Producing a Clean Hedge that is Defensible

Hedging can really be a gamble if not done right. The latest news from OW Bunker A/S highlights some of the concerns from hedging. The stock has fallen 60% largely as a result of uncertainty in the hedge taken by the company. In this case, it may very well been a clean hedge that was poorly timed (failure of analytics) or it was a “dirty” hedge which constituted a gamble in the market place. Either way the Chief Risk Officer has been fired.

I demonstrated last time in Effective Power Hedging that PMA can be used as an analytical tool to develop a systematic hedging program. I want to highlight the value of PMA as a career saving tool (AKA: cover your a** (CYA) tool) PMA can be customized to store and run every day. All the analytical background for decision making can be pulled up. I am sure management at OW Bunker A/S wish they had simulations at least demonstrating the risk/reward they saw when they made the hedge. With PMA, series of simulations can be pulled to justify the transaction. In addition, the Risk Officer would have liked the simulation to be developed from a third-party stand point. PMA does offer customization, but the backbone and secret sauce is the extensive work in calibrating the model to emulate the market prices and fuel consumption. You can throw the kitchen sink at PMA and it will return the appropriate value given the inputs into the model. PMA can be customized, but can be still considered external to your organization.

A failure of identifying the risk reward profile appropriately would come from your simulation lacking enough uncertainty. One can use PMA to backcast to “prove” the simulation supported an appropriate range of uncertainty. For those looking to manage and perform hedging in power I am strongly suggesting you reach out to me to show how PMA can potentially save your career. Not only do we have the tools to help you, but we have the experience and knowledge. In many cases, not hedging commodities that offer liquidity can be constituted as much gambling as a person who trades for profit. You can always be second guessed for your decisions. All Energy Consulting can give you support for your decisions or indecisions.

Note on your calendar, I will be speaking at an event in Dec 10-11 on Solving Commodity Risk Exposures for the power industry. * POSTPONED TO FEB 15 The event is focused on Energy and Commodity trading. I look forward to seeing many of you there.

Your CYA Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter

Crude Oil Markets Are Not Like 1998

I have been giving a presentation on the future of the oil markets to various people. I am working on converting the presentation to paper. So far, all have appreciated my unique and refreshing insights to the oil markets. I would post my presentation material, but like most of my presentation materials, it is not designed to be a stand-alone document.

In order to find the future price of oil, we need to understand how the market got to where it is now. The presentation starts off with the fundamental question – IF you had forecasted the following fundamental parameters relative to the actual results, where would your price forecast relative to actual results be?

-

World oil demand forecasted too high by 10 million bpd

-

US oil demand forecasted too high by 5 million bpd

-

US crude oil imports forecasted too high by 10 million bpd

-

OPEC world oil supply represented 15% less than anticipated

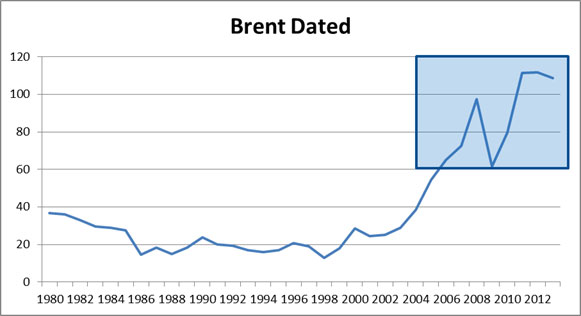

Most rational energy analysts would suggest the price forecast would have been too high given these factors. However, this is far from reality. In 2013, the average price of Brent was $111/bbl. The EIA Annual Energy Outlook in 2002 high price outlook forecasted $40/bbl. All other analyst, including myself, would have been ridiculed to show prices above $50/bbl for 2013 – (less than 10 years out). Four years later in 2006, there was only a slight improvement in the forecast. The EIA high case now showed $80/bbl for 2013. At the time, I had forecast subscriptions from PIRA, CERA, and WoodMac. None of them had a forecast for 2013 – less than a decade out – remotely close to the actualization of $111/bbl other than CERA extreme scenarios with a range of $110-$30/bbl (any use when the range is that wide?).

I hate being wrong and vehemently detest being wrong without knowing why. It would seem the market has conveniently reset their forecast and have accepted this new price paradigm without really finding some fundamental rational to this new price level. Many will bring up geopolitical risk and supply disruptions – but all the supply disruptions would not amount to being wrong by 10 million bpd. Then the next excuse is cost of production being higher. I think this is more a symptom rather than a cause for being too low in the forecast. Another reason mentioned is increase trading in oil, but once I again I feel it to be a symptom not a root cause.

