Hedging Pitfalls

A timely article related to my recent blog on hedging came out two days ago in regards to Ft. Lauderdale evaluating hedging their fuel exposure. There are some positive and alarming statements from the article. Clearly the city can better plan and manage their finances with a steady price of energy. Below are the postitive statements:

City Manager Lee Feldman correctly noted “What I’m looking at is budget certainty,” Feldman said. “When we start budgeting, we don’t want to artificially inflate our budget to make sure we have enough money in our fuel budget to protect against price increases.” Mayor Jack Seiler makes a correct statement about hedging “We’re not in the business of playing the market,” Seiler said. “The problem we have is you have such a fluctuation in gas prices.”

So far everything above is reasonable and perfect for a hedging program. The alarming parts are below:

“Palm Bay accumulated almost $600,000 in savings during the three years the program was in place, said John Cady, the city’s fleet services division manager.”

The word of savings is not correct in the context of the hedge program. It is true the hedge saved you, but I think the important stress needs to be budget and planning certainty. Because it could have been easily $600,000 in extra cost.

Another concerning statement “”That’s why you want to have somebody on your team, basically an adviser in the fuel market, telling you now’s the time to place your hedge and now’s the time not to,” Feldman said.”

Once again this leads you off the track of the prime reason, which is budget certainty and planning. If you believe someone can advise you of better timing – which I don’t doubt – then you now want to have your cake and eat it to. You want to speculate and make sure your budget certainty also makes you good money. The best method for a pure hedge program is not timing the markets via the advice of a person, but to develop a systematic method of building the hedge. I do believe in good trading, but I don’t think you want to be an active player in the trading markets as a city, when you prime goal is budget certainty for better planning. A trader’s goal is to make money. The risk reward profiles are much different. I would advise someone in the energy business of that route, but not an entity, not staffed or experienced in the energy world.

A systematic method allows all stakeholders to remove any concerns of manipulation and/or risk taking. As I pointed out in the previous blog, I have many years in the trading environment along with the corporate planning environment. My group at AEP was instrumental in designing the first approved hedging program by the public utility commission for our supply chains consumption of on-road diesel and gasoline. At All Energy Consulting we understand the energy markets and can effectively navigate you in deciding and designing a hedging program for the various energy commodities.

Your Energy Consultant,

614-356-0484

Climate Change Discussion

Though David Roberts from the Grist once called me a “troll” via twitter because of my perceived different opinions– I don’t mind subscribing to his twitter and viewing his works. Mr. Roberts self-professed in the video below that he is just a blogger. I am: a beginning blogger, but a recognized and an accomplished prognosticator of the commodity markets (1998 crude oil collapse – noted in USA Today among the many other publications), employed for many years on a management team of one of the largest utilities American Electric Power, served on multiple committees from the National Petroleum Council to the National Renewable Energy Laboratories, rated as one of the best speakers in multiple energy conferences, and more importantly a successful family man who has been with his wife for over 20 years and has five wonderful kids. So perhaps next time Mr. Roberts would come up with a better adjective for me than a “troll” just because of some differences. Nonetheless, I don’t see the value of surrounding one-self with liked minded individuals -where is the fun and the learning experience in that? Mr. Roberts recently did a TEDx video, which I thought was very well done and intelligently articulated about the concerns of climate change.

Personally, I do believe with a statistical odd that climate change is real and that it could have significant impact to society. Mr. Robert is correct to point out the 2C is likely past. The odds of this occurring are very high. The depth of the problem is very large. Using the mathematical models and running my own simulations, I showed that de-carbonizing both the US and Europe would amount to a delay of 30-50 years in hitting the same level of ppm. Without worldwide effort, the problem is almost futile to solve.

The problem is more than an economic question, it is a philosophical issue. Our society, particularly in the US, is hell-bent on living for the now – Carpe Diem. Many people are not properly planning for retirement. Our political leaders, rather borrow from the future than to have a recession on their watch. In fact, one could probably plot the growth of credit/debt along with the global climate problem, which Mr. Roberts presents in the video; it would be a similar story to global warming. We have a refusal to change the financial path, since it is much easier to see that borrowing now makes us feel better. Likewise changing our energy consumption would take “work” to say the least. Many politicians have little regards for future consequences much like their statement for climate change as Mr. Roberts points out. Therefore in order to solve this problem, we need to change society and its view on planning. Taking near term pain maybe what the doctor is ordering for long-term survival. If we can’t do it in the financial world, I am afraid we cannot do it in the real world for energy.

