Ready for March Gas Demand? Duke’s Merchant Coal Plant Value?

All Energy Consulting’s (AEC) latest product offering,Power Market Analysis (PMA) is a compelling product that provides subscribers a dynamic new approach to interpreting and explaining market fundamentals affecting North America’s power markets and their impact on the coal and gas industry. Prime subscribers get additional analysis which is demonstrated below. Also demonstrated is the value PMA offers in generating custom reports from the daily runs at minimal cost for our subscribers.

In February, we started examining the hydro impact due to the drought in the West that is occurring now. Our initial findings show natural gas demand changes throughout the year with the most dramatic change in March.

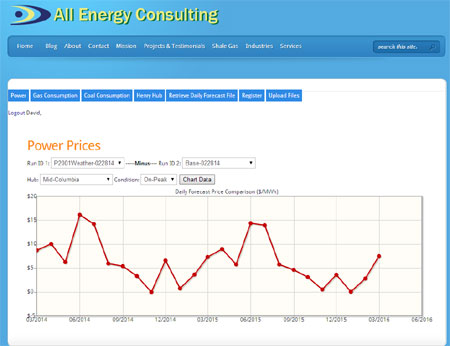

Online Interface Screenshot – 2001 Weather and Hydro Condition Impact on Gas Demand:

Complete chart and data available now for subscribers.

Prices did materially change, but mainly in the West, as expected. As a subscriber you will get the full output and briefing of the run.

Online Interface Screenshot – 2001 Weather and Hydro Condition Impact on Mid-Columbia Power Prices:

2001 Weather/Hydro Run files available online see power prices and fuel consumption.

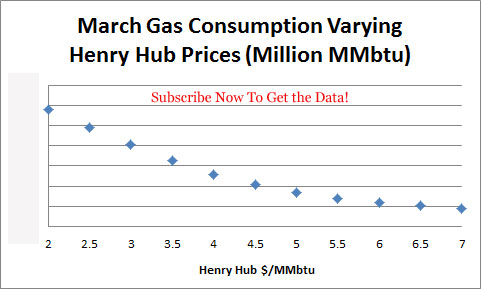

With March right here and now, we decided to investigate March gas demand. Our first analysis examined changing Henry hub prices by 50 cents from $2/mmbtu to $7/mmbtu. *This graph will be generated for the next month gas demand for our prime subscribers in the middle of each month.

Henry Hub Price Iteration Runs:

Complete chart and data available now for subscribers.

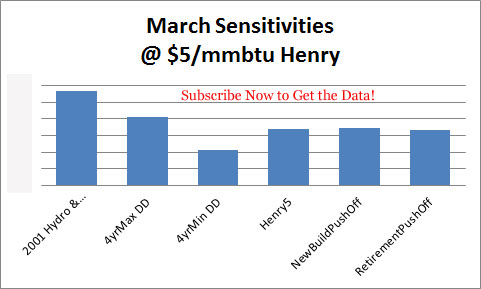

We then examined the various sensitivities at the $5/MMbtu range. From our analysis, it shows that if the hydro and weather aligns with 2001, we could experience a gas demand increase as significant as a dollar drop in Henry Hub prices.

Natural Gas Demand at Various Sensitivities:

Complete chart and data available now for subscribers.

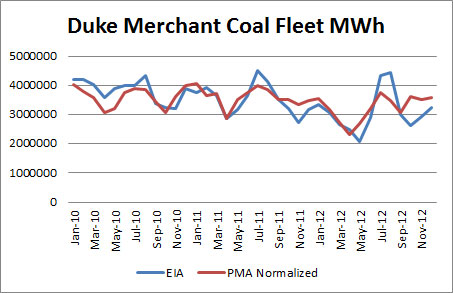

The above analysis is all available to Prime Subscribers each month. In terms of a custom report example, we put together an analysis of the Duke coal assets in the portfolio which is up on the market. Duke is selling this portfolio as whole looking for $2 billion. The coal assets represent the majority of the MWhs produced. In 2010, the coal assets represented 87% of the MWhs for those plants. An example of a custom report request might show how units performed in the model in the past and how they are expected to perform in future.

