Positive Externalities Still Missing in Academia for Power

I was made aware of this study during a dialogue on a LinkedIn group – http://www.aeaweb.org/articles.php?doi=10.1257/aer.101.5.1649 To see the context of dialogue please click here.

There is a huge assumption made by the authors. And that is the current price of power holds all the value of power in it. The authors fail to realize power markets are not based on personal value of power but mainly on power COST plus a fix return – particularly in regulated markets. In de-regulated markets perhaps one could argue to some extent, but I would contend there are no completely de-regulated markets yet. Many markets still have legacy regulated assets in them.

When goods are sold below their personal value (the price someone would pay in order to balance the value they receive from it) many academia market models will fail. First the mere fact a good would sell below their personal value breaks some of the free market model. Typically a good will sell below their personal value because of excess supply and governmental involvement. Clean water is a simple example. The personal value of having clean water is quite high – you get to live and not be sick. We could probably all individually boil water and everyone would probably have different levels of clean water. Or we could have governmental/regulated entity treat water and make it convenient, standardize, and accessible for everyone. Society then pays a price for this which typically is based on COST plus a return not personal value to each individual.

In the case of electricity, the cost of individual electricity production is quite high and dangerous – everyone can’t simply boil water like in the water example. It would have been out of the reach of so many. Therefore the utility model was built – A guaranteed return on investment on a COST basis, so that people may have access to power on a cost effective and safe basis. Once again it is not priced at the personal value that a person is getting from power. Ask yourself if access to power was limited and it was auctioned on ebay how much would you pay and outbid your neighbor? In times of blackout that value is quite high. Certainly worth sacrificing your monthly cell phone, internet, and cable bill since without power the phone, internet, and cable is meaningless. Because electricity is sold at a cost plus basis there exist many positive externalities beyond the simple cost of power. The personal value generated by having electricity will vary by individual. To the simple mundane person who does nothing with electricity, but indulges one-self with entertainment perhaps the personal value caps out at the value of that individuals disposable income. However if we use the authors example of a Berry farmer perhaps that value is much higher.

The author takes a very pessimistic view point of the value of electricity and ONLY views electricity production as having negative externalities. I do acknowledge the negatives do exist, but I am also a political and pragmatic to realize inherit personal value being derived by electricity beyond the cost paid. In the case of the berry farmer example, which they start to discuss on page 5, they only note the negative cost that power production has on the farmer. I acknowledge this does exist. However the gain not mentioned is the availability of cheap power. Clearly the market choice was to take the cheap power and deal with some of the consequences and in return the cheap power will deliver value beyond the cost. For example, it could have enabled the berry farmer to create an electronic packing system which doubles his productivity. If it wasn’t for the environmentally damaging, but cheap generation the cost of electricity may have been out of reach to install and operate this new packing system.

In an ideal world perhaps he could have BOTH cheap power and clean energy, but the laws of nature did not make it so. We can easily create a scenario that the pollution caused from the generation may reduce his production by 20%, but having an electronic packing system more than made up for his losses; as getting his product to market in efficient time before the berries expired was a crucial step. In addition because electricity is available for the masses in relative cheaper cost, more people have more disposable income to purchase berries vs. the 99 cent menu at the local fast food store.

The access of cost effective electricity allows internet and commerce to grow. If we add a global view to it – the berry farm and their access to low power enabled them to be competitive from farmers from S. America. If the cost of power was greater the farmer may not be able to compete. Having cleaner air by itself does the berry farmer no good if his livelihood is eliminated. Clearly the Berry Farmer would pay a lot more for power – particularly in hindsight given all the economic gains he may have not imagined. They simplified the problem too much and focused only on the negatives of generation. There are positive externalities not shown in the price perhaps as much as negative externalities. Both of the externalities are hard to discuss.

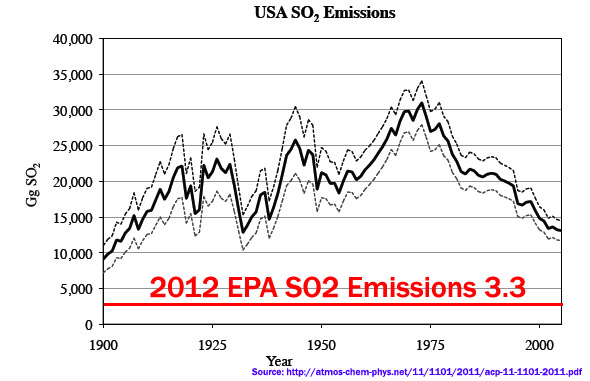

Increasing the cost of electricity could put electricity out of the reach to the common man. At a point, air pollution becomes a subsidy for the wealthy. I would contend the current air standards in the US are suffice for the majority of society if they were given the option to allocate money into either housing, food, healthcare, and even transportation versus better/cleaner air. I do believe the air could be cleaner, it is just a question of priorities. The inverse to the US, I would contend is probably China. The pollution is so bad there that it is at the tipping point that priorities need to shift. It is good to have a job, but if you can’t live very well what is the point. In the US we prioritized the environment later in our industrial revolution. Did you know – US sulfur dioxide emissions are below 1890 levels now!? http://atmos-chem-phys.net/11/1101/2011/acp-11-1101-2011.pdf

When will it be enough? To believe that you have infinite amount of money/resources and can effectively solve everything is not reality. Perhaps we are designed to listen to the squeakiest wheel versus helping the truly needed. The nation needs to prioritize and make some sacrifices. This has been proven over time.

Please do consider All Energy Consulting for your energy consulting needs. We offer well-rounded pragmatic solutions to your issues.

Your Pragmatic Energy Analyst,

614-356-0484

It’s not the end of the world – Climate Change& Quantitative Easing (Printing Money)

I have wanted to write about the similarity between the two most potentially transformative societal issues confronting us, Climate Change & Quantitative Easing (AKA Printing Money). Of recent the latest debacle in a spreadsheet error by Rogoff and Reinhart in their paper “Growth in a Time of Debt” has led my writing astray. However this issue further substantiates the similarity. I am sure my readers know that there was also an issue with climate change data. The most famous was the hockey stick graph presented in the IPCC report. The graph originally came from a report done by Michael Mann in the paper “Northern Hemisphere Temperatures During the Past Millennium: Inferences, Uncertainties, and Limitations”. (One difference is the climate change titles are much longer than economic papers!)

Though the recent debacle includes a simple spreadsheet error the biggest difference from what was reported to what is being challenged by Thomas Herndon, Michael Ash, and Robert Pollin is based on how one treats data and what one excludes or includes. Mr. Herndon and team believe since more data was available for other countries they should be weighted more no matter the differences in economy or time period. Many of the same arguments were made to refute the Mann graph. In the end, BOTH data sets from Mann and Rogoff can be presented to be less dramatic than what both authors presented. However in BOTH cases it does not eliminate the issue that both have presented. In Rogoff case, Mr. Herndon and team state and their own data shows that high debt does not likely lead to better outcomes relative to a lower debt situation. The Herndon and team did conclude there is no magic number that leads to a NEGATIVE growth. However they do note that growth is much less than it would be when debt levels grow above the 90% level. In Mann case, one could argue the graph he presented was on the high-end of uncertainty but the end message no matter what statistical approach you use there is some warming relative to the last 1000 year perhaps just not as dramatic as Mann’s graph.

We can ignore both the issues just because of some technicalities and potential showmanship or we can pay attention to these both very critical points because they contain some probability. We can argue to death to the extent of probability, but there is some threshold that action becomes required no matter what. I believe we have crossed that threshold a while ago in both issues. In terms of actionable items I am not as extreme as some could be since everything is a probable outcome in my mind. Actions need to be commensurate with the probability and timing of the impact. And both issues probability and timing may change as more information and responses are made.

