Energy Policy – Too Complex to do for the US?

In several energy conferences I have attended, many people are dismayed on how we fail to have a national energy policy in the United States. At the same time, many people are actually very grateful for that fact. This is typically coming from those who are very cynical of government action and ability to appropriately execute. An in-depth national energy policy for the United States is likely infeasible due to the geographical diversity of the US to use various energy forms and the complexity of energy. The only energy policy I could see from a US federal perspective would be a generic focus on allowing inter-state energy transfer no matter what form of energy, a focus on maintaining some level of energy security through technology, storage, and trade, and finally a push to use energy productively.

Energy is a means to many ends. Having energy does nothing useful without an objective of using the energy. The discussion of energy in the public space is typically done with a bias to favor one form of energy to another even though they may not even be directly related. Energy is so broad making it very complex. The complexity allows the energy discussion to be manipulated to the public. This manipulation is sometimes intentional and sometimes out of ignorance.

The two broad forms of energy is potential and kinetic energy. Kinetic energy is the useable form of energy. The potential form of energy is eventually converted to kinetic for final use to achieve an end goal. An example of end goal could be heating your house to traveling from point A to point B. The usable forms of kinetic energy are radiant, thermal, motion, sound, and electrical. To produce those forms of energy, a medium is needed. These can be Oil, Natural Gas, Wind, Sun, Coal, Earth (Geothermal), Hydro, Atoms (Nuclear), etc… Within each of these forms and mediums, people have dedicated their lives to them generating multiple academic and business people. Only a few actually involve themselves across the various forms of kinetic energy and the mediums.

I was fortunate only because of my career path and my desire to continue to learn. Most of my colleagues and friends in the energy space are dedicated to one medium and one form of kinetic energy. This highlights the complexity of the space and the desire for individuals to bias a certain form and medium of energy. My Oil and Gas colleagues would not be interested in understanding the Demand Response call option value compared to the tariff rates structured, just as my Utility colleagues would not be interested in understanding the light-heavy relationships in petroleum products and its impact on crude oil valuations. At some level each of the groups will be “fighting” to support his or her industry. Therefore just as Eisenhower was concerned about the military-industrial complex, I would be concerned about an energy policy driven by one of the energy forms complex versus generating a generic goal of using energy productively and securely.

Having a clear discussion on energy is near to impossible because of the generic “energy” concepts. Energy discussions are littered with ignorant or bias agenda. Case in point, many articles will point to the renewable initiatives leading to a reduction of petroleum products (gasoline, diesel, jet fuel, etc…). However, this is not genuine since the renewables mediums are generally focused on the electric form of kinetic energy whereas the petroleum medium is focused on the thermal form of kinetic energy. Therefore, significant transformation to renewables will not displace the petroleum uses without a mass change in vehicles which in itself will take decades.

State energy policy focused on specific mediums would make more sense than federal. If federal policy were to take a medium stance this would immediately favor certain states over other states. However, keeping it on a state basis allows the state to excel their mediums and create a competitive landscape. The evolution of civilization to use one form of medium to another is typically not altruistic, but of natural evolution of necessity. People always point out the vast nuclear usage of the French as a potential ideal goal for a carbon free world. The French did not set out to do this for the sake of carbon, but because France lacked the abundance of oil and coal. If France was sitting on the Powder River Basin or Barnett Shale, France’s nuclear fleet would be much smaller. The same can be said of the US distribution of energy medium uses in the various states. There is an abundance of hydro plants in the North West and coal plants in the Appalachian area because of the resources there. If there were significant coal in Washington and huge hydro opportunities in West Virginia, they would be promoting each other’s current concerns. A national energy policy would have to be careful to not pick winners, but to support the individual states and a national goal of energy security.

