Refining in the 21st Century Part 1 Cont’d

“He who can no longer pause to wonder and stand rapt in awe, is as good as dead; his eyes are closed.” Albert Einstein

I am sorry for those anxiously awaiting the continuation of Refining in the 21st century. I have been very busy for which I am very grateful for. I hope you have taken the time to reflect on what was discussed in the previous blog. A pause goes a long way in allowing us to process. Without further ado…..Part 1 cont’d.

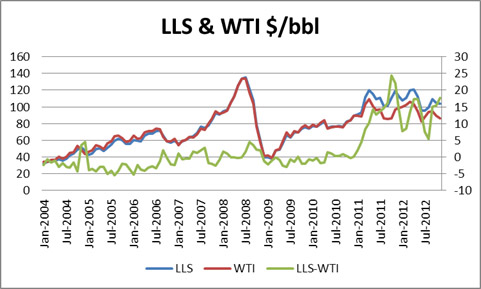

Now that the new paradigm has been set for oil, there are many inter-relationship that have changed. Of recent ,the EIA has shifted its reference fuel to Brent. This is a very reasonable shift as the center of demand is no longer the US but the growing Asia region. As an aside note, all the years I was at Purvin & Gertz, we never really believed WTI represented an appropriate benchmark for USGC. The better benchmark was LLS. However the financial market was too fixed to WTI to be able to change the benchmark. Currently you can see the reason why WTI can fail as a USGC benchmark. With the spread to LLS blowing up as pressure from Canada and shale oil have practically filled the center of the US; and with limited access to the USGC from Cushing WTI, it has decoupled to say the least against LLS – see chart below.

In the long run, this is one of the less costly economic arbitrages to solve via pipelines. In fact there is a pipeline reversal occurring this year along with an expansion. However the future markets continue to show a large spread with 2014 spread still above $5/bbl. A pipeline from Cushing to USGC should be able to produce reasonable economic return for $2/bbl with the past demonstrating much less.

Also many don’t understand a very important policy choice, that the Energy Policy and Conservation Act 1075 (P.L. 94-163, ECPA) which directs the President to restrict the export of crude oil. The US is in a very unique position given the shale revolution not only increased natural gas production, but also significant liquids production. This policy decision should lead to some strong US refining outlooks.

When we examine the refining world as I discussed previously, it is very highly dependent on the feedstock. There is so much to cover in understanding refining economics that I will write this section requiring some basic understanding of refining. Basics include crude oil quality and the difference between hydroskimming, cracker, and coker. Also an understanding of why refiners chose various crudes. I have spent days teaching the basics to clients who are brand new in the refining business. In fact one of my first international task was a course on refining to PDVSA. I have built some of the most sophisticated models for crude evaluations for both buying and selling. I believe the Kuwait Petroleum Company still uses the model we worked up for them at Purvin & Gertz. Nonetheless refining is not a simple discussion without some basic understanding.

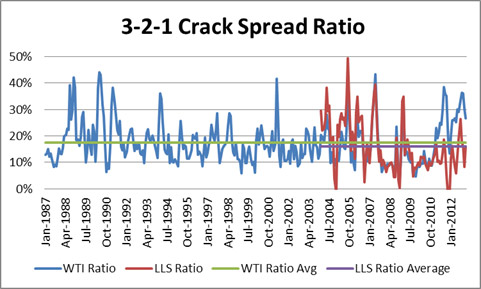

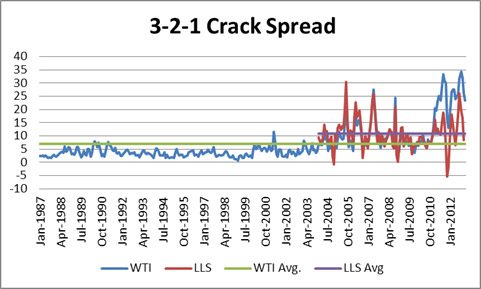

With the paradigm shift of higher prices allowed the spread of products to widen. It is only natural to think margins should move as percentages instead of absolutes. If your feedstock cost you $10 and your margin is $1 your return is 10%. If your feedstock is $20 and you still only obtained a dollar margin your return not drops down to 5%. This is likely going to hamper your ability to get financing and potentially put you out of business as your weighted average capital cost is above that unless you are regulated entity. This should be no different in the refining industry. The absolute value of the margin spread will be forever much larger than historical view until the feedstock falls back down. The proper view for refining margin is to view it as return on feedstock as seen below.

A return of 16-18% will likely suffice in the USGC to keep the industry going. WTI and LLS will converge to produce a return at that level. If we looked at it on an absolute basis – see below, it would suggest that refining margins will have much to fall in this $100/bbl environment, which is not the case.

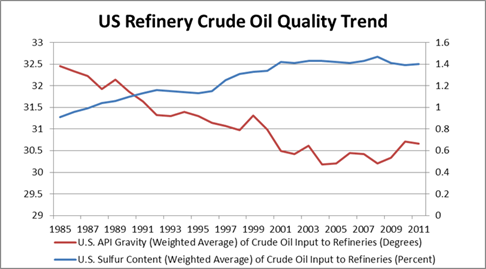

The second most significant change in refining was the underlying belief in the increasing lower API and higher sulfur crudes – figure below. This made the refining strategy focus on technology and those that can process the more complex crudes would win over the simple refiners.

This came at a cost in both technology and variable cost. However the shale revolution has changed that paradigm. The liquids being discovered within the shale did not increase in API and also has lower sulfur. This caused those who embarked on the above strategy a mismatch. The light/heavy differential is not as wide enough for the increase cost these refiners now have compared to the simpler configurations. This will likely not alter the long-term requirement of the crack spread to produce 16-18% return on feedstock, but it will impact inter-refinery competition and the strategy used to manage a refinery. Once again my services would include helping you review your refinery and from crude selection to refinery optimization.

In Part 2 we will discuss where the markets will go from here. If you review what we have covered you will likely have a good idea already where the markets will go. Critical thinking is key in the forecasting business. I have had good fortune in my career to build that skill set. Please do consider All Energy Consulting for your energy consulting needs.

Your Very Grateful Energy Consultant,

614-356-0484

Refining in the 21st Century Part 1

“Life can only be understood backwards; but it must be lived forwards.” – Søren Kierkegaard

This is my thoughts on refining and where it is likely to go from here. Why would/should you care to listen to me? I had the fortune to work at the beginning of my career at Purvin & Gertz Inc. I had a great boss, Ken Miller, who unselfishly gave me his 30 years of experience in rather a short time period. My 15 minutes of fame was used up early in my career. I had the call of my lifetime when the oil markets collapsed in 1998.

Months ahead I was at my desk managing the firms World Supply/Demand balances. With my boss gone, a reporter, Beth Belton, from the USA Today called. I discussed my concerns at that time and was quoted that “It was very possible there will be a price collapse to $10/bbl.” As the cards turned out the market collapsed and in fact hit $8/bbl. At that level you might as well burn oil rather than refine it. This is important to understand if you want to understand refining. The value of petroleum products becomes very dependent on the price of the feedstock. If the feedstock becomes too low the products can only be valued so much. As the feedstock price rise, so will the ability of the product price rise. Many forecasters still fail to account for this simple concept. I still see many forecasts try to revert to old absolute value refining margins in face of this current $100/bbl environment. This is no longer your grandfathers’ market. We have moved into a new world in understanding the dynamics of petroleum market.

Part 1. How we got here

I plan not to cover the history of oil as presented so well in The Prize by Daniel Yergin, but to unearth the recent shift in oil price.

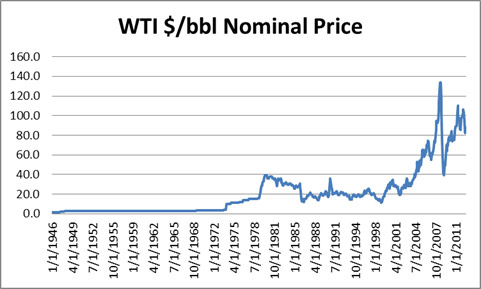

The sudden rise in crude oil prices in 2005 has been poorly explained in my estimates – see below. The crude oil markets are no different than any other commodity or goods other than its vast uses and requirements in modern day living. The rule of economics of supply/demand and price interaction applies. If we don’t understand the past we will likely not understand the future. There were two major forces to produce our current price regime. The most talked about is the enormous demand of the developing countries. However people stop there and make the assumption that the growth in those regions should explains the paradigm shift we see in prices. They don’t take the time to explain how exactly the growth in those areas could cause such a high price response.

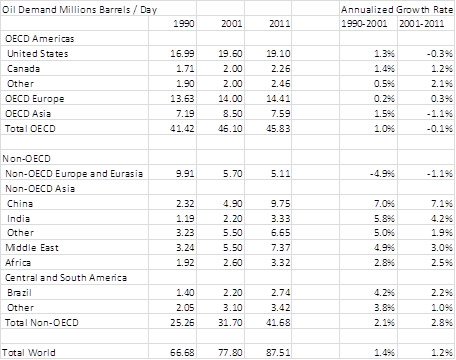

If we pause and take a look back at the spike in 1979, we see the market acted rationally. There was a supply shocked placed onto the market amounting around 4.5 million b/d. Annual prices moved up almost 3X in four years resulting in the first annual drop in world oil demand for three consecutive years (3% annum drop per year from 1979-1982). The market, then, entered into its new $20/bbl paradigm. The market had a few spikes with the Gulf War and other Middle East related issues, but overall the market was range bound. The growth from the 1980 to 1990 was around 0.7% per year. From 1990 to 2001 we saw demand rise by 2% per year – yet the price rise was relatively stable. Table below presents the change in demand in key areas.

Combined this with the price chart you get a fascinating picture. Within 4 years from 2001 to 2005, prices had more than doubled and by 2007 prices had moved up larger than the spike from 1977 to 1980. If you recall the previous rise resulted in 3 years of decline in demand, in this case nothing of the sort happened. World oil demand continued to grow. The reason for this is obvious if you examined the regions of strong growth. China, India, and the Middle East represent over 80% of the demand increase from 2001 to 2011. Each of these areas heavily subsidized the price of petroleum products for their citizens. To remove any regional issues you can look at Mexico in the Other OECD category. Mexico continued their demand growth in face of significantly higher prices while both US and Canadian growth declined. Mexico was able to do this because of the subsidies supplied by the Mexican government to its citizen.

The cure for high prices is high prices, but when the majority of the growth of oil demand does not see high prices; this causes an exponential price response. The demand response was shifted to the baseload demand in other regions. This is how the demand growth of the other regions impacted our price so significantly. It really is a trade issue. However for some reason this has escaped most of the pundits and the government officials. For the regions which exports oil, this was their bonanza. They got the rest of the world in essence to pay for their internal subsidies. Countries like China and India, they made a bet that the cost of the subsidy represented enough value for maintaining growth and civil obedience.

The “free” market countries basically got taken for a ride. One could say those who are subsidizing pay for it, but the question is who is getting paid and who really pays. I believe without this discussion and issue being brought to the forefront, many pundits misforecasted their outlook. People expected an economic response to pull price back down, but it never came. By itself one would think prices this extreme (nearly 4X that of the previous price level) should start modifying behavior and planning. However, demand and subsidies by itself cannot rationalize the extreme new price regime. It is the second reason that people fail to even consider to be a part of this historic price rise – Monetary Policy.

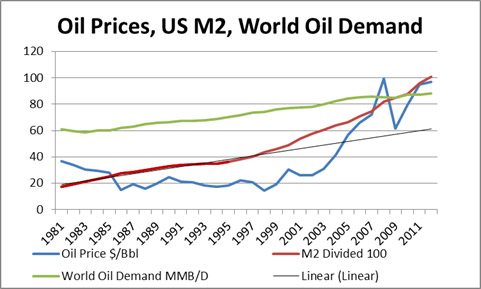

The chart above clearly shows the rise in US money supply began a new path in 1998 and accelerated in 2001. This was all done under the Greenspan’s thinking that we could avoid a recession through monetary policy, known as the Greenspan Put. It started in late 1998 while Greenspan initiated his first experiment by lowering rates to help recapitalize Long-Term Capital Management L.P. (LTCM). Many have deemed this a success in the early 2000’s and for that Greenspan, Robert Rubin and Larry Summers graced the cover of Time magazine.

However no good deed goes unpunished. As I have noted several times on my blog, spending what you don’t have, always will feel good in the moment. If you can spend without a credit limit you would probably be happy for the next 30 days before the bill comes. In the case of government spending, they never were forced to pay the bill – yet. The US is riding a credit card bill that has a perpetual moving due date with low interest. When you increase debt you are in essence borrowing from the future growth. In fact when you think about it, monetary policy is subsidization but in a more obfuscated form. Society does not really see the true cost until much later. Is there any difference to that and ignoring climate change? (for a future discussion).

The new trajectory in essence has further discounted the value of the currency as compared to the expected value. At some level the market begins to realize this issue as excess money cause asset values to rise, such as commodities. As a consequence many have suggested to blame traders for the run up in prices, partially true but more symptomatic as excess money usually tries to find a home. I ran multiple regressions from demand to population but no variable by itself produces a better correlation than money supply to the price of oil. If we take the former trajectory of money supply and compare it where we are now, the monetary impact would be 40%. This would in effect suggest without monetary impact the price of oil would be more in the range of $60/bbl vs. $100/bbl. This price still represents a strong price rise of over 2X from 2001 prices. Remember the 1979 issue saw a price rise of 2.6, but in seven years the new price regime settled at 2X. The combination of demand growth with subsidies for the growing regions along with monetary policy has given us our current landscape and both of these factors allows us to understand our current situation with our past.

Part 1 will be continued as we talk about the refining side of the picture and then move on to Part 2 where I plan to cover where we are going. I look forward to your comments and feedback. Please do consider All Energy Consulting for your energy consulting needs. I offer a unique blend of Oil, Gas, Coal, Power, and Renewable Experience. I have been blessed to have a very dynamic career, allowing me to continually grow which is perfectly situated to help your company not to be static in this ever changing world. I can offer my own forecast, or better yet, help you develop one, including many scenarios.

Your Energy Consultant,

614-356-0484

“How you gather, manage, and use information will determine whether you win or lose.” Bill Gates

AEO 2013 Early Release – Arbitrage Remains

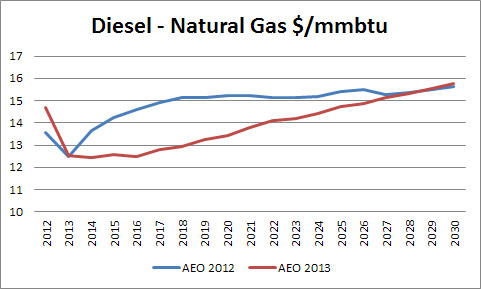

The EIA released an early release of the AEO 2013 in December. I have been so busy, I haven’t got a chance to note some of the changes (Once again, not complaining but very grateful). As I mentioned in my previous blog of the AEO 2012 release, the first thing I like to look at is the relationship changes.

In this release, it looks like the arbitrage remains for someone to capitalize on the difference between natural gas and diesel. They did narrow the spread relative to last year which I believe is directionally correct. The difference continues to be large on the scale of over $15/mmbtu in the next decade plus. The propane difference is over $10/mmbtu. With this spread premium, one really needs to question the science and economics of Gas to Liquids (GTL). GTL is possible, though costly, as proven by Shells Qatar Pearl facility. With the economics presented from Shell, you would need your input price below a dollar to make the project worth its large capital cost ($19 billion) and the associated market risk.

The opportunities exist for Shell to learn from this large venture to see if they could lower the cost and/or improve the yield or perhaps, Shell technology is just not the way to go. This could be a worthy consideration for research from the US government and universities. GTL could be the game changer which would bolt on perfectly with the game changer shale gas. I have spent much of my time as Chemical Engineering examining this area. The cost is what I believe really shifted the spread to be so large; $19 billion for 1.6 bcf/d of conversion is incredible. Perhaps. Shell is scaring the competitors away from researching this?

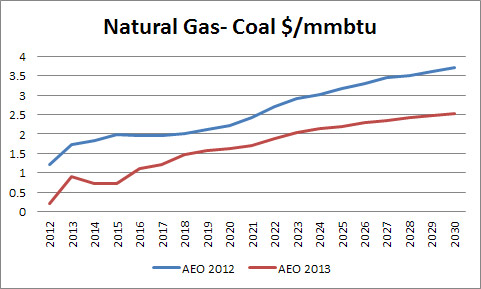

Jumping to the next relationship, Gas – Coal; we see they have narrowed the spread more in this year’s AEO 2013. Essentially they have lowered the gas price relative to last year by around $1/mmbtu. I cannot agree with their 2014-2017 outlook. I believe they have gone too far down. If you look at the balance, it would not make sense that 2015 gas demand in the power sector would be lower than it was projected in 2013 with lower gas prices in 2015. I understand as new gas units come into the power stack, you get an improvement in efficiency for gas units.

However, at the same time, we do have a retiring coal fleet plus the “must-run” coal plants to manage the safety of the coal piles will be going away over time. I believe it is possible to see gas demand higher than in 2012, even with higher gas price. For the very reason that coal units were running more than economically reasonable to manage inventories, under coal contracts which were contracted years back. To the coal industry own doing, the coal contracts were shortened to be no greater than 5 years. This would mean many coal contracts are in negotiation at the lowest need time period for coal generators. I suspect as much as coal generators over bought in the contracts over the past 5 years, they will under buy now. Coal “must-run” units to manage inventory will be a thing of the past over the next 5 years. I will take the bullish position on coal spot prices.

As a commodity forecaster for many years, when the general equilibrium fancy models catches up to your outlook, you know that you now have to take a difference stance. I believe gas prices in the AEO 2013 are too low now. This belief is driven from the fundamentals of economic demand creation from low gas price in both the industrial and power sector. I believe coal prices in the spot market will be stronger than most think, as the most likely outcome is under-contracted coal volumes.

I hope to have more time to review the final report which is expected to be released in the spring. Does the report come sooner now since Punxsutawney Phil saw no shadow and predicts an early spring?

Please do consider All Energy Consulting for your energy consulting needs from forecasting to planning to actually doing hands on work in creating models, we are here for our clients.

Your Energy Consultant,

614-356-0484

ERCOT Modeling Issues – Scenarios vs. Sensitivities

ERCOT released a new 10 yr system assessment. The big news among the renewable community is a “scenario” labeled BAU All Tech with Updated Wind Shapes. In this “scenario”, they have updated the wind profile (capacity factors) for the wind technology option. The surprise from the output was the large swing from the BAU case to install 17,000 MW of wind, which did not occur in the base. In addition, the combined cycle units fell by 10,000 MW. Also solar added 10,000 MW into the system versus the BAU. I have nothing against renewable, in fact I am pro renewable in many ways, however I am skeptical on these results. My skepticism is focused on the one supposed change made by the modelers for this “scenario”. By changing just windshapes, they were able to produce these dramatic swings from the BAU case.

I have been modeling power systems for over 10 years and I cannot rationalize this outcome without more knowledge than what was presented in the paper. Let me start out with the basic concerns before moving over into the technical realm. The BAU case vs. this new wind case drops gas consumption by around 40%. If this wind profile enhancement was driven by turbine technology, then the rest of the country would also add to the lessening of natural gas demand. Anything greater than a 10% change in natural gas demand will surely impact the price of natural gas. A true scenario would iterate and or rationalized this issue. This type of analysis seems to be more of a sensitivity analysis versus a real scenario development. Another fundamental concern is the extent of wind development and the on-going production tax credit (PTC). At some point in the wind penetration, the PTC would be removed. I am sure the non-wind blessed state would like to stop subsidizing states, particularly whose economy is much better off.

Another fundamental missing piece is any discussion on rates. More capital is being spent in the wind shape case than the BAU. This is simple math, as the cost of capital of wind and solar for each MW is greater than gas units. The balancing act is the long-term fuel cost will balance the additional capital. However large capital investments usually require some guarantees. This comes in the form of Power Purchase Agreements with the local utility. The PPA’s are signed and prices set based on the current markets as that time of the contract. Even though wholesale market prices may come down it does not mean rates will change as PPA contracts are typically fixed in order for the investor to know they will recover their capital investment. Over time the PPA deals will begin to look worse and worse as wholesale markets fall. Eventually industrial and commercial customers could become wise and remove themselves from the utilities poor PPA arrangements by creating distributed generation. This then lead to higher residential rates in the face of low wholesale power. This then leads to limited PPA deals. With more than half of the wind and solar build after 2020 one would need to seriously doubt the extent of those developments becoming real, assuming PPA is the mechanism for development.

On a technical basis the major issue lies in how the modelers are treating wind generation. As a panel of experts, including me, in a report done for the Northwest Power & Conservation Council noted wind generation, when sufficiently large relative to the market, should be viewed in a risk analysis as much as in the price of natural gas is commonly analyzed. The dependence on wind to the level seen in this new wind shape case will likely caused some dramatic grid events when the weather decides to not co-operate. This event may be 1 in 10 years to 1 in 100 years, but the point is not if, but when. Given the nature of weather and the sub hourly nature of electricity markets, I would suspect the issue will be closer to 1 in 10 years than 1 in 100 years. It is certainly possible to expect a weather front changing the landscape of wind generation in particular day, adding on top of that a drought situation limiting nuclear and fossil generation. In a stress case, the grid will likely fail in the new wind shape case. The value of the combined cycle will likely be re-gained in risk analysis. This once again will limit the number of wind builds presented by ERCOT in this new wind shape case.

As noted in the NWPCC report, I have had extensive experience in modeling power systems for market forecasting and planning purposes. If you are beginning your resource plan or are looking for another perspective, please do consider reaching out to me for assistance.

Your Energy Consultant,

614-356-0484

Strong Manufacturing / Producing Sector Needed in a Vibrant Economy of Our Size

My last few blogs, I have indicated the need for the manufacturing/producing sector. I want to directly addresse the reason why – beyond the statement “the sector will not make everyone wealthy, but it will allow those who are willing and capable, the pursuit of happiness”. If you are as curious as me, I would continue to be that annoying kid and ask, but WHY? Why can they not pursue happiness in other areas? Why not a service economy? The key words in the title are “OUR SIZE”. We have diverse group of people in the country. Also take note that I ended the statement with the pursuit of happiness. As much as we all have different concepts of religion, we vastly have different concepts of what makes each of us happy.

There are many scholars who believe our economy can be a service economy driven by our minds and intellect. This reminded me of a dinner conversation I had with Dr. Nariman Behravesh, Chief Economist at IHS Global Insight. Nariman has always been very cordial with me and I do believe we have entertaining conversations; so I hold a very high regards for his opinions and thoughts. I did have to ponder and eventually confront him on the statement he once made “we (referring to the US), can be a service industry because we have our minds”. I will take a risk in my statements to perhaps be considered an elitist, but my real life experience is where my response comes from. At AEP, we served some of the worst economic territories in the country.

The people in those regions are still happy and they do things for which many parts of the country should take note. Consumption does not necessarily drive their happiness. I noted to Nariman, not everyone has ambition or even the desire to drive a fancy car. There will always be people who just need something to do, no matter how mundane the task from 8-5, Monday-Friday. Their enjoyments come from hunting, TV watching, raising their kids, enjoying the outdoors, etc…We cannot transform to 100% service industry because of this. If we lived in Cambridge, MA for many years, I can see perhaps how one can envisioned this. However the US is vast and its own vastness offers a plethora of individuals who hold their own goals in life.

And as our Declaration of Independence state “Life, Liberty, and the pursuit of happiness” – to each his own on what happiness is. There is something admirable when the pursuit of your happiness is not part of the rat race to accumulate wealth. This reminds me of a recent clip I saw while channel surfing from the movie Con Air – “Garland Greene: What if I told you insane was working fifty hours a week in some office for fifty years, at the end of which they tell you to piss off; ending up in some retirement village, hoping to die before suffering the indignity of trying to make it to the toilet on time? Wouldn’t you consider that to be insane?”

I never stated we need to be 100% manufacturing, but I think it is reasonable to say we have dwindled our capabilities of manufacturing too low. I understand productivity advancements and automation reducing the amount of people required to do a task. This actually supports my thesis for having to create more of a manufacturing base. People cannot be allowed to sit around and lose hope and desire to be productive. And then be expected to be able to jump back on the ship as it passes by. As much as prisoners can be institutionalized to their environment, people can be institutionalized to their routines. They need to know how to work. They need the pattern of waking up Monday-Friday while adding some productivity to society. With that added productivity, they will be allowed to pursue their happiness on the weekends and nights. The manufacturing sector gives this capability. A service industry is lean and mean. It cannot ever measure up to the scale that a manufacturing sector can do whether it is chemicals, textile, paper, etc…

The latest thinking among many economists is that the US economy will grow sub 3% for many years to come. This creates increasing unemployment each year by 1%+ with the status quo setup we have. We need to think about creating jobs that create an added value and some social stability. This means you can’t just create jobs by creating inefficient process – spoons instead of shovels or even bulldozer in moving and clearing land. Jobs cannot be priced way above the net value to society. We cannot have a job paying $40K/yr for a mundane task – e.g. screwing in bolts. At the same time executive compensation is also taking many of the jobs away and forcing outsourcing in order to balance the unequal productivity to capital. CEO’s not bringing new ideas and concepts that actually work, but being paid at 800 to 1 their average worker is unsustainable. Mass institutional holding and crony boards are much to blame for this trend. I digress slightly, but I did not want to be picking on the lower class exclusively. There is much blame to pass around in all parts of society for our lack of “real” productivity.

I hope I have rationalized to some extent of my thoughts on the value and the requirement of a strong manufacturing base. We are not all over-achievers, in fact there are probably more under-achievers. These people, for society sake, need to be part of the productivity cycle, so their kids can have the opportunity to be over-achievers, if so desired. This is the American dream in my mind – To be given the opportunity to be successful and to create the most fair and balance system to make sure those who cheat the system do not sustain themselves in the upper class. The last part we have failed given the lack of prosecution in the banking sector. We can still right the ship by re-aligning our economy from less financial engineering to real engineering.

Perhaps we don’t always agree on seeing things, but it is always good to continually examined different viewpoints. I look forward to hearing your views. In the meantime please do consider All Energy Consulting for your consulting needs. We will always have you in mind once you are our clients.

Your Energy Consultant,

614-356-0484

Macroeconomic Impacts of LNG Exports from the United States – Review

Macroeconomic Impacts of LNG Exports from the United States report done by NERA for the EIA brings to mind my saying- It is better to know what questions to ask than to have all the answers. There are many wise sayings that are very similar. One missing from that list is “It is better to ask some of the questions than to know all of the answers.” James Thurber.

There are several issues I could comment on in the report, but many are already discussed by the several commentators . A good acquaintance of mine, Carlton Buford, does a fine job highlighting his concerns with point 4 resonating with my response. However, as I discussed above, the report should have asked a bigger question beyond energy markets impact.

I will agree with the overall conclusions of the report – exporting LNG will benefit the country to some extent. However, this should never have been the goal or the premise of the report. NERA cannot be faulted in terms of answering the question. However, as a consultants, there is somewhat a responsibility to address the clients’ real concerns.

I directly addressed this issue with another consultant’s report done on renewables about green jobs, where I discussed with the author about not addressing net jobs. The author told me they did not do it, because they were not asked to. In both of these reports, someone at the consulting companies should have brought up the real issue to each of these clients. A true consultant will make sure their client is asking the right question before setting out and answering the question asked. The real concern for LNG is whether exporting LNG is the BEST option for the country in terms of maximizing the economic potential for the US. This question is not just an economic study to impact the energy markets, but it should be about getting the US back onto the path of economic prosperity.

Even if natural gas prices were to minimally changed, as the report indicated, the next question should be:” Will the US be better benefited from consuming its own resources knowing it is a net consumer of most products?”. This question was not addressed in the report. It is the crucial benchmark of deciding to export. It does not take a massive model to understand the holistic value of using your own resource. If you know you will have to consume products which are made from the natural resources that you have available; could you not economically increase the internal value of your system by using the resource to produce what you plan to consume? Perhaps if the outside system can more effectively produce a good above and beyond the cost of shipping both the goods and resources to make it –the outside system could be a better option economically.

This then leads to the question:” why can they produce/manufactures goods we need with our resources more effectively? labor policies, subsidies, etc.. “. Is there a better way for us to produce and manufacture products in this country versus outsourcing? In addition, simple economics typically do not cover the social economic issues at hand. As I mentioned in my previous blog – Energy Independence Misguided Focus – the value of manufacturing a good goes beyond the simple economics of making the product. Manufacturing offers a level of social economic stability while still giving people the opportunity to aspire if they so wish. We need to make sure we take this into account. Many countries do value being able to keep their people at work. They know social unrest is likely when mass amounts of people sit around. I will further address this issue in my next blog.

The report fails to address the root of the issue which the leaders of this country should be asking and thinking about – how best to maximize the US economic well-being using the resources available. I will contend we should do what we can to offer incentives to use our resource locally first and foremost. If our ineptness to do the right thing by restructuring our society to allow for manufacturing continues, I would then support the exportation of LNG through a strategic approach. First, there is an obvious US outlet for LNG. Right now Puerto Rico – one of the poorest regions in the US – has to purchase LNG at oil related prices. This brings to mind the technical concerns of LNG vessel. Will the LNG vessels be US flagged vessels – none so far? If not given the Jones Act, the US territories could not even benefit from the liquefaction facilities.

The largest deficiency in the report, as many of the others have commentated, is not considering the chess move made by the largest exporter of LNG – Qatar. This would be akin to forecasting oil markets with no consideration of Saudi Arabia – do we not remember the 70’s oil crisis or 1998 when Saudi Arabia showed the rest of OPEC what it meant to take market share? The plain fact is the cost of natural gas in Qatar is likely below or near $0.50/mmbtu. In the US, even with greater shale development, the cost will still be greater than $2/mmbtu. Even if we subtract some value for liquids, development cost may approach $1/mmbtu, still twice as large as Qatar. Who in their right mind can see grounds to compete with Qatar without some internal subsidy/incentive or it being a niche play? Unless foreign money is financing the projects, I would be skeptical on the extent of LNG exports vs. the report’s conclusions in terms of the economic value to the US.

It is not an either/or issue in terms of export LNG versus using it domestically, but the report was done as if LNG exporting was the only issue. Ultimately a portfolio option with more of the portfolio balance to what will add value is the best approach. If the goal is to maximize the US economy, domestic uses of resources should be the number one priority, LNG exports should be examined in the context of first supporting the US territories, and only after those issues are resolved we should examine the exportation of our resources. I am optimistic that our consumption levels are high enough to support the use of all our domestic resources. Plus, I anticipate that we can become a net exporter of products, keeping further margins in supplying products to the world.

As with everything I put out, this analysis was done given the current construct that exist today. There are many levers that could change my mind to believe LNG exportation is the BEST path for this country; but at this time I believe it is best to maximize our natural gas resources first. States in the US will also benefit from this message – e.g. Ohio. I would not let your resources easily leave the boundaries of your system if you are to maximize your potential economic value. Whoever advised the Houston Mayor, Anise Parker, was wrong in her response. Houston could significantly gain more, if more industrial and manufacturing complexes were built near and around Houston than a few liquefaction facilities. The same can be said for comments made by Senator Jake Corman and State Representative Matthew E. Baker.

In order to right the economic ship of the United States, we must find better ways to use our resources be it fossil, renewables, or human capital. Perhaps beyond the scope of the Department of Energy, but the real issue at hand is to transform our economy back into a balance economy with a strong producing/manufacturing sector. The DOE does have the capability to jump start the sector by continuing to signal there will be cost effective resources for some time to come and support the use of our resources domestically. A strong and vibrate manufacturing sector will go a long way in creating a more stable and prosperous society. It will not make everyone wealthy, but it will allow those who are willing and capable the pursuit of happiness.

We really need to apply some common sense when dealing with complicated issues. Huge models allow one to bias and obfuscate the truth through manipulation of inputs and relationships. Models do have value – being a modeler myself – but the models should never drive the outcome; they are there to enhance the understanding. Ultimately, someone needs to be accountable for the decision and not use models as their excuse for making a decision.

Please do consider All Energy Consulting for your energy consulting needs. We ALWAYS have our client’s best interest in mind. We know the questions to ask and can help find the right answers to them.

Your Energy Analyst,

614-356-0484