Renewables No Impact with Low Oil Price – False

The belief that low oil prices will have no impact on renewable is very misguided and optimistically biased. The practical reality is the path of renewables will be altered with continued low oil prices. Many of those focused on renewables, having nothing to do with oil, are focused on the power sector being isolated from the rest of the world. It is a true statement that renewable generation is likely less costly than oil generation even at $50/bbl. However, in the power sector, the competition is not with oil directly but with natural gas and coal.

The coal market benefits when oil prices are low as transportation can make up over 50% of the end cost of coal. The natural gas markets may results in higher prices as economics of some oil field gets reduced, thereby, reducing the associated natural gas production. However, this may lead to more focus on natural gas finds versus oil finds increasing gas production. At best I think the impact of low oil prices on natural gas may only slightly increase gas prices.

Given renewables connection to electric generation, the amount of renewable will be highly dependent on the amount of electric demand. Also one of the largest mechanisms to de-carbonize came from the conversion of vehicles to electric vehicle as renewable generation offered a potential zero carbon source. Therefore, one of the largest anticipated sources of electric demand in the future was going to come from electric vehicles. However, with low oil prices, this makes the economics of mass electric vehicle adoption very unlikely.

In most cases, the economic break-even of electric vehicles vs. gasoline vehicles requires gasoline prices north of $4/gallon. More likely it would be north of $5/gallon given most of these economic analysis were based on a huge advantage of gasoline vehicles paying for the road infrastructure. This is unsustainable once EV vehicles grow in usage – eventually the road tax will be collected from EV vehicles. Nonetheless $4+/gallon prices are now diminishing in probability as oil price remain below $100/bbl. With low oil prices, this transition to electric vehicles will be limited. In order to transition, a much larger carbon price will be needed which will not likely be politically sustainable. The sacrifice for saving a potential disaster may just be too high for society.

Low oil prices will limit the ability for renewables to grow in the energy mix. The portability of energy is superior in petroleum products relative to any other forms of energy including batteries. This physical attribute of petroleum will require a monetary mechanism to allow a switch to greater renewable forms of energy. A rising crude oil price with transportation north of $4/gallon, and with an expected small impact of carbon allowed many to discuss the potential of a zero carbon system. However, with the recent changes in oil prices and potentially a protracted time period below the $100/bbl mark, many dreams of the zero-carbon world are likely shattered.

The energy markets are intertwined. High oil prices lead to greater opportunities for change. A low oil price supports the status quo. Renewables can continue to grow with current societal goals within the power sector – but the potential will be so much less now than when oil was north of $100/bbl.

Your All Forms of Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Capacity Market and Updated Performance

For our followers, we have a link to our complete thought piece published in Public Utilities Fortnightly – February 2015 Click Here. In this article, we examined the capacity market. For those tired of all the numbers I present, this piece is focused on explaining and presenting a concern with the latest adaption of capacity markets. There are limited numbers in this discussion. This is not an anti-capacity market article – nor is it a very supportive article on where the capacity market is going. The major underlying concern is we are developing a market with limited downside for participants, but leaving major upside to them. If this is the case then why not consider re-regulation. Please enjoy the thought piece and I look forward to your feedback.

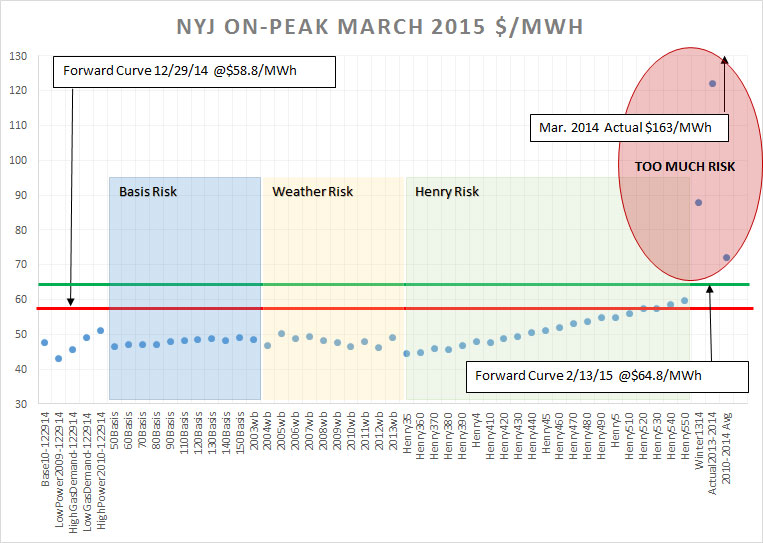

On another note we have updated the results of our December trade strategy screener – click here to see the results. The amazing performance continues with the December strategy producing the most calls and all but one lost money (Sell March NYJ On-peak 2015). The one that lost probably would not have been suggested if we applied one more layer of analysis – see below figure. Using a historical screener and running our weather risk of last year, we see the risk was likely too great to put a NYJ ON-Peak March sell.