Beyond our own societal sentiment for Carpe Diem, we need to contemplate balancing all our concerns/special projects. We cannot solve everything equally – capital allocations are a necessity. I don’t see a way out to have social security, medicare, our policing of the world, and then add more expenses for global climate change. Money is really not just paper. Something needs to give. Our attitude to be able to fund everything is due to society being used to living on debt. We need to start making some tough decisions and ultimately sacrifices will be made. Very similar to families on a budget, one cannot spend on everything even if the desire is great.

Adding to the complexity, some of these special projects also include projects that for 100% certainty can save millions of lives at a discrete cost – as proven by the Bill and Melinda Gates Foundation as they try to eliminate polio and malaria. Where is the humanity balance between saving lives now or for some statistical probability saves lives later? Perhaps this brings me to a very interesting possible paper on human behavior action – if someone hasn’t already written one. I would hypothesize one could mathematically derive that the level of certainty must approach infinity as time goes beyond a few years for action to occur. Meaning I believe the way we are wired is to act on known issues, but when there are unknowns the greater the time the greater of increased probability is needed before we act. Given this thesis, I find our ability to react to global warming very minimal at this time – even though it may be the correct thing to do.

Mr. Roberts alludes to the point – it would seem adaptation is inevitable. Personally I wish it wasn’t the case, but wishing doesn’t usually solve problems. It may be more appropriate to start making decisions on the adaptation level e.g. building near or below sea level seems to be very short sighted. Perhaps one should contemplate redirecting existing mitigation research to proactive ways to modify the climate via geo-engineering since by the time we act; mitigation will not be an option. We certainly need to be more open minded – myself included – in viewing these issues in multiple lenses. The problem is a lot more complex than what a single individual can comprehend.

At All Energy Consulting, we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant / Troll to some,

614-356-0484

Renewable Futures Part 2 Idealistic Speak

This is partly a continuation of my last blog – Renewable Electricity Futures NREL Report Critical Assessment. I had personal emails on the assessment discussing the other topic I did not want to get into at the time – Cost. I also received references to the report put out by the WWF and Ecofys report. This report is very pretty in its design and perhaps a good document for a stretch goal concept, but in terms of application and reality it is far from real.

For some reason we have an idealism that the cost of placing renewables into the system will be at zero cost relative to the baseline. To address this topic let me first say in general; most people including myself would very much like renewable power that is until the discussion of cost and allocation is brought up. The executives at utility companies are also very inclined for renewables. Essentially almost every human being other than those individuals who are so incentivized to maintain current ways are pro-renewable. If it was really no incremental cost, I promise you renewable technology and implementation would be much further along. There is no hidden conspiracy – particularly at the generation level to not implement renewable. The utilities could/should care less where and what was making the electrons. There is very little connection between a utility and the various fossil fuel producers particularly for a regulated utility. The regulated utility is incentivized by capital investments. Most utilities should drive to achieve greater renewables which require large capital investments-that is a direct return to shareholders. Whereas operating costs are not, they are passed through – therefore shareholders get no return. However, what causes them not to build massive renewables is the cost. Higher cost limits the ability to spend on maintaining the system, since rates are limited by a political/societal demand. By allocating cost to renewables, it will leave little room for other spending- some perhaps more necessary than others.

The way to view cost from studies like this is to view the total investment needed. For some reason many want to discuss retail rates. However many fail to note and/or realize rate structures are very complicated and are not just a function of wholesale power prices and/or generation investments. The NREL Renewable Futures Report did note it, but ended up using a wrong proxy in my estimates – “…the retail price of electricity must also cover distribution and other costs. These additional costs are not estimated directly in ReEDS. Instead, the markup from wholesale to retail prices is estimated based on a calibration with historical (2006) prices.” I will promise you the difference between wholesale and retail will continue to grow. Many right now will see on their bill that the Transmission & Distribution (T&D) cost will be greater than the Generation (G). This is a function of many things. One was a failure for many utilities to allocate capital appropriately in the past for required T&D expenses. In addition, given many markets decoupling of generation many of the cost which are traditional G cost are being moved into T&D. As an example, many utilities are attempting to move their renewable requirements as T&D expenses.

