Natural Gas Revolution?

Natural gas revolution, perhaps, is real, but it will take more to make it a real revolution. There is no doubt that shale development has made a major leap in gas supplies. However, energy is just a means to an end. In order to make this a real revolution, we need to see ingenuity in using natural gas. With the largest spread between natural gas and oil we should start seeing advancements in gas to liquids. I have done much in this area and have failed to come across something transforming in this field.

You can have all the energy you need and more, but if you don’t use it in a productive fashion you will end up like a third world producer of energy for others to exploit. As a domestic policy focusing on finding and developing energy is valid, but in the end, it is how you plan to use it. We need energy because it brings value to society by enhancing our way of life from keeping us warm in the winter to allowing us to read at night.

So much debate is focused on the industry on how many jobs it can create. Who really cares? Why would one want an economy built on the means not the ends? The less we can require of our means the greater the value of the ends become. The notion of a grand green economy to the massive employment of natural gas or coal is quite unproductive for the long run. Jobs in a sector which only enables you the option to live better cannot deliver much value as in the sector that actually implements better living. Natural gas has an opportunity for electrification, chemicals, petroleum products, goods manufacturing, heating, etc… Focus is needed on how we use natural gas.

Currently natural gas is still being flared around the world including the US. In Iraq alone they are flaring quite bit – http://blogs.platts.com/2013/06/17/iraq-flare/?sf429145=1. For a country who is lacking consistent electricity it would make sense to build up the infrastructure to transport and use the gas for electrification. Ingenuity in developing a means to manage stranded gas and/or increasing the value of that gas is lacking. This will be a revolution as soon as we are able to reduce and/or eliminate flaring of natural gas. The fear is we found a way to find more natural gas, but in the end flare it off in search of the higher value liquids product.

A revolution requires more than a one-sided story. Perhaps the low price signal is the beginning in terms of the market place action. However, there is much needed on the domestic policy front. We need to stop focusing on policies aimed at boosting production and creating an economy from developing energy and start to focus on an economy on using the energy in a productive fashion. Then, and only then, will it be considered a revolution.

As you ponder the path of energy please do consider All Energy Consulting as potential partner. We do technology valuation to forecasting commodities.

Your Energy Consultant,

614-356-0484

Shale Gas Bashing Gone Wrong

There are some very poor “journalism/reporting” on the internet. Businessinsider.com seems to be getting worse. I give them credit for being good entertainment at times. I usually just laugh and scoff at the poor articles and move on. However this latest attempt of journalism/reporting hit home with me – 12 Reasons The American Energy Boom Is Totally Overrated . I didnt read Michael Levi’s book that may have sparked this. I believe Michael would have been more logical and less sensational than BI, given I do follow Michael’s work.

The biggest oversight is the fact the low natural gas price over the last few years have allowed the population to have much more disposable income. This is very simple math as I showed in my previous blog I did last year in January. In that blog, I showed at least a savings of $193 billion dollars. Adding 2012 figures into the analysis total savings are now $283 billion. One needs to remember energy is just a MEANS to an end. Having energy by itself is worthless. Therefore anything to reduce the cost of the means adds directly to the benefit of society.

Let me go graph by graph and refute and/or elaborate where they should have.

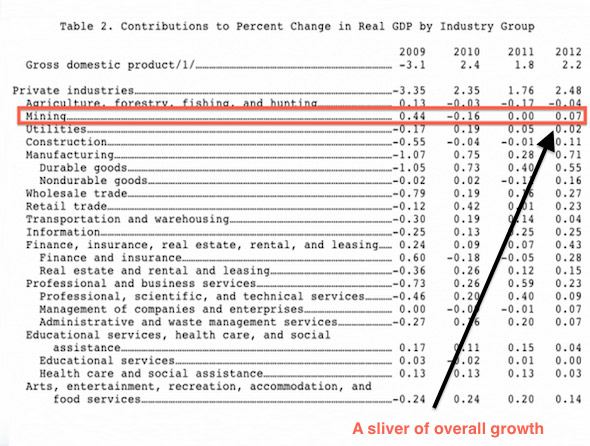

BI:“According to the BEA, the U.S. mining sector, which includes oil and gas production, contributed a measly 7/100ths of a point to the 2.2 GDP growth we saw in 2012”. Please don’t just focus on what they are highlighting, but notice the largest item of growth is manufacturing. Having lower cost power and more disposable income allows this gain.

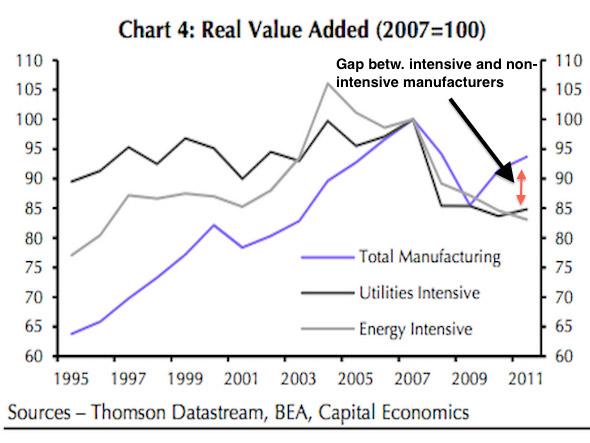

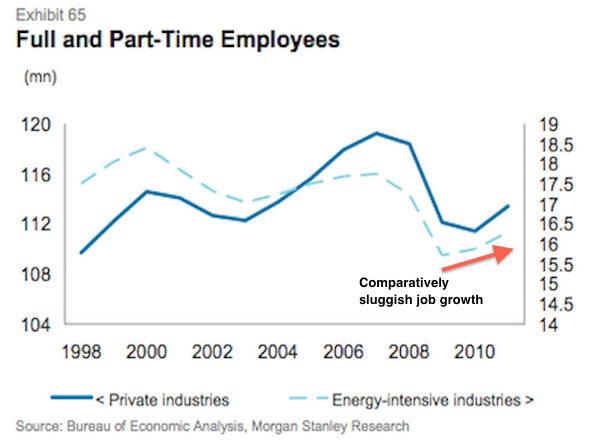

BI: “Energy intensive industries are adding about 10% less value than all manufacturers.” Energy intensive industries take many years to develop due to their large capital investments needed. It is not reasonable to expect the uptick in the energy intensive sectors first. As pointed out in my blog my first year point of shale impact started in 2008. The graph above shows only to 2011 – hardly any time for people to believe and put billions into a project requiring low gas prices.

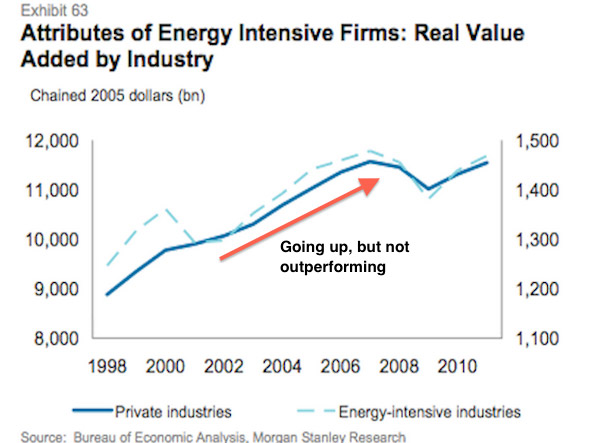

BI: “Relative to the rest of the economy, the energy intensive industries aren’t outperforming.” My response would be similar to the point above. The graphic is even worse since only up to 2010.

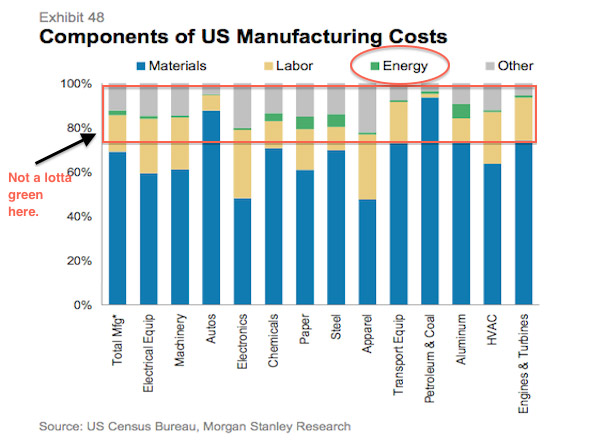

BI: “Energy comprises just a tiny 2% of US of manufacturing costs.” There is a multiplier effect for energy cost in manufacturing. Materials are clearly a large part of manufacturing. How do you think you get materials such as aluminum to make cars? Though Auto, HVAC, Engines, Electronics, Machinery, Transportation, Electrical Equipment shows little energy cost they are highly dependent on the cost of energy per the materials. Materials are not naturally produced as the BI “reporter” would like you to believe.

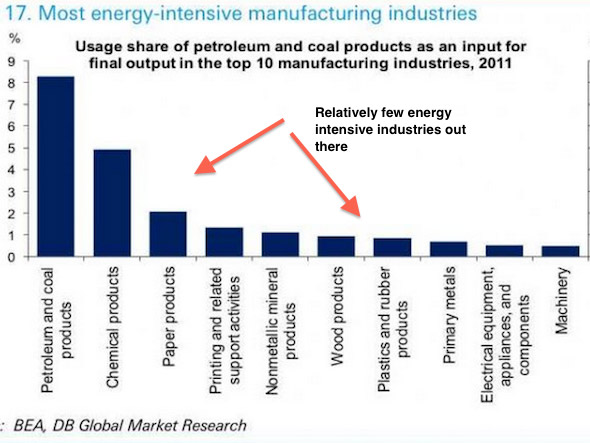

BI: “And only handful of industries are truly energy intensive.” This is a chicken and egg issue. The reason our economy has shifted to be less energy intensive is because of the cost of energy and labor increased relative to the rest of the world. With sustainable lower energy cost there will be a change in the above profile. This is another failure to think and deduce a wrong conclusion. It takes a certain amount of time before energy intensive industries come back, but they will if we don’t mess it up.

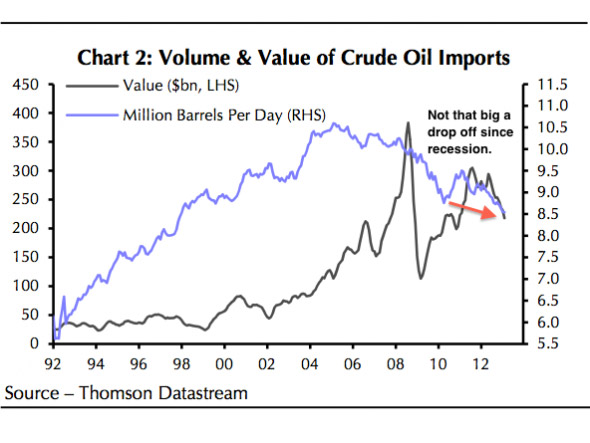

BI: “The volume of petroleum imports have long been declining, and have moved independent of prices.” This is less to do with shale. Shale’s focus is natural gas not oil. The oil decline has more to do with the price of the global oil markets.

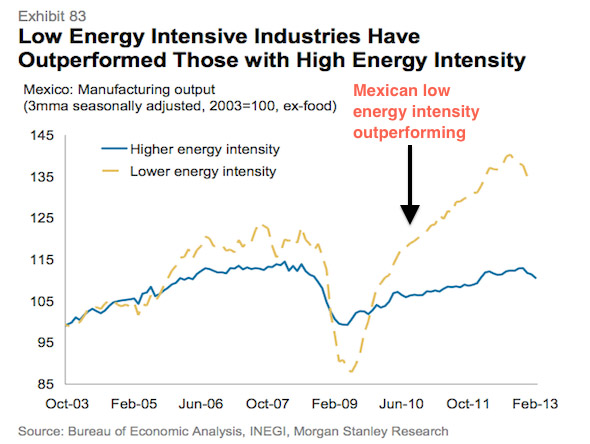

BI: “Mexico has long enjoyed abundant natural gas reserves, but it too hasn’t seen its energy-intensive industries go gangbusters.” Mexico has enjoyed abundant amount of oil also. This has more to do with the political structure and the inefficiencies in their market. Their infrastructure is so bad they import electricity from the US.

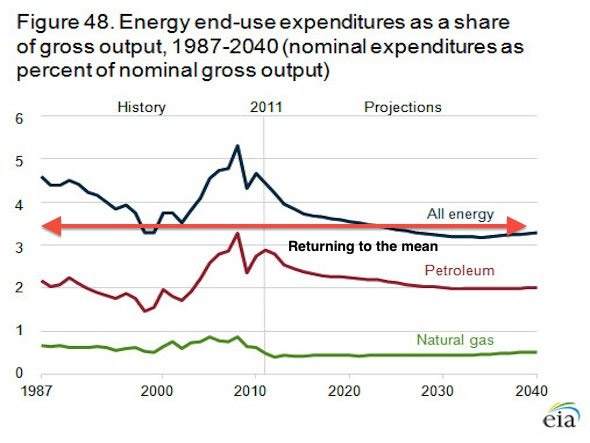

BI: “Energy as a share of gross output has declined to a little over 3%, but it’s almost certainly more a function of oil prices resetting after spiking in 2008.” This is so wrong in so many ways. Half the graph is based on a very poor forecast. The EIA forecast models I have debunked several times on my blog. Just because an agency says something doesn’t make it so, particularly since you can look at their old forecast and see they have a poor track record.

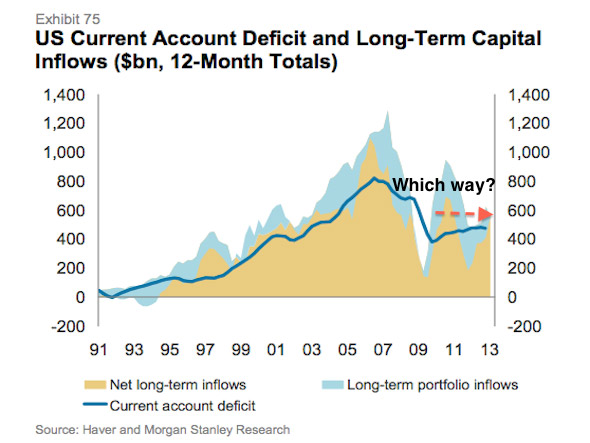

BI: “America’s current account deficit is narrowing, but Morgan Stanley says it’s unclear whether energy will have a material impact on this.” I don’t see this supporting the stance that shale is not impactful. In addition the own statement of “unclear” they should have left it out of the analysis.

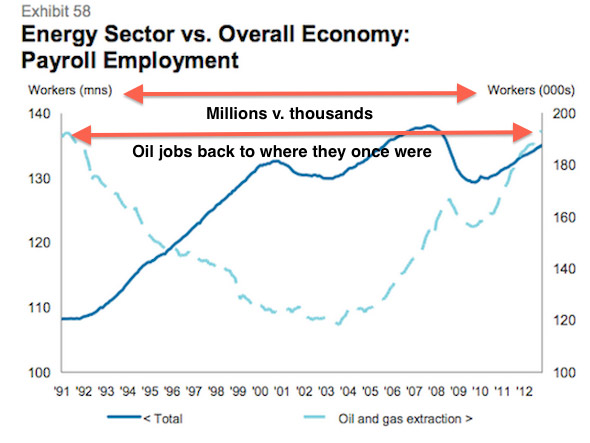

BI: “Employment in the oil and gas industry is less than 1% of the national total, according to Morgan Stanley.” Employment in the oil and gas industry is not the target. As noted energy is a means to an end. You use energy because it allows you to do something. The cheaper the energy the more things get created.

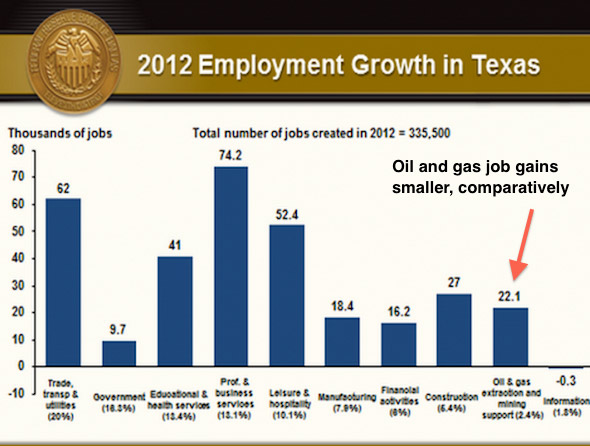

BI: “Even in Texas, the oil and gas industry and its support services constituted just 6.5% of all jobs.” Why would you want a sector who only allows you to do something be the major portion of your economy? Energy is creator of jobs which should be focused in the use of energy not the finding or developing.

BI: “Employment in energy intensive industries has picked up, but the rate trails that of the rest of the economy.” As I pointed out in many points above, the energy intensive industry takes time to develop given the billions required. A new steel or chemical plant is not cheap. They are assets which will last decades. Making an investment decision takes time to build a sustained belief in lower natural gas price – just few years back gas was forecasted to $8+/mmbtu. The shale revolution is only in its 4th year.

Very funny the next article in BI after this shale article is the SOLAR BOOM! Well, I bet they will discuss how many jobs are created. Once again having an energy source which requires lots of manpower is not something to strive for. Having employment in using energy by creating something to better society should be the goal.

This was a very poor article by BusinessInsider. I hope Henry Blodget does a better job screening. My appreciation for BI has dropped over the past year. The page creation machine will eventually get you if you don’t manage your quality.

Energy is a means to an end. The shale revolution is advantageous to the US if we let it be. I believe carefully constructed regulation and enforcement should be implemented to constrain the bad actors, but we should not villianized a whole sector out of ignorance.

Your Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

It’s not the end of the world – Climate Change& Quantitative Easing (Printing Money)

I have wanted to write about the similarity between the two most potentially transformative societal issues confronting us, Climate Change & Quantitative Easing (AKA Printing Money). Of recent the latest debacle in a spreadsheet error by Rogoff and Reinhart in their paper “Growth in a Time of Debt” has led my writing astray. However this issue further substantiates the similarity. I am sure my readers know that there was also an issue with climate change data. The most famous was the hockey stick graph presented in the IPCC report. The graph originally came from a report done by Michael Mann in the paper “Northern Hemisphere Temperatures During the Past Millennium: Inferences, Uncertainties, and Limitations”. (One difference is the climate change titles are much longer than economic papers!)

Though the recent debacle includes a simple spreadsheet error the biggest difference from what was reported to what is being challenged by Thomas Herndon, Michael Ash, and Robert Pollin is based on how one treats data and what one excludes or includes. Mr. Herndon and team believe since more data was available for other countries they should be weighted more no matter the differences in economy or time period. Many of the same arguments were made to refute the Mann graph. In the end, BOTH data sets from Mann and Rogoff can be presented to be less dramatic than what both authors presented. However in BOTH cases it does not eliminate the issue that both have presented. In Rogoff case, Mr. Herndon and team state and their own data shows that high debt does not likely lead to better outcomes relative to a lower debt situation. The Herndon and team did conclude there is no magic number that leads to a NEGATIVE growth. However they do note that growth is much less than it would be when debt levels grow above the 90% level. In Mann case, one could argue the graph he presented was on the high-end of uncertainty but the end message no matter what statistical approach you use there is some warming relative to the last 1000 year perhaps just not as dramatic as Mann’s graph.

We can ignore both the issues just because of some technicalities and potential showmanship or we can pay attention to these both very critical points because they contain some probability. We can argue to death to the extent of probability, but there is some threshold that action becomes required no matter what. I believe we have crossed that threshold a while ago in both issues. In terms of actionable items I am not as extreme as some could be since everything is a probable outcome in my mind. Actions need to be commensurate with the probability and timing of the impact. And both issues probability and timing may change as more information and responses are made.

Getting back to the discussion of similarity, both are issues that rely on sacrifice of the future for the current state. Clearly it is “easier” and “cheaper” to continue to burn fossil fuel versus transform the economy. The consequences may be dire, but they are many years off. It is also easier and politically more appealing to increase the money supply driving investments now and have the savers and the future generation deal with the pain later. In each case one could argue we don’t really know the future and perhaps even solutions in the future we cannot predict now will come to fruition. However I would attest that is very poor planning.

There are measures we do each day thinking of the future. Some are simple and have been engrained in society – such as buckling up. We buckle up because it can save our lives. The odd of getting into a serious car accident in your lifetime is 30%. I am not arguing for you not to buckle up, but to show we do act when probabilities are not as great along as the action can be commensurate with the risk and its probability. I am sure you can find many climate deniers to admit there is a 20-30% probability they are wrong – of course that means they are 70% confident it is not. Nonetheless this would argue for action at SOME level if one cared about the future.

Both climate change and quantitative easing are actions that are not apparent at the moment similar to indulging on funnel cake and other unhealthy foods. It feels good now but eventually you will likely get obese and have health issues not worth the gains gathered from the near term enjoyment of sweets. In fact, it will typically be better to emit and print money now. The ultimate consequence of each of them requires a view over many years if not hundreds of years.

On the point of obesity, it clearly shows society is not ready for problems requiring long-term thought. Obesity in the US is very high. This is a matter of caring about what you eat and the long-term issues involved with your choices. We are a society designed for Carpe-Diem and keeping up with the Jones. It may be quite pointless to argue the science of climate change and/or long-term impacts of quantitative easing when society could really care less. It amazes me to see such low savings in both general and retirement savings. So much of society is living on debt. By that logic people don’t really focus on the long-term. I can see somewhat the rationale for many religions to eliminate interest charges – usury. Most religions are focused on maintaining/reducing our vices – e.g. Ten Commandments. I think they realize debt living is not healthy. Living on debt makes you feel good in the moment, but any day it can overwhelm you with a change in your life. A humble lifestyle is too easily gone with the ability to borrow money. We cannot solve these two very large issues without changing society to think longer term. If people do not care about their own lives and cannot plan even their meals to live healthy, do we really expect them to be able to comprehend and plan for climate change which impacts us significantly in 100 years?

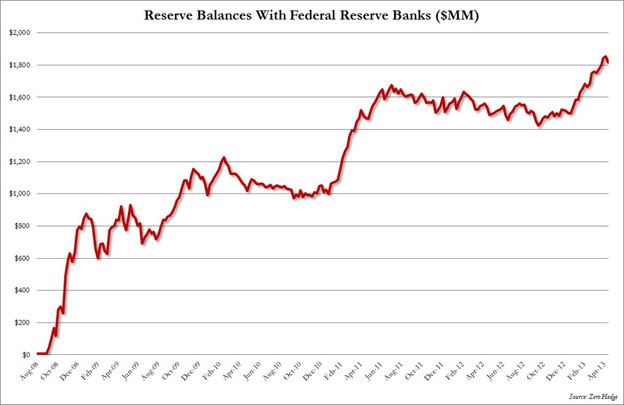

Climate change to me seems more tangible and more discussed with various opinions across academia compared to quantitative easing. This may be based on my career largely in the energy space. However I do read quite a bit and find much more literature on climate than quantitative easing impacts. Climate change certainly seems to have much more historical data with ice core samples thousands of years old. The oldest data set Rogoff and Herndon was working with was 1830. Given this I thought I put some graphs up from various recent reports just so you see why I am alarmed with quantitative easing even though the “market” is doing well.

We are in a world so dependent on debt and fossil fuels. Current trends on climate change and quantitative easing cannot be changed until we change the mindsets of people to think ahead. Planning is gone for Carpe Diem. I like the concept to live for the moment, but what if the next moment depends on how you live in this moment. Do you want more moments? We do not live in Hollywood we live in reality. Please take care of yourselves – eat healthy – do not over-extend your finances – reduce the temptation to keep up with the Jones.

The world will not end because of climate change and quantitative easing. However the world could be very different and potentially less inhabitable and stable if we don’t start dealing with some of our issues which require thought. The probabilities of significant harm to society may not be significant (+50%) but given the extent of outcomes it does make it worthwhile to do some actions similarly as we buckle up.

Your very concerned and thoughtful Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

Revisited Post – Coal is not Dead!

Coal is not dead as I pointed out in last years post – https://allenergyconsulting.com/blog/2012/04/11/the-demise-of-coal-overstated/

I am sorry I am late in publishing my blog. Life is catching up on me. For a quick blog I thought I review what I wrote around this time last year. It was good that I was right. Gas prices have significantly firmed up relative to last year – in fact they have DOUBLED!

As I pointed out in my blog last year, much of the downfall can be attributed to the weather. There is some attribution for weather again for the move up. This years winter was cold relative to normal. Global warming this year took a break – unfortunate for those in Ohio. We actually had a freeze warning last week! Nonetheless, as I expected, prices of natural gas price rose from their extreme low. Even if winter was not as cold but normal, I am sure gas would be still north of $3.75/mmbtu.

The fun thing to watch this year will be spot prices of coal. I suspect we will see firming in the spot prices as I expect many coal generators given their pain over the past few years under contracted the amount of coal they will actually consume. This may not present itself till after June/July given they are right now suspecting weather could save them.

I am still working on my piece of Global Warming and Quantitative Easing and their similarities. Just like the hockey stick issue that occured in Global Warming – looks like there is a hockey stick issue for QE in academia – http://www.forbes.com/sites/realspin/2013/04/18/that-reinhart-and-rogoff-committed-a-spreadsheet-error-completely-misses-the-point/

Please do consider All Energy Consulting for your energy consulting needs. The blog has documented our general outlook. As you can review my blog we are quite prescient of the future as it pertains to energy.

Your very Prescient Energy Consultant,

David K. Bellman

614-356-0484

Refining in the 21st Century Part 1 Cont’d

“He who can no longer pause to wonder and stand rapt in awe, is as good as dead; his eyes are closed.” Albert Einstein

I am sorry for those anxiously awaiting the continuation of Refining in the 21st century. I have been very busy for which I am very grateful for. I hope you have taken the time to reflect on what was discussed in the previous blog. A pause goes a long way in allowing us to process. Without further ado…..Part 1 cont’d.

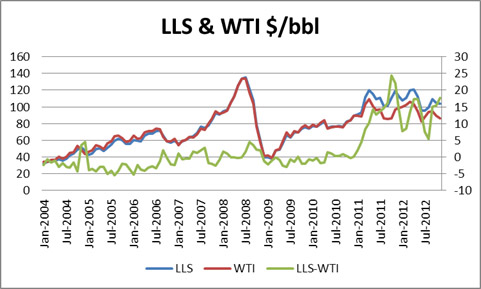

Now that the new paradigm has been set for oil, there are many inter-relationship that have changed. Of recent ,the EIA has shifted its reference fuel to Brent. This is a very reasonable shift as the center of demand is no longer the US but the growing Asia region. As an aside note, all the years I was at Purvin & Gertz, we never really believed WTI represented an appropriate benchmark for USGC. The better benchmark was LLS. However the financial market was too fixed to WTI to be able to change the benchmark. Currently you can see the reason why WTI can fail as a USGC benchmark. With the spread to LLS blowing up as pressure from Canada and shale oil have practically filled the center of the US; and with limited access to the USGC from Cushing WTI, it has decoupled to say the least against LLS – see chart below.

In the long run, this is one of the less costly economic arbitrages to solve via pipelines. In fact there is a pipeline reversal occurring this year along with an expansion. However the future markets continue to show a large spread with 2014 spread still above $5/bbl. A pipeline from Cushing to USGC should be able to produce reasonable economic return for $2/bbl with the past demonstrating much less.

Also many don’t understand a very important policy choice, that the Energy Policy and Conservation Act 1075 (P.L. 94-163, ECPA) which directs the President to restrict the export of crude oil. The US is in a very unique position given the shale revolution not only increased natural gas production, but also significant liquids production. This policy decision should lead to some strong US refining outlooks.

When we examine the refining world as I discussed previously, it is very highly dependent on the feedstock. There is so much to cover in understanding refining economics that I will write this section requiring some basic understanding of refining. Basics include crude oil quality and the difference between hydroskimming, cracker, and coker. Also an understanding of why refiners chose various crudes. I have spent days teaching the basics to clients who are brand new in the refining business. In fact one of my first international task was a course on refining to PDVSA. I have built some of the most sophisticated models for crude evaluations for both buying and selling. I believe the Kuwait Petroleum Company still uses the model we worked up for them at Purvin & Gertz. Nonetheless refining is not a simple discussion without some basic understanding.

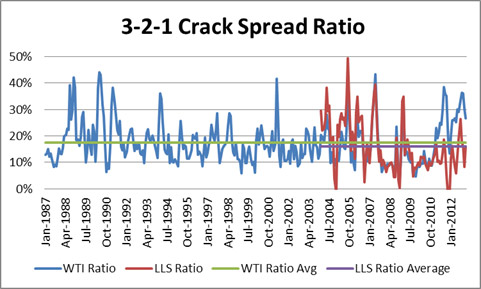

With the paradigm shift of higher prices allowed the spread of products to widen. It is only natural to think margins should move as percentages instead of absolutes. If your feedstock cost you $10 and your margin is $1 your return is 10%. If your feedstock is $20 and you still only obtained a dollar margin your return not drops down to 5%. This is likely going to hamper your ability to get financing and potentially put you out of business as your weighted average capital cost is above that unless you are regulated entity. This should be no different in the refining industry. The absolute value of the margin spread will be forever much larger than historical view until the feedstock falls back down. The proper view for refining margin is to view it as return on feedstock as seen below.

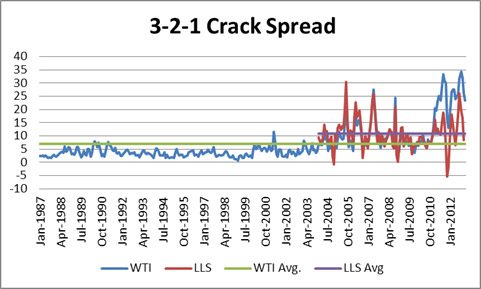

A return of 16-18% will likely suffice in the USGC to keep the industry going. WTI and LLS will converge to produce a return at that level. If we looked at it on an absolute basis – see below, it would suggest that refining margins will have much to fall in this $100/bbl environment, which is not the case.

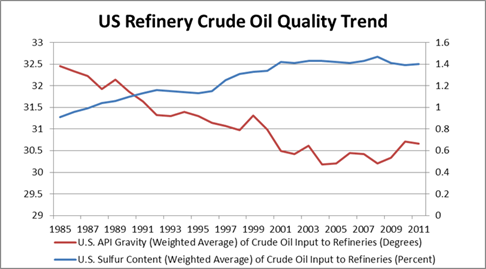

The second most significant change in refining was the underlying belief in the increasing lower API and higher sulfur crudes – figure below. This made the refining strategy focus on technology and those that can process the more complex crudes would win over the simple refiners.

This came at a cost in both technology and variable cost. However the shale revolution has changed that paradigm. The liquids being discovered within the shale did not increase in API and also has lower sulfur. This caused those who embarked on the above strategy a mismatch. The light/heavy differential is not as wide enough for the increase cost these refiners now have compared to the simpler configurations. This will likely not alter the long-term requirement of the crack spread to produce 16-18% return on feedstock, but it will impact inter-refinery competition and the strategy used to manage a refinery. Once again my services would include helping you review your refinery and from crude selection to refinery optimization.

In Part 2 we will discuss where the markets will go from here. If you review what we have covered you will likely have a good idea already where the markets will go. Critical thinking is key in the forecasting business. I have had good fortune in my career to build that skill set. Please do consider All Energy Consulting for your energy consulting needs.

Your Very Grateful Energy Consultant,

614-356-0484

AEO 2013 Early Release – Arbitrage Remains

The EIA released an early release of the AEO 2013 in December. I have been so busy, I haven’t got a chance to note some of the changes (Once again, not complaining but very grateful). As I mentioned in my previous blog of the AEO 2012 release, the first thing I like to look at is the relationship changes.

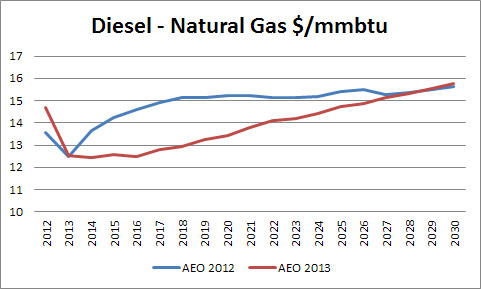

In this release, it looks like the arbitrage remains for someone to capitalize on the difference between natural gas and diesel. They did narrow the spread relative to last year which I believe is directionally correct. The difference continues to be large on the scale of over $15/mmbtu in the next decade plus. The propane difference is over $10/mmbtu. With this spread premium, one really needs to question the science and economics of Gas to Liquids (GTL). GTL is possible, though costly, as proven by Shells Qatar Pearl facility. With the economics presented from Shell, you would need your input price below a dollar to make the project worth its large capital cost ($19 billion) and the associated market risk.

The opportunities exist for Shell to learn from this large venture to see if they could lower the cost and/or improve the yield or perhaps, Shell technology is just not the way to go. This could be a worthy consideration for research from the US government and universities. GTL could be the game changer which would bolt on perfectly with the game changer shale gas. I have spent much of my time as Chemical Engineering examining this area. The cost is what I believe really shifted the spread to be so large; $19 billion for 1.6 bcf/d of conversion is incredible. Perhaps. Shell is scaring the competitors away from researching this?

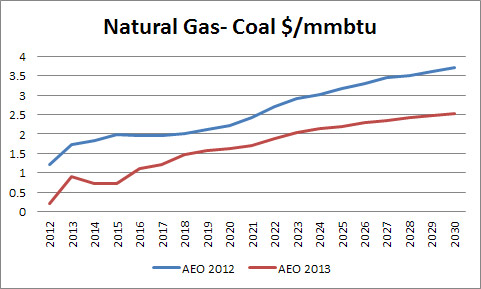

Jumping to the next relationship, Gas – Coal; we see they have narrowed the spread more in this year’s AEO 2013. Essentially they have lowered the gas price relative to last year by around $1/mmbtu. I cannot agree with their 2014-2017 outlook. I believe they have gone too far down. If you look at the balance, it would not make sense that 2015 gas demand in the power sector would be lower than it was projected in 2013 with lower gas prices in 2015. I understand as new gas units come into the power stack, you get an improvement in efficiency for gas units.

However, at the same time, we do have a retiring coal fleet plus the “must-run” coal plants to manage the safety of the coal piles will be going away over time. I believe it is possible to see gas demand higher than in 2012, even with higher gas price. For the very reason that coal units were running more than economically reasonable to manage inventories, under coal contracts which were contracted years back. To the coal industry own doing, the coal contracts were shortened to be no greater than 5 years. This would mean many coal contracts are in negotiation at the lowest need time period for coal generators. I suspect as much as coal generators over bought in the contracts over the past 5 years, they will under buy now. Coal “must-run” units to manage inventory will be a thing of the past over the next 5 years. I will take the bullish position on coal spot prices.

As a commodity forecaster for many years, when the general equilibrium fancy models catches up to your outlook, you know that you now have to take a difference stance. I believe gas prices in the AEO 2013 are too low now. This belief is driven from the fundamentals of economic demand creation from low gas price in both the industrial and power sector. I believe coal prices in the spot market will be stronger than most think, as the most likely outcome is under-contracted coal volumes.

I hope to have more time to review the final report which is expected to be released in the spring. Does the report come sooner now since Punxsutawney Phil saw no shadow and predicts an early spring?

Please do consider All Energy Consulting for your energy consulting needs from forecasting to planning to actually doing hands on work in creating models, we are here for our clients.

Your Energy Consultant,

614-356-0484