Now that ALL the cost and fees of connecting and operating solar is to be paid by the developers, it will be hard to produce significant volumes within their price caps. So for those pro-renewables folks, I suspect they might not be too happy. For the utilities around the country, this is a great starting point to make sure all the headaches around solar are not yours and there is a clear cut method of recovering your cost.

I have many years of experience in evaluating various technologies, planning, and developing an integrated resource plan. If you are looking for some insights or additional points of view into future technologies or power markets, please consider contacting All Energy Consulting.

Your Energy Consultant,

614-356-0484

Surveys Can Easily Be Used to Mislead the Public

A new survey hitting the public that is not related to the presidential election. It focuses on the low-income group as it relates to Smart Grid initiative. This survey done by the Smart Grid Consumer Collaborative (SGCC) is purported to support continued Smart Grid investments since the low-income survey “demonstrated” value and interest from them. The SGCC is made up of the various participants that have much to gain from the Smart Grid initiatives. I am in no way suggesting a group of participants cannot gain and have the best in mind for society. There are several parts of the Smart Grid which make sound and practical sense. However, this article is not focused on that issue, but the fact misleading survey and reporting by media can produce false evidence to support unsubstantiated claims.

If you take the time to download the survey it shows the numbers of respondents and goes through the report quite well. However I immediately paused on page 12. Out of the 1001 which surveyed in the low-income group, only 150 had a clue what Smart Grid was about. Only 220 had a clue on Smart Meters. However when you start looking at the questions in regards to Smart Grid and Smart Meters ,they had more respondents than the numbers above. Case in point, page 15 shows the favorability of Smart Grid and Smart Meters. The responses for this question amounted to 371 and 423.

Are we to assume and take note of 221 (60% of response) and 203 (48% of response) who are self-admitted clueless from this subject for the respective category? Now perhaps there was some form of education after admitting their cluelessness. if so, the report should have told us what education was provided.. I certainly would like to know SGCC explanation of smart grid and meters to a clueless low-income group. Did they really discuss all the pros and cons for them? Did they discuss the meter cost will be the same whether you are in 5000+sq ft mansion or 300 sq ft shack? Did they discuss those who used more energy will save more – similar argument with tax cuts – those who pay more taxes will likely get more of the benefit in a tax cut? Did they really have the time to inform the clueless to get them to produce a legitimate response?

I really couldn’t absorb all the conclusions the group and many of the media are expounding from this survey. Once I saw the amount of clueless people, which is understandable since many of them are just trying to get by and have many other more important issues; it just didn’t seem to make sense to draw conclusions from the responses.In my opinion, they would have done a better job of the survey to only show the 150 and 220 answers rather than continuing to show the clueless responses.

Surveys need to be carefully designed and administered. The processing of the results should also be well thought out. If you are looking for some insights and or additional points of view into the future technologies and/or power markets, please consider contacting All Energy Consulting.

