Term Limits for Academia

As I begun to review the report “Examining the feasibility of converting New York State’s all-purpose energy infrastructure to one using wind, water, and sunlight” I decided to get to know the authors of the report. To my shock and dismay, none of them has had any experience in the utility industry, much less any industry.

There is no doubt in my mind, Academia represents an important part in society. Many professors have had profound impact on myself Those include Dr. Grant Wilson and the late Dr. David Himmelblau.

Though Dr. Himmelblau spent a majority of his life in Academia, he did serve in the army and a decade in industry. He taught me a very important lesson that I continue to use till this day.

He had a take home final exam. The final exam involved finding the hydrogen values at various points in the process. Many points in the process were easy to identify. However, there were a few points that no matter what, one could not prove conclusively the hydrogen amounts. Many in class were dumbfounded and turned in incomplete test. I spent an all-nighter trying to get it. Finally I decided to write several reasons to support my assumption.

Dr. Himmelblau later told the class there was no way to conclusively get several points, and the key was to make an educated guess based on supporting assumptions. In life there are many unknowns and you will have to make the best guess you can with all the factors you have at your disposal. This advice probably allowed me to be a great forecaster. This advice is so true when you attempt to understand the future. You won’t have all the facts and you can’t always wait for them either. Operating with unknowns is a reality – learn to embrace it. I believe this is something that cannot come from just being in academia.

Dr. Wilson helped me out in many ways. His ability to take things from a theoretical world to real life applications helped bridge my thinking on how to apply school work into life. Dr. Wilson had a very impressive industry experience, which I believed allowed this lesson to be prominent in his teachings.

Back to the issue at hand, my google search on each of the authors show no industry experience. This is not a personal attack. I am sure all of the authors are genuine decent human beings. The fact is they are discussing about something very complicated and real. No matter what you may say about the utility industry, there is one thing everyone should know, there are real hard-working people there who do their job out of true concern. I have not met a planner in any utility who takes their job lightly. They do deserve some credit for keeping the lights on over the past decades.

Yes there have been outages, but when those outages occurred did you think about your bill not being enough and how much more you would spend for those outages not to occur. Utility planning does include some social aspect. Reliability levels are set for the required masses not for those who COULD afford more. There are many dimensions when setting a resource plan. It is not just economic nor is it just a social cause nor is it just wishful thinking but significant applied mathematics with significant engineering calculations. The fact that not one of the authors had SOME utility experience, therefore, in my mind it immediately reduces the value of the study. It would be akin to having someone do surgery on your body without any experience other than from what one read. Perhaps success is quite possible, but it would be beneficial if they actually built up some real experience in the real world where all the dimensions are taken into account.

My quest to evaluate the study content quickly got diverted. My quick author search got me thinking not of the study, but the thought of term limits for academia. Many people point to the fact that a lifelong politician loses sight of reality – is this true for academia? It would seem that more and more professors are taking the lifelong route versus the professors I had who had spent time in the world then came back to academia. I hope institutions think about this as they look to build their staff. Colleges should implement a term limit so that their professors do not lose sight of the real world. This probably should apply with your consultant. Hopefully you don’t have a consultant who has lost track of the real world.

Now back to reading the report…..

A supporter of term limits for politicians, academia, and consultants – Your Energy Consultant,

614-356-0484

Power Industry Challenges – Strategic Threat

The power industry is the most capital intensive industry. This capital intensity was one of the key factors in regulating the market. Centralizing a large unit lowered the cost significantly even though transmission and distribution cost would be increased. The irony is we now build units such as wind that are more expensive and also cost more in transmission and distribution cost. In addition, we have de-regulated the generation piece of the business in several markets. The de-regulation experiment is bound to have some significant failures as the ends may not be great enough to justify the means. Society is use to capacity being built when market prices return a 10-12% return. However in de-regulated world returns would need to be commensurate with the risk. High capital cost in addition to volatile uncertainty in commodity and policy would require a 20+% return. In order to get such a return the prices in the market will likely be at levels that brownouts and rolling black out occurs at peak time periods. Society will not deem this as acceptable.

The weighted average age of all the plants in the US is 28 years old. This means somewhere between 10 and 30 years from now 600GW will need to be built assuming NO load growth. If we add 1% load growth over the next 40 year we are looking at an additional 100GW. The total investment for just the generation piece will be around $700 billion.

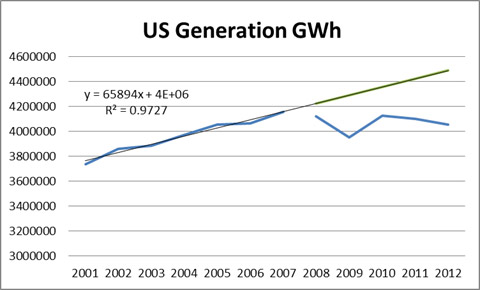

This comes at a time when utilities are bleeding in the nation from lack of load growth. Load growth is the key revenue line item for utilities. Projects and investments are based on assumed load growth and rates are adjusted to represent the revenue requirements. When load does not grow as it didn’t for the last few year, revenues dramatically fall and rates will need to be adjusted up to account for the expected load growth which did not appear.

Based on the expected trend before 2008, utilities load drop has resulted in a loss of expected revenue around $140 billion.

In addition, there are so many other initiatives beyond generation that are on the shoulder of utilities. This includes Environmental controls, Smart grid, Demand side management, Conservation, Efficiency, Renewables / Feed In Tariffs, Carbon, Pension obligations, Jobs support, Transmission, and Distribution investments. If you think the ages of plants are old distribution equipment is much older.

All this added cost points to higher rates for the consumer. Rates can only go so high before society revolts and/or the business model of the utility folds. This issue becomes a strategic threat.

Please do consider All Energy Consulting in helping you assess your strategic risk and understanding the future of the energy markets.

Your Energy Consultant,

614-356-0484

Twitter: AECDKB

Study vs. Advocacy – Wind Generation

I recently came across this “study” – The Net Benefits of Increased Wind Power in PJM – done by Synapse Energy Economics for Americans for a Clean Energy Grid. Based on the information on the website from their website they seem to be a very credible organization. However I think the “study” shows that they are smart enough to manipulate the setup and presentation to create a document to their client’s desire. The study became an advocacy piece and those calling it a study better review it first.

The first alarm bell from any study requiring a model, particularly the power markets, there needs to be back test of the model. They should show the back cast results and prove the model is ready for future applications. The main mechanism to show the impact of increasing wind actually was beneficial was to start the analysis with a draconian setup and to guise the result under a delta impact of 2026. By pushing the analysis to 2026 they were able to state a capacity setup which does not exist and will likely not exist, thereby making a delta analysis potentially more positive. Below table shows the current PJM resource mix (http://www.pjm.com/~/media/documents/reports/2012-rtep/2012-rtep-book-2.ashx) vs. the proposed 2026 setup by Synapse.

|

Installed Capacity GW |

||

| Synapse 2026 | PJM Current 2012 | |

| Wind |

32 |

1 |

| Gas |

123 |

54 |

| Coal |

18 |

73 |

| Nuclear |

34 |

34 |

| Hydro |

3 |

8 |

| Other |

42 |

11 |

| Total |

252 |

181 |

I will agree to the direction of the reduction of coal, but the extent is far from reality. First, there are 37 GW of coal assets with scrubber installed in the last 5 years. Do you think utilities spend a billion dollar not to recover their assets over a longer time period? In addition in the planning queue for scrubber installation I see 12GW of coal. I suspect not all of those will install, but compared to the 18GW Synapse is assuming to be left in 2026 because it doesn’t pass the sanity check.

By starting at the reference point at a system that is already expensive, makes it very easy to conclude wind generation is better. Another advocacy maneuver was to have wind generation at such high levels 36+% compared to NREL own assessment for many of the PJM states in the upper 20%. Besides the output, I would be curious to see the wind shapes they used to and whether they are close to industry standards or biased.

I could go on and do more analysis, but I think my concerns thatI have addressed are sufficient to make the conclusion the report is more advocacy than study. It is ashame they went that direction. I believe the assessment done by NREL that wind costs are coming down is real and will have an impact for more wind. I also believe solar impacts will be larger than stated in this study, but this would likely not support the initiatives set forth by the Americans for Clean Energy Grid as most of the members are wind centric.

I don’t think I would be a good advocate. The numbers drive me. However I am open to latitudes of probabilities, but those probabilities must sit inside some reality. I suspect over time people would want to deal with people who don’t just color the picture how you want them to, but actually consult with you to make better decisions. At All Energy Consulting we promise to offer you real consulting minus the advocacy.

