Road Tax (Electric Vehicle Issue), De-regulation (Natural Gas), & Gasoline prices

Given my fortunate position of being so busy that I can’t blog as much as I want; I am trying a new format for blogging. “Quick” summaries of blogworthy articles.

I have been telling people to look, re-examine the economics for non-traditional gasoline/diesel vehicles and make sure it includes some sort of recovery for the loss of tax revenue. Many show the calculation for comparing electric vehicles, assuming the gain from tax revenues will be there forever. I am surprised it is coming to the forefront this early with penetration of alternative vehicles still in the low single digits. Article on electric and hybrid vehicles draining dollars from road tax

My neighbors always ask about who they should choose for their energy provider. In many markets, the ability to choose a provider for natural gas and electric generation is now available. The system is still not fully de-regulated given the providers still have regulated rates of distribution which will be paid to the incumbent utility, commonly called non-by-passable cost/rates/riders. In theory, the open choice concept will reduce the inefficiencies in a regulated company by offering a form of competition. By doing so the consumer in the long run should save.

However, like most things involving customer decisions, it is more complicated than that. Many things influence the decision of the consumer and as the article alludes to the key thing is knowledge. Knowledge is not just information but the ability to understand the information to make informed decision. The consumer has significant amount of information available to them via the internet. I would suspect information is not the issue, it is the consumer who does not have the ability to really convert the information to knowledge, particularly given their decision will only impact them less than their monthly cell phone bill.

As I point out to my neighbors, I don’t have time to analyze each of their choice for them, but I do suggest not doing anything about their gas bill. Why would I do that? Natural gas really offers no competition in order to weed out inefficiencies that a utility may build up. In electricity, there are many opportunities to make inefficient decision making. An example of poor decisions is building a coal plant assuming natural gas prices will be greater than $8/mmbtu. Natural gas is natural gas. Commodity risk is limited through hedges. The pipeline and delivery cost has to be recovered through the regulated rate portion which all providers must pay. The ability for the gas utility to make a poor capital allocation is limited compared to electricity. Alternatively a provider in natural gas can only give you so much of their margin before they are equal to the competing regulated utility. Article demonstrating natural gas choice as a failure for the consumer

Word of caution for the administration – don’t take credit for the lower gasoline prices. Each year around this time the administration takes a look at the gasoline prices and starts taking credit for lower prices. However the market is seasonal; prices typically always come off in the fall and into the winter time period when people drive less! Article falling gasoline prices

We positively and evocatively challenge the current thinking involving any aspect of energy use. We look for projects that offer meaningful, transformative, with impactful outcome to the marketplace or society. Please consider and contact All Energy Consulting for your consulting needs.

Your Energy Consultant,

614-356-0484

Positive Externalities Exist

Ed Dolan recently posted on his blog: “Why do we Need Government to Tell Business to be Energy Efficient?” .

Of course, I wouldn’t blog about it if there wasn’t something I could highlight. Thanks Ed for the inspiration to write something – I have had bloggers block. The first issue to comment on is the following:

“…stopping government subsidies that make the prices of some inputs artificially low. For example, without subsidies to corn farmers and ethanol blenders, we would use less corn ethanol in our automotive fuel. According to most studies I have seen, less ethanol would mean a more efficient fuel mix.”

The thing here is that Ed is not relating the context of why the subsidies in ethanol must occur. Clearly every action is not about efficiency or even energy itself. It is a balancing mechanism – though not the best – for the subsidies that occur in several middle east countries for petroleum. In those countries their citizens are paying a fraction of the world market prices. As Ed should know those areas are also seeing one of the largest growths in petroleum demand. We have seen an unprecedented price rise in petroleum prices in such short time period. The cure for high prices has been high prices. However if the areas observing the greatest growth for petroleum do not see the high price signal then the responsibility for the demand destruction lies on economies like the US. Our continued purchases of the high prices support/subsidizes them. Without stronger trade restrictions, a subsidy on what we produce the most and what the rest of the world needs makes sense; in this case it is corn. In essence the US is swapping food for oil to balance out the trade and price discrepancy issue. It is not perfect, but until we come up with a better way, I wouldn’t want it to go away.