Your Energy Consultant,

614-356-0484

US Refining Margin Outlook Sept. 2012

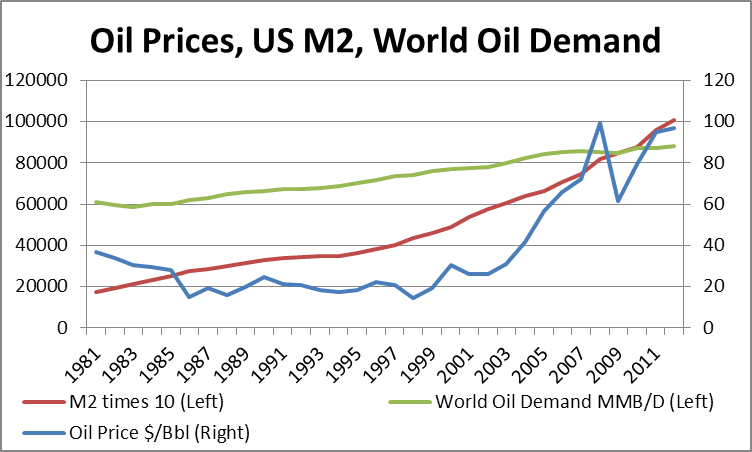

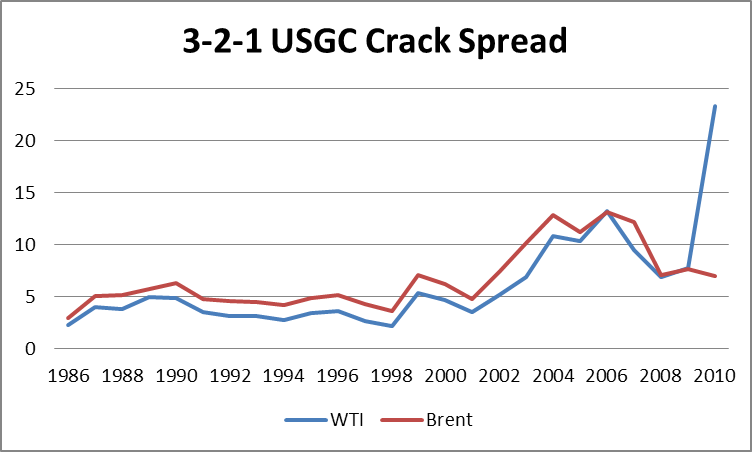

The refining outlook has been impacted by two major fundamental changes in the crude oil market. The first major change is the new crude oil price regime, driven by increase demand from Asia and partially due to global monetary policy from central banks. In relative short time, crude oil markets have moved into the $100/bbl environment. From the 80’s to 2000 prices stayed in the range of $20-40/bbl.

Since 2003 oil prices continued to climb and only very recently have settled into a range $80-100/bbl. Given the much higher crude oil prices, refining margins seen in the 80’s to 2000 will likely not be comparable on an absolute basis. On an absolute basis the current margins would be deemed as historical by multiple factors.

A certain amount of the WTI crack spread can be attributed to the current disconnect between WTI and the USGC, which represents the product part of the spread. The difference in the WTI crack spread can be attributed to the region – Cushing, Oklahoma – existing infrastructure. The WTI – Brent Spread is producing a historical discount to Brent. This is translated to the WTI – LLS spread, to a lesser extent.

However, this spread is not likely to exist for a substantial amount of time since the arbitrage to move oil to the USGC can easily be solved/monetized through investments in pipeline. This is already being seen in the reversal of the Seaway pipeline which will increase flows from Cushing to Gulf Coast from 150,000 bpd to 400,000 in 2013. In addition, there are several other discussions from the TransCanada Gulf Coast project.

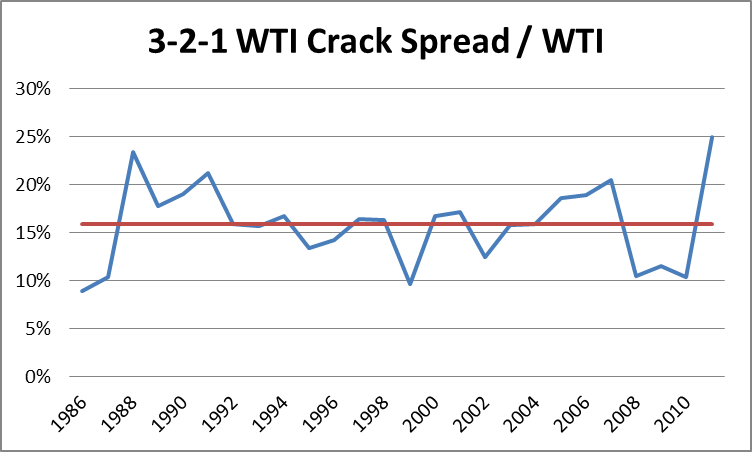

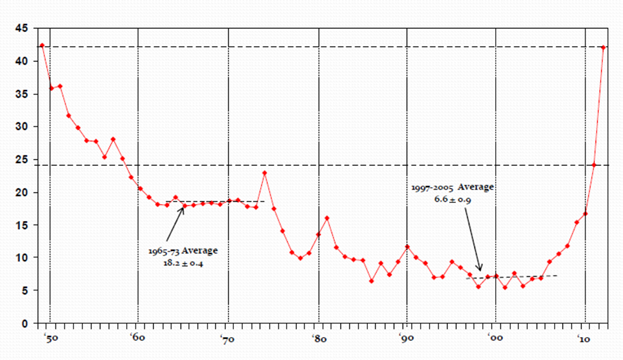

Besides the local issue with WTI, Brent and LLS are still showing a rather high absolute refining margin compared to history. This portion is attributed to the elevated price of oil which is producing a larger absolute refining margin. In economic sense, it is rationale to expect a higher absolute value of return as the cost of the feedstock rises. On a percentage basis of the feedstock, the returns are high now, but are not historically high.

