Eagle Ford What Are You?

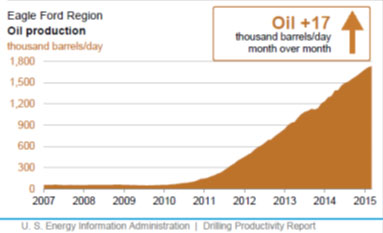

“May the real Eagle Ford stand up” is another title I was thinking for this article. As I get ready to launch Oil Market Analysis,one of the areas I have been focusing in is the condensate issues in the Gulf. In particular, the production from the Eagle Ford region – see figure below.

There is much discussion on this production being mainly condensate. Condensate is a crude oil – just a really light crude oil. A common unit of measurement for the density/gravity of the crude is API. The higher the API, the lighter the crude oil becomes. Some consider 45+API to be condensate. Most condensates are also extremely low in sulfur – very sweet. To put it into context LLS is around 36 and WTI is around 41 API. There is an issue in being too light – but you can never be too sweet (such is life). Your product yields will suffer particularly in the No. 2 cut (Diesel, Heating Oil, and Jet). Also being so light, in a refining region not expecting this trend, causes operational issues that can be addressed overtime given the right pricing incentive.

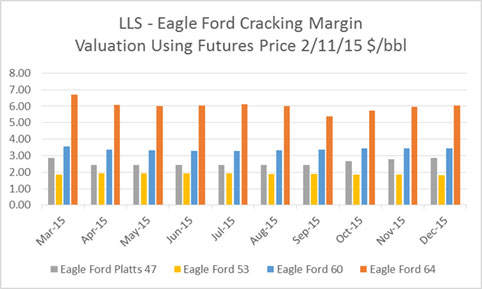

I have gathered 4 different assays of Eagle Ford. They range from 47 to 64 API. Platts own price marker methodology notes the range of assays from 40.1-62.3 . They settled upon a 47 API. They also note the cut range used and I adjusted another assay to reflect the Platts assessment seen in the figure below. The other interesting thing to note is there seems to be an Eagle Ford and an Eagle Ford Condensate marketed. This may explain the large variance. However, regardless of the marketing, the value of your Eagle Ford as a refiner can swing significantly. Below is the cracking value of the various Eagle Ford assays relative to LLS from our USGC cracking model, from our Oil Market Analysis Platform using the futures market strip on 2/11/15.

Cracking valuation models are strictly based on the yield and product value. This does not take into account the logistic issues of having to truck condensate, which could easily add another few dollars to the discount of Eagle Ford. The model does take into account the quality issues for both octane and sulfur. Having run and managed the South Louisiana Quality Bank, crude quality can have significant ramifications. Declaring a label of Eagle Ford, given the variations of quality, will likely not mean much. Contracts dealing with Eagle Ford will have to have quality specifications and processes to deal with variations.

The largest driver among the various assays is the amount of diesel and jet produced. In some assays, we produce too much light ends, making a limited amount of finished gasoline and left with Naphtha. This drives the discount seen in the Eagle Ford 64. Increasing the reformer capacity is needed.

To deal with the lighter crudes, more reformer capacity will be needed along with greater alkylation. The octane values from these lighters crudes are not high, at least from the data I have. The discount to Eagle Ford will come in some, over time. This will not be due to the ability to export the crude oil. The export market is expected to be ultra-competitive when it comes to condensates (discussed at a later time). There will be operation issues in the US as refiners adapt to the new feedstock. These issues could include needing to run your crackers less; thereby, likely impacting heat balances. However, these are solvable engineering issues, given an economic incentive. The infrastructure of Eagle Ford is being built out. This will lead to a reduction in discount as the transportation cost is reduced. Eventually the market will see a uniform stabilized Eagle Ford blend. Until then, pay attention to your quality specifications in your contract and hopefully leave room for adjustments.

By the way, I will be speaking at the Platts 4th Annual Refining Convention in May – See agenda. I will be addressing the issue of condensate and NGL’s in the market and what we can expect to see in terms of market forces in the future. I hope to see you there or even sooner. Please do consider All Energy Consulting to help you in the crude oil and refined products market space.

Your Crude Processing Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Capacity Market and Updated Performance

For our followers, we have a link to our complete thought piece published in Public Utilities Fortnightly – February 2015 Click Here. In this article, we examined the capacity market. For those tired of all the numbers I present, this piece is focused on explaining and presenting a concern with the latest adaption of capacity markets. There are limited numbers in this discussion. This is not an anti-capacity market article – nor is it a very supportive article on where the capacity market is going. The major underlying concern is we are developing a market with limited downside for participants, but leaving major upside to them. If this is the case then why not consider re-regulation. Please enjoy the thought piece and I look forward to your feedback.

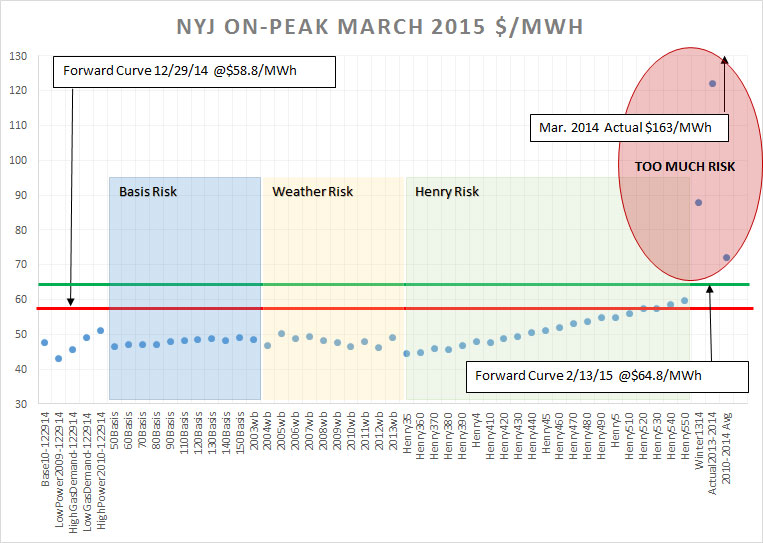

On another note we have updated the results of our December trade strategy screener – click here to see the results. The amazing performance continues with the December strategy producing the most calls and all but one lost money (Sell March NYJ On-peak 2015). The one that lost probably would not have been suggested if we applied one more layer of analysis – see below figure. Using a historical screener and running our weather risk of last year, we see the risk was likely too great to put a NYJ ON-Peak March sell.

We will continue to show and track the performance of the model in the pdf. Our clients were presented the strategy two weeks ago. This time the model only has two recommendations for April.

We realize this platform can be used beyond enriching power traders so we have expanded our offering to help End Users evaluate their power purchase. Please review our presentation that shows how All Energy Consulting can help End Users navigate the complexity of the power markets. No other energy management nor energy providers offer such in-depth analytical capability to let you know what impacts particular events may have to the power markets. We can really quantify the future power market risk to help you make an informed decision. This is a state of the art dispatch model with in-depth industry experience applied not just some historical price analysis typically done for the sector. We will collaborate with you to create an optimal strategy balancing your budget and energy needs.

Please help us help you! Call now before it is too late 614-356-0484.

Your Trying to Help You Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Case Study on Using Analytics to Save Money for Ratepayers

The origin of Power Market Analysis (PMA) was for power trading. However given my experience in all facets at one of the largest utility in N. America – American Electric Power – I knew the use of the knowledge of the power markets extended beyond enriching power traders. With the growth of deregulation and development of regional transmission organization (RTO), the power market has evolved as a legitimate option for power generation versus self-generation for utilities, municipals, Co-op, energy providers, and large consumers.

The power market is fascinating to me as compared to the stock market or other commodity markets as it offers a market that is pure. The power market has limited storage opportunities producing a fundamental convergence immediately not many months from now. The ability to manipulate the markets has situated from the rules of the market not the market itself.

Many utilities have only touch the surface of the power markets as they still largely depend on their own generation. This is changing as many baseload plants will be retiring over the next several years. In addition, dependence on renewable generation will lead to greater market reliance as intermittent issues are real. I have put together this case study to demonstrate and calculate a real dollar impact to the ratepayer if one can better account for the risk in the future market power prices. PMA cannot forecast the future in terms of weather, commodity prices, outages, etc… but it can let you know how much each of those variables can impact the market. This knowledge allows an informed decision on evaluating the option of using the future power market as part of your generation mix. In addition, this analysis gives you a firm and reasonable support for your decision making removing the stress from Monday morning quarterbacks. Many people understand there is much uncertainty in future events; however one should not leave decisions to chance or just assume futures markets represent reality – we can do better than a flip of a coin.

Please enjoy the case study and I look forward to your comments. CLICK HERE TO DOWNLOAD CASE STUDY – Case Study on Using Analytics to Save Money for Ratepayers – Beyond a Flip of a Coin

Your Energy Analyst Looking to Help You Succeed,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Renewable Cost Dropping – Impact to Resource Planning

A very good report on renewable cost is supplied by IRENA – Renewable Power Generation Costs in 2014. The absolute price numbers presented are hard to confirm, but the trends are likely undeniable. Most of the report is based on Levelized Cost of Electricity (LCOE). I have noted LCOE is not the best metric given the structure of the electricity market per my old article in 2012 (which, by the way, is the most popular page on my website for the last few months – not sure why, but it is). IRENA did note the issue with LCOE in their report.

The results from this report lead to implications that go beyond the obvious that renewable cost are coming down and potentially being very competitive with fossil generation. The first implication is the fact a report like this will lead to significant second guessing and planning work by resource planners.

Price discovery and the realities of renewable projects should be made transparent. IRENA report notes cost is very dependent on location. In states or local areas with renewable mandates with incentives, an open platform for project submissions should be created given ratepayer subsidies. Developers, ratepayers, utilities, and government officials should be able to access this site. I noted this in my article with my concerns to Senate Bill 310 in Ohio. There was an advance energy requirement in SB 221 which was removed per reasoning that there was a lack of projects under the guidelines of advance energy. My main concern with SB221 was the failure of the legislation to enable the commission to regulate and enforced the targets set forth. An enabler could have been budgeting and creating an open bidding platform promoted and managed by the state for advance energy projects. The platform would remove the concerns of pricing and the availability of advanced energy projects. This is beneficial to all parties. The utility removes the second guessing of the market place. Ratepayers and the commission know the project premiums and the depth of projects available. The cloak of the “evil” utilities preventing renewables will be removed with an open bid platform for advance energy. Cost produced from reports like IRENA will quickly be confirmed or denied. There is no need for commercial secrecy and competitive advantage when the ratepayer is willing to subsidize and potentially pay a premium.

The second implication from this report is to realize utility scale projects saves money. The report shows utility scale vs. residential PV produces a savings of over 50%. This savings not only comes in scale of projects, but by the utility cost of capital and other business intrinsic properties. Utilities should move into the PV space as Tucson Electric Power has done. There is no doubt a utility can drive more installation than a private company given the correct leadership and vision.

The third implication is the need to revisit biomass opportunities. Biomass generation’s ability to operate more closely to traditional resources offers significant operational advantages over wind and solar. The cost from this report indicate the premium for biomass is in line if not more favorable than many wind and solar projects. Many coal plants are making the conversion to gas. However given the trends and technology improvements in biomass a serious option to consider is the conversion from coal to biomass or even co-firing. The initial biomass projects in the US were a disaster in many cases. However, as with anything new, sometimes it takes a few failures to become a great success. The ratepayers should be equally willing to pay a premium for biomass as they do for solar and wind.

A final implication I will discuss is the subsidies applied to renewable generation. According to the IRENA report all their numbers represented cost without subsidies. Perhaps subsidies need to be removed from the most developed forms of renewables (e.g. wind) and the subsidies rolled down to other advanced energy forms. Advanced energy initiatives can be consider as insurance to the unknown of the future. As a society, we should be able to realize paying an insurance premium at a certain level is reasonable. Legislatures and commissions need to work to establish that reasonable level. Progress from anything new will come with some failures, but we must learn from these failures and move forward. The trend in falling prices from renewables was stimulated from government mandates. As generally a libertarian, this claim is hard for me to make, but being a realistic libertarian one realizes the system is not free to begin with therefore ideal principles cannot always work in an unideal environment. Utilities in their design are quasi-governments with limited competition. Stimulating the renewable investments from government mandates were likely necessary to achieve the fall in prices being observed. Much credit still must be given to the market players who took advantage of the mandates and delivered the cost improvements. It is my hope that at some point the subsidies and mandates will not be needed and we will have the capability to remove them. History is not our friend on subsidy removal. The agriculture industry still sees subsidies developed from the great depression. Even though our economy has shifted from agriculture, we continue with huge subsidies for farms no longer owned by families, but large corporations. Common in today’s political climate, we accept corporate welfare much easier than we accept social welfare. The reason for this is likely the effective capability of recycling corporate welfare dollars to the political process. I guess corporations are people to – right (Citizens United vs. Federal Election Commission)?

All Energy Consulting examines all the areas involved in energy and works hard to be open minded to the changing landscape. Please do consider us for your consulting needs as we are here for your success and have a proven track record of successfully identifying the paradigm shifts.

Your Continually Advancing Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB

Oil Price Drop Impacts Part 2 – The Bright Side!

The oil price drop is not all bad for the energy sector. In our first part on the Oil Price Drop, we examined the fallout that will occur with Renewable Fuel Standard as a result of the price drop. With the completion of our USGC Refining Models, we review the dynamics in the region and have great news for those downstream and a positive highlight for certain upstream players.

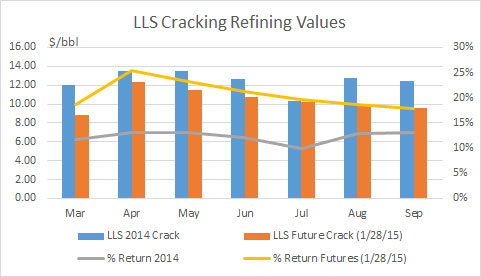

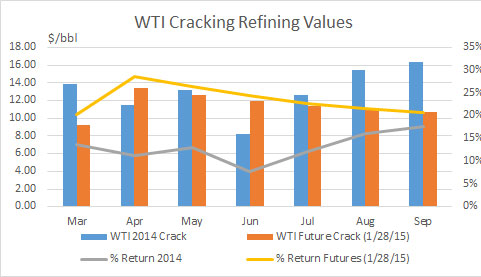

For this analysis, we present the information ignoring the dynamics of the renewable fuels standard, which we will discuss at a later time. The focus is to compare the change from 2014 to 2015 therefore any issue of RFS will be reduced given similar circumstances for 2014 and 2015. The figures below represent the calculated margins from our USGC Cracking configuration refinery for LLS and WTI. The 2014 figures represent last year actual results whereas the 2015 uses the futures market on 1/28/15 to represent 2015 March through September (longer time period available – please contact us for information). With Oil Market Analysis (OMA) product/service, we will actively publish the results daily using the latest futures market with an ability to go back into time. You will be able to also upload your own forecast of products to recompute expected margins based on our yields per our refinery configurations.

Given the drastic swings in crude oil price over the last decade, I focus on the returns versus the absolute cracking margin. Returns are calculated by taking the value of refinery yield over the cost of the feedstock. Being able to sustain reasonable returns supports the industry. Producing a $10/bbl margin in a $100/bbl feedstock world is not sustainable given the risk in the market place even though $10/bbl margin historically would have been a wonderful dream for many refineries in 80’s and 90’s. The bright side is the refining world is showing returns of over 20% compared to the low teens observed in 2014. Also I suspect, even though the absolute margins are down from 2014, refineries may be able to make up the dollars through increased volume as demand will be much higher in 2015 vs. 2014.

Not to leave out the upstream folks completely out of the bright side, we examined the changing landscape of condensate given the enormous production growth from Eagle Ford. Though the indexed crude oil price is down over 50% from last year, the discount to the condensate has narrowed given the futures product prices outlook. Refiners should not be so aggressive in asking for discounts to Eagle Ford. This could change as Naphtha price and octane value could move in opposite direction (Naphtha down and Octane Up) increasing the discount asked by refiners.

All Energy Consulting offers our market based approach on refining to assist producers and downstream participants in understanding the market risk. We work with you to develop a collaborative view of the future and the risk it holds. Please do consider us for your consulting needs as we are here for your success and have a proven track record of successfully identifying the paradigm shifts.

Your Energy Analyst,

David

David K. Bellman

Founder/Principal

All Energy Consulting LLC- “Adding insights to the energy markets for your success.”

614-356-0484

[email protected]

@AECDKB