“…fixing government policies that allow businesses to take resources without paying for them. Promarket economists like my early mentor Murray Rothbard have long argued that pollution is a form of “taking” via uncompensated harm to other people and their property. That means harm to people and property owners who live downstream or downwind from a specific factory or power plant, and in the case of some pollutants, it means harms that are felt even more widely, even globally….Look at it this way: A business owner is like a dog owner. Just as the burden of cleaning up the dog’s poop is the owner’s responsibility and becomes part of the cost of owning a dog, the harm that pollution does to downwind residents and property owners is a both a moral and an economic responsibility of the businesses”

This thinking has become very common – the values of externalities need to be incorporated into the price of energy. However most people assume externalities are only negative value. I will agree there are negative values for downstream/downwind people who are not directly consuming the energy – e.g. particulate matter. However even the downstream/downwind people are seeing positive value ,even though they are not directly consuming or paying for energy. What are those values?

Societal stability through economic prosperity. As complicated as tracking negative externalities, there is a complex web for tracking positive externalities. I will state a few potential examples. Because the upwind region has local energy to consume, though potentially polluting to downwind. Their ability to use the local resource limits the population from migrating downwind and potentially causing instability through crime, disruption of supply/demand of other resources, etc… Also there is value that the upwind region is consuming a source of energy. If they did not consume the local source of energy they may demand the source that the downwind region is using. This will likely cause economic harm to the downwind region particularly if the upwind region has more capability to buy the resource. There are numerous examples I could come up with among the numerous examples discussed for negative value externalities.

The value for the negative externalities is as real as those of the positive externalities. And how to value each of them is complicated. The dog poop example Ed brings up really doesn’t work unless you add more reality to the situation. The caveat could be: by allowing the dog owner to have the dog, you are reducing your chance, the owner would be a grumpy and potentially go postal on you one day. Therefore potentially an occasional poop missed is worth the trade-off on not allowing him to have a dog because he doesn’t always clean up. There is some level of pollution that balances the trade-off. What that balance is becomes very variable and will depend on the situation and societal choices. Ed does note at the end:

“to safeguard the integrity of energy pricing we can use government fines, or pollution charges, or taxes, or whatever you want to call them. So much per ton of SO2, so much per ton of carbon and so on. Yes, in some philosophical sense, that is a second best, a less elegant solution than one that internalizes all pollution costs through voluntary contracts and the enforcement of property rights. Yes, it is hard to get the prices just right. But I see it as the best hope we have for making our planet cleaner, healthier, more sustainable and–importantly–more efficient.”

However society needs to know all the facts not just the negative side of things. In Ed’s article, he did not balance the negative externalities with the positive externalities. How will the price ever be close to being “right” if we don’t have a comprehensive dialogue’s of both the pros and cons?

I take pride in making sure I take a 360 perspective. One always needs to challenge one’s own thinking to make sure all bases are covered. If you are looking for an unbiased well-rounded perspective on energy issues please, consider contacting All Energy Consulting.

Your Energy Consultant,

614-356-0484

US Refining Margin Outlook Sept. 2012

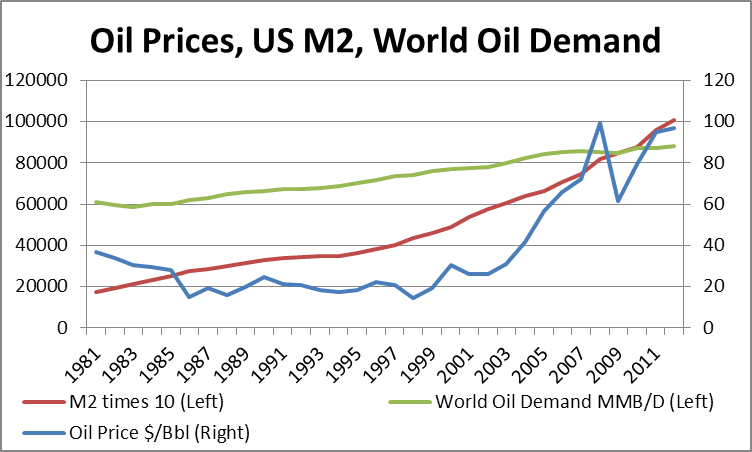

The refining outlook has been impacted by two major fundamental changes in the crude oil market. The first major change is the new crude oil price regime, driven by increase demand from Asia and partially due to global monetary policy from central banks. In relative short time, crude oil markets have moved into the $100/bbl environment. From the 80’s to 2000 prices stayed in the range of $20-40/bbl.

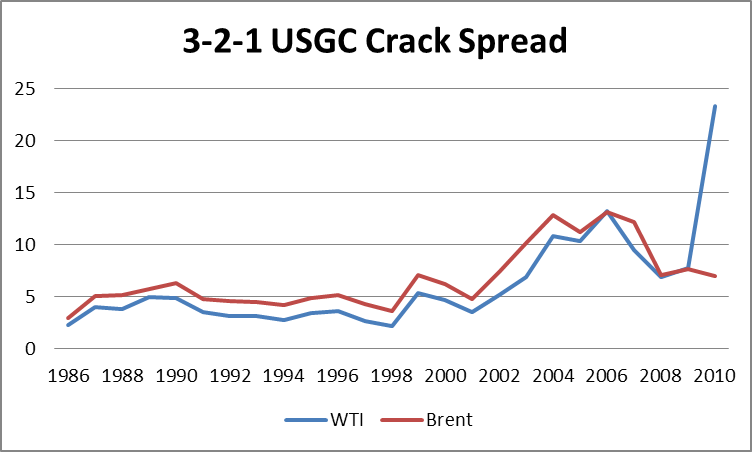

Since 2003 oil prices continued to climb and only very recently have settled into a range $80-100/bbl. Given the much higher crude oil prices, refining margins seen in the 80’s to 2000 will likely not be comparable on an absolute basis. On an absolute basis the current margins would be deemed as historical by multiple factors.

A certain amount of the WTI crack spread can be attributed to the current disconnect between WTI and the USGC, which represents the product part of the spread. The difference in the WTI crack spread can be attributed to the region – Cushing, Oklahoma – existing infrastructure. The WTI – Brent Spread is producing a historical discount to Brent. This is translated to the WTI – LLS spread, to a lesser extent.

However, this spread is not likely to exist for a substantial amount of time since the arbitrage to move oil to the USGC can easily be solved/monetized through investments in pipeline. This is already being seen in the reversal of the Seaway pipeline which will increase flows from Cushing to Gulf Coast from 150,000 bpd to 400,000 in 2013. In addition, there are several other discussions from the TransCanada Gulf Coast project.

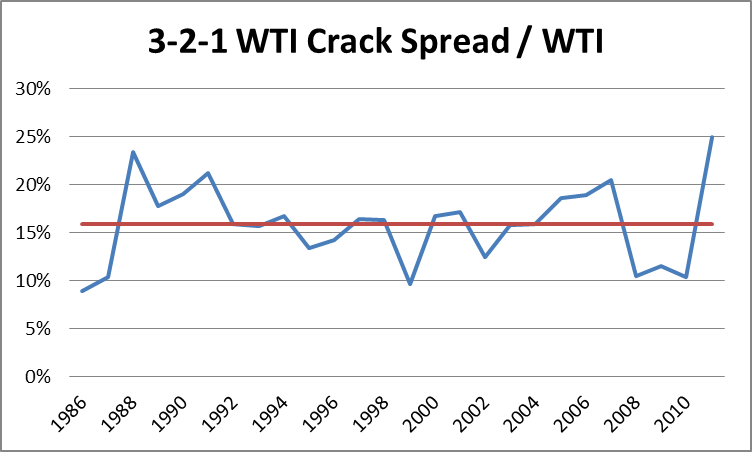

Besides the local issue with WTI, Brent and LLS are still showing a rather high absolute refining margin compared to history. This portion is attributed to the elevated price of oil which is producing a larger absolute refining margin. In economic sense, it is rationale to expect a higher absolute value of return as the cost of the feedstock rises. On a percentage basis of the feedstock, the returns are high now, but are not historically high.

The average percentage of the 3-2-1 WTI Crack Spread / WTI is around 16% from 1986 to 2011. The future should be expected to be around that level with perhaps a chance for it be slightly higher. The rationale for this is the increase level in crude oil prices increases the carrying cost relative to a lower crude oil market. In addition, the higher crude oil price has led to higher volatility. Both of these issues add additional cost that will likely be passed on in the market. In a $100/bbl crude oil market, a sustainable 3-2-1 crack spread for WTI should be around $16/bbl.

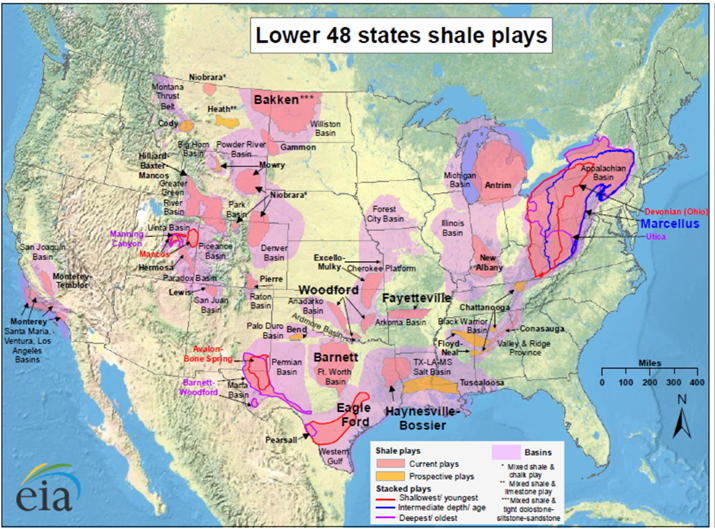

The next major fundamental impact for refining margins comes from the shale gas revolution. As noted by several oil analysts, shale gas has and will continue to significantly alter the energy space. The various shale gas areas are shown in the map below.

Besides the natural gas production, shale gas has added significant volumes of liquids as the shale gas technology led to an increase in extractions of natural gas liquids. The desire for more liquids is due to circular loop. In a circular fashion, the increase in natural gas production led to a lower value in gas, but with oil markets being strong the spread between oil and natural gas is the highest since 1950’s. This has led to increase focus on liquids rich shale gas plays.

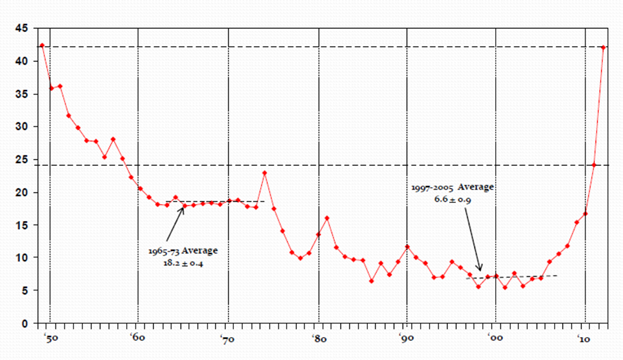

US Oil price divided by Natural Gas Price

The drive for shale gas is currently been driven by the liquid value. Natural gas plays by themselves are not very economic with the current natural gas price. However adding the liquids economics justify some of the decisions to continue to develop gas fields – see figure below.

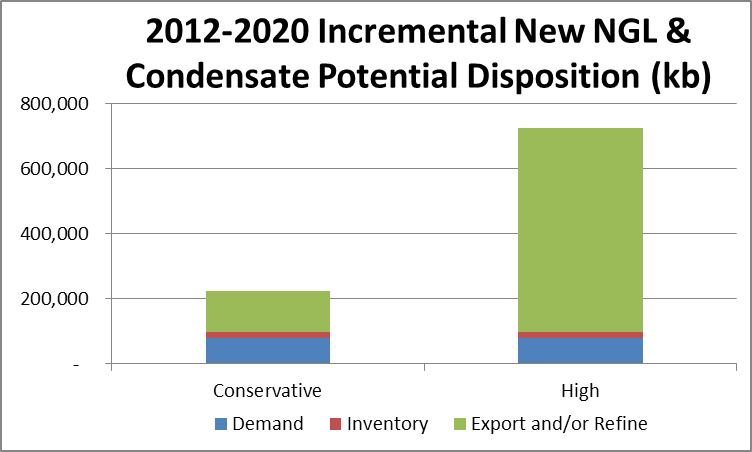

Based on the various USGS surveys and production trends, the liquids from shale gas should amount to an additional 400,000-2,200,000 bpd by 2020 with most of that volume needing to be exported or refined. A recent Morgan Stanley report evaluated the Eagle Ford and expects over 600,000 bpd of oil production by 2013 versus the current level of 170,000 bpd. Currently the Energy Policy and Conservation Act of 1975 (P.L. 94-163, EPCA) directs the President to restrict the export of crude oil. This will put pressure on US condensate prices and giving price advantages to US facilities that can process the condensate.

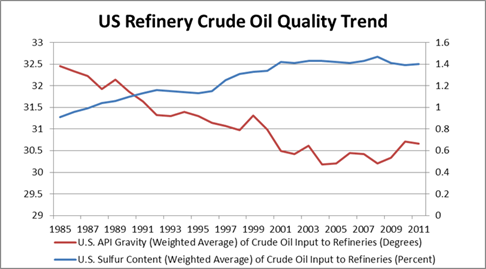

The volume of liquids from the shale gas play is not significant to change the overall oil markets over the next few years. However the volume is significant in terms of the impact on the quality differential. All of the liquids from shale gas represent a category of light sweet oil – API >40 and Sulfur <1%. This has caused a dramatic shift in the oil paradigm. For the greater part of the last two decades it was common theme to consider the crude oil slate to become heavier and higher sulfur. This caused the refinery industry to believe a successful refinery is one with size and technology in order to convert the heavier crude oil. The light-heavy differential was expected to widen significantly putting simple refineries out of business. However shale gas revolution with its exclusive light liquids is reversing that trend in the US.

The impact of the lighter crude oil will be bringing a simple refinery back into positive economics. In addition, without the large spread in light-heavy crude oils, highly complex refineries can actually be put in negative economics given their high variable cost. This is partially responsible for the Aruba and Hovensa refineries closing down. Both of those facilities are designed to convert heavy crudes from Latin. America. In addition, those refineries are dependent on oil for its energy whereas all the gulf coast refineries can rely on natural gas.

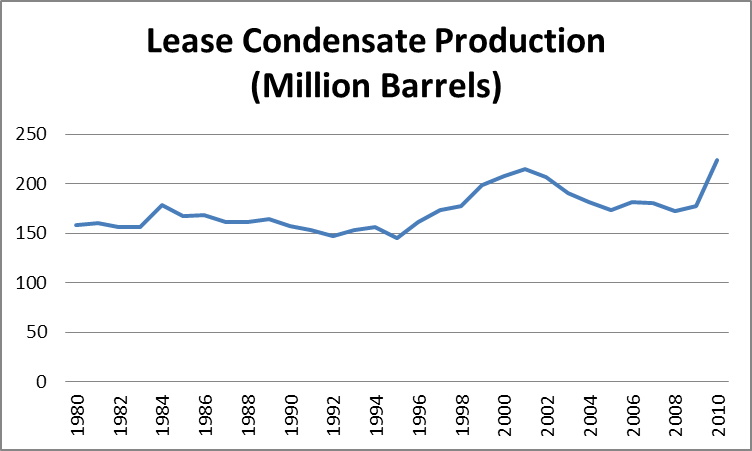

The impact of the liquids can be directly seen in the drop of imports from light oil greater than API 45. Beginning in 2011, the imports of crude oil greater than 45.1 API fell by over 100 kbd.

This drop coincides with the increasing domestic production of lease condensates. Lease condensates as defined by the Energy Information Agency (EIA): A mixture consisting primarily of hydrocarbons heavier than pentanes that is recovered as a liquid from natural gas in lease separation facilities. This category excludes natural gas plant liquids, such as butane and propane, which are recovered at downstream natural gas processing plants or facilities.

I believe the two fundamental shifts impacting the refining industry, higher crude oil price and increase in lighter feedstock, is sustainable for some time period (5+ years). The US economic solution is fixated on continued quantitative easing. With M2 currently producing the highest correlation for crude oil prices using data since 1981 – R^2 ~0.6 vs. world demand R^2 ~0.5 – high crude oil prices ($80+/bbl) will likely continue into the future years. Shale gas production is not likely to cease, given the high value of oil products and the cost of production being around $3-5/mmbtu on just a natural gas basis. Liquids rich plays will continue to be found and produced. The combination of these fundamental shifts will result in higher absolute refining margins. The recipe for a successful refinery will be modified from size and technology to refineries able to minimize operating cost, given that the complexity advantages have eroded with lighter feedstock.

