Demand Response (DR) & Demand Side Management (DSM) Insights

Demand Response (DR) & Demand Side Management (DSM) are very hot topics that are interrelated however was broken apart in the ScottMadden Energy Industry Update. The ScottMadden Energy Industry Update addresses the DR and DSM discussion,albeit with an unexpected slide on the nuclear power sector in between. There are not many insights to offer on nuclear, other than nuclear waste being very expensive for taxpayers and gas prices are impacting renewal of existing plants. I can offer insights on DSM, particularly as it relates to the utility industry. I believe utilities can be, as effective if not more effective in DSM roles than third parties. It is just a matter of aligning the incentives for the utilities similar to the third parties. If this happens, I suspect many will be crying wolf.

I have spent time working in the DSM (DR and efficiency) space for utilities. Similar to the insights derived in my previous ScottMadden Energy Industry Update executive summary, the utilities need to change business model. This includes their approach to demand related options. Society and the commissions and are siding with the capability of efficiency programs due in part to some results coming from the western states energy intensity over time, but I believe that may be overly optimistic. I cautioned the extent of the results from the western states being translated to the rest of the country, as western states saw a migration of industry on which the rest are more dependent. In addition, the climate is more temperate in the west, which leads to the ability to be easily more efficient. Energy intensity is not the best metric as it covers up the underlying changes and issues. DSM is a detailed process since it focuses in on what your customer uses energy for. If your customer uses heat pumps to stay warm as their primary energy usage, implementing a large light bulb program will only get you so far compare to places like California. Besides all that caution, DSM does have a place and the utilities can create a win-win situation. They just need to change the model.

All Energy Consulting has experience facilitating such a change to the model in the following roles:

- Developing management understanding of the issues and the various strategies that could create a win-win situation

- Working with the regulatory team and the commissions to make sure all parties understand that the win-win situation is being created

- Assisting the modeling and planning groups to treat the DSM, not as a top layer input, rather more akin to a resource option

Third party facilitation has the following advantages:

- Removes the emotional attachment of keeping the status quo

- Allows people to take comfort in having someone to blame if something goes wrong

- Removes fears that prevent many organizations from changing.

Stay tuned for more insights derived from ScottMadden review.

Please do consider All Energy Consulting for your consulting needs as I can help being the facilitator to change.

Your Energy DSM/DR Consultant,

614-356-0484

ScottMadden Energy Update 2 – Coal generation and capacity markets in flux

In this blog, I am moving forward into the ScottMadden Energy Industry update from the previous posting on the Executive Summary. As I noted many times, the real meat of the discussion is in the details. ScottMadden brings up much meat to generate insights.

Coal & Capacity Markets

In terms of the coal retirement story, two fascinating things bring to mind that were not discussed in the update. The first one is the PJM capacity auction which is and should be in serious flux, given the required must run (RMR) status put on First Energy Hatfields Ferry Power Station. A moral hazard has been created probably without intention.

In July, after the capacity auctions dropped from the last auction, First Energy announces the retirement of the plant. In theory, the capacity auction should be high enough to keep the necessary units running. Hatsfield Ferry already has SO2 controls and some mercury mitigation which they recently spent $650 million. It is quite peculiar they announce a retirement for such a plant. Nonetheless, with an RMR designation, First Energy is in the driver seat for this plant. They can in effect “guarantee” a return for the plant regardless of the market condition – low load or low gas prices. This may be quite unintentional but perhaps other utilities should follow and announce retirements.

There is no real mandate one has to follow through with an announcement – similar to announcing a new power plant. (Tidbit of fact if you look at new power plant announcement only around 10-20% get built). One could at least see if they can get their plant to be guaranteed for some time. If not decide later to retire or not retire.

Another point worth discussing, coal in areas of significant wind development (e.g. MISO), how can you not mention the interplay with wind. The big debate is how much wind can be attributed to capacity. When you need capacity in times of high load typically wind is not blowing. The most obvious occasions are the very hot days. However, even on very cold days there is a good chance there is too much ice buildup on the blades to obtain any electricity. Therefore, the wind capacity is generally discounted for capacity value. At the same time a trend you can see to the angst of coal units in markets with large wind is the intermittent availability. The coal plants cannot cycle without significant risk of increase maintenance. This has led some coal units to just turn off versus trying to chase the wind.

To capacity market or to not is the question of many market organizers. ScottMadden presents the grand experiment in ERCOT with an energy only market. Discussing capacity markets are as contentious as religion as noted in my Regulation vs. De-regulation blog. In hopes of taking out some of the religious fever on the topic I like to discuss it on a math basis. A market with regulation typically gets a return on investment between 8-12%. If the market is free to compete, the risk is increased. Therefore, the reward needs to increase above the regulated return requirements. This increase leads to boom bust cycles as rewards are large and eventually attract many suppliers.

Not all the suppliers are smart and so herd mentality is likely leading to a market bust when in a boom and market boom when in bust. A boom bust cycle is okay for goods such as beanie babies to cars to cell phones etc… However, power and water have become essentials for society and producing boom and bust cycles will likely lead to very instable society. The spread between the current regulated framework of 8-12% return to now 15+% rate of return, I contend is too great for society. I do agree the potential for a more efficient market is very possible with an open market, but society is not willing to take the means needed to achieve the ends of a more efficient market.

