EPA Proposed CO2 Pollution Standard – Gas more impactful near-term

EPA 2013 Proposed Carbon Pollution Standard for New Power Plants has made some news with much of the focus on coal. I believe the coal issue could be quite a smokescreen given the current economics of coal as it relates to gas. The coal limits are not likely going to impact much of anything over the next few years – perhaps not even in the next 5+ years. For the current impact the devil is in the details.

The natural gas limits probably could use more discussion for its near term relevance to prices for the consumer. For baseload gas plants, the limit is a non-issue (heat rate of 8.4 to 9.2 mmbtu/MW). However anyone with some/limited experience in the power markets realize the diversity of plants is needed not just on fuel perspective, but on a performance perspective. Load can be quite volatile and spiky. There is no need to build a baseload plant for a few hours of the year. Therefore the industry builds peakers to meet these events. Peakers attributes are a cheap unit that is not required to run a lot, therefore variable cost less important than fixed cost and that they need to turn on and off quickly.

Peakers have generally been very high heat rate units as the variable performance was not important. As noted in a paper I lead for the National Petroleum Council – ELECTRIC GENERATION EFFICIENCY – “The efficiency of a new power plant is largely a function of economic choice. The technology is well understood in order to produce a highly efficient plant. In order to produce higher efficiencies, higher pressure and temperatures are required. This increases the cost of the plant as special alloy materials will be needed.”

Therefore higher efficiency is not a leading attribute for a unit expected to run only a few hours in year. The additional expense of higher capital and higher operational cost is not worth it. Currently the average natural gas peaker heat rate in the country stands at 11.3 mmbtu/MW. There are new “peakers” being built at heat rates around 8, but they are not really being built for peaking operations as described above. They do cost more and therefore are anticipated to operate more often. This new carbon standard will first impact capacity markets. As an example the PJM capacity market is using a Cost of New Entry (CONE), the peaker attribute used to calculate CONE is at 10-10.3 mmbtu/MW. This will need to be changed, which will increase the cost of the CONE, therefore increase the cost of the capacity markets. The cost will go directly to the ratepayers.

I am not saying the standard is wrong in any way and that we should not be doing any risk mitigation for carbon. I am just pointing out the real impact of the standard that will likely be felt in the short-term. As long as society knows its cost and benefit and is in agreement than the standard is appropriate. Adding a CO2 hourly limit standard for peaking plants seems in-appropriate. They could have put in a daily limit for small gas plants so that they could still run a few hours and be within the standard. This small amount of CO2 emissions will not do much risk mitigation, but may add more cost than benefit.

In the long-term, this pretty much puts a nail in the coffin into new coal plants. The effective heat rate being asked of a coal plant which cannot be achieved even by a gas plant is 5.4 mmbtu/MWh. This essentially requires some sort of carbon capture and sequestration/storage (CCS). Being involved in CCS at AEP, the cost is extremely high and there are some serious risks. The risk/reward profile is not there for an investment in new coal plants even if gas prices were to be $6+/mmbtu. Once gas prices rise closer to $7+/mmbtu, partial capture could make economic sense as noted by the EPA. However the world of $7+/mmbtu prices currently seems far away.

Your Energy Consultant looking at the details for you,

614-356-0484

Gas Basis Phenomenon – Million Dollar Plus Question Will it Go On?

I am surprised not to hear more discussion on what I believe is one of the biggest market questions for both the natural gas and power markets in the US. The gas basis (spread between the locational point and henry hub) in the Midwest has gone negative in June and has stayed that way. In addition, the forward curves portray that outlook with the 2016 basis spread averaging a minus 40 cents for Dominion South Point.

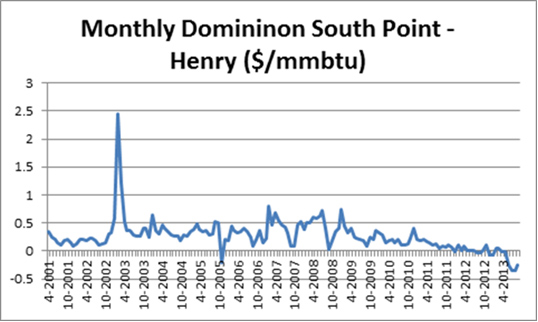

Looking at the basis spread on a monthly level through time clearly shows historically the basis is a positive 30 cents with some extreme upside.

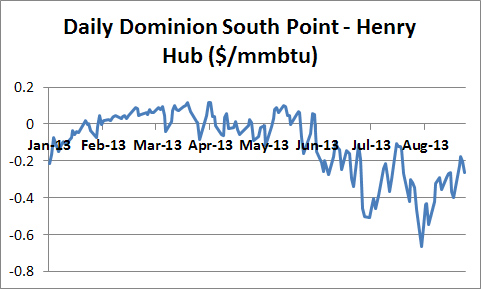

Viewing the spread on the daily basis shows the amazing change in June of this year.