We will continue to show and track the performance of the model in the pdf. Our clients were presented the strategy two weeks ago. This time the model only has two recommendations for April.

We realize this platform can be used beyond enriching power traders so we have expanded our offering to help End Users evaluate their power purchase. Please review our presentation that shows how All Energy Consulting can help End Users navigate the complexity of the power markets. No other energy management nor energy providers offer such in-depth analytical capability to let you know what impacts particular events may have to the power markets. We can really quantify the future power market risk to help you make an informed decision. This is a state of the art dispatch model with in-depth industry experience applied not just some historical price analysis typically done for the sector. We will collaborate with you to create an optimal strategy balancing your budget and energy needs.

Please help us help you! Call now before it is too late 614-356-0484.

Your Trying to Help You Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Case Study on Using Analytics to Save Money for Ratepayers

The origin of Power Market Analysis (PMA) was for power trading. However given my experience in all facets at one of the largest utility in N. America – American Electric Power – I knew the use of the knowledge of the power markets extended beyond enriching power traders. With the growth of deregulation and development of regional transmission organization (RTO), the power market has evolved as a legitimate option for power generation versus self-generation for utilities, municipals, Co-op, energy providers, and large consumers.

The power market is fascinating to me as compared to the stock market or other commodity markets as it offers a market that is pure. The power market has limited storage opportunities producing a fundamental convergence immediately not many months from now. The ability to manipulate the markets has situated from the rules of the market not the market itself.

Many utilities have only touch the surface of the power markets as they still largely depend on their own generation. This is changing as many baseload plants will be retiring over the next several years. In addition, dependence on renewable generation will lead to greater market reliance as intermittent issues are real. I have put together this case study to demonstrate and calculate a real dollar impact to the ratepayer if one can better account for the risk in the future market power prices. PMA cannot forecast the future in terms of weather, commodity prices, outages, etc… but it can let you know how much each of those variables can impact the market. This knowledge allows an informed decision on evaluating the option of using the future power market as part of your generation mix. In addition, this analysis gives you a firm and reasonable support for your decision making removing the stress from Monday morning quarterbacks. Many people understand there is much uncertainty in future events; however one should not leave decisions to chance or just assume futures markets represent reality – we can do better than a flip of a coin.

Please enjoy the case study and I look forward to your comments. CLICK HERE TO DOWNLOAD CASE STUDY – Case Study on Using Analytics to Save Money for Ratepayers – Beyond a Flip of a Coin

Your Energy Analyst Looking to Help You Succeed,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Renewable Cost Dropping – Impact to Resource Planning

A very good report on renewable cost is supplied by IRENA – Renewable Power Generation Costs in 2014. The absolute price numbers presented are hard to confirm, but the trends are likely undeniable. Most of the report is based on Levelized Cost of Electricity (LCOE). I have noted LCOE is not the best metric given the structure of the electricity market per my old article in 2012 (which, by the way, is the most popular page on my website for the last few months – not sure why, but it is). IRENA did note the issue with LCOE in their report.

The results from this report lead to implications that go beyond the obvious that renewable cost are coming down and potentially being very competitive with fossil generation. The first implication is the fact a report like this will lead to significant second guessing and planning work by resource planners.

Price discovery and the realities of renewable projects should be made transparent. IRENA report notes cost is very dependent on location. In states or local areas with renewable mandates with incentives, an open platform for project submissions should be created given ratepayer subsidies. Developers, ratepayers, utilities, and government officials should be able to access this site. I noted this in my article with my concerns to Senate Bill 310 in Ohio. There was an advance energy requirement in SB 221 which was removed per reasoning that there was a lack of projects under the guidelines of advance energy. My main concern with SB221 was the failure of the legislation to enable the commission to regulate and enforced the targets set forth. An enabler could have been budgeting and creating an open bidding platform promoted and managed by the state for advance energy projects. The platform would remove the concerns of pricing and the availability of advanced energy projects. This is beneficial to all parties. The utility removes the second guessing of the market place. Ratepayers and the commission know the project premiums and the depth of projects available. The cloak of the “evil” utilities preventing renewables will be removed with an open bid platform for advance energy. Cost produced from reports like IRENA will quickly be confirmed or denied. There is no need for commercial secrecy and competitive advantage when the ratepayer is willing to subsidize and potentially pay a premium.

