Natural Gas Revolution?

Natural gas revolution, perhaps, is real, but it will take more to make it a real revolution. There is no doubt that shale development has made a major leap in gas supplies. However, energy is just a means to an end. In order to make this a real revolution, we need to see ingenuity in using natural gas. With the largest spread between natural gas and oil we should start seeing advancements in gas to liquids. I have done much in this area and have failed to come across something transforming in this field.

You can have all the energy you need and more, but if you don’t use it in a productive fashion you will end up like a third world producer of energy for others to exploit. As a domestic policy focusing on finding and developing energy is valid, but in the end, it is how you plan to use it. We need energy because it brings value to society by enhancing our way of life from keeping us warm in the winter to allowing us to read at night.

So much debate is focused on the industry on how many jobs it can create. Who really cares? Why would one want an economy built on the means not the ends? The less we can require of our means the greater the value of the ends become. The notion of a grand green economy to the massive employment of natural gas or coal is quite unproductive for the long run. Jobs in a sector which only enables you the option to live better cannot deliver much value as in the sector that actually implements better living. Natural gas has an opportunity for electrification, chemicals, petroleum products, goods manufacturing, heating, etc… Focus is needed on how we use natural gas.

Currently natural gas is still being flared around the world including the US. In Iraq alone they are flaring quite bit – http://blogs.platts.com/2013/06/17/iraq-flare/?sf429145=1. For a country who is lacking consistent electricity it would make sense to build up the infrastructure to transport and use the gas for electrification. Ingenuity in developing a means to manage stranded gas and/or increasing the value of that gas is lacking. This will be a revolution as soon as we are able to reduce and/or eliminate flaring of natural gas. The fear is we found a way to find more natural gas, but in the end flare it off in search of the higher value liquids product.

A revolution requires more than a one-sided story. Perhaps the low price signal is the beginning in terms of the market place action. However, there is much needed on the domestic policy front. We need to stop focusing on policies aimed at boosting production and creating an economy from developing energy and start to focus on an economy on using the energy in a productive fashion. Then, and only then, will it be considered a revolution.

As you ponder the path of energy please do consider All Energy Consulting as potential partner. We do technology valuation to forecasting commodities.

Your Energy Consultant,

614-356-0484

Consulting Value and the Information Age Impact

The value of consulting comes primarily into two forms – reaffirmation or value creation.

Of the two, reaffirmation is not likely to lead to as great of a value formation since the consultant is re-affirming what you would likely do. However there is significant value as it will likely make you act quicker than if you were not re-affirmed. In addition, the re-affirmation value would be more robust if your consultant came from another perspective, but still ended up with the same conclusion. Here in lies the value of a re-affirmation consultant. If your consultant primarily thinks like you do, re-affirming your thoughts should not be a surprise. A consultant who has a different thought process and different perspective really adds value, even though the conclusions may be the same. This re-affirms the conclusion to be robust not just a chance outcome. If you hire consultant for re-affirmation, ask yourself if my consultant is going to color my situation the same as I would, or would he or she be able to add substance/robustness to my conclusion.

Value creation from a consultant comes from the consultant being able to take his or her own unique experience and produce something you would not expect to be able to do because of the time frame and/or plain knowledge of the situation. The “super” consultants will not create an average thought piece that you could get from a government paper and/or mass media. If average is what you need, you would be better off asking your employees and/or industry associations versus paying a consultant.

I have been fortunate to be both a person who hired consultants and worked as a consultant. I understand the value of consultants and how one picks a consultant. At AEP I was in charge of the consultants we hired to examine the energy markets. The consultants I have hired included CERA, Wood Mackenzie, PIRA, Energy Ventures Analysis, Hill and Associates, Global Insights, Moody’s,etc…Over the years I saw changes in consulting. There were many consulting companies in the beginning that offered deep insights and different perspectives which challenge my thought process, allowing me to build my knowledge of the markets. The fascinating transformation occurred as many of these consultants got larger. As one could expect as a consultant firm gets larger, thoughts need to “co-mingle” as corporate heads expect team/consensus building.