Your Energy Analyst who paints it like he sees it,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

It’s not the end of the world – Climate Change& Quantitative Easing (Printing Money)

I have wanted to write about the similarity between the two most potentially transformative societal issues confronting us, Climate Change & Quantitative Easing (AKA Printing Money). Of recent the latest debacle in a spreadsheet error by Rogoff and Reinhart in their paper “Growth in a Time of Debt” has led my writing astray. However this issue further substantiates the similarity. I am sure my readers know that there was also an issue with climate change data. The most famous was the hockey stick graph presented in the IPCC report. The graph originally came from a report done by Michael Mann in the paper “Northern Hemisphere Temperatures During the Past Millennium: Inferences, Uncertainties, and Limitations”. (One difference is the climate change titles are much longer than economic papers!)

Though the recent debacle includes a simple spreadsheet error the biggest difference from what was reported to what is being challenged by Thomas Herndon, Michael Ash, and Robert Pollin is based on how one treats data and what one excludes or includes. Mr. Herndon and team believe since more data was available for other countries they should be weighted more no matter the differences in economy or time period. Many of the same arguments were made to refute the Mann graph. In the end, BOTH data sets from Mann and Rogoff can be presented to be less dramatic than what both authors presented. However in BOTH cases it does not eliminate the issue that both have presented. In Rogoff case, Mr. Herndon and team state and their own data shows that high debt does not likely lead to better outcomes relative to a lower debt situation. The Herndon and team did conclude there is no magic number that leads to a NEGATIVE growth. However they do note that growth is much less than it would be when debt levels grow above the 90% level. In Mann case, one could argue the graph he presented was on the high-end of uncertainty but the end message no matter what statistical approach you use there is some warming relative to the last 1000 year perhaps just not as dramatic as Mann’s graph.

We can ignore both the issues just because of some technicalities and potential showmanship or we can pay attention to these both very critical points because they contain some probability. We can argue to death to the extent of probability, but there is some threshold that action becomes required no matter what. I believe we have crossed that threshold a while ago in both issues. In terms of actionable items I am not as extreme as some could be since everything is a probable outcome in my mind. Actions need to be commensurate with the probability and timing of the impact. And both issues probability and timing may change as more information and responses are made.

Getting back to the discussion of similarity, both are issues that rely on sacrifice of the future for the current state. Clearly it is “easier” and “cheaper” to continue to burn fossil fuel versus transform the economy. The consequences may be dire, but they are many years off. It is also easier and politically more appealing to increase the money supply driving investments now and have the savers and the future generation deal with the pain later. In each case one could argue we don’t really know the future and perhaps even solutions in the future we cannot predict now will come to fruition. However I would attest that is very poor planning.

There are measures we do each day thinking of the future. Some are simple and have been engrained in society – such as buckling up. We buckle up because it can save our lives. The odd of getting into a serious car accident in your lifetime is 30%. I am not arguing for you not to buckle up, but to show we do act when probabilities are not as great along as the action can be commensurate with the risk and its probability. I am sure you can find many climate deniers to admit there is a 20-30% probability they are wrong – of course that means they are 70% confident it is not. Nonetheless this would argue for action at SOME level if one cared about the future.

Both climate change and quantitative easing are actions that are not apparent at the moment similar to indulging on funnel cake and other unhealthy foods. It feels good now but eventually you will likely get obese and have health issues not worth the gains gathered from the near term enjoyment of sweets. In fact, it will typically be better to emit and print money now. The ultimate consequence of each of them requires a view over many years if not hundreds of years.

On the point of obesity, it clearly shows society is not ready for problems requiring long-term thought. Obesity in the US is very high. This is a matter of caring about what you eat and the long-term issues involved with your choices. We are a society designed for Carpe-Diem and keeping up with the Jones. It may be quite pointless to argue the science of climate change and/or long-term impacts of quantitative easing when society could really care less. It amazes me to see such low savings in both general and retirement savings. So much of society is living on debt. By that logic people don’t really focus on the long-term. I can see somewhat the rationale for many religions to eliminate interest charges – usury. Most religions are focused on maintaining/reducing our vices – e.g. Ten Commandments. I think they realize debt living is not healthy. Living on debt makes you feel good in the moment, but any day it can overwhelm you with a change in your life. A humble lifestyle is too easily gone with the ability to borrow money. We cannot solve these two very large issues without changing society to think longer term. If people do not care about their own lives and cannot plan even their meals to live healthy, do we really expect them to be able to comprehend and plan for climate change which impacts us significantly in 100 years?

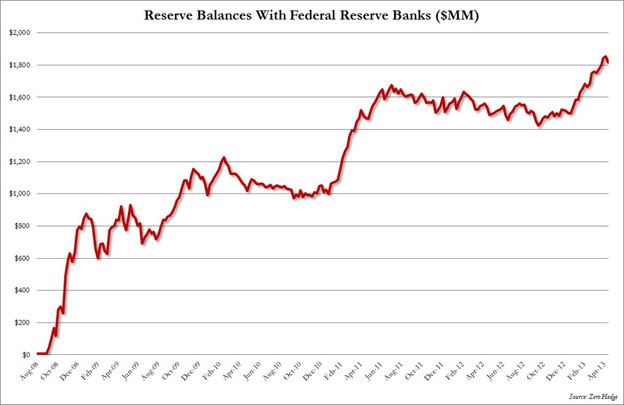

Climate change to me seems more tangible and more discussed with various opinions across academia compared to quantitative easing. This may be based on my career largely in the energy space. However I do read quite a bit and find much more literature on climate than quantitative easing impacts. Climate change certainly seems to have much more historical data with ice core samples thousands of years old. The oldest data set Rogoff and Herndon was working with was 1830. Given this I thought I put some graphs up from various recent reports just so you see why I am alarmed with quantitative easing even though the “market” is doing well.

We are in a world so dependent on debt and fossil fuels. Current trends on climate change and quantitative easing cannot be changed until we change the mindsets of people to think ahead. Planning is gone for Carpe Diem. I like the concept to live for the moment, but what if the next moment depends on how you live in this moment. Do you want more moments? We do not live in Hollywood we live in reality. Please take care of yourselves – eat healthy – do not over-extend your finances – reduce the temptation to keep up with the Jones.

The world will not end because of climate change and quantitative easing. However the world could be very different and potentially less inhabitable and stable if we don’t start dealing with some of our issues which require thought. The probabilities of significant harm to society may not be significant (+50%) but given the extent of outcomes it does make it worthwhile to do some actions similarly as we buckle up.

Your very concerned and thoughtful Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

ERCOT Modeling Issues – Scenarios vs. Sensitivities

ERCOT released a new 10 yr system assessment. The big news among the renewable community is a “scenario” labeled BAU All Tech with Updated Wind Shapes. In this “scenario”, they have updated the wind profile (capacity factors) for the wind technology option. The surprise from the output was the large swing from the BAU case to install 17,000 MW of wind, which did not occur in the base. In addition, the combined cycle units fell by 10,000 MW. Also solar added 10,000 MW into the system versus the BAU. I have nothing against renewable, in fact I am pro renewable in many ways, however I am skeptical on these results. My skepticism is focused on the one supposed change made by the modelers for this “scenario”. By changing just windshapes, they were able to produce these dramatic swings from the BAU case.

I have been modeling power systems for over 10 years and I cannot rationalize this outcome without more knowledge than what was presented in the paper. Let me start out with the basic concerns before moving over into the technical realm. The BAU case vs. this new wind case drops gas consumption by around 40%. If this wind profile enhancement was driven by turbine technology, then the rest of the country would also add to the lessening of natural gas demand. Anything greater than a 10% change in natural gas demand will surely impact the price of natural gas. A true scenario would iterate and or rationalized this issue. This type of analysis seems to be more of a sensitivity analysis versus a real scenario development. Another fundamental concern is the extent of wind development and the on-going production tax credit (PTC). At some point in the wind penetration, the PTC would be removed. I am sure the non-wind blessed state would like to stop subsidizing states, particularly whose economy is much better off.

Another fundamental missing piece is any discussion on rates. More capital is being spent in the wind shape case than the BAU. This is simple math, as the cost of capital of wind and solar for each MW is greater than gas units. The balancing act is the long-term fuel cost will balance the additional capital. However large capital investments usually require some guarantees. This comes in the form of Power Purchase Agreements with the local utility. The PPA’s are signed and prices set based on the current markets as that time of the contract. Even though wholesale market prices may come down it does not mean rates will change as PPA contracts are typically fixed in order for the investor to know they will recover their capital investment. Over time the PPA deals will begin to look worse and worse as wholesale markets fall. Eventually industrial and commercial customers could become wise and remove themselves from the utilities poor PPA arrangements by creating distributed generation. This then lead to higher residential rates in the face of low wholesale power. This then leads to limited PPA deals. With more than half of the wind and solar build after 2020 one would need to seriously doubt the extent of those developments becoming real, assuming PPA is the mechanism for development.

On a technical basis the major issue lies in how the modelers are treating wind generation. As a panel of experts, including me, in a report done for the Northwest Power & Conservation Council noted wind generation, when sufficiently large relative to the market, should be viewed in a risk analysis as much as in the price of natural gas is commonly analyzed. The dependence on wind to the level seen in this new wind shape case will likely caused some dramatic grid events when the weather decides to not co-operate. This event may be 1 in 10 years to 1 in 100 years, but the point is not if, but when. Given the nature of weather and the sub hourly nature of electricity markets, I would suspect the issue will be closer to 1 in 10 years than 1 in 100 years. It is certainly possible to expect a weather front changing the landscape of wind generation in particular day, adding on top of that a drought situation limiting nuclear and fossil generation. In a stress case, the grid will likely fail in the new wind shape case. The value of the combined cycle will likely be re-gained in risk analysis. This once again will limit the number of wind builds presented by ERCOT in this new wind shape case.

As noted in the NWPCC report, I have had extensive experience in modeling power systems for market forecasting and planning purposes. If you are beginning your resource plan or are looking for another perspective, please do consider reaching out to me for assistance.

Your Energy Consultant,

614-356-0484

Power Dispatch More than a Supply Stack

The most used tool for new comers to the power market is the dispatch stack. The dispatch stack is basically the variable cost of production of power by each generating unit, stacked from least cost to most cost. Clearly units with low fuel to no fuel cost will be the lowest to the least efficient, highest fuel cost being the far right. EIA put out the hypothetical 2011 stack – http://www.eia.gov/todayinenergy/detail.cfm?id=9430

Those not directly involved in power markets will first take note of the low cost of renewables. However, you will also note nuclear being near zero cost. The stack does not take into account the capital cost portion of the project. As economic nature would have it, the high capital cost projects typically have the lower fuel cost and vice versa. The best of both worlds is very hard to achieve, hence a complicated process of developing a cost effective resource plan to balance the various tradeoffs. Besides the stack not accounting for capital cost therefore the typical dispatch cost does not account for operational issues.

Once again economic nature also produces higher variable power cost units as the unit becomes more flexible (the ability to turn off and on and ramp quickly). Case in point, most coal or nuclear plant cannot quickly ramp or turn off and on rapidly to account for the fluctuations of the market whereas inefficient gas units have extreme flexibility, but it comes with much higher power cost. If the market had constant energy level than perhaps supply stacks would be useful tools for analyzing power markets. However that is not the case as documented in my other blog. A deeper analysis is needed for the power markets – https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/

Detailed analysis is needed on at least an hourly basis to really understand what is going on in the power markets. Another important feature of the power market due to the instantaneous issues is how the market gets priced. In the power market, all generators get the marginal price. As an example, if we had a system with 500MW of demand with only three power plants. Each power plant is sized at 200MW of capacity. Plant A bids at $50/MWh. Plant B bids at $5/MWh. Plant C bids at $35/MWh. If we assume a flat load the following outcomes occur based on varying demand.

Demand 550MW – Plant A gets to dispatch 150MW. Plant B and C gets to dispatch at 200MW each. They all get $50/MWh.

Demand 300MW – Plant B gets to dispatch 200MW. Plant C gets to dispatch 100MW. Plant A does not get dispatch and gets no revenue. Plant B and C get $35/MWh.

With this bidding mechanism, many of the renewable plants given that they only get their tax credit when they produce power will actually bid into the market to a NEGATIVE $22/MWh to ensure they are dispatched to collect their tax credit. Renewable plants typically already have a fixed power purchase agreement with the rate payer typically paying the bill. This dispatch price just impacts the wholesale market. The only concern utilities should have is when the wholesale price diverges so far away from the arranged power purchase contracts. At this point commissions should step up and question the decision making from the utilities and perhaps even their own mandates. This difference is really the true cost impact of renewables on society. Calculating wholesale power price as the cost to society from renewables is misleading and misrepresenting reality given most renewable deals are fixed. Another potential outcome of large digression between wholesale prices and retail prices is further push for more de-regulation.

There is much to discuss in how power markets work, but in a nutshell I tried to explain at high-level the dispatch stack and the realities of the market place. If you have further questions or are in need of examining the power markets please do consider All Energy Consulting.

Happy New Year – May you have a prosperous year!

Your Energy Analyst,

614-356-0484