Coal Producer and Coal Generator Strategy to Survive

A block buster deal by Consol along with my continuing blogs with the ScottMadden Energy Industry update in the section on rates, regulation, and policy, is inspiring this insight. As noted in the industry update, several policies are set to minimize coal generation. However, the biggest harm to coal did not come from the government, but the natural gas industry. Shale gas revolution is causing the big harm. If gas prices were to be in the $4-7+/mmbtu range, many decisions to install control equipment at these power plants would have been easily made. However, prices are now at the point that it does not make too much economic sense to invest in a several decade old plant when a brand new gas plant can be built at roughly the same cost. The benefit of added capital cost in the past was made up by the lower fuel price over time.

Shale gas has placed a big question mark on the long-term price of natural gas in the US on the market participants. If prices were to sustain around $3/mmbtu, there is no doubt that a significant amount of coal retirements would occur, including possibly fully control plants, as low power prices are not covering existing fixed cost. Eventually the coal industry would be left with barely a shell from the past. However, before we all jump on that trajectory, I will be willing, as I have been in the past to be the counter forecaster to the rest of the market.

On the bearish side of gas, there is quite a bit of evidence that production cost may actually be coming down for shale. Also, producers have a strong zeal to continue to post strong production numbers in face of relatively poor economics, as share prices are being rewarded. The btu in the ground will still be there for a few years later, but money now is the key for many publically traded companies. Long-term thinking may be pushed to the wayside as management teams have options, and shareholders want dividends now.

On the bullish side, what is not discussed more is the demand response that is likely to occur, but just takes time. As noted in several post, the demand for natural gas in the industrial sector is very binary. There is not ramping of natural gas demand as a brand new chemical plant, power generator, or LNG export terminal comes online. All these investments take time and large amount s of capital. No one places a $1+billion dollar investment for a price move which occurred in a one or two year period. A sustained belief that prices will be relatively low allows investments to be made. As noted in the ScottMadden energy update over 35 Bcf/d are looking for export license. We have at least 5-10Bcf/d already approved and very likely. To put that into some perspective, total US demand in 2012 was around 70 Bcf/d. If around 40GW of coal retire plus the addition of the LNG exports, the total demand from those two activities can surpass the entire US residential demand in natural gas. This is not insignificant.

Note: Expect in the coming months a long-term gas price projection from All Energy Consulting.

With world markets natural gas price north of $7/mmbtu, the US natural gas prices will likely move in that direction, as LNG exports try to capitalize on the market differences. IF coal producers and generators can believe over the next few years, we will see prices north of $4/mmbtu, on a consistent basis coal retrofit decisions become more likely. The coal market participants must realize there will likely be no more coal builds with the number one reason, not being the EPA or natural gas prices directly, but the plain fact the cost of building a coal plant is very high as seen in the recent Turk Coal plant built by AEP. The article is honoring the plant, but that honor comes with a high price tag of $3000/kW, almost twice expensive as the state of the art gas plant. For this very reason, new coal plants will be limited. Therefore, the only coal demand in the US will be from the existing coal plants. Coal producers and generators need to realize this fact. If the units retire, there is no coming back for that demand. Therefore, it is of the greatest need to figure out a way to keep the units economical to the point they do not retire.

My strategy for the survival of the US coal industry is to be creative with coal contracts. Go back to the old fashion way of creating coal contracts which are plant specific and less commodity like (non-homogenous). Both the producer and generator need to do the analysis and/or hire third party like myself to evaluate the economics at each plant. A spread should be produce based on the local natural gas benchmark. This spread should be to the point that it enables the plant to economically run in the current poor gas price. For the shared suffering in today’s price, the producer will then get the upside when the market recovers. If the market does not recover it does not matter anyway. The industry needs to save what they can or it will be lost forever.

As noted in the article, I would be glad to facilitate and produce a contract which produces a win-win situation for both the coal producer and coal plant. I have the ability to produce unique solutions which can benefit both parties. Please do consider All Energy Consulting.

Stay tuned for the Long-term Natural Gas price outlook.

Your Energy Consultant,

614-356-0484

Shale Gas and Carbon thoughts

Taking a break on the various issues of utilities from my previous blogs, I was inspired by this article to take on a macro issues of energy involving Shale gas and carbon issues – Is shale gas our future or should we look at other sources of energy? (Molten Consulting).

The title is opened ended… how far is future? And whose future? Shale gas does not and will not make up the majority of energy usage worldwide. It is a substantial portion for the US oil and gas balance. Before there were shale expectations, the theme to balance the energy market was to use all sources of energy including improvement in efficiencies. Supply and demand always meet, it is just a matter of convergence with price as the critical variable to impact supply and demand.

Before Shale:

- LNG imports were going to save the US from sustained $8+/mmbtu prices.

- Imports of crude with a large dependency from Canadian tar sands were going to fill in to maintain oil markets while we slowly convert the US auto fleet to alternative fuels.

- Advance coal would even play a part.

- Nuclear plants were going to easily be relicensed.

- Wind and solar cost would come down in cost and the cross intersection with gas prices at $8+/mmbtu would allow the elimination of subsidies in a few years.

However, shale has allowed this delay as it came with a bonus of liquids production. Middle East LNG and Canadian heavy oil are still there. Both coal and nuclear are actually being hampered because of the shale gas producing poor economics, therefore a significant decline is likely in the US. Renewables will likely continue to require subsidies, and the ability to transform quickly is hampered by the fact that there are physically known recoverable sources of energy to be used if shale gas drops off whether heavy oil, LNG, or even coal.

Technology breakthrough in energy is extremely tough given the capital intensity in the industry. New technology cannot plan or wish for peak oil to produce higher prices to enable their technology. Shale gas has pushed the peak curve much farther out than any of these peak oil theorists would ever imagined. Mr. Shaw brings up the carbon issue as a critical path. Once again, as much new technology cannot plan for peak oil, they probably should not plan on significant carbon prices to make their technology viable. Carbon is not going away, but when countries and individuals cannot even balance their check books, can we really plan beyond 10 years much less 100 years which many of the impacts of climate change will be felt? Debt is no different than carbon, it is kicking the can for the next generation. Therefore, to see any government put in a sustained economic penalty for benefits not seen in decades does not seem likely.

The stretch goal for all new technology in the energy space try to compete with prices now, not on a dependence on something in the future. Just as shale gas came into the picture, other sources of technology have the same opportunity.

Your Optimistic Energy Consultant,

614-356-0484

EPA Proposed CO2 Pollution Standard – Gas more impactful near-term

EPA 2013 Proposed Carbon Pollution Standard for New Power Plants has made some news with much of the focus on coal. I believe the coal issue could be quite a smokescreen given the current economics of coal as it relates to gas. The coal limits are not likely going to impact much of anything over the next few years – perhaps not even in the next 5+ years. For the current impact the devil is in the details.

The natural gas limits probably could use more discussion for its near term relevance to prices for the consumer. For baseload gas plants, the limit is a non-issue (heat rate of 8.4 to 9.2 mmbtu/MW). However anyone with some/limited experience in the power markets realize the diversity of plants is needed not just on fuel perspective, but on a performance perspective. Load can be quite volatile and spiky. There is no need to build a baseload plant for a few hours of the year. Therefore the industry builds peakers to meet these events. Peakers attributes are a cheap unit that is not required to run a lot, therefore variable cost less important than fixed cost and that they need to turn on and off quickly.

Peakers have generally been very high heat rate units as the variable performance was not important. As noted in a paper I lead for the National Petroleum Council – ELECTRIC GENERATION EFFICIENCY – “The efficiency of a new power plant is largely a function of economic choice. The technology is well understood in order to produce a highly efficient plant. In order to produce higher efficiencies, higher pressure and temperatures are required. This increases the cost of the plant as special alloy materials will be needed.”

Therefore higher efficiency is not a leading attribute for a unit expected to run only a few hours in year. The additional expense of higher capital and higher operational cost is not worth it. Currently the average natural gas peaker heat rate in the country stands at 11.3 mmbtu/MW. There are new “peakers” being built at heat rates around 8, but they are not really being built for peaking operations as described above. They do cost more and therefore are anticipated to operate more often. This new carbon standard will first impact capacity markets. As an example the PJM capacity market is using a Cost of New Entry (CONE), the peaker attribute used to calculate CONE is at 10-10.3 mmbtu/MW. This will need to be changed, which will increase the cost of the CONE, therefore increase the cost of the capacity markets. The cost will go directly to the ratepayers.

I am not saying the standard is wrong in any way and that we should not be doing any risk mitigation for carbon. I am just pointing out the real impact of the standard that will likely be felt in the short-term. As long as society knows its cost and benefit and is in agreement than the standard is appropriate. Adding a CO2 hourly limit standard for peaking plants seems in-appropriate. They could have put in a daily limit for small gas plants so that they could still run a few hours and be within the standard. This small amount of CO2 emissions will not do much risk mitigation, but may add more cost than benefit.

In the long-term, this pretty much puts a nail in the coffin into new coal plants. The effective heat rate being asked of a coal plant which cannot be achieved even by a gas plant is 5.4 mmbtu/MWh. This essentially requires some sort of carbon capture and sequestration/storage (CCS). Being involved in CCS at AEP, the cost is extremely high and there are some serious risks. The risk/reward profile is not there for an investment in new coal plants even if gas prices were to be $6+/mmbtu. Once gas prices rise closer to $7+/mmbtu, partial capture could make economic sense as noted by the EPA. However the world of $7+/mmbtu prices currently seems far away.

Your Energy Consultant looking at the details for you,

614-356-0484

Gas Basis Phenomenon – Million Dollar Plus Question Will it Go On?

I am surprised not to hear more discussion on what I believe is one of the biggest market questions for both the natural gas and power markets in the US. The gas basis (spread between the locational point and henry hub) in the Midwest has gone negative in June and has stayed that way. In addition, the forward curves portray that outlook with the 2016 basis spread averaging a minus 40 cents for Dominion South Point.

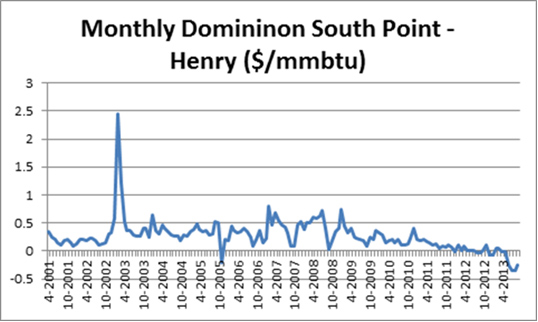

Looking at the basis spread on a monthly level through time clearly shows historically the basis is a positive 30 cents with some extreme upside.

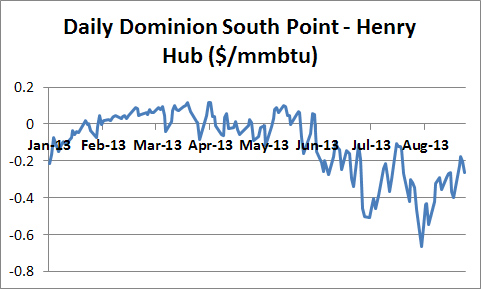

Viewing the spread on the daily basis shows the amazing change in June of this year.

There is much significance to this paradigm shift. Number one the coal competition lies in the Midwest not much in Texas. Henry Hub is the most quoted and reference gas price, but with this shift a $4 henry is not the same impact as it was just a year back for coal to gas switching. A years back you were talking a $4-4.5/mmbtu gas price to coal spread, now you are talking about $3.50-4/mmbtu. As I have noted before moving into the sub $4 range the competition heats up. Retirement and operational decisions of the coal plants in the Midwest becomes even more dire with such a negative basis outlook.

On a trading perspective, one can trade the basis. Trading basis removes the guess work of where the macro supply/demand of natural gas is going. In doing so, you somewhat mitigate some of the weather impacts. Arbritrages like this don’t come so often. The shift in basis and the continuation has resulted from infrastructure and related issues. Utica and Marcellus has clearly changed the dynamic of natural gas pricing in the US. The million dollar plus question is how long can this persist. Natural gas infrastructure development is rather quick compared to power development. Right of ways issues can be mitigated by building right on top of the existing path ways. Rates of returns can be captured with spreads such as a 40 cent differential to henry hub. I am surprised how long the forward curve goes out with such a discount. In fact the discount is seen every month even on the historically largest premium month February. Perhaps the trade you should not leave on the table….

Your Energy Consultant looking for a few good clients – if you are interested, please call me,

614-356-0484

Sacrifice Now and for Others … Tough Choice

Recent NPR story goes to the heart of the issue of sacrificing for the environment. Whether the country is Ecuador or the environmental concern, the issue is global warming to water pollution. There is some form of sacrifice that the environmentalists ask for and typically from others. On many levels, these are reasonable and self-beneficial sacrifices. However, in this case, I can empathize with Ecuador’s President, Rafael Correa. “Do we protect 100 percent of the Yasuní and have no resources to meet the urgent needs of our people, or do we save 99 percent of it and have $18 billion to fight poverty?””

The country is far from the standards of living seen in the western developed world. At the same time, the biodiversity in much of Ecuador is abundant and untouched. The price of oil has risen to such great levels of recent and could supply much needed capital resource to the country. The environmentalist would argue that sacrifices need to be made to protect this rich environment, yet no one seems to really see who is actually hurt by this sacrifice. The environmentalists in the west continue to live in the comfort of their homes with vehicles and roads not seen in Ecuador. The environmental fears presented in the end cannot outweigh the economic fact and reality of sub-standard living in Ecuador, and the real impact that further resource extraction could add.

In this case, the larger society gains can be seen and the environment sacrifice is likely inevitable. People who care would have the right to purchase the land, but as anyone selling something, it will be priced at the cost of the value it would add. This cost would seem too much for anyone or any country. The article noted they only were able to obtain $6.5 million.

This trade-off issue can also be seen in the US in the shale plays. Many environmentalists, who once again, do not live on or around the land that they are trying to protect, continue to try to limit the development with no empathy for those people who have direct benefit. The people who are directly involved and owned the land, typically for many generations, are not empathized with the environmentalists in their pitch to stop the shale development. In many cases, these owners have been left behind in the economic boom over the last 30 years in the US. As in Ecuador, economic well-being of those directly involved,make environmental sacrifices harder. Without the acknowledgement and consideration of those individuals’ benefits, we cannot come to a fair balance for the environment and economy.

Food for thought as you see and hear more on the anti-shale front.

Your Energy Consultant,

614-356-0484

Anti-Shale Gas – Anti-Fracking The case for more Effective Regulation

There is so much negativity on shale and frackin, it is quite amazing. You have the Gas Land movies who document all the POTENTIAL negatives of fracking.; a big push by many environmental groups to stop fracking, likely as a result of low gas prices lead to poor economics for renewables; and shale bashing all in the name of generating page hits, as pointed out in my previous blog.

I will agree that bad things CAN happen with fracking. However, it is no different than bad things happening with cars. Do we ban cars? We have drunk drivers and now texting drivers, and odds of being in a serious accident as high as 30%. Let us ban cars! Why we don’t ban cars because of the many examples of safe driving and the amount of value it can add to society. Because of these potentially bad outcomes of driving, we have regulations for driving from age limits, alcohol blood limits, stop lights, driving rules, etc… Fracking has occurred for many years – over 40,000 wells in the US since 1990. To say low natural gas price has not helped society is to deny reality. As I noted in the previous blog since 2012, shale gas has added $283 billion to the economy.

I will agree that there has been some bad incidents associated with fracking. However, these bad incidents could have been easily avoided with EFFECTIVE regulations. Government, in its raw form, is designed to control our vices. “Society is produced by our wants, and government by our wickedness; the former promotes our happiness positively by uniting our affections, the latter negatively by restraining our vices.” Thomas Paine.

Bad eggs/actors will come and go no matter what the subject, from sports to academia, to government, to industry. The system of checks and balances regulates and manages these bad eggs. Fracking issues are not any different. Effective regulations are needed. As a society, we need to spend capital and time on the regulators and building logical rules and inspection processes. We can take some of the $283 billion saved from fracking and add some “insurance” component to do more routine inspections of wells and in all parts of the life cycle of the well. We need to hold accountable companies who break the rules. The judicial system and all the loop holes of paying a fine and admitting no wrong-doing is a bunch of BS. People justify this because of the cost it would have on the government to litigate it all the way. I say, just add a law stating if found guilty, the company would also pay ALL the legal fees of the government. I am not sure they would want to litigate all the way at that point.

There are many who fail to empathize with those farmers and land owners in the middle of nowhere. Instead they want to stop them from seizing an opportunity to advance their lives in the name of the environment they do not live in. These people now have the ability to advance their standards of living, not only for themselves, but for future generations. It is almost like winning a lottery ticket. As the winning lottery ticket, if you don’t manage it properly it will not bring much happiness. People who are attempting to stop fracking need to also consider the people who are directly involved.

You can potentially know if someone is unbias when not many people will agree with their stance. You can see my fellow industry friends have failed to support my push due to my insistence on effective regulation. My fellow environmentalist friends don’t like that I point out society values that could balance out many of the negative environmental outcomes. This is a potential problem with a truly opened democratic society which focuses on popularity. You don’t always get the best outcomes if you go with the crowd.

Your Energy Consultant,

614-356-0484