The second implication from this report is to realize utility scale projects saves money. The report shows utility scale vs. residential PV produces a savings of over 50%. This savings not only comes in scale of projects, but by the utility cost of capital and other business intrinsic properties. Utilities should move into the PV space as Tucson Electric Power has done. There is no doubt a utility can drive more installation than a private company given the correct leadership and vision.

The third implication is the need to revisit biomass opportunities. Biomass generation’s ability to operate more closely to traditional resources offers significant operational advantages over wind and solar. The cost from this report indicate the premium for biomass is in line if not more favorable than many wind and solar projects. Many coal plants are making the conversion to gas. However given the trends and technology improvements in biomass a serious option to consider is the conversion from coal to biomass or even co-firing. The initial biomass projects in the US were a disaster in many cases. However, as with anything new, sometimes it takes a few failures to become a great success. The ratepayers should be equally willing to pay a premium for biomass as they do for solar and wind.

A final implication I will discuss is the subsidies applied to renewable generation. According to the IRENA report all their numbers represented cost without subsidies. Perhaps subsidies need to be removed from the most developed forms of renewables (e.g. wind) and the subsidies rolled down to other advanced energy forms. Advanced energy initiatives can be consider as insurance to the unknown of the future. As a society, we should be able to realize paying an insurance premium at a certain level is reasonable. Legislatures and commissions need to work to establish that reasonable level. Progress from anything new will come with some failures, but we must learn from these failures and move forward. The trend in falling prices from renewables was stimulated from government mandates. As generally a libertarian, this claim is hard for me to make, but being a realistic libertarian one realizes the system is not free to begin with therefore ideal principles cannot always work in an unideal environment. Utilities in their design are quasi-governments with limited competition. Stimulating the renewable investments from government mandates were likely necessary to achieve the fall in prices being observed. Much credit still must be given to the market players who took advantage of the mandates and delivered the cost improvements. It is my hope that at some point the subsidies and mandates will not be needed and we will have the capability to remove them. History is not our friend on subsidy removal. The agriculture industry still sees subsidies developed from the great depression. Even though our economy has shifted from agriculture, we continue with huge subsidies for farms no longer owned by families, but large corporations. Common in today’s political climate, we accept corporate welfare much easier than we accept social welfare. The reason for this is likely the effective capability of recycling corporate welfare dollars to the political process. I guess corporations are people to – right (Citizens United vs. Federal Election Commission)?

All Energy Consulting examines all the areas involved in energy and works hard to be open minded to the changing landscape. Please do consider us for your consulting needs as we are here for your success and have a proven track record of successfully identifying the paradigm shifts.