History of Coal Plants in Duke’s Portfolio MWh:

Based on our quick analysis, without any fine tuning, we can anticipate the Duke units will generate 6% less energy from their 2010-2012 actuals as Beckjord, and a Miami Fort unit is retiring. However, the economics compared to 2010-2012 will improve by 60+% as higher gas prices and regional supply/demand will benefit the units still running.

Future Expectation of Coal Plants in Duke’s Portfolio MWh:

As a subscriber to PMA, the above custom output request would cost you only $2K. In addition, you can expect a 24 hour turn around from request to final output. Output will include all the data behind the graphs.

We would recommend further due diligence if an acquisition was being pursued. AEC can help. Our due diligence efforts would involve reviewing historical performance to evaluate sustainability of the assets, fine tuning our model to accurately reflect cash flow for those assets, and performing long term scenario analysis to understand your risk. As a subscriber, you will get a discount to our consulting fee.

Hopefully, I have demonstrated that PMA can bring you great insights into the power markets at an incredible value. The above analysis can easily payback your investment by helping you make better decisions whether trading, planning, or purchasing assets. PMA will offer a better understanding of the power market from power prices to coal and gas consumption.

Your Inspired Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/

P.S. Send an email to get a free one week trial.

Peak Energy – Are we there in the US?

Peak energy can be related to many things from Peak Demand, Peak Oil, etc… Let me clarify my discussion. Peak energy in my context is the electric energy being consumed by the end user each hour and averaged. Therefore, the unit of peak energy is Megawatt Average (MWa). This is much different than the peak demand Megawatt (MW) which occurs in one hour.

I am writing about this topic as I have just analyzed 118 Load Zones across the N. American continent. Statistical analysis was done on those areas incorporating 26 variables, which included 9 weather zones (CDD & HDD) and 8 economic regions starting with data back to 2009. This was an arduous and complex task as each individual zone needed its own menu of variables to optimize the analysis. AEC is about to launch a new online product – Power Market Analysis (PMA). PMA will be an online product with annual subscription access to power prices projections across the country and fuel consumption forecast of coal and gas in the power sector for the next two years – More information on PMA to come. Load represents a fundamental input in analyzing the power markets, so the task had to be done.

The results of the analysis are very eye opening. The R squared (indication of how well data points fits to the variables analyzed with – ranges from 0 to 1, poor to perfect fit) across all 118 load zones averaged 0.92. There were several regions which have now begun to decouple from GDP. The economic well-being of several regions is no longer driving the growth of power. At this point, I can hear grumblings and concerns at investor held utilities since the load growth is the main mechanism on shareholder returns. Don’t stop reading, it’s not all gloom or doom for all utilities. There are two main reasons for this decoupling of GDP. First is the increase spending in Demand Side Management programs across the country to a tune of $9 Billion. Second, we may have reached a peak point in energy consumption per capita. As you look around, how many more devices can you obtain? Each new device is incorporating better and improved efficiency. At some point, we will hit a limit to the energy consumption each of us can do. We are clearly seeing this in this analysis in certain large metropolitan areas when you strip out the weather component. However. I am only seeing this in certain regions.

The EIA put out a briefing on March 22, 2013 alluding to this. The graph below does not seem to be weather normalized. This can lead to a skew vision of what has gone on recently.

Weather has been a large factor over the recent years. If you look at the GDP from 2010 to 2013 the growth is close to 4%/yr. If you look at electricity consumption without normalized weather the picture will show an annual decline of 1%/yr. However, if you strip out the weather component, the load growth is closer to 2.3%/yr. 2010 was an extremely warm year with cooling degree days across the country 21% greater than a normal year.

Weather variations will lead to consumption change as we have become quite temperate in our ability to adapt to various climates. The weather piece will need to be stripped out of the discussion when it concerns understanding the relationship between power consumption and the economy. Peak energy discussions cannot include a conclusion on the basis of extreme weather events. Based on our analysis we still project a rather robust growth in power consumption of 1.9%/yr for N. America based on normal weather and GDP growth around 3%. Areas that are seeing significant growth are related to the Oil & Gas areas such as Texas, Alberta, Louisiana, and even pockets in the Midwest with shale development.

PMA will offer a daily view of the next two years with three different scenarios – base, high power price, and low power price. The changes between the cases will be weather, GDP, and gas prices. In addition subscribers to PMA will be presented monthly with scenario and sensitivities which delve into the greater market dynamics seen in the power space. PMA will be valuable to those in the Oil & Gas, Coal, and Power industry. For the Oil, Gas, and Coal companies the focus will be on better understanding on fuel consumption in the power sector. The power industry the fuel and power prices will be available. In terms of functions within an organization, expect value to be given to Trading, Fundamentals, Budgeting, Fuel Contracts, and Policy groups.

There is more to come on PMA as we expect a product launch sometime in February.

Your Tireless Analyzing Energy Consultant,

614-356-0484

Twitter: AECDKB

LNG Export Revisited

LNG exporting discussion is increasing. Clearly the Oil & Gas industry is in favor of the initiative. On the other hand you have the Dow and Alcoa being concerned. Now the environmentalists have stepped in to denounce the plan. As I noted in my previous discussion on this subject last January I was more cautious on the level of exporting in the hopes that we could develop manufacturing and other creative ways of using a cheap and abundant resource. The question is to ask what is best for the country as a whole not to focus on certain questions as will it raise prices. A price rise is not bad in itself.

Since the last year, I have added my perspective by having intellectually challenging conversations with my many energy colleagues and friends. In general, I do agree with the premise that government should not be in the business of picking winners. My Oil & Gas industry friends will use this as instrument to justify their stance to export – not allowing exports you are picking a winning industry. As I noted before I think we should phase in the volume. In addition to staying true to avoid government picking winners – why are my Oil & Gas colleague not supporting my stance on auctioning of the export license in order to phase in the LNG export volume. Going site by site offers some element of picking winners. The US citizens should want to find additional funding for the government versus raising taxes and losing benefits. LNG export volume license would likely bring a decent revenue stream for the government and would avoid “picking” winners. Obviously the company that wins the license will still need to find an approved site along with approved technology which would pass environmental and safety needs.

I am always open to a discussion on merit. Please do send me email or feel free to comment below.

Your Open Thinking Energy Consultant,

614-356-0484

Twitter: AECDKB

Energy Policy – Too Complex to do for the US?

In several energy conferences I have attended, many people are dismayed on how we fail to have a national energy policy in the United States. At the same time, many people are actually very grateful for that fact. This is typically coming from those who are very cynical of government action and ability to appropriately execute. An in-depth national energy policy for the United States is likely infeasible due to the geographical diversity of the US to use various energy forms and the complexity of energy. The only energy policy I could see from a US federal perspective would be a generic focus on allowing inter-state energy transfer no matter what form of energy, a focus on maintaining some level of energy security through technology, storage, and trade, and finally a push to use energy productively.

Energy is a means to many ends. Having energy does nothing useful without an objective of using the energy. The discussion of energy in the public space is typically done with a bias to favor one form of energy to another even though they may not even be directly related. Energy is so broad making it very complex. The complexity allows the energy discussion to be manipulated to the public. This manipulation is sometimes intentional and sometimes out of ignorance.

The two broad forms of energy is potential and kinetic energy. Kinetic energy is the useable form of energy. The potential form of energy is eventually converted to kinetic for final use to achieve an end goal. An example of end goal could be heating your house to traveling from point A to point B. The usable forms of kinetic energy are radiant, thermal, motion, sound, and electrical. To produce those forms of energy, a medium is needed. These can be Oil, Natural Gas, Wind, Sun, Coal, Earth (Geothermal), Hydro, Atoms (Nuclear), etc… Within each of these forms and mediums, people have dedicated their lives to them generating multiple academic and business people. Only a few actually involve themselves across the various forms of kinetic energy and the mediums.

I was fortunate only because of my career path and my desire to continue to learn. Most of my colleagues and friends in the energy space are dedicated to one medium and one form of kinetic energy. This highlights the complexity of the space and the desire for individuals to bias a certain form and medium of energy. My Oil and Gas colleagues would not be interested in understanding the Demand Response call option value compared to the tariff rates structured, just as my Utility colleagues would not be interested in understanding the light-heavy relationships in petroleum products and its impact on crude oil valuations. At some level each of the groups will be “fighting” to support his or her industry. Therefore just as Eisenhower was concerned about the military-industrial complex, I would be concerned about an energy policy driven by one of the energy forms complex versus generating a generic goal of using energy productively and securely.

Having a clear discussion on energy is near to impossible because of the generic “energy” concepts. Energy discussions are littered with ignorant or bias agenda. Case in point, many articles will point to the renewable initiatives leading to a reduction of petroleum products (gasoline, diesel, jet fuel, etc…). However, this is not genuine since the renewables mediums are generally focused on the electric form of kinetic energy whereas the petroleum medium is focused on the thermal form of kinetic energy. Therefore, significant transformation to renewables will not displace the petroleum uses without a mass change in vehicles which in itself will take decades.

State energy policy focused on specific mediums would make more sense than federal. If federal policy were to take a medium stance this would immediately favor certain states over other states. However, keeping it on a state basis allows the state to excel their mediums and create a competitive landscape. The evolution of civilization to use one form of medium to another is typically not altruistic, but of natural evolution of necessity. People always point out the vast nuclear usage of the French as a potential ideal goal for a carbon free world. The French did not set out to do this for the sake of carbon, but because France lacked the abundance of oil and coal. If France was sitting on the Powder River Basin or Barnett Shale, France’s nuclear fleet would be much smaller. The same can be said of the US distribution of energy medium uses in the various states. There is an abundance of hydro plants in the North West and coal plants in the Appalachian area because of the resources there. If there were significant coal in Washington and huge hydro opportunities in West Virginia, they would be promoting each other’s current concerns. A national energy policy would have to be careful to not pick winners, but to support the individual states and a national goal of energy security.

Energy is too generic and covers too many topics for too many people. A discussion on a particular medium and form is required for people to understand the topic. However, the fact is a global market for thermal uses have grown. The domestic surpluses of the electric form of energy have been consumed. US society is slowly changing from a thermal to electric form of energy. This is seen in electric vehicle to telecommunicating. The growing abundance of our gadgets from laptops to tablets to phones has increased our dependence on electricity vs. thermal.

In addition, the mediums of energy are being used in different forms of energy versus historical norms. Natural gas typically was used in thermal form of energy, but is now being more used in its electric form. Coal to liquids could become an option as coal plants are being shunned. Renewables offer a competitive option to not only substitute electric mediums, but could be used to substitute thermal forms of energy. In order to use energy productively we need to cross over the various forms and mediums to develop an optimal path. More people who have experience and knowledge in multi-energy forms and mediums need to be developed.

The cross overs are very hard. I have consulted with Oil & Gas companies to let them know the future of their largest demand source, but several don’t like to understand the regulatory nuances. I have tried to discuss with utilities the dynamics of the gas business, but several don’t like the market risk and the need to change. I have also consulted with renewables institutions and companies. I did serve on the National Renewable Energy Laboratories (NREL) technical advisory team. The issue I saw at NREL is the limited commercialization focus and the limited appreciation of the other fuels. They did a wonderful job in the technical world for renewable, but to see how it was going to enter the market space you have to understand the current investments.

In the end, the convergence will be made and those standing in resistance or blissfully ignorant will likely be left behind. A convergence in the various forms of energy and the mediums has become inevitable. A larger holistic approach to energy planning is needed not just on a national and state basis, but in individual companies. Companies who consider themselves an Oil & Gas or Electric Company should rethink their models and their plans.

Energy is a means to many ends. The energy sector serves society not the other way around. If we do develop a national energy policy, let us hope the developers remember that. States with abundant mediums of energy should think about using the energy. To export the energy medium to only buy back the medium in another form of energy is not optimal for the state economy. Optimal economic benefits occur from productive uses of energy not exporting energy mediums. This is one reason Nations (e.g. Venezuela, Libya, Mexico, etc..) with huge oil resources fail to progress as they do not come up with productive uses of energy and in the end purchase back their own energy mediums, but in more expensive forms.

Let me end with a Thank You! I am grateful for my past in order to have the current moment. I wish each and everyone a wonderful and enlightening 2014.

Your very grateful and humble Energy consultant,

David K. Bellman

US Natural Gas Demand Outlook

Natural gas demand outlook is probably more uncertain than the production side of natural gas. The natural gas production is limited on the upside by the technology capability and infrastructure. To the production downside, there is some political constraints. However, the variability for natural gas demand is likely more uncertain as the upside could be quite high with exports, revitalization of the US manufacturing base, and the power sector increases. All of these variables involve the economy and the political willingness to act.

Whenever one starts with fundamental analysis, it is always good to take a trip down memory lane. Of recent, the largest impact to demand occurred in the winter of 2011-2012. Examining the winter residential demand, the volume has been at its lowest since the winter of 1986-1987. This was a drop of 3.2 BCF/D compared to the 5 year average. The significance of this mild winter is comparable to the supply disruption that occurred from Katrina in 2005. Therefore, it is very important to put that into context that the 2011-2012 was the once in one hundred year winter. The impact of such event should and has been felt for multiple years similar to the Katrina impact. The timing of the winter with the coincided shale gas production has led us to observe low gas prices over the last two years. I would contend without this winter impact, we likely might not have observed the prices below $3/mmbtu. The Katrina impact took about 18 months for the market to come back to fundamental balance. The disruption of 2011-2012 winter should be done by this year. The remaining bearish impacts will be directly with a function of shale gas production.

Another demand for natural gas which cannot be avoided, given it now represents the largest demand sector for natural gas, the power sector. A historical phenomenon for natural gas demand was the rise of natural gas demand in the power sector which occured with one of the largest price rise. From 2002 to 2008, we observed a 15% annualized growth of natural prices while demand in the power sector grew nearly 4% on annualized basis. Most people outside the energy space do not realize this. The reason this happened was the incremental load growth had to be met and the spare capacity in the markets came from the over build out of gas units in the later 90’s and early 2000’s. Load growth was averaging 1.2% from 1998-2008. The rising price of natural gas demand would not stop gas being used in the power sector. Therefore the load growth was expected to add around 1 Bcf/d of gas demand each year. This also played a crucial part in natural gas price collapse. As load growth has been stymied since the 2008 financial collapse. Three areas are driving the lack of growth one economic, the other, the push on energy efficiencies initiatives and the huge renewable development. Renewable growth is likely to slow down, now that gas prices are putting damper on renewable economics. Energy efficiencies still have room to alter the demand landscape, but the big unknown is the economic recovery.

As noted in the previous report on the challenges in the power sector, the growth is far from the trend line. Will there be a reversion to the mean trend line? Will low natural gas price stimulate not just natural gas demand for the raw material but will it generate electrical demand from a manufacture revival? For the base case, I have decided to take a conservative approach to revert demand back to the trend line as if it was going to get reset. In addition, due to the $9 billion energy efficiency market, I have trimmed load growth by 0.5% similar to the EIA load forecast of 0.58%. Counterbalancing the load reduction is the increase retirements. Without load growth much of the old units whether coal or other types of unit cannot afford their fixed cost to operate. Therefore we still see incremental power demand will add 1 Bcf/d of natural gas demand each year in the outer years.

The other major power story is the coal retirements due to environmental requirements. EPA mercury rules hit in 2015, but plants can apply for a year extension and so far no plants have been denied an extension. Basically the rules force existing coal plants to be fully controlled (scrubber, SCR, bag house/ precipitator). This can cost as much as a brand new combined cycle plant. Natural gas will likely need to make up a good portion of those unit retirments. However, many have simply multiplied the retirement times a gas heat rate to come up with the gas demand impact. This is bad math. The coal units do not operate at all hours that would require a gas unit. During many hours, a coal unit fleet will be at minimum operation level which could be around 40-60% of full capacity in order for the fleet to be ready for the on-peak hours. Off-peak hours amount to 43% of the year. Many of these hours will actually be made up by the existing coal fleet, so their requirement to run at minimum would be reduced.

Based on some of my models, I anticipate the number to represent 30% of gas demand. In total, in 2016 we could see an increase of 3 bcf/d driven by the coal retirements from the MATS ruling. Both the demand growth and coal retirements continue to make the power sector the most important piece in the puzzle with much subject to change given EPA rules. For those engaged in natural gas, it is important to monitor this situation. All Energy Consulting can help you out with our power modeling outsourcing option. A more detailed breakout of the power gas demand will be available in the final report and presentation available if you email David K. Bellman . The report will dive into the load outlook and renewable competition.

The next major category for natural gas is the use of the raw material for chemical manufacturing and LNG exports. They are somewhat connected. As I reported in my comments to the DOE – we need to realize the use of our natural resources which will add significantly more to the bottom line economics than to export the product only to buy the products back. However, I am cognizant on the inability of the political process to make it worthwhile to bring manufacturing back into competitive setup in the US. I do believe there will be a compromise needed between the corporate culture and the unions. There needs to be a balance and I believe it can be done through new businesses not established companies. I suspect many established companies are supporting the LNG project and the pipeline build up to deliver products to their sunken investments in the Gulf versus constructing new plants at the source. For the base, I have a higher outlook than EIA largely because I believe there will be balance between imports from Canada. An optimal US economic benefit of LNG would be the LNG exports equal to the amount being imported from Canada. It would be more of economic gain to export Canadian LNG than to let the Canadians export their own LNG. Based on history this would amount to 3.5 Bcf/d.. BHP is projecting11 Bcf/d export from the US by 2030 .

If LNG approach the 11 Bcf/d figure there will be a demand price response. If the global market of gas demand is not growing proportionally to the increase some of the LNG investors may be hit with big losses. The reason I state this is the understanding of the Middle East. The mentality of the Middle East cannot be ignored. They have and will manage the market with the focus on market share. The experience in 1998 cannot be forgotten. This was my 15 minutes of fame in which I was published in many national magazines predicting the crude oil collapse. The basis all came from the fact the supply demand balances showed a large expansion of supply when the demand dropped out from underneath producers as Asia was the growth everyone built for. Saudi Arabia at the time constrained production but eventually lost too much market share and decided to show the world the value of being constrained and as I estimated, the market went below $10/bbl. I think for those who are looking into LNG export from the US need to examine the Middle East. Market share erosion is not taken lightly. Qatar can easily add more capacity now if it wanted to but similar to Saudi Arabia for oil, it is managing the market. However, the management comes with a fee of maintaining market share. I, therefore, promoted some LNG exports but with foreign investors. This will put them into a take or pay situation vs. leaving US investors holding the debt on a non-used asset. If you think shale gas production which on average likely cost greater than $1/mmbtu even with oil considerations can compete with countries like Qatar with gas production cost less than $0.50/mmbtu, you will be in for a rude awakening. Shell pulled out of a gas to liquids (GTL) project in the US Gulf as a result of this concern. , A supporting news for LNG export volumes is Qatar is investing in US LNG with ExxonMobil.,

Another hidden demand is the exports to Mexico. I expect Mexico will not be able to get their act together to manage their resource. It will be much easier for them to build pipeline and import the natural gas from the US. I expect this will be a surprise demand source in many of the models. EIA doesn’t have exports crossing 2 Bcf/d till past 2030. It would not be a surprise to me to see it cross over closer to 2020.

Similar to the supply side, we have a much higher demand than the EIA when we add all these factors together. The final price outlook is that gas prices are expected to be range bound in 2014-2015. With the coal retirement and manufacturing uptick in 2016 we will likely see prices moving strongly up. Then LNG exports hitting in 2018 and beyond would likely give another boost. The real insight will be from the high and low side development of both the supply and demand demonstrating an upside and downside risk. The likely asymmetric relationship can show a great trade opportunity.

A complete report for the Natural Gas Outlook with graphs and excel tables are available with a presentation, in which I will include a report with a high and low gas price developed using the key variables discussed above. If interested please email [email protected]

Your Fundamental Energy Consultant,

614-356-0484

Shale Gas Production Expectations

Shale gas production is probably one of the greatest mind twist component in creating a supply/demand balance for US natural gas. My posting has been slowed as I have promised to come up with a long-term natural gas price outlook. As a longtime fundamentalist, the supply/demand model represents the root of the forecast. The key steps in creating one is to understand the individual components and developing a logical rationale to what makes each of those components tick.

The supply outlook for shale is a very fascinating supply side component for which I spent considerable time understanding. People will generally work their way through running cost and reserves calculations to get some sort of projection. However, I believe this method is invalid here as cost seems to be an impact not a direct variable of production. In the long-run, economics should balance with cost; but in the near term, which could be many years, we can have what is perceived to be irrational, but is quite rational decision making on an individual basis.

The last comment has more to do with management of Oil & Gas companies. With much of the incentives for executive management based on stock price, the decisions do not necessarily become making a resilient long-term decision for the company, but what propels the current share price. If you examine the markets, you have many players being rewarded on the bottom line production numbers regardless of net profits. Shareholders have taken to a metric which does not necessarily promote the best long-term decision. The energy in the ground (AKA btu) is not going anywhere yet there is drive to produce now vs. later which could be more promising. Even looking out on the forward strip there shows a 5% premium a year out. This obviously is not really worth the time value of money, but there is an indication that there are better days ahead for producers. Forward curves are a poor predictor of actual outcomes, but it does show market sentiment.

The analogy of the current market is let’s all slit our wrist and we will see who will faint first. Those who faint, their blood will be taken and used to supply another player still in the game. Therefore, if you are playing the game, you better cut cost and look for opportunities to take on those who can’t cut it. In the long run the market will balance, but in the meantime, expect production numbers to be less connected to price. Added Note 12/16 – I understand all the traditional means of forecasting shale from reserve curves, lease retentions, acreage analysis, and well economics. What I am about to suggest is not random nor taken lightly but the fact is traditional mechanism could not come close to backcasting what has happened over the past 5 years. I don’t believe in using methods that cannot be calibrated to the history. Show me a model that can account for multi-year 40% supply growth using traditional methods and I will accept that method. However I will contend those methods would consistently not been able to forecast what has occurred. This is largely a result of behavior and technology advancement. For this very reason I decided to expand beyond traditional means to see if I could find a METHOD to be able to substantiate the past to be able to potentially understand the future.

With that in mind, one needs to examine the development curves of being productive in order to get a view of shale gas production. I examined oil production back to 1890 and looked at various time periods of production evolution. However, nothing can compare to the current production growth observed in shale gas over the last 8 years. I expect the 2012 numbers of shale gas production will be revised to show more like a 10% growth vs. what you see in the AEO 2013 figure of 4%. Update 12/19 – Natural Gas Annual 2012 came out and BAAM! Shale gas production 10.3 TCF vs. AEC Forecast 10.5 TCF – far from AEO 2013 figure of 8.1 TCF! Therefore for 8 consecutive years, you had a production growth from a single source of technology that produced double digit growth. My quest to find something similar to that pace led me to examine Moores law. However, resources cannot keep up with technology innovation as seen in Moores Law. After many hours of research, I did find a logical and rationale curve which sets the foundation of my supply projections for shale gas. Once again, my past has been my friend. My diverse experience in all parts of the energy markets took me back to coal to find my answer.

The Powder River Basin coal production was able to sustain 11 years of double digit growth of production. Similar to shale gas the BTU was known to exist. It was just about jumping the potential energy to make it work and once that was done it was all kinetic energy that propelled the basin from a zero player to 16% of the largest coal market in the world. Using the Powder River Basin as a foundation and modifying to shale, shale gas supply will likely exceed current EIA projections of shale gas. Before you go out and sell the forward strip, the demand picture is also likely to exceed EIA outlook. Added Note 12/16 – This is not as random as Chilean Sea Bass imports – there is some fundamental connection to shale gas. You had a known energy source, but a large barrier to untapped the source. Once the barrier was overcome a tidal wave of production came. The recent shape of shale does fit the path observed by PRB. The future of shale will likely revert back to the fundamental variables of production, but to be able to account for the current evolution and behavior the PRB history is more capable of describing the potential.

I have described the foundation of the supply outlook, but not the actual mechanism of my forecast as I still need to make due for my lovely family. My demand models are coming along and eventually the final price projections. If there is interest, please contact me to schedule a presentation at your company where I will go over the outlook and take questions and answers. The cost of this endeavor we can discuss on an individual company basis and based on my timing. Those who book earliest will get the best deal. You can contact me at 614-356-0484 or email me at [email protected]

I do have a proven and successful track record in forecasting commodities and developing world supply and demand models. You can see my front page USA Today prediction of the crude oil collapse in 1998 – March 10, 1998. I was also very prescient at AEP –unfortunately those forecast are behind the close door, but many do know I was the bull in the early 2000 and turned to be quite a bear as the market went crazy in 2008. The markets will change and you need to be fundamentally connected at all times.

Your Fundamental Energy Consultant,

614-356-0484