AEO 2013 Early Release – Arbitrage Remains

The EIA released an early release of the AEO 2013 in December. I have been so busy, I haven’t got a chance to note some of the changes (Once again, not complaining but very grateful). As I mentioned in my previous blog of the AEO 2012 release, the first thing I like to look at is the relationship changes.

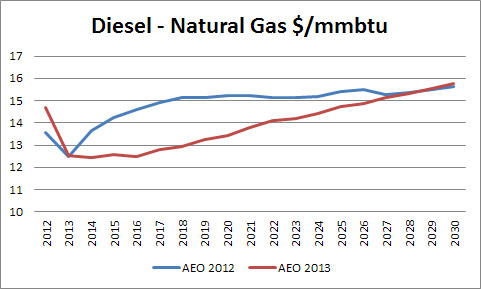

In this release, it looks like the arbitrage remains for someone to capitalize on the difference between natural gas and diesel. They did narrow the spread relative to last year which I believe is directionally correct. The difference continues to be large on the scale of over $15/mmbtu in the next decade plus. The propane difference is over $10/mmbtu. With this spread premium, one really needs to question the science and economics of Gas to Liquids (GTL). GTL is possible, though costly, as proven by Shells Qatar Pearl facility. With the economics presented from Shell, you would need your input price below a dollar to make the project worth its large capital cost ($19 billion) and the associated market risk.

The opportunities exist for Shell to learn from this large venture to see if they could lower the cost and/or improve the yield or perhaps, Shell technology is just not the way to go. This could be a worthy consideration for research from the US government and universities. GTL could be the game changer which would bolt on perfectly with the game changer shale gas. I have spent much of my time as Chemical Engineering examining this area. The cost is what I believe really shifted the spread to be so large; $19 billion for 1.6 bcf/d of conversion is incredible. Perhaps. Shell is scaring the competitors away from researching this?

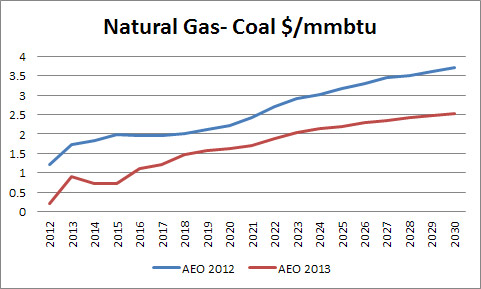

Jumping to the next relationship, Gas – Coal; we see they have narrowed the spread more in this year’s AEO 2013. Essentially they have lowered the gas price relative to last year by around $1/mmbtu. I cannot agree with their 2014-2017 outlook. I believe they have gone too far down. If you look at the balance, it would not make sense that 2015 gas demand in the power sector would be lower than it was projected in 2013 with lower gas prices in 2015. I understand as new gas units come into the power stack, you get an improvement in efficiency for gas units.

However, at the same time, we do have a retiring coal fleet plus the “must-run” coal plants to manage the safety of the coal piles will be going away over time. I believe it is possible to see gas demand higher than in 2012, even with higher gas price. For the very reason that coal units were running more than economically reasonable to manage inventories, under coal contracts which were contracted years back. To the coal industry own doing, the coal contracts were shortened to be no greater than 5 years. This would mean many coal contracts are in negotiation at the lowest need time period for coal generators. I suspect as much as coal generators over bought in the contracts over the past 5 years, they will under buy now. Coal “must-run” units to manage inventory will be a thing of the past over the next 5 years. I will take the bullish position on coal spot prices.

As a commodity forecaster for many years, when the general equilibrium fancy models catches up to your outlook, you know that you now have to take a difference stance. I believe gas prices in the AEO 2013 are too low now. This belief is driven from the fundamentals of economic demand creation from low gas price in both the industrial and power sector. I believe coal prices in the spot market will be stronger than most think, as the most likely outcome is under-contracted coal volumes.

I hope to have more time to review the final report which is expected to be released in the spring. Does the report come sooner now since Punxsutawney Phil saw no shadow and predicts an early spring?

Please do consider All Energy Consulting for your energy consulting needs from forecasting to planning to actually doing hands on work in creating models, we are here for our clients.

Your Energy Consultant,

614-356-0484