The figure to examine in the NREL Renewables Future Report – assuming it is done appropriately to include investment cost – for cost is A-4 A. It shows the baseline investment of $4 Trillion dollars – $100 Billion per year for the next 40 years. For the 80% case it shows an additional Trillion dollars – $25 billion per year. It is true there will be a fuel savings which is the basis of many of the “crazy speak” announcing renewables are zero cost. However, the fuel savings needs to be discounted back to present since the savings are coming from the outer years. In addition, you are asking a society to think about the future when in general people are not thinking about their own personal finances with a median 401k savings amounting to $23K. Also, you have global financial system/society fixated on debt as a way of growth. To have society care about future savings is truly an uphill battle now. The cost to increase renewable generation is not free. However if we think about capital allocation and the areas to invest/spend money which we may or may not have, renewable investments certainly would not rank the lowest compared to wars, executive compensation, financial bailouts – but it will have to compete with other societies special projects social security, education, shelter, nutrition, etc…

At All Energy Consulting we can help you view the energy markets through a pragmatic unbiased lens. We hope to offer color to the energy discussion, which should stimulate thought. Please consider us for your energy consulting needs.

Your Energy Consultant,

614-356-0484

Renewable Electricity Futures Study NREL Report Critical Assessment

Renewable Electricity Futures report study by the National Renewable Energy Laboratory (NREL) was just released. As with many reports done by numerous participants, there are several areas of concerns which I have identified below. I will admit, it is much easier to be critical of a report after the fact versus while you are working on it. However being accepting of critical assessments, which NREL based on my experience has always been willing to do, will improve the future reports. On the positive side NREL did a great job in directionally highlighting the concerns to moving to higher renewable electricity future.

As I pointed out in my previous blog, the levelized approach is not appropriate for the electricity market. NREL noted this as a concern and therefore addressed it by using GridView and dispatching hourly. However, they only went part way to truly analyze the situation of large amounts of renewables. They did note in their own report that the report lacked a reliability component. However leaving out the hourly and reliability analysis is similar to leaving out the concerns for refill stations in an analysis to convert to hydrogen and/or natural gas vehicles.

My concerns for the report is the extent of work that was done while leaving out some very important analysis. They noted they did 12 scenarios. The key for this type of study is the information going into the models. Given most of the information should have been available from laboratories; this keeps the study cost down. Based on that, my personal budget for the modeling portion for this type of project is around $120-150K – see below for more details. In addition, I would have not left out a very critical piece of the study. Reliability is the key to sustained large penetration of renewables. They noted in the study they could not do this in multiple parts of the report. In addition they noted a full reliability assessment cannot be done. I agree with this statement, but that does not preclude running some various sensitivities to understand the reliability issues. I will show below one easy add-on that would have indicated some level of reliability. One can model directionally, the reliability balance needed for large renewables without doing a full blown transmission study. I understand their following statement:

“System Adequacy: To understand overall system adequacy fully, detailed simulations would be required to measure loss of load probability with the correct probability density functions of various power system variables. Many scenarios would need to be analyzed to understand whether the overall electric system has adequate system capacity to meet load under a variety of operating conditions. With conventional generation units, this type of study typically involves running reliability models using the forced outage rate and mean time to repair of the full suite of conventional units, while also considering possible changes in electricity demand, to estimate the loss of load probability. With high amounts of variable generation, analyses of this type become somewhat more difficult due to the unique behavior of variable generation. As discussed elsewhere, ReEDS addressed system adequacy largely on a statistical basis, whereas GridView was used to analyze a subset of the scenarios to determine whether loss of load would be expected in 2050. Further analysis of system adequacy would require an assessment of a broader array of scenarios, using GridView or alternative tools, as well as more detailed assessment of system voltage and frequency.”

However the study is about renewables penetration not the existing reliability of the grid. The addition of renewable generation produces a dynamic similar to loss of load probability via the loss of generation as weather changes. Having an understanding of the incremental needs of reliability with more renewable is the key. Modeling a level of reliability is not that hard once you have hourly dispatching model.