The average percentage of the 3-2-1 WTI Crack Spread / WTI is around 16% from 1986 to 2011. The future should be expected to be around that level with perhaps a chance for it be slightly higher. The rationale for this is the increase level in crude oil prices increases the carrying cost relative to a lower crude oil market. In addition, the higher crude oil price has led to higher volatility. Both of these issues add additional cost that will likely be passed on in the market. In a $100/bbl crude oil market, a sustainable 3-2-1 crack spread for WTI should be around $16/bbl.

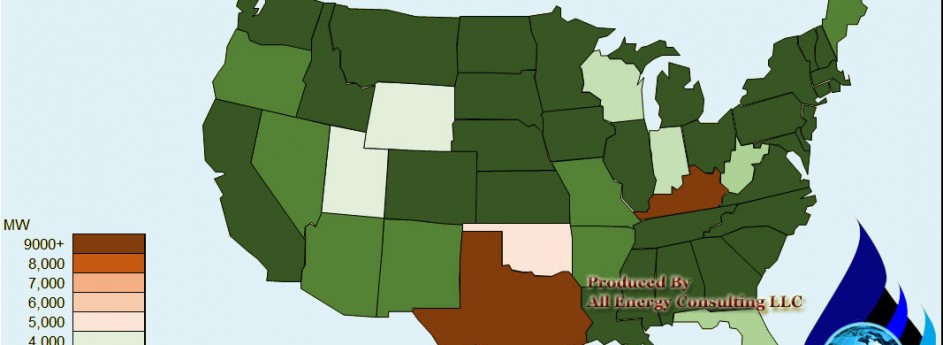

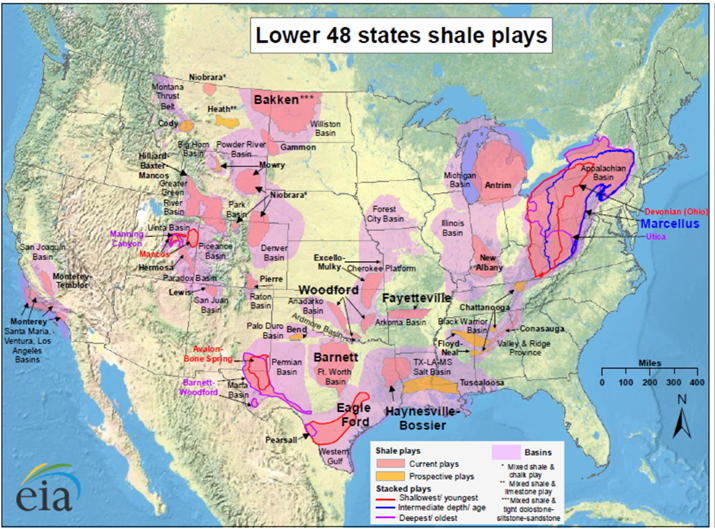

The next major fundamental impact for refining margins comes from the shale gas revolution. As noted by several oil analysts, shale gas has and will continue to significantly alter the energy space. The various shale gas areas are shown in the map below.

Besides the natural gas production, shale gas has added significant volumes of liquids as the shale gas technology led to an increase in extractions of natural gas liquids. The desire for more liquids is due to circular loop. In a circular fashion, the increase in natural gas production led to a lower value in gas, but with oil markets being strong the spread between oil and natural gas is the highest since 1950’s. This has led to increase focus on liquids rich shale gas plays.

US Oil price divided by Natural Gas Price

The drive for shale gas is currently been driven by the liquid value. Natural gas plays by themselves are not very economic with the current natural gas price. However adding the liquids economics justify some of the decisions to continue to develop gas fields – see figure below.

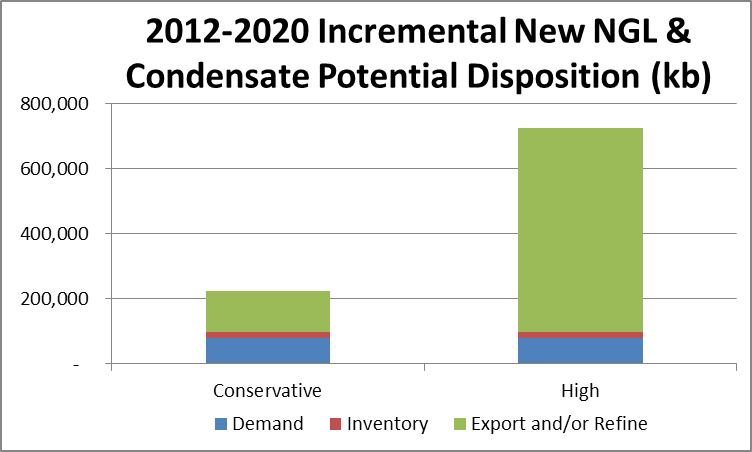

Based on the various USGS surveys and production trends, the liquids from shale gas should amount to an additional 400,000-2,200,000 bpd by 2020 with most of that volume needing to be exported or refined. A recent Morgan Stanley report evaluated the Eagle Ford and expects over 600,000 bpd of oil production by 2013 versus the current level of 170,000 bpd. Currently the Energy Policy and Conservation Act of 1975 (P.L. 94-163, EPCA) directs the President to restrict the export of crude oil. This will put pressure on US condensate prices and giving price advantages to US facilities that can process the condensate.

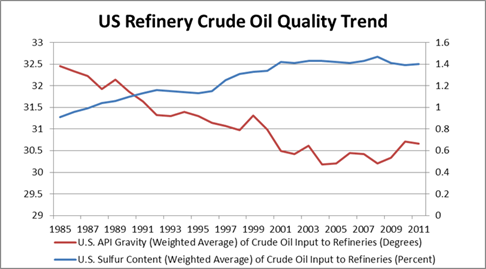

The volume of liquids from the shale gas play is not significant to change the overall oil markets over the next few years. However the volume is significant in terms of the impact on the quality differential. All of the liquids from shale gas represent a category of light sweet oil – API >40 and Sulfur <1%. This has caused a dramatic shift in the oil paradigm. For the greater part of the last two decades it was common theme to consider the crude oil slate to become heavier and higher sulfur. This caused the refinery industry to believe a successful refinery is one with size and technology in order to convert the heavier crude oil. The light-heavy differential was expected to widen significantly putting simple refineries out of business. However shale gas revolution with its exclusive light liquids is reversing that trend in the US.

The impact of the lighter crude oil will be bringing a simple refinery back into positive economics. In addition, without the large spread in light-heavy crude oils, highly complex refineries can actually be put in negative economics given their high variable cost. This is partially responsible for the Aruba and Hovensa refineries closing down. Both of those facilities are designed to convert heavy crudes from Latin. America. In addition, those refineries are dependent on oil for its energy whereas all the gulf coast refineries can rely on natural gas.

The impact of the liquids can be directly seen in the drop of imports from light oil greater than API 45. Beginning in 2011, the imports of crude oil greater than 45.1 API fell by over 100 kbd.

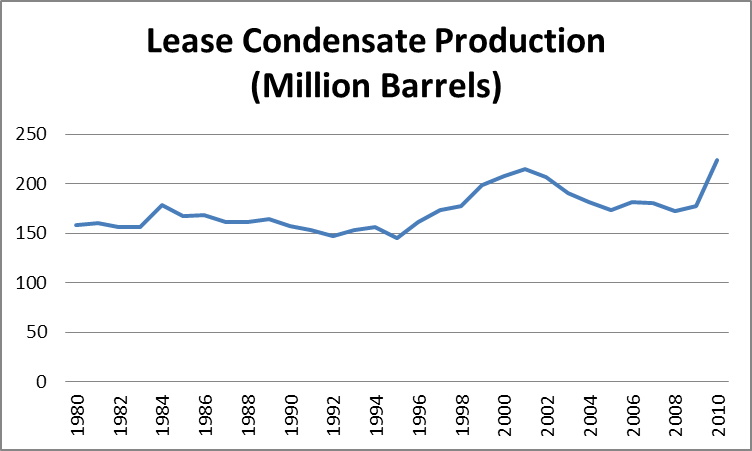

This drop coincides with the increasing domestic production of lease condensates. Lease condensates as defined by the Energy Information Agency (EIA): A mixture consisting primarily of hydrocarbons heavier than pentanes that is recovered as a liquid from natural gas in lease separation facilities. This category excludes natural gas plant liquids, such as butane and propane, which are recovered at downstream natural gas processing plants or facilities.

I believe the two fundamental shifts impacting the refining industry, higher crude oil price and increase in lighter feedstock, is sustainable for some time period (5+ years). The US economic solution is fixated on continued quantitative easing. With M2 currently producing the highest correlation for crude oil prices using data since 1981 – R^2 ~0.6 vs. world demand R^2 ~0.5 – high crude oil prices ($80+/bbl) will likely continue into the future years. Shale gas production is not likely to cease, given the high value of oil products and the cost of production being around $3-5/mmbtu on just a natural gas basis. Liquids rich plays will continue to be found and produced. The combination of these fundamental shifts will result in higher absolute refining margins. The recipe for a successful refinery will be modified from size and technology to refineries able to minimize operating cost, given that the complexity advantages have eroded with lighter feedstock.

Higher resolution graphics are available upon request. Presentation with Q and A are also available. Please do consider All Energy Consulting for your energy consulting needs.

Your energy analyst,

David K. Bellman

614-356-0484

Economy Bubble the Student Loan Market

I typically like to keep the discussion directly related to energy on this blog, but economic discussions become inevitable when dealing with energy. I have had the good fortune to sit and talk with many leading economist from Nouriel Roubini (RGE Economics), Mark Zandi (Chief Economist Moodys), and Nariman Behravesh (Chief Economist IHS Global Insights). I had dinner with both Mark and Nariman on different occasions within months of each other late 2008 and early 2009 to discuss my concerns of the next bubble – at that time the focus was on the housing market. I questioned both of them on my concern on the student loan issue. They both scoffed at me and said it was much too small of an issue – perhaps true in that I was early to the issue, but why not solve things before they do become an issue? I have since emailed them with no response on how big it would need to be. Back in April this year it has surpassed both credit card and auto loan debt crossing the $1 trillion dollar mark.

The reason I thought of the student loan was the realization that upper education expense was the last great cost that has been going up since 1970s by over 10%/yr, given that the housing market went pop. If you dig down into it, it really becomes even more “sinister” than the housing market in terms of issuance of loans. There were confirmed stories of migrant workers being issued significant loans ($500K+) to purchase houses. Of course the dream of home ownership was instilled in society; so the desire to have a house was clearly at play. Even though loans perhaps could not be paid, at the very least the banks had the collateral of the home. As the home market was rising, some bankers actually made money on those defaulting. For the consumer, in many cases those who defaulted had an opportunity to declare bankruptcy and move on with their lives. The bankruptcy opportunity is designed to put some responsibility on the loaner to not loan with recklessness, but to do some fiduciary review. However the market regulators allowed shifting of the burden of the loans to multiple institutions including government run entities, removing any need for fiduciary review. Thereby you had a significant increase in demand for housing which would have not been there. Economics 101 states increasing demand leads to increasing prices. However since the loan amounts were allowed to rise to such significant value that a migrant farmer could get a loan for $500+K the housing market went on a multi-year growth spurt. I would be wrong if I also didn’t add the credit derivatives (CD) – obligations (CDO) and swaps (CDS) – played a large role in the explosion. Perhaps a positive side to the student loan market, currently no credit derivatives in the student loan markets that I am aware off. I presume since it cannot be discharged – see below – why have to insure it. The CD instruments certainly speed up the process of the bubble. If it were not for the CD, it would have gone on longer and perhaps at a more gradual pace as seen in the student loan market. Lastly failed regulators, in allowing false documents and misleading robo-signers without significant penalty also led to the bubble. In the housing debacle, we are dealing with grown adults with life experiences.

In the student loan case, you have a young individual being given a loan to study and earn a college degree which is preached since his ability to read is a must have. The person takes the loan, but the loaner does not do any fiduciary review with this individual. A background check on the person’s ability to perform in college in the discipline chosen is not even examined. The ability of the loaner to even payback once that degree is given is not done. Simple checkups during the school year to make sure the student is attending class are not even done. All this work is no more complicated than actuarial work used in the insurance business or evaluating small business loans. The reason for this recklessness is unlike housing loans there are no means to discharge this loans – bankruptcy will not help you. Your wages will be garnished for the rest of your life or until you are able to pay off the loan. (Students taking loans please re-read the last two sentences – the loaner is not your friend). Once again, just like the housing market, “new” demand causes an increase in price. As the colleges continue to get students who are willing to pay more and more; why would they stop the price rise? The students are paying more and more, but really they are just loaning more and more.

A recent article on Zerohedge demonstrates the extent of the bubble as it relates to the housing market and shows how such a key player, Ben Bernanke, in these issues can be so wrong. The graph are very poignant in there is bubble – just when will it pop is the trillion+ dollar question.

Independent analysis and opinions without a bias is what we offer to our clients. Please consider All Energy Consulting for your energy consulting needs.

Your Energy Consultant,

614-356-0484

Solar Tax Breaks – if it were only that simple

Solar tax breaks is the big talk in some parts of the country. A new report published by the US Partnership for Renewable Finance (US PREF), a program of the American Council On Renewable Energy (ACORE), highlights, the extent of campaigning to promote subsidization of the industry. The analysis leaves much room for skepticism and criticism. Before I delve into the depths and details of the report, it would be easy and clean to simply say giving a tax break promotes more tax revenue – trickle down economics. The basis of their analysis is based on trickle down economics which many have justifiably become distrusting given the economic condition of the US with the significant tax breaks over the past decades. The theory is: in lieu of the tax credit, the company would not exist therefore no tax revenue will come from the company. And the theory goes on to say the on-going tax revenue will make up for the initial loss. You can note I did not have to specify an industry. This logic could apply to about everything. The positives about solar versus other industry is possibly it is the gift that keeps on giving via clean energy. There are certainly externalities that exist beyond the product itself.

However the world/US is not that simple to conclude giving tax breaks pays off – particularly when you are running deficits. In affect a credit to any industry in the time the country is running a deficit is certainly at least valued at the interest cost to society. Currently we are fixing our interest rate through monetary policy so the rate is quite low. Secondly the opportunity cost to produce more debt for future growth has a full range of items e.g. autos, homes, roads, etc… Will someone develop a capital allocation model to identify the top 10 investment that would be best for the economy? Personally I don’t know if solar would be in that list in terms of returns for the next 10 years. In the PREF analysis they do show positive returns (though skeptical on results), but I am sure many other industries would tout the same thing if given the chance. Thirdly, the government policies that encourage certain outcomes are typically design and sold as social just expenses – not requiring full economic principles e.g. welfare, tax on cigarettes, home ownership etc… Perhaps we could categorize solar/renewable policies as a social just expense. It would certainly merit it in terms of cleaner energy and potentially long-term value if something were to happen to fossil fuel supply.

If we were a country without much opportunity for other forms of energy I would see it easily being a top 10 investment. However the US is the land of the bountiful not only in land, but food and energy. We are led to believe we are short on energy. This is not the case. We have chosen to limit the amount of domestic energy use by creating national parks and restricting drilling. These choices are worthwhile choices given the ability to let others pillage their resources at prices which we deem too low to think about pillaging our lands. In addition, because of the abundance and relatively cheap cost of energy, we consume more than we “need”. I am sure if push comes to shove we can consume much less without much change in our happiness. This abundance of energy does put into question the motivation and the desire to advance solar for the benefit for other countries not blessed with our resources. On a global warming basis I certainly can see the value. But as I pointed out in my other articles , society is not ready to plan for the long-term.

In terms of the paper itself, they left out many economic and mathematical concerns. Here are my litanies of concerns: Why no discount rate? At the very least should not be the value of interest? On a nominal basis many investments will payoff in 30 year. Another reason to do it on a real basis is they have energy price escalators all in the realm of inflation. The study basis on generating revenue lies on the premise creating a leasing deal promotes a good tax policy since the leaseholder is seeing taxable revenue. With this logic, the government should promote all types of leasing – why not give tax credits to lease cars. The Excel file shows the assumption that PPA will be signed not only on premium price relative to current market conditions, but the utility would continue to pay additional cost each year via an escalator. Most solar PPA deals I have seen are at fixed cost. Solar does have a fixed cost component (land management, solar cleaning, inverter repair/replace) which will occur over the 30 year period and is missing in their economics.

Let me leave you saying I agree that promotion of solar could produce a long-term value for society. I don’t have all the answers, but I don’t shy from the tough questions. However the article and many people involved in these issues are not talking about all the facts and concerns to make a decision for the best of society for the long haul. Without a complete discussion of the pros and cons, people end up cherry picking information to support their own internal biases which in most cases supports ones self-interest regardless of society value.

I have many years of experience in evaluating various technologies, planning, and developing an integrated resource plan. If you are looking for some insights and or additional points of view into the future technologies and/or power markets please consider contacting All Energy Consulting.

Your Energy Consultant,

614-356-0484