There is much significance to this paradigm shift. Number one the coal competition lies in the Midwest not much in Texas. Henry Hub is the most quoted and reference gas price, but with this shift a $4 henry is not the same impact as it was just a year back for coal to gas switching. A years back you were talking a $4-4.5/mmbtu gas price to coal spread, now you are talking about $3.50-4/mmbtu. As I have noted before moving into the sub $4 range the competition heats up. Retirement and operational decisions of the coal plants in the Midwest becomes even more dire with such a negative basis outlook.

On a trading perspective, one can trade the basis. Trading basis removes the guess work of where the macro supply/demand of natural gas is going. In doing so, you somewhat mitigate some of the weather impacts. Arbritrages like this don’t come so often. The shift in basis and the continuation has resulted from infrastructure and related issues. Utica and Marcellus has clearly changed the dynamic of natural gas pricing in the US. The million dollar plus question is how long can this persist. Natural gas infrastructure development is rather quick compared to power development. Right of ways issues can be mitigated by building right on top of the existing path ways. Rates of returns can be captured with spreads such as a 40 cent differential to henry hub. I am surprised how long the forward curve goes out with such a discount. In fact the discount is seen every month even on the historically largest premium month February. Perhaps the trade you should not leave on the table….

Your Energy Consultant looking for a few good clients – if you are interested, please call me,

614-356-0484

Power Market Complexity

A very good blog by James Bushnell highlights the complexity of the electric markets. There are areas that Dr. Bushnell and I will diverge in the article, but I like the fact that he brings two major themes into the blog – the electric market construct and the technical issues of running the electric system.

The electric market construct, in terms of regulation and deregulation is the topic I have discussed many times particularly in my December 2011 blog Regulation vs. De-regulation. Based on the comments and new information I have received, I still believe that regulation is likely the most robust path for society when it comes to electricity. Dr. Bushnell noted even in regulated form, there will be energy trading as he points out “it usually doesn’t make sense for them to generate it all themselves”. This is true, but IF the market was regulated, this volume would be substantially less and the ability to rig or game the system will be limited. The key issue for regulation is the governing bodies of the regulated institution. Will they be properly compensated to be highly educated on the issues and to avoid any potential regulatory capture? As I noted in my previous blog, this is much easier to manage than to deal with abundance of complicated trade structure and high powered attorneys.

Dr. Bushnell is correct in highlighting the commitment issues in dispatching power plants. Dr. Bushnell seems to have miss-portrayed the historical dispatch mechanism. He noted, “ the California power exchange took bids for price and quantity, but not much else…” First of, California certainly is not the best representation of how electricity was managed. However, beside that point, typically in the days before regional transmission organization (RTO) – most of the utilities were somewhat regulated. They would generate power based on their OWN loads before accounting for other opportunities. The jump to supply, not only your own load that causes this variation that you cannot manage very well. This is the issue of ramping and turning on and off as Dr. Bushnell alluded to “…The fact that a price solution coming out of a computer program did not explicitly model them did not mean that the costs were not represented in the prices. Its just that they were the problem of the plant owners, who had to figure out how to best operate their plants to meet the sales orders being produced by the market.” If you just managed your own load you will eventually understand it and build and operate generation resources for that particular profile.

In addition, if you did operate wrongly in the old model you got paid anyway since it was all cost past through, so it was not really the plant owners problem. However, by operating more effectively, you will reduce ratepayer cost which will allow for more investments in the future. By accepting off-system sales and purchases, it adds the nuance which requires a “centralized” optimizer – RTO. This was the first step in de-regulation and allowing the independent power producers – such as JP Morgan – to begin their conquest.

Before I wrap up, I will have to disagree on this last point where he refers to the electricity market as complex, but so are other areas and then names Refining as an example. I believe I am perfectly situated to compare these two industries given my significant and successful experience in both these industry. Dr. Bushnell background does not seem to show enough substance to compare these two industries. To the dismay of many of my Oil & Gas colleagues, I will state that the electric markets are, by far much more complex than anything in the Oil & Gas industry. The simple physics of electricity makes this so. You cannot store electricity in any significant volume. You cannot even think about managing it just in time (JIT) – it has to be all the time.

If a gasoline station runs out of its inventory, the consumer can drive to another gas station or worse walk there with a container. In the case of the electric world, if there is any imbalance with demand and supply the whole grid may shut down. At this point, there is no walking down to the next station. It will take a coordinated effort to restart the grid. Hence, there is a lot of complexity within the electric markets that need to be considered. I will not get into the numerous governing bodies that get themselves involved into electricity. Where are the low-income gasoline subsidies?