Outside ERCOT, many are trying to rectify the de-regulation imbalance with the security of regulation by offering a capacity value to incentive build before the energy only market induces a build. I believe that there needs to be a more creative way to reduce risk, thereby reduces rewards requirements. As an example, one source of reducing risk is to offer pre-designated projects with permitting and locational issues cleared by the RTO. The RTO can then auction off these locations.

We are now at the half way point of the ScottMadden Energy Update. As you can see the update is more valuable in not just the facts they present, but from those facts the ability to stimulate alternative ideas and potential concerns – insights as like to call it. I will continue on with this in my next blog.

In the meantime, please do consider All Energy Consulting for your consulting needs as I can help you see beyond the facts to find issues impacting your business directly.

Your Energy Consultant,

614-356-0484

ScottMadden Energy Industry Update – Times are Changing but the Utility Not so Much

ScottMadden Energy Industry update offers much knowledge and points to ponder. I want to thank ScottMadden in making the report publically available.

Executive Summary Thoughts

I couldn’t agree more with the Executive summary theme – Times are Changing. However, what is not addressed is the root of the utility business involves the status quo. Not because of the lack of understanding, but the very nature of their business design and incentive. The root of utility business without elaborating too much involves a regulatory return on investments and minimizing cost to allow more returns on investment. The risk-reward paradigm does not offer enough or any reward for change. If you happened to guess right, your rewards are limited, and if you guess wrong, the punishment could be severe particularly on a personal level not necessarily the company level. In addition, because uncertainty in the sector and revolving commissions doing what was done in the past, has been viewed as not being wrong, even if that is the case.

The mergers & acquisitions noted in the report continue to follow the root of the utility business which ignores that changing landscape. I believe that getting larger in the face of the customer getting more knowledge and involvement in the electric sector goes against the desire of the customer. The business model needs to change and find a way to get back to serving customers, not just by class, but by individual needs and requirement. This would have been impossible in 1970’s, but we have come a long way now, in terms of technical capabilities.

You will note many of the themes in investment, ScottMadden notes goes right back to following the old business model. A “No-regrets” activity in the T&D space is the perfect lingo of doing what one did before. The T&D space is really the only no-regret activity, since it still falls under regulatory paradigm. Anything involving generation can now be considered outside that no-regret policy.

ScottMadden concludes in the executive summary section accurately that new business models are needed. However, I feel they offer quite a bit of optimism that change can happen in time. One may consider many utilities as big and clunky as the Titanic, but the positive thing is, even if one see the iceberg ahead, yet refuse to alter course; they will not likely sink as the Titanic, given the broad need and still some regulatory format, but they will be altered. The real decisions is whether they want to prosper by the change or be left in a much smaller, less active role, similar to the newspaper industry. Print is here to stay and there will be returns for some, but nothing like the good ole days.

Let me break my reporting of the ScottMadden, given the abundance of topics covered in the next sections. I want to close with thanking ScottMadden in sharing this very enlightening document. Business decisions are made by – Information turning into Knowledge turning into Action – the consultant part in the process is not hoarding the information or knowledge but helping you with the turning.

Your Energy Consultant Focused on Helping You Turn,

614-356-0484

Integrated Resource Planning (IRP) Continues to Use Antiquated Methods – Strategist at risk of disallowances

The most popular software for Integrated Resource Planning (IRP) in the US is probably Strategist by Ventyx, who is now part of ABB family. ABB focus is power and automation technologies with revenues of $40 billion. Unfortunately, for Ventyx, software represents a speckle in terms of revenue in the grand scheme of ABB business.

The history of power planning involved numerous methods of short cuts, given the instantaneous nature of power and the lack of processing capabilities in the past. The instantaneous nature continues with power markets being settled hourly, if not sub-hourly, in some markets. Processing power has well advanced forward, following the famous Moore’s law. However, we still see short cuts in software such as Strategist.

In the recent filing done by Public Service of Colorado – parent company Xcel Energy – http://www.dora.state.co.us/pls/efi/efi_p2_v2_demo.show_document?p_dms_document_id=240772&p_session_id=

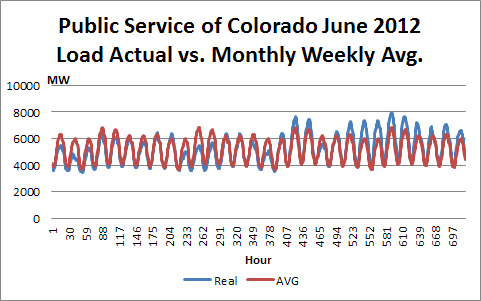

You will note in the documentation: “The Strategist model represents load for each month with a typical week composed of 168 hours that is then repeated to capture the full load for that month. As a consequence each 168 hour week is individually dispatched to minimize system cost.” A large assumption is being made that a week hourly shape within a month is relatively consistent. This is not a good assumption given the changing of seasons plus just the very nature of weather. Averaging the weeks into a month loses the variability of peaks and troughs. Historically, this was not important when intermittent resources were not so relevant, and computing power was limited.

However, times have changed and the process need not be shortcut. Below is the graph of Public Service of Colorado hourly load for the month of June 2012. The graph compares the average weekly line that would be used in a tool like Strategist to the actual hourly data. You can see significant differences in the shape. In fact the peak drops 14% and the minimum load rises 7%.

I currently don’t work for any software company, nor am I being paid to endorse any software product so I can say without a bias, Strategist,in its current form, is a risky software to use in the world of intermittent resources. With cost rising in all areas in the utility business, any misstep can lead to significant disallowances. Also, noted in the same document was an issue of space which limited the software to do a full optimization. “Despite algorithm efficiencies and Company efforts, such as locked expansion plan tails, this particular approach to expansion planning has the potential to eventually build more candidate plans than the data storage capabilities of the software can accommodate.”

This concern came from a result of Strategist design to evaluate the various options. Strategist will calculate all permutations regardless of cost effectiveness. Strategist limits some of the permutations by employing the Bellman Optimization method – no relation to your Energy Consultant but worthy tidbit of knowledge. To a large degree, I concur with this method. You want to see the various permutations since the most likely case to choose from will be a plan that is likely suboptimal in all reasonable scenarios. At the same time, it is also cost effective in all scenarios. If one were to focus on a particular optimal plan, feeling certain about the future would be too much of a gamble given the many moving parts in the energy space. A robust and resilient plan, that can be relatively cost effective in low and high for natural gas price, economy, carbon constraints, etc. world, is the better plan. This resilient/robust plan in each individual outlook of the future will likely be sub-optimal.

An alternative way to produce the robust/resilient plan with limiting the permutations is to go ahead and solve for the optimal plan given a discrete input. Ignore the various permutations. Alter the discrete input/scenario and solve again. In the end, you may generate many optimal plans in the various discrete input/scenario. With the various optimal plans, one could then run the optimal plans in the various discrete inputs/scenarios and see the additional cost of not knowing the future exactly. In addition, one could also create a permutation from the runs and see if it would produce a net benefit in terms of the cost in all the discrete inputs/scenario. The most robust/resilient plan will demonstrate a cost limiting plan in the various discrete input or scenarios employed. One could also test all the plans through a Monte Carlo simulation giving additional analytical rigor to the robustness and resilience of the plan.

I have spent much time thinking about devising ways to enhance and produce robust and resilient resource plans. There is much thought and process that can go into making a plan that would be at the very least considered a CYA plan. Taking short cuts in calculating and processing the power markets given its reliance on more and more intermittent resources should be avoided. Processing power, the value obtained, and the precision available for the various inputs support moving to hourly modeling without shortcuts. Sub-hourly inputs are not precise enough to do long-term planning runs and the benefits will be limited. Strategist could still have its place as an IRP software given that they spend some time upgrading it.

Your Resource Planning Energy Consultant,

614-356-0484

Be wary of Energy articles ….take the time to go an inch deep

I found this article highlighted and posted on several sites – http://www.renewableenergyworld.com/rea/blog/post/2013/09/utility-agrees-their-solar-should-supplant-natural-gas#!

I was not planning to respond to this article posting as I did not want to legitimize the article, but it looks like there are so many comments on it already and that it has spread to many other sites. I think I can, at least, use the article to highlight the fact that many people post them without much substance, and it seems like the public does not mind or care. All you have to do is look an inch deep to see this article is not credible.

This article is clearly bias from the author to the publisher – probably no different than those found on the American Petroleum Institute on Oil & Gas related documents.

The article tries to relay an analytical unbiased rigor – however, that is clearly not the case with just a simple digging of the facts. Mr. Farrell reports the cost of a natural gas power plant which at the very least he links to the report. However, I guess he knows the average reader will not look into it, and it will make him look like he is on top of it. The report is a 2009 California report. IF one just took the time to look at it, the report is not a good document to source from. The natural gas price used in the report for 2013 is $8.28/mmbtu and rising to $12.23 by 2020. For a frame of reference the current forward curve for natural gas is marked at $4.96/mmbtu for 2020. The current fuel price shows a 60% discount from the report he is referring his readers to.

In addition as I have noted many times, Levelized Cost of Electricity (LCOE) needs to be taken with some caution – https://allenergyconsulting.com/blog/2012/06/05/levelized-cost-of-electricity-lcoe-analysis-potentially-misguides-you-in-the-power-markets/ LCOE gives the person who is doing the calculation many opportunities to introduce bias – from assumed operational performance without incorporating reality.

I understand people will post things likely to their bias, but I do not think we should legitimize articles which lack any analytical rigor. I really did not have to dig far to see the article lacked substance. If Mr. Farrell just focused on the falling solar prices – which is a real, credible and worthy of noting – then, the article could have had some credibility. However, he introduces a comparison which is outdated, only to support an attention getting theme, which holds no credibility, but in fact, misinforms the reader.

Please do consider All Energy Consulting for your energy consulting needs – Market Analysis – Technology Review – Modeling – etc…

Your Unbiased Energy Consultant,

614-356-0484