However what do you expect to get if you build a consensus of many people vs. a vision and thoughts of a few? There is some sort of scale at which adding expertise into a consulting firm produces an effect of converting knowledge back into information. For my consulting experience, I was fortunate to have the experience in a 50 person consulting company Purvin & Gertz. We had some very interesting and heated debates on the outlook of the petroleum markets. The process was very personal, but in the end there was no requirement of consensus as accountability could not be washed out in numbers.

I also had the experience to work in a mega consulting company Deloitte Consulting. As expected, the outlook in the mega company generally involved more political maneuvering as people tried to climb the corporate ladder. I saw a dampening of individual thought as corporate mantras would likely lead to greater career success. Not much different than one would expect in any corporate setting regardless of the consulting aspect. There will be those individualists who can make a name for themselves and rise above the consensus thoughts, but the odds are against them. If you are a number person and/or just observant you can plainly see; tying ones ideas and thoughts to the corporate mantra will likely/statistically lead to a -greater career success. Coming back to consulting, if you create a mega corporate consulting company- are you creating a potential to dilute the very in-depth different insights your client requires of you? I am not saying that it is not possible to obtain this from large consulting companies, but it certainly requires a company to be different than most corporate cultures at that point.

Perhaps someday I may once again join the ranks of a mega-consulting company, but it would have to be on the grounds of still being able to offer a unique perspective to my clients, or else what is the reason to consult? The world is well into the Information Age, given the internet revolution. We all have access to mainstream media, government analysis, industry associations, and the futures market. There is more data than you can possibly analyze now. Consulting becomes harder as consulting is not just about bringing information anymore since that seems to be ubiquitous, it is about bringing your unique experiences and processes to the table and converting that into knowledge for the client. At All Energy Consulting that is the very premise of the creation of this consulting group. We don’t want to be another information shop – we focus on value-creation and robust re-affirmation through transferring knowledge.

Please do consider the reasons for hiring a consulting company and then consider All Energy Consulting.

Your very thoughtful Energy Consultant,

614-356-0484

Twitter: AECDKB

“The answer was fewer clients. Less money. More attention. Caring for them, caring for ourselves and the games, too. Just starting our lives, really. Hey – I’ll be the first to admit, what I was writing was somewhat touchy feely. I didn’t care. I have lost the ability to bullshit. It was the me I’d always wanted to be.” Jerry Maguire

“Look I don’t have all the answers. To be honest, in life, I failed as often as I succeeded. But I love my wife. I love my life. And I wish you my kind of success.” Dicky Fox from Jerry Maguire

Power Industry Challenges – Strategic Threat

The power industry is the most capital intensive industry. This capital intensity was one of the key factors in regulating the market. Centralizing a large unit lowered the cost significantly even though transmission and distribution cost would be increased. The irony is we now build units such as wind that are more expensive and also cost more in transmission and distribution cost. In addition, we have de-regulated the generation piece of the business in several markets. The de-regulation experiment is bound to have some significant failures as the ends may not be great enough to justify the means. Society is use to capacity being built when market prices return a 10-12% return. However in de-regulated world returns would need to be commensurate with the risk. High capital cost in addition to volatile uncertainty in commodity and policy would require a 20+% return. In order to get such a return the prices in the market will likely be at levels that brownouts and rolling black out occurs at peak time periods. Society will not deem this as acceptable.

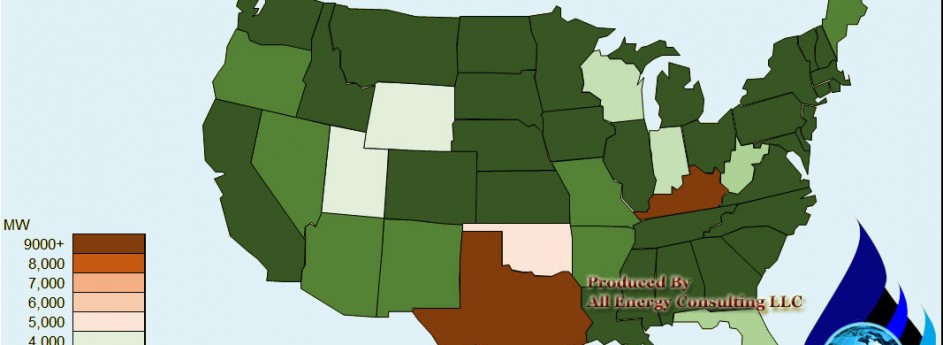

The weighted average age of all the plants in the US is 28 years old. This means somewhere between 10 and 30 years from now 600GW will need to be built assuming NO load growth. If we add 1% load growth over the next 40 year we are looking at an additional 100GW. The total investment for just the generation piece will be around $700 billion.

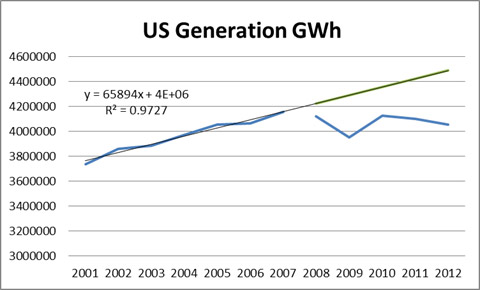

This comes at a time when utilities are bleeding in the nation from lack of load growth. Load growth is the key revenue line item for utilities. Projects and investments are based on assumed load growth and rates are adjusted to represent the revenue requirements. When load does not grow as it didn’t for the last few year, revenues dramatically fall and rates will need to be adjusted up to account for the expected load growth which did not appear.

Based on the expected trend before 2008, utilities load drop has resulted in a loss of expected revenue around $140 billion.

In addition, there are so many other initiatives beyond generation that are on the shoulder of utilities. This includes Environmental controls, Smart grid, Demand side management, Conservation, Efficiency, Renewables / Feed In Tariffs, Carbon, Pension obligations, Jobs support, Transmission, and Distribution investments. If you think the ages of plants are old distribution equipment is much older.

All this added cost points to higher rates for the consumer. Rates can only go so high before society revolts and/or the business model of the utility folds. This issue becomes a strategic threat.

Please do consider All Energy Consulting in helping you assess your strategic risk and understanding the future of the energy markets.

Your Energy Consultant,

614-356-0484

Twitter: AECDKB

Study vs. Advocacy – Wind Generation

I recently came across this “study” – The Net Benefits of Increased Wind Power in PJM – done by Synapse Energy Economics for Americans for a Clean Energy Grid. Based on the information on the website from their website they seem to be a very credible organization. However I think the “study” shows that they are smart enough to manipulate the setup and presentation to create a document to their client’s desire. The study became an advocacy piece and those calling it a study better review it first.

The first alarm bell from any study requiring a model, particularly the power markets, there needs to be back test of the model. They should show the back cast results and prove the model is ready for future applications. The main mechanism to show the impact of increasing wind actually was beneficial was to start the analysis with a draconian setup and to guise the result under a delta impact of 2026. By pushing the analysis to 2026 they were able to state a capacity setup which does not exist and will likely not exist, thereby making a delta analysis potentially more positive. Below table shows the current PJM resource mix (http://www.pjm.com/~/media/documents/reports/2012-rtep/2012-rtep-book-2.ashx) vs. the proposed 2026 setup by Synapse.

|

Installed Capacity GW |

||

| Synapse 2026 | PJM Current 2012 | |

| Wind |

32 |

1 |

| Gas |

123 |

54 |

| Coal |

18 |

73 |

| Nuclear |

34 |

34 |

| Hydro |

3 |

8 |

| Other |

42 |

11 |

| Total |

252 |

181 |

I will agree to the direction of the reduction of coal, but the extent is far from reality. First, there are 37 GW of coal assets with scrubber installed in the last 5 years. Do you think utilities spend a billion dollar not to recover their assets over a longer time period? In addition in the planning queue for scrubber installation I see 12GW of coal. I suspect not all of those will install, but compared to the 18GW Synapse is assuming to be left in 2026 because it doesn’t pass the sanity check.

By starting at the reference point at a system that is already expensive, makes it very easy to conclude wind generation is better. Another advocacy maneuver was to have wind generation at such high levels 36+% compared to NREL own assessment for many of the PJM states in the upper 20%. Besides the output, I would be curious to see the wind shapes they used to and whether they are close to industry standards or biased.

I could go on and do more analysis, but I think my concerns thatI have addressed are sufficient to make the conclusion the report is more advocacy than study. It is ashame they went that direction. I believe the assessment done by NREL that wind costs are coming down is real and will have an impact for more wind. I also believe solar impacts will be larger than stated in this study, but this would likely not support the initiatives set forth by the Americans for Clean Energy Grid as most of the members are wind centric.

I don’t think I would be a good advocate. The numbers drive me. However I am open to latitudes of probabilities, but those probabilities must sit inside some reality. I suspect over time people would want to deal with people who don’t just color the picture how you want them to, but actually consult with you to make better decisions. At All Energy Consulting we promise to offer you real consulting minus the advocacy.

Your Energy Analyst who paints it like he sees it,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.

Shale Gas Bashing Gone Wrong

There are some very poor “journalism/reporting” on the internet. Businessinsider.com seems to be getting worse. I give them credit for being good entertainment at times. I usually just laugh and scoff at the poor articles and move on. However this latest attempt of journalism/reporting hit home with me – 12 Reasons The American Energy Boom Is Totally Overrated . I didnt read Michael Levi’s book that may have sparked this. I believe Michael would have been more logical and less sensational than BI, given I do follow Michael’s work.

The biggest oversight is the fact the low natural gas price over the last few years have allowed the population to have much more disposable income. This is very simple math as I showed in my previous blog I did last year in January. In that blog, I showed at least a savings of $193 billion dollars. Adding 2012 figures into the analysis total savings are now $283 billion. One needs to remember energy is just a MEANS to an end. Having energy by itself is worthless. Therefore anything to reduce the cost of the means adds directly to the benefit of society.

Let me go graph by graph and refute and/or elaborate where they should have.

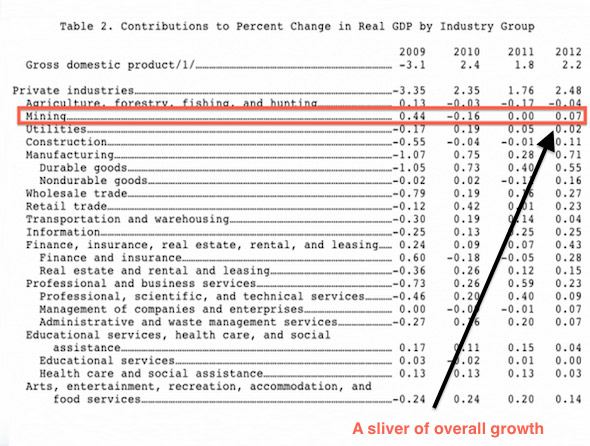

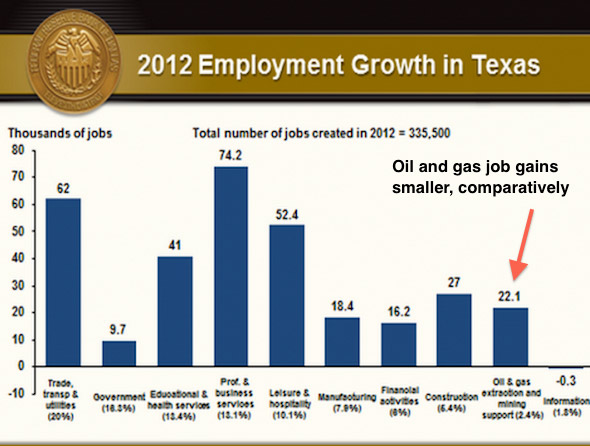

BI:“According to the BEA, the U.S. mining sector, which includes oil and gas production, contributed a measly 7/100ths of a point to the 2.2 GDP growth we saw in 2012”. Please don’t just focus on what they are highlighting, but notice the largest item of growth is manufacturing. Having lower cost power and more disposable income allows this gain.

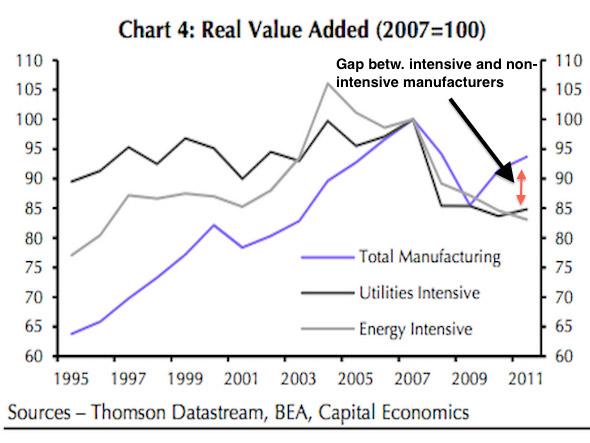

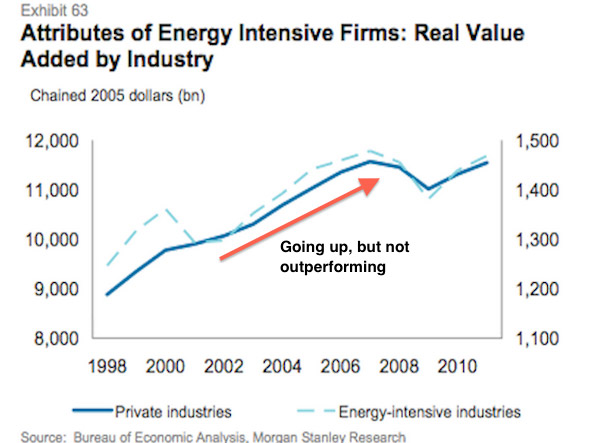

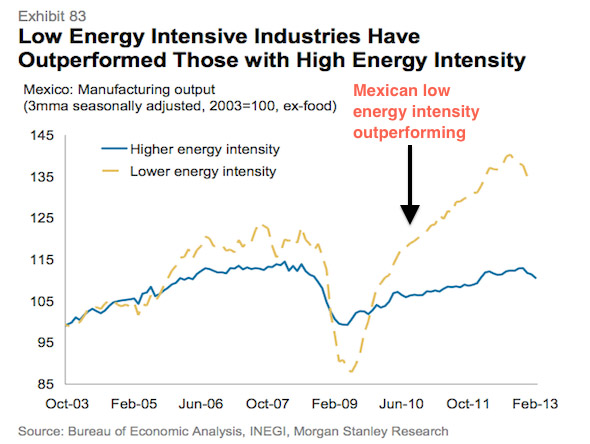

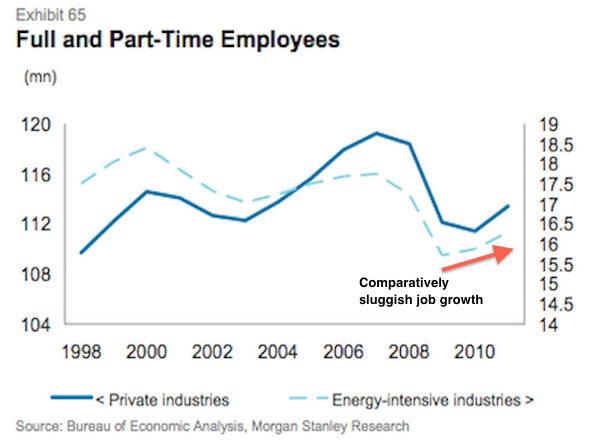

BI: “Energy intensive industries are adding about 10% less value than all manufacturers.” Energy intensive industries take many years to develop due to their large capital investments needed. It is not reasonable to expect the uptick in the energy intensive sectors first. As pointed out in my blog my first year point of shale impact started in 2008. The graph above shows only to 2011 – hardly any time for people to believe and put billions into a project requiring low gas prices.

BI: “Relative to the rest of the economy, the energy intensive industries aren’t outperforming.” My response would be similar to the point above. The graphic is even worse since only up to 2010.

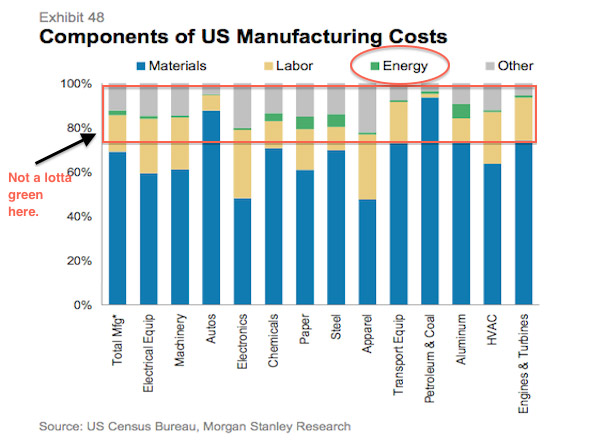

BI: “Energy comprises just a tiny 2% of US of manufacturing costs.” There is a multiplier effect for energy cost in manufacturing. Materials are clearly a large part of manufacturing. How do you think you get materials such as aluminum to make cars? Though Auto, HVAC, Engines, Electronics, Machinery, Transportation, Electrical Equipment shows little energy cost they are highly dependent on the cost of energy per the materials. Materials are not naturally produced as the BI “reporter” would like you to believe.

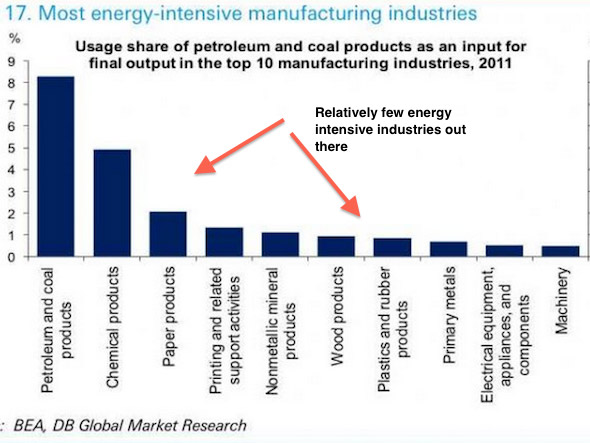

BI: “And only handful of industries are truly energy intensive.” This is a chicken and egg issue. The reason our economy has shifted to be less energy intensive is because of the cost of energy and labor increased relative to the rest of the world. With sustainable lower energy cost there will be a change in the above profile. This is another failure to think and deduce a wrong conclusion. It takes a certain amount of time before energy intensive industries come back, but they will if we don’t mess it up.

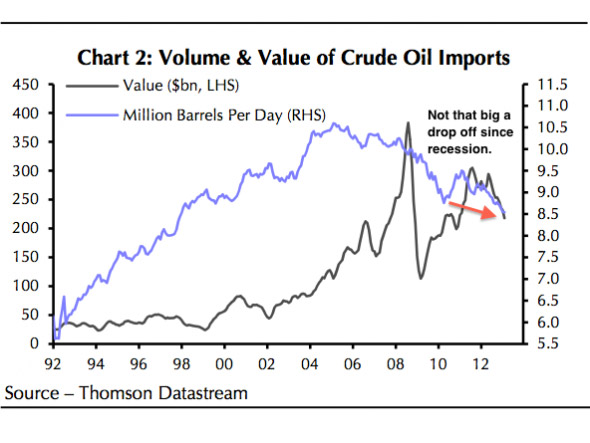

BI: “The volume of petroleum imports have long been declining, and have moved independent of prices.” This is less to do with shale. Shale’s focus is natural gas not oil. The oil decline has more to do with the price of the global oil markets.

BI: “Mexico has long enjoyed abundant natural gas reserves, but it too hasn’t seen its energy-intensive industries go gangbusters.” Mexico has enjoyed abundant amount of oil also. This has more to do with the political structure and the inefficiencies in their market. Their infrastructure is so bad they import electricity from the US.

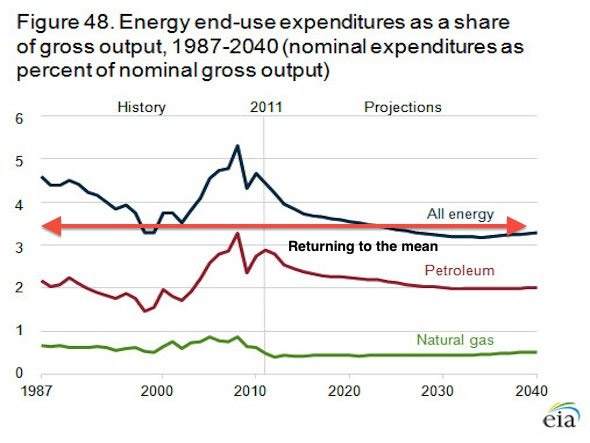

BI: “Energy as a share of gross output has declined to a little over 3%, but it’s almost certainly more a function of oil prices resetting after spiking in 2008.” This is so wrong in so many ways. Half the graph is based on a very poor forecast. The EIA forecast models I have debunked several times on my blog. Just because an agency says something doesn’t make it so, particularly since you can look at their old forecast and see they have a poor track record.

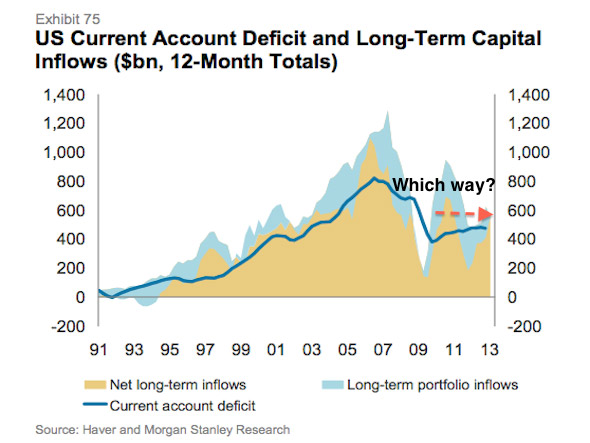

BI: “America’s current account deficit is narrowing, but Morgan Stanley says it’s unclear whether energy will have a material impact on this.” I don’t see this supporting the stance that shale is not impactful. In addition the own statement of “unclear” they should have left it out of the analysis.

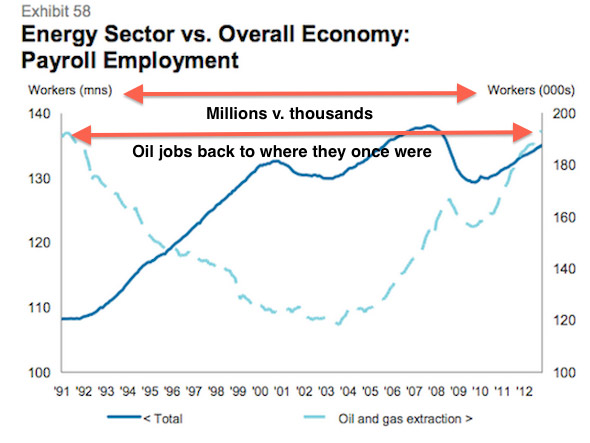

BI: “Employment in the oil and gas industry is less than 1% of the national total, according to Morgan Stanley.” Employment in the oil and gas industry is not the target. As noted energy is a means to an end. You use energy because it allows you to do something. The cheaper the energy the more things get created.

BI: “Even in Texas, the oil and gas industry and its support services constituted just 6.5% of all jobs.” Why would you want a sector who only allows you to do something be the major portion of your economy? Energy is creator of jobs which should be focused in the use of energy not the finding or developing.

BI: “Employment in energy intensive industries has picked up, but the rate trails that of the rest of the economy.” As I pointed out in many points above, the energy intensive industry takes time to develop given the billions required. A new steel or chemical plant is not cheap. They are assets which will last decades. Making an investment decision takes time to build a sustained belief in lower natural gas price – just few years back gas was forecasted to $8+/mmbtu. The shale revolution is only in its 4th year.

Very funny the next article in BI after this shale article is the SOLAR BOOM! Well, I bet they will discuss how many jobs are created. Once again having an energy source which requires lots of manpower is not something to strive for. Having employment in using energy by creating something to better society should be the goal.

This was a very poor article by BusinessInsider. I hope Henry Blodget does a better job screening. My appreciation for BI has dropped over the past year. The page creation machine will eventually get you if you don’t manage your quality.

Energy is a means to an end. The shale revolution is advantageous to the US if we let it be. I believe carefully constructed regulation and enforcement should be implemented to constrain the bad actors, but we should not villianized a whole sector out of ignorance.

Your Energy Analyst,

614-356-0484

“What is the hardest thing in the world – To think” Ralph Waldo Emerson.