Power Modeling More Complex than Refining Modeling

With my background in refining modeling, I can say power modeling is more complex than modeling most other markets. The process of producing power is not as complex as refinery production, but the final product pricing and market is significantly more complex. The refining modeling focus is typically on optimizing yield value while changing the crude input quality within the refineries capabilities. The products can be stored and transported to the highest paying markets. With power you just do not have that luxury of storing or even watching where it goes. I will admit there are certainly more dollars in the Oil & Gas world than the power world.

The power market is highly reliant on what the neighboring power plants are doing, and now potentially, your own customers. The other power producers may not be using the same feedstock as you. They also may be operating the plant differently, nonetheless, their actions impact the price and flow of your power in that instant. The amount of information that must be processed in the power markets, to say the least, is voluminous. To do proper power modeling, an hourly model is recommend. If you do not do an hourly calculation you can be misled, for example as in LCOE calculations (https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/ )

There are really two types of modeling that one can do. One is to try to understand market pricing and market dynamics, such as coal and gas demand. In this setup, you draw your circle quite large and potentially model the entire N. America, which I have done numerous of times. In this setup you will model over twenty thousand units. The alternative is to model one’s own system for near-term operations or long-term resource planning, or both. The market prices become exogenous inputs to the model. I would caution against this setup in isolation due to the potential impact you may have on the exogenous inputs. However, in most cases, one typically runs a series of exogenous price inputs to capture the variability.

Both alternatives still deal with the commodity inputs and the load forecast, with the latter being the more potent of the two, assuming you use commodity outlooks across a reasonable range. Whether you are trying to understand market fundamentals or your system budget, you will have to deal with significant uncertainties. Market based modeling compounds your uncertainty multiple times. Modeling your own system, you compress a good portion of the uncertainty into the market price. However, you still are left with dealing with policy issues (to Carbon Price or not – Renewable Portfolios – Demand Side Management – etc…). Of the many moving pieces noted in the check list below, most change frequently over time.

Power Modeling Check List

- Load

- Resources and their Fuel Options

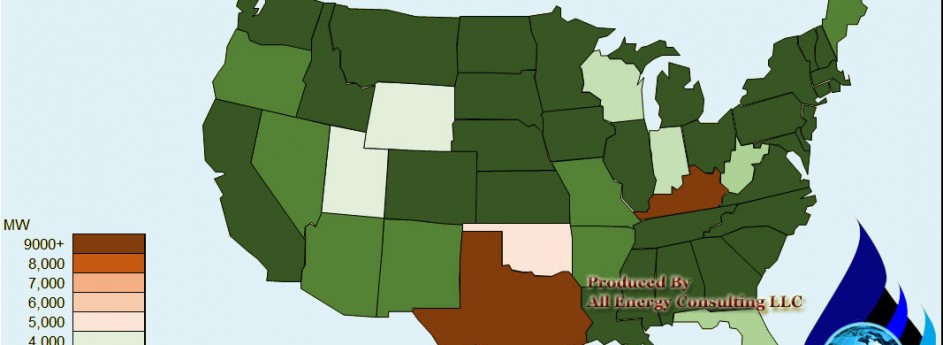

- o Coal – by unit, as coal type and transportation is individual (~1300 units)

- o Gas – by unit, as each plant could have multiple fuel pipeline access (~4600 units)

- Resources and their Performance Attributes

- o Uptimes and downtimes

- o Ramp rates

- o Maintenance

- o Cycling

- o Start-Up Cost

- o Minimum Capacity

- o Variable Cost

- o Fixed Cost

- o Emission Rates

- o Secondary Fuels

- o Heat Rate – Heat Rate Minimum and Curves

- o Storage, Recharge and Initial Contents – for battery & pump storage

- o Bidding – fuel adders to multipliers

- o Performance Shapes (Solar & Wind)

- Emission Pricing

- Federal, Regional, and State Policies and Standards (Renewable & Carbon)

I have been power modeling for over 10 years now – both hands on and managing a team. Recently, I have spent two years modeling for a client essentially being their outsourced modeler. The experience has proven to me the viability and value power modeling outsourcing can have. I would not recommend a complete outsourcing, but I can certainly see outsourcing the functionality pieces. As Managing Director of Strategic Planning at AEP, I would have loved to maintain some continuity with my power fundamentals team and my modelers as they left for bigger and better jobs. Each modeler when left to their own devices will devise a custom setup to manage all this information. The new process would likely leave out something or be organized slightly differently. Sometimes you get quite an inexperienced modeler and they leave out some crucial issues in the power model.

Power modeling implementation is not as simple as rolling out a new version of office and should not be treated that way. Even with “out of the box” software implementations from People Soft, Oracle, SAP, CRM, you still need to bring a whole team of consultants to make sure the process gets implemented effectively. Why would you not take the care to make sure your power modeling is implemented effectively? It does not take a whole team of consultants as People Soft, Oracle, SAP, CRM software would, but you should take advantage of experienced professionals. I know some of the software vendors offer implementation help – but just like People Soft, Oracle, SAP, CRM software, it is best to get people who actually do it as a living. The software people are spending their main resources on their software rightly so. Therefore, talent is not necessarily on par to achieve your business needs.

My power modeling offering is here for you to maximize your investment in both software and staffing. To read more about my offering please visit – http://allenergyconsulting.com/2011/11/modeling/

Your Power Modeling Consultant,

614-356-0484

EPA Proposed CO2 Pollution Standard – Gas more impactful near-term

EPA 2013 Proposed Carbon Pollution Standard for New Power Plants has made some news with much of the focus on coal. I believe the coal issue could be quite a smokescreen given the current economics of coal as it relates to gas. The coal limits are not likely going to impact much of anything over the next few years – perhaps not even in the next 5+ years. For the current impact the devil is in the details.

The natural gas limits probably could use more discussion for its near term relevance to prices for the consumer. For baseload gas plants, the limit is a non-issue (heat rate of 8.4 to 9.2 mmbtu/MW). However anyone with some/limited experience in the power markets realize the diversity of plants is needed not just on fuel perspective, but on a performance perspective. Load can be quite volatile and spiky. There is no need to build a baseload plant for a few hours of the year. Therefore the industry builds peakers to meet these events. Peakers attributes are a cheap unit that is not required to run a lot, therefore variable cost less important than fixed cost and that they need to turn on and off quickly.

Peakers have generally been very high heat rate units as the variable performance was not important. As noted in a paper I lead for the National Petroleum Council – ELECTRIC GENERATION EFFICIENCY – “The efficiency of a new power plant is largely a function of economic choice. The technology is well understood in order to produce a highly efficient plant. In order to produce higher efficiencies, higher pressure and temperatures are required. This increases the cost of the plant as special alloy materials will be needed.”

Therefore higher efficiency is not a leading attribute for a unit expected to run only a few hours in year. The additional expense of higher capital and higher operational cost is not worth it. Currently the average natural gas peaker heat rate in the country stands at 11.3 mmbtu/MW. There are new “peakers” being built at heat rates around 8, but they are not really being built for peaking operations as described above. They do cost more and therefore are anticipated to operate more often. This new carbon standard will first impact capacity markets. As an example the PJM capacity market is using a Cost of New Entry (CONE), the peaker attribute used to calculate CONE is at 10-10.3 mmbtu/MW. This will need to be changed, which will increase the cost of the CONE, therefore increase the cost of the capacity markets. The cost will go directly to the ratepayers.

I am not saying the standard is wrong in any way and that we should not be doing any risk mitigation for carbon. I am just pointing out the real impact of the standard that will likely be felt in the short-term. As long as society knows its cost and benefit and is in agreement than the standard is appropriate. Adding a CO2 hourly limit standard for peaking plants seems in-appropriate. They could have put in a daily limit for small gas plants so that they could still run a few hours and be within the standard. This small amount of CO2 emissions will not do much risk mitigation, but may add more cost than benefit.

In the long-term, this pretty much puts a nail in the coffin into new coal plants. The effective heat rate being asked of a coal plant which cannot be achieved even by a gas plant is 5.4 mmbtu/MWh. This essentially requires some sort of carbon capture and sequestration/storage (CCS). Being involved in CCS at AEP, the cost is extremely high and there are some serious risks. The risk/reward profile is not there for an investment in new coal plants even if gas prices were to be $6+/mmbtu. Once gas prices rise closer to $7+/mmbtu, partial capture could make economic sense as noted by the EPA. However the world of $7+/mmbtu prices currently seems far away.

Your Energy Consultant looking at the details for you,

614-356-0484

Gas Basis Phenomenon – Million Dollar Plus Question Will it Go On?

I am surprised not to hear more discussion on what I believe is one of the biggest market questions for both the natural gas and power markets in the US. The gas basis (spread between the locational point and henry hub) in the Midwest has gone negative in June and has stayed that way. In addition, the forward curves portray that outlook with the 2016 basis spread averaging a minus 40 cents for Dominion South Point.

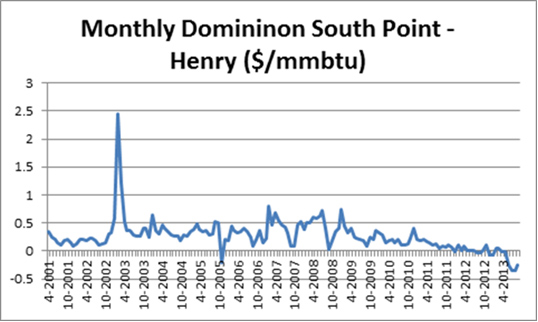

Looking at the basis spread on a monthly level through time clearly shows historically the basis is a positive 30 cents with some extreme upside.

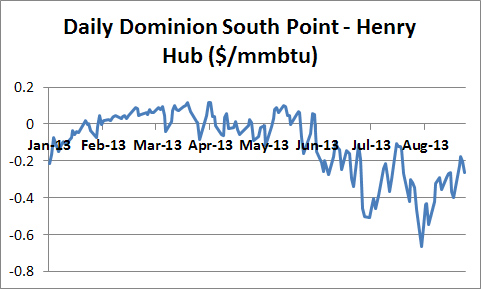

Viewing the spread on the daily basis shows the amazing change in June of this year.

There is much significance to this paradigm shift. Number one the coal competition lies in the Midwest not much in Texas. Henry Hub is the most quoted and reference gas price, but with this shift a $4 henry is not the same impact as it was just a year back for coal to gas switching. A years back you were talking a $4-4.5/mmbtu gas price to coal spread, now you are talking about $3.50-4/mmbtu. As I have noted before moving into the sub $4 range the competition heats up. Retirement and operational decisions of the coal plants in the Midwest becomes even more dire with such a negative basis outlook.

On a trading perspective, one can trade the basis. Trading basis removes the guess work of where the macro supply/demand of natural gas is going. In doing so, you somewhat mitigate some of the weather impacts. Arbritrages like this don’t come so often. The shift in basis and the continuation has resulted from infrastructure and related issues. Utica and Marcellus has clearly changed the dynamic of natural gas pricing in the US. The million dollar plus question is how long can this persist. Natural gas infrastructure development is rather quick compared to power development. Right of ways issues can be mitigated by building right on top of the existing path ways. Rates of returns can be captured with spreads such as a 40 cent differential to henry hub. I am surprised how long the forward curve goes out with such a discount. In fact the discount is seen every month even on the historically largest premium month February. Perhaps the trade you should not leave on the table….

Your Energy Consultant looking for a few good clients – if you are interested, please call me,

614-356-0484

Sacrifice Now and for Others … Tough Choice

Recent NPR story goes to the heart of the issue of sacrificing for the environment. Whether the country is Ecuador or the environmental concern, the issue is global warming to water pollution. There is some form of sacrifice that the environmentalists ask for and typically from others. On many levels, these are reasonable and self-beneficial sacrifices. However, in this case, I can empathize with Ecuador’s President, Rafael Correa. “Do we protect 100 percent of the Yasuní and have no resources to meet the urgent needs of our people, or do we save 99 percent of it and have $18 billion to fight poverty?””

The country is far from the standards of living seen in the western developed world. At the same time, the biodiversity in much of Ecuador is abundant and untouched. The price of oil has risen to such great levels of recent and could supply much needed capital resource to the country. The environmentalist would argue that sacrifices need to be made to protect this rich environment, yet no one seems to really see who is actually hurt by this sacrifice. The environmentalists in the west continue to live in the comfort of their homes with vehicles and roads not seen in Ecuador. The environmental fears presented in the end cannot outweigh the economic fact and reality of sub-standard living in Ecuador, and the real impact that further resource extraction could add.

In this case, the larger society gains can be seen and the environment sacrifice is likely inevitable. People who care would have the right to purchase the land, but as anyone selling something, it will be priced at the cost of the value it would add. This cost would seem too much for anyone or any country. The article noted they only were able to obtain $6.5 million.

This trade-off issue can also be seen in the US in the shale plays. Many environmentalists, who once again, do not live on or around the land that they are trying to protect, continue to try to limit the development with no empathy for those people who have direct benefit. The people who are directly involved and owned the land, typically for many generations, are not empathized with the environmentalists in their pitch to stop the shale development. In many cases, these owners have been left behind in the economic boom over the last 30 years in the US. As in Ecuador, economic well-being of those directly involved,make environmental sacrifices harder. Without the acknowledgement and consideration of those individuals’ benefits, we cannot come to a fair balance for the environment and economy.

Food for thought as you see and hear more on the anti-shale front.

Your Energy Consultant,

614-356-0484

Climate Change a Risk Worth Taking Some Action

A very good blog on climate change and risk was posted on Grist – an environmental website which I like to read to round out my perspectives. I like the fact the author discussed climate change within the context of risk. Any time you talk about risk you are talking about probabilities not absolutes.

I had similarly discussed the probability concerns of climate change in my previous blog. In that blog I pointed out the fact we do things given small probabilities. My example was buckling up whereas Dana discussed even smaller probabilities such as getting cancer and the risk mitigation placed on environmental hazards when presented with cancer risk.

Dana concludes the failure or acting on climate change is from: “This is in large part due to a lack of public comprehension of the magnitude of the risk we face; a perception problem that social scientists are trying to determine how to overcome.” The real issue once again I noted in my previous blog is society focus on NOW and the concept of Carpe Diem and the ME concept. Health related issues are certainly going to impact you in your lifetime. Climate change direct impact on you is more of a probability. In fact, the impact could be positive for you depending on your location and attitude/(lack off)care of others.

Climate change actions will require people to think much longer-term and less about themselves. For this reason climate change actions have failed not because of the lack of comprehension. I understand why some scientists are trying to put extreme cases out in order for some action. However the fact is we cannot change that the climate change impacts may take many years to play out and potentially a lifetime. As noted in my previous blog, we have too many living on so much on debt with little savings. How do you really expect them to plan beyond 10 years much less a lifetime, regardless of the dire outcomes you may present?

Without a shift in societies attitude for planning and thinking beyond themselves, we will not likely move forward in any meaningful way in any risk mitigation for climate change. When society gets healthier and reduces the debt load and increases savings, perhaps we will be ready.

Your Energy Consultant,

614-356-0484