In the past, the markets had limited computer power therefore much shortcuts were done. They did the best with what they have. Now computer power has progressed much. We could decide to keep it simple and manage it with the shortcuts or we can take advantage of what technology has to offer with all its latest computing skills and start making better real-time decision. The abuse of trading is not from this step, but from the step of de-regulating the markets without enough enforcements and pragmatic thinking of rules and regulations. Many of the de-regulating bodies captured the process and found all the loop holes similar to the tax code development.

In wrapping up, I am very grateful for Dr. Bushnell in bringing up the complexities in the electric markets. Decentralized decision making was done because the market was decentralized. To try to have decentralized thinking in a centralized market is like having your cake and eating it to. No doubt garbage in is garbage out. Assuming we don’t restructure the market but continues its current form. We need better governing bodies to throw out the trash before it happens, not when it is in the system or after the fact per the JP Morgan case.

Your Energy Consultant,

614-356-0484

Term Limits for Academia

As I begun to review the report “Examining the feasibility of converting New York State’s all-purpose energy infrastructure to one using wind, water, and sunlight” I decided to get to know the authors of the report. To my shock and dismay, none of them has had any experience in the utility industry, much less any industry.

There is no doubt in my mind, Academia represents an important part in society. Many professors have had profound impact on myself Those include Dr. Grant Wilson and the late Dr. David Himmelblau.

Though Dr. Himmelblau spent a majority of his life in Academia, he did serve in the army and a decade in industry. He taught me a very important lesson that I continue to use till this day.

He had a take home final exam. The final exam involved finding the hydrogen values at various points in the process. Many points in the process were easy to identify. However, there were a few points that no matter what, one could not prove conclusively the hydrogen amounts. Many in class were dumbfounded and turned in incomplete test. I spent an all-nighter trying to get it. Finally I decided to write several reasons to support my assumption.

Dr. Himmelblau later told the class there was no way to conclusively get several points, and the key was to make an educated guess based on supporting assumptions. In life there are many unknowns and you will have to make the best guess you can with all the factors you have at your disposal. This advice probably allowed me to be a great forecaster. This advice is so true when you attempt to understand the future. You won’t have all the facts and you can’t always wait for them either. Operating with unknowns is a reality – learn to embrace it. I believe this is something that cannot come from just being in academia.

Dr. Wilson helped me out in many ways. His ability to take things from a theoretical world to real life applications helped bridge my thinking on how to apply school work into life. Dr. Wilson had a very impressive industry experience, which I believed allowed this lesson to be prominent in his teachings.

Back to the issue at hand, my google search on each of the authors show no industry experience. This is not a personal attack. I am sure all of the authors are genuine decent human beings. The fact is they are discussing about something very complicated and real. No matter what you may say about the utility industry, there is one thing everyone should know, there are real hard-working people there who do their job out of true concern. I have not met a planner in any utility who takes their job lightly. They do deserve some credit for keeping the lights on over the past decades.

Yes there have been outages, but when those outages occurred did you think about your bill not being enough and how much more you would spend for those outages not to occur. Utility planning does include some social aspect. Reliability levels are set for the required masses not for those who COULD afford more. There are many dimensions when setting a resource plan. It is not just economic nor is it just a social cause nor is it just wishful thinking but significant applied mathematics with significant engineering calculations. The fact that not one of the authors had SOME utility experience, therefore, in my mind it immediately reduces the value of the study. It would be akin to having someone do surgery on your body without any experience other than from what one read. Perhaps success is quite possible, but it would be beneficial if they actually built up some real experience in the real world where all the dimensions are taken into account.

My quest to evaluate the study content quickly got diverted. My quick author search got me thinking not of the study, but the thought of term limits for academia. Many people point to the fact that a lifelong politician loses sight of reality – is this true for academia? It would seem that more and more professors are taking the lifelong route versus the professors I had who had spent time in the world then came back to academia. I hope institutions think about this as they look to build their staff. Colleges should implement a term limit so that their professors do not lose sight of the real world. This probably should apply with your consultant. Hopefully you don’t have a consultant who has lost track of the real world.

Now back to reading the report…..

A supporter of term limits for politicians, academia, and consultants – Your Energy Consultant,

614-356-0484

Power Industry Challenges – Strategic Threat

The power industry is the most capital intensive industry. This capital intensity was one of the key factors in regulating the market. Centralizing a large unit lowered the cost significantly even though transmission and distribution cost would be increased. The irony is we now build units such as wind that are more expensive and also cost more in transmission and distribution cost. In addition, we have de-regulated the generation piece of the business in several markets. The de-regulation experiment is bound to have some significant failures as the ends may not be great enough to justify the means. Society is use to capacity being built when market prices return a 10-12% return. However in de-regulated world returns would need to be commensurate with the risk. High capital cost in addition to volatile uncertainty in commodity and policy would require a 20+% return. In order to get such a return the prices in the market will likely be at levels that brownouts and rolling black out occurs at peak time periods. Society will not deem this as acceptable.

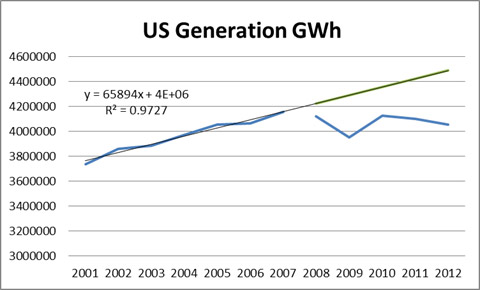

The weighted average age of all the plants in the US is 28 years old. This means somewhere between 10 and 30 years from now 600GW will need to be built assuming NO load growth. If we add 1% load growth over the next 40 year we are looking at an additional 100GW. The total investment for just the generation piece will be around $700 billion.

This comes at a time when utilities are bleeding in the nation from lack of load growth. Load growth is the key revenue line item for utilities. Projects and investments are based on assumed load growth and rates are adjusted to represent the revenue requirements. When load does not grow as it didn’t for the last few year, revenues dramatically fall and rates will need to be adjusted up to account for the expected load growth which did not appear.

Based on the expected trend before 2008, utilities load drop has resulted in a loss of expected revenue around $140 billion.

In addition, there are so many other initiatives beyond generation that are on the shoulder of utilities. This includes Environmental controls, Smart grid, Demand side management, Conservation, Efficiency, Renewables / Feed In Tariffs, Carbon, Pension obligations, Jobs support, Transmission, and Distribution investments. If you think the ages of plants are old distribution equipment is much older.

All this added cost points to higher rates for the consumer. Rates can only go so high before society revolts and/or the business model of the utility folds. This issue becomes a strategic threat.

Please do consider All Energy Consulting in helping you assess your strategic risk and understanding the future of the energy markets.

Your Energy Consultant,

614-356-0484

Twitter: AECDKB

Study vs. Advocacy – Wind Generation

I recently came across this “study” – The Net Benefits of Increased Wind Power in PJM – done by Synapse Energy Economics for Americans for a Clean Energy Grid. Based on the information on the website from their website they seem to be a very credible organization. However I think the “study” shows that they are smart enough to manipulate the setup and presentation to create a document to their client’s desire. The study became an advocacy piece and those calling it a study better review it first.

The first alarm bell from any study requiring a model, particularly the power markets, there needs to be back test of the model. They should show the back cast results and prove the model is ready for future applications. The main mechanism to show the impact of increasing wind actually was beneficial was to start the analysis with a draconian setup and to guise the result under a delta impact of 2026. By pushing the analysis to 2026 they were able to state a capacity setup which does not exist and will likely not exist, thereby making a delta analysis potentially more positive. Below table shows the current PJM resource mix (http://www.pjm.com/~/media/documents/reports/2012-rtep/2012-rtep-book-2.ashx) vs. the proposed 2026 setup by Synapse.

|

Installed Capacity GW |

||

| Synapse 2026 | PJM Current 2012 | |

| Wind |

32 |

1 |

| Gas |

123 |

54 |

| Coal |

18 |

73 |

| Nuclear |

34 |

34 |

| Hydro |

3 |

8 |

| Other |

42 |

11 |

| Total |

252 |

181 |

I will agree to the direction of the reduction of coal, but the extent is far from reality. First, there are 37 GW of coal assets with scrubber installed in the last 5 years. Do you think utilities spend a billion dollar not to recover their assets over a longer time period? In addition in the planning queue for scrubber installation I see 12GW of coal. I suspect not all of those will install, but compared to the 18GW Synapse is assuming to be left in 2026 because it doesn’t pass the sanity check.

By starting at the reference point at a system that is already expensive, makes it very easy to conclude wind generation is better. Another advocacy maneuver was to have wind generation at such high levels 36+% compared to NREL own assessment for many of the PJM states in the upper 20%. Besides the output, I would be curious to see the wind shapes they used to and whether they are close to industry standards or biased.

I could go on and do more analysis, but I think my concerns thatI have addressed are sufficient to make the conclusion the report is more advocacy than study. It is ashame they went that direction. I believe the assessment done by NREL that wind costs are coming down is real and will have an impact for more wind. I also believe solar impacts will be larger than stated in this study, but this would likely not support the initiatives set forth by the Americans for Clean Energy Grid as most of the members are wind centric.

I don’t think I would be a good advocate. The numbers drive me. However I am open to latitudes of probabilities, but those probabilities must sit inside some reality. I suspect over time people would want to deal with people who don’t just color the picture how you want them to, but actually consult with you to make better decisions. At All Energy Consulting we promise to offer you real consulting minus the advocacy.

Your Energy Analyst who paints it like he sees it,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.