Your Continually Advancing Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

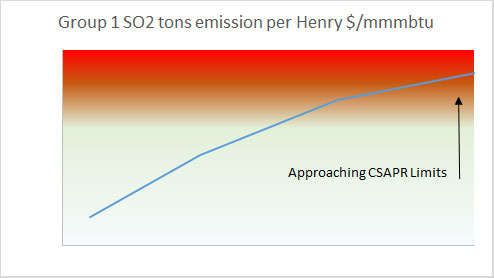

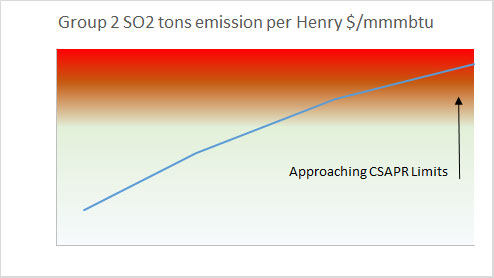

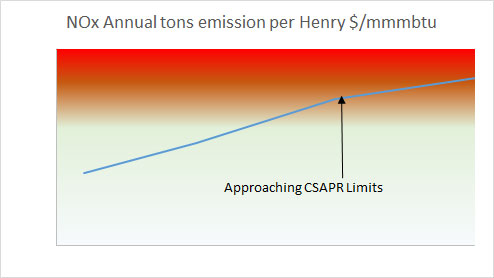

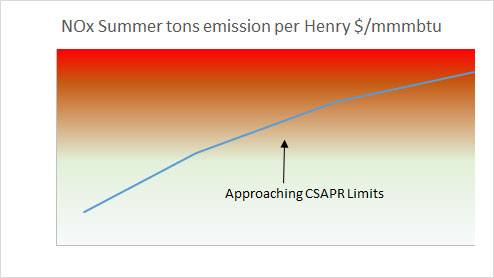

Are you ready for EPA CSAPR? NOx and SO2 Values Computed

Emission markets are one of All Energy Consulting core expertise given our work at the largest emitter American Electric Power. Modeling the emission markets requires game theory and operations research – both those categories are my personal favorite. With the Supreme Court reinstating Cross State Air Pollution Rule (CSAPR) in April 2014 and with the D.C. Circuit granted EPA’s request on October 23, 2014,, CSAPR Phase 1 implementation is now scheduled for 2015, with Phase 2 beginning in 2017.

As typical of the emissions market, the initial market over reacted valuing credits way above reality – starting 2015 – 2015 NOx annual and season $250/ton and Group 1 SO2 $250/ton and Group 2 SO2 $450/ton. The market is slowly coming back to reality. One variable to watch is the direct link between the price spread between natural gas price and coal and the value of emissions credit. The smaller the spread the easier to achieve if not overachieve the goals set forth in CSAPR.

The key in modeling this system is to run multiple scenarios for the entire system and focus on the end total levels not a particular month. The ultimate value of a credit really is at the end of the season. This is akin to buying a stock option; the ultimate value of your options is when you can exercise that option. Making it slightly more complex is the banking. Therefore in order to truly value the program, modeling the end goal targets beyond year 1 will also be required.

We have run multiple scenarios and have computed values for NOx and SO2 along the paradigm of changing events from gas prices to weather. On a high level, the value of NOX and SO2 will be way lower than the current market pricing including accounting for the banking value. NOX summer is the most constrained versus the other emission credits. In order to make an effective decision in your emission credits please reach out to us to view our results of our analysis and potentially customize a case run for your portfolio. We can help you maximize your credit values.

Once again I promise unparalleled analysis and knowledge on this subject matter from me personally, not a person without any industry knowledge or experience in the emission markets. Please do consider All Energy Consulting for you emissions credits analysis – we are here for your success.

Your Emissions Market Expert Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Modeling Efficacy Report

There are so many ways one can validate a model. In power modeling, the bottom line comes out to be how your model translates the various inputs (commodity prices, outages, load, hydro conditions, etc…) into power prices. We cannot know for certain the inputs we place into the model will be the outcome of the future. Developing a range of simulations allows that uncertainty to be quantified. The next and final step is to make actionable items from all the work. This actionable item ultimately proves the value and efficacy of the model.

In this report, we take our default Power Market Analysis Near-term (PMA-NT) and put it through the test of making sure it is able to translate the risk and produce profitable actionable trades from April to December 2014. Though you may not be into trading and rather want to understand your asset or your procurement risk, by proving this process it will surely prove to be useful for your needs. Every day the model produces results and a screener can be run. All this is stored so you can always go back and validate it. Unlike other consulting companies all calibrations and historical performances are saved and clients have FULL access to them.

The test we used was to produce a list of recommended trades using a screener at the end of the month for a monthly power contract three months out (e.g. April analysis for July Contract). The screener takes the forward curve of closing and compares it to the all the runs. The screener is customizable and shows the calculated gains and potential losses from the simulations. The screener that was used for this report was to find trades having an upside of 3X compared to its loss. Finally all positions were closed mid-month prior to expiration.

The results were beyond expectations – 43% return from April to December 2014 without any additional analysis. For each month the model was able to screen the entire N. American power hubs and find trading strategies that produce positive returns. There were no months producing negative returns. The screener was sufficient to reduce high risk trades yet produce some options each month. A full monthly analysis and listing of each trade strategy is available in this PDF.

There is still much room to make the model results even better. All the trades were weighted equally. Further analysis of history and using the 60+ simulations could have indicated better trades likely re-weighting or eliminating some trades. In addition, a spread analysis could have been done to reduce some of the risk. Employing current market intelligence in terms of liquidity and market directions could improve results.

We challenge your modelers / consultants to do this post analysis. Do not add any additional analysis but use just the model results and see if your model can really quantify risk to produce actionable items. Please accept our challenge and may the best model win.

Your Modeling Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB