Peak Oil not before Peak Demand?

A very interesting article in the Washington Post brings up a point that I have always been thinking about – Peak Oil Demand. The premise is, at some point we may reach a point where demand peaks before supply; because of new alternatives and driving behaviors which largely are a result of price induction. It is true if we look at the modes of transportation and energy use, going back to using horse and wood that transformations occur. They do not occur because we physically ran out of them;we still have horses and plenty of wood. Typically it is because better alternatives became viable. And perhaps these better alternatives did not show up until the prices got high enough to incentivise certain individuals to think outside the box.

The question as we look out into the future; have we started to reach that point in oil? Currently I would say besides price induction we have policy induction. In the US, we have large renewable requirements in the gasoline space. Much has been talked about electricity renewable requirements, but there is a transportation fuels renewable requirement. If you go to your gasoline station you will see stickers noting up to 10% ethanol. This is a result of this policy. Ethanol is not necessarily cheaper, but it is a push by policy makers to promote a renewable and domestic option since most of the ethanol will come from the corn industry.

As I noted before in an IDEAL world, I would not support such a program, but we do not live in an ideal world. You have multiple countries who subsidize their citizens for gasoline and diesel; leaving the US and Europe to be the marginal demand countries to stabilize demand with significant price action. If these countries did not do this, then we should not be promoting something more costly and benefiting such few. However the world is what it is.

The current policy actually grows the mandate over the 10% level. This is problematic in that cars are not designed to handle that amount of ethanol. Ethanol burns a lot hotter, requiring better materials and design in cars. There are too many cars out in the market to just allow the rise in ethanol percentage in the gasoline pool. If they did, many cars will likely have mechanical issues. So far policy makers have not done a good job in resolving this issue.

I don’t believe we will reach peak oil demand as quickly as talked about in the article. Demand and price are very well linked. It is possible to hit a peak but given petroleum’s portability and energy density and also the lack of energy use in many parts of the world, demand will continue to rise albeit at a much slower level than in the past, as prices will likely settle. Demand and price is finicky. In the US, as it pertains to gasoline, people are more concern on the rate than the absolute, given the room to adapt as disposable incomes have risen. Many people now consider sub $3.50/gallon gasoline price as cheap, but looking back only a few years ago that would be quite expensive.

Your Energy Consultant,

614-356-0484

WTI – Brent Relationship

It has been a long time since I last blogged. I was busy with work and then had some Rest and Relaxation. I just didn’t get much inspiration from the various energy topics. I was reviewing and reading the “Examining the feasibility of converting New York State’s all-purpose energy infrastructure to one using wind, water, and sunlight” but as I noted in my last blog, it was nothing substantial due to an overwhelming amount of academia and less practical experience. Many others had already commented on the study and noted it as more of a thought piece versus a practical document.

The latest discussion I have had with people is on the WTI-Brent relationship. I alluded in my previous blog that the spread will come in. This was probably one of the best trades I have seen in a while, given all the factors that point to the spread coming in – Pipeline Construction, Potential weakening in Europe and Asia economy relative to the US, increase product Exports from US, and product demand growth in US. The only negative for the spread was the on-going production boom in the US. But the cure for prices whether low or high is usually prices itself.

Now that the spread has come in, many are now jumping on the bandwagon for WTI to be a permanent premium to Brent. However, I believe that is not a likely paradigm, given the US has switch to a products export center – largely to the Americas. In addition continued production from both domestic and Canada will likely make it a discount to Brent, just not as much as was observed over the past year. This is largely based on believing the economic quandaries in Europe and Asia get settled. If that does not work out, the future gets really foggy as US economic conditions will also falter.

I will promise to be more inspired and have more time to discuss the energy issues going forward.

Your well rested blogger Energy Consultant,

614-356-0484

Term Limits for Academia

As I begun to review the report “Examining the feasibility of converting New York State’s all-purpose energy infrastructure to one using wind, water, and sunlight” I decided to get to know the authors of the report. To my shock and dismay, none of them has had any experience in the utility industry, much less any industry.

There is no doubt in my mind, Academia represents an important part in society. Many professors have had profound impact on myself Those include Dr. Grant Wilson and the late Dr. David Himmelblau.

Though Dr. Himmelblau spent a majority of his life in Academia, he did serve in the army and a decade in industry. He taught me a very important lesson that I continue to use till this day.

He had a take home final exam. The final exam involved finding the hydrogen values at various points in the process. Many points in the process were easy to identify. However, there were a few points that no matter what, one could not prove conclusively the hydrogen amounts. Many in class were dumbfounded and turned in incomplete test. I spent an all-nighter trying to get it. Finally I decided to write several reasons to support my assumption.

Dr. Himmelblau later told the class there was no way to conclusively get several points, and the key was to make an educated guess based on supporting assumptions. In life there are many unknowns and you will have to make the best guess you can with all the factors you have at your disposal. This advice probably allowed me to be a great forecaster. This advice is so true when you attempt to understand the future. You won’t have all the facts and you can’t always wait for them either. Operating with unknowns is a reality – learn to embrace it. I believe this is something that cannot come from just being in academia.

Dr. Wilson helped me out in many ways. His ability to take things from a theoretical world to real life applications helped bridge my thinking on how to apply school work into life. Dr. Wilson had a very impressive industry experience, which I believed allowed this lesson to be prominent in his teachings.

Back to the issue at hand, my google search on each of the authors show no industry experience. This is not a personal attack. I am sure all of the authors are genuine decent human beings. The fact is they are discussing about something very complicated and real. No matter what you may say about the utility industry, there is one thing everyone should know, there are real hard-working people there who do their job out of true concern. I have not met a planner in any utility who takes their job lightly. They do deserve some credit for keeping the lights on over the past decades.

Yes there have been outages, but when those outages occurred did you think about your bill not being enough and how much more you would spend for those outages not to occur. Utility planning does include some social aspect. Reliability levels are set for the required masses not for those who COULD afford more. There are many dimensions when setting a resource plan. It is not just economic nor is it just a social cause nor is it just wishful thinking but significant applied mathematics with significant engineering calculations. The fact that not one of the authors had SOME utility experience, therefore, in my mind it immediately reduces the value of the study. It would be akin to having someone do surgery on your body without any experience other than from what one read. Perhaps success is quite possible, but it would be beneficial if they actually built up some real experience in the real world where all the dimensions are taken into account.

My quest to evaluate the study content quickly got diverted. My quick author search got me thinking not of the study, but the thought of term limits for academia. Many people point to the fact that a lifelong politician loses sight of reality – is this true for academia? It would seem that more and more professors are taking the lifelong route versus the professors I had who had spent time in the world then came back to academia. I hope institutions think about this as they look to build their staff. Colleges should implement a term limit so that their professors do not lose sight of the real world. This probably should apply with your consultant. Hopefully you don’t have a consultant who has lost track of the real world.

Now back to reading the report…..

A supporter of term limits for politicians, academia, and consultants – Your Energy Consultant,

614-356-0484

Natural Gas Revolution?

Natural gas revolution, perhaps, is real, but it will take more to make it a real revolution. There is no doubt that shale development has made a major leap in gas supplies. However, energy is just a means to an end. In order to make this a real revolution, we need to see ingenuity in using natural gas. With the largest spread between natural gas and oil we should start seeing advancements in gas to liquids. I have done much in this area and have failed to come across something transforming in this field.

You can have all the energy you need and more, but if you don’t use it in a productive fashion you will end up like a third world producer of energy for others to exploit. As a domestic policy focusing on finding and developing energy is valid, but in the end, it is how you plan to use it. We need energy because it brings value to society by enhancing our way of life from keeping us warm in the winter to allowing us to read at night.

So much debate is focused on the industry on how many jobs it can create. Who really cares? Why would one want an economy built on the means not the ends? The less we can require of our means the greater the value of the ends become. The notion of a grand green economy to the massive employment of natural gas or coal is quite unproductive for the long run. Jobs in a sector which only enables you the option to live better cannot deliver much value as in the sector that actually implements better living. Natural gas has an opportunity for electrification, chemicals, petroleum products, goods manufacturing, heating, etc… Focus is needed on how we use natural gas.

Currently natural gas is still being flared around the world including the US. In Iraq alone they are flaring quite bit – http://blogs.platts.com/2013/06/17/iraq-flare/?sf429145=1. For a country who is lacking consistent electricity it would make sense to build up the infrastructure to transport and use the gas for electrification. Ingenuity in developing a means to manage stranded gas and/or increasing the value of that gas is lacking. This will be a revolution as soon as we are able to reduce and/or eliminate flaring of natural gas. The fear is we found a way to find more natural gas, but in the end flare it off in search of the higher value liquids product.

A revolution requires more than a one-sided story. Perhaps the low price signal is the beginning in terms of the market place action. However, there is much needed on the domestic policy front. We need to stop focusing on policies aimed at boosting production and creating an economy from developing energy and start to focus on an economy on using the energy in a productive fashion. Then, and only then, will it be considered a revolution.

As you ponder the path of energy please do consider All Energy Consulting as potential partner. We do technology valuation to forecasting commodities.

Your Energy Consultant,

614-356-0484

Consulting Value and the Information Age Impact

The value of consulting comes primarily into two forms – reaffirmation or value creation.

Of the two, reaffirmation is not likely to lead to as great of a value formation since the consultant is re-affirming what you would likely do. However there is significant value as it will likely make you act quicker than if you were not re-affirmed. In addition, the re-affirmation value would be more robust if your consultant came from another perspective, but still ended up with the same conclusion. Here in lies the value of a re-affirmation consultant. If your consultant primarily thinks like you do, re-affirming your thoughts should not be a surprise. A consultant who has a different thought process and different perspective really adds value, even though the conclusions may be the same. This re-affirms the conclusion to be robust not just a chance outcome. If you hire consultant for re-affirmation, ask yourself if my consultant is going to color my situation the same as I would, or would he or she be able to add substance/robustness to my conclusion.

Value creation from a consultant comes from the consultant being able to take his or her own unique experience and produce something you would not expect to be able to do because of the time frame and/or plain knowledge of the situation. The “super” consultants will not create an average thought piece that you could get from a government paper and/or mass media. If average is what you need, you would be better off asking your employees and/or industry associations versus paying a consultant.

I have been fortunate to be both a person who hired consultants and worked as a consultant. I understand the value of consultants and how one picks a consultant. At AEP I was in charge of the consultants we hired to examine the energy markets. The consultants I have hired included CERA, Wood Mackenzie, PIRA, Energy Ventures Analysis, Hill and Associates, Global Insights, Moody’s,etc…Over the years I saw changes in consulting. There were many consulting companies in the beginning that offered deep insights and different perspectives which challenge my thought process, allowing me to build my knowledge of the markets. The fascinating transformation occurred as many of these consultants got larger. As one could expect as a consultant firm gets larger, thoughts need to “co-mingle” as corporate heads expect team/consensus building.

However what do you expect to get if you build a consensus of many people vs. a vision and thoughts of a few? There is some sort of scale at which adding expertise into a consulting firm produces an effect of converting knowledge back into information. For my consulting experience, I was fortunate to have the experience in a 50 person consulting company Purvin & Gertz. We had some very interesting and heated debates on the outlook of the petroleum markets. The process was very personal, but in the end there was no requirement of consensus as accountability could not be washed out in numbers.

I also had the experience to work in a mega consulting company Deloitte Consulting. As expected, the outlook in the mega company generally involved more political maneuvering as people tried to climb the corporate ladder. I saw a dampening of individual thought as corporate mantras would likely lead to greater career success. Not much different than one would expect in any corporate setting regardless of the consulting aspect. There will be those individualists who can make a name for themselves and rise above the consensus thoughts, but the odds are against them. If you are a number person and/or just observant you can plainly see; tying ones ideas and thoughts to the corporate mantra will likely/statistically lead to a -greater career success. Coming back to consulting, if you create a mega corporate consulting company- are you creating a potential to dilute the very in-depth different insights your client requires of you? I am not saying that it is not possible to obtain this from large consulting companies, but it certainly requires a company to be different than most corporate cultures at that point.

Perhaps someday I may once again join the ranks of a mega-consulting company, but it would have to be on the grounds of still being able to offer a unique perspective to my clients, or else what is the reason to consult? The world is well into the Information Age, given the internet revolution. We all have access to mainstream media, government analysis, industry associations, and the futures market. There is more data than you can possibly analyze now. Consulting becomes harder as consulting is not just about bringing information anymore since that seems to be ubiquitous, it is about bringing your unique experiences and processes to the table and converting that into knowledge for the client. At All Energy Consulting that is the very premise of the creation of this consulting group. We don’t want to be another information shop – we focus on value-creation and robust re-affirmation through transferring knowledge.

Please do consider the reasons for hiring a consulting company and then consider All Energy Consulting.

Your very thoughtful Energy Consultant,

614-356-0484

Twitter: AECDKB

“The answer was fewer clients. Less money. More attention. Caring for them, caring for ourselves and the games, too. Just starting our lives, really. Hey – I’ll be the first to admit, what I was writing was somewhat touchy feely. I didn’t care. I have lost the ability to bullshit. It was the me I’d always wanted to be.” Jerry Maguire

“Look I don’t have all the answers. To be honest, in life, I failed as often as I succeeded. But I love my wife. I love my life. And I wish you my kind of success.” Dicky Fox from Jerry Maguire

Power Industry Challenges – Strategic Threat

The power industry is the most capital intensive industry. This capital intensity was one of the key factors in regulating the market. Centralizing a large unit lowered the cost significantly even though transmission and distribution cost would be increased. The irony is we now build units such as wind that are more expensive and also cost more in transmission and distribution cost. In addition, we have de-regulated the generation piece of the business in several markets. The de-regulation experiment is bound to have some significant failures as the ends may not be great enough to justify the means. Society is use to capacity being built when market prices return a 10-12% return. However in de-regulated world returns would need to be commensurate with the risk. High capital cost in addition to volatile uncertainty in commodity and policy would require a 20+% return. In order to get such a return the prices in the market will likely be at levels that brownouts and rolling black out occurs at peak time periods. Society will not deem this as acceptable.

The weighted average age of all the plants in the US is 28 years old. This means somewhere between 10 and 30 years from now 600GW will need to be built assuming NO load growth. If we add 1% load growth over the next 40 year we are looking at an additional 100GW. The total investment for just the generation piece will be around $700 billion.

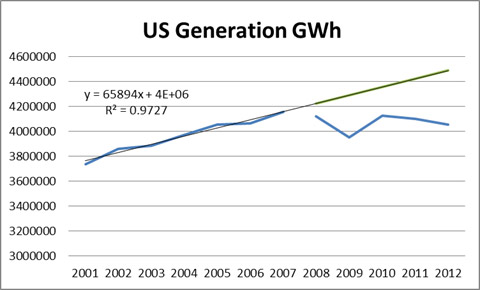

This comes at a time when utilities are bleeding in the nation from lack of load growth. Load growth is the key revenue line item for utilities. Projects and investments are based on assumed load growth and rates are adjusted to represent the revenue requirements. When load does not grow as it didn’t for the last few year, revenues dramatically fall and rates will need to be adjusted up to account for the expected load growth which did not appear.

Based on the expected trend before 2008, utilities load drop has resulted in a loss of expected revenue around $140 billion.

In addition, there are so many other initiatives beyond generation that are on the shoulder of utilities. This includes Environmental controls, Smart grid, Demand side management, Conservation, Efficiency, Renewables / Feed In Tariffs, Carbon, Pension obligations, Jobs support, Transmission, and Distribution investments. If you think the ages of plants are old distribution equipment is much older.

All this added cost points to higher rates for the consumer. Rates can only go so high before society revolts and/or the business model of the utility folds. This issue becomes a strategic threat.

Please do consider All Energy Consulting in helping you assess your strategic risk and understanding the future of the energy markets.

Your Energy Consultant,

614-356-0484

Twitter: AECDKB