Getting back to the discussion of similarity, both are issues that rely on sacrifice of the future for the current state. Clearly it is “easier” and “cheaper” to continue to burn fossil fuel versus transform the economy. The consequences may be dire, but they are many years off. It is also easier and politically more appealing to increase the money supply driving investments now and have the savers and the future generation deal with the pain later. In each case one could argue we don’t really know the future and perhaps even solutions in the future we cannot predict now will come to fruition. However I would attest that is very poor planning.

There are measures we do each day thinking of the future. Some are simple and have been engrained in society – such as buckling up. We buckle up because it can save our lives. The odd of getting into a serious car accident in your lifetime is 30%. I am not arguing for you not to buckle up, but to show we do act when probabilities are not as great along as the action can be commensurate with the risk and its probability. I am sure you can find many climate deniers to admit there is a 20-30% probability they are wrong – of course that means they are 70% confident it is not. Nonetheless this would argue for action at SOME level if one cared about the future.

Both climate change and quantitative easing are actions that are not apparent at the moment similar to indulging on funnel cake and other unhealthy foods. It feels good now but eventually you will likely get obese and have health issues not worth the gains gathered from the near term enjoyment of sweets. In fact, it will typically be better to emit and print money now. The ultimate consequence of each of them requires a view over many years if not hundreds of years.

On the point of obesity, it clearly shows society is not ready for problems requiring long-term thought. Obesity in the US is very high. This is a matter of caring about what you eat and the long-term issues involved with your choices. We are a society designed for Carpe-Diem and keeping up with the Jones. It may be quite pointless to argue the science of climate change and/or long-term impacts of quantitative easing when society could really care less. It amazes me to see such low savings in both general and retirement savings. So much of society is living on debt. By that logic people don’t really focus on the long-term. I can see somewhat the rationale for many religions to eliminate interest charges – usury. Most religions are focused on maintaining/reducing our vices – e.g. Ten Commandments. I think they realize debt living is not healthy. Living on debt makes you feel good in the moment, but any day it can overwhelm you with a change in your life. A humble lifestyle is too easily gone with the ability to borrow money. We cannot solve these two very large issues without changing society to think longer term. If people do not care about their own lives and cannot plan even their meals to live healthy, do we really expect them to be able to comprehend and plan for climate change which impacts us significantly in 100 years?

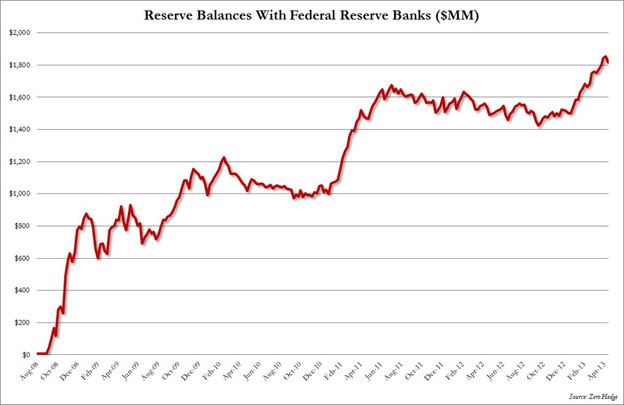

Climate change to me seems more tangible and more discussed with various opinions across academia compared to quantitative easing. This may be based on my career largely in the energy space. However I do read quite a bit and find much more literature on climate than quantitative easing impacts. Climate change certainly seems to have much more historical data with ice core samples thousands of years old. The oldest data set Rogoff and Herndon was working with was 1830. Given this I thought I put some graphs up from various recent reports just so you see why I am alarmed with quantitative easing even though the “market” is doing well.

We are in a world so dependent on debt and fossil fuels. Current trends on climate change and quantitative easing cannot be changed until we change the mindsets of people to think ahead. Planning is gone for Carpe Diem. I like the concept to live for the moment, but what if the next moment depends on how you live in this moment. Do you want more moments? We do not live in Hollywood we live in reality. Please take care of yourselves – eat healthy – do not over-extend your finances – reduce the temptation to keep up with the Jones.

The world will not end because of climate change and quantitative easing. However the world could be very different and potentially less inhabitable and stable if we don’t start dealing with some of our issues which require thought. The probabilities of significant harm to society may not be significant (+50%) but given the extent of outcomes it does make it worthwhile to do some actions similarly as we buckle up.

Your very concerned and thoughtful Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

Revisited Post – Coal is not Dead!

Coal is not dead as I pointed out in last years post – https://allenergyconsulting.com/blog/2012/04/11/the-demise-of-coal-overstated/

I am sorry I am late in publishing my blog. Life is catching up on me. For a quick blog I thought I review what I wrote around this time last year. It was good that I was right. Gas prices have significantly firmed up relative to last year – in fact they have DOUBLED!

As I pointed out in my blog last year, much of the downfall can be attributed to the weather. There is some attribution for weather again for the move up. This years winter was cold relative to normal. Global warming this year took a break – unfortunate for those in Ohio. We actually had a freeze warning last week! Nonetheless, as I expected, prices of natural gas price rose from their extreme low. Even if winter was not as cold but normal, I am sure gas would be still north of $3.75/mmbtu.

The fun thing to watch this year will be spot prices of coal. I suspect we will see firming in the spot prices as I expect many coal generators given their pain over the past few years under contracted the amount of coal they will actually consume. This may not present itself till after June/July given they are right now suspecting weather could save them.

I am still working on my piece of Global Warming and Quantitative Easing and their similarities. Just like the hockey stick issue that occured in Global Warming – looks like there is a hockey stick issue for QE in academia – http://www.forbes.com/sites/realspin/2013/04/18/that-reinhart-and-rogoff-committed-a-spreadsheet-error-completely-misses-the-point/

Please do consider All Energy Consulting for your energy consulting needs. The blog has documented our general outlook. As you can review my blog we are quite prescient of the future as it pertains to energy.

Your very Prescient Energy Consultant,

David K. Bellman

614-356-0484

Refining in the 21st Century Part 2

Part 2: Where do we go from here….

“It is far better to foresee even without certainty than not to foresee at all.” Henri Poincare

It is very important to ponder the implications discussed in Part 1. There is quite a bit of uncertainty but one should not give up the process of predicting. The very process of forecasting can gain you immense knowledge even when you fail miserably. Forecasting takes time and humility. Very similar to wine if you keep at it – like I have been – it will be much better over time. And like a good cellar – having a consultant, like myself, guiding you through the process, your wine will come out better and require less aging.

Subsidies are being removed in many regions with the intent of going to market based pricing. However monetary policy has not changed and will not likely in the near future. I believe we will continue to be priced in the $100/bbl range plus or minus $20/bbl. There is a chance with economic destabilization, prices may fall somewhat; but I suspect it will be temporary as printing becomes the only acceptable way to avoid pain.

Given this new elevated pricing of $100/bbl, we expect to see healthy absolute margin with the return on feedstock falling to around 16-18% rate of return. This, coupled with lower requirements of refining complexity, should allow many smaller refiners to prosper.

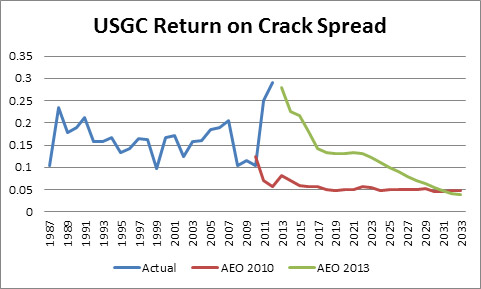

There is no doubt that there is a systematic issue with DOE/EIA models of the petroleum market – see below graph. The model wants to revert back to an historical level of absolute margin forgetting the business/economics side. The risk is not commensurate with a 5% return if we use the crack spread as a guide to returns. The AEO 2010 was wrong and I suspect the final AEO 2013 will be wrong. Being wrong is inevitable, but the level of error is too large to be acceptable. They have not learned from their errors which is key component in successful forecasting. Question everything! You drive your model not the other way around. Common business understanding would likely lead a model to produce a retirement cycle when returns fell below 10%, and then a rebound in returns as the market responds to loss of refining capability. Hopefully oil pundits stay away from this type of modeling.

As noted in the previous blog, there are some very interesting inter-relationships worth pondering for the future. I have given a general assessment of the future and even though I believe in knowledge sharing, there is a pragmatic side of me that requires me to hold back some information in order to balance my business side. If you were to send me an email with a business email and a description of your business role I will offer an additional write ups with graphs detailing a “base” case projection.

It is quite intentional to see that part 2 is much briefer than part 1. As a forecaster, one should spend a lot more time understanding the past and the inputs going into your model. The forecast stands on the past understanding and is the marginal output of all your work.

Your Pragmatic Energy Analyst,

614-356-0484

Refining in the 21st Century Part 1 Cont’d

“He who can no longer pause to wonder and stand rapt in awe, is as good as dead; his eyes are closed.” Albert Einstein

I am sorry for those anxiously awaiting the continuation of Refining in the 21st century. I have been very busy for which I am very grateful for. I hope you have taken the time to reflect on what was discussed in the previous blog. A pause goes a long way in allowing us to process. Without further ado…..Part 1 cont’d.

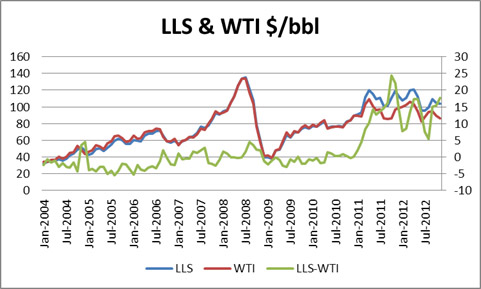

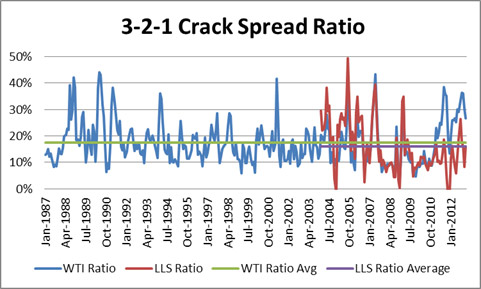

Now that the new paradigm has been set for oil, there are many inter-relationship that have changed. Of recent ,the EIA has shifted its reference fuel to Brent. This is a very reasonable shift as the center of demand is no longer the US but the growing Asia region. As an aside note, all the years I was at Purvin & Gertz, we never really believed WTI represented an appropriate benchmark for USGC. The better benchmark was LLS. However the financial market was too fixed to WTI to be able to change the benchmark. Currently you can see the reason why WTI can fail as a USGC benchmark. With the spread to LLS blowing up as pressure from Canada and shale oil have practically filled the center of the US; and with limited access to the USGC from Cushing WTI, it has decoupled to say the least against LLS – see chart below.

In the long run, this is one of the less costly economic arbitrages to solve via pipelines. In fact there is a pipeline reversal occurring this year along with an expansion. However the future markets continue to show a large spread with 2014 spread still above $5/bbl. A pipeline from Cushing to USGC should be able to produce reasonable economic return for $2/bbl with the past demonstrating much less.

Also many don’t understand a very important policy choice, that the Energy Policy and Conservation Act 1075 (P.L. 94-163, ECPA) which directs the President to restrict the export of crude oil. The US is in a very unique position given the shale revolution not only increased natural gas production, but also significant liquids production. This policy decision should lead to some strong US refining outlooks.

When we examine the refining world as I discussed previously, it is very highly dependent on the feedstock. There is so much to cover in understanding refining economics that I will write this section requiring some basic understanding of refining. Basics include crude oil quality and the difference between hydroskimming, cracker, and coker. Also an understanding of why refiners chose various crudes. I have spent days teaching the basics to clients who are brand new in the refining business. In fact one of my first international task was a course on refining to PDVSA. I have built some of the most sophisticated models for crude evaluations for both buying and selling. I believe the Kuwait Petroleum Company still uses the model we worked up for them at Purvin & Gertz. Nonetheless refining is not a simple discussion without some basic understanding.

