Winter Power Fuels Consumption Sensitivities (Gas & Coal)

As noted in my previous write up, we could see a record amount of natural gas demand in the power sector if certain stars align. One of the major drivers is the price of natural gas. The two price components for natural gas is the benchmark location of Henry Hub price and the basis (price differential to Henry Hub). In this Winter Power Outlook report, we ran over 50 cases. Our gas price sensitivities included changing Henry Hub (28 sensitivities) and then just changing basis prices (10 sensitivities). The below figure is a redacted output from the report.

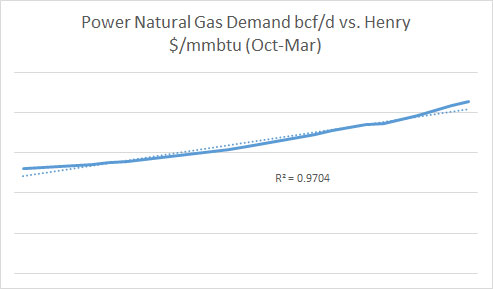

For this winter, the correlation with Henry Hub price and power natural gas demand is very linear. With the purchase of this report for only $3000, you will get the data and the associated linear equation. This will give you grounds to estimate the power markets natural gas demand as a function of your expectations of Henry Hub.

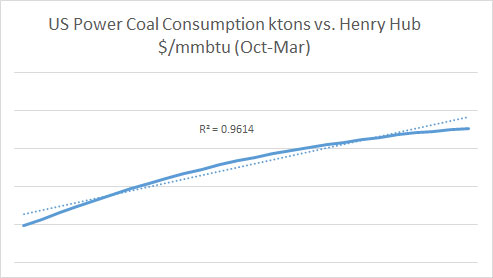

Changing the price of Henry Hub also altered the coal demand. The redacted figure below shows the relationship of coal demand and Henry Hub. As in the natural gas demand figure, the coal demand outlook is very linear with the changing Henry Hub price.

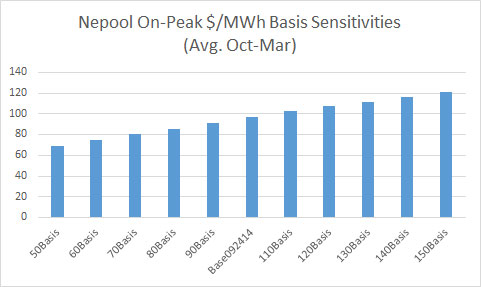

Changing basis by a set percentage from 50% to 150% did not significantly alter the gas demand. The basis impact altered gas demand by +/-2%. However, power prices did significantly change. In the Nepool region, the basis sensitivities produced nearly a +/-30% swing in on-peak power prices – see below figure. The winter report will contain price output for all major power hubs in N. America with the associated simulations.

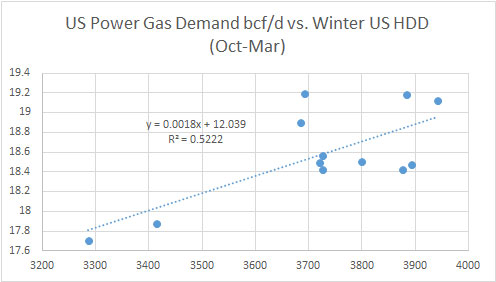

A common mechanism used in the industry to estimate natural gas demand is the usage of a relationship with Heating Degree Day (HDD). However, in the power sector, that relationship is very fragile as location and price relationships can cause a non-linear relationship. The figure below demonstrates this with simulations of each weather year between 2003 and 2013.

For only $3000, our Winter Power Outlook report will have enough information for you so there will be no guessing to what the power markets will do for gas and coal consumption under various scenarios, whether it be price, weather, or unit performance. The first 5 subscribers will also be able to create their own custom outlook run. You can select and combine various weather years, change henry, and/or change basis price. We will run your custom case and give you all the output from that case. In addition, to the report you will get access to PMA-NT for one month. PMA-NT updates daily, therefore you will always have an updated third-party view of the near term market (2-3 years). PMA-NT can be used for hedging or trading as demonstrated in our previous articles – Effective Power Hedging and Excellent Returns.

A new product is coming. PMA-LT will be released soon. PMA LT is a monthly forecast out to 2035 produced quarterly. Given the long-term outlook, a fundamental gas view point was developed in coordination with RBAC the makers of the GPCM® Natural Gas Market Model. The quarterly outlook will present monthly prices for all major N. American power hubs. In addition, a report will be included to support the outlook. Description of retirement and expected new builds will be detailed in the report. PMA LT subscribers can get access to gas pricing and a report supporting the gas fundamental outlook. Customization of long-term outlook (e.g. Carbon policy) is also available to subscribers.

Please call or email to sign up for the Winter Power Outlook Report or PMA-NT or PMA-LT [email protected] or 614-356-0484.

Your Grateful Energy Consultant,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter