Excellent Returns Were Produced From PMA’s Summer Model Predictions

As noted in our previous article – Effective Power Hedging, Power Market Analysis (PMA) can also be used for strictly hedging purposes. However the roots of PMA are for power trading. In this article we will examine PMA power trading results for the summer of 2014. We will demonstrate that our model and our advance trade screener have produced numerous winning trades over the course of the summer, generating significant returns with minimal risk.

As illustrated in our previous article, the non-customized PMA trade screener produced a winning portfolio of trades yielding over 10% returns in a month. This portfolio of trade opportunities was developed with no additional tools and insights other than our model calculations. All Energy Consulting believes incorporating PMA with other tools such as weather forecast (e.g., temperatures, rainfall, etc.) and market data feeds (e.g., outages, transmission constraints, etc.) will lead to even greater returns. We believe incorporating that knowledge in our previous example would have likely led to redistribution in the PMA portfolio, producing returns in excess of 20% vs. the 10% demonstrated.

PMA does not forecast weather. However it does run a range of simulations which can be used to predict the various outcomes of the future given changes in weather, gas prices, outages, and more. These sensitivities can easily be customized for your efforts. Using the default changes setup by All Energy Consulting, the model can identify fundamentally-flawed future market expectations, given the likely realities displayed in various future outcomes the model generates. These are the minimal risk trade opportunities identified by the trade screener. The trade screener scans through the various permutations and identifies these minimal risk trade opportunities, allowing one to quickly find a trade to execute.

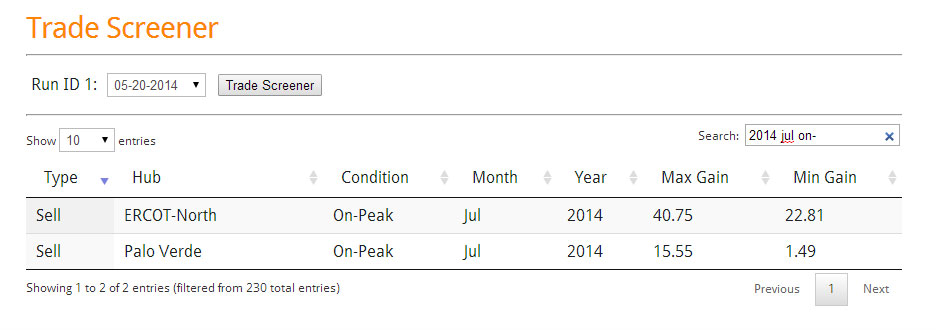

In this article, we will not only review trades on a physical basis (as presented in the last article), but we also demonstrate the trade screener and how it can be used as a power tool within a financial trading effort to great success. In order to demonstrate the financial trading value of PMA, we will examine our predictions two months out, which was developed by PMA. As in our previous article, our starting date is May 20th 2014. We’ve screened for the trades in July On-Peak. Two value creating trades (both sell recommendations) were identified by PMA, – ERCOT North and Palo Verde – displayed in the screen shot below.

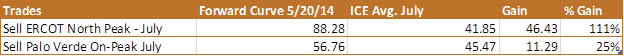

Executing both these of these trades would have yielded an average return of 22%. The results are presented below. In this case, a financial trade to sell ERCOT North and Palo Verde July contract is made on May 20th and then bought back a month later on June 20th.

If the trades were taken to the physical market an average gain of 68% could have been made.

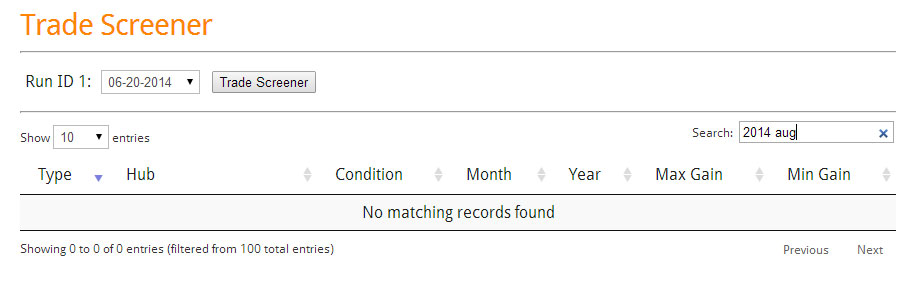

For June 20th 2014 the trade screener found no minimal risk trades two months out. Note: In trading, sometimes it’s best to hold on to what you have.

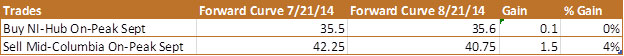

Our July 21st 2014 screening did produce a set of winning physical trades for August — yielding 13% with three trades. For the two months out trade (September) – PMA showed its first buy signal in a while – NI-Hub On-Peak. On a financial basis that trade was only slightly up as seen below.

As noted previously, the above examples were produced using PMA only, absent of any additional tools such as (weather, market changes, etc.). As also mentioned earlier, integration of additional tools can be incorporated to produce even better portfolio results. All Energy Consulting is willing to team up with trading firms to advise and customize runs and screens to produce a winning power trading book with no upfront cost. This commitment should illustrate our confidence in the value created using PMA. AEC will consider taking a percentage of the profits as our only compensation. Please call or email for more information on this limited opportunity.

All historical runs and reports are online. The above can be easily recreated when you subscribe. We do not hide from our past results. Never be out of touch with the market. PMA is updated daily. Get a 30 day trial for only $1000.

Your Energy Consultant,

David

David K. Bellman

Founder & Principal

All Energy Consulting LLC

“Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

blog: https://allenergyconsulting.com/blog/category/market-insights/