Procure enough fuel this winter for your generating asset?

Fuel procurement for power plants has always been a tricky game, particularly when you add the element of cost. Buying too much fuel makes you look foolish and not buying enough makes you a gambler. Finding that sweet spot and the ability to justify the level of procurement is part of the Power Market Analysis (PMA) package. In this article, we will demonstrate the process of using PMA to find the right volume of fuel to purchase.

We randomly selected WS Lee coal plant in South Carolina and pulled out all the information from our 54+ scenarios we produced for this winter outlook. The key variables we examined in this example were load and gas price changes. PMA is designed for customization, so you can create custom cases for nuclear outages, hydro capabilities, fuel deliverability issues, coal pricing, etc…

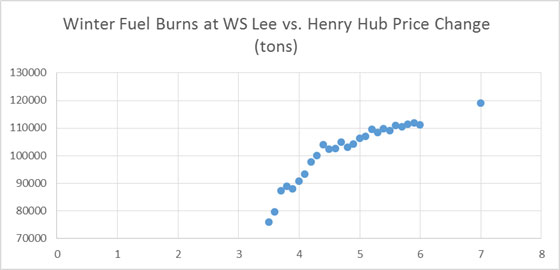

For gas price impacts on fuel consumption, we examined Henry Hub prices from $3.5-$6/mmbtu and added a stress point of $7/mmbtu. The graph below shows the amount of tons of coal consumed in the various price changes. The reference case used a varying strip (forward curve 9/24/2014) averaging $4.03/mmbtu.

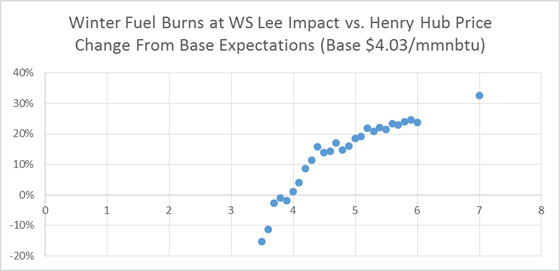

We like to look at it as it relates to the Base run. This view enables you to quickly assess the changes as function of a reference point. This also allows one to recalibrate to your actuals as the model is only a proxy and does not contain your exact cost structure and operational details. A custom PMA can be created to emulate your units cost and operational details. The percentage view gives a good assessment and allows easy comparison to other variables without worrying about the exact numbers. Based on the below graph, we can conclude the risk of gas prices moving up $1/mmbtu could lead to a 20% increase in WS Lee fuel consumption.

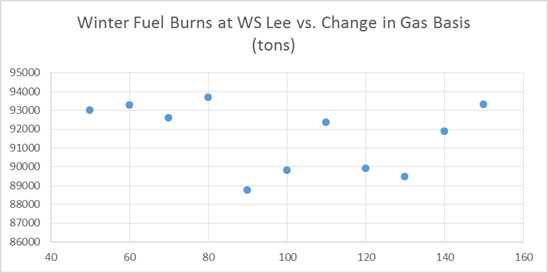

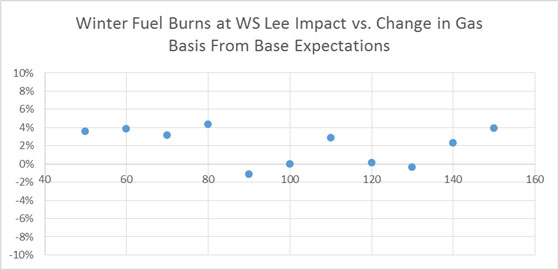

Another gas price impact view was to change the basis price. In this example, we took basis around the country and multiplied it by a percentage. So in the case labled 50 – we multiplied the basis spread by 50% making it half as small as the reference point. Inversely the 150 case makes it 50% higher. The absolute and percentage cases are shown below.

Given the facility is located in S. Carolina, it is reasonable to expect this unit to be less sensitive to basis versus Henry Hub changes. WS Lee, from this analysis, does not have to worry about basis causing significant variance in fuel consumption. However it is prudent and reasonable to be prepared to procure ~20% from base expectations given the real possibility of $5/mmbtu Henry.

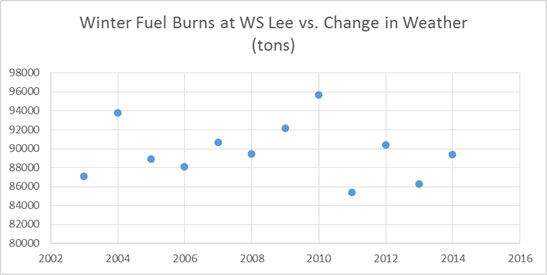

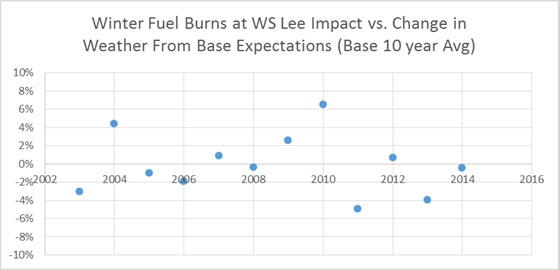

For load we looked at the last 12 years of actual weather and simulated each year into the model. The following graph shows the changes in WS Lee coal consumption and the percentage from base.

Once again, because we chose WS Lee a coal plant in S. Carolina – weather variance in the winter time is less important relative to a gas unit in the Northeast. However weather would support procuring almost 10% above base expectations given a recent actual weather event (2010) did necessitate 7% more burn from the 10 year average.

Several more custom runs could be generated from nuclear to coal outages to coal pricing (transportation & mine price) that would aid in the justification of the level of coal procurement of WS Lee. Using this example, a clear and precise justification can be made to procure somewhere between 10-20% more than the base expectations given the weather and natural gas market variance.

This demonstration used the analysis for this winter season, but this could easily be done for many months to years out. PMA can easily be used as a third-party validation to your procurement process. Avoid any accusations of being a fool or a gambler – sign up to PMA and start creating your custom run. PMA is more than just output – it is a proven process and platform designed just for you. We give enough customization, but allow you to still refer to it as a third-party source due to our involvement in the process.

Your Looking Out for You Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/