In my presentation and my future paper, I delve into the reasons used to rationalize how we got where we are. On a high level, the reasons investigated beyond the typical fundamental supply/demand country analysis are Monetary Policy and the shift in the demand elasticity curve. Finally, I will also address why this is not 1998 for which I have first-hand experience given my 15 minutes of fame was all used up that year (Front Page USA Today and other). Please contact me if you are interested in me presenting to your team this unique and refreshing view on the oil markets from a pundit who was in the trenches in 1998 and made the call for the collapse.

Your Used All My Fame Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter

“In the future, everyone will be world-famous for 15 minutes” Andy Warhol

Finding Winning Power Trades – The Process

Many people have asked me to further explain the process of coming up with my recommend best winter trade posted on October 9th, 2014 which on 10/28/2014 was up over 20% in less than a month. Obviously the root of finding the trade was to use Power Market Analysis Near Term (PMA-NT). As I have noted many times PMA-NT is more of a service than a product. The default setup is still very useful without any customization, which I will demonstrate here. PMA-NT default is based on the forward curve. In this setup, the arbitrage being found are the disconnects between gas futures and power futures. In essence, gas futures get lost in translation converting to power futures due to the moving parts in the power sector. PMA-NT can help find those translation errors. PMA-NT can also be fed your fundamental outlook of natural gas markets to find those disconnects.

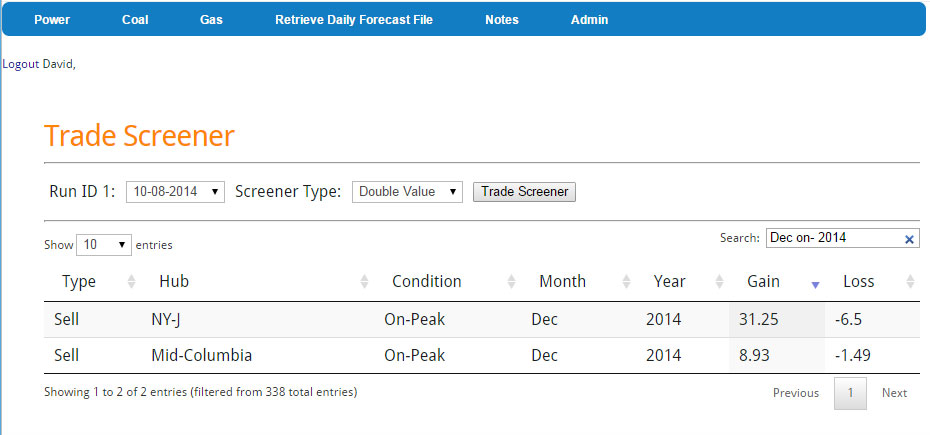

Part of PMA-NT includes some very advance and powerful trading tools. There are about 650 trading opportunities calculated in the default PMA-NT within in just 1 case (more can be added). The PMA-NT default runs five potential scenarios of the future. In order to find out my best winter trade I used a new customizable trade screener tool called Double Value versus One Sided Screener. Double value screens out all the trades with at least a double value relative to the potential loss. This list quickly reduces the 650 trading options. Given I wanted a winter trade and something that didn’t hold the risk of the Vermont Yankee nuclear retirement I filtered the results for Dec 2014 Winter. I also wanted a liquid contract so I filtered for On-Peak. Then finally I sorted by Max gain. All this occurred on one page in less than a few key strokes – screenshot below.

In the five cases simulated on 10-08-2014, the results show two trades that qualify on the logic that I wanted On-Peak trades in Dec 2014 that would have the potential to gain more than twice the loss potential. Out of the five outlooks simulated by PMA, there was a case that showed a potential gain of $31.25/MWh if one sold the NY-J On-Peak Dec 2014 contract. Inversely there was a case that would show a loss of $6.5/MWh. The default 5 cases involved moving the Henry Hub prices and altering weather impacts. These cases can be customized for your region of interest. Further descriptions of the default cases are available.

