Winter Power Price Outlook – Not as Bullish as Last Year

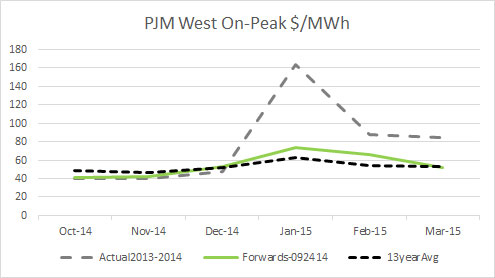

The forward curve is shaped to expect last year’s historic cold winter – see graph below. However last year was very atypical and back to back winter extremes are not common. The power prices being extreme multiple years in a row are nearly impossible to find. This is because generators take action based on last year’s results more often than relying on statistical or analytical process to account for potential variations.

The largest issue in 2013-2014 winter was not directly the result of weather, but 2012 and 2013 market conditions. Due to poor market conditions in 2013, many coal plants before winter did not prepare for winter as they typically would do. Many plants were likely not allocated their standard fixed cost budget to prepare for winter given such poor market conditions for plants in 2012 and 2013. As a result 70% of the forced outages were not from increased gas demand due to weather as some may think, but from plants not prepared for so much demand and the colder than normal operation requirements. This does show the importance of maintaining and operating base load units. Without base load units,we can expect to have price run-ups much more frequently resulting in historically high wholesale power prices. Given this behavior pattern of generators, I strongly anticipate outages this winter to be very close to the average forced outage levels if not the best in years regardless of winter conditions. This will limit the price rise.

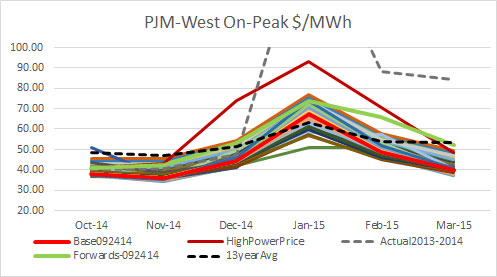

We have almost finished our winter outlook report using our advance product line Power Market Analysis Near Term (PMA-NT) (Click to Get Presentation on PMA-NT). For this winter analysis, we ran over 50 permutations simulating all the various conditions. These cases included changing henry hub in 10 cents increments from $3.5/mmbtu to $6/mmbtu to understand how natural gas price can change power prices. We also ran a range of natural gas basis price changes to better understand the natural gas price impact. For a better understanding of weather impacts to power price, we ran each weather year from 2003 to 2014 – including the 2013-2014 winter. In addition, we ran our standard high and low power prices which take a combination of the 50 permutations to produce a realistic high and low case.

A sneak preview of the analysis below shows the concern I have with the forward curve being bias to last year. If you look at the historic data for PJM-West, the former highest winter monthly power price was in December of 2005 at $101/MWh. The graph shows all the permutations we have produced. Based on the forward curve, if I wanted to be bullish this winter I would be more interested in the December than January contract.

All this analysis is available to you for only $3000 in our Winter Power Outlook Report. We will also supply a free 1 month access to PMA-NT (Click to Get Presentation on PMA-NT). Plus if you are the first five customers for this offer you can get a custom scenario based on the permutations already used. You can create your very own extreme case (e.g. Basis up 30%, 2013-2014 Weather, Plus Henry at $5.5/mmbtu, double forced outage rates). There is no other place to get so much information for so little. The report will be even larger and more comprehensive than the Summer Outlook we produced this year. If you take the time to review and understand the report, you will be fully prepared to understand the risk and key variables driving the power markets this winter. Call 614-356-0484 or email [email protected] to get this limited offer.

Your Energy Consultant,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/