Energy is too generic and covers too many topics for too many people. A discussion on a particular medium and form is required for people to understand the topic. However, the fact is a global market for thermal uses have grown. The domestic surpluses of the electric form of energy have been consumed. US society is slowly changing from a thermal to electric form of energy. This is seen in electric vehicle to telecommunicating. The growing abundance of our gadgets from laptops to tablets to phones has increased our dependence on electricity vs. thermal.

In addition, the mediums of energy are being used in different forms of energy versus historical norms. Natural gas typically was used in thermal form of energy, but is now being more used in its electric form. Coal to liquids could become an option as coal plants are being shunned. Renewables offer a competitive option to not only substitute electric mediums, but could be used to substitute thermal forms of energy. In order to use energy productively we need to cross over the various forms and mediums to develop an optimal path. More people who have experience and knowledge in multi-energy forms and mediums need to be developed.

The cross overs are very hard. I have consulted with Oil & Gas companies to let them know the future of their largest demand source, but several don’t like to understand the regulatory nuances. I have tried to discuss with utilities the dynamics of the gas business, but several don’t like the market risk and the need to change. I have also consulted with renewables institutions and companies. I did serve on the National Renewable Energy Laboratories (NREL) technical advisory team. The issue I saw at NREL is the limited commercialization focus and the limited appreciation of the other fuels. They did a wonderful job in the technical world for renewable, but to see how it was going to enter the market space you have to understand the current investments.

In the end, the convergence will be made and those standing in resistance or blissfully ignorant will likely be left behind. A convergence in the various forms of energy and the mediums has become inevitable. A larger holistic approach to energy planning is needed not just on a national and state basis, but in individual companies. Companies who consider themselves an Oil & Gas or Electric Company should rethink their models and their plans.

Energy is a means to many ends. The energy sector serves society not the other way around. If we do develop a national energy policy, let us hope the developers remember that. States with abundant mediums of energy should think about using the energy. To export the energy medium to only buy back the medium in another form of energy is not optimal for the state economy. Optimal economic benefits occur from productive uses of energy not exporting energy mediums. This is one reason Nations (e.g. Venezuela, Libya, Mexico, etc..) with huge oil resources fail to progress as they do not come up with productive uses of energy and in the end purchase back their own energy mediums, but in more expensive forms.

Let me end with a Thank You! I am grateful for my past in order to have the current moment. I wish each and everyone a wonderful and enlightening 2014.

Your very grateful and humble Energy consultant,

David K. Bellman

Shale Gas and Carbon thoughts

Taking a break on the various issues of utilities from my previous blogs, I was inspired by this article to take on a macro issues of energy involving Shale gas and carbon issues – Is shale gas our future or should we look at other sources of energy? (Molten Consulting).

The title is opened ended… how far is future? And whose future? Shale gas does not and will not make up the majority of energy usage worldwide. It is a substantial portion for the US oil and gas balance. Before there were shale expectations, the theme to balance the energy market was to use all sources of energy including improvement in efficiencies. Supply and demand always meet, it is just a matter of convergence with price as the critical variable to impact supply and demand.

Before Shale:

- LNG imports were going to save the US from sustained $8+/mmbtu prices.

- Imports of crude with a large dependency from Canadian tar sands were going to fill in to maintain oil markets while we slowly convert the US auto fleet to alternative fuels.

- Advance coal would even play a part.

- Nuclear plants were going to easily be relicensed.

- Wind and solar cost would come down in cost and the cross intersection with gas prices at $8+/mmbtu would allow the elimination of subsidies in a few years.

However, shale has allowed this delay as it came with a bonus of liquids production. Middle East LNG and Canadian heavy oil are still there. Both coal and nuclear are actually being hampered because of the shale gas producing poor economics, therefore a significant decline is likely in the US. Renewables will likely continue to require subsidies, and the ability to transform quickly is hampered by the fact that there are physically known recoverable sources of energy to be used if shale gas drops off whether heavy oil, LNG, or even coal.

Technology breakthrough in energy is extremely tough given the capital intensity in the industry. New technology cannot plan or wish for peak oil to produce higher prices to enable their technology. Shale gas has pushed the peak curve much farther out than any of these peak oil theorists would ever imagined. Mr. Shaw brings up the carbon issue as a critical path. Once again, as much new technology cannot plan for peak oil, they probably should not plan on significant carbon prices to make their technology viable. Carbon is not going away, but when countries and individuals cannot even balance their check books, can we really plan beyond 10 years much less 100 years which many of the impacts of climate change will be felt? Debt is no different than carbon, it is kicking the can for the next generation. Therefore, to see any government put in a sustained economic penalty for benefits not seen in decades does not seem likely.

The stretch goal for all new technology in the energy space try to compete with prices now, not on a dependence on something in the future. Just as shale gas came into the picture, other sources of technology have the same opportunity.

Your Optimistic Energy Consultant,

614-356-0484

Power Modeling More Complex than Refining Modeling

With my background in refining modeling, I can say power modeling is more complex than modeling most other markets. The process of producing power is not as complex as refinery production, but the final product pricing and market is significantly more complex. The refining modeling focus is typically on optimizing yield value while changing the crude input quality within the refineries capabilities. The products can be stored and transported to the highest paying markets. With power you just do not have that luxury of storing or even watching where it goes. I will admit there are certainly more dollars in the Oil & Gas world than the power world.

The power market is highly reliant on what the neighboring power plants are doing, and now potentially, your own customers. The other power producers may not be using the same feedstock as you. They also may be operating the plant differently, nonetheless, their actions impact the price and flow of your power in that instant. The amount of information that must be processed in the power markets, to say the least, is voluminous. To do proper power modeling, an hourly model is recommend. If you do not do an hourly calculation you can be misled, for example as in LCOE calculations (https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/ )

There are really two types of modeling that one can do. One is to try to understand market pricing and market dynamics, such as coal and gas demand. In this setup, you draw your circle quite large and potentially model the entire N. America, which I have done numerous of times. In this setup you will model over twenty thousand units. The alternative is to model one’s own system for near-term operations or long-term resource planning, or both. The market prices become exogenous inputs to the model. I would caution against this setup in isolation due to the potential impact you may have on the exogenous inputs. However, in most cases, one typically runs a series of exogenous price inputs to capture the variability.

Both alternatives still deal with the commodity inputs and the load forecast, with the latter being the more potent of the two, assuming you use commodity outlooks across a reasonable range. Whether you are trying to understand market fundamentals or your system budget, you will have to deal with significant uncertainties. Market based modeling compounds your uncertainty multiple times. Modeling your own system, you compress a good portion of the uncertainty into the market price. However, you still are left with dealing with policy issues (to Carbon Price or not – Renewable Portfolios – Demand Side Management – etc…). Of the many moving pieces noted in the check list below, most change frequently over time.

Power Modeling Check List

- Load

- Resources and their Fuel Options

- o Coal – by unit, as coal type and transportation is individual (~1300 units)

- o Gas – by unit, as each plant could have multiple fuel pipeline access (~4600 units)

- Resources and their Performance Attributes

- o Uptimes and downtimes

- o Ramp rates

- o Maintenance

- o Cycling

- o Start-Up Cost

- o Minimum Capacity

- o Variable Cost

- o Fixed Cost

- o Emission Rates

- o Secondary Fuels

- o Heat Rate – Heat Rate Minimum and Curves

- o Storage, Recharge and Initial Contents – for battery & pump storage

- o Bidding – fuel adders to multipliers

- o Performance Shapes (Solar & Wind)

- Emission Pricing

- Federal, Regional, and State Policies and Standards (Renewable & Carbon)

I have been power modeling for over 10 years now – both hands on and managing a team. Recently, I have spent two years modeling for a client essentially being their outsourced modeler. The experience has proven to me the viability and value power modeling outsourcing can have. I would not recommend a complete outsourcing, but I can certainly see outsourcing the functionality pieces. As Managing Director of Strategic Planning at AEP, I would have loved to maintain some continuity with my power fundamentals team and my modelers as they left for bigger and better jobs. Each modeler when left to their own devices will devise a custom setup to manage all this information. The new process would likely leave out something or be organized slightly differently. Sometimes you get quite an inexperienced modeler and they leave out some crucial issues in the power model.

Power modeling implementation is not as simple as rolling out a new version of office and should not be treated that way. Even with “out of the box” software implementations from People Soft, Oracle, SAP, CRM, you still need to bring a whole team of consultants to make sure the process gets implemented effectively. Why would you not take the care to make sure your power modeling is implemented effectively? It does not take a whole team of consultants as People Soft, Oracle, SAP, CRM software would, but you should take advantage of experienced professionals. I know some of the software vendors offer implementation help – but just like People Soft, Oracle, SAP, CRM software, it is best to get people who actually do it as a living. The software people are spending their main resources on their software rightly so. Therefore, talent is not necessarily on par to achieve your business needs.

My power modeling offering is here for you to maximize your investment in both software and staffing. To read more about my offering please visit – http://allenergyconsulting.com/2011/11/modeling/

Your Power Modeling Consultant,

614-356-0484

Peak Oil not before Peak Demand?

A very interesting article in the Washington Post brings up a point that I have always been thinking about – Peak Oil Demand. The premise is, at some point we may reach a point where demand peaks before supply; because of new alternatives and driving behaviors which largely are a result of price induction. It is true if we look at the modes of transportation and energy use, going back to using horse and wood that transformations occur. They do not occur because we physically ran out of them;we still have horses and plenty of wood. Typically it is because better alternatives became viable. And perhaps these better alternatives did not show up until the prices got high enough to incentivise certain individuals to think outside the box.

The question as we look out into the future; have we started to reach that point in oil? Currently I would say besides price induction we have policy induction. In the US, we have large renewable requirements in the gasoline space. Much has been talked about electricity renewable requirements, but there is a transportation fuels renewable requirement. If you go to your gasoline station you will see stickers noting up to 10% ethanol. This is a result of this policy. Ethanol is not necessarily cheaper, but it is a push by policy makers to promote a renewable and domestic option since most of the ethanol will come from the corn industry.

As I noted before in an IDEAL world, I would not support such a program, but we do not live in an ideal world. You have multiple countries who subsidize their citizens for gasoline and diesel; leaving the US and Europe to be the marginal demand countries to stabilize demand with significant price action. If these countries did not do this, then we should not be promoting something more costly and benefiting such few. However the world is what it is.

The current policy actually grows the mandate over the 10% level. This is problematic in that cars are not designed to handle that amount of ethanol. Ethanol burns a lot hotter, requiring better materials and design in cars. There are too many cars out in the market to just allow the rise in ethanol percentage in the gasoline pool. If they did, many cars will likely have mechanical issues. So far policy makers have not done a good job in resolving this issue.

I don’t believe we will reach peak oil demand as quickly as talked about in the article. Demand and price are very well linked. It is possible to hit a peak but given petroleum’s portability and energy density and also the lack of energy use in many parts of the world, demand will continue to rise albeit at a much slower level than in the past, as prices will likely settle. Demand and price is finicky. In the US, as it pertains to gasoline, people are more concern on the rate than the absolute, given the room to adapt as disposable incomes have risen. Many people now consider sub $3.50/gallon gasoline price as cheap, but looking back only a few years ago that would be quite expensive.

Your Energy Consultant,

614-356-0484

WTI – Brent Relationship

It has been a long time since I last blogged. I was busy with work and then had some Rest and Relaxation. I just didn’t get much inspiration from the various energy topics. I was reviewing and reading the “Examining the feasibility of converting New York State’s all-purpose energy infrastructure to one using wind, water, and sunlight” but as I noted in my last blog, it was nothing substantial due to an overwhelming amount of academia and less practical experience. Many others had already commented on the study and noted it as more of a thought piece versus a practical document.

The latest discussion I have had with people is on the WTI-Brent relationship. I alluded in my previous blog that the spread will come in. This was probably one of the best trades I have seen in a while, given all the factors that point to the spread coming in – Pipeline Construction, Potential weakening in Europe and Asia economy relative to the US, increase product Exports from US, and product demand growth in US. The only negative for the spread was the on-going production boom in the US. But the cure for prices whether low or high is usually prices itself.

Now that the spread has come in, many are now jumping on the bandwagon for WTI to be a permanent premium to Brent. However, I believe that is not a likely paradigm, given the US has switch to a products export center – largely to the Americas. In addition continued production from both domestic and Canada will likely make it a discount to Brent, just not as much as was observed over the past year. This is largely based on believing the economic quandaries in Europe and Asia get settled. If that does not work out, the future gets really foggy as US economic conditions will also falter.

I will promise to be more inspired and have more time to discuss the energy issues going forward.

Your well rested blogger Energy Consultant,

614-356-0484

It’s not the end of the world – Climate Change& Quantitative Easing (Printing Money)

I have wanted to write about the similarity between the two most potentially transformative societal issues confronting us, Climate Change & Quantitative Easing (AKA Printing Money). Of recent the latest debacle in a spreadsheet error by Rogoff and Reinhart in their paper “Growth in a Time of Debt” has led my writing astray. However this issue further substantiates the similarity. I am sure my readers know that there was also an issue with climate change data. The most famous was the hockey stick graph presented in the IPCC report. The graph originally came from a report done by Michael Mann in the paper “Northern Hemisphere Temperatures During the Past Millennium: Inferences, Uncertainties, and Limitations”. (One difference is the climate change titles are much longer than economic papers!)

Though the recent debacle includes a simple spreadsheet error the biggest difference from what was reported to what is being challenged by Thomas Herndon, Michael Ash, and Robert Pollin is based on how one treats data and what one excludes or includes. Mr. Herndon and team believe since more data was available for other countries they should be weighted more no matter the differences in economy or time period. Many of the same arguments were made to refute the Mann graph. In the end, BOTH data sets from Mann and Rogoff can be presented to be less dramatic than what both authors presented. However in BOTH cases it does not eliminate the issue that both have presented. In Rogoff case, Mr. Herndon and team state and their own data shows that high debt does not likely lead to better outcomes relative to a lower debt situation. The Herndon and team did conclude there is no magic number that leads to a NEGATIVE growth. However they do note that growth is much less than it would be when debt levels grow above the 90% level. In Mann case, one could argue the graph he presented was on the high-end of uncertainty but the end message no matter what statistical approach you use there is some warming relative to the last 1000 year perhaps just not as dramatic as Mann’s graph.

We can ignore both the issues just because of some technicalities and potential showmanship or we can pay attention to these both very critical points because they contain some probability. We can argue to death to the extent of probability, but there is some threshold that action becomes required no matter what. I believe we have crossed that threshold a while ago in both issues. In terms of actionable items I am not as extreme as some could be since everything is a probable outcome in my mind. Actions need to be commensurate with the probability and timing of the impact. And both issues probability and timing may change as more information and responses are made.

Getting back to the discussion of similarity, both are issues that rely on sacrifice of the future for the current state. Clearly it is “easier” and “cheaper” to continue to burn fossil fuel versus transform the economy. The consequences may be dire, but they are many years off. It is also easier and politically more appealing to increase the money supply driving investments now and have the savers and the future generation deal with the pain later. In each case one could argue we don’t really know the future and perhaps even solutions in the future we cannot predict now will come to fruition. However I would attest that is very poor planning.