Now that I have identified a trade of interest I didn’t just stop there. As noted in the previous article I am risk adverse and would like a way to mitigate against tail-events such as pipeline explosions to other unforeseen extreme events. In order to mitigate the risk I usually use a spread or heat rate play. In addition, 5 cases are not enough for me to put on a trade – good enough to identify a trade. The good news is I also had run a Winter Outlook. The winter outlook included 54 more cases to examine. It was clear to me the NY-J power forward price was being impacted from last year’s polar vortex. This risk is a potential reality, but it would seem to be less of a probability. However because of my risk adverse nature, I wanted to find a price hub that was not taking into account the polar vortex as much as NY-J. Therefore if a polar vortex would occur to the level seen last winter I could be covered somewhat. Out of my 54 winter cases included running last year’s weather outlook, but without all the extreme outages. Base on that simulation it shows the AD-Hub having some room to run up with a polar vortex relative to the forward curve and relative to NY-J. The NY-J contracts seems to be limited as the “fear” premium is already in play.

Besides all these simulations I also did a walk back in history. There are many questions that needed to be understood. Polar Vortex last year was not really a January impact , how cold has it gotten in December and where did AD-Hub – NY-J spread moved to? As I noted in the previous article – From 2010 to 2013 December spread between AD-HUB minus NY-J went as wide as $-39/MWh in 2010. With the spread at $44/MWh I felt comfortable going with this trade as the best winter power trade.

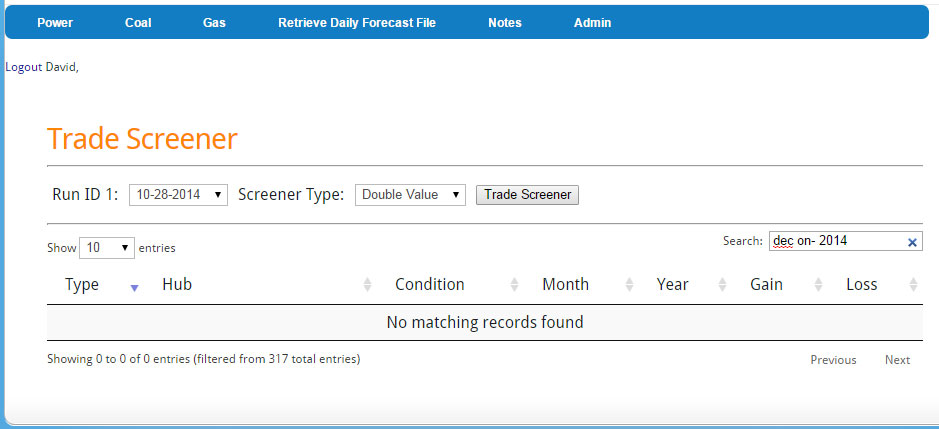

Given the market changes in less than a month, it is a good thing PMA-NT is designed to run daily. The exact screener on 10-28-2014 shows no trade opportunities in the Double Value category. The AD-HUB minus NY-J spread likely should be closed given the 20% return – per my risk averse nature. I am sure there are other traders who can stomach the swings better than me – looking for an aggressive trading partner to work together to create a perfect balance.

At All Energy Consulting we understand supplying you with forecasts is only one step of the process and may even be the smallest value of the process. The real value comes from the interaction with us and the willingness to explain the process and have frank discussions on the results. We believe no other consulting product will offer this unparalleled experience. You will work directly with me, an experienced analyst from one of the top energy consulting company (Purvin & Gertz / now IHS, Deloitte) and one of the largest utilities in the industry (American Electric Power (AEP)). PMA-NT is not just a product, but more of a service. We want to work with you in understanding the volatile power markets.

This also applies to our long-term service PMA-LT. We can work with you to understand the impacts of various policies and develop a cohesive resource plan.

Please contact us at your earliest convenience. We look forward to beginning the conversation.

Your Willing to Work with You Energy Consultant,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Sign Up to AEC Free Energy Market Insights Newsletter

Procure enough fuel this winter for your generating asset?

Fuel procurement for power plants has always been a tricky game, particularly when you add the element of cost. Buying too much fuel makes you look foolish and not buying enough makes you a gambler. Finding that sweet spot and the ability to justify the level of procurement is part of the Power Market Analysis (PMA) package. In this article, we will demonstrate the process of using PMA to find the right volume of fuel to purchase.