Higher resolution graphics are available upon request. Presentation with Q and A are also available. Please do consider All Energy Consulting for your energy consulting needs.

Your energy analyst,

David K. Bellman

614-356-0484

Adaptation will happen as the climate changes

The key sentence with keywords bolded from my previous discussion of climate change is “statistical odd that climate change is real, and that it could have significant impact to society.” I leave room for doubt as many things cannot be modeled. Simple things such as predicting cloud formation is still not understood. Given simple things cannot be understood one could surely extrapolate, perhaps more complicated feedbacks are not incorporated appropriately in many climate models. A recent discovery in the arctic articulates this issue.

The article points out a new massive discovery of phytoplankton in the arctic. In addition they note the following: “…it could explain how the ocean has been absorbing larger quantities of carbon dioxide (CO2) from the atmosphere than data could verify, the researchers suggest.” This bio-feedback from higher CO2 contents demonstrates how the earth/nature will adapt to changes. There are other bio-feedbacks that have been demonstrated. Scientists have noted that certain plants are becoming more dominant as CO2 content in the atmosphere increases. This would make Darwinian sense in the fact if the environment is changing those creatures/plants that would prefer easier access to CO2 will be more dominant as more CO2 is available in the atmosphere. Duke demonstrated this bio-feedback with poison ivy being the beneficial plant.

These types of bio-feedback are not all captured in the various climate models. There are so many areas we do not fully understand or can comprehend. However on a risk adjusted basis, I will stick with my premise that there is a statistical odd that the models are showing a possibility of unintended consequences of our emissions of CO2. As I concluded in the previous blog, we will likely have to adapt due to societies focus on Carpe Diem.

At All Energy Consulting we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant,

David K. Bellman

614-356-0484

Hedging Pitfalls

A timely article related to my recent blog on hedging came out two days ago in regards to Ft. Lauderdale evaluating hedging their fuel exposure. There are some positive and alarming statements from the article. Clearly the city can better plan and manage their finances with a steady price of energy. Below are the postitive statements:

City Manager Lee Feldman correctly noted “What I’m looking at is budget certainty,” Feldman said. “When we start budgeting, we don’t want to artificially inflate our budget to make sure we have enough money in our fuel budget to protect against price increases.” Mayor Jack Seiler makes a correct statement about hedging “We’re not in the business of playing the market,” Seiler said. “The problem we have is you have such a fluctuation in gas prices.”

So far everything above is reasonable and perfect for a hedging program. The alarming parts are below:

“Palm Bay accumulated almost $600,000 in savings during the three years the program was in place, said John Cady, the city’s fleet services division manager.”

The word of savings is not correct in the context of the hedge program. It is true the hedge saved you, but I think the important stress needs to be budget and planning certainty. Because it could have been easily $600,000 in extra cost.

Another concerning statement “”That’s why you want to have somebody on your team, basically an adviser in the fuel market, telling you now’s the time to place your hedge and now’s the time not to,” Feldman said.”

Once again this leads you off the track of the prime reason, which is budget certainty and planning. If you believe someone can advise you of better timing – which I don’t doubt – then you now want to have your cake and eat it to. You want to speculate and make sure your budget certainty also makes you good money. The best method for a pure hedge program is not timing the markets via the advice of a person, but to develop a systematic method of building the hedge. I do believe in good trading, but I don’t think you want to be an active player in the trading markets as a city, when you prime goal is budget certainty for better planning. A trader’s goal is to make money. The risk reward profiles are much different. I would advise someone in the energy business of that route, but not an entity, not staffed or experienced in the energy world.

A systematic method allows all stakeholders to remove any concerns of manipulation and/or risk taking. As I pointed out in the previous blog, I have many years in the trading environment along with the corporate planning environment. My group at AEP was instrumental in designing the first approved hedging program by the public utility commission for our supply chains consumption of on-road diesel and gasoline. At All Energy Consulting we understand the energy markets and can effectively navigate you in deciding and designing a hedging program for the various energy commodities.

Your Energy Consultant,

614-356-0484

Climate Change Discussion

Though David Roberts from the Grist once called me a “troll” via twitter because of my perceived different opinions– I don’t mind subscribing to his twitter and viewing his works. Mr. Roberts self-professed in the video below that he is just a blogger. I am: a beginning blogger, but a recognized and an accomplished prognosticator of the commodity markets (1998 crude oil collapse – noted in USA Today among the many other publications), employed for many years on a management team of one of the largest utilities American Electric Power, served on multiple committees from the National Petroleum Council to the National Renewable Energy Laboratories, rated as one of the best speakers in multiple energy conferences, and more importantly a successful family man who has been with his wife for over 20 years and has five wonderful kids. So perhaps next time Mr. Roberts would come up with a better adjective for me than a “troll” just because of some differences. Nonetheless, I don’t see the value of surrounding one-self with liked minded individuals -where is the fun and the learning experience in that? Mr. Roberts recently did a TEDx video, which I thought was very well done and intelligently articulated about the concerns of climate change.

Personally, I do believe with a statistical odd that climate change is real and that it could have significant impact to society. Mr. Robert is correct to point out the 2C is likely past. The odds of this occurring are very high. The depth of the problem is very large. Using the mathematical models and running my own simulations, I showed that de-carbonizing both the US and Europe would amount to a delay of 30-50 years in hitting the same level of ppm. Without worldwide effort, the problem is almost futile to solve.

The problem is more than an economic question, it is a philosophical issue. Our society, particularly in the US, is hell-bent on living for the now – Carpe Diem. Many people are not properly planning for retirement. Our political leaders, rather borrow from the future than to have a recession on their watch. In fact, one could probably plot the growth of credit/debt along with the global climate problem, which Mr. Roberts presents in the video; it would be a similar story to global warming. We have a refusal to change the financial path, since it is much easier to see that borrowing now makes us feel better. Likewise changing our energy consumption would take “work” to say the least. Many politicians have little regards for future consequences much like their statement for climate change as Mr. Roberts points out. Therefore in order to solve this problem, we need to change society and its view on planning. Taking near term pain maybe what the doctor is ordering for long-term survival. If we can’t do it in the financial world, I am afraid we cannot do it in the real world for energy.

Beyond our own societal sentiment for Carpe Diem, we need to contemplate balancing all our concerns/special projects. We cannot solve everything equally – capital allocations are a necessity. I don’t see a way out to have social security, medicare, our policing of the world, and then add more expenses for global climate change. Money is really not just paper. Something needs to give. Our attitude to be able to fund everything is due to society being used to living on debt. We need to start making some tough decisions and ultimately sacrifices will be made. Very similar to families on a budget, one cannot spend on everything even if the desire is great.

Adding to the complexity, some of these special projects also include projects that for 100% certainty can save millions of lives at a discrete cost – as proven by the Bill and Melinda Gates Foundation as they try to eliminate polio and malaria. Where is the humanity balance between saving lives now or for some statistical probability saves lives later? Perhaps this brings me to a very interesting possible paper on human behavior action – if someone hasn’t already written one. I would hypothesize one could mathematically derive that the level of certainty must approach infinity as time goes beyond a few years for action to occur. Meaning I believe the way we are wired is to act on known issues, but when there are unknowns the greater the time the greater of increased probability is needed before we act. Given this thesis, I find our ability to react to global warming very minimal at this time – even though it may be the correct thing to do.

Mr. Roberts alludes to the point – it would seem adaptation is inevitable. Personally I wish it wasn’t the case, but wishing doesn’t usually solve problems. It may be more appropriate to start making decisions on the adaptation level e.g. building near or below sea level seems to be very short sighted. Perhaps one should contemplate redirecting existing mitigation research to proactive ways to modify the climate via geo-engineering since by the time we act; mitigation will not be an option. We certainly need to be more open minded – myself included – in viewing these issues in multiple lenses. The problem is a lot more complex than what a single individual can comprehend.

At All Energy Consulting, we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant / Troll to some,

614-356-0484