There are measures we do each day thinking of the future. Some are simple and have been engrained in society – such as buckling up. We buckle up because it can save our lives. The odd of getting into a serious car accident in your lifetime is 30%. I am not arguing for you not to buckle up, but to show we do act when probabilities are not as great along as the action can be commensurate with the risk and its probability. I am sure you can find many climate deniers to admit there is a 20-30% probability they are wrong – of course that means they are 70% confident it is not. Nonetheless this would argue for action at SOME level if one cared about the future.

Both climate change and quantitative easing are actions that are not apparent at the moment similar to indulging on funnel cake and other unhealthy foods. It feels good now but eventually you will likely get obese and have health issues not worth the gains gathered from the near term enjoyment of sweets. In fact, it will typically be better to emit and print money now. The ultimate consequence of each of them requires a view over many years if not hundreds of years.

On the point of obesity, it clearly shows society is not ready for problems requiring long-term thought. Obesity in the US is very high. This is a matter of caring about what you eat and the long-term issues involved with your choices. We are a society designed for Carpe-Diem and keeping up with the Jones. It may be quite pointless to argue the science of climate change and/or long-term impacts of quantitative easing when society could really care less. It amazes me to see such low savings in both general and retirement savings. So much of society is living on debt. By that logic people don’t really focus on the long-term. I can see somewhat the rationale for many religions to eliminate interest charges – usury. Most religions are focused on maintaining/reducing our vices – e.g. Ten Commandments. I think they realize debt living is not healthy. Living on debt makes you feel good in the moment, but any day it can overwhelm you with a change in your life. A humble lifestyle is too easily gone with the ability to borrow money. We cannot solve these two very large issues without changing society to think longer term. If people do not care about their own lives and cannot plan even their meals to live healthy, do we really expect them to be able to comprehend and plan for climate change which impacts us significantly in 100 years?

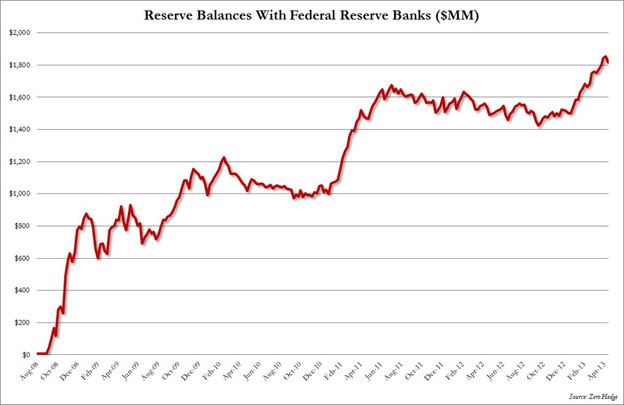

Climate change to me seems more tangible and more discussed with various opinions across academia compared to quantitative easing. This may be based on my career largely in the energy space. However I do read quite a bit and find much more literature on climate than quantitative easing impacts. Climate change certainly seems to have much more historical data with ice core samples thousands of years old. The oldest data set Rogoff and Herndon was working with was 1830. Given this I thought I put some graphs up from various recent reports just so you see why I am alarmed with quantitative easing even though the “market” is doing well.

We are in a world so dependent on debt and fossil fuels. Current trends on climate change and quantitative easing cannot be changed until we change the mindsets of people to think ahead. Planning is gone for Carpe Diem. I like the concept to live for the moment, but what if the next moment depends on how you live in this moment. Do you want more moments? We do not live in Hollywood we live in reality. Please take care of yourselves – eat healthy – do not over-extend your finances – reduce the temptation to keep up with the Jones.

The world will not end because of climate change and quantitative easing. However the world could be very different and potentially less inhabitable and stable if we don’t start dealing with some of our issues which require thought. The probabilities of significant harm to society may not be significant (+50%) but given the extent of outcomes it does make it worthwhile to do some actions similarly as we buckle up.

Your very concerned and thoughtful Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.