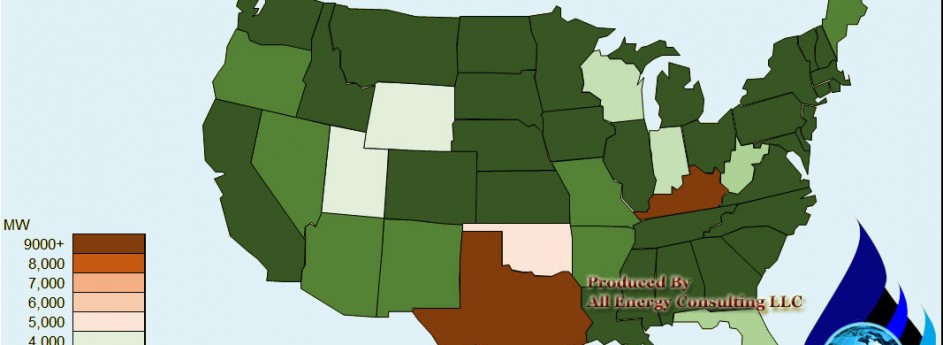

We randomly selected WS Lee coal plant in South Carolina and pulled out all the information from our 54+ scenarios we produced for this winter outlook. The key variables we examined in this example were load and gas price changes. PMA is designed for customization, so you can create custom cases for nuclear outages, hydro capabilities, fuel deliverability issues, coal pricing, etc…

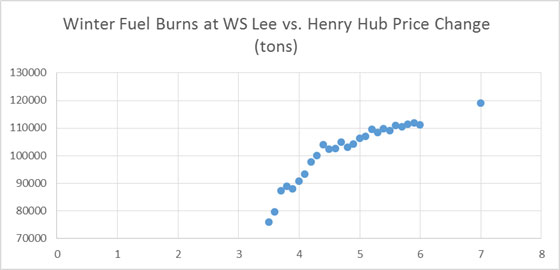

For gas price impacts on fuel consumption, we examined Henry Hub prices from $3.5-$6/mmbtu and added a stress point of $7/mmbtu. The graph below shows the amount of tons of coal consumed in the various price changes. The reference case used a varying strip (forward curve 9/24/2014) averaging $4.03/mmbtu.

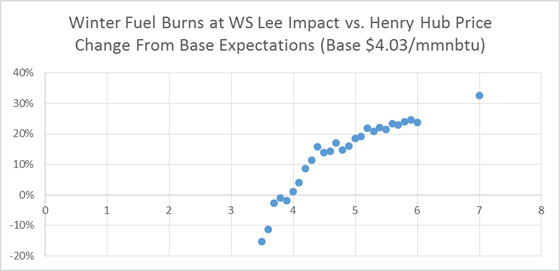

We like to look at it as it relates to the Base run. This view enables you to quickly assess the changes as function of a reference point. This also allows one to recalibrate to your actuals as the model is only a proxy and does not contain your exact cost structure and operational details. A custom PMA can be created to emulate your units cost and operational details. The percentage view gives a good assessment and allows easy comparison to other variables without worrying about the exact numbers. Based on the below graph, we can conclude the risk of gas prices moving up $1/mmbtu could lead to a 20% increase in WS Lee fuel consumption.

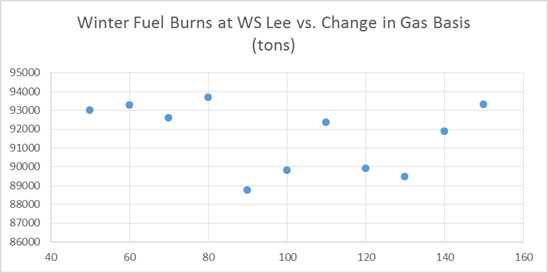

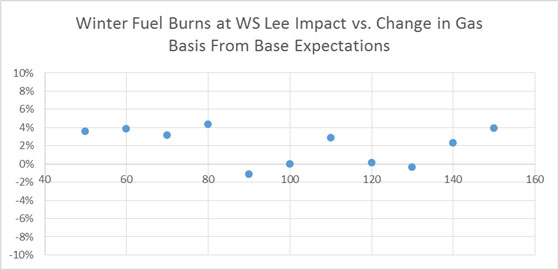

Another gas price impact view was to change the basis price. In this example, we took basis around the country and multiplied it by a percentage. So in the case labled 50 – we multiplied the basis spread by 50% making it half as small as the reference point. Inversely the 150 case makes it 50% higher. The absolute and percentage cases are shown below.

Given the facility is located in S. Carolina, it is reasonable to expect this unit to be less sensitive to basis versus Henry Hub changes. WS Lee, from this analysis, does not have to worry about basis causing significant variance in fuel consumption. However it is prudent and reasonable to be prepared to procure ~20% from base expectations given the real possibility of $5/mmbtu Henry.

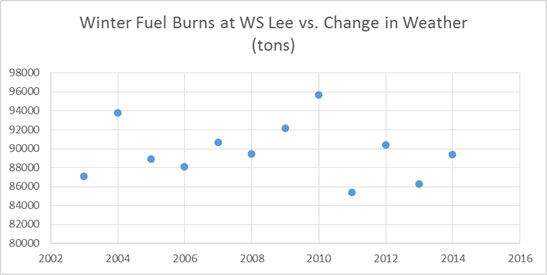

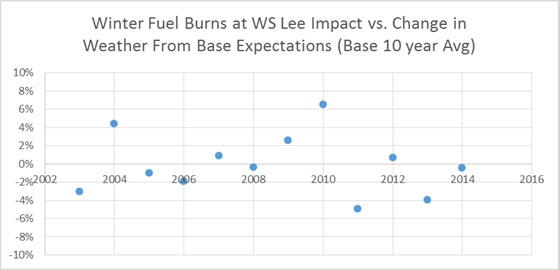

For load we looked at the last 12 years of actual weather and simulated each year into the model. The following graph shows the changes in WS Lee coal consumption and the percentage from base.

Once again, because we chose WS Lee a coal plant in S. Carolina – weather variance in the winter time is less important relative to a gas unit in the Northeast. However weather would support procuring almost 10% above base expectations given a recent actual weather event (2010) did necessitate 7% more burn from the 10 year average.

Several more custom runs could be generated from nuclear to coal outages to coal pricing (transportation & mine price) that would aid in the justification of the level of coal procurement of WS Lee. Using this example, a clear and precise justification can be made to procure somewhere between 10-20% more than the base expectations given the weather and natural gas market variance.

This demonstration used the analysis for this winter season, but this could easily be done for many months to years out. PMA can easily be used as a third-party validation to your procurement process. Avoid any accusations of being a fool or a gambler – sign up to PMA and start creating your custom run. PMA is more than just output – it is a proven process and platform designed just for you. We give enough customization, but allow you to still refer to it as a third-party source due to our involvement in the process.

Your Looking Out for You Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/

Crude Oil Collapse?

A sustained collapse of crude oil is too early to call. This is speaking from the one who is not shy to call crude oil collapse – Front Page USA Today March 10, 1998. The dynamics are different than it was back in 1998. Right now we are entering a shoulder period of oil demand where you have reduced driving and limited oil demand for heating purpose. Add to this the global economic concerns; you have the perfect recipe for driving the oil prices down. The key difference from 1998, which still has limited discussions from oil pundits, is monetary policy. I noted this concern back in 2012 in my CERAWeek 2012 summary. There is a fine balance between correlation and causation. The strengthening of the US dollar of recent is occurring simultaneously with a fall in oil prices. In 1998, the US dollar index was much higher than it is now and was not declining during the collapse.

The monetary strength of US dollars is important as the buying and selling of crude oil is typically done in US dollars. Therefore the ability to buy global widgets, if you are a producer, will be a function of where the currency is going. The OPEC members are seeing a loss in revenue as crude oil falls, but their ability to purchase the same amount of widgets is being buffered with a strengthening US dollar.

The global race to negative currency continues as the US experience documented that a printing of currency can actually lead to recovery. Now with the US stock market heading down, will the US policy of leaving no investor behind force another round of the very successful quantitative easing (sarcasm – see my article on Quantitative Easing and Climate Change)? If we do see a FED reaction to the strengthening of the dollar, I suspect we will see a rise in oil prices as a natural rebalance or in the form OPEC reacting to a drop in widget purchase capability.

Clearly, fundamentals of supply and demand of crude oil should and will dominate the crude oil price. But, I believe monetary policy deserves some more discussions as a strong influence to oil pricing. The supply /demand trend does show potential for a significant weakening, but it is not the best time to do ones balance as fall and spring season can result in wild oil demand swing. The oil markets given the growth of various alternatives of fuels (e.g. electric, ethanol, natural gas) will result in increasing demand volatility producing significant inter-year price swings. Storage will increase in value as selling in shoulder months will likely worsen in price versus peak periods of oil demand.

Planning to be in Houston the week of the 27th. Please let me know if you are interested to discuss the energy markets- send me an email and we can schedule a time to meet – [email protected]

Your Keeping an Eye on the Oil Markets Energy Analyst,

David

David K. Bellman

All Energy Consulting LLC- “Independent analysis and opinions without a bias.”

614-356-0484

[email protected]

@AECDKB

blog: https://allenergyconsulting.com/blog/category/market-insights/