Refining Economics Will Be Focused on Simplicity

Refining in the US has been focused on a premise that never came true. The age old belief in refining economics:

1. Crude oil was going to get heavier and higher in sulfur.

2. Gasoline demand would continue to grow and represent a premium of diesel.

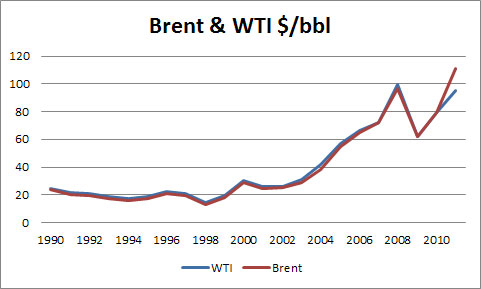

Unfortunately for many, those beliefs never transpired. This belief breakdown can be attributed to the strength of the word markets versus US markets. Crude oil prices breaking beyond the historical norm of $20-40/bbl changed the game.

With prices this high, what was once un-economic now has become proven reserves. These new recoverable supply broke the trend of heavier crudes by offer lighter finds. Shale development is leading to an increase in condensates lightening US refiners feedstock.

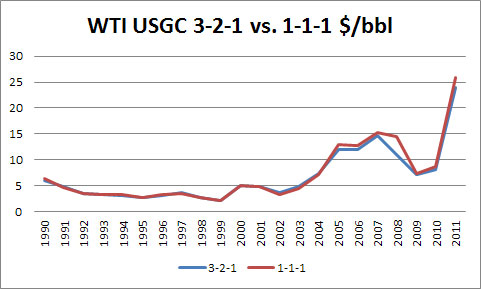

The quality of condensates also produces yields of more gasoline than diesel. World oil demand is growing from diesel demand, not gasoline demand. Diesel is the premium product. US refiners had geared up to produce gasoline, only to have the product, not offer the value compared to all the expenses refiners put into to produce gasoline. As seen below, simpler refining setup would produce better margins, particularly if one account for fixed and variable expenses.

What does this all mean and where do we go from here: I expect US gasoline demand to continue to fall this year. Diesel will continue to be the premium product. Even though refining margins seem high relative to history, this is the wrong perspective.

With the higher crude oil price paradigm, one needs to look at margins at a percent of feedstock cost. With a cost of $20/bbl one could be satisfied with a $4/bbl return (20%). However at $100/bbl, a $4/bbl really wouldn’t satisfy the risk or cost. The figure below shows the current margins are not high on a historical basis when one accounts for the underlying feedstock cost.

Refiners who will be successful in this environment will be those who can simplify. Lower operating cost will be the key, as added complexity with additional cost offers no value. Hovensa and Valero Aruba refineries both noted they have much higher operating cost than USGC refiners. This is a result of the higher crude oil price world. Refiners who have access to natural gas can save over $2/bbl on operating cost, as fuel oil prices remain de-coupled from the gas markets.

At All Energy Consulting we have put together forecast for our clients. We can use our expertise for margins calculation to developing a crude oil forecast. If you are evaluating a project/investment, I would suggest calling or emailing All Energy Consulting. We can provide an independent analysis along with key solutions to maximize your potential in making a successful project/investment.

Your Energy Consultant,

David K. Bellman