The critical scenario they left out and perhaps the big fault of the study is the level of generation capacity needed to balance the system to produce a level of reliability of a loss of load probability level. With significant renewable, particularly wind and solar, one could mathematically derive an acceptable level of the expected loss of generation level given the sporadic weather patterns. This expected loss of generation should have been focused on the peak time period. Running the analysis on average weather expectations is not an appropriate level of capacity planning. I am sure there is a reasonable level of risk expectations to see limited and/or sporadic wind and solar performance during peak time periods. Figure ES-6 should have been supplemented with this “weather risk case” (perhaps only few days of work). What I find immediately alarming in the report is the limited amount of capacity build of gas units as more renewables penetrate the market – Figure ES-3. In my mind, I would expect a sustain if not larger capacity buildup of gas units as the larger penetration of renewables. However, they have it declining. I believe the generation piece can grow very large for renewable, but I suspect the capacity chart not to look the same. The likely error in the study is largely because the choice of fossil fuel technology was limiting. Looking at the Black & Veatch study used for technology selection for the study, I am shocked to see very limited flexible power selection. I know for a fact B&V should have known and included reciprocating engines to aero-derivatives given the study was about significant renewable generation. As the study noted, flexible generation is a requirement including requiring conventional plants to be flexible. This requirement would have driven technology improvements and/or adoption of the un-traditional manufacturers. The current selection choices biases the study to traditional technology manufactures (GE & Siemens). Balancing the system can be done by generation not just transmission, storage, and curtailments. However one cannot see this without offering the choice in the model. Depending on large transmission builds where a 90 mile line takes 13 years is a problem. Also the dependence on large compressed air energy storage (CAES) when it has yet to be deployed in either bedded salt or in porous rock formations is another problem.

My hypothesis would be including technology such as the Wartsila reciprocating unit – which is up and running in multiple US locations – will lower the cost for renewable penetration given the technology capability to ramp and start within minutes and also its very low plant minimum capacity (4%) with still a very good heat rates (7.2-8.5 mmbtu/MW).

Designing and running future scenarios and then deciding and understand the optimal and robust choices is my forte. Working at AEP I had to cover 11 states and had to deal with multiple resource plans with multiple biases to different fuels. Our decisions at AEP can and will influence the market therefore we modeled the entire US. Bi-yearly we ran 6 Scenarios for the US – at least two represented economic conditions (low and high). Others typically dealt with various legislations. The core team to model and evaluate these scenarios represented me and another colleague. The input team represented my entire team along with the various parts of the organization. The decision to build goes beyond economics, but it is a good place to start. However as many modelers will tell you – you will be only as good as your input. Therefore more time should be dedicated to the input than the output – particularly when you are starting out. It is crucial to examine the conditions confronting you and plan accordingly. Details of your runs need to balance with precisions of your knowledge. There is no point in over analyzing as much as under analyzing.

As many know, I have served on the National Renewable Energy Laboratory Advisory Panel. There are many very studious hard working individuals at NREL. They continue to improve and come up with new concepts and ideas. Though I was critical on this study, I do see much progress and expect further progress from them. Technically, I am sure the US can operate at 80% level of renewable generation. The question really is the cost and the benefits of obtaining that level. There are a lot more questions I can posed for the report, but I will have to leave it for another day and time.

At All Energy Consulting we can help you run and model your resource options/plans. We can either offer a third-party assessment or help design and build you a process plan for which you can manage yourself. To run a resource plan, the core offering would be a base forecast along with two scenarios. This would run would be about $60K. For additional scenarios and risk simulations we are talking about $10K/per design.

I hope all the fathers of the world had a great day with their family. I did! In fact, I got to spend some time with ALL my kids (5) – even my two teenagers. And I had time to read the report, write, ride 20 miles on my bike, go boating with the kids, wakeboard, run 50 risk simulations of the Eastern Interconnect for one of my clients, and have a picnic with the family and friends. Life can be short so make it worth it!

Your Energy Consultant,

614-356-0484

Hedging Commodities Is Not Gambling When Done Right

Hedging commodities seems to be a recent interest among many companies I have talked with. There are significant discrepancies of what a hedge really is/should be. Hedging a product can be better worded as insuring an outcome within a certain degree. Those who tout profits and riches are not talking about hedging, but gambling/trading. Gambling/trading does have its own merit when done right, but for this blog I would like to focus on hedging.

Hedging should not be focused on the concept of making money. It should be focused much like insurance. One does not buy insurance to obtain wealth, but to protect against wealth destruction. A proper hedge should protect oneself, commensurate with the level of cost for the hedge. An analogy would be buying a low deductible versus a high deductible insurance. The decision to purchase is the function of perceived risk and financial stability. Another misstatement by many is the fact there could be “free” hedges. There are no free hedges as there are no free cakes.

When to hedge? Hedging makes sense when the product to hedge is not a core part or does not represent a large portion of your business profits. If it does represent a large portion of your business, it should not be represented as only as a hedge, since the product should represent a large core competence of your business. Your team should have a good understanding of the trend and the fundamental nature of the product and be able to effectively trade the product. In the case it represents a smaller portion of your total cost of business, designing an effective hedging program would be a worthy cause.

A hedging program should be tailored and incentivized to reduce volatility and offer a stable cost for projections of earnings. It should not be seen as a profit center. Hedging programs which get caught up in profits eventually becomes a trading program. The hedging program may produce positive results, but these profits should be saved for the rainy days when the hedging program produces negative results. The best hedge programs are systematic.

I have many years in the trading environment along with the corporate planning environment. My group at AEP was instrumental in designing the first approved hedging program by the public utility commission for our supply chains consumption of on-road diesel and gasoline. At All Energy Consulting we understand the energy markets and can effectively navigate you in deciding and designing a hedging program for the various energy commodities. Please contact us to help you evaluate and/or decide on a hedging program.

Your Energy Consultant,

614-356-0484

Levelized Cost of Electricity (LCOE) Analysis Potentially Misguides You in the Power Markets

Levelized cost of electricity (LCOE) approach is very popular in the financial circles. When I was at American Electic Power (AEP), many of the large financial companies would come and speak with our executives and present LCOE on various technologies. However, the levelized cost method has too much simplicity, giving the presenter and the viewer internal biases. Levelized costing is way too simple and will typically produce results not valid in reality. I will present the case to you in this blog.

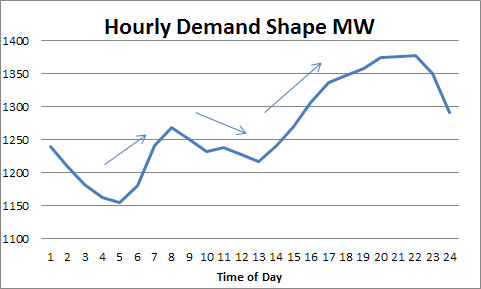

One must understand the reality of power; it is a market of instantaneous nature. There is minimal ability to have inventory unlike other products and commodities. This difference requires a market that trades intra-day and in many places intra-hour as load is not consistent through the day – as seen below for a typical load shape.

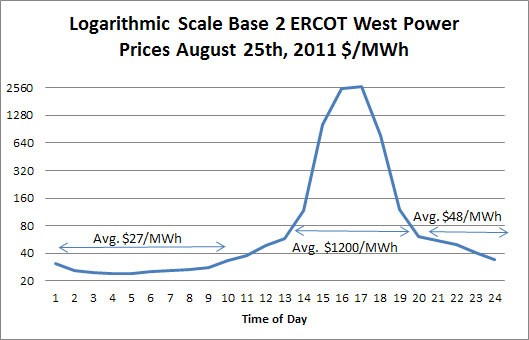

Not only is the load changing, but perhaps the supply to fill in the load could also change within the hour, depending on mechanical issues at each plant, transmission line, or distribution system. In addition with the implementation of wind and solar resources, we are now more dependent on the weather. As we see in our local news, the weatherman struggles; weather can be very unpredictable even just a day out. As result of load and supply availability changes, price swings within a day can be significant. Below is hourly price ERCOT West on August 25th 2011. The prices are so volatile that I had to plot it on a logarithmic scale, so you could see the variations. We had prices go from $24/MWh to $2600/MWh back to $34/MWh within a day. The second important realization is that only a few generation technologies can turn on and off within minutes to an hour. These units will likely have less efficiency than units who take their time to turn on. A fine economic balance is needed. Given the variations and the volatility I would always suggest a portfolio of technologies.

To show the misguided nature of levelized cost analysis, I have developed an excel file capable of dispatching various unit technologies to an hourly price curve for a year. In this example, I am using the actual 2011 ERCOT West hourly price curve. With the price curve and my model, I dispatched the unit. To prove the fallacy of the levelized cost mechanism, the easiest technology to model is the reciprocating engine. Given its ability to turn on and off in minutes and obtain full load heat rate, the reciprocating engine is an ideal candidate for hourly dispatching. With information that I obtained from Wartsila, I used the following design parameters 8 Heat Rate (mmbtu/MWh) for the initial and final hour and $4/MWh variable O&M. This unit either produced 0 MWh or 250 MWh based on whether the unit was economical to run. For the fuel price I used daily henry hub prices minus $0.20/mmbtu to account for the basis issue (Average fuel cost $3.79/mmbtu). Using my model, the unit produced a capacity factor of 30%.

For those interested, I have spent much time and analysis evaluating the Wartsila technology. If you are interested in an independent evaluation of their technology in your portfolio please do contact me. In most cases, I see a large value add in their technology for a resource portfolio, particularly when combined with various wind and solar resources.

Using the publicly available levelized calculator from the NREL, I supplied the same parameters from above plus the following financial condition: 30 year analysis, discount rate of 8%, capital cost $950/kW, fixed O&M $12/kW-yr. Levelized cost analysis concludes a cost of power of $71/MWh. With the average power price in ERCOT West in 2011 of $41/MWh, one may conclude the unit would be unlikely to produce much value in that environment. However, when we look at my model, including the corresponding financials of a reciprocating unit placed in that environment, the plant produces close to $34 million in net revenue in 2011 in power sales alone. Subtracting FOM and firm gas transport, we are still in the $30 million neighborhood. If we place this condition into a cash flow model, with the same economic parameters used in the levelized cost model, the internal rate of return (IRR) of the project over the 30 year period will be around 12%. This is in the environment of the average price of power for the year is $41/MWh versus the levelized cost calculation of $71/MWh. (Of course I am not endorsing that 2011 would be representative of the future, my purpose here is to point out the potential to be misguided by levelized costing. However, if you are interested in seeing various scenarios and forecasts, I would be more than happy to assist).

What went wrong with the levelized cost approach is the inability to actually be in the real world. Power is much too complex to simplify into a year model. In the example above, which represents real world economics, because of the significant price volatility, 10 days represented over 50% of the plants revenue.

I do believe in simplification versus paralysis analysis, but it has to be in context of the problem. By creating an hourly dispatched model in Excel, I did simplify real life, but not to the point it didn’t mean anything.

Some people feel comfortable using the levelized cost analysis to simply compare alternative technologies. Once again, I believe it will misguide you, probably towards traditional past generating technologies, largely because of the influence of the capacity factor assumed. Many people go back in time to quantify the capacity factor for various technologies, often not considering the environment nor the actual engineered capacity factor. Case in point, at AEP some wanted to use capacity factors of gas units in the teens because many of the units had experienced that or even less. When one put in a low capacity factor for the gas unit while putting in the high capacity factors (65+%) for the coal and nuclear plants the bias is tremendous. The lower historical heat rates were a function of the past market conditions. Obviously the market is changing with increasing load and increasing coal retirements. How will units respond given this changing environment? One will not know using the levelized costing approach. Levelized costing puts the threshold of gas very high relative to the reality of the world in the future. In addition, the capacity factors do not need to be high for units that are flexible because they will mitigate the hours where the units are losing money. However, units such as coal and even combined cycles will have to swallow many hours when the unit is out of the money in order to capture the times the unit is in the money. Another simple example is that solar technology will be generating only in the on-peak hours (unless you are in Alaska during summer times). Looking at the levelized cost of solar will mislead you in how bad the economics of solar is compared to wind, which in most places occur in off-peak periods. Levelized costing generalizes too much of the operations and interactions with the market. In conclusion, the levelized cost analysis is not appropiate to use for the power markets. My suggestion is to model units on an hourly basis incorporating some of the operations reality. I have many years of experience in evaluating various technologies, planning, and developing an integrated resource plan.

If you are looking for some insights and or additional points of view into the future technologies and/or power markets please contact All Energy Consulting.

Your Energy Consultant,

David K. Bellman

614-356-0484