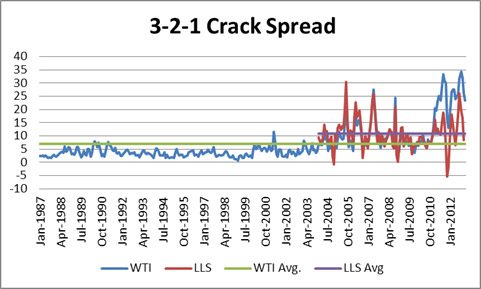

With the paradigm shift of higher prices allowed the spread of products to widen. It is only natural to think margins should move as percentages instead of absolutes. If your feedstock cost you $10 and your margin is $1 your return is 10%. If your feedstock is $20 and you still only obtained a dollar margin your return not drops down to 5%. This is likely going to hamper your ability to get financing and potentially put you out of business as your weighted average capital cost is above that unless you are regulated entity. This should be no different in the refining industry. The absolute value of the margin spread will be forever much larger than historical view until the feedstock falls back down. The proper view for refining margin is to view it as return on feedstock as seen below.

A return of 16-18% will likely suffice in the USGC to keep the industry going. WTI and LLS will converge to produce a return at that level. If we looked at it on an absolute basis – see below, it would suggest that refining margins will have much to fall in this $100/bbl environment, which is not the case.

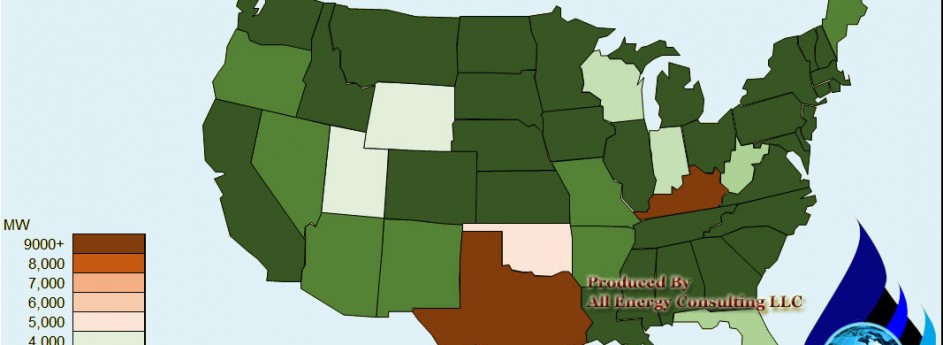

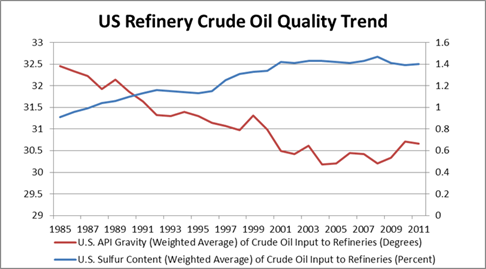

The second most significant change in refining was the underlying belief in the increasing lower API and higher sulfur crudes – figure below. This made the refining strategy focus on technology and those that can process the more complex crudes would win over the simple refiners.

This came at a cost in both technology and variable cost. However the shale revolution has changed that paradigm. The liquids being discovered within the shale did not increase in API and also has lower sulfur. This caused those who embarked on the above strategy a mismatch. The light/heavy differential is not as wide enough for the increase cost these refiners now have compared to the simpler configurations. This will likely not alter the long-term requirement of the crack spread to produce 16-18% return on feedstock, but it will impact inter-refinery competition and the strategy used to manage a refinery. Once again my services would include helping you review your refinery and from crude selection to refinery optimization.

In Part 2 we will discuss where the markets will go from here. If you review what we have covered you will likely have a good idea already where the markets will go. Critical thinking is key in the forecasting business. I have had good fortune in my career to build that skill set. Please do consider All Energy Consulting for your energy consulting needs.

Your Very Grateful Energy Consultant,

614-356-0484