Oil Price Drop Impacts Part 2 – The Bright Side!

The oil price drop is not all bad for the energy sector. In our first part on the Oil Price Drop, we examined the fallout that will occur with Renewable Fuel Standard as a result of the price drop. With the completion of our USGC Refining Models, we review the dynamics in the region and have great news for those downstream and a positive highlight for certain upstream players.

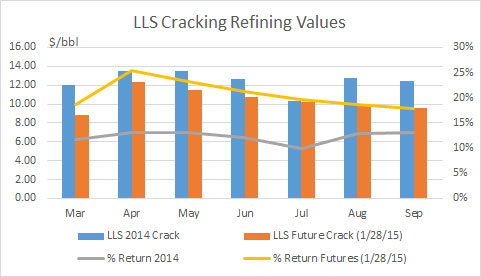

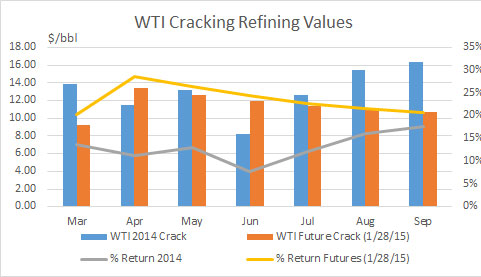

For this analysis, we present the information ignoring the dynamics of the renewable fuels standard, which we will discuss at a later time. The focus is to compare the change from 2014 to 2015 therefore any issue of RFS will be reduced given similar circumstances for 2014 and 2015. The figures below represent the calculated margins from our USGC Cracking configuration refinery for LLS and WTI. The 2014 figures represent last year actual results whereas the 2015 uses the futures market on 1/28/15 to represent 2015 March through September (longer time period available – please contact us for information). With Oil Market Analysis (OMA) product/service, we will actively publish the results daily using the latest futures market with an ability to go back into time. You will be able to also upload your own forecast of products to recompute expected margins based on our yields per our refinery configurations.

Given the drastic swings in crude oil price over the last decade, I focus on the returns versus the absolute cracking margin. Returns are calculated by taking the value of refinery yield over the cost of the feedstock. Being able to sustain reasonable returns supports the industry. Producing a $10/bbl margin in a $100/bbl feedstock world is not sustainable given the risk in the market place even though $10/bbl margin historically would have been a wonderful dream for many refineries in 80’s and 90’s. The bright side is the refining world is showing returns of over 20% compared to the low teens observed in 2014. Also I suspect, even though the absolute margins are down from 2014, refineries may be able to make up the dollars through increased volume as demand will be much higher in 2015 vs. 2014.

Not to leave out the upstream folks completely out of the bright side, we examined the changing landscape of condensate given the enormous production growth from Eagle Ford. Though the indexed crude oil price is down over 50% from last year, the discount to the condensate has narrowed given the futures product prices outlook. Refiners should not be so aggressive in asking for discounts to Eagle Ford. This could change as Naphtha price and octane value could move in opposite direction (Naphtha down and Octane Up) increasing the discount asked by refiners.

All Energy Consulting offers our market based approach on refining to assist producers and downstream participants in understanding the market risk. We work with you to develop a collaborative view of the future and the risk it holds. Please do consider us for your consulting needs as we are here for your success and have a proven track record of successfully identifying the paradigm shifts.

Your Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB