Refining Outlook Refined for 2014

As I review my last year’s thoughts on refining with updated data, it has caused me to be more bullish on the outlook for refining – which historically is very hard to do. US refining may be entering another golden age – or perhaps it never left, but just took a nap. There will be refiners who benefit more than others. However, the overall market should see additional boost.

What is new or more reaffirming from last year’s review:

- Continued liquids production from the shale plays.

- Crude imports are coming whether we like it or not by rail or by pipeline.

- Continued growth in developing countries.

Shale Play

Shale production continues to beat expectations. I researched over a dozen papers reviewing and analyzing shale decline curves and initial production rates. The amazing outcome is not the technology acceleration, but the ability to learn to use and adapt existing technology is accelerating. Each shale play is unique with an initial set of known. Applying the techniques done in one play to another play generally does not optimize the production. The ability to be creative with the tools and resources available has clearly shown an increase in production. Data is available showing initial production rates to decline curves are improving at wells within existing plays. In addition, the newer plays are seeing even a more accelerated path of improvements than the Bakken.

It is our belief, this will continue leading to more oil production in the US. And this oil production is of the sweet and light crude oil. This very fact is causing the US producers to want to lift the ban on exporting crude oil from the US. As discussed in my previous refining outlook discussion, the US refiners outsmarted themselves and built the wrong refining configuration. All is not lost; they just don’t value the sweet crude as much as the outside world might. At some discount, the oil will be processed and changes will be made in the US refining complex. This discount is driving producers mad and so the hope is with the ability to export. They could find better buyers across the ocean. In the meantime, without the lift in crude oil exports, we should continue to see a feedstock price discount to several refiners. This will cause a drop in finished product prices in the US for the consumer. However, I anticipate the drop in finished product prices to not be as low as the drop in feedstock prices given the export outlet for finished products.

Crude Imports

Crude imports are coming no matter what you are hearing about the Keystone pipeline issue. The Keystone pipeline encompasses a greater plan which is shown on this website. The project is actually three parts with 2 of three pushing forward as the main Keystone Pipeline still is being debated. Right now, we have 180,000 barrels/day of crude oil moving by rail from Canada to the US. The debate perhaps is really the rail industry supporting the ban on Keystone, because the oil will come, it’s really just how you want it to come here, assuming we still want to maintain free trade with our Canadian friends. This crude oil is more to the liking of the US refining sector. I suspect logic will prevail and the pipeline will move forward and pressure on the US crude oil markets relative to the foreign markets will maintain itself. The forward curve as of 02/06/14 continues to show a very stout spread between Brent – WTI of $14/bbl. Overtime, I suspect that to come back down to perhaps the $5/bbl range. However, I think gone is the convention that on annual basis they will trade in parity.

Non-OECD Oil Demand Growth

Over the last 8 years the OECD region demand dropped nearly 5 million b/d. The US represented nearly half of this drop with half of that drop coming from the push on alternatives fuels mainly ethanol. Ethanol production now stands at 0.9 million b/d. Biodiesel adds another 0.1 million b/d. Even though much is talked about renewable in the power space that there is now significant volumes to be discusses in the petroleum space. As I indicated in the power space reaching a peak consumption one can conclude the same in the oil space for US consumers.

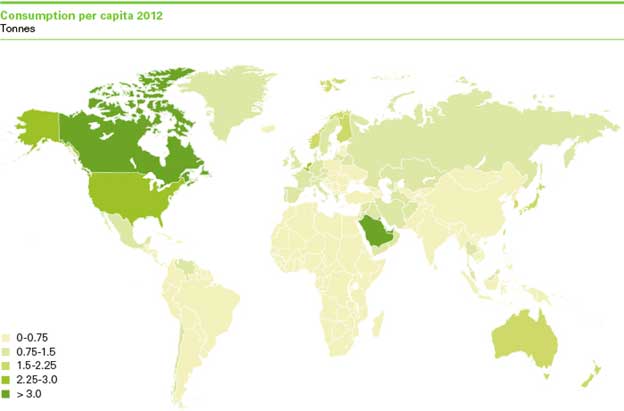

With the entire demand decline in OECD region, one would think prices should have declined versus rising 70% in the US gasoline markets. However, Non-OECD demand grew 9.7 million b/d over that same time period OECD was declining. There is so much more room to grow for non-OECD region. BP shows a graphical view of oil consumption per capita across the world. Even though the US observed a great drop in demand there is still a large gap between the US and the majority of the world.

With those three outlooks solidified, I am optimistic on US refining. Within the sector, there will be winners and losers. I can help the refining sector by offering crude oil evaluation to strategic planning to optimize the above concerns. A fundamental view of crude oil prices and refined products are available.

By the way I do have an opportunity for those interested in a 80,000 bpd condensate refinery in the Caribbean. A detailed cost study along with an economic analysis was done showing an investment need of around $600 million producing 20+% IRR. To build a brand new refinery of this scale would be around $1.2-$1.8 Billion. Please contact me if there is interest in this investment.

Your